TIDMUSF TIDMUSFP

RNS Number : 2393I

US Solar Fund PLC

01 December 2022

1 December 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF THAT JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

US SOLAR FUND PLC

("USF", the "Company")

Change of Investment Manager personnel

On 17(th) October 2022 the Board of Directors of USF (the

"Board") announced that it is undertaking a strategic review of the

options available to the Company to maximise value for shareholders

(the Strategic Review).

Following the announcement of the Strategic Review, the Board

has been in ongoing discussions with the Company's investment

manager, New Energy Solar Manager Pty Limited (NESM) with respect

to its continuing obligations and transition arrangements. As part

of these discussions, NESM has indicated that it has established

incentivisation arrangements with key employees to encourage them

to remain with NESM during the period while the Strategic Review is

being conducted. The cost of these arrangements will be borne by

NESM and will not result in any incremental cost to USF.

Notwithstanding these incentivisation arrangements, NESM has

informed the Board of the following changes to its key

personnel:

-- Liam Thomas will continue to lead the Strategic Review process however

will cease being a n employee of E&P Financial Group Pty Limited

(E&P), NESM's parent company, from 31 December 2022. After this

date, Liam will be retained as a consultant to E&P and will devote

25% of his time to USF and the Strategic Review;

-- Adam Haughton will be leaving NESM in December to pursue an alternative

career opportunity;

-- Bert Snarr has been promoted to Director at NESM and will serve

as the commercial lead on the Strategic Review. Prior to joining

NESM, Bert worked at Bank of America Merrill Lynch across a variety

of M&A and corporate finance transactions. An appropriate remuneration

and retention package has been put in place by NESM to reflect Bert's

role; and

-- Brian Disler, formerly general counsel of E&P's US operations, will

provide management oversight and support as well as legal expertise

during any forthcoming negotiations with third parties participating

in the Strategic Review.

The Company's asset management arrangements will remain

unaffected and all activities with respect to operations and

maintenance (O&M) and asset management will continue to be

undertaken by the existing third-party operators. The Board is

confident that these developments will not impact the operational

performance of USF's assets and that the remaining NESM team, with

additional support from NESM's existing advisers and consultants,

will be able to continue effectively managing and monitoring the

performance of all third-party O&M Contractors.

The Board confirms that the Strategic Review process is well

advanced and the Board currently expects to advise shareholders of

the outcome of the process in Q1 2023.

Commenting on today's announcement, Gill Nott, Chairman,

said:

"Following the announcement of our Strategic Review, the Board

is sympathetic to the decision of both Liam and Adam to each

separately pursue other career opportunities beyond NESM. We are

grateful to Liam for agreeing a contractual commitment with his new

employer to continue to lead the Strategic Review process. The

Board remains fully committed to the Strategic Review process and

is entirely focused on delivering a successful outcome that

maximises value for all our shareholders as soon as practically

possible. The Board would like to wish both Liam and Adam well in

their new endeavours and thank them for their commitment to USF

since its IPO"

Jefferies International Limited

(Joint Financial

Adviser and Joint Corporate Broker)

Stuart Klein Lorna Shearin Paul

Bundred +44 20 7029 8000

KeyBanc Capital Markets (Joint

Financial

Adviser)

Timothy Beach

Aaron Klein

Bill Chamberlin +1 415 659 0946

Cenkos Securities plc (Joint Corporate

Broker)

James King

Tunga Chigovanyika Will Talkington +44 20 7397 8900

KL Communications +44 20 3995 6673

Charles Gorman

Charlotte Francis Millie Steyn

The person responsible for arranging the release of this

announcement on behalf of the Company is Susan Fadil of JTC (UK)

Limited, Company Secretary.

About US Solar Fund plc

US Solar Fund plc, established in 2019, listed on the premium

segment of the London Stock Exchange in April 2019. The Company's

investment objective is to provide investors with attractive and

sustainable dividends with an element of capital growth by owning

and operating solar power assets in North America and other OECD

countries in the America.

The solar power assets that the Company acquires or constructs

are expected to have an asset life of at least 30 years and

generate stable and uncorrelated cashflows by selling electricity

to creditworthy offtakers under long-term power purchase agreements

(or PPAs). The Company's portfolio consists of 42 operational solar

projects with a total capacity of 543MW DC , all located in the

United States.

About the Investment Manager

US Solar Fund plc is managed by New Energy Solar Manager Pty

Limited, which also manages Australian Securities Exchange

(ASX)-listed New Energy Solar (www.newenergysolar.com.au).

Combined, USF and New Energy Solar have invested approximately

US$1.3 billion in 57 projects totaling 1.2 GW DC .

NESM is owned by E&P Funds, the funds management division of

E&P Financial Group, an ASX listed company (ASX: EP1) with over

A$20 billion of funds under advice.

Other Notices

Jefferies International Limited, which is authorised and

regulated in the UK by the FCA, is acting exclusively for USF and

no one else in connection with the Strategic Review and shall not

be responsible to anyone other than USF for providing the

protections afforded to clients of Jefferies, nor for providing

advice in connection with the Strategic Review or any matter

referred to herein. Neither Jefferies nor any of its affiliates

(nor any of its or their respective directors, officers, employees,

representatives or agents) owes or accepts any duty, liability or

responsibility whatsoever (whether direct, indirect, consequential,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Jefferies in connection with the

Strategic Review, this announcement, any statement contained herein

or otherwise.

KeyBanc Capital Markets is a trade name under which corporate

and investment banking products and services of KeyCorp and its

subsidiaries, KeyBanc Capital Markets Inc., Member NYSE/FINRA/SIPC,

and KeyBank National Association ("KeyBank N.A."), are marketed.

Securities products and services are offered by KeyBanc Capital

Markets Inc. and by its licensed securities representatives.

Banking products and services are offered by KeyBank N.A.

Cenkos Securities plc, which is authorised and regulated in the

UK by the FCA, is acting exclusively for USF and no one else in

connection with the Strategic Review and shall not be responsible

to anyone other than USF for providing the protections afforded to

clients of Cenkos Securities plc, nor for providing advice in

connection with the Strategic Review or any matter referred to

herein. Neither Cenkos Securities plc nor any of its affiliates

(nor any of its or their respective directors, officers, employees,

representatives or agents) owes or accepts any duty, liability or

responsibility whatsoever (whether direct, indirect, consequential,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Cenkos Securities plc in connection

with the Strategic Review, this announcement, any statement

contained herein or otherwise.

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of, any securities whether pursuant to this

announcement or otherwise.

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about, and observe, such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law or any such jurisdiction.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRVFLBBLLLLFBZ

(END) Dow Jones Newswires

December 01, 2022 03:29 ET (08:29 GMT)

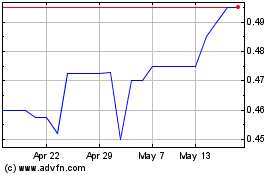

Us Solar (LSE:USF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Us Solar (LSE:USF)

Historical Stock Chart

From Jul 2023 to Jul 2024