US Solar Fund PLC SIXTH BINDING ACQUISITION AGREEMENT (2836B)

February 10 2022 - 3:46AM

UK Regulatory

TIDMUSF TIDMUSFP

RNS Number : 2836B

US Solar Fund PLC

10 February 2022

10 February 2022

US SOLAR FUND PLC (USF, the Company)

SIXTH BINDING ACQUISITION AGREEMENT

USF exercises option to acquire further 25% of 200MW(DC) Mount

Signal 2

US Solar Fund Plc ( LON:USF (USD) / USFP (GBP) ) is pleased to

announce it has exercised its option to acquire a further 25%

interest in the 200MW(DC) Mount Signal 2 (MS2, the Project), taking

its total ownership of the Project to 50%.

USF committed to acquire an initial 25% (Tranche One) of MS2 in

December 2020 and had twelve months from Tranche One completion

(which was in March 2021) to exercise its option over a second 25%

(Tranche Two). The purchase price for Tranche Two is $21m, taking

USF's total equity investment for 50% of the Project to $44m.

On completion of Tranche Two of the Transaction, which is

subject to customary regulatory and financier approvals and

consents, USF's total portfolio will be 543 MW(DC) across 42 fully

operational assets in five states of the US, with a weighted

average investment-grade power purchase agreement (PPA) term of

14.7 years.

USF will fund Tranche Two with available cash.

For further information, please contact:

US Solar Fund

Whitney V oûte +1 718 230 4329

Cenkos Securities plc

James King

Tunga Chigovanyika

Will Talkington +44 20 7397 8900

Jefferies International Limited

Stuart Klein

Gaudi le Roux

Neil Winward +44 20 7029 8000

KL Communications +44 20 3995 6673

Charles Gorman

Will Sanderson

Millie Steyn

About US Solar Fund plc

US Solar Fund plc, established in 2019, listed on the premium

segment of the London Stock Exchange in April 2019 and has a

current market capitalisation of approximately $340m. The Company's

investment objective is to provide investors with attractive and

sustainable dividends with an element of capital growth by owning

and operating solar power assets in North America and other OECD

countries in the America.

The solar power assets that the Company acquires or constructs

are expected to have an asset life of at least 30 years and

generate stable and uncorrelated cashflows by selling electricity

to creditworthy offtakers under long-term power purchase agreements

(or PPAs). The Company's portfolio currently consists of 42

operational solar projects with a total capacity of 493MW (DC) ,

all located in the United States.

Further information on the Company can be found on its website

at http://www.ussolarfund.co.uk .

About the Investment Manager

USF is managed by New Energy Solar Manager Pty Limited, which

also manages Australian Securities Exchange (ASX)-listed New Energy

Solar ( www.newenergysolar.com.au ). Combined, US Solar Fund and

New Energy Solar have committed approximately US$1.3 billion to 57

projects totalling 1.2GW (DC) .

NESM is owned by E&P Funds, the funds management division of

E&P Financial Group, an ASX listed company (ASX: EP1) with over

A$20 billion of funds under advice.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRBKKBQFBKKQBD

(END) Dow Jones Newswires

February 10, 2022 03:46 ET (08:46 GMT)

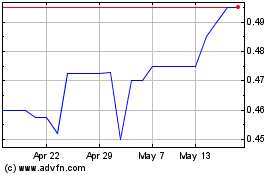

Us Solar (LSE:USF)

Historical Stock Chart

From Jul 2024 to Jul 2024

Us Solar (LSE:USF)

Historical Stock Chart

From Jul 2023 to Jul 2024