TIDMUSF TIDMUSFP

RNS Number : 9371C

US Solar Fund PLC

28 February 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO OR WITHIN

THE UNITED STATES, AUSTRALIA, CANADA OR JAPAN, OR ANY OTHER

JURISDICTION WHERE, OR TO ANY OTHER PERSON TO WHOM, TO DO SO WOULD

BE UNLAWFUL. THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE

OR FORM PART OF ANY OFFER TO SELL OR ISSUE, OR ANY SOLICITATION OF

ANY OFFER TO PURCHASE, SUBSCRIBE FOR OR OTHERWISE ACQUIRE, ANY

INVESTMENTS IN ANY JURISDICTION.

28 February 2022

US SOLAR FUND PLC (USF, the "Company")

Q4 2021 Unaudited NAV and Factsheet

US Solar Fund plc (LON: USF (USD)/USFP (GBP)) is pleased to

announce its unaudited NAV at 31 December 2021 of $324 million or

$0.975 per Ordinary Share (30 September 2021 NAV of $314.7 million

or $0.947 per Ordinary Share).

Highlights for the period to 31 December 2021:

-- The key drivers of the 3% increase from the 30 September 2021

NAV of $0.947 per Ordinary Share were useful life extensions for

assets in the portfolio ($0.045) and an uplift in the initial

valuation of the interest in and option over Mount Signal 2 (MS2)

($0.024); which more than offset a softer average long-term

electricity price outlook, tax and working capital adjustments, and

model roll forward (collectively -$0.041).

-- In coordination with a leading independent engineer (IE), 30

of 42 assets in the portfolio were subject to useful life

extensions up to a maximum of 40 years from commencement of

commercial operations. The IE reviewed the geotechnical and

structural design, historical operational performance, budgeted

operating costs, and other key components to determine a

recommended useful life and associated assumptions, including

additional maintenance and capital expenditure. Assets that were

considered for extensions have permits, contracts, and land control

to support the term of useful life.

-- Full-year production for 2021 was 3.9% below budget with 1.5%

due to lower-than-expected irradiance and 2.4% due predominantly to

the H1 contractually allowable and expected curtailment at MS2 in

California, isolated performance issues, unplanned outages, snow,

and other adverse weather impacts. All issues are now resolved or

scheduled to be resolved in coming months.

-- The dividend remained comfortably cash covered, at 1.82x for

the twelve months ended 31 December 2021.

-- USF's dividend for the quarter ended 30 September 2021 of 1.5

cents per Ordinary Share was paid on 7 January 2022. Including this

third 2021 Interim Dividend, dividends paid and declared for the

2021 financial year thus far total 4.0 cents, in line with the

Company's full year dividend target of 5.5 cents per Ordinary

Share. The final 2021 dividend will be announced in March 2022

alongside the 2021 annual results.

-- All assets in the portfolio have power purchase agreements

(PPAs) with contracted prices for 100% of electricity generated.

The portfolio weighted average PPA term is 14.4 years as of 31

December 2021, and all PPA counterparties are investment-grade

(S&P rated A to BBB).

-- As of 31 December 2021, the Investment Manager's pipeline

included 1,940 MW(DC) of high-quality assets, with an aggregate

value of approximately $2.2 billion in cash equity value and a

weighted-average PPA term of 17.7 years.

In February 2022, after the end of the period, USF exercised its

option to acquire a further 25% (50MW(DC) ) of MS2, a 200MW(DC)

project in California. Upon close, this will bring USF's total

ownership of MS2 to 50% or 100 MW(DC) and the total USF portfolio

to 543MW(DC) .

In February, USF released its inaugural Sustainability Report ,

available on the Company's website at:

www.ussolarfund.co.uk/investor-centre/key-documents-and-disclosure.

This report forms a core part of USF's commitment to support our

investors with their own ESG-related obligations. While USF is not

formally required to comply with the upcoming EU Sustainable

Financial Disclosure Regulation, we intend to align reporting with

a view to compliance with this regime.

The NAV update and the Company's factsheet for Q4 2021 are

available on the Company's website at:

www.ussolarfund.co.uk/investor-centre. A separate Solar Market

Update can be found on the website at:

www.ussolarfund.co.uk/media-and-insights.

Liam Thomas, CEO of New Energy Solar, US Solar Fund's investment

manager, said

"The energy transition is progressing well in the United States,

and we're pleased to report a stronger fourth quarter net asset

value, rising 3% over the quarter This was driven by an improvement

in the valuation of our Mount Signal 2 asset in California, coupled

with useful life extensions in the portfolio which more than offset

a marginally softer average long-term electricity price

outlook.

The use of existing cash reserves to purchase a an additional

25%, or 50 MW(DC) of MS2, earlier this month increased the income

generating portfolio, further supporting the dividend. We continue

to target a 5.5 cent dividend for the year, equivalent to just over

a 5.5% nominal yield."

For further information, please contact:

US Solar Fund

Whitney Voute +1 718 230 4329

Cenkos Securities plc

James King

Tunga Chigovanyika

Will Talkington +44 20 7397 8900

Jefferies International Limited

Stuart Klein

Gaudi le Roux +44 20 7029 8000

KL Communications +44 20 3995 6673

Charles Gorman

Will Sanderson

About US Solar Fund plc

US Solar Fund plc, established in 2019, is listed on the premium

segment of the London Stock Exchange in April 2019 with a market

capitalisation of approximately $340m. The Company's investment

objective is to provide investors with attractive and sustainable

dividends with an element of capital growth by owning and operating

solar power assets in North America and other OECD countries in the

America.

The solar power assets that the Company acquires or constructs

are expected to have an asset life of at least 30 years and

generate stable and uncorrelated cashflows by selling electricity

to creditworthy offtakers under long-term power purchase agreements

(or PPAs). The Company's portfolio consists of 42 operational solar

projects with a total capacity of 543MW(DC) , all located in the

United States.

Further information on the Company can be found on its website

at http://www.ussolarfund.co.uk .

About the Investment Manager

USF is managed by New Energy Solar Manager (NESM). NESM also

manages New Energy Solar, an Australian Securities Exchange

(ASX)-listed fund. Combined, US Solar Fund and New Energy Solar

have committed approximately US$1.3 billion to 57 projects

totalling 1.2GWDC.

NESM is owned by E&P Funds, the funds management division of

E&P Financial Group, an ASX listed company (ASX: EP1) with over

A$20 billion of funds under advice.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVBKPBNBBKBFBB

(END) Dow Jones Newswires

February 28, 2022 02:01 ET (07:01 GMT)

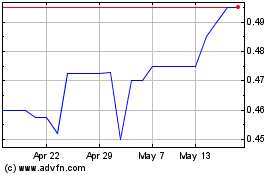

Us Solar (LSE:USF)

Historical Stock Chart

From Jul 2024 to Jul 2024

Us Solar (LSE:USF)

Historical Stock Chart

From Jul 2023 to Jul 2024