TIDMUSF TIDMUSFP

RNS Number : 1881T

US Solar Fund PLC

23 November 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO OR WITHIN

THE UNITED STATES, AUSTRALIA, CANADA OR JAPAN, OR ANY OTHER

JURISDICTION WHERE, OR TO ANY OTHER PERSON TO WHOM, TO DO SO WOULD

BE UNLAWFUL. THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE

OR FORM PART OF ANY OFFER TO SELL OR ISSUE, OR ANY SOLICITATION OF

ANY OFFER TO PURCHASE, SUBSCRIBE FOR OR OTHERWISE ACQUIRE, ANY

INVESTMENTS IN ANY JURISDICTION.

23 November 2021

US SOLAR FUND PLC ("USF" or the "Company")

DIVIDEND, QUARTERLY TRADING AND NAV UPDATE

US Solar Fund plc (LON: USF (USD)/USFP (GBP)) is pleased to

announce that its unaudited NAV at 30 September 2021 was $314.7

million or $0.947 per ordinary share, a 0.4% increase from the 30

June 2021 NAV of $313.3 million or $0.943 per ordinary share.

USF is also pleased to announce its Interim Dividend for the

three month period ended 30 September 2021 (Third 2021 Interim

Dividend) of 1.5 cents per Ordinary Share. The Third 2021 Interim

Dividend will be paid on 7 January 2022 to shareholders on the

register as at the close of business on 17 December 2021. The

ex-dividend date is 16 December 2021.

Of this dividend, 1.5 cents are declared as dividend income with

no portion treated as qualifying interest income.

This Third 2021 Interim Dividend is in line with the Company's

target full year dividend of 5.5 cents per Ordinary Share. The

Company expects to declare modestly lower quarterly dividends in

the first and second quarters and slightly higher quarterly

dividends in the third and fourth quarters due to the cash flow

profile of the assets. USF expects to continue covering dividends

paid in 2021 with operating cashflows.

Highlights for the quarter to 30 September 2021:

-- Consistent with the Company's policy, USF's assets were

internally valued this quarter . An uplift in long-term electricity

prices from one of USF's two electricity price forecasters

increased asset valuations which, combined with working capital

movements and dividends paid and accrued, resulted in the small NAV

uplift. USF's other electricity price forecaster expected to

release an updated forecast in November which will be incorporated

in the 31 December 2021 valuations. Discount rates remained

unchanged this period and will be reviewed in the 31 December 2021

valuations.

-- Portfolio production was 7.9% below budgeted expectations for

the quarter. Production over the period had a smaller impact on

revenue generated for the quarter, with revenue 5.9% below budget.

Approximately half of the losses were due to below-average

irradiation with the remaining losses largely attributable to an

equipment outage at Milford in Utah and some other equipment and

grid-related issues across the portfolio. The equipment issue at

Milford was repaired in October 2021 and the project has resumed

normal operations. The other equipment and grid issues have been

resolved and were determined to be transitory.

-- Despite below budget performance, the dividend was

comfortably covered, at 2.57x for the nine months ended 30

September 2021.

-- USF's dividend for the quarter ended 30 June 2021 of 1.25

cents per ordinary share was paid on 29 October 2021. Including the

Third 2021 Interim Dividend, dividends paid and declared for the

2021 financial year thus far total 4.0 cents per ordinary

share.

-- All assets in the portfolio have power purchase agreements (

PPA s) with contracted prices for 100% of electricity generated.

The portfolio weighted average PPA term is 14.6 years as at 30

September 2021, and all PPA counterparties are investment-grade

(S&P rated A to BBB).

-- As of 30 September 2021, the Investment Manager's pipeline

included 4,300MW(DC) of high-quality assets, with an aggregate

value of approximately $4.2 billion in cash equity value and a

weighted-average PPA term of 16.9 years.

The NAV update and the Company's factsheet for Q3 2021 are

available on the Company's website at:

www.ussolarfund.co.uk/investor-centre . A separate Solar Market

Update can be found on the website at:

www.ussolarfund.co.uk/media-and-insights .

For further information, please contact:

US Solar Fund

Whitney Voute +1 718 230 4329

Cenkos Securities plc

James King

Tunga Chigovanyika

Will Talkington +44 20 7397 8900

Jefferies International Limited

Stuart Klein

Gaudi le Roux

Neil Winward +44 20 7029 8000

KL Communications +44 20 3995 6673

Charles Gorman

Will Sanderson

Millie Steyn

About US Solar Fund plc

US Solar Fund plc listed on the premium segment of the London

Stock Exchange in April 2019, following its successful US$200m IPO,

and raised a further $132m in May 2021 taking cumulative proceeds

to $332 million. The Company's investment objective is to provide

investors with attractive and sustainable dividends with an element

of capital growth by investing in a diversified portfolio of solar

power assets in North America and other OECD countries in the

Americas.

US Solar Fund acquires or constructs, owns and operates solar

power assets that are expected to have an asset life of at least 30

years and generate stable and uncorrelated cashflows by selling

electricity to creditworthy offtakers under long-term power

purchase agreements (or PPAs).

Further information on the Company can be found on its website

at http://www.ussolarfund.co.uk .

About the Investment Manager

USF is managed by New Energy Solar Manager (NESM). NESM also

manages New Energy Solar, an Australian Securities Exchange

ASX-listed fund (ASX:NEW) which has committed over US$900m to US

and Australian solar plants since late 2015.

NESM is owned by E&P Funds, the funds management division of

E&P Financial Group, an ASX-listed company (ASX: EP1) with over

A$20 billion of funds under advice.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVEAPFAALFFFFA

(END) Dow Jones Newswires

November 23, 2021 02:00 ET (07:00 GMT)

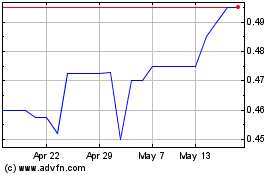

Us Solar (LSE:USF)

Historical Stock Chart

From Jul 2024 to Jul 2024

Us Solar (LSE:USF)

Historical Stock Chart

From Jul 2023 to Jul 2024