TIDMWSP

RNS Number : 8123R

Wynnstay Properties PLC

10 November 2011

Wynnstay Properties PLC

Interim Results for the six months ended 29th September 2011

Chairman's Statement

At a time of economic uncertainty and difficulty that is

unprecedented in recent times, I am pleased to report to you with

satisfactory results of the first half of the financial year for

your company.

The results for the six months to 29(th) September 2011 may be

summarised as follows:-

2011 2010

Operating income before movement

in fair value of (8.4)% GBP484,000 GBP676,000

investment properties:

Income before Taxation 44.0% GBP690,000 GBP479,000

Earnings per share 39.7% 19.0p 13.6p

Interim Dividend per share 0% 2.90p 2.90p

Net Asset value per share 2.4% 473p 462p

As anticipated, property income for the half year fell to

GBP763,000 (2010 - GBP903,000) primarily due to the absence of

rental income from properties disposed of over the past eighteen

months and from the Twickenham site, to which I refer further

below, as well as the incidence of costs, mainly business rates

which are now charged on vacant properties. As a result, our

operating income of GBP484,000 (2010 - GBP676,000) was

substantially lower than for the same period last year.

However, despite this fall in income, our pre-tax profit of

GBP690,000 (2010 - GBP479,000) was substantially higher than at the

same time last year. This was mainly due to the profit of

GBP267,000 arising on the sale of our Crawley property, which

completed in early June, and far lower finance costs of GBP64,000

(2010 - GBP158,000). These lower finance costs arose from a

combination of lower interest rates, notably following the expiry

of the fixed rate on part of our facility to which I have

previously referred to, and our reduced total borrowings resulting

from repayments made under our facility following the disposal of

properties.

In my statement in June, I referred to the busy activity in the

management of the portfolio. This has continued in the first half

of the year.

At our estate in Aylesford, we have been successful in letting

one of the larger units to a new tenant and also completed lease

renewals on two units at both Basingstoke and Hertford and one unit

at Norwich as well as granting leases to new tenants at Norwich and

Uckfield. Terms have also recently been agreed for a new tenant to

occupy one of the two vacant units at Uckfield.

Despite the difficult conditions that many of our tenants are

facing, it is pleasing that, once again, we did not suffer any

material bad debts resulting from the failure of tenants and that

we have collected substantially all the rental income due for the

period. In addition, rental income due for the current quarter

commencing 29(th) September 2011 has also been substantially

collected.

I have reported previously at some length on our planning

application and the consent obtained to redevelop our industrial

units at Twickenham. We have now demolished the old industrial

units on the site in order to preserve the existing planning

permission whilst we discuss various alternatives with the planners

that may increase the flexibility of the future development of the

site. I hope to have further news for you when I report at the end

of the financial year.

We continue to look for additions to the portfolio and have

examined a number of potential opportunities. Recently we submitted

an offer, which has been accepted, for two retail trade counter

units within an established out of town retail location of a county

town in Southern England. I look forward to updating you on

progress regarding this.

As regards interest rates, the present economic conditions seem

to lead most commentators to now consider that any rise in base

rates is unlikely to take place in the short to medium term and, as

I have previously indicated, a sustained period of low interest

rates will benefit Wynnstay, though it is important that we

continue to proceed cautiously on the basis that rates will rise in

due course. Our disposals mean that we now have circa GBP2.5m of

unused facilities together with uncharged properties that we can

use to secure additional borrowings, if required.

The recessionary conditions and recurrent crises in the

financial and banking markets inevitably affect commercial property

and impact your company in terms of both rental levels and capital

values. With our active management policy, we are managing at

present to keep the proportion of the portfolio that is unlet at

any time under close control, thus minimising, as far as possible,

the costs of vacant premises, which as noted above mainly consist

of business rates. Whilst our rental income will be lower in the

immediate future than it has been in prior years, we have our costs

firmly under control. Thus I am confident that we can continue to

develop and grow the company for shareholders' benefit, albeit at a

slower rate than might have been possible a few years ago.

In the light of the matters discussed above, the Directors have

decided to hold the interim dividend at the same level as last

year, i.e. 2.9 pence per share. This will be paid on 16(th)

December 2011 to those shareholders on the register on 18(th)

November 2011. As in prior years, a decision on the appropriate

amount to recommend as a final dividend will be taken in the light

of the results for the full year.

A number of shareholders have mentioned that they have received

unsolicited approaches over the telephone in relation to their

shares in Wynnstay, in which the callers suggest interest in

purchasing their holdings in Wynnstay at prices that are far in

excess of both the quoted price on the London Stock Exchange and

the net asset value per share. These approaches are what are known

as "boiler room scams", relying on the use of publicly available

information about shareholders' names, addresses and holdings, and

typically operating from outside the UK.

Enclosed with this report you will find a letter that largely

repeats the information and warning that I gave shareholders in

mid-2009. We have already reported some instances of these scams to

the Financial Services Authority. I would urge extreme caution in

dealing with unsolicited calls about your investments and would

urge any shareholders who receive such calls to contact the

Financial Services Authority or Toby Parker, our Finance Director

and Company Secretary.

Our Annual General Meeting next year will again be held at the

Royal Automobile Club, 89 Pall Mall, London SW1 on Thursday 19th

July 2012 at 12 noon and I hope that as many shareholders as

possible will take the opportunity of a day in London to attend the

event.

Finally, on behalf of the Board, I wish all shareholders a Happy

Christmas and our best wishes for 2012. Your continued interest in

Wynnstay, its current activities and its prospects for the future

are always greatly appreciated.

Philip G.H. Collins

10(th) November 2011 Chairman

For further information please contact:

Wynnstay Properties Plc

Toby Parker, Finance Director 020 7554 8766

Charles Stanley Securities

- Nominated Adviser 020 7149 6000

Dugald J. Carlean / Carl

Holmes

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED 29TH SEPTEMBER 2011

Six months ended Year

ended

29th September 29th September 25th

March

2011 2010 2011

GBP'000 GBP'000 GBP'000

Property Income 763 903 1,691

Property Costs (74) (22) (136)

Administrative Costs (205) (205) (389)

--------------- --------------- --------

484 676 1,166

Movement in fair value

of:

Investment Properties - - (225)

Profit/(Loss) on Sale

of Investment Property 267 (40) (39)

Operating Income 751 636 902

Investment Income 3 1 6

Finance Costs (64) (158) (247)

--------------- --------------- --------

Income before Taxation 690 479 661

Taxation (174) (111) (212)

--------------- --------------- --------

Income after Taxation 516 368 449

--------------- --------------- --------

The company has no other

items of comprehensive

income

Basic and Diluted Earnings

per Share 19.0 13.6 16.6p

UNAUDITED STATEMENT OF FINANCIAL POSITION

AT 29TH SEPTEMBER 2011

29th September 29th September 25th March

2011 2010 2011

GBP'000 GBP'000 GBP'000

Non Current Assets

Investment Properties 18,825 20,345 18,825

Other Property,

Plant and Equipment - 5 6

Investments 3 3 3

--------------- --------------- -----------

18,828 20,353 18,834

Current Assets

Accounts Receivable 157 170 26

Cash and Cash Equivalents 484 501 881

--------------- --------------- -----------

641 671 907

Non Current Assets

held for Sale 365 - 1,295

Current Liabilities

Bank Loans Payable - - -

Accounts Payable (387) (519) (757)

Derivative Financial

Instruments - (65) -

Income Taxes Payable (403) (380) (240)

--------------- --------------- -----------

(790) (964) (997)

Net Current Assets 216 (293) 1,205

Total Assets Less

Current Liabilities 19,044 20,060 20,039

Non-Current Liabilities

Bank Loans Payable (6,150) (7,452) (7,455)

Deferred Taxation (56) (81) (56)

--------------- --------------- -----------

Net Assets 12,838 12,527 12,528

=============== =============== ===========

Capital and Reserves

Share Capital 789 789 789

Treasury shares (1,570) (1,570) (1,570)

Share Premium Account 1,135 1,135 1,135

Capital Redemption

Reserve 205 205 205

Retained Earnings 12,279 11,968 11,969

--------------- --------------- -----------

12,838 12,527 12,528

=============== =============== ===========

UNAUDITED STATEMENT OF CASH FLOW

FOR THE SIX MONTHS ENDED 29TH SEPTEMBER 2011

Year

ended

Six months ended

29 September 25 March

2011 2010 2011

GBP'000 GBP'000 GBP'000

Cashflow from operating

activities

Income before taxation 690 479 661

Adjusted for:

Depreciation 6 3 2

Decrease in fair value

of investment properties - - 225

Interest income (3) (1) (6)

Interest expense 64 158 312

(Profit) on financial

liabilities at fair value - - (65)

(Profit)/Loss on disposal

of investment properties (267) 39 39

Changes in:

Trade and other receivables (131) (67) 77

Trade and other payables (260) (377) (120)

Income taxes paid (11) - (266)

Interest paid (64) (158) (312)

Net cash from operating

activities 25 76 547

========= ======== =========

Cashflow from investing

activities

Interest and other income

received 3 1 6

Sale of investment properties 1,087 925 906

Net cash from investing

activities 1,090 926 912

========= ======== =========

Cashflow from financing

activities

Dividends paid (206) (206) (286)

Repayments on bank loans (1,305) (1,048) (1,045)

Net cash used in financing

activities (1,511) (1,254) (1,331)

========= ======== =========

Net (decrease)/increase

in cash and cash equivalents (397) (252) 128

Cash and cash equivalents

at beginning of period 881 753 753

Cash and cash equivalents

at end of period 484 501 881

========= ======== =========

STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS ENDED 29TH SEPTEMBER 2011

SIX MONTHS ENDED 29 SEPTEMBER 2011

Capital Share

Share Redemption Premium Treasury Retained

Capital Reserve Account Shares Earnings Total

GBP GBP GBP GBP GBP

GBP 000 000 000 000 000 000

Balance at 26

March 2011 789 205 1,135 (1,570) 11,969 12,528

Total comprehensive

income for the

period - - - - 516 516

Dividends - - - - (206) (206)

Balance at 29

September 2011 789 205 1,135 (1,570) 12,279 12,838

========= ============ ========= ========= ========== =======

SIX MONTHS ENDED 29 SEPTEMBER 2010

Capital Share

Share Redemption Premium Treasury Retained

Capital Reserve Account Shares Earnings Total

GBP GBP GBP GBP GBP

GBP 000 000 000 000 000 000

Balance at 26

March 2010 789 205 1,135 (1,570) 11,806 12,365

Total comprehensive

income for the

period - - - - 368 368

Dividends - - - - (206) (206)

Balance at 29

September 2010 789 205 1,135 (1,570) 11,968 12,527

========= ============ ========= ========= ========== =======

YEAR ENDED 25 MARCH 2011

Capital Share

Share Redemption Premium Treasury Retained

Capital Reserve Account Shares Earnings Total

GBP GBP GBP GBP GBP

GBP 000 000 000 000 000 000

Balance at 26

March 2010 789 205 1,135 (1,570) 11,806 12,365

Total comprehensive

income for the

year - - - - 449 449

Dividends - - - - (286) (286)

Balance at 25

March 2011 789 205 1,135 (1,570) 11,969 12,528

========= ============ ========= ========= ========== =======

NOTES

1. ACCOUNTING POLICIES

Wynnstay Properties PLC is a public limited company incorporated

and domiciled in England and Wales. The principal activity of the

company is property investment, development and management. The

Company's ordinary shares are traded on the Alternative Investment

Market.

Basis of Preparation

These unaudited condensed interim financial statements have been

prepared in accordance with International Financial Reporting

Standard (IFRS) IAS 34 Interim Financial Reporting. They do not

constitute statutory accounts within the meaning of section 435 of

the Companies Act 2006.

The unaudited condensed interim financial statements should be

read in conjunction with the financial statements of the Company as

at and for the year ended 25(th) March 2011 which were prepared in

accordance with IFRS as adopted by the European Union and those

parts of the Companies Act 2006 applicable to companies reporting

under IFRS, and have been reported on by the Company's auditors.

The financial information for the interim periods ended 25(th)

September 2011 and 25th September 2010 has not been audited and the

auditors have not reported on or reviewed these interim financial

statements. The information for the year ended 25(th) March 2011

has been extracted from the latest published audited financial

statements.

Key Sources of Estimation Uncertainty

The preparation of the financial statements requires management

to make judgements, estimates and assumptions that may affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expenses.

Revisions to accounting estimates are recognised in the period

in which the estimate is revised if the revision affects only that

period. The key sources of estimation uncertainty that have a

significant risk of causing material adjustment to the carrying

amounts of assets and liabilities within the next financial year,

are those relating to the fair value of investment properties.

Investment Properties

All the Company's investment properties are revalued annually

and stated at fair value at 25th March. The aggregate of any

resulting surpluses or deficits are recognised through the

statement of comprehensive income.

Non-Current assets held for sale

Non-current assets classified as held for sale are measured at

the lower of the assets' previous carrying amount and fair value

less cost to sell.

Depreciation

In accordance with IAS 40, freehold and leasehold investment

properties are included at the reporting date at fair value, and

are not depreciated. Leasehold improvements are amortised over the

period of the underlying lease.

Depreciation of other plant and equipment is on a straight line

basis calculated at annual rates estimated to write off each asset

over its useful life of 5 years.

Disposal of Investments

The gains and losses on the disposal of investment properties

and other investments are included in the statement of

comprehensive income in the year of disposal.

Property Income

Property income represents the value of accrued charges under

operating leases for rental of the Company's properties. Revenue is

measured at the fair value of the consideration received. All

income is derived in the United Kingdom.

Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax. Current tax is the expected tax payable on the

taxable income for the year based on the tax rate enacted or

substantially enacted at the reporting date, and any adjustment to

tax payable in respect of prior years. Taxable profit differs from

income before tax as reported in the income statement because it

excludes items of income or expense that are deductible in other

years, and it further excludes items that are never taxable or

deductible.

Deferred taxation is the tax expected to be payable or

recoverable on differences between the carrying amounts of assets

and liabilities in the financial statements and the corresponding

tax bases used in the computation of taxable profits, and is

accounted for using the financial position liability method.

Deferred tax liabilities are recognised for all taxable temporary

differences (including unrealised gains on revaluation of

investment properties) and deferred tax assets are recognised to

the extent that it is probable that taxable profits will be

available against which deductible temporary differences can be

utilised.

Deferred tax is calculated at the rates that are expected to

apply in the period when the liability is settled, or the asset is

realised. Deferred tax is charged or credited in the statement of

comprehensive income, including deferred tax on the revaluation of

the asset.

Investments

Quoted investments are recognised as held at fair value, and are

measured at subsequent reporting dates at fair value, which is

either at the bid price, or the latest traded price, depending on

the convention of the exchange on which the investment is quoted.

Changes in fair value are recognised in profit or loss.

Trade and other accounts receivable

Trade and other receivables are initially measured at fair value

as reduced by appropriate allowances for estimated irrecoverable

amounts. All receivables do not carry any interest and are short

term in nature.

Cash and cash equivalents

Cash comprises cash at bank and on demand deposits. Cash

equivalents are short term (less than three months from inception),

repayable on demand and which are subject to an insignificant risk

of change in value.

Trade and other accounts payable

Trade and other payables are initially measured at fair value.

All trade and other accounts payable are not interest bearing.

Comparative information

The information for the year ended 25(th) March 2011 has been

extracted from the latest published audited financial

statements.

Pensions

Pension contribution towards employees' pension plans are

charged to the statement of comprehensive income as incurred. The

pension scheme is defined as a pension contribution scheme.

Financial Instruments

Derivative financial instruments are initially measured at fair

value at the contract date entered into, and subsequently measured

to their fair value at each reporting date. Embedded derivatives

are recognised separately on the statement of financial position,

when not closely related to the host contract. Changes in the fair

value of derivative financial instruments that do not qualify for

ledger accounting are recognised in profit or loss.

2. DIVIDENDS

Payment Per Amount

share absorbed

Period Date (pence) GBP'000

6 months to 29th 16(th) Dec

September 2011 2011 2.9 79

6 months to 29th 17(th) Dec

September 2010 2010 2.9 79

Year ended 25th 22(nd) July

March 2011 2011 7.6 206

3. EARNINGS PER SHARE

Basic earnings per share are calculated by dividing income after

taxation attributable to Ordinary Shareholders of GBP516,000 (2010:

GBP368,000) by the weighted average number of 2,711,617 ordinary

shares in issue during the period (2010: 2,711,617). There are no

instruments in issue that would have the effect of diluting

earnings per share.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GMMGMVLNGMZM

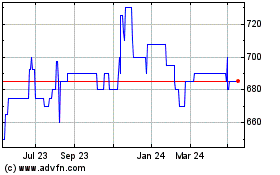

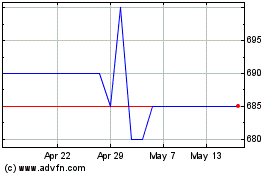

Wynnstay Properties (LSE:WSP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Wynnstay Properties (LSE:WSP)

Historical Stock Chart

From Jul 2023 to Jul 2024