TIDMQRT

RNS Number : 2237V

Quarto Group Inc

30 November 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF THAT JURISDICTION

FOR IMMEDIATE RELEASE

30 November 2023

THE QUARTO GROUP INC.

PROPOSED CANCELLATION OF ADMISSION OF THE COMPANY'S COMMON

SHARES TO THE PREMIUM SEGMENT OF THE OFFICIAL LIST AND TO TRADING

ON THE MAIN MARKET FOR LISTED SECURITIES OF THE LONDON STOCK

EXCHANGE

The Quarto Group Inc. ("Quarto" or the "Company") today

announces:

-- the Company's intention to cancel the admission of the

Company's common shares of US$0.10 each to the premium segment of

the Official List and to trading on the Main Market for listed

securities of the London Stock Exchange ("De-listing"), subject to

Shareholder Approval, with effect from 18 January 2024; and

-- the posting of a circular to Shareholders (the "Circular"),

which contains further information on the De-listing and the effect

of the De-listing on Shareholders and holders of Depository

Interests and notice of a special meeting (the "Special Meeting"),

which is to be held at 1 Triptych Place, Second Floor, London, SE1

9SH, United Kingdom on 14 December 2023 at 12.00 p.m. at which

shareholder approval will be sought for the De-listing.

The Listing Rules require that, if a company wishes to cancel

its listing on the Official List, it must seek the approval of (i)

a majority of not less than 75 per cent of votes attaching to

shares voted on a resolution of Shareholders (the "Resolution") and

(ii) a majority of the votes attaching to the shares of Independent

Shareholders who votes on the Resolution, in each case voting in

person or by proxy. If approved, it is anticipated that the

effective date of the De-listing will be 18 January 2024, being not

less than 20 business days from the passing of the Resolution.

The Board considers that the De-listing is in the best interests

of the Company and its Shareholders as a whole. Accordingly, the

Board unanimously recommend Shareholders vote in favour of the

Resolution.

The Company has received irrevocable undertakings to vote in

favour of (or recommend to the registered holder that they vote in

favour of) the Resolution at the Special Meeting and not to accept

the Tender Offer in the event that the Company implements the

Tender Offer from certain Shareholders representing in aggregate

29,612,326 Common Shares, representing in aggregate approximately

72.4% of the Company's issued share capital as at close of business

on 28 November 2023.

The Board recognises that the effects of the De-listing are

significant for Shareholders and holders of Depository Interests,

in particular the loss of protections afforded by the Listing Rules

and the loss of liquidity provided by the existing listing

arrangements. The Board therefore intends to make the Tender Offer

to provide Qualifying Shareholders and holders of Depository

Interests with a means to realise their investment in the Company

for cash after the De-listing has occurred. Further details of the

proposed Tender Offer are set out in the Circular. Shareholders and

holders of Depository Interests should be aware that although as at

the date of this announcement it is the intention of the Board to

proceed with the Tender Offer, there can be no guarantee that the

Company will actually make the Tender Offer.

Unless otherwise defined herein, capitalised terms have the same

meaning as those defined in the Circular.

BACKGROUND TO AND REASONS FOR THE DE-LISTING

The Directors have conducted a review of the benefits and

drawbacks to the Company, its Shareholders and holders of

Depository Interests in relation to its listing on the Main Market.

As part of their review, the Directors considered the following

matters, amongst others:

a) the effects of the De-listing being significant for

Shareholders and holders of Depository Interests, in particular in

terms of the loss of the protections afforded to Shareholders and

holders of Depository Interests by the Listing Rules;

b) the loss of protections given by the Disclosure Guidance and Transparency Rules ("DTR"); and

c) the loss of liquidity provided by the existing listing arrangements.

The Board explored the possibility of transferring the Company's

listing to AIM in the past few years. However, the Board concluded

that the benefits of becoming an unlisted private company at this

stage of the Company's development outweigh the potential benefits

of seeking admission to another market in London.

The Directors have considered the strategy for the Company to

ensure that it is in the best position to be able to raise funds

and enter into strategic transactions to develop the business

whilst also ensuring the Company continues to meet its financial

commitments and yields a return for Shareholders and holders of

Depository Interests.

The Directors unanimously believe that the De-listing is in the

best interests of the Company and its Shareholders (and holders of

Depository Interests) as a whole. In reaching their decision, the

Directors have considered the following key factors, amongst

others:

1) the De-listing will result in certain costs savings, plus

administrative and transactional efficiencies for the Company;

2) the Company will gain the flexibility to close future

acquisitions more quickly without having to comply with the Listing

Rules;

3) that the Company's Common Shares historically have a low

average daily trading volume, which makes the Company's share price

susceptible to significant fluctuations after trades involving

small numbers of shares; and

4) that the Company's Common Shares suffer from limited

liquidity and a low free float of approximately 17%, which limits

the benefits that the Company can gain from accessing capital

through the London Stock Exchange.

Further details of the factors considered by the Board in

reaching its decision are set out in the Circular.

PRINCIPAL EFFECTS OF THE DE-LISTING

(1) Trading and liquidity

Following the De-listing, the Common Shares will no longer be

traded on a public market or trading facility on any recognised

investment exchange. As a result, Shareholders and holders of

Depository Interests will not be able to trade their Common Shares

on the London Stock Exchange and, consequently, the opportunity for

Shareholders and holders of Depository Interests to realise their

investment in the Company will be limited.

Following the De-listing, the liquidity and marketability of the

Common Shares may be significantly reduced, and the value of such

shares may be adversely affected as a consequence. It may also be

more difficult for Shareholders and holders of Depository Interests

to determine the market value of their investment in the Company at

any given time.

As described above, however, if there is sufficient interest

from Shareholders and holders of Depository Interests, it is the

current intention of the Board to make the Tender Offer following

the De-listing, which will enable Shareholders to sell some or all

of their shares if they would like to do so. Furthermore, the Board

will consider making arrangements for a matched bargain facility to

be put in place in order to give Shareholders and holders of

Depository Interests the opportunity to trade in the Common Shares

after the De-listing and Tender Offer have completed. However,

there are no guarantees that the Company will proceed with the

Tender Offer and/or put in place a matched bargain facility.

(2) Disclosure and Reporting

The Company will no longer be subject to the regulatory and

financial reporting regime applicable to companies whose shares are

admitted to the Official List and to trading on the Main Market

including the Listing Rules, the Disclosure and Transparency Rules,

Market Abuse Regulations and the Corporate Governance Code.

To mitigate the loss of protections set out above, after the

De-listing has become effective, the Company will implement certain

corporate governance and disclosure measures as set out below:

-- The Board is committed to keeping Shareholders and holders of

Depository Interests informed of key developments in the business,

which it will do by sending the Company's annual report to

Shareholders and holders of Depository Interests by post.

Shareholders and holders of Depository Interests should be aware

that there will be no obligation on the Company to include all of

the information required by, or to update the website as required

by, the Listing Rules.

-- 1010 Printing Limited of the Lion Rock Group is a controlling

shareholder of the Company. The Company and the controlling

shareholder shall enter into a relationship agreement to ensure

that the controlling shareholder does not exert improper influence

over the Company and all transactions between the Company and the

controlling shareholder shall be conducted at arm's length and on

market terms and conditions.

-- As part of the Lion Rock Group, which is listed on the Hong

Kong Stock Exchange, the Company will provide updates in accordance

with the applicable disclosure requirements of Appendix 16 of the

Rules Governing the Listing of Securities on The Stock Exchange of

Hong Kong Limited and with Hong Kong Accounting Standard 34

"Interim Financial Reporting" issued by the Hong Kong Institute of

Certified Public Accountants.

(3) Corporate Governance

The Company will no longer be required to comply with the FRC's

Corporate Governance Code or any of the additional corporate

governance requirements applicable to companies admitted to the

premium segment of the Official List of the FCA and to trading on

the Main Market for listed securities of the London Stock Exchange.

However, the Directors intend to continue to operate the Company

for the benefit of all Shareholders and holders of Depository

Interests. They also intend to continue to keep Shareholders and

holders of Depository Interests informed of progress and remain

committed to high standards of corporate governance. As such, the

Company will hold shareholder meetings in accordance with statutory

requirements and the Company's by-laws.

The Company does not currently envisage making any changes to

its Board composition as a consequence of the De-listing.

(4) Taxation

The De-listing might have personal taxation consequences for

Shareholders and holders of Depository Interests. Shareholders and

holders of Depository Interests who are in any doubt about their

tax position should consult their own professional independent

adviser immediately.

(5) Depository Interests

Following the De-listing, those interests in Common Shares held

as Depository Interests will remain in place until further

notice.

The above considerations are not exhaustive, and Shareholders

and holders of Depository Interests should seek their own

independent advice when assessing the likely impact of De-listing

on them.

SHAREHOLDER CIRCULAR

Shareholders are urged to read the Circular as a whole and in

its entirety. The Circular contains further information on the

De-Listing and a notice of Special Meeting.

The Circular will be submitted to the National Storage Mechanism

and available shortly at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

A copy of this announcement and the Circular will also be

available at the Company's website:

https://www.quarto.com/aboutus/investornews.aspx.

DISCLAIMER

Forward-looking statements

This announcement contains statements about the Company that are

or may be "forward-looking statements". All statements, other than

statements of historical facts, included in this announcement may

be forward-looking statements. Without limitation, any statements

preceded or followed by, or that include, the words "targets",

"plans", "believes", "expects", "aims", "intends", "will", "may",

"should", "anticipates", "estimates", "projects" or words or terms

of similar substance, or the negative thereof, are forward-looking

statements. These forward-looking statements are not guarantees of

future performance and have not been reviewed by the auditors of

the Company. They appear in a number of places throughout this

announcement and include statements regarding the intentions,

beliefs and current expectations of the Company or the Directors

concerning, amongst other things, the results of operations,

financial condition, liquidity, prospects, growth and strategies of

the Company and the industry in which the Group operates.

These forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company to be

materially different from any results, performance or achievements

expressed or implied by such forward-looking statements. These

forward-looking statements are based on numerous assumptions

regarding the present and future business strategies of the Company

and the environment in which it will operate in the future.

Past performance is not a guarantee of future performance.

Investors should not place undue reliance on such forward-looking

statements and, save as is required by law or regulation, the

Company does not undertake any obligation to update publicly or

revise any forward-looking statements (including to reflect any

change in expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based).

All subsequent forward-looking statements attributed to the Company

or any persons acting on its behalf are expressly qualified in

their entirety by the cautionary statement above. All

forward-looking statements contained in this announcement are based

on information available to the Directors of the Company at the

date of this announcement, unless some other time is specified in

relation to them, and the posting or receipt of this announcement

shall not give rise to any implication that there has been no

change in the facts set forth herein since such date.

Inside information

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (596/2014) ("MAR"). Upon the

publication of this announcement via Regulatory Information

Service, this inside information is now considered to be in the

public domain.

General

This announcement shall not constitute an offer to sell or the

solicitation of an offer to buy the Common Shares or Depository

Interests, nor shall there be any sale of the Common Shares or

Depository Interests in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction.

ENQUIRIES

The Quarto Group Inc.

Daniel Logan, Group Finance Director +44 (0)20 7700 6700

Michael Clarke, Company Secretary

ABOUT QUARTO

Quarto creates a wide variety of books and intellectual property

products, with a mission to inspire life's experiences. Produced in

many formats for adults, children and the whole family, our

products are visually appealing, information rich and

stimulating.

Quarto encompasses a diverse portfolio of imprints and

businesses that are creatively independent and expert in developing

long-lasting content across specific niches of interest.

Quarto sells and distributes its products globally in over 50

countries and 40 languages, through a variety of sales channels,

partnerships and routes to market. The group was founded in London

in 1976. It is domiciled in the US and listed on the London Stock

Exchange.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CIRBGBDBXDXDGXG

(END) Dow Jones Newswires

November 30, 2023 05:28 ET (10:28 GMT)

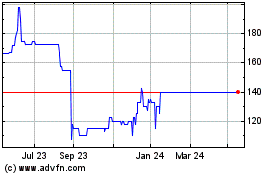

Quarto (LSE:QRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

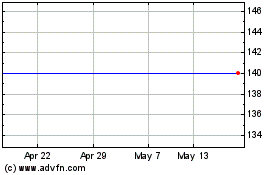

Quarto (LSE:QRT)

Historical Stock Chart

From Nov 2023 to Nov 2024