TIDMSAV

RNS Number : 3992H

Savannah Resources PLC

06 April 2022

6 April 2022

Savannah Resources plc

("Savannah" or the "Company")

Financial Results for the Year Ended 31 December 2021

Savannah Resources plc, the European lithium development

company, is pleased to announce its audited financial results for

the year ended 31 December 2021.

2021 Summary

Corporate

-- Portfolio streamlined: Savannah has a singular focus as a

European lithium "pure play" following the amicable exit from the

Consortium Agreement with Rio Tinto on the Mutamba Mineral Sands

Project in Mozambique

-- Cash balance: Stood at GBP13.0m as at 31 December (31 December 2020: GBP2.0m), driven by the significantly oversubscribed GBP10.3m (gross) equity financing and the Consortium Agreement Cash Termination Compensation (US$9.5m)

-- ESG: Corporate Environmental and Social Management System

("ESMS") designed to aid implementation of Savannah's ESG goals

-- Decarbonisation commitment: Committed to moving towards Scope

1 and 2 net zero emissions goals during the operating phase of the

Barroso Lithium Project, and additionally targeting the reduction

of Scope 3 emissions

-- COVID-19: Mitigation measures continued with staff and stakeholder wellbeing a priority

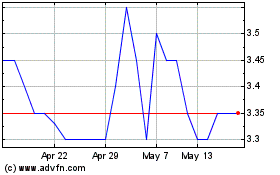

-- Net loss from continuing operations: Reported at GBP3.5m

(2020: GBP2.5m). The total attributable loss reduced to GBP3.3m

(2020: GBP8.2m) as there was no repeat of the non-cash write-down

(GBP5.5m) associated with the Oman project divestment

-- Recruitment: To support the Company's continued growth, key

new staff with a range of skills have been added to our project and

corporate teams in Portugal and the UK respectively

Barroso Lithium Project (the "Project"), Portugal

Technical

-- Environmental Impact Assessment ("EIA"): During the year the

conformity of the content of the EIA was declared by the

environmental regulator ("APA") and the Public Consultation

exercise on the EIA was completed. Savannah believes the calling of

a snap general election in Portugal in early November 2021 for 30

January 2022 impacted the decision-making processes in government

agencies such as APA during that period. The Board remains hopeful

that the Environmental Impact Declaration ("DIA") for the Project

will be made in coming months

-- Definitive Feasibility Study ("DFS"): Metallurgical process

design work continued in Australia throughout the period leading to

finalisation of the Project's process flowsheet in February 2022.

Field work in Portugal was limited as a result of COVID-related

restrictions and the ongoing EIA review process. The DFS is now

expected to be completed within twelve months of approval of the

EIA

Commercial

-- Offtake and Investment: Received increasing investment and

offtake interest in parallel with the major improvement in lithium

pricing and growing expectations of future lithium raw material

supply shortages

-- Partnerships: Savannah was pleased to become a member of the

International Lithium Association, the Portuguese Association for

the Battery Cluster; and the Business Council for Sustainable

Development Portugal

-- EV sales: European car sales saw strong annual growth again

to 2.33m units (+66%) as part of global sales of 6.75m (+108%,

source EV-volumes.com)

-- Lithium prices: In 2021 lithium chemical prices rose on

average by 410% vs. year-end 2020 and spodumene spot prices rose by

over 500% and are currently reported to be trading at $5,000/t

(source: S&P Global Platts)

Public and Government Relations:

-- Local stakeholder engagement: Savannah continued to engage

and inform the local community about the Project through multiple

channels; support was also maintained for local ventures and

services

-- Wider stakeholder engagement: As travel restrictions eased,

interaction with civil society, business and academic leaders, and

journalists was stepped up

-- Future community engagement and environment planning:

Savannah continued to develop its planned programmes including the

Benefit Sharing Programme, Good Neighbour Plan, Community Owned

Service Providers, and Land Stewardship Programme

Mutamba Mineral Sands Project, Mozambique

-- Strategic review: Following completion of its strategic

review the Company amicably exited the Consortium Agreement with

Rio Tinto in December 2021 in return for US$9.5m Cash Termination

Compensation

2022 Year to Date Summary

-- Decarbonisation: To support its commitments made in 2021, a

decarbonisation strategy has been initiated, led by consultants

ECOPROGRESSO and in association with leading global technology

company ABB

-- Definitive Feasibility Study: Finalisation of environmentally

enhanced process flowsheet to produce high quality spodumene

concentrate

-- ESMS: Expanding the overarching Corporate Environmental and

Social Management System to specifically cover Barroso Lithium

Project

-- Broker appointment: RBC Capital Markets appointed as Joint Corporate Broker

-- Rebrand: Rebrand of the Company and the launch of its new website

To view the press release with the images and diagrams please

use the following link:

http://www.rns-pdf.londonstockexchange.com/rns/3992H_1-2022-4-5.pdf

Availability of Annual Report and Financial Statements

Copies of the Company's full Annual Report and Financial

Statements are expected to be posted to shareholders shortly and

will also be made available to download today from the Company's

website www.savannahresources.com .

Regulatory Information

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Savannah - Enabling Europe's Energy Transition

Follow @SavannahRes on Twitter

Follow Savannah Resources on LinkedIn

For further information please visit www.savannahresources.com

or contact:

Savannah Resources PLC Tel: +44 20 7117 2489

David Archer, CEO

SP Angel Corporate Finance LLP (Nominated Tel: +44 20 3470 0470

Advisor)

David Hignell / Charlie Bouverat

finnCap Ltd (Joint Broker) Tel: +44 20 7220 0500

Christopher Raggett/ Tim Redfern

RBC Capital Markets (Joint Broker) Tel: +44 20 7653 4000

Marcus Jackson/ Farid Dadashev/ Jamil

Miah

WH Ireland Limited (Joint Broker) Tel: +44 20 7220 1666

Jessica Cave/ Ben Good (Corporate Finance)

Aimee McCusker (Corporate Broking)

Camarco (Financial PR) Tel: +44 20 3757 4980

Gordon Poole/Emily Hall/Tessa Gough-Allen

CHAIRMAN'S STATEMENT

The global events of 2021, while difficult and often tragic for

many, have conversely served to reinforce my view that your Company

owns a vital strategic asset via its Barroso Lithium Project , (the

'Project') . Furthermore, the geopolitical consequences of the

invasion of Ukraine in February seem likely to increase its

importance. Following the sale of our interest in the Mutamba

project in Mozambique to the Rio Tinto Group ('Rio'), Savannah is

now a "pure lithium" company and is well-placed to benefit from the

drive to identify alternatives to fossil fuels and increase in

electrification. Moreover, the US$9.5m termination compensation

from Rio along with the GBP10.3m gross proceeds from the

over-subscribed April placing helped take Savannah's year-end cash

position to GBP13m, putting us in a good financial position for the

year ahead. It is therefore particularly frustrating that these

matters are not reflected in our share price.

In terms of market forces, 2021 sa w a continuation of the same

market drivers which first triggered the lithium sector's strong

recovery in the second half of 2020. Supply again failed to keep up

with the demand created by increasing battery manufacturing and

electric vehicle sales around the world. As a result, lithium raw

material prices moved to new record highs.

However, as in 2020, the positive news our sector enjoyed was

overshadowed by the spectre of the COVID pandemic. Though COVID's

impact ebbed and flowed during the period, the rise of the Omicron

variant late in the year acted as a stark reminder that Europe and

the rest of the world still has some way to go to be fully free of

the impacts of this virus. Savannah must continue to play its part

in protecting our staff and those with whom we work and associate

by mitigating risk accordingly. Hence, we will continue to manage

COVID-related risk as actively as possible and adhere to relevant

laws and guidance for as long as is necessary.

Responsibility is embedded in our corporate strategy

The Board is determined that your Company should develop the

Project in a responsible and innovative way. We are pursuing a

number of initiatives to reduce the Project's carbon footprint, as

described more fully in the CEO's Report, and these will all

contribute to our goal of achieving Scope 1 and 2 net zero

emissions during the life of the Project. We are also targeting a

reduction in Scope 3 emissions. These objectives do not take

account of the estimated 100 million tonnes of greenhouse gas

emissions Savannah's lithium can help avoid in Europe's transport

sector. These initiatives will also be tracked as part of your

Company's Environment, Social and Governance ('ESG') programme. An

ESG statement was adopted by the Board during the course of the

year and a comprehensive Environmental and Social Management System

(ESMS) which is in the process of being rolled out at corporate

level will be extended to our Portuguese operations during

2022.

Our key focus in Portugal is on the approval of our EIA

We at Savannah share our shareholders' frustration at the slow

rate of progress in obtaining the necessary approvals required for

the Project to progress. Foremost among these is the approval of

the EIA report we first submitted in 2020 to the Portuguese

regulator, Agência Portuguesa do Ambiente ('APA'). Our report was

declared in conformity with APA's requirements in April 2021 and

this was followed by a public consultation phase, completed in July

2021, when all interested parties had the opportunity to lodge

their comments with APA.

We had expectations that APA's decision would be forthcoming in

the final quarter of 2021, but in October 2021 an impromptu General

Election was called for 30 January 2022, which has evidently

impacted on decision-making processes in the relevant Government

departments. Appointments to the relevant cabinet positions were

made in March 2022 and we are hopeful that the APA decision could

be made in coming months. If APA does approve our EIA, we will

re-initiate the fieldwork required for completion of the Definitive

Feasibility Study ('DFS') and accelerate the build-out of our

in-country team.

Given the uncertainty on when a decision from APA will be

received, it would be imprudent of me to give precise guidance on

timing for completion of the DFS. Furthermore, as our shareholders

will understand, given the second phase of the environmental

licencing process also relates to the Project's final design, it

will have an important bearing on the DFS. However, I can guide to

the time we estimate for the outstanding work required for the DFS'

completion as being approximately no more than 12 months following

APA's approval of the EIA.

Figure 1: Savannah hopes to receive approval for the Barroso

Lithium Project EIA in the coming months:

Source: Company photo

The energy transition endorses our strategic move into

lithium

Despite the delays, I still firmly believe that Savannah's move

into the lithium sector in 2017 remains a good, long term,

strategic decision for our Company. This can be backed-up by

reference to growing electric vehicles sales, the record prices now

seen in key lithium raw materials, and the increased corporate

activity in the lithium market itself, particularly in Europe. We

therefore remain hopeful that the Barroso Lithium Project will

receive environmental regulatory approval, and have backed our

confidence by continuing the land acquisition programme at the

Project throughout the period.

In late 2021 we were delighted to see not one, but two

in-country lithium chemical refinery projects announced by

significant companies in the battery, energy and chemicals sectors.

We also saw the Portuguese Government move closer to initiating the

long-awaited tender process for six exploration areas prospective

for lithium across the country. Hence, the lithium industry in

Portugal is really starting to take shape and Savannah is part of a

growing industrial, academic and governmental community which is

focused on providing materials and products key to the energy

transition i n Europe and has the potential to bring very

significant economic, environmental and social benefits for a large

number of people, while at all times following a responsible

approach to the production of this critical raw material.

Commercial interest in the Project has increased

On a commercial front, 2021 started on a positive note with

announcement of the Heads of Agreement ('HoA') with Galp Energia,

SGPS, S.A ('Galp'), around a 100,000tpa offtake agreement and

project level investment. This provided proof of concept that the

Barroso Lithium Project could attract commercial partners for its

spodumene concentrate but, as the first and second quarters

progressed and sentiment and prices within the lithium sector

improved, Savannah received further commercial inquiries. The

expiry of the HoA at the end of May not only allowed us to continue

negotiations with Galp but also to speak freely with a host of

other parties who have approached us during the year. This includes

European and non-European groups either looking for a new source of

spodumene for existing or new conversion plants, or potential

strategic partners looking for exposure to the lithium battery

value chain.

While we had targeted conclusion of a first offtake agreement by

the end of 2021, it is not a concern to the Board that this

self-imposed deadline was not met. The developments we have seen in

the past eighteen months in the European and global lithium

markets, and the growing concern around future supply among

consumers of lithium feedstock, lead us to believe that the delay

is working out to our benefit and that securing suitable offtakes

and/or partnerships remains eminently achievable, and particularly

as and when a positive decision on the EIA is received. In addition

to these 'direct' commercial relationships and associated

financings, Savannah continues to assess its options on other

sources of development finance such as government or European Union

grants.

Divesting non-core mineral sands asset supports our core

growth

As our shareholders will know, December 2021 marked the end of

Savannah's active involvement in the Mozambiquan mineral sands

sector after eight years including the last five years spent

focused on our role as operator in the unincorporated joint venture

with Rio on the Mutamba Project ('Mutamba'). As time working in

Mozambique went on it became clear to our team that to progress

both the Mutamba and Barroso Lithium Projects under Savannah's

leadership simultaneously would likely overstretch our human and

financial resources. A thorough technical assessment of Mutamba and

a review of the various restructuring and market opportunities

available to us was made assisted by Farview Solutions and its

principal, Bruce Griffin, and it was amicably agreed that

cancelling our unincorporated joint venture was the best option for

both parties and the project.

Rio has assumed full responsibility for the Mutamba project

(Mining Concessions 9228C and 9229C and Mining Concession

application 9230C) and Savannah's in-country staff have transferred

across to Rio to remain with the project. In return Savannah

received a US$9.5m termination compensation from Rio and is now in

the process of divesting its residual Mozambiquan assets (Matilda

Minerals Lda and Mining Concession 9735C). As stated, the cash

received helped to lift Savannah's year end cash position to

GBP13m. During our tenure we and Rio were able to make some notable

progress on the project, publishing a first economic study in 2017,

and being awarded the three, 25-year, Mining Concessions in 2019

and 2020 which covered the vast majority of the project's 4.4

billion tonne resource.

Savannah leaves the Mutamba Mining Concessions in good order for

Rio Tinto with work on securing land use and utilisation agreements

and EIAs progressed during 2021. We wish Rio well with their

ongoing development of the project. Given Rio's long involvement

with Mutamba, I have no doubt they are the most appropriate group

to take the project forward. I would also like to thank our former

team members for all their hard work over the years and wish them

well with their new careers at Rio.

Savannah can also be proud of its legacy in Mozambique which it

has left through its extensive community engagement programmes,

more details of which can be found in the ESG section.

Using our market position to promote a responsible future

During 2021 we have been consciously attempting to consolidate

Savannah's position in Portugal's business environment and the

European and global lithium industry. To that end, we became a

founder member of Portugal's new Association for the Battery

Cluster, as we announced last June, and joined the country's

130-member strong Business Council for Sustainable Development.

Within the lithium sector, we became one of the first 12 Associate

Members of the newly formed International Lithium Association, a

not-for-profit industry association created by major industry

participants as a voice for the lithium industry and to promote ESG

and sustainability practices within the sector.

We also continued to add to our own team across a range of

disciplines such as geology and finance, and we look forward to

growing our team further during 2022.

Figure 2: European and Global sales of electric vehicles reached

new record highs in 2021:

Source: Adobe stock images

Financial Overview

During the year the Board lifted some of the COVID-related cost

control measures it had put in place in early 2020. The

accompanying uptick in corporate activity resulted in a 27%

increase in the Group's administrative expenses to GBP3.3m (2020:

GBP2.6m). Combining this with a GBP0.2m loss on foreign exchange,

resulted in losses from continuing operations increasing by 39% to

GBP3.5m (2020: loss GBP2.5m). However, without a repeat of the

GBP5.8m non-cash adjustments recorded last year in association with

the divestment of our copper projects in Oman, losses before tax of

GBP3.5m (2020: loss GBP8.3m) and the total comprehensive loss for

the year of GBP3.3m (2020: loss GBP8.2m) were approximately 60%

lower than 2020.

The Group's net assets increased by 33% during the year to

GBP27.2m with the 18% reduction in intangible assets to GBP14.1m

(2020: GBP17.3m) associated with the termination of the

unconsolidated joint venture with Rio on the Mutamba project, more

than offset by the 550% increase in the Group's year-end cash

position to GBP13.0m (2020: GBP2.0m). This greatly improved cash

position reflected the income received from the combination of the

oversubscribed GBP10.3m (gross) placing, the US$9.5m termination

compensation from Rio as part of our exit from the Mutamba project

and the GBP0.7m received from the sale of shares in Force

Commodities which Savannah had received as part of the divestment

of its assets in Oman.

Outlook

2022 is shaping up to be another key year for Savannah. I am

sure I speak for all in saying that our current thoughts are with

the people of Ukraine at this terrible time and that our sincerest

hopes are for the conflict in their country to be brought to an end

as soon as possible.

Savannah has no direct exposure to Ukraine or Russian markets

but given the European location of this conflict and the

significance of Russia in global geopolitics and the world's

energy, commodity and financial markets, ongoing impact of the

invasion on international markets must be expected. As a result,

Savannah will continue to monitor the situation closely and be

ready to put plans in place if required. At present it is hard to

accurately predict what the long-term outcomes may be, but this

rapidly deteriorating situation has again shown the risk inherent

in many global supply chains which are based on commodity and

energy production in high sovereign risk jurisdictions. In the

lithium sector at least, Savannah would like to offer Europe a

low-risk alternative.

The Company is now solely focused on lithium and has the capital

at hand to make meaningful progress towards development and

production at the Barroso Lithium Project. Despite the current

uncertainty, the market backdrop remains highly supportive with

high lithium prices, global EV sales forecast to grow year-on-year,

and ever greater emphasis being placed on responsible, low carbon,

manufacturing techniques and products. All these factors mean that

Savannah has real optionality available to it in regard to future

commercial arrangements for the Project.

We remain hopeful that APA will approve our EIA in the coming

months, and this will then allow us to finalise the Project's

design and undertake the remaining work required for the DFS. APA's

decision will also dispel much of the uncertainty which has

bedevilled our share price and bring clarity for all the Project's

stakeholders as to its future status in that it will provide

assurance to our potential commercial customers that Savannah is a

responsible operator and that the Project can be a future source of

low carbon, lithium raw material for their operations and the wider

battery value chain.

As ever, my thanks go to all our staff who continue to make

their very best efforts to move Savannah towards its long-held

goals of responsible production, cash flow generation, benefit

sharing with stakeholders, and creating greater shareholder

value.

I would also like to thank all our shareholders for their

continued interest and support for Savannah and wish them well as

we all try to navigate our way back towards 'normality' through the

residual challenges of the pandemic and the fresh uncertainty and

alarm caused by the conflict in Ukraine.

Matthew King

Chairman

Date: 5 April 2022

CHIEF EXECUTIVE'S REPORT

We have started 2022 in great shape with a strong cash balance,

100% ownership of one of Europe's most strategic lithium projects,

no overriding royalties, no offtakes written at low prices and a

clear and defined path to production as the pre-eminent, pure

lithium play in one of the world's largest lithium consuming

regions.

For the lithium sector as a whole, it was an exceptional year

with the industry's three major raw materials, lithium hydroxide,

lithium carbonate, and spodumene concentrate, seeing spot price

rises of over 370%, 450% and 530% respectively. These large and

rapid price rises show that raw material supply is a major problem

in this market which, in turn, has major implications for the

energy transition and the e-mobility revolution required to

effectively tackle greenhouse gas emissions from the energy and

transport sectors. Simply put, lithium is in great demand and the

companies that supply or will supply lithium are in great demand.

This is a very supportive backdrop for Savannah and its goal of

becoming a major European-based lithium supplier. What Europe needs

now is for the same legislators who rightly seek to affect the

energy transition and cut emissions, to also facilitate the

responsible supply of all the raw materials with the removal of

unnecessary red tape, siloed bureaucracies and the application of

project management tools to make this target achievable.

By this time, I would have liked to have been discussing the

exciting phase of project development that Savannah has underway

following receipt of the Project's environmental approval and

completion of the DFS. However, with market conditions as they now

are and with climate change being front and centre of government

policy, I believe the context for the Project has never been more

promising. In fact, it can be argued that the opportunity presented

by the Barroso Lithium Project is greater now than at any time in

during our ownership, particularly bearing in mind current spot

spodumene lithium prices at US$5,000/t versus the US$685/t assumed

in our 2018 Scoping Study.

The development of the Barroso Lithium Project is designed to

benefit all stakeholders

We are determined that all the relevant stakeholders benefit

from the Project as it progresses. Within Portugal that means from

the National Government, which will benefit from the economic

growth created by a new pan-European industry, through to customers

and suppliers, and individuals in the towns and villages near the

Project. This latter group will see new job opportunities created,

greater demand for local goods and services, improvements to local

infrastructure, and meaningful and long-term financial support

given to community projects and groups. Above all, this brings to

light the necessity to support regional energy autonomy.

I note that the average share price performance during 2021

amongst a large group of lithium development and production

companies principally listed outside of the UK was +218% compared

to the flat performance recorded by Savannah. Our shareholders

should certainly benefit too as we move through value adding

gateways in coming months.

Importantly, our team was agile in the face of the EIA delay and

maintained and adapted plans wherever possible to ensure that not

only was progress made, but that we are prepared to accelerate

quickly as and when a decision from the regulator is received. The

excellent progress we have seen with our metallurgical test work

and our decarbonisation initiatives are key cases in point.

Preparation work on key DFS inputs underway

On a technical front, our team prepared as much as possible for

the next phase of the environmental licencing process ( 'Relatório

de Conformidade Ambiental do Projeto de Execução', 'RECAPE').

During this phase, our team and our panel of consultants will work

on the final detailed design for the Project which adhere to any

conditions set by the regulator.

Preparation work was also undertaken for the drilling campaigns

and fieldwork which is required for input into the Definitive

Feasibility Study. We plan to get back into the field with an

in-fill resource drilling programme once a positive EIA decision

has been received.

While we were not able to create as many of the 'fixed points'

for the DFS as we may have liked during 2021 because of the need

for fieldwork and input from the environmental regulator, the key

elements of the processing route to produce the spodumene

concentrate and associated by-products from Barroso ore have now

been fixed following a successful metallurgical test work programme

in Australia during the year. As announced recently, our expert

consultants and in-house team have been able to design a circuit

which will produce a high quality, commercial spodumene concentrate

based on the use of processes and reagents which meet or exceed all

relevant legislation. We have been able to achieve excellent

lithium recoveries in the high 70s per cent range with coarser

grind sizes which will help reduce energy requirements and

operating costs. Alongside the upcoming pilot testing on the main

processing route, we are also investigating opportunities to

recover additional lithium from some of the waste streams.

Our test work has also involved trade-off studies where we have

examined the trade-off between grade of the product and recovery.

While we can produce a nominal 6% product which is the industry

standard reference, the trade-off studies show that overall

revenues are maximised with a product grade of 5.5%. A 5.5% graded

product is well within acceptable marketing tolerances although

with an arithmetic adjustment for price from the reference price

for 6% material. Rejection limits are for material less than 5.0%.

And we should remember that the Barroso lithium product benefits

from having one of the lowest levels of iron.

The on-going de-carbonisation programme is also a key

work-stream for the DFS and we have already made a great start by

commissioning ECOPROGRESSO, part of the Quadrante Group, to develop

our strategy and with the announcement of a collaboration with the

major global group, ABB, around automation and electrification

aspects.

With the metallurgical work-stream for the DFS largely done and

the de-carbonisation work underway we are well placed to move into

the design phase of the DFS upon receiving EIA approval.

I should hasten to add that the metallurgical work outcomes are

an important de-risking achievement as this area has been

problematic for many of the earlier spodumene developments in

Australia. This will be important from a project financing and

commissioning perspective.

European EV demand is strong and growing even stronger

There is no doubt as to the level of regional demand for the

product Savannah hopes to make. European car sales saw strong

annual growth again to 2.33m units (+66%) as part of global sales

of 6.75m (+108%, source EV-volumes.com), and the latest tally on

capacity of existing or planned European battery plants is

approximately 800GW. This capacity equates to over 600kt of lithium

carbonate equivalent ('LCE'). At present, we estimate total future

supply from European based lithium projects to be approximately

130kt of LCE, including the c.25kt provided by the Barroso Lithium

Project in the form of spodumene concentrate. Hence, all future

supply from Europe, including Savannah's, could easily be consumed

domestically in the future. As further proof of this assumption,

several of Savannah's European peers have announced offtake

agreements in the past year for lithium chemical supply.

Figure 3: European Electric Vehicle Sales Figure 4: Global

Electric Vehicle Sales

Source: EV-volumes.com Source: EV-volumes.com

European industrial development to drive demand for spodumene

concentrate

Amongst our European peer group, we believe Savannah will be the

most significant future supplier of spodumene concentrate, the same

material which has made Australia the world's largest supplier of

lithium raw material. 2021 was the year that the concept of

European 'merchant' lithium conversion plants really gathered pace.

These are plants which are not integrated with a specific mine but

purchase feedstock, such as spodumene concentrate, under long term

offtake agreements or in the spot market from mining companies,

such as Savannah. When we originally secured the Project the major

source of demand for our product was China. Europe is now looking

to build out its processing capacity to help optimise its strategic

autonomy, eliminate potential international bottlenecks and build a

decarbonised lithium value chain in Europe. This is a major shift

which has only benefited Savannah and means our low carbon

spodumene lithium is highly sought after.

Figure 5: Over 2.3m electric vehicles were sold in Europe last

year representing 17% of all new cars sold:

Source: Adobe stock images

Looking just at Portugal alone, Galp has already stated its

intention of moving into lithium chemical production earlier in

2021 with such a plant, but we welcomed the news in December that

it was partnering with Northvolt, the major Swedish battery

manufacturer, to create Aurora, a new 50:50 joint venture, which

will develop a facility in Portugal targeting 35,000tpa of lithium

hydroxide production from 2026. Meanwhile, Portuguese chemical

company Bondalti and Australia's Reed Advanced Materials (70%

Neometals/30% Mineral Resources) are trialling Reed's Eli(R)

processing technology at Bondalti's chemical plant in Estarreja.

This technology can process brine or hard rock concentrate feeds,

and the groups are targeting a plant capacity of 25,000tpa of

lithium hydroxide or carbonate if the initial pilot plant test work

goes well. Barroso's concentrate would represent a natural

feedstock for these proposed plants with the added benefit that its

proximity to the likely site locations would help to minimise the

carbon footprint associated with the lithium chemicals produced.

Having both raw material and chemical production in country would

also maximise the overall economic benefit available to Portugal

from its lithium natural resources. As shareholders will be aware,

our discussions with Galp around possible spodumene supply

continued in the second half of the year, after the expiry of the

previous Heads of Agreement between the companies at the end of

May.

Outside of Portugal, groups in Europe planning to build merchant

plants have reached out to Savannah and a number of high quality

discussions are ongoing. While transport distances would be longer

to these plants than to potential sites in Portugal, any sales

partnerships with these groups would still represent a wholly

European endeavour, and compared to alternative sources of feed

from Africa, the Americas or Australia, these plants would be

producing 'low carbon' lithium chemicals if they took Barroso

concentrate.

Based on our current schedule, we expect to be in production

ahead of any of the conversion plants planned in Europe. If this

proves to be the case, then we may need to make short-term selling

arrangements for our concentrate until the conversion plants are

commissioned. Metal and commodity traders may be the best placed

groups to assist us with this, being able to both market the

Project's concentrate on our behalf and provide financing support

and assistance with logistics. Again, Savannah has already

attracted significant interest from groups in this sector of the

market, many of whom are looking to grow their businesses into the

battery metal space.

Finally, such is the concern about raw material supply among

consumers further downstream in the battery chain that we have also

been contacted in recent months by some of these groups, both

European and non-European. They are seeking to secure raw material

supply which they can then direct through their existing supply

chains. Discussions are continuing.

In summary, regarding offtake agreements, Savannah has multiple

options with national, regional or international avenues remaining

open to us whether it be trading directly with a conversion group,

or a company from downstream in the value chain. With our strong

cash balance, we are in a good position to work patiently at

striking the right agreements and not to just accept the deals that

are available right now.

Responsible Production is core to what we do

While continuing to push on the commercial front, we have also

been preparing to further enhance the Barroso Lithium Project's

environmental credentials as part of our wider formalisation of our

ESG framework. Our EIA speaks for itself in terms of the

commitments Savannah will put into action around either eliminating

or minimising the Project's individual impacts. However, we will be

happy to refine our plans as required based on feedback we receive

from the environmental regulator.

We have an evolving range of programmes to support the community

and the environment including:

-- The Benefit Sharing Programme - provides EUR500,000 per annum to worthy community programmes

-- Good Neighbour Plan - those things that we bring with us and

can have dual use by the community e.g., water from our storages

for firefighting

-- Community Owned Service Providers - community owned companies

to provide services to the Project e.g., progressive

rehabilitation

-- Land Stewardship Programme - reforestation of unused areas of

Project with appropriate native species

Equally we look to all opportunities for continuous improvement

of the Barroso Lithium Project.

A prime example is our major de-carbonisation initiative with

our commitment made in November to move towards net zero Scope 1

and 2 emissions once the Project is in operation, and to also

reduce the Scope 3 (indirect emissions, i.e., road haulage

transport) as much as possible. Following these commitments, we

were pleased to announce the initiation of a Decarbonisation

Strategy in March 2022, led by the Portuguese environmental

consultant, ECOPROGRESSO, part of the Quadrante Group.

This initiative is only the start of the build out of a strong

coalition of European industrial partnerships around the

Project.

On 30 March 2022 we further strengthened our 'decarbonisation'

team with the signature of a MoU with ABB, the global industrial

technology business with revenues of US$28.9b , which is providing

its expertise in automation and electrification in the mineral

production sector to Savannah under MoU . This will help us build

out integrated digital applications for operations, maintenance,

and other processes such as environmental performance optimisation.

The Project will very much be a showcase of European

innovation.

We have also been holding discussions with a number of major

mining equipment manufacturers which are all planning on developing

and commercialising zero or low emission vehicles during the period

the Project will be in operation. In regard to the electrical power

the Project will use, we continue to evaluate the options available

to increase the provision of renewable power above the already

impressive c.60% available through the Portuguese grid. Once our

suppliers and offtake partners are confirmed, we will work with

them to plan reductions of scope 3 emissions associated with

offsite haulage to our customers. Finalisation of the

Decarbonisation Strategy is expected in Q2 2022 and we look forward

to providing more follow-on news later in the year.

Following on from our commissioning of a Corporate ESMS in

Spring 2021, we have now also commissioned the creation of a

project specific system tailored to the Barroso Lithium Project. A

tendering process was initiated in Q1 2022, and the selected

consultants will work with our team to enhance and extend our

existing stakeholder engagement and environmental programmes and

policies to cover the current phase of project development and also

the construction and operating phases of the Project.

Figure 6: Savannah's lithium can play an important role in

reducing emissions from the European transport sector:

Source: Adobe stock images

On the ground in the Barroso

While the more formalised ESMS system for the Project is being

created, we have continued wholeheartedly with a range of ESG

initiatives.

While the pandemic and the associated vulnerability of the aging

local populations tempered our ability to engage directly with many

stakeholders in 2020 and 2021 we did maintain regular contact with

the communities throughout 2021 via advertising in the local press,

radio features and monthly newsletters distributed in local

villages. Regular virtual and physical meetings were held with

community leaders and stakeholders. We maintained a staffed

information centre in the village of Covas do Barroso, supported

local firefighters and helped with repairs to deteriorated local

housing of villagers. We appointed a village ambassador who has

been instrumental in supporting our local activities.

An online presentation of the Project was made to stakeholders

on 12 May 2021 and major community consultation presentation was

held in the Boticas Municipality auditorium on 19 May 2021 to

present and review the Environmental Impact Assessment. This was

supplemented with a site visit the following day.

So far this year we will shortly open a new office and

information centre in the main street of Boticas and we have

launched the "Litio do Barroso" magazine which will provide local

news and information about the Project to local villages in the

area of the Project. A comprehensive community mapping and opinion

gathering programme was completed in the villages of Covas do

Barroso and Dornelas in recent months and the results of the survey

are being compiled.

We have incorporated the Barroso Lithium Foundation which will

be responsible for the investment of up to EUR500,000 per annum,

once construction has begun, in worthy community programmes and

initiatives chosen by local people on the Foundation board. The

Foundation will also build a corpus of capital that will be

deployed following the conclusion of the Project and so provide a

long-term legacy for the region.

We continue to receive excellent support from many members of

the community who are excited about the opportunity that the

Project will bring to their families, their livelihoods and their

businesses. Local, regional and interest in the Project is

underscored by the hundreds of unsolicited job applications that we

are receiving.

Unfortunately, much of this has been obscured with push-back

from a small group of local activists who have tucked in beneath

the umbrella of a number of anti-mining groups, much of which is

led from outside Portugal. This in turn has been picked up in some

press articles. Despite his early support for the Project, the

mayor of Boticas has aligned himself with these groups.

Nevertheless, members of the community appreciate what our

Project offers. Like many parts of the Iberian Peninsula, the

region is suffering from a demographic collapse. The 2011

government census shows that the population of Boticas declined by

13.0% to 5,002 people in the ten years to 2011 while the population

of the village of Covas do Barroso declined by 26.7% to a total of

192 people, the vast majority of whom are elderly. The Boticas

region is one of the poorest in Portugal and has suffered from the

long-term flight of young people to Porto, Lisbon and points

beyond. The Project will help to reverse these trends bringing

prosperity and opportunity to the region, drawing young people to

return or to take up residency and to build quality lives for their

families.

We see strong support from people in the region whose inevitable

question is "When are you going to start?". Their eagerness is

matched by the hundreds of job applications we have received and

the broad support and interest of the Boticas business community in

seeing the Project develop.

Perhaps our most significant progress 'on the ground' was

represented by our land acquisition programme across the C-100

Mining Lease area. This has required significant investigation by

our team and consultants into existing land ownership and has

needed to be handled and transacted with great sensitivity within

the local community setting. To date we have signed 24 purchase and

sale contracts and executed 15 deeds involving 67 individual blocks

of land.

We were joined in litigation filed by the Parish of Covas do

Barroso in the Mirandela Fiscal and Administrative Court in

Portugal against the Republic of Portugal and the Ministry of

Economy as defendants. The litigation seeks to nullify certain

administrative actions by the defendants in June 2016 including the

addition of lithium to and the expansion in the area of the C-100

Mining Lease. The C-100 Mining Lease which contains the Barroso

Lithium Project is fully granted, has a term of 30 years to 2036

and remains in good standing.

Savannah's lawyers have confirmed their initial advice that the

claim by the Parish is without foundation. The claim has been

challenged by Savannah as the counter-interested party alongside

and we will be exploring all potential options, including making a

claim for damages against the plaintiff and its officers. Both the

Republic of Portugal and the Ministry of Economy as defendants have

now filed their defences.

The litigation neither impacts the Project's activities nor the

current Environmental Impact Assessment process which we believe is

moving to a conclusion.

The Environment - we care

Foremost in our plans is the responsible and innovative

development of the Barroso Lithium Project while eliminating or

mitigating individual impacts. Integral to this is our policy of

using best available techniques (BAT) to be a global example of

economy in the management of water, materials, energy and

resources.

The impact assessment carried out in the EIA study, establishes

the control and evolution of the more sensitive environmental

aspects, such as water resources quality and potential

vulnerability (surface and underground), air and sound environment,

vibrations, soils (quality and geochemistry), ecological systems,

landscape, social component, and local heritage.

Operations will be controlled, managed and reported to via a

comprehensive Environmental and Social Management System (ESMS) to

help implement and maintain Savannah's Environmental, Social and

Governance (ESG) commitments for the Project. The ESMS will be

aligned with internationally recognised ESG criteria, namely the

requirements of the International Finance Corporation (IFC)

Performance Standards on Environmental and Social Sustainability,

as well as the World Bank Group's Environmental, Mining and General

Health and Safety Standards.

Some 238 individual mitigation measures will be implemented and

an estimated investment of EUR5-6million in road/transport

infrastructure investment ensuring that the Project's traffic

by-passes local villages. Water trucks will suppress dust in dryer

periods while forestation and landscaping will help contain sound

and visual impacts.

A programme of progressive rehabilitation will be implemented

from day one and throughout the life of the Barroso Lithium

Project. We will be evaluating the potential for the use of the

site for pumped storage of renewable energy generated by wind

and/or solar at the end of the mineral lifecycle.

Our operating times are tailored to minimise discomfort for

local communities and impact on flora and fauna. Detailed computer

simulations show that the operation will meet the more demanding

legal night-time noise limit of 43db at all times of the day. The

only exception to this is blasting, each blast will last between

5-10 seconds and not exceed the legal limit of 55dB. Blasts will

only occur between Monday and Friday, between 12pm and 3pm on 3 to

4 days per week. There will be no blasting at weekends.

The Barroso Lithium Project is specifically designed to be

self-sufficient in and to minimise the amount of water that it

would require to support its operations while at the same time

having no impact on water available for local communities, villages

or towns. Neither will it have any impact on agriculture. In

Savannah's preferred model, water will not need to be abstracted

from any local rivers. Water for the project will be sourced from

surface water collected from part of the project's site footprint.

Savannah is obliged by the Portuguese environmental regulator to

capture surface water from the site footprint (contact water) in

sediment control structures so as to ensure that untreated contact

water does not flow into creeks, streams or rivers. Contact water

collected in the sediment control structures are of the type

commonly seen beside expressways which are designed to capture run

off from road surfaces. There will be no impacts on the ecological

flow of the Covas River in summer months.

The area of the contact water catchments to be developed to

collect surface water for the Project represent only 1.7% of the

area of the local Covas River watershed, 0.3% of the area of the

larger Beça River watershed and an insignificant 0.2% of the main

Tâmega watershed. In overall terms these numbers are not material

to water volumes in the region and, in any case, potentially

overstate the water volumes that will be captured in any year by

the Project.

85% of the water supporting operations will be recycled. In our

preferred model, contact water will be supplemented by water

sourced from the de-watering of the open cuts. Again, this is not

expected to impact community water supplies or local

agriculture.

Questions have been raised concerning the continued status of

the Barroso region as a Globally Important Agricultural Heritage

Systems (GIAHS) area. This status was awarded in 2018 and was not

intended to impact the integrity of existing economic activities in

the area such as mineral production. It is also important to

understand that the total Barroso Lithium Project concession area

occupies just 0.53% GIAHS area in the region and, depending on the

development alternative chosen by APA, the area of actual

disturbance on the concession area will be less than 0.25% of the

GIAHS area. The Project has no impact on the GIAHS classification.

Agricultural areas represent 10% of the Mining Lease land area. Of

the projected area for mining use and associated activities,

agricultural land represents just 3.1% (18.3ha) of the Mining Lease

area. This area is not material to agriculture in the areas around

the Barroso Lithium Project development. Today, one of the main

threats to this territorial dynamic is the depopulation and

abandonment of land, factors that pose a major risk of degradation

of the existing natural, cultural and built heritage, and which are

decisive for the classification of this region as a GIAHS Site. As

part of our plan we will look to implement measures with local

partners to recover agrarian system areas that have deteriorated as

a result of demographic changes in the area.

Preservation of fauna and flora will be a priority for Savannah.

Studies we have supported have shown that the Project area does not

intercept the known territory of any Iberian Wolf packs although

there are packs in surrounding areas. In the case of local water

mole and mussel populations particular care will be taken to

eliminate or at least minimise disturbances to riverbanks.

The quality of the soil will be monitored, managed, and

preserved, since the operation will not use chemical products that

might alter it. Topsoil will be removed, stored, safeguarded, and

cared for appropriately so that it can be re-laid during

rehabilitation as a basis for revegetation of native species.

The Barroso Lithium Project will employ local farmers for

progressive land rehabilitation during the life cycle of operations

and we are evaluating expanding this into a community owned company

to provide rehabilitation services to the Project and so build an

enduring new benefit for the community.

As part of our developing Land Stewardship Programme, land we

are acquiring which will not form an immediate part of the

Project's developed footprint will be reforested with guidance from

local authorities using native species appropriate to the area. We

will also work to the recovery of the site at the conclusion of the

Project's life with the requalification of these areas for

traditional agro-silvan-use e.g., honey, chestnuts, meat, sausages,

aromatic herbs, amongst others.

Intensive management of land is a major cause of biodiversity

loss in Portugal. Creating clear initiatives for removing invasive

non-native species and creating new native woodland will

demonstrate to stakeholders that we have a responsible stewardship

approach and our overall commitment. As part of this programme we

are also developing a Stewardship Policies Handbook so it can be

used in perpetuity.

Finally, as another example of both our commitment and our

transparency we will be implementing a sophisticated, sensor

network that will measure key environmental operating parameters

that will be made available in real time to stakeholders including

regulators via a mobile phone app.

EIA Progressing

The original 6,000-page EIA and Mine Plan documents were lodged

with the regulator in May of 2020. A community consultation process

was undertaken in May of 2021. The completion of APA's evaluation

has however has not been possible while it awaits the result of a

treaty mandated, cross-border consultation process with Spain and

the formation of a new government in Portugal following the calling

of a snap General Election held on 30 January 2022.

As our chairman has said, we are hopeful that the environmental

regulator in Portugal will approve our Project in coming months.

Savannah's team and its large team of subject matter specialists

have put in an amazing effort to design a project to international

standards and best practices, and we hope that the Barroso Lithium

Project will be held up as a positive case study for a new

generation of mining projects in Europe which are sourcing minerals

critical for European society in a responsible, low carbon, way

which brings economic and social benefits for all stakeholders.

While we await the outcome of the regulator's review, there is

much for us to do. In addition to remaining open to dialogue with

APA, we will continue to engage with all stakeholders and elevate

our position in Portuguese civil society and be as prepared as we

can for when a decision is made, and the next exciting phase can

begin.

Divesting Mozambique allows us to focus on our core business

We achieved our target in 2021 of bringing resolution on the

future of our investment in Mozambique with the sale of our

interest in the Mutamba Project to Rio Tinto. The long term and

sizeable financial and resourcing commitment we would have needed

to make to bring Mutamba to a final investment decision would have

made it challenging to achieve alongside the imperatives of the

Barroso Project's development. Our review looked at various styles

of development as well as introducing alternative corporate

structures around the project. After deliberation, the option to

transfer the project back to Rio, and for Savannah to exit

Mozambique with US$9.5m cash termination compensation represented

the best outcome.

I would like to add my sincere thanks to all our former staff

members for their hard work on what has been, at times, a

challenging project, and to wish them and Rio Tinto well for the

exciting journey towards production.

Outlook

Now with a singular focus on lithium in Europe, a strong cash

balance, strong lithium prices and a myriad of inbound investment

and offtake interest makes for an excellent starting position from

which we can push hard on all fronts to make the Barroso Lithium

Project Europe's first major lithium raw material production

centre.

It has not been an easy undertaking in the last two years, a

pandemic and now deeper tension at the heart of our region, and I

thank our staff for their efforts and our shareholders for their

support. There remains much to do but I'm sure we are all in

agreement that the prize is very much worth pursuing.

David Archer

Chief Executive Officer

Date: 5 April 2022

The financial statements below should be read in conjunction

with the notes contained within the full financial report which

will be available online at the Company's website at:

https://www.savannahresources.com/investors/corporate-documents/

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEARED 31

DECEMBER 2021

2021 2020*

GBP GBP

CONTINUING OPERATIONS

Revenue - -

Other Income - 26,099

Administrative Expenses (3,305,649) (2,595,738)

Foreign exchange (loss)/gain (213,088) 37,580

OPERATING LOSS (3,518,737) (2,532,059)

Finance Income 671 4,819

Finance Costs (139) (765)

------------- -------------

LOSS FROM CONTINUING OPERATIONS BEFORE

AND AFTER TAX (3,518,205) (2,528,005)

GAIN/(LOSS) ON DISCONTINUED OPERATIONS

BEFORE AND AFTER TAX 2,371 (5,797,753)

------------- -------------

LOSS BEFORE AND AFTER TAX ATTRIBUTABLE

TO EQUITY OWNERS OF THE PARENT (3,515,834) (8,325,758)

------------- -------------

OTHER COMPREHENSIVE INCOME

Items that will not be reclassified

to profit or loss:

Net change in Fair Value Through Other

Comprehensive Income of Equity Investments 82,006 320,151

Items that will or may be reclassified

to profit or loss:

Exchange Losses arising on translation

of foreign operations 154,815 (163,284)

------------- -------------

OTHER COMPREHENSIVE INCOME FOR THE YEAR 236,821 156,867

------------- -------------

TOTAL COMPREHENSIVE LOSS FOR THE YEAR

ATTRIBUTABLE TO EQUITY OWNERS OF THE

PARENT (3,279,013) (8,168,891)

============= =============

Loss per share attributable to equity

owners of the parent expressed in pence

per share:

Basic and diluted

From Operations (0.22) (0.62)

From Continued Operations (0.22) (0.19)

From Discontinued Operations 0.00 (0.43)

* The disclosures as at 31 December 2020 have been re-presented

so that the operations that are discontinued at the end of the 2021

financial year are classified as discontinued.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2021

2021 2020

GBP GBP

ASSETS

NON-CURRENT ASSETS

Intangible Assets 14,137,817 17,246,222

Right-of-Use Assets 5,390 21,709

Other Intangible Assets - 6,682

Property, Plant and Equipment 676,536 973,528

Other Non-Current Assets 69,542 73,530

Bank Deposits - 590,175

-------------- --------------

TOTAL NON-CURRENT ASSETS 14,889,285 18,911,846

-------------- --------------

CURRENT ASSETS

Equity instruments at FVTOCI 31,575 606,245

Trade and Other Receivables 962,058 194,301

Other Current Assets 19,300 13,670

Cash and Cash Equivalents 13,002,084 2,000,209

-------------- --------------

TOTAL CURRENT ASSETS 14,015,017 2,814,425

TOTAL ASSETS 28,904,302 21,726,271

============== ==============

EQUITY AND LIABILITIES

SHAREHOLDERS' EQUITY

Share Capital 16,889,598 14,309,910

Share Premium 41,693,178 34,474,884

Merger Reserve 6,683,000 6,683,000

Foreign Currency Reserve (38,726) (193,541)

Warrant Reserve - 12,157

Share Based Payment Reserve 305,095 393,865

FVTOCI Reserve (21,437) 276,712

Retained Earnings (38,284,665) (35,450,713)

-------------- --------------

TOTAL EQUITY ATTRIBUTABLE TO

EQUITY HOLDERS OF THE PARENT 27,226,043 20,506,274

-------------- --------------

LIABILITIES

NON-CURRENT LIABILITIES

Lease Liabilities - 1,130

-------------- --------------

TOTAL NON-CURRENT LIABILITIES - 1,130

-------------- --------------

CURRENT LIABILITIES

Lease Liabilities 1,132 11,608

Trade and Other Payables 1,677,127 1,207,259

-------------- --------------

TOTAL CURRENT LIABILITIES 1,678,259 1,218,867

-------------- --------------

TOTAL LIABILITIES 1,678,259 1,219,997

-------------- --------------

TOTAL EQUITY AND LIABILITIES 28,904,302 21,726,271

============== ==============

The Financial Statements were approved and authorised for issue

by the Board of Directors on 5 April 2022 and were signed on its

behalf by:

David Archer

Chief Executive Officer

Company number: 07307107

COMPANY STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2021

2021 2020

GBP GBP

ASSETS

NON-CURRENT ASSETS

Investments in Subsidiaries 333,831 621,582

Other Intangible Asset - 5,948

Other Receivables 26,184,402 32,995,016

Other Non-Current Assets 6,776 6,776

------------- --------------

TOTAL NON-CURRENT ASSETS 26,525,009 33,629,322

------------- --------------

CURRENT ASSETS

Equity instruments at FVTOCI 31,575 604,136

Trade and Other Receivables 207,129 47,908

Cash and Cash Equivalents 11,085,944 1,237,876

------------- --------------

TOTAL CURRENT ASSETS 11,324,648 1,889,920

TOTAL ASSETS 37,849,657 35,519,242

============= ==============

EQUITY AND LIABILITIES

SHAREHOLDERS' EQUITY

Share Capital 16,889,598 14,309,910

Share Premium 41,693,178 34,474,884

Merger Reserve 6,683,000 6,683,000

Warrant Reserve - 12,157

Share Based Payment Reserve 305,095 393,865

FVTOCI Reserve (21,437) 276,712

Retained Earnings (28,707,640) (21,455,793)

TOTAL EQUITY 36,841,794 34,694,735

------------- --------------

LIABILITIES

CURRENT LIABILITIES

Trade and Other Payables 1,007,863 824,507

TOTAL LIABILITIES 1,007,863 824,507

------------- --------------

TOTAL EQUITY AND LIABILITIES 37,849,657 35,519,242

============= ==============

The Company total comprehensive loss for the financial year was

GBP7,851,723 (2020: GBP4,833,165).

The Financial Statements were approved and authorised for issue

by the Board of Directors on 5 April 2022 and were signed on its

behalf by:

David Archer

Chief Executive Officer

Company number: 07307107

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31

DECEMBER 2021

Share

Foreign Based

Share Share Merger Currency Warrant Payment FVTOCI Retained Total

Capital Premium Reserve Reserve Reserve Reserve Reserve Earnings Equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2020 12,974,598 33,511,787 6,683,000 (30,257) 975,679 410,121 (43,439) (28,163,712) 26,317,777

---------------- ------------ ------------ ----------- ----------- ----------- ----------- ----------- -------------- -------------

Loss for the

year - - - - - - - (8,325,758) (8,325,758)

Other

Comprehensive

Income - - - (163,284) - - 320,151 - 156,867

------------ ------------ ----------- ----------- ----------- ----------- ----------- -------------- -------------

Total

Comprehensive

Income for

the

year - - - (163,284) - - 320,151 (8,325,758) (8,168,891)

Issue of share

capital (net

of expenses) 1,300,113 920,537 - - - - - - 2,220,650

Shares issued

in lieu 20,199 16,160 - - - - - - 36,359

Share based

payment

charges - - - - - 58,979 - - 58,979

Exercise of

options 15,000 26,400 - - - (16,650) - 16,650 41,400

Lapse of

options - - - - - (58,585) - 58,585 -

Lapse of

warrants - - - - (963,522) - - 963,522 -

------------ ------------ ----------- ----------- ----------- ----------- ----------- -------------- -------------

At 31 December

2020 14,309,910 34,474,884 6,683,000 (193,541) 12,157 393,865 276,712 (35,450,713) 20,506,274

---------------- ------------ ------------ ----------- ----------- ----------- ----------- ----------- -------------- -------------

Loss for the

year - - - - - - - (3,515,834) (3,515,834)

Other

Comprehensive

Income - - - 154,815 - - 82,006 - 236,821

---------------- ------------ ------------ ----------- ----------- ----------- ----------- ----------- -------------- -------------

Total

Comprehensive

Income for

the

year - - - 154,815 - - 82,006 (3,515,834) (3,279,013)

Issue of share

capital (net

of expenses) 2,579,688 7,218,294 - - - - - - 9,797,982

Share based

payment

charges - - - - - 200,800 - - 200,800

Lapse of

options - - - - - (289,570) - 289,570 -

Lapse of

warrants (12,157) - - 12,157 -

Disposal of

FVTOCI

investments - - - - - - (380,155) 380,155 -

At 31 December

2021 16,889,598 41,693,178 6,683,000 (38,726) - 305,095 (21,437) (38,284,665) 27,226,043

================ ============ ============ =========== =========== =========== =========== =========== ============== =============

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Description and purpose

Share Capital Amounts subscribed for share capital at nominal value.

Share Premium Amounts subscribed for share capital in excess of nominal

value less costs of fundraising.

Merger Reserve Amounts subscribed for share capital in excess of nominal

value in respect of the consideration paid in an acquisition

arrangement, when the issuing company takes its interest

in another company from below 90% to 90% or above equity

holding.

Foreign Currency Gains/losses arising on retranslating

Reserve the net assets of

group operations into Pound Sterling.

Warrant Reserve Fair value of the warrants issued.

Share Based Represents the accumulated balance of share based payment

Payment Reserve charges recognised in respect of asset acquired and share

options granted by Savannah Resources Plc, less transfers

to retained losses in respect of options exercised, lapsed

and forfeited.

FVTOCI Reserve Cumulative changes in fair value of equity investments classified

at fair value through other comprehensive income (FVTOCI).

Retained Earnings Cumulative net gains and losses recognised in the Consolidated

Statement of Comprehensive Income and other transactions

recognised directly in Retained Earnings.

COMPANY STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31

DECEMBER 2021

Share

Based

Share Share Merger Warrant Payment FVTOCI Retained Total

Capital Premium Reserve Reserve Reserve Reserve Earnings Equity

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2020 12,974,598 33,511,787 6,683,000 975,679 410,121 (43,439) (17,341,234) 37,170,512

---------------- ------------ ------------ ----------- ----------- ----------- ----------- -------------- -------------

Loss for the

year - - - - - - (5,153,316) (5,153,316)

Other

Comprehensive

Income - - - - - 320,151 - 320,151

----------------

Total

Comprehensive

Income for

the

year - - - - - 320,151 (5,153,316) (4,833,165)

Issue of share

capital (net

of expenses) 1,300,113 920,537 - - - - - 2,220,650

Shares issued

in lieu 20,199 16,160 - - - - 36,359

Share based

payment

charges - - - - 58,979 - - 58,979

Exercise of

options 15,000 26,400 - - (16,650) - 16,650 41,400

Lapse of

options - - - - (58,585) - 58,585 -

Lapse of

warrants - - - (963,522) - - 963,522 -

---------------- ------------ ------------ ----------- ----------- ----------- ----------- -------------- -------------

At 31 December

2020 14,309,910 34,474,884 6,683,000 12,157 393,865 276,712 (21,455,793) 34,694,735

---------------- ------------ ------------ ----------- ----------- ----------- ----------- -------------- -------------

Loss for the

year - - - - - - (7,933,729) (7,933,729)

Other

Comprehensive

Income - - - - - 82,006 - 82,006

Total

Comprehensive

Income for

the

year - - - - - 82,006 (7,933,729) (7,851,723)

Issue of share

capital (net

of expenses) 2,579,688 7,218,294 - - - - - 9,797,982

Share based

payment

charges - - - - 200,800 - - 200,800

Lapse of

options - - - - (289,570) - 289,570 -

Lapse of

warrants - - - (12,157) - - 12,157 -

Disposal of

FVTOCI

investments - - - - - (380,155) 380,155 -

At 31 December

2021 16,889,598 41,693,178 6,683,000 - 305,095 (21,437) (28,707,640) 36,841,794

================ ============ ============ =========== =========== =========== =========== ============== =============

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Description and purpose

Share Capital Amounts subscribed for share capital at nominal value.

Share Premium Amounts subscribed for share capital in excess of nominal

value less costs of fundraising.

Merger Reserve Amounts subscribed for share capital in excess of nominal

value in respect of the consideration paid in an acquisition

arrangement, when the issuing company takes its interest

in another company from below 90% to 90% or above equity

holding.

Warrant Reserve Fair value of the warrants issued.

Share Based Represents the accumulated balance of share based payment

Payment Reserve charges recognised in respect of asset acquired and

share options granted by Savannah Resources Plc, less

transfers to retained losses in respect of options

exercised, lapsed and forfeited.

FVTOCI Reserve Cumulative changes in fair value of equity investments

classified at fair value through other comprehensive

income (FVTOCI).

Retained Earnings Cumulative net gains and losses recognised in the Consolidated

Statement of Comprehensive Income and other transactions

recognised directly in Retained Earnings.

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEARED 31 DECEMBER

2021

2021 2020

GBP GBP

Cash flows used in operating activities

Loss for the year (3,515,834) (8,325,758)

Depreciation and amortisation charges 35,369 44,663

Impairment of other assets 5,948 -

Share based payment charge 200,800 58,979

Shares issued in lieu of payments

to suppliers - 36,359

Finance income (671) (38,747)

Finance expense 139 765

Exchange losses / (gains) 213,088 (37,580)

Loss on sale of discontinued operations - 5,373,633

Gain on relinquishment of the rights

and obligations of discontinued

operations (627,078) -

Cash flow used in operating activities before

changes

in working capital (3,688,239) (2,887,686)

(Increase) /Decrease in trade and

other receivables (267,267) 176,312

Increase in trade and other payables 451,801 443,541

------------- -------------

Net cash used in operating activities (3,503,705) (2,267,833)

------------- -------------

Cash flow used in investing activities

Purchase of intangible exploration

assets (1,603,208) (1,577,532)

Purchase of right-to-use assets (798) -

Purchase of tangible fixed assets (633,090) (2,721)

Proceeds from sale of investments 654,347 3,272

Bank deposits for mining licences - 57,319

Interest received 671 38,747

Proceeds from sale of discontinued

operations - 27,543

Proceeds from relinquishment of

the rights and obligations of discontinued

operations 6,506,852 -

Net cash from/(used in) investing

activities 4,924,774 (1,453,372)

Cash flow from financing activities

Proceeds from issues of ordinary

shares (net of expenses) 9,797,982 2,220,650

Proceeds from exercise of share

options - 41,400

Principal paid on lease liabilities (11,607) (18,310)

Interest paid on lease liabilities (139) (765)

Net cash from financing activities 9,786,236 2,242,975

Increase/(Decrease) in Cash and

Cash Equivalents 11,207,305 (1,478,230)

Cash and Cash Equivalents at beginning

of year 2,000,209 3,484,781

Exchange losses on cash and cash

equivalents (205,430) (6,342)

Cash and Cash Equivalents at end

of year 13,002,084 2,000,209

============= =============

COMPANY STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER

2021

2021 2020

GBP GBP

Cash flows used in operating activities

Loss for the year (7,933,729) (5,153,316)

Impairment of financial assets 39,215 (404,684)

Impairment of other assets 5,948 -

Share based payment reserve charge 200,800 58,979

Shares issued in lieu of payments

to suppliers - 36,359

Finance income (671) (4,819)

Exchange losses / (gains) 1,756,702 (1,289,781)

Loss on sale of subsidiaries - 5,438,172

Loss on relinquishment of the rights

and obligations of discontinued

operations 4,439,229 -

------------ -------------

Cash flow used in operating activities

before changes

in working capital (1,492,506) (1,319,090)

(Increase)/Decrease in trade and

other receivables (181,160) 258,071

Increase in trade and other payables 34,184 439,527

------------ -------------

Net cash used in operating activities (1,639,482) (621,492)

------------ -------------

Cash flow used in investing activities

Investment in subsidiaries - (36,180)

Loans to subsidiaries (4,784,700) (3,658,442)

Proceeds from repayment of loans

to subsidiaries 6,014,021 -

Proceeds from sale of investments 654,347 -

Proceeds from sale of subsidiaries - 27,543

Interest received 671 4,819

Net cash from/(used in) investing

activities 1,884,339 (3,662,260)

------------ -------------

Cash flow from financing activities

Proceeds from issues of ordinary

shares (net of expenses) 9,797,982 2,220,650

Proceeds from exercise of share

options - 41,400

Net cash from financing activities 9,797,982 2,262,050

------------ -------------

Increase/(Decrease) in Cash and

Cash Equivalents 10,042,839 (2,021,702)

Cash and Cash Equivalents at beginning

of year 1,237,876 3,277,943

Exchange losses on cash and cash

equivalents (194,771) (18,365)

Cash and Cash Equivalents at end

of year 11,085,944 1,237,876

============ =============

** ENDS **

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms