LLC "AISI VIDA" 15/10/2014 10.000.000 310.000 310.000

--------------------- ------------ ------------ ---------------------- ---------------------

LLC "AISI VAL" 15/10/2014 7.000.000 210.000 210.000

--------------------- ------------ ------------ ---------------------- ---------------------

LLC "AISI ROSLAV" 15/10/2014 10.000.000 310.000 310.000

--------------------- ------------ ------------ ---------------------- ---------------------

LLC " SI KONSTA" 15/10/2014 8.000.000 610.000 610.000

--------------------- ------------ ------------ ---------------------- ---------------------

LLC "AISI ILVO" 15/10/2014 10.000.000 610.000 610.000

--------------------- ------------ ------------ ---------------------- ---------------------

LLC "AISI DONETSK" 19/11/2014 40.000.000 930.000 930.000

--------------------- ------------ ------------ ---------------------- ---------------------

LLC "TORGOVI CENTR" 18/10/2014 10.000.000 120.000 120.000

--------------------- ------------ ------------ ---------------------- ---------------------

25. Contingent liabilities

The Group is involved in various legal proceedings in the

ordinary course of its business.

25.1 Tax litigation

The Group performed during the reporting period most of its

operations in the Ukraine and therefore within the jurisdiction of

the Ukrainian tax authorities. The Ukrainian tax system can be

characterized by numerous taxes and frequently changing

legislation, which may be applied retroactively, open to wide

interpretation and in some cases, is conflicting. Instances of

inconsistent opinions between local, regional, and national tax

authorities and between the National Bank of Ukraine and the

Ministry of Finance are not unusual. Tax declarations are subject

to review and investigation by a number of authorities, that are

enacted by law to impose severe fines and penalties and interest

charges. A tax year remains open for review by the tax authorities

during the three subsequent calendar years, however, under certain

circumstances a tax year may remain open for longer. These facts

create tax risks which are substantially more significant than

those typically found in countries with more developed tax systems.

Management believes that it has adequately provided for tax

liabilities, based on its interpretation of tax legislation,

official pronouncements and court decisions. However, the

interpretations of the relevant authorities could differ and the

effect on these consolidated financial statements, if the

authorities were successful in enforcing their interpretations,

could be significant.

At the same time the Group's entities are involved in court

procedures with tax authorities; Management believes that the

estimates provided within the financial statements present a

reasonable estimate of the outcome of these court cases.

25.2 Construction related litigation

There are no material claims from constructors due to the

postponement of projects or delayed delivery other than those

appearing in the financial statements.

25.3 Other Litigation

Management does not believe that the result of any legal

proceedings will have a material effect on the Group's financial

position or the results of its operations other than the one

already provided for, within the financial statements.

In the case of the ex management company AISI Realty Capital

LLC, initiating a liquidation procedure in Cyprus against the

Company, the company has created a provision that equals the amount

requested pursuant to the settlement agreement signed in July 2011

(Note 28).

25.4 Other Contingent Liabilities

The Group had no other contingent liabilities as at 30 June

2012.

26. Commitments

26.1 Capital commitments

The Group has two (2) construction agreements:

a) for the construction of Brovary Logistics Park (Note 20)

b) for the construction of Bella Logistics Center (Note 20)

26.2 Operational commitments

In December 2011 the Company entered into a three year Property

Management and Maintenance Service Agreement with DTZ Consulting

Limited Liability Company. The Agreement stipulates a range of

services that were outsourced by Terminal Brovary to DTZ (billing,

servicing, maintaining) so as to both reduce cost and improve

quality. The Company has the right to terminate the Agreement with

DTZ unilaterally before its expiration date subject to prior

written notice to DTZ for 90 days before the desired date of

termination.

27. Financial Risk Management

27.1 Capital Risk Management

The Group manages its capital to ensure that it will be able to

continue as a going concern while maximizing the return to

stakeholders through the optimization of the debt-equity structure

and value enhancing actions in respect of its portfolio of

investments. The capital structure of the Group consists of

borrowings (note 19), cash and cash equivalents, receivables (note

13) and equity attributable to ordinary shareholders (issued

capital, reserves and retained earnings).

The Group is not subject to any externally imposed capital

requirements.

Management reviews the capital structure on an on-going basis.

As part of the review Management considers the differential capital

costs in the debt and equity markets, the timing at which each

investment project requires funding and the operating requirements

so as to proactively provide for capital either in the form of

equity (issuance of shares to the Group's shareholders) or in the

form of debt. Management balances the capital structure of the

Group with a view of maximizing the shareholder's Return on Equity

(ROE) while adhering to the operational requirements of the

property assets and exercising prudent judgment as to the extent of

gearing.

27.2 Significant Accounting Policies

Details of the significant accounting policies and methods

adopted, including the criteria for recognition, the basis on which

income and expenses are recognized, in respect of each class of

financial asset, financial liabilities and equity instruments are

disclosed in note 3 of the financial statements.

27.3 Categories of Financial Instruments

Financial Assets Note 30/06/2012 30/06/2011

----------------------------------------- ----- ----------- -----------

US$ US$

----------------------------------------- ----- ----------- -----------

Cash at Bank 15 154.672 18.504

----------------------------------------- ----- ----------- -----------

Interest receivable 13 - 693.431

----------------------------------------- ----- ----------- -----------

Total 154.672 711.935

----------------------------------------- ----- ----------- -----------

Financial Liabilities Note 30/06/2012 30/06/2011

----------------------------------------- ----- ----------- -----------

US$ US$

----------------------------------------- ----- ----------- -----------

Interest bearing borrowings 19 15.813.857 16.343.535

----------------------------------------- ----- ----------- -----------

Trade and other payables 20 4.257.618 16.077.102

----------------------------------------- ----- ----------- -----------

Finance lease liabilities 23 668.311 608.067

----------------------------------------- ----- ----------- -----------

Current and Provisional tax liabilities 22 1.167.227 1.133.571

----------------------------------------- ----- ----------- -----------

Total 21.907.013 34.162.275

----------------------------------------- ----- ----------- -----------

27.4 Financial Risk Management Objectives

The Group's Treasury function provides services to its various

corporate entities, coordinates access to local and international

financial markets, monitors and manages the financial risks

relating to the operations of the Group, mainly the investing and

development functions. Its primary goal is to secure the Group's

liquidity and to minimize the effect of the financial asset price

variability on the cash flow of the Group. These risks cover market

risks including foreign exchange risks and interest rate risk as

well as credit risk and liquidity risk.

The above mentioned risk exposures may be hedged using

derivative instruments whenever appropriate. The use of financial

derivatives is governed by the Group's approved policies which

indicate that the use of derivatives is for hedging purposes only.

The Group does not enter into speculative derivative trading

positions. The same policies provide for the investment of excess

liquidity. As at 30 June 2012, the Group had not entered into any

derivative contracts.

Post August 2011, the priority on cash use and management was

set on settling all past liabilities (eliminating thus the relevant

legal and financial risks) while maintaining a minimum liquidity to

allow for the future development of the Group's strategy.

27.5 Economic Market Risk management

The Group operates in the Region. The Group's activities expose

it primarily to financial risks of changes in currency exchange

rates and interest rates. The exposures and the management of the

associated risks are described below. There has been no change to

the Group's manner in which it measures and manages risks.

Foreign Exchange Risk

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jun 2024 to Jul 2024

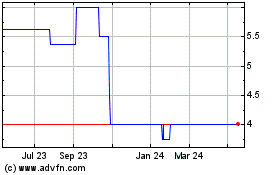

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jul 2023 to Jul 2024