TIDMSAE

RNS Number : 5156A

SIMEC Atlantis Energy Limited

30 September 2020

INTERIM RESULTS (UNAUDITED)

30 September 2020

SIMEC ATLANTIS ENERGY LIMITED

("Atlantis", the "Company" or the "Group")

Interim Results (unaudited)

SIMEC Atlantis Energy Limited, the global developer, owner and

operator of sustainable energy projects is pleased to announce its

unaudited Interim Results for the six months ended 30 June

2020.

Trading Statement

The first six months of 2020 have seen significant global

economic and social challenges as a result of the COVID-19

pandemic. Despite these challenges, we have maintained a high level

of activity across each of our business units and we continue to

see encouraging progress on all key projects notwithstanding all of

the logistical and workplace challenges COVID-19 social distancing

restrictions present. In particular, we note the major technical,

planning and commercial milestones that have been achieved recently

on the Uskmouth power station conversion project in Wales, our

recent entry into the NPA Fuels joint venture with the N+P Group,

the performance from the MeyGen project in Scotland and the recent

over-subscribed equity placement in August 2020.

Financial summary

The overall loss before tax of GBP6.1 million for the six months

ended 30 June 2020 was almost half of the loss of GBP11.8 million

reported for the same period in 2019. This improvement is largely

attributable to strong revenue contributions generated by the

Atlantis tidal turbine and engineering services division, together

with good performance from the MeyGen project in Scotland. Six

months of revenue contributions from GHR added to the improved

performance relative to 2019. Overall, costs were in line with

expectations with significant contractors' costs being incurred in

delivery of the subsea hub project and the AR500 turbine for Japan,

as well as the ongoing Uskmouth operational costs.

Depreciation, as expected, has remained stable and is being

driven by Uskmouth and MeyGen.

Finance costs in the current period are materially in line with

the same period last year and also included five months of the

GBP3.79 million Abundance bond raise, which closed in February

2020.

The unaudited consolidated cash position of the Atlantis Group

at 30 June 2020 was GBP9.8 million.

Tim Cornelius, Chief Executive of Atlantis, commented:

The impact of COVID-19 on our business, society and personal

lives cannot be underestimated and we have all had to find new ways

to work and to live. I am immensely proud of all the team at

Atlantis who have ensured that during these unprecedented times we

have continued to make material progress on our important portfolio

of projects, where we connect carbon cutting projects with

industries looking to ensure that they can reduce their carbon

intensity and be at the forefront of the green agenda.

Each of our business units, being tidal energy, hydro power and

power station conversions, have delivered exceptional performance

under challenging conditions.

The full Interim Report will be available to download from the

Company's website today.

www.simecatlantis.com

Enquiries:

Investec Bank PLC +44 (0) 20 7597 5970

Jeremy Ellis

Sara Hale

Ben Griffiths

-----------------------

SIMEC Atlantis Energy Limited +44 (0) 7739 832 446

-----------------------

Sean Parsons, Director of External

Affairs

-----------------------

Notes to Editors

SIMEC Atlantis Energy

Atlantis is a global developer, owner and operator of

sustainable energy projects with a diverse portfolio in various

stages of development. This includes a 77 per cent. stake in the

world's largest tidal stream power project, MeyGen, 100 per cent.

of the 220MW Uskmouth Power Station conversion project and 100 per

cent. of Green Highland Renewables, a leading developer of

mini-hydro projects.

https://www.simecatlantis.com/

SIMEC Atlantis Energy Limited

Registration Number: 200517551R

Consolidated Interim Financial Statements

(unaudited)

For the six months ended 30 June 2020

Trading Update Statement

The first six months of 2020 have seen significant global

economic and social challenges as a result of the COVID-19

pandemic. Here at Atlantis we have maintained activity across each

of our business units and we continue to see encouraging progress

despite the logistical and workplace challenges COVID-19 social

distancing restrictions present. In particular, we note the

continued progress of the Uskmouth power station conversion project

in Wales with major technical, planning and commercial milestones

having been successfully achieved, the entry into the NPA Fuels

joint venture with the N+P Group, and the resulting over-subscribed

equity placement in August 2020.

Power Station Conversion

The Uskmouth conversion project started the year in March with

successful commercial fuel pellet production and milling trials and

followed this up in May with the launch of the project

pre-application planning consultation. The most significant

technical achievement of 2020 was announced in June in relation to

the large scale fuel combustion tests which took place in Nagasaki,

Japan. These tests were successfully completed by Mitsubishi Power

Systems and results exceeded combustion performance expectations.

In August, we announced entry into a fuel supply joint venture with

the N+P Group to supply fuel to Uskmouth and other future

conversion projects. This joint venture is expected to improve the

security of Uskmouth's fuel supply whilst providing access to

additional revenues from the sale of fuel and the gate fees

chargeable for receipt of the input waste materials at the fuel

production plants. In order to optimise revenues generated by power

sales from Uskmouth we have also announced that we are working with

data centre development specialist TechRE to evaluate opportunities

to sell output via private wire networks to data centre customers.

Finally, we recently updated the market on our relationship with

South Korean infrastructure investor Hana Financial Investment Co,

with whom we are seeking to secure debt and equity bridge financing

for the conversion of the first 110MW of capacity at Uskmouth.

Marine Energy

The 6MW first phase of the MeyGen project has now exported more

than 33GWh to the grid, enough to charge more than 750,000 standard

electric vehicles. Whilst the three Andritz turbines have been

performing well, the Atlantis AR1500 turbine requires further

repair and maintenance following its redeployment in August. We

expect the AR1500 to be reinstated and fully operational by the end

of December 2020. The variable pitch upgrade is expected to deliver

a 4% increase in annual revenue with no increase in the turbine's

operating cost. The August operations included the completion of

the installation of MeyGen's new subsea hub, which was provided by

Atlantis under a GBP2.4m delivery contract supported by a grant

from the Saltire Tidal Energy Challenge Fund. This subsea hub is a

key enabler for cost reductions in future tidal arrays as it is

designed to allow for the connection of multiple turbines

offshore.

Atlantis is in the final stages of construction and testing for

an AR500 turbine system to be delivered to Japan for our client

Kyuden Mirai Energy ("KME") in Q4 2020. The turbine will be

deployed in the Straits of Naru, within the southern Japanese Goto

island chain. It is intended that this would be the first phase of

a larger testing programme at the site, subject to initial

performance.

Hydro Energy

The Atlantis group's hydro division, SIMEC GHR Ltd ("GHR"), has

continued to develop its operations and maintenance business and

currently provides services to over 45 separate hydroelectric

schemes throughout Scotland. New clients are being added and

additional resources are being deployed to ensure that the service

levels are of the highest standard. GHR's project management

division is actively involved in the construction of 4 new hydro

schemes and, although COVID-19 closed these sites for a short

while, construction is now progressing well towards the required

commissioning dates.

Equity Placement

On 6 August 2020, the Company announced the launch of a

fundraising comprising a placing by way of an accelerated bookbuild

process by Investec and Arden and an offer for subscription by

PrimaryBid, each at a price of 12 pence per share (together, the

"Fundraising"). The placing raised gross proceeds of GBP6.5 million

through the issue of 54,166,666 new ordinary shares and the

PrimaryBid offer raised GBP1 million through the issue of 8,333,333

new ordinary shares. In aggregate, therefore, the Fundraising

raised gross proceeds of approximately GBP7.5 million and resulted

in the issue of 62,499,999 new Ordinary Shares at 12 pence per

share. The proceeds are being used to fund the Company's working

capital requirements and in connection with the proposed investment

by the Company in NPA Fuels Limited.

Summary of Results

The overall loss before tax of GBP6.1 million for the six months

ended 30 June 2020 was almost half of the loss of GBP11.8 million

reported for the same period in 2019. This improvement is largely

attributable to strong revenue contributions generated by the tidal

turbines and engineering services division, together with good

performance from the MeyGen project in Scotland. Six months of

revenue contributions from GHR added to the improved performance

relative to 2019. Overall, costs were in line with expectations

with significant contractors' costs being incurred in delivery of

the subsea hub project and the AR500 turbine for Japan, as well as

the ongoing Uskmouth operational costs.

Depreciation, as expected, has remained stable and is being

driven by Uskmouth and MeyGen.

Finance costs in the current period are materially in line with

the same period last year and also included five months of the

GBP3.79 million Abundance bond raise, which closed in February

2020.

The unaudited consolidated cash position of the Atlantis Group

at 30 June 2020 was GBP9.8 million.

Condensed consolidated statement of profit and loss and

other comprehensive income

For the six months ended 30 June 2020

Group

Six months ended

------- ------------------------

30 June 30 June

Note 2020 2019

------- ----------- -----------

GBP'000 GBP'000

------- ----------- -----------

Revenue 7,935 1,974

------- ----------- -----------

Other gains and losses 154 76

------- ----------- -----------

Employee benefits expense (3,203) (3,125)

------- ----------- -----------

Subcontractor costs (2,251) (1,739)

------- ----------- -----------

Depreciation and amortisation (5,318) (5,219)

------- ----------- -----------

Acquisition costs - (980)

------- ----------- -----------

Other operating expenses (1,534) (1,651)

------- ----------- -----------

Total expenses (12,306) (12,714)

------- ----------- -----------

Results from operating activities (4,217) (10,664)

------- ----------- -----------

Finance costs (1,959) (1,749)

------- ----------- -----------

Loss before tax (6,176) (12,413)

------- ----------- -----------

Tax credit 69 581

------- ----------- -----------

Loss for the period (6,107) (11,832)

------- ----------- -----------

Other comprehensive income:

------- ----------- -----------

Items that are or may be reclassified

subsequently to profit or loss

------- ----------- -----------

Exchange differences on translation

of foreign operations 4 -

------- ----------- -----------

Total comprehensive income for

the period (6,103) (11,832)

------- ----------- -----------

Loss attributable to:

------- ----------- -----------

Owners of the Group (5,868) (11,436)

------- ----------- -----------

Non-controlling interests (239) (396)

------- ----------- -----------

Total comprehensive income attributable

to:

------- ----------- -----------

Owners of the Group (5,864) (11,436)

------- ----------- -----------

Non-controlling interests (239) (396)

------- ----------- -----------

Loss per share (basic and diluted)

(pence) 5 (0.01) (0.03)

------- ----------- -----------

Condensed consolidated statement of financial position

As at 30 June 2020

Group

----------------------------

30 June 31 December

2020 2019

------------ --------------

GBP'000 GBP'000

------------ --------------

Assets

------------ --------------

Property, plant and equipment 134,069 136,315

------------ --------------

Intangible assets 16,253 17,058

------------ --------------

Right-of-use assets 1,296 1,436

------------ --------------

Investment in joint venture 47 47

------------ --------------

Non-current assets 151,665 154,856

------------ --------------

Trade and other receivables 2,420 7,830

------------ --------------

Inventory 861 864

------------ --------------

Cash and cash equivalents 9,819 4,521

------------ --------------

Current assets 13,100 13,215

------------ --------------

Total assets 164,765 168,071

------------ --------------

Liabilities

------------ --------------

Trade and other payables 11,195 9,449

------------ --------------

Lease liabilities 192 276

------------ --------------

Provisions 118 120

------------ --------------

Loans and borrowings 3,625 4,559

------------ --------------

Current liabilities 15,130 14,404

------------ --------------

Loans and borrowings 42,782 40,662

------------ --------------

Lease liabilities 981 1,091

------------ --------------

Provisions 14,669 14,539

------------ --------------

Deferred tax liabilities 3,275 3,344

------------ --------------

Non-current liabilities 61,707 59,636

------------ --------------

Total liabilities 76,837 74,040

------------ --------------

Net assets 87,928 94,031

------------ --------------

Equity

------------ --------------

Share capital 188,018 188,018

------------ --------------

Capital reserve 12,665 12,665

------------ --------------

Translation reserve 7,083 7,079

------------ --------------

Share option reserve 740 740

------------ --------------

Accumulated losses (126,654) (120,786)

------------ --------------

Total equity attributable to owners

of the Company 81,852 87,716

------------ --------------

Non-controlling interests 6,076 6,315

------------ --------------

Total equity 87,928 94,031

------------ --------------

Condensed consolidated statement of changes in equity

For the six months ended 30 June 2020

Attributable to owners of the Company

-------------------------------------------------------------

Share Non-

Share Capital Translation option Accumulated controlling

capital reserve reserve reserve losses Total interest Total

------- ------- ----------- ------- ----------- --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------- ------- ----------- ------- ----------- -------- ----------- --------

Group

------- ------- ----------- ------- ----------- -------- ----------- --------

At 1 January 2019 178,218 12,665 7,073 3,224 (88,479) 112,701 6,862 119,563

------- ------- ----------- ------- ----------- -------- ----------- --------

Total comprehensive

income for the

period

------- ------- ----------- ------- ----------- -------- ----------- --------

Loss for the period - - - - (11,436) (11,436) (396) (11,832)

------- ------- ----------- ------- ----------- -------- ----------- --------

Other comprehensive

income - - (1) - - (1) - (1)

------- ------- ----------- ------- ----------- -------- ----------- --------

Total comprehensive

income for the

period - - (1) - (11,436) (11,437) (396) (11,833)

------- ------- ----------- ------- ----------- -------- ----------- --------

Transactions with

owners

------- ------- ----------- ------- ----------- -------- ----------- --------

Contributions and

distributions

------- ------- ----------- ------- ----------- -------- ----------- --------

Issue of share

capital 9,800 - - - - 9,800 - 9,800

------- ------- ----------- ------- ----------- -------- ----------- --------

Recognition of

share-based

payments - - - 36 - 36 - 36

------- ------- ----------- ------- ----------- -------- ----------- --------

Transfer between

reserves - - - (799) 799 - - -

------- ------- ----------- ------- ----------- -------- ----------- --------

Total transactions

with owners 9,800 - - (763) 799 9,836 - 9,836

------- ------- ----------- ------- ----------- -------- ----------- --------

At 30 June 2019 188,018 12,665 7,072 2,461 (99,116) 111,100 6,466 117,566

------- ------- ----------- ------- ----------- -------- ----------- --------

Total comprehensive

income for the

period

------- ------- ----------- ------- ----------- -------- ----------- --------

Loss for the period - - - - (23,436) (23,436) (151) (23,587)

------- ------- ----------- ------- ----------- -------- ----------- --------

Other comprehensive

income - - 7 - - 7 - 7

------- ------- ----------- ------- ----------- -------- ----------- --------

Total comprehensive

income for the

period - - 7 - (23,436) (23,429) (151) (23,580)

------- ------- ----------- ------- ----------- -------- ----------- --------

Transactions with

owners

------- ------- ----------- ------- ----------- -------- ----------- --------

Contributions and

distributions

------- ------- ----------- ------- ----------- -------- ----------- --------

Recognition of

share-based

payments - - - 45 - 45 - 45

------- ------- ----------- ------- ----------- -------- ----------- --------

Transfer between

reserves - - - (1,766) 1,766 - - -

------- ------- ----------- ------- ----------- -------- ----------- --------

Total transactions

with owners - - - (1,721) 1,766 45 - 45

------- ------- ----------- ------- ----------- -------- ----------- --------

At 31 December 2019 188,018 12,665 7,079 740 (120,786) 87,716 6,315 94,031

------- ------- ----------- ------- ----------- -------- ----------- --------

Total comprehensive

income for the

period

------- ------- ----------- ------- ----------- -------- ----------- --------

Loss for the period - - - - (5,868) (5,868) (239) (6,107)

------- ------- ----------- ------- ----------- -------- ----------- --------

Other comprehensive

income - - 4 - - 4 - 4

------- ------- ----------- ------- ----------- -------- ----------- --------

Total comprehensive

income for the

period - - 4 - (5,868) (5,864) (239) (6,103)

------- ------- ----------- ------- ----------- -------- ----------- --------

Transactions with

owners

------- ------- ----------- ------- ----------- -------- ----------- --------

Contributions and

distributions

------- ------- ----------- ------- ----------- -------- ----------- --------

Issue of share - -

capital - - - - - -

------- ------- ----------- ------- ----------- -------- ----------- --------

Recognition of - - -

share-based

payments - - - - -

------- ------- ----------- ------- ----------- -------- ----------- --------

Transfer between - - -

reserves - - - - -

------- ------- ----------- ------- ----------- -------- ----------- --------

Total transactions

with owners - - - - - - - -

------- ------- ----------- ------- ----------- -------- ----------- --------

At 30 June 2020 188,018 12,665 7,083 740 (126,654) 81,852 6,076 87,928

------- ------- ----------- ------- ----------- -------- ----------- --------

Condensed consolidated statement of cash flows

For the six months ended 30 June 2020

Group

----- ----------------------------

Six months ended

----- ----------------------------

30 June 30 June

----- -------------- --------------

2020 2019

----- -------------- --------------

GBP'000 GBP'000

----- -------------- --------------

Cash flows from operating activities

----- -------------- --------------

Loss before tax for the period (6,176) (12,413)

-------------- --------------

Adjustments for:

----- -------------- --------------

Grant income (71)

-------------- --------------

Depreciation of property, plant and

equipment 4,497 4,454

-------------- --------------

Amortisation of intangible asset 821 765

-------------- --------------

Interest income (18) (7)

-------------- --------------

Finance costs 1,959 1,749

-------------- --------------

Share-based payments - 36

-------------- --------------

Provision movement - (1,054)

-------------- --------------

Net foreign exchange (23) 3

-------------- --------------

Operating cash flows before movements

in working capital 989 (6,467)

-------------- --------------

Movement in trade and other receivables 1,376 857

-------------- --------------

Movement in trade and other payables 1,625 (1,946)

-------------- --------------

Net cash used in operating activities 3,990 (7,556)

-------------- --------------

Cash flows from investing activities

----- -------------- --------------

Purchase of property, plant and equipment (3,514) (751)

-------------- --------------

Acquisition of subsidiary, net of

cash acquired - -

----- -------------- --------------

Net cash used in investing activities (3,514) (751)

-------------- --------------

Cash flows from financing activities

----- -------------- --------------

Proceeds from grants received 1,509 -

----- -------------- --------------

Proceeds from issue of shares (1) 4,000 5,030

-------------- --------------

Costs related to fund raising - (260)

-------------- --------------

Proceeds from borrowings 1,056 -

----- -------------- --------------

Repayment of borrowings (961) (65)

-------------- --------------

Deposits (pledged) / released (492) (1)

-------------- --------------

Payment of lease liabilities (235) (204)

-------------- --------------

Interest paid (547) (394)

-------------- --------------

Net cash from financing activities 4,330 4,106

-------------- --------------

Net increase / (decrease) in cash

and cash balances 4,806 (4,201)

-------------- --------------

Cash and cash equivalents at beginning

of period 3,602 8,351

-------------- --------------

Cash and cash equivalents at end

of period 8,408 4,150

-------------- --------------

Included in cash and cash equivalents in the statements of

financial position is GBP1.4 million (2019: GBP0.9 million) of

encumbered deposits.

(1) Shares were issued as part of March 2019 share placing. Cash

received from SIMEC in 2020.

Notes to the Consolidated Interim Financial Statements

The condensed consolidated statement of financial position of

SIMEC Atlantis Energy Limited (the "Company") and its subsidiaries

(the "Group") as at 30 June 2020, the condensed consolidated

statement of profit or loss and other comprehensive income, the

condensed consolidated statement of changes in equity and the

condensed consolidated statement of cash flows for the Group for

the six-month period then ended and certain explanatory notes (the

"Consolidated Interim Financial Statements"), were approved by the

Board of Directors for issue on 29 September 2020

These notes form an integral part of the Consolidated Interim

Financial Statements.

The Consolidated Interim Financial Statements do not comprise

statutory accounts of the Group within the meaning in the

provisions of the Singapore Companies Act, Chapter 50. The Group's

statutory accounts for the year ended 31 December 2019 were

prepared in accordance with Singapore Financial Reporting Standards

(International) (SFRS(I)) and International Financial Reporting

Standards (IFRS). SFRS(I)s are issued by the Accounting Standards

Council Singapore, which comprise standards and interpretations

that are equivalent to IFRS issued by the International Accounting

Standards Board. All references to SFRS(I)s and IFRSs are

subsequently referred to as IFRS in these financial statements

unless otherwise specified.

The Group's statutory accounts for the year ended 31 December

2019 were approved by the Board of Directors on 11 August 2020 and

have been reported by the Group's auditors.

1 Domicile and activities

SIMEC Atlantis Energy Limited (the "Company") is a company

incorporated in Singapore. The Company's registered office address

is c/o Level 4, 21 Merchant Road, #04-01, Singapore 058267. The

principal place of business is Edinburgh Quay 2, 139

Fountainbridge, Edinburgh, EH3 9QG, United Kingdom.

The principal activity of the Group is to develop and operate as

a global sustainable energy provider. The Company is an inventor,

developer, owner, marketer and licensor of technology, intellectual

property, trademarks, products and services and an investment

holding company.

2 Significant accounting policies

Basis of preparation

The Consolidated Interim Financial Statements have been prepared

in accordance with the AIM Rules for Companies and are therefore

not required to comply with International Accounting Standard 34

Interim Financial Reporting to maintain compliance with IFRS. In

all other respects, the financial statements are drawn up in

accordance with International Financial Reporting Standards as

issued by the International Accounting Standards Board.

Selected explanatory notes are included to explain events and

transactions that are significant to an understanding of the

changes in financial position and performance of the Group since

the last annual consolidated financial statements as at and for the

year ended 31 December 2019.

The Consolidated Interim Financial Statements, which do not

include the full disclosures of the type normally included in a

complete set of financial statements, are to be read in conjunction

with the last issued consolidated financial statements of the Group

as at and for the year ended 31 December 2019.

Accounting policies

The accounting policies and method of computation used in the

Consolidated Interim Financial Statements are consistent with those

applied in the last issued consolidated financial statements of the

Group for the year ended 31 December 2019.

3 Critical accounting judgements and key sources of estimation uncertainty

In preparing this set of Consolidated Interim Financial

Statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements for the year ended 31 December

2019.

4 Going concern basis

The Group has prepared financial forecasts for a period beyond

30 September 2021, including sensitivity analysis. These forecasts,

which take into account the ongoing committed costs of the Group,

demonstrate that the Company is able to operate within its

available cash and funding balances for a period beyond 30

September 2021. The forecasts indicate that the Group is projected

to operate within its available cash facilities for the forecast

period although mitigating action may be required to be taken in

advance of periods when cash and cash equivalents available for use

are forecast to be limited.

While the Directors cannot envisage all possible circumstances

that may impact the Group in the future, the Directors believe

that, taking account of the forecasts, future plans and available

cash resources, the Group will have sufficient resources to support

the Company to meet all ongoing working capital and committed

capital expenditure requirements as they fall due. Further details

on the going concern assessment are provided in the 31 December

2019 consolidated financial statements published on the 11(th)

August 2020.

5 Other notes

(i) In respect of the six months to 30 June 2020, the diluted

earnings per share is calculated on a loss attributable to owners

of the Company of GBP5.8 million on the basic weighted average of

429,077,656 ordinary shares (30 June 2019: loss of GBP11.8 million

and basic weighted average shares of 399,201,964). Share options

were excluded from the diluted weighted average number of ordinary

shares calculations as their effect would have been anti-dilutive.

No dividends has been declared (2019: nil).

6 Events after the reporting date

On 11 August the Company raised GBP7.5 million, before expenses,

through the placing of 62,499,999 new ordinary shares at a placing

price of 12 pence per share.

COMPANY INFORMATION

NON-EXECUTIVE DIRECTORS AUDITOR

John Mitchell Neill Ernst & Young LLP

Mark Edward Monckton Elborne One Raffles Quay

George Jay Hambro North Tower, Level 18

Ian Raymond Wakelin Singapore 048583

John Anthony Clifford Woodley

EXECUTIVE DIRECTORS REGISTRAR

Timothy James Cornelius Boardroom Corporate & Advisory

Andrew Luke Dagley Services Pte Ltd

50 Raffles Place

#32-01 Singapore Land Tower

Singapore 048623

---------------------------------

REGISTERED OFFICE AND DEPOSITARY

COMPANY NUMBER Link Market Services Trustees

c/o Level 4, 21 Merchant Road, Limited

#04-01 The Registry

Singapore 058267 34 Beckenham Road

Company Number: 200517551R Beckenham BR3 4TU

---------------------------------

COMPANY SECRETARY GUERNSEY BRANCH REGISTER

Kelly Tock Mui Han Link Market Services (Guernsey)

21 Merchant Road Limited

#04-01 Royal Merukh S.E.A Mont Crevelt House

Singapore 058267 Bulwer Avenue

St Sampson

Guernsey GY2 4LH

---------------------------------

NOMINATED ADVISER AND BROKER

Investec Bank plc

30 Gresham Street

London

EC2V 7QP

---------------------------------

WEBSITE

www.simecatlantis.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR ZZGZLZLVGGZZ

(END) Dow Jones Newswires

September 30, 2020 02:00 ET (06:00 GMT)

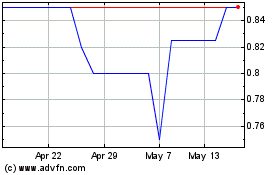

Simec Atlantis Energy (LSE:SAE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Simec Atlantis Energy (LSE:SAE)

Historical Stock Chart

From Jul 2023 to Jul 2024