TIDMTAM

RNS Number : 2495W

Titanium Asset Management Corp

16 November 2010

Titanium Asset Management Corp.

Reports 2010 Third Quarter Results

Milwaukee, WI, November 16, 2010 - Titanium Asset Management Corp. (AIM - TAM)

today reported results for the third quarter ended September 30, 2010.

Highlights for the third quarter are as follows:

· Managed and fee paying assets increased by 2.0% from $9,371.4 million to

$9,560.3 million during the third quarter of 2010 primarily reflecting strong

returns in both fixed income and equity assets.

· Average managed and fee paying assets of $9,465.9 million for the third

quarter of 2010, an increase of 6.6% over $8,882.7 million for the same period

last year.

· Operating revenues of $5,822,000 for the third quarter of 2010, a 9.2%

increase over operating revenues of $5,335,000 for the same period last year.

· Adjusted EBITDA of $174,000 for the third quarter of 2010 compared to an

Adjusted EBITDA deficit of $557,000 for the same period last year.

· Net investment income of $290,000 for the third quarter of 2010 compared

to $126,000 for the same period last year.

· Net loss of $5,484,000, or $0.27 per diluted common share, for the third

quarter of 2010 compared to a net loss of $6,197,000, or $0.30 per diluted

common share, for the third quarter of 2009.

Highlights for the first nine months of the year are as follows:

· Average managed and fee paying assets of $9,472.2 million for the first

nine months of 2010, an increase of 9.8% over $8,629.0 million for the same

period last year.

· Operating revenues of $17,064,000 for the first nine months of 2010, a

9.2% increase over operating revenues of $15,631,000 for the same period last

year.

· Adjusted EBITDA deficit of $1,064,000 for the first nine months of 2010

compared to an Adjusted EBITDA deficit of $2,584,000 for the same period last

year. Excluding severance costs, the Adjusted EBITDA deficit was $251,000 for

the first nine months of 2010.

· Net investment income of $1,025,000 for the first nine months of 2010

compared to $173,000 for the first nine months of 2009.

· Net loss of $7,570,000, or $0.37 per diluted common share, for the first

nine months of 2010 compared to a net loss of $8,934,000, or $0.43 per diluted

common share, for the first nine months of 2009.

Commenting on these results, Robert Brooks, CEO of Titanium Asset Management

Corp. said:

"We are pleased to report a return to positive EBITDA for the first quarter

since we became a public reporting company in the third quarter of 2008. The

positive operating performance was achieved through continuing growth in

revenues and through significant reductions in our structural administrative

expenses."

"In the third quarter, we continued our positive momentum in growing the

business, with our average assets under management for the third quarter

increasing 6% over the prior year average and with our distributed assets

increasing 7%. As a result, revenue in the third quarter of 2010 grew by

$487,000, or 9%, over the prior year period. We are particularly pleased with

the strong growth achieved by our real estate advisory practice, which added $90

million of new assets during the quarter and $170 million of new assets during

the year-to-date period."

"We also continued to achieve excellent investment performance, with 87% of our

managed assets outperforming their benchmarks. In addition, several of our

significant strategies are now in the upper deciles of our peer group rankings

for three year investment performance. We believe these strong performance

rankings position us for strong growth over the next year."

"Through our integration activities, we have achieved significant reductions in

our structural administrative expenses. Since the first quarter following the

acquisition of Boyd in 2008, we have reduced headcount from 97 to 82 and have

reduced our annualized administrative expenses from approximately $25.1 million

to $22.7 million. We believe these reductions now position us to achieve

significant growth in profitability as we achieve revenue growth."

For further information please contact:

Titanium Asset Management Corp.

Robert Brooks, CEO

312-335-8300

Seymour Pierce Ltd

Jonathan Wright

+44 20 7107 8000

Assets Under Management

Our managed and distributed assets totaled $9,560.3 million at September 30,

2010, an increase of 2.0% over the amount at June 30, 2010, and an increase of

4.8% over the amount at December 31, 2009. Distributed assets are those managed

by a hedge fund advisor on which we earn referral fees. The changes in managed

and distributed assets over the three months ended September 30, 2010 were as

follows:

+---------------------------+----------+-------------+----------+

| | Managed |Distributed | Total |

| | Assets | Assets | |

+---------------------------+----------+-------------+----------+

| | (in millions) |

+---------------------------+-----------------------------------+

| | | | |

+---------------------------+----------+-------------+----------+

| Balance at June 30, 2010 | $ | $ | $ |

| | 8,415.8 | 955.6 | 9,371.4 |

+---------------------------+----------+-------------+----------+

| Net flows | (168.2) | - | (168.2) |

+---------------------------+----------+-------------+----------+

| Market value change | 315.2 | 41.9 | 357.1 |

+---------------------------+----------+-------------+----------+

| Balance at September 30, | $ | $ | $ |

| 2010 | 8,562.8 | 997.5 | 9,560.3 |

+---------------------------+----------+-------------+----------+

| Average assets under | $ | $ | $ |

| management | 8,489.3 | 976.6 | 9,465.9 |

+---------------------------+----------+-------------+----------+

Net flows are a combination of new and lost accounts plus contributions and

withdrawals from existing accounts. During the quarter, we experienced net

outflows primarily as a result of withdrawals on the part of pension clients of

NIS and continued softness in our retail distribution channel, in particular

with equity mandates. The market value change reflects solid performance for

fixed income assets, which comprise approximately 89% of our assets under

management, and a strong recovery for equity assets.

The changes in managed and distributed assets over the nine months ended

September 30, 2010 were as follows:

+---------------------------+----------+-------------+----------+

| | Managed |Distributed | Total |

| | Assets | Assets | |

+---------------------------+----------+-------------+----------+

| | (in millions) |

+---------------------------+-----------------------------------+

| | | | |

+---------------------------+----------+-------------+----------+

| Balance at December 31, | $ | $ | $ |

| 2009 | 8,151.4 | 974.9 | 9,126.3 |

+---------------------------+----------+-------------+----------+

| Net flows | (126.2) | 24.2 | (102.0) |

+---------------------------+----------+-------------+----------+

| Market value change | 537.6 | (1.6) | 536.0 |

+---------------------------+----------+-------------+----------+

| Balance at September 30, | $ | $ | $ |

| 2010 | 8,562.8 | 997.5 | 9,560.3 |

+---------------------------+----------+-------------+----------+

| Average assets under | $ | $ | $ |

| management | 8,492.2 | 980.0 | 9,472.2 |

+---------------------------+----------+-------------+----------+

Net flows for the nine months ended September 30, 2010 were essentially flat as

new business generated by our real estate advisory service was offset by the

outflows from NIS and the retail distribution channel. Outflows for the nine

month period ended September 30, 2010 also include the elimination of

approximately $100 million of advisory-only accounts whose fees are not

asset-based. The market value change reflects solid performance for fixed

income assets, which comprise approximately 89% of our assets under management,

and modest gains for equity assets.

For the nine months ended September 30, 2010, 87% of our managed and fee paying

assets with defined performance benchmarks outperformed their respective

benchmarks.

Our assets under management by major investment strategy were as follows:

+---------------------------+-----------+-----------------+-----------+-----------------+

| | September 30, | September 30, |

| | 2010 | 2009 |

+---------------------------+-----------------------------+-----------------------------+

| | (in | % of | (in | % of |

| |millions) | total |millions) | total |

+---------------------------+-----------+-----------------+-----------+-----------------+

| | | | | |

+---------------------------+-----------+-----------------+-----------+-----------------+

| Fixed income | $ | 88.9% | $ | 90.3% |

| | 7,607.5 | | 7,516.9 | |

+---------------------------+-----------+-----------------+-----------+-----------------+

| Equity | 749.0 | 8.7% | 780.0 | 9.4% |

+---------------------------+-----------+-----------------+-----------+-----------------+

| Real estate | 206.3 | 2.4% | 23.2 | 0.3% |

+---------------------------+-----------+-----------------+-----------+-----------------+

| Balance at end of period | $ | 100.0% | $ | 100.0% |

| | 8,562.8 | | 8,320.1 | |

+---------------------------+-----------+-----------------+-----------+-----------------+

Our assets under management by broad client type were as follows:

+---------------------------+-----------+----------------+-----------+----------------+

| | September 30, | September 30, |

| | 2010 | 2009 |

+---------------------------+----------------------------+----------------------------+

| | (in | % of | (in | % of |

| |millions) | total |millions) | total |

+---------------------------+-----------+----------------+-----------+----------------+

| | | | | |

+---------------------------+-----------+----------------+-----------+----------------+

| Institutional | $ | 85.1% | $ | 79.7% |

| | 7,286.9 | | 6,634.3 | |

+---------------------------+-----------+----------------+-----------+----------------+

| Retail | 1,275.9 | 14.9% | 1,685.8 | 20.3% |

+---------------------------+-----------+----------------+-----------+----------------+

| Balance at end of period | $ | 100.0% | $ | 100.0% |

| | 8,562.8 | | 8,320.1 | |

+---------------------------+-----------+----------------+-----------+----------------+

Operating Results

+-------------------------+-------------+-------------+-------------+--------------+

| | Three Months | Nine Months Ended |

| | Ended | September 30, |

| | September 30, | |

+-------------------------+---------------------------+----------------------------+

| | 2010 | 2009 | 2010 | 2009 |

+-------------------------+-------------+-------------+-------------+--------------+

| | | | | |

+-------------------------+-------------+-------------+-------------+--------------+

| Average assets under | $ | $ | $ | $ |

| management (in | 8,489.3 | 7,967.5 | 8,492.2 | 7,764.3 |

| millions) | | | | |

+-------------------------+-------------+-------------+-------------+--------------+

| Average fee rate (basis | 25 | 24 | 24 | 24 |

| points) | | | | |

+-------------------------+-------------+-------------+-------------+--------------+

| | | | | |

+-------------------------+-------------+-------------+-------------+--------------+

| Operating revenue | $ | $ | $ | $ |

| | 5,822,000 | 5,335,000 | 17,064,000 | 15,631,000 |

+-------------------------+-------------+-------------+-------------+--------------+

| Adjusted EBITDA | 174,000 | (557,000) | (1,064,000) | (2,584,000) |

| (deficit)(1) | | | | |

+-------------------------+-------------+-------------+-------------+--------------+

| Impairment of goodwill | 5,100,000 | 4,847,000 | 5,100,000 | 4,847,000 |

+-------------------------+-------------+-------------+-------------+--------------+

| Operating loss | (5,774,000) | (6,557,000) | (8,579,000) | (10,884,000) |

+-------------------------+-------------+-------------+-------------+--------------+

| Net loss | (5,484,000) | (6,197,000) | (7,570,000) | (8,934,000) |

+-------------------------+-------------+-------------+-------------+--------------+

| | | | | |

+-------------------------+-------------+-------------+-------------+--------------+

| Earnings per share: | | | | |

+-------------------------+-------------+-------------+-------------+--------------+

| Basic | $ | $ | $ | $ |

| | (0.27) | (0.30) | (0.37) | (0.43) |

+-------------------------+-------------+-------------+-------------+--------------+

| Diluted | $ | $ | $ | $ |

| | (0.27) | (0.30) | (0.37) | (0.43) |

+-------------------------+-------------+-------------+-------------+--------------+

(1) See the accompanying table on page 9 for a definition of Adjusted EBITDA,

a non-GAAP financial measure. The table provides a description of this non-GAAP

financial measure and a reconciliation to the most directly comparable GAAP

measure.

Our third quarter revenues increased $487,000, or 9.1%, relative to the third

quarter of 2009 due to the increase in average assets under management. The

increase in average assets under management reflects asset gains from our

participation in the TALF program and from our new real estate investment

advisory business, as well as strong market returns for fixed income assets.

For the year to date periods, our 2010 revenues increased by $1,433,000, or

9.2%, relative to 2009 due to the increase in average assets under management.

Our Adjusted EBITDA of $174,000 for the third quarter of 2010 reflects an

improvement of $731,000 over the prior year amount. The improvement reflects

the 9.1% increase in revenues and a 5.9% decrease in administrative expenses.

Our administrative expenses declined $357,000, as a result of the ongoing

integration activities and reduced operating staff.

Our Adjusted EBITDA deficit of $1,064,000 for the first nine months of 2010

includes $813,000 of severance costs. Excluding severance costs, our Adjusted

EBITDA deficit would have been $251,000, an improvement of $2,333,000 over the

prior year amount. The improvement reflects the 9.2% increase in revenues and

an 7.3% decrease in administrative expenses, excluding severance costs. Our

administrative expenses, excluding severance costs, declined $1,365,000, as a

result of the ongoing integration activities and reduced operating staff.

We completed the acquisition of Boyd at December 31, 2008. Since the first

quarter of 2009, we have reduced our headcount from 97 to 82 and we have reduced

annualized administrative expenses of approximately $25.1 million to

approximately $22.7 million at September 30, 2010.

Goodwill Impairment

We perform goodwill impairment tests annually, or whenever events or changes in

circumstances indicate that the carrying amount of goodwill might not be

recoverable, using a two-step process with the first step being a test for

potential impairment by comparing our reporting unit's fair value with its

carrying amount (including goodwill). If the carrying amount of the reporting

unit exceeds its fair value, we complete the second step under which the fair

value of the reporting unit is allocated to its assets and liabilities,

including recognized and unrecognized intangibles. If the implied fair value of

the reporting unit's goodwill is lower than its carrying amount, goodwill is

impaired and written down to its implied fair value. We complete our annual

test for impairment during our fourth quarter.

For purposes of testing goodwill for impairment, the Company attributes all

goodwill to a single reporting unit. We have aggregated all of our subsidiaries

into a single reporting unit because they provide similar services to similar

clients, operate in the same regulatory framework, and share similar economic

characteristics. The Company's shared sales force is organized to market the

full range of the Company's products and services.

We estimate fair value averaging fair value established using an income approach

and fair value established using a market approach. The fair value from the

income approach was weighted 75%, while the fair value from the market approach

was weighted 25%. The weighting reflects that the market approach includes more

mature asset management companies with greater scale than the Company. We use

independent valuation specialists to assist us in our valuation process.

The income approach uses a discounted cash flow model that takes into account

assumptions that marketplace participants would use in their estimates of fair

value, current period actual results, and forecasted results for future periods

that have been reviewed by senior management. In preparing our forecasts, we

considered historical and projected growth rates, our business plans, prevailing

business conditions and trends, anticipated needs for working capital and

capital expenditures, and historical and expected levels and trends of operating

profitability.

The market approach employs market multiples for comparable companies. Fair

value estimates are established using multiples of assets under management and

current and forward multiples of revenue and earnings before income taxes,

depreciation and amortization (referred to as EBITDA).

Based on interim results through September 30, 2010, initial work in connection

with preparing our 2011 budget, and some trading activity in our common stock,

we determined that we should complete a goodwill impairment test as of September

30, 2010. For the current operating forecasts, our estimates for net inflows of

assets under management and market returns resulted in estimated revenue growth

rates of approximately 9% per annum, which are less than the estimated growth

rates in the immediately prior valuation. Cash flows beyond the five year

forecast period were projected at 4% per annum. We used a weighted average cost

of capital of 14.5% determined using the capital asset pricing model, which is

consistent with the rate used in the immediately prior valuation.

Upon completion of the goodwill impairment test as of September 30, 2010, we

concluded that our recorded goodwill balance was impaired and recorded an

impairment charge of $5,100,000 in the third quarter of 2010. In addition, we

expect to settle the remaining acquisition obligation for Boyd in the fourth

quarter for the full $8,000,000. This settlement would result in an additional

$8,000,000 of goodwill. However, based on the current estimates, we expect will

have to take an additional goodwill impairment charge for this entire amount in

the fourth quarter of 2010.

During 2009, we incurred impairment charges of $8,489,000, of which $4,847,000

was recorded in the third quarter of 2009 and $3,642,000 was recorded in the

fourth quarter of 2009.

Forward-looking Statements

This press release contains certain statements that are "forward-looking

statements" within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are subject to a number of assumptions, risks, and

uncertainties, many of which are beyond the control of Titanium.

Any forward-looking statements made in this press release speak as of the date

made and are not guarantees of future performance. Actual results or

developments may differ materially from the expectations expressed or implied in

the forward-looking statements, and the Company undertakes no obligation to

update any such statements. Results may differ significantly due to market

fluctuations that alter our assets under management; termination of investment

advisory agreements; impairment of goodwill and other intangible assets; our

inability to compete; market pressure on investment advisory fees; ineffective

management of risk; changes in interest rates, equity prices, liquidity of

global markets and international and regional political conditions; or actions

taken by Clal Finance Ltd., as our significant stockholder. Additional factors

that could influence Titanium's financial results are included in its Securities

and Exchange Commission filings, including its Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

The Company's Quarterly Report on Form 10-Q for the three months ended September

30, 2010, is expected to be filed with the Securities and Exchange Commission on

or before November 15, 2010. The report will be available on the SEC's website

at www.sec.gov and on the Company's website at www.ti-am.com.

+--------------------------------------------------------------------+

| Titanium Asset Management Corp. |

| Condensed Consolidated Balance Sheets |

+--------------------------------------------------------------------+

+----------------------------------------------+--------------+--------------+

| | September | December |

| | 30, | 31, 2009 |

| | 2010 | |

+----------------------------------------------+--------------+--------------+

| | (unaudited) | |

+----------------------------------------------+--------------+--------------+

| Assets | | |

+----------------------------------------------+--------------+--------------+

| Current assets | | |

+----------------------------------------------+--------------+--------------+

| Cash and cash equivalents | $ | $ |

| | 1,599,000 | 4,773,000 |

+----------------------------------------------+--------------+--------------+

| Investments | 9,351,000 | 12,549,000 |

+----------------------------------------------+--------------+--------------+

| Accounts receivable | 4,014,000 | 5,030,000 |

+----------------------------------------------+--------------+--------------+

| Other current assets | 1,509,000 | 1,162,000 |

+----------------------------------------------+--------------+--------------+

| Total current assets | 16,473,000 | 23,514,000 |

+----------------------------------------------+--------------+--------------+

| | | |

+----------------------------------------------+--------------+--------------+

| Investments in affiliates | 6,423,000 | 2,179,000 |

+----------------------------------------------+--------------+--------------+

| Property and equipment, net | 488,000 | 427,000 |

+----------------------------------------------+--------------+--------------+

| Goodwill | 23,047,000 | 28,147,000 |

+----------------------------------------------+--------------+--------------+

| Intangible assets, net | 22,434,000 | 24,920,000 |

+----------------------------------------------+--------------+--------------+

| Total assets | $ | $ |

| | 68,865,000 | 79,187,000 |

+----------------------------------------------+--------------+--------------+

| | | |

+----------------------------------------------+--------------+--------------+

| Liabilities and Stockholders' Equity | | |

+----------------------------------------------+--------------+--------------+

| Current liabilities | | |

+----------------------------------------------+--------------+--------------+

| Accounts payable | $ | $ |

| | 64,000 | 237,000 |

+----------------------------------------------+--------------+--------------+

| Acquisition payments due | - | 1,746,000 |

+----------------------------------------------+--------------+--------------+

| Other current liabilities | 3,004,000 | 3,504,000 |

+----------------------------------------------+--------------+--------------+

| Total current liabilities | 3,068,000 | 5,487,000 |

+----------------------------------------------+--------------+--------------+

| | | |

+----------------------------------------------+--------------+--------------+

| Acquisition payments due | 960,000 | 960,000 |

+----------------------------------------------+--------------+--------------+

| Total liabilities | 4,028,000 | 6,447,000 |

+----------------------------------------------+--------------+--------------+

| Commitments and contingencies | | |

+----------------------------------------------+--------------+--------------+

| Stockholders' equity | | |

+----------------------------------------------+--------------+--------------+

| Common stock, $0.0001 par value; 54,000,000 | 2,000 | 2,000 |

| shares authorized; 20,491,824 shares issued | | |

| and outstanding at September 30, 2010 and | | |

| 20,564,816 shares issued and outstanding at | | |

| December 31, 2009 | | |

+----------------------------------------------+--------------+--------------+

| Restricted common stock, $0.0001 par value; | - | - |

| 720,000 shares authorized; 612,716 issued | | |

| and outstanding at September 30, 2010 and | | |

| December 31, 2009 | | |

+----------------------------------------------+--------------+--------------+

| Preferred stock, $0.0001 par value; | - | - |

| 1,000,000 shares authorized; none issued | | |

+----------------------------------------------+--------------+--------------+

| Additional paid-in capital | 100,135,000 | 100,332,000 |

+----------------------------------------------+--------------+--------------+

| Accumulated deficit | (35,336,000) | (27,766,000) |

+----------------------------------------------+--------------+--------------+

| Other comprehensive income | 36,000 | 172,000 |

+----------------------------------------------+--------------+--------------+

| Total stockholders' equity | 64,837,000 | 72,740,000 |

+----------------------------------------------+--------------+--------------+

| Total liabilities and stockholders' equity | $ | $ |

| | 68,865,000 | 79,187,000 |

+----------------------------------------------+--------------+--------------+

+-------------------------------------------------------------------------+

| Titanium Asset Management Corp. |

| Condensed Consolidated Statements of Operations |

| (unaudited) |

+-------------------------------------------------------------------------+

+------------------------------+------------------+------------------+------------------+-------------------+

| | Three Months | Nine Months Ended |

| | Ended | September 30, |

| | September 30, | |

+------------------------------+-------------------------------------+--------------------------------------+

| | 2010 | 2009 | 2010 | 2009 |

+------------------------------+------------------+------------------+------------------+-------------------+

| | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| Operating revenues | $ | $ | $ | $ |

| | 5,822,000 | 5,335,000 | 17,064,000 | 15,631,000 |

+------------------------------+------------------+------------------+------------------+-------------------+

| | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| Operating expenses: | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| Administrative | 5,668,000 | 6,025,000 | 18,057,000 | 18,609,000 |

+------------------------------+------------------+------------------+------------------+-------------------+

| Amortization of intangible | 828,000 | 1,020,000 | 2,486,000 | 3,059,000 |

| assets | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| Impairment of goodwill | 5,100,000 | 4,847,000 | 5,100,000 | 4,847,000 |

+------------------------------+------------------+------------------+------------------+-------------------+

| Total operating expenses | 11,596,000 | 11,892,000 | 25,643,000 | 26,515,000 |

+------------------------------+------------------+------------------+------------------+-------------------+

| Operating loss | (5,774,000) | (6,557,000) | (8,579,000) | (10,884,000) |

+------------------------------+------------------+------------------+------------------+-------------------+

| | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| Other income | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| Interest income | 69,000 | 98,000 | 233,000 | 333,000 |

+------------------------------+------------------+------------------+------------------+-------------------+

| Gain (loss) on investments | 54,000 | 28,000 | 181,000 | (160,000) |

+------------------------------+------------------+------------------+------------------+-------------------+

| Income from equity investees | 167,000 | - | 611,000 | - |

+------------------------------+------------------+------------------+------------------+-------------------+

| Interest expense | - | (15,000) | (16,000) | (44,000) |

+------------------------------+------------------+------------------+------------------+-------------------+

| Loss before taxes | (5,484,000) | (6,446,000) | (7,570,000) | (10,755,000) |

+------------------------------+------------------+------------------+------------------+-------------------+

| | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| Income tax benefit | - | (249,000) | - | (1,821,000) |

+------------------------------+------------------+------------------+------------------+-------------------+

| | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| Net loss | $ | $ | $ | $ |

| | (5,484,000) | (6,197,000) | (7,570,000) | (8,934,000) |

+------------------------------+------------------+------------------+------------------+-------------------+

| | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| Earnings (loss) per share | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| Basic | $ | $ | $ | $ |

| | (0.27) | (0.30) | (0.37) | (0.43) |

+------------------------------+------------------+------------------+------------------+-------------------+

| Diluted | $ | $ | $ | $ |

| | (0.27) | (0.30) | (0.37) | (0.43) |

+------------------------------+------------------+------------------+------------------+-------------------+

| | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| Weighted average number of | | | | |

| common shares outstanding: | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| Basic | 20,683,824 | 20,546,490 | 20,691,303 | 20,546,490 |

+------------------------------+------------------+------------------+------------------+-------------------+

| Diluted | 20,683,824 | 20,546,490 | 20,691,303 | 20,546,490 |

+------------------------------+------------------+------------------+------------------+-------------------+

| | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

| | | | | |

+------------------------------+------------------+------------------+------------------+-------------------+

+--------------------------------------------------------------------+

| Titanium Asset Management Corp. |

| Condensed Consolidated Statements of Cash Flows |

| (unaudited) |

+--------------------------------------------------------------------+

+----------------------------------------------+--------------+--------------+

| | Nine Months Ended |

| | September 30, |

+----------------------------------------------+-----------------------------+

| | 2010 | 2009 |

+----------------------------------------------+--------------+--------------+

| | | |

+----------------------------------------------+--------------+--------------+

| Cash flows from operating activities | | |

+----------------------------------------------+--------------+--------------+

| Net loss | $ | $ |

| | (7,570,000) | (8,934,000) |

+----------------------------------------------+--------------+--------------+

| Adjustments to reconcile net loss to net | | |

| cash used in operating activities: | | |

+----------------------------------------------+--------------+--------------+

| Amortization of intangible assets | 2,486,000 | 3,059,000 |

+----------------------------------------------+--------------+--------------+

| Impairment of goodwill | 5,100,000 | 4,847,000 |

+----------------------------------------------+--------------+--------------+

| Depreciation | 67,000 | 80,000 |

+----------------------------------------------+--------------+--------------+

| Share compensation expense (credit) | (139,000) | 313,000 |

+----------------------------------------------+--------------+--------------+

| Loss (gain) on investments | (181,000) | 160,000 |

+----------------------------------------------+--------------+--------------+

| Income from equity investees | (611,000) | - |

+----------------------------------------------+--------------+--------------+

| Distributions from equity investees | 367,000 | - |

+----------------------------------------------+--------------+--------------+

| Accretion of acquisition payments | 16,000 | 40,000 |

+----------------------------------------------+--------------+--------------+

| Deferred income taxes | - | (1,821,000) |

+----------------------------------------------+--------------+--------------+

| Changes in assets and liabilities: | | |

+----------------------------------------------+--------------+--------------+

| Decrease in accounts receivable | 1,016,000 | 538,000 |

+----------------------------------------------+--------------+--------------+

| Decrease in other current assets | (347,000) | (440,000) |

+----------------------------------------------+--------------+--------------+

| Decrease in accounts payable | (173,000) | (398,000) |

+----------------------------------------------+--------------+--------------+

| Decrease in other current liabilities | (576,000) | 876,000 |

+----------------------------------------------+--------------+--------------+

| Net cash used in operating activities | (545,000) | (1,680,000) |

+----------------------------------------------+--------------+--------------+

| | | |

+----------------------------------------------+--------------+--------------+

| Cash flows from investing activities | | |

+----------------------------------------------+--------------+--------------+

| Purchases of investments | (12,163,000) | (16,340,000) |

+----------------------------------------------+--------------+--------------+

| Sales and redemptions of investments | 15,406,000 | 13,929,000 |

+----------------------------------------------+--------------+--------------+

| Investments in equity investees | (4,000,000) | - |

+----------------------------------------------+--------------+--------------+

| Purchases of property and equipment | (128,000) | (128,000) |

+----------------------------------------------+--------------+--------------+

| Acquisitions of subsidiaries, net of cash | (1,744,000) | (8,151,000) |

| acquired | | |

+----------------------------------------------+--------------+--------------+

| Net cash used in investing activities | (2,629,000) | (10,690,000) |

+----------------------------------------------+--------------+--------------+

| | | |

+----------------------------------------------+--------------+--------------+

| Net decrease in cash and cash equivalents | (3,174,000) | (12,370,000) |

+----------------------------------------------+--------------+--------------+

| | | |

+----------------------------------------------+--------------+--------------+

| Cash and cash equivalents: | | |

+----------------------------------------------+--------------+--------------+

| Beginning | 4,773,000 | 18,753,000 |

+----------------------------------------------+--------------+--------------+

| Ending | $ | $ |

| | 1,599,000 | 6,383,000 |

+----------------------------------------------+--------------+--------------+

| | | |

+----------------------------------------------+--------------+--------------+

+-------------------------------------------------------------------------+

| Titanium Asset Management Corp. |

| Reconciliation of Adjusted EBITDA |

| (unaudited) |

+-------------------------------------------------------------------------+

+------------------------------+-------------+-------------+-------------+--------------+

| | Three Months | Nine Months Ended |

| | Ended | September 30, |

| | September 30, | |

+------------------------------+---------------------------+----------------------------+

| | 2010 | 2009 | 2010 | 2009 |

+------------------------------+-------------+-------------+-------------+--------------+

| | | | | |

+------------------------------+-------------+-------------+-------------+--------------+

| Operating loss | $ | $ | $ | $ |

| | (5,774,000) | (6,557,000) | (8,579,000) | (10,884,000) |

+------------------------------+-------------+-------------+-------------+--------------+

| | | | | |

+------------------------------+-------------+-------------+-------------+--------------+

| Amortization of intangible | 828,000 | 1,020,000 | 2,487,000 | 3,059,000 |

| assets | | | | |

+------------------------------+-------------+-------------+-------------+--------------+

| Impairment of goodwill | 5,100,000 | 4,847,000 | 5,100,000 | 4,847,000 |

+------------------------------+-------------+-------------+-------------+--------------+

| Depreciation expense | 20,000 | 26,000 | 67,000 | 80,000 |

+------------------------------+-------------+-------------+-------------+--------------+

| Share compensation expense | - | 107,000 | (139,000) | 314,000 |

| (credit) | | | | |

+------------------------------+-------------+-------------+-------------+--------------+

| | | | | |

+------------------------------+-------------+-------------+-------------+--------------+

| Adjusted EBITDA deficit(1) | $ | $ | $ | $ |

| | 174,000 | (557,000) | (1,064,000) | (2,584,000) |

+------------------------------+-------------+-------------+-------------+--------------+

Notes:

(1) Adjusted EBITDA is defined as operating income or loss before non-cash

charges for amortization and impairment of intangible assets and goodwill,

depreciation, and share compensation expense. We believe Adjusted EBITDA is

useful as an indicator of our ongoing performance and our ability to service

debt, make new investments, and meet working capital obligations. Adjusted

EBITDA, as we calculate it may not be consistent with computations made by other

companies. We believe that many investors use this information when analyzing

the operating performance, liquidity, and financial position of companies in the

investment management industry.

This information is provided by RNS

The company news service from the London Stock Exchange

END

QRTZMMMMLVZGGZG

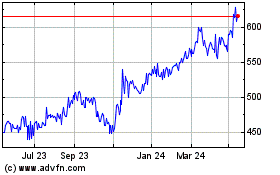

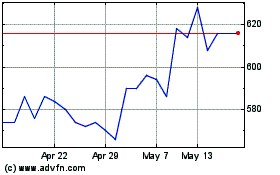

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024