TIDMUSF TIDMUSFP

RNS Number : 9871G

US Solar Fund PLC

21 November 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO OR WITHIN

THE UNITED STATES, AUSTRALIA, CANADA OR JAPAN, OR ANY OTHER

JURISDICTION WHERE, OR TO ANY OTHER PERSON TO WHOM, TO DO SO WOULD

BE UNLAWFUL. THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE

OR FORM PART OF ANY OFFER TO SELL OR ISSUE, OR ANY SOLICITATION OF

ANY OFFER TO PURCHASE, SUBSCRIBE FOR OR OTHERWISE ACQUIRE, ANY

INVESTMENTS IN ANY JURISDICTION.

21 November 2022

US SOLAR FUND PLC (USF, the "Company")

DIVIDEND, QUARTERLY TRADING AND NAV UPDATE

US Solar Fund plc (LON: USF (USD)/USFP (GBP)) is pleased to

announce that its unaudited NAV at 30 September 2022 was $322.2

million or $0.970 per ordinary share, a 0.3% increase from the 30

June 2022 NAV of $321.2 million or $0.967 per ordinary share.

USF is also pleased to declare an Interim Dividend of 1.52 cents

per Ordinary Share for the quarter ended 30 September 2022. The

Interim Dividend will be paid in line with the timetable below:

Ex-Dividend Date: 15 December 2022

Record Date: 16 December 2022

Pay ment Date: 6 January 2023

Of this dividend, 1.52 cents are declared as dividend income

with no portion treated as qualifying interest income. The Company

confirms its target 5.58 cents per Ordinary Share annual

cash-covered dividend target for FY2022.

Highlights for the quarter to 30 September 2022:

-- USF's unaudited NAV at 30 September 2022 was $322.2 million

or $0.970 per share, an increase from the 30 June 2022 NAV of

$321.2 million or $0.967 per share. An increase in working capital

and cash balances drove the increase in fair value of the

portfolio's underlying solar investments. Discount rates and other

macro assumptions were held steady for this period, as is typically

done for USF outside of year-end and interim results. They will be

reviewed at 31 December and included in NAV.

-- During the period, the portfolio produced 281GWh (including

reimbursed curtailment). Year-to-date generation remains within the

expected range of annual variance and USF expects to continue to

cash cover the dividend.

-- All assets in the portfolio have power purchase agreements

(PPAs) with contracted prices for 100% of electricity generated.

The portfolio weighted average PPA term is 14.0 years as of 30

September 2022, and all PPA counterparties are investment-grade

(S&P rated A to BBB).

-- The Company paid its Q2 2022 dividend of 1.27 cents per

ordinary share on 21 October 2022. The dividend is consistent with

the Company's target full year dividend of 5.58 cents per ordinary

share. USF expects to continue covering dividends paid in 2022 with

cashflow from portfolio operations.

-- Reflecting the normal seasonality of cash flows, dividend

cover for the nine months to 30 September was 1.46x.

-- In August, USF announced it has sold a purchase option

(Option) over its 50% interest in its 200MWDC Mount Signal 2 (MS2)

to MN8 Energy LLC (MN8), a renewable energy business formerly known

as Goldman Sachs Renewable Power LLC. Under the terms of the

Option, MN8 paid USF a non-refundable option fee of US$1 million

and has the option, for an initial term of six months extendable

for a further three months by mutual agreement, to acquire USF's

50% interest in MS2 for an additional US$52.2 million excluding

working capital. If executed, the proceeds would be consistent with

the net asset value at which USF held MS2 at 31 March 2022 and the

sale would imply a gross return of 11% per annum [1] since USF

announced the agreement to acquire up to 50% of MS2 from New Energy

Solar (NEW) in December 2020. A further announcement will be made

in due course.

Highlights post period end:

-- The USF Board has announced that it is undertaking a

strategic review of the options available to the Company to

maximise value for shareholders. Although USF has successfully

executed its strategy of delivering a sustainable dividend for

shareholders, structural challenges in the US solar sector

alongside a recent sustained discount of the share price to its net

asset value have impeded the Company's ability to grow its asset

base. The Board will consider all options available to the Company,

including, but not limited to, a sale of the entire issued, and to

be issued, share capital of the Company which is being conducted

under the framework of a "formal sale process" in accordance with

the Takeover Code, selling the Company's portfolio and returning

funds to shareholders or changing the investment management

arrangements of the Company. There is no certainty that any changes

will result from the Strategic Review. The Board will make further

announcements in due course.

The NAV update and the Company's factsheet for Q3 2022 are

available on the Company's website at:

www.ussolarfund.co.uk/investor-centre .

A separate Solar Market Update can be found on the website

at:

www.ussolarfund.co.uk/media-and-insights .

For further information, please contact:

US Solar Fund

Whitney Voute +1 718 230 4329

Cenkos Securities plc

James King

Tunga Chigovanyika

Will Talkington +44 20 7397 8900

Jefferies International Limited

Stuart Klein

Gaudi le Roux +44 20 7029 8000

KL Communications +44 20 3995 6673

Charles Gorman

Charlotte Francis

Millie Steyn

About US Solar Fund plc

US Solar Fund plc, established in 2019, is listed on the premium

segment of the London Stock Exchange. The Company's investment

objective is to provide investors with attractive and sustainable

dividends with an element of capital growth by owning and operating

solar power assets in North America and other OECD countries in the

America.

The solar power assets that the Company acquires or constructs

are expected to have an asset life of at least 30 years and

generate stable and uncorrelated cashflows by selling electricity

to creditworthy offtakers under long-term power purchase agreements

(or PPAs). The Company's portfolio consists of 42 operational solar

projects with a total capacity of 543 MW(DC) , all located in the

United States.

Further information on the Company can be found on its website

at http://www.ussolarfund.co.uk .

About the Investment Manager

USF is managed by New Energy Solar Manager (NESM). NESM also

manages New Energy Solar, an Australian Securities Exchange

(ASX)-listed fund. Combined, US Solar Fund and New Energy Solar

have committed approximately US$1.3 billion to 57 projects

totalling 1.2GW(DC) .

NESM is owned by E&P Funds, the funds management division of

E&P Financial Group, an ASX listed company (ASX: EP1) with over

A$20 billion of funds under advice.

[1] Before tax and based on USF's announcement date of 31

December 2021, second 25% option exercise date of 10 February 2022,

MN8 option date of 21 August 2022, and an assumed completion date

of 31 March 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKZMZMMGDGZZZ

(END) Dow Jones Newswires

November 21, 2022 02:00 ET (07:00 GMT)

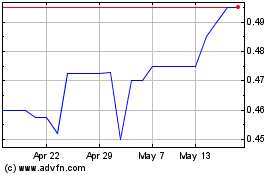

Us Solar (LSE:USF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Us Solar (LSE:USF)

Historical Stock Chart

From Jul 2023 to Jul 2024