TIDMWSP

RNS Number : 6693Q

Wynnstay Properties PLC

08 November 2012

Wynnstay Properties PLC

Interim Results for the six months ended 29th September 2012

Chairman's Statement

Despite the continuing difficult conditions affecting the UK

economy, Wynnstay has continued to perform well and I am pleased to

report to you with good results of the first half of the financial

year to 29(th) September 2012 which may be summarised as

follows:-

2012 2011

Operating income before movement

in fair value of investment 24.1% GBP601,000 GBP484,000

properties:

Income before Taxation (8.1)% GBP641,000 GBP690,000

Earnings per share (5.3)% 18.0p 19.0p

Interim Dividend per share 10% 3.2p 2.90p

Net Asset value per share (1.5)% 466p 473p

Property income for the half-year increased to GBP838,000 (2011

- GBP763,000) as rental income from our latest additions to the

portfolio, at Lewes and at Surbiton, to which I referred in my

statement in last year's accounts came on stream, albeit offset to

some degree by the disposals of our office building at Colchester

at the end of the last financial year and of our industrial

property at Alton which was completed in this half-year. As a

result, our operating income of GBP601,000 (2011 - GBP484,000) was

somewhat higher than for the same period last year.

Our pre-tax profit of GBP641,000 (2011 - GBP690,000) is slightly

lower than at the same time last year, mainly as a result of the

profit on the sale of investment properties being different in the

two years: GBP100,000 in the current year to date, compared to

GBP267,000 in the comparable period last year. Finance costs have

been about the same in the two comparable periods, reflecting the

continuing low interest rates.

Management activity of the portfolio has been busy but rather

less intense than in the recent past, reflecting a degree of

stability amongst our tenant base. During the period, we renewed

three leases on the industrial estate at Aylesford, renegotiated

the leases of two trade units at Heathfield, notably to remove the

tenant's ability to break the leases, and welcomed new tenants for

industrial units at Norwich, St Neots and Uckfield. I consider this

is an excellent position given the current weakness of the

commercial property letting market as it ensures continuity of

income while minimising as far as possible the costs associated

with vacant properties.

There is no doubt that the economic conditions are causing

difficulties for some of our tenants, particularly small local

traders. Although we did not suffer any material bad debts

resulting from the failure of tenants, it seems almost inevitable

that some business failures will occur and, if they do, it will

affect Wynnstay's income and we will incur costs while properties

are vacant and in reletting them. On a more positive note, we have

a good mix of tenant profiles, ranging from the Government through

national businesses to small and medium-sized enterprises and the

voluntary and charitable sectors. At the time of writing, we have

collected over 95% of the rental income due for the current quarter

commencing 29 September 2012 and our vacancy rate remains at under

1% on a rental basis.

With the changes that we have made to the portfolio over the

past eighteen months and in particular the disposal of Twickenham

and the acquisitions of Lewes and Surbiton, the immediate outlook

is perhaps more favourable than it was when I wrote to you at this

time last year. Nevertheless it is important to remain cautious

whilst on the lookout for opportunities that will enhance

shareholder value in the medium-to-longer term as I consider we

have done with our recent purchases.

As has been the case for a considerable period interest rates

remain at a historically low level due to the economic conditions

and it is clear from our results that these low interest rates

benefit Wynnstay. It is important to recognise that market rates

will inevitably rise in due course to more normal levels and that

the terms we presently enjoy under our borrowing facility which

expires in December 2013 may not be available when we seek to

renegotiate the facility next year although the current portfolio

places us in a good position to agree acceptable terms.

In the light of the matters discussed above, the Directors have

decided to increase the interim dividend by 10% to 3.2p per share

compared to the 2.9p per share paid in 2011. We have now held the

dividend for several years, and a modest increase in the interim

seems justified. This should not be taken as any indication that

the final dividend will also be increased, and a decision on this

will be taken in the light of the results for the year in June

2013. However, our desire is to achieve a slightly better balance

between the interim and the final dividends. The interim dividend

will be paid on 14th December 2012 to those Shareholders on the

register on 16th November 2012.

I would repeat the reminder that I gave you last year and in my

Chairman's statement in June 2012 concerning unsolicited approaches

to shareholders over the telephone in relation to their shares in

Wynnstay and I would refer you to the letter distributed with the

Annual Report and Financial Statements in June.

Our Annual General Meeting next year will again be held at the

Royal Automobile Club, 89 Pall Mall, London SW1 on Thursday 18th

July 2013 at 12 noon and I hope that as many shareholders as

possible will make arrangements to attend and meet the Board and

fellow shareholders.

Finally, on behalf of the Board, I would like to convey to all

shareholders our best wishes for a Happy Christmas 2012 and for

good health and happiness in 2013. Wynnstay, despite its compact

size, benefits from considerable loyalty amongst its shareholders,

many of whom have held their shares for a considerable time. The

interest in Wynnstay's continued development that is shown by

shareholders notably in the run up to and at our annual general

meetings is greatly appreciated by the Board.

Philip G.H. Collins

Chairman

8th November 2012

For further information please contact:

Wynnstay Properties Plc

Toby Parker, Finance Director 020 7554 8766

Charles Stanley Securities

- Nominated Adviser 020 7149 6000

Dugald J. Carlean / Carl

Holmes

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED 29TH SEPTEMBER 2012

Six months ended Year

ended

29th September 29th September 25th

March

2012 2011 2012

GBP'000 GBP'000 GBP'000

Property Income 838 763 1,503

Property Costs (46) (74) (182)

Administrative Costs (191) (204) (389)

--------------- --------------- --------

601 484 932

Movement in fair value

of:

Investment Properties (866)

Profit/(Loss) on Sale

of Investment Property 100 267 346

Operating Income 701 751 412

Investment Income 1 3 3

Finance Costs (61) (64) (123)

--------------- --------------- --------

Income before Taxation 641 690 292

Taxation (154) (174) (175)

--------------- --------------- --------

Income after Taxation 487 516 117

--------------- --------------- --------

The company has no other

items of comprehensive

income

UNAUDITED STATEMENT OF FINANCIAL POSITION

AT 29TH SEPTEMBER 2012

25th

29th September 29th September March

2012 2011 2012

GBP'000 GBP'000 GBP'000

Non Current Assets

Investment Properties 18,630 18,825 16,965

Investments 3 3 3

--------------- --------------- --------

18,634 18,828 16,968

Current Assets

Accounts Receivable 274 158 319

Cash and Cash Equivalents 705 484 966

--------------- --------------- --------

979 642 1,285

Non Current Assets

held for Sale 365 2,324

Current Liabilities

Accounts Payable (820) (387) (808)

Income Taxes Payable (373) (403) (217)

--------------- --------------- --------

(1,193) (790) (1,025)

Net Current (Liabilities)/Assets (212) 217 2,584

Total Assets Less

Current Liabilities 18,421 19,045 19,552

Non-Current Liabilities

Bank Loans Payable (5,775) (6,150) (7,187)

Deferred Taxation (6) (56) (6)

--------------- --------------- --------

Net Assets 12,640 12,838 12,359

=============== =============== ========

Capital and Reserves

Share Capital 789 789 789

Treasury shares (1,570) (1,570) (1,570)

Share Premium Account 1,135 1,135 1,135

Capital Redemption

Reserve 205 205 205

Retained Earnings 12,081 12,279 11,800

--------------- --------------- --------

12,640 12,838 12,359

=============== =============== ========

UNAUDITED STATEMENT OF CASH FLOW

FOR THE SIX MONTHS ENDED 29TH SEPTEMBER 2012

Year

ended

Six months ended

29 September 25 March

2012 2011 2012

GBP'000 GBP'000 GBP'000

Cashflow from operating

activities

Income before taxation 641 690 292

Adjusted for:

Depreciation - 6 6

Decrease in fair value

of investment properties - - 866

Interest income - (3) (3)

Interest expense 61 64 123

(Profit)/Loss on disposal

of investment properties (100) (267) (346)

Changes in:

Trade and other receivables 45 131 (293)

Trade and other payables (3) (260) 51

Income taxes paid - (11) (248)

Interest paid 61 64 (123)

Net cash from operating

activities 704 25 325

========= ======== =========

Cashflow from investing

activities

Interest and other income

received - 3 3

Purchase of investment

properties (1,679) - (1,330)

Sale of investment properties 2,333 1,087 1,641

Net cash from investing

activities 654 1,090 314

========= ======== =========

Cashflow from financing

activities

Dividends paid (206) (206) (286)

Repayments on bank loans (1,412) (1,305) (1,605)

Drawdown on bank loans 1,337

Net cash used in financing

activities (1,619) (1,511) (554)

========= ======== =========

Net (decrease)/increase

in cash and cash equivalents (261) (397) 85

Cash and cash equivalents

at beginning of period 966 881 881

Cash and cash equivalents

at end of period 705 484 966

========= ======== =========

STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS ENDED 29TH SEPTEMBER 2012

SIX MONTHS ENDED 29TH SEPTEMBER

2012

Capital Share

Share Redemption Premium Treasury Retained

Capital Reserve Account Shares Earnings Total

GBP GBP GBP GBP GBP

GBP 000 000 000 000 000 000

Balance at 26

March 2012 789 205 1,135 (1,570) 11,800 12,359

Total comprehensive

income for the

period - - - - 487 487

Dividends - - - - (206) (206)

Balance at 29

September 2012 789 205 1,135 (1,570) 12,081 12,640

========= ============ ========= ========= ========== =======

SIX MONTHS ENDED 29TH SEPTEMBER

2011

Capital Share

Share Redemption Premium Treasury Retained

Capital Reserve Account Shares Earnings Total

GBP GBP GBP GBP GBP

GBP 000 000 000 000 000 000

Balance at 26

March 2011 789 205 1,135 (1,570) 11,969 12,528

Total comprehensive

income for the

period - - - - 516 516

Dividends - - - - (206) (206)

Balance at 29

September 2011 789 205 1,135 (1,570) 12,279 12,838

========= ============ ========= ========= ========== =======

YEAR ENDED 25TH MARCH 2012

Capital Share

Share Redemption Premium Treasury Retained

Capital Reserve Account Shares Earnings Total

GBP GBP GBP GBP GBP

GBP 000 000 000 000 000 000

Balance at 26

March 2011 789 205 1,135 (1,570) 11,969 12,528

Total comprehensive

income for the

year - - - - 117 117

Dividends - - - - (286) (286)

Balance at 25

March 2012 789 205 1,135 (1,570) 11,800 12,359

========= ============ ========= ========= ========== =======

NOTES

1. ACCOUNTING POLICIES

Wynnstay Properties PLC is a public limited company incorporated

and domiciled in England and Wales. The principal activity of the

company is property investment, development and management. The

Company's ordinary shares are traded on the Alternative Investment

Market.

Basis of Preparation

These unaudited condensed interim financial statements have been

prepared in accordance with International Financial Reporting

Standard (IFRS) IAS 34 Interim Financial Reporting. They do not

constitute statutory accounts within the meaning of section 435 of

the Companies Act 2006.

The unaudited condensed interim financial statements should be

read in conjunction with the financial statements of the Company as

at and for the year ended 25(th) March 2012 which were prepared in

accordance with IFRS as adopted by the European Union and those

parts of the Companies Act 2006 applicable to companies reporting

under IFRS, and have been reported on by the Company's auditors.

The financial information for the interim periods ended 29th

September 2012 and 29th September 2011 has not been audited and the

auditors have not reported on or reviewed these interim financial

statements. The information for the year ended 25th March 2012 has

been extracted from the latest published audited financial

statements.

Key Sources of Estimation Uncertainty

The preparation of the financial statements requires management

to make judgements, estimates and assumptions that may affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expenses.

Revisions to accounting estimates are recognised in the period

in which the estimate is revised if the revision affects only that

period. The key sources of estimation uncertainty that have a

significant risk of causing material adjustment to the carrying

amounts of assets and liabilities within the next financial year

are those relating to the fair value of investment properties.

Investment Properties

All the Company's investment properties are revalued annually

and stated at fair value at 25th March. The aggregate of any

resulting surpluses or deficits are recognised through the

statement of comprehensive income.

Depreciation

In accordance with IAS 40, freehold and leasehold investment

properties are included at the reporting date at fair value, and

are not depreciated. Leasehold improvements are amortised over the

period of the underlying lease.

Depreciation of other plant and equipment is on a straight line

basis calculated at annual rates estimated to write off each asset

over its useful life of 5 years.

Disposal of Investments

The gains and losses on the disposal of investment properties

and other investments are included in the statement of

comprehensive income in the year of disposal.

Property Income

Property income represents the value of accrued charges under

operating leases for rental of the Company's properties. Revenue is

measured at the fair value of the consideration received. All

income is derived in the United Kingdom.

Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax. Current tax is the expected tax payable on the

taxable income for the year based on the tax rate enacted or

substantially enacted at the reporting date, and any adjustment to

tax payable in respect of prior years. Taxable profit differs from

income before tax as reported in the income statement because it

excludes items of income or expense that are deductible in other

years, and it further excludes items that are never taxable or

deductible.

Deferred taxation is the tax expected to be payable or

recoverable on differences between the carrying amounts of assets

and liabilities in the financial statements and the corresponding

tax bases used in the computation of taxable profits, and is

accounted for using the financial position liability method.

Deferred tax liabilities are recognised for all taxable temporary

differences (including unrealised gains on revaluation of

investment properties) and deferred tax assets are recognised to

the extent that it is probable that taxable profits will be

available against which deductible temporary differences can be

utilised.

Deferred tax is calculated at the rates that are expected to

apply in the period when the liability is settled, or the asset is

realised. Deferred tax is charged or credited in the statement of

comprehensive income, including deferred tax on the revaluation of

the asset.

Investments

Quoted investments are recognised as held at fair value, and are

measured at subsequent reporting dates at fair value, which is

either at the bid price, or the latest traded price, depending on

the convention of the exchange on which the investment is quoted.

Changes in fair value are recognised in profit or loss.

Trade and other accounts receivable

Trade and other receivables are initially measured at fair value

as reduced by appropriate allowances for estimated irrecoverable

amounts. All receivables do not carry any interest and are short

term in nature.

Cash and cash equivalents

Cash comprises cash at bank and on demand deposits. Cash

equivalents are short term (less than three months from inception),

repayable on demand and which are subject to an insignificant risk

of change in value.

Trade and other accounts payable

Trade and other payables are initially measured at fair value.

All trade and other accounts payable are not interest bearing.

Comparative information

The information for the year ended 25 March 2012 has been

extracted from the latest published audited financial

statements.

Pensions

Pension contribution towards employees' pension plans are

charged to the statement of comprehensive income as incurred. The

pension scheme is a defined contribution scheme.

2. DIVIDENDS

Payment Per share Amount absorbed

Period Date (pence) GBP'000

6 months to 29th September 14th Dec

2012 2012 3.20 87

6 months to 29th September 17th Dec

2011 2011 2.90 79

Year ended 25th March 22nd July

2012 2012 7.6 206

3. EARNINGS PER SHARE

Basic earnings per share are calculated by dividing income after

taxation attributable to Ordinary Shareholders of GBP487,000 (2011:

GBP516,000) by the weighted average number of 2,711,617 ordinary

shares in issue during the period (2011: 2,711,617). There are no

instruments in issue that would have the effect of diluting

earnings per share.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DMMGMZRNGZZM

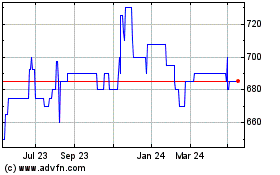

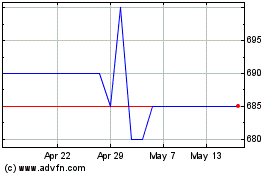

Wynnstay Properties (LSE:WSP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Wynnstay Properties (LSE:WSP)

Historical Stock Chart

From Jul 2023 to Jul 2024