TIDMUOG

RNS Number : 5842T

United Oil & Gas PLC

21 March 2023

United Oil & Gas PLC / Index: AIM / Epic: UOG / Sector: Oil

& Gas

21 March 2023

United Oil and Gas plc

("United" or "the Company")

Commencement of Production from the ASH-8 well

United Oil & Gas PLC (AIM: "UOG"), the full-cycle oil and

gas company with a portfolio of production, development,

exploration and appraisal assets is pleased to announce an update

on the ASH-8 development well ("ASH-8") in the Abu Sennan licence,

onshore Egypt. United holds a 22% working interest in the licence,

which is operated by Kuwait Energy Egypt.

Summary

- ASH-8 well commenced production on 16 March at an initial

stabilised rate of c. 2,980 bopd and 2.64 mmscf/d gross (c. 656

bopd and 0.58 mmscf/d net)

- Production has come onstream six weeks ahead of the

anticipated schedule, at a higher rate than originally forecast

resulting in group H1 production now expected to be at the upper

end of the guided range of 700 - 900 bopd net

ASH-8

As previously announced, the ASH-8 development well was

interpreted to have encountered 22 metres of net oil pay in the

primary Alam El Bueib ("AEB") reservoir target, in line with

pre-drill expectations. After reaching TD on the 21 February, the

well was completed and tested on a number of different choke sizes,

as summarised in the table below.

Choke Size Duration of Average gross flow rate

test

Oil (bopd) Gas (mmscf/d) Combined

(boepd)

----------- -------------- ---------

24/64" 16.5 hours 1,737 2.2 2,177

------------ ----------- -------------- ---------

32/64" 6.5 hours 3,114 3.3 3,774

------------ ----------- -------------- ---------

64/64" 6.5 hours 6,023 8.2 7,663

------------ ----------- -------------- ---------

The well has now been tied into the existing facilities and

brought on stream at an initial rate of c. 2,980 bopd and 2.64

mmscf/d gross (656 bopd and 0.58 mmscf/d net) on a 32/64" choke.

The production from the well will continue to be monitored, so that

the long-term production potential can be assessed. However, the

currently stable rates coupled with the lack of water-cut and the

pressures observed in the well provide positive indicators for its

longer-term potential. With the well coming onstream nearly six

weeks ahead of schedule, and with rates above pre-drill

expectations, the Company's H1 actual production is expected to be

at the upper end of the production guidance of 700-900 bopd

net.

The ST-1 rig is now moving towards the ASD-3 location to drill

the second development well in the 2023 drilling programme, which

is expected to spud in the coming weeks.

Brian Larkin, CEO, commented:

"We are very happy with the results from the ASH-8 well, and it

is pleasing to see the well being brought on stream at a stabilised

production rate of over 2,900 bopd some six weeks ahead of

schedule. This is the fifth well in the highly productive ASH

field, which has so far produced in excess of 4 million barrels of

oil. The successful result at ASH-8 will have a positive impact on

group production levels and revenue and further highlights the

long-term value of the field. We look forward to drilling the next

development well at ASD-3 on a location that was high-graded by the

JV Partners following the success of the ASD-2 well in March

2022."

END

Jonathan Leather, an Executive Director of the Company, who has

over 20 years of relevant experience in the oil and gas industry,

has reviewed and approved the information contained in this

announcement. Dr Jonathan Leather is a qualified person as defined

in the guidance note for Mining Oil & Gas Companies of the

London Stock Exchange and is a member of the Petroleum Exploration

Society of Great Britain and the Society of Petroleum

Engineers.

This announcement contains inside information for the purposes

of Article 7 of Regulation 2014/596/EU which is part of domestic UK

law pursuant to the Market Abuse (Amendment) (EU Exit) regulations

(SI 2019/310).

Glossary:

bopd - barrels of oil per day

boepd - barrels of oil equivalent per day

choke- device to control the flow of fluids produced from

wells

JV Partners- Joint Venture Partners

mmscf/d - million standard cubic feet per day

TD - Total Depth

Enquiries

United Oil & Gas Plc (Company)

Brian Larkin, CEO brian.larkin@uogplc.com

Sharan Dhami, Head of IR & sharan.dhami@uogplc.com

ESG

Beaumont Cornish Limited (Nominated

Adviser)

Roland Cornish | Felicity Geidt +44 (0) 20 7628 3396

Tennyson Securities (Joint

Broker)

Peter Krens +44 (0) 020 7186 9030

Optiva Securities Limited (Joint

Broker)

Christian Dennis +44 (0) 20 3137 1902

Camarco (Financial PR)

Georgia Edmonds | Emily Hall +44 (0) 20 3757 4983 |

|Sam Morris uog@camarco.co.uk

Notes to Editors

United Oil & Gas is a high growth oil and gas company with a

portfolio of low-risk, cash generative production, development,

appraisal and exploration assets across Egypt, UK and a high impact

exploration licence in Jamaica.

The business is led by an experienced management team with a

strong track record of growing full cycle businesses, partnered

with established industry players and is well positioned to deliver

future growth through portfolio optimisation and targeted

acquisitions.

United Oil & Gas is listed on the AIM market of the London

Stock Exchange. For further information on United Oil and Gas

please visit www.uogplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDPPURCWUPWGMU

(END) Dow Jones Newswires

March 21, 2023 03:00 ET (07:00 GMT)

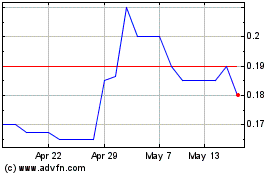

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Jan 2025 to Feb 2025

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Feb 2024 to Feb 2025