TIDMOCN

RNS Number : 0687U

Ocean Wilsons Holdings Ltd

24 March 2023

Ocean Wilsons Holdings Limited

Preliminary results for the year ended 31 December 2022

STRATEGIC REPORT

About Ocean Wilsons Holdings Limited

Ocean Wilsons Holdings Limited ("Ocean Wilsons" or the

"Company") is a Bermuda investment holding company which, through

its subsidiaries, holds a portfolio of international investments

and operates a maritime services company in Brazil. The Company is

listed on both the London Stock Exchange and the Bermuda Stock

Exchange.

Principal Activities

The Company's principal activities are the management of a

diverse global investment portfolio and the provision of maritime

and logistics services in Brazil.

Ocean Wilsons has two operating subsidiaries: Ocean Wilsons

(Investments) Limited ("OWIL") and Wilson Sons Holdings Brasil S.A.

("Wilson Sons") (together with the Company and their subsidiaries,

the "Group").

The Company owns 57% of Wilson Sons which is fully consolidated

in the financial statements with a 43% non-controlling interest.

Wilson Sons is one of the largest providers of maritime services in

Brazil with activities including towage, container terminals,

offshore oil and gas support services, small vessel construction,

logistics and ship agency.

Objective

The Company's objective is to focus on long-term value creation

through both the investment portfolio and the investment in Wilson

Sons. This longer-term view directs an OWIL investment strategy of

a balanced thematic portfolio of funds leveraging our long-standing

investment market relationships and through detailed insights and

analysis. The Wilson Sons strategy focuses on providing best in

class or innovative solutions in a rapidly growing maritime

logistics market.

Data Highlights

Key Data at 31 December

(In US$ millions) 2022 2021 Change

------- ------

Revenue $440.1 $396.4 +11.0%

Operating Profit $112.1 $97.0 +15.6%

Profit after tax $11.5 $82.5 -86.1%

Investment portfolio net

return ($51.0) $44.5 ($95.5)

Investment portfolio assets $293.8 $351.8 ($58.0)

Net assets $754.1 $783.7 -3.8%

Net debt $442.3 $440.9 +0.3%

Net cash inflow from operating

activities $97.1 $106.1 -8.5%

------- ------ --------

Share Data at 31 December 2022 2021 Change

------------ ----------------

Earnings per share USD (52.8) USD 180.1 cents USD (232.9)

cents cents

Proposed/Actual dividend US 70 cents US 70 cents -

per share

Share price discount to net

asset value 50.5% 41.6% -8.9%

Implied net asset value per

share* GBP 18.78 GBP 15.95 +17.7%

Share price GBP 9.30 GBP 9.32 -0.2%

------------ ---------------- ------------

*net asset value per share of Ocean Wilsons based on the market

value of each operating subsidiary

The Chair's Statement

I am delighted to report that, in spite of a challenging 2022,

the business has navigated the year with confidence and delivered

both strong operational results and investment returns that are

respectable compared to benchmarks. Elevated risks and

uncertainties with respect to the supply chain challenges and the

impacts of the sanctions on shipping markets, coupled with

inflation and the effects of the fears of recession on global

financial markets all had a dampening effect. Notwithstanding these

headwinds, the Group performed particularly well in our maritime

operations, and our defensive positions minimized losses in the

investment portfolio against index comparatives.

Our investment portfolio was, of course, not immune to the

global market volatility spurred by inflationary fears and

geopolitical instability. However, the portfolio loss of 13.8%

compared favourably to a notional balanced portfolio of global

equities and government bonds, which fell by 18.2% for the year. In

the most challenging investment year in a decade, it is important

to remember that the fundamental tenet of our investment strategy

is the long-term generation of capital through the cycle. In

addition to our equity and diversifying fund investments, our

longstanding relationships with proven fund managers allows us to

access compelling investment opportunities not always available to

others that support our longer-term views. To reflect this, our

portfolio continues to include a substantial weighting in private

equity funds which are less correlated to equity market volatility

and have outperformed those indices by over 100% since 2014.

Wilson Sons grew revenues despite lower container volumes as the

business benefited from increases in volumes at its towage and

offshore support base divisions. This rebalancing of product mix

allowed Wilson Sons to pivot its operations and to harden pricing

in the towage sector, fill empty capacity at the offshore support

bases and improve margins to maximize profitability in the

container terminals.

Results Overview

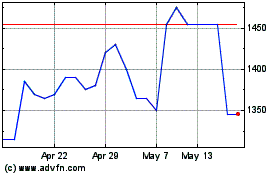

At the close of markets on 31 December 2022, the Wilson Sons'

share price was R$10.81 (US$2.05), resulting in a market value for

the Ocean Wilsons holding of 248,644,000 shares (57% of Wilson

Sons) of US$509.7 million which is equivalent to US$14.41

(GBP11.91) per Ocean Wilsons share. This together with the value of

the investment portfolio at 31 December 2022 of US$8.29 results in

an implied net asset value per Ocean Wilsons Holdings Limited share

of US$22.69 (GBP18.78). The Ocean Wilsons Holdings Limited share

price was GBP9.30 at 31 December 2022.

Earnings per share for the year was a loss of US 52.8 cents

compared with a profit of US 180.1 cents in 2021.

The Financial Report provides further details in relation to the

performance of the Group.

Our Environmental Social and Governance (ESG) Practices

The Board is committed to driving and implementing responsible

investing policies and operating practices for the Group. Ocean

Wilsons' ESG practices and related strategy continued to receive

close attention at our Board meetings over the past year.

The investment portfolio is managed by the investment manager,

Hanseatic Asset Management LBG ("Hansa Capital"). During the year,

Hansa Capital became a signatory to the internationally recognised

United Nations' Principles for Responsible Investment in line with

the Board's strategy to further its ESG commitment within its

subsidiaries. While the Company does not have a specific ESG policy

to exclude investments in companies or sectors, new investments

which the Board believes will further the Company's long-term

growth objectives are considered with an ESG lens in addition to

other factors. Our Investment Manager follows a rigorous onboarding

process for any new investments which include a review of the

funds' ESG practices and philosophies.

On the Board's recent visit to our operations in Brazil, we were

able to witness first-hand Wilson Sons' continued commitment to its

corporate culture that drives innovation, sustainability, social

and diversity initiatives and strong governance practices. Part of

Wilson Sons' criteria when considering expansion and capital

investments is the improvement of the Company's impact on the

environment and climate, opportunities to improve employee

engagement and to ensure its governance procedures are effective.

For example, Wilson Sons recently launched the first two of six new

tugs whose design reduces carbon emissions and have recently moved

into new office space which is smaller and more energy efficient.

Employees are encouraged to participate in corporate innovation

think tanks and are rewarded when their ideas are implemented

through donations to charities of their choice. These are just a

few examples of the strong sense of commitment to being a better

corporate citizen to all its stakeholders that embodies the

corporate culture at Wilson Sons.

Further details of the Company's ESG practices and our TCFD

disclosures are presented in the annual report.

The Board

I would like to take the opportunity to recognise that after 23

years as the Chair of Ocean Wilsons, José Francisco Gouvêa Vieira

retired at the Annual General Meeting held in May 2022. On behalf

of the Board and the shareholders, I would like to say thank you

for his leadership and many contributions. We continue to benefit

from his knowledge of Brazilian markets as he maintains his

directorship on the Wilson Sons Board. We wish him well in his

future endeavours.

Outlook

The first quarter of 2023, in terms of uncertainty, is

reminiscent of the first quarter of 2022, which saw the Russian

invasion of Ukraine and a commensurate change in the prevailing

world order regarding supply chains, food security and armed

conflict; 2023 has already been jolted by the effect on the US and

global banking sectors from the demise of Silicon Valley Bank and

Signature Bank and the current uncertainty around Credit Suisse and

possible others. There is much debate as to the mid-term impact of

this on financial markets, but what is clear is that there

continues to be little expectation of predictability.

Our outlook for 2023, in terms of our investment portfolio, is

that there are new opportunities with inflation beginning to

decline, interest rates likely nearing their peak, some greens

shoots of growth, albeit slow, lower valuations and an expectation

that geo-political risks will continue to be a factor for the

longer term. In anticipation of this, we broadened the investment

portfolio by adding more exposure to value strategies to balance

and complement our quality and growth holdings. The key investment

objective for the portfolio remains unchanged; generate real

returns through long-term capital growth rather than overly

responding to short-term moves in equity markets.

We expect Wilson Sons to continue to leverage its strong market

position in Brazil and seek opportunities to expand its maritime

services and grow market share. Market consensus is for an easing

of the constraints on the global shipping industry caused by the

container shortages and supply chain interruptions in recent years.

The Wilson Sons' management team will continue to drive results

from its towage and offshore support bases to offset challenges in

the container terminals sector. Fundamental to the continued

success of Wilson Sons is their commitment to innovation which

steers investment towards new technologies that promote revenue

growth, sustainability and operating efficiency.

There are choppy waters ahead in the global economy, however the

experience of 2022 has demonstrated that there are always

navigation opportunities to be found and the Board believes that

both our divisions are well placed to seek them out.

Caroline Foulger

Chair

23 March 2023

Business Review

Investment Manager's Report

Market Backdrop

After a highly volatile year, the MSCI ACWI + FM, a key

benchmark index, finished down 18.4% with most equity markets

across the world declining. It was a similar story in bond markets

with the Bloomberg Global Treasury index down 17.5%. The start of

the year was fraught with concerns about growing inflation and

increasing interest rates before Russia's invasion of Ukraine

dominated the news and impacted global prices of energy and

commodities. These worries over inflation, interest rates and

commodity prices eased slowly through the year, leading to stronger

market performance in the last quarter.

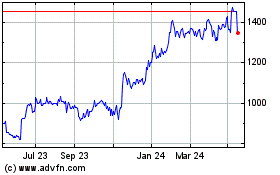

Cumulative Portfolio Returns

3 years 5 years

2022 2021 p.a. p.a.

------------------------------ ------- ------ -------- --------

OWIL -13.8% 16.1% 3.9% 4.3%

------------------------------ ------- ------ -------- --------

OWIL (Net)* -14.7% 14.5% 2.7% 3.1%

------------------------------ ------- ------ -------- --------

Performance Benchmark** 9.5% 10.0% 7.9% 6.8%

------------------------------ ------- ------ -------- --------

MSCI ACWI + FM NR US$ -18.2% 18.5% 0.3% 2.3%

------------------------------ ------- ------ -------- --------

Bloomberg Global Treasury TR

US$ (Unhedged) -18.4% -6.6% 4.0% 5.2%

------------------------------ ------- ------ -------- --------

MSCI Emerging Markets NR US$ -20.1% -2.5% 2.7% -1.4%

------------------------------ ------- ------ -------- --------

*Net of management and performance fees. No performance fees

were earned in 2022.

** The OWIL Performance Benchmark is an absolute benchmark of US

CPI Urban Consumers NSA +3% p.a.

Portfolio Commentary

The investment portfolio declined by 13.8% over the year in

contrast to a comparable portfolio represented by a 60:40 composite

of the MSCI ACWI + FM index and the Bloomberg Global Treasury which

fell by 18.2%. The portfolio's absolute benchmark (US CPI Urban

Consumers NSA + 3%), which is inflation based, returned +9.5%,

boosted by rising inflation.

Within the public market equity investments, the MSCI North

American Net Return USD Index declined by 19.5% and the MSCI Europe

Net Return USD Index declined by 15.1%. Long duration sectors, such

as technology, which dominates the US market, were hit hard by

concerns over rising interest rates while more traditional

industries, such as energy, commodities and utilities, benefited.

The market rotation away from growth stocks towards value stocks

drove the decision to add Beutal Goodman US Value and Schroders ISF

Global Recovery to the portfolio with both performing positively,

returning 1.7% and 13.7%, respectively. Our largest position,

Findlay Park American, declined 21.5% leaving it slightly behind

the US index. Several thematic investments were more resilient, in

terms of the market environment, with energy and commodities

gaining 24.0% and declining 6.1%, respectively. A new position

initiated in Polar Capital Global Insurance gained 12.9%. Our

health care holdings were more mixed with Worldwide Healthcare

Trust down 18.9% while RA Capital Healthcare fared relatively

better, declining 10.5%.

The portfolio's private market investments were more resilient

with many still seeing their value increasing and returning

significant capital to investors. While there is often a time lag

between public and private markets, several of our private

investments in Europe, healthcare and venture continue to add value

to their portfolios and be able to achieve strong exits of their

portfolio companies. Additionally, many of our North American funds

are now able to purchase assets at far more attractive prices.

Those of our investments that are designed to be less correlated

to equity markets had a particularly strong year. The

non-directional hedge funds, MKP Opportunity (+8.9%), Hudson Bay

(+3.2%) and Keynes Dynamic Beta (+10.2%) all finished the year with

a positive return as did the trend-following CTA funds, GAM

Systematic Core Macro and Schroder GAIA BlueTrend. Our investment

in BioPharma Credit, a healthcare secured lending specialist, also

performed well returning 9.9%, as did our long/short government

bond fund, Brevan Howard Absolute Return Government Bond (+7.5%),

with its ability to go short proving crucial given the broad

declines seen in world bond markets.

Looking Forward

Despite the rally of the past few months being underpinned by

expectations that inflation and interest rates may have peaked and

that some of the more pessimistic outlooks for the economy are now

looking to be overly cautious, we would still advocate proceeding

with some caution. We are yet to see a weakening of the economy or

corporate earnings, many important economic indicators are still in

expansionary territory and employment figures remain very strong in

many key markets. With regards to inflation, whilst it is

encouraging that some of the more cyclical factors appear to be

rolling over, there is concern that some of the more structural

factors will be more persistent and challenging to eliminate. This

combination of stronger than expected growth together with stickier

inflation is likely to make it harder for central banks to cut

rates.

It seems likely that markets will face a period of continued

uncertainty. It is very possible that the rally seen at the end of

the year continues in the first part of 2023 with reports of

inflation coming off its highs and global growth bolstered by

China's reopening process. In contrast, if there is a growing

realisation that inflation will be more permanent than many

believe, then markets may well experience a setback. Weaker growth

would suggest that central bank policy measures are working, in

contrast, stronger growth is likely to lead to central banks being

more aggressive, forcing rates higher, and ultimately driving

economies into a much deeper recession. Hence, at this stage, while

the building blocks are being put in place for better market

conditions, our approach will be more circumspect with a

longer-term view.

Hanseatic Asset Management LBG

March 2023

Investment Portfolio at 31 December 2022

Market

Value % of

US$000 NAV Primary Focus

------------------------------------------ -------- ------ -----------------------------------

Findlay Park American Fund 24,154 8.2 US Equities - Long Only

BlackRock Strategic Equity Hedge

Fund 12,920 4.4 Europe Equities - Hedge

Select Equity Offshore, Ltd 10,597 3.6 US Equities - Long Only

NG Capital Partners II, LP 7,465 2.5 Private Assets - Latin America

Pangaea II, LP 6,823 2.3 Private Assets - GEM

BA Beutel Goodman US Value Fund 6,317 2.2 US Equities - Long Only

Stepstone Global Partners VI, Private Assets - US Venture

LP 6,117 2.1 Capital

Pershing Square Holdings Ltd 5,836 2.0 US Equities - Long Only

iShares Core MSCI Europe UCITS

ETF 5,758 2.0 Europe Equities - Long Only

Schroder ISF Asian Total Return Asia ex-Japan Equities - Long

Fund 5,669 1.9 Only

Top 10 Holdings 91,656 31.2

------------------------------------------ -------- ------ -----------------------------------

Polar Capital Global Insurance Financials Equities - Long

Fund 5,304 1.8 Only

Silver Lake Partners IV, LP 5,304 1.8 Private Assets - Global Technology

Hudson Bay International Fund

Ltd 5,266 1.8 Market Neutral - Multi-Strategy

Egerton Long - Short Fund Limited 4,957 1.7 Europe/US Equities - Hedge

Asia ex-Japan Equities - Long

NTAsian Discovery Fund 4,948 1.7 Only

KKR Americas XII, LP 4,731 1.6 Private Assets - North America

Navegar I, LP 4,481 1.5 Private Assets - Asia

Indus Japan Long Only Fund 4,226 1.4 Japan Equities - Long Only

iShares Core S&P 500 UCITS ETF 4,165 1.4 US Equities - Long Only

TA Associates XIII-A, LP 4,152 1.4 Private Assets - Global Growth

Top 20 Holdings 139,190 47.4

------------------------------------------ -------- ------ -----------------------------------

Baring Asia Private Equity Fund

VII, LP 4,101 1.4 Private Assets - Asia

Schroder GAIA BlueTrend 3,771 1.3 Market Neutral - Multi-Strategy

Global Event Partners Ltd 3,647 1.2 Market Neutral - Event-Driven

Silver Lake Partners V, LP 3,616 1.2 Private Assets - Global Technology

Goodhart Partners: Hanjo Fund 3,563 1.2 Japan Equities - Long Only

GAM Star Fund PLC - Disruptive Technology Equities - Long

Growth 3,554 1.2 Only

Schroder ISF Global Recovery 3,549 1.2 Market Neutral - Multi-Strategy

GAM Systematic Core Macro (Cayman)

Fund 3,342 1.1 Market Neutral - Multi-Strategy

Healthcare Equities - Long

Worldwide Healthcare Trust PLC 3,295 1.1 Only

Reverence Capital Partners Opportunities

Fund II 3,222 1.1 Private Assets - Financials

Top 30 Holdings 174,850 59.5

------------------------------------------ -------- ------ -----------------------------------

Remaining Holdings 98,081 33.4

------------------------------------------ -------- ------ -----------------------------------

Cash and cash equivalents 20,895 7.1

------------------------------------------ -------- ------ -----------------------------------

TOTAL 293,826 100.0

------------------------------------------ -------- ------ -----------------------------------

Wilson Sons Management Report

The Wilson Sons 2022 Earnings Report was released on 23 March

2023 and is posted on www.wilsonsons.com.br.

In the report, Mr Fernando Salek, CEO of Wilson Sons, said:

"Wilson Sons' 2022 revenues of US$440.1 million were 11.0%

higher than the prior year (2021: US$396.4 million), and EBITDA of

US$181.8 million (R$939.0 million) was 14.1% above the comparative

with resilient towage and logistics results. In R$ terms, EBITDA

increased 9.3% year-over-year.

Towage results rose 4.1% with an increase in average revenue per

manoeuvre and special operations. During the year, our shipyard

delivered WS Centaurus and WS Orion, the first two of a six-tugboat

series with over 90 tonnes of bollard pull. Both vessels are in

operation serving the largest bulk carriers currently calling at

Brazilian ports, with capacities reaching 400,000 tonnes

deadweight.

Container terminal results were impacted by the global limited

availability of empty containers and logistics bottlenecks causing

vessel call cancellations. However, the situation has started to

improve with aggregated volumes up 16.1% year-over-year in January

2023.

Demand for our offshore energy-linked services improved markedly

as vessel turnarounds in our offshore support base division

increased 30.6% over 2021 and operating days in our

non-consolidated offshore support vessel joint venture rose 20.1%

year-over-year. In the last quarter of 2022, new support-base

contracts were signed with Petronas and 3R Petroleum. Under the

Petrobras support-base contract, PSVs Torda, Biguá and Fulmar also

began new four-year operating contracts.

Looking back over the past two years of turmoil to global supply

chains created by the pandemic we are pleased to report that Wilson

Sons performed and managed these challenges while continuing

growth, ensuring the safety of our employees, and the continuity of

excellent service to our customers and trade flow partners. We

continue to advance the world-class performance of our

infrastructure, maintain the safety levels of our operations, and

consistently seek opportunities to leverage our market position,

the resilience of our business model and the versatility of our

services to challenge and transform maritime transport for the

benefit of all our stakeholders."

KPIs 2022 2021 Change

Towage

Number of harbour manoeuvres 54,865 54,389 0.9%

----------------------------------------- ------- -------- -------

Offshore support bases

Number of vessel turnarounds 785 601 30.6%

Number of operating days 6,488 5,400 20.1%

----------------------------------------- ------- -------- -------

Container terminal - aggregated Volumes

Exports - full containers 254.5 306.2 -16.9%

Imports - full containers 129.3 150.4 -14.0%

Cabotage - full containers 122.7 121.1 1.3%

Inland Navigation - full containers 21.3 22.2 -4.1%

Transhipment - full containers 142.2 160.2 -11.2%

Empty containers 245.8 282.2 -12.9%

Total Volume 915.8 1,042.3 -12.1%

----------------------------------------- ------- -------- -------

Financial Report

Operating Profit

Operating profit of US$112.1 million (2021: US$97.0 million) was

US$15.1 million better than the prior year. Operating margin

improved year over year to 25.5% (2021: 24.5%) principally due to

an 11.0% increase in revenues and lower foreign exchange losses on

monetary items.

Operating expenses increased US$31.0 million driven by higher

costs for both raw materials and employee related costs. Raw

materials and consumables used were US$9.0 million higher at

US$33.0 million (2021: US$24.0 million). Employee charges and

benefits expenses were US$14.3. million higher at US$126.3 million

(2021: US$112.0 million) although remained relatively unchanged as

a percentage of revenue at 28.7% (2021: 28.3%). Other operating

expenses increased US$7.8 million to US$106.1 million (2021:

US$98.3 million) driven by increases in freight charges and

utilities costs. Depreciation increased to US$62.0 million (2021:

US$58.7 million) due to the planned increases in capital spending

during the year.

Revenue from Maritime Services

Revenue for the year increased by 11.0% to US$440.1 million

(2021: US$396.4 million) attributed to higher towage manoeuvres,

growth in the offshore support bases contracts, warehousing and

ship agency services. Harbour manoeuvre revenues increased 12.8% to

US$201.4 million (2021: US$178.6 million) and the offshore support

bases revenue increased 47.2% to US$10.6 million (2021: US$7.2

million) with the start of new contracts during the year.

Returns on the Investment Portfolio

Returns on the investment portfolio were a loss of US$47.9

million (2021: gain of US$49.5 million) and comprised realised

profits on the disposal of financial assets of US$24.3million

(2021: US$11.9 million), net income from underlying investments of

US$11.8 million (2021: US$3.8 million) and unrealised losses of

US$80.0 million (2021: unrealised gains of US$33.9 million).

Additionally, the only Russia focused investment was written off

during the year for a loss of US$4.1 million.

Other Investment Income

Other investment income for the year increased US$4.3 million to

US$8.4 million (2021: US$4.1 million). Increased interest on bank

deposits and higher other interest income were the contributing

factors.

Finance Costs

Finance costs for the year at US$34.5 million were US$4.3

million higher than the prior year (2021: US$30.2 million) due to

interest on lease liabilities and interest on bank loans

increasing.

Exchange Rates

The Group reports in USD and has revenues, costs, assets and

liabilities in both BRL and USD. Therefore, movements in the

USD/BRL exchange rate influence the Group's results either

positively or negatively from year to year. During 2022 the BRL

appreciated 6.5% against the USD from R$5.58 at 1 January 2022 to

R$5.22 at the year end. In 2021 the BRL depreciated 7.1% against

the USD from R$5.20 at 1 January 2021 to R$5.57 at the year end.

The foreign exchange gains on monetary items were US$1.6 million in

2022, compared to a loss of US$3.1 million in 2021.

Profit Before Tax

Profit before tax for the year decreased US$72.3 million to

US$38.1 million compared to US$110.4 million in 2021. The decline

in profit is primarily due to the unrealised losses in valuation of

the investment portfolio which contributed negative returns of

US$47.9 million compared to a positive return of $49.5 million in

the prior year in common with macro trends globally.

The tax charge for the year at US$26.7 million was US$1.2

million lower than prior year (2021: US$27.9 million). The Company

is taxed on its maritime services operations. This represents an

effective tax rate for the year of 29% (2021: 40%) for maritime

services. A more detailed breakdown of taxation reconciling the

effective tax rate is provided in note 9 to the consolidated

financial statements.

Loss/Profit for the year

The loss for the year attributable to the equity holders of the

Company is US$18.6 million (2021: US$63.7 million profit) and the

profit attributable to the non-controlling interests is US$30.2

million (2021: US$18.8 million profit). While the US$25.1 million

increase in Wilson Sons' profit after tax was attributed to both

the equity holders of the Company and the non-controlling interests

based on ownership, the US$47.9 million loss on the investment

portfolio (2021: US$49.5 million gain) was only attributed to the

equity holders of the Company since the Company has full ownership

of it.

Cash Flows

Net cash inflow from operating activities for the period at

US$97.1 million was US$9.0 million lower than prior year (2021:

US$106.1 million). Capital expenditure for the year at US$63.3

million was US$15.9 million higher than the prior year (2021:

US$47.4 million).

The Group drew down new bank loans of US$59.8 million (2021:

US$19.4 million) to finance capital expenditure, while making

repayments of US$49.3 million (2021: US$57.9 million). Dividends of

US$24.8 million were paid to shareholders of Ocean Wilsons (2021:

US$24.8 million).

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statement of Profit or Loss and Other Comprehensive

Income

For the year ended 31 December 2022

(Expressed in thousands of US Dollars)

Note 2022 2021

------------------------------------------------------------------------------- ---- ----------------- ---------

Sales of services 5 440,107 396,376

Raw materials and consumables used (32,956) (24,036)

Employee charges and benefits expenses 6 (126,330) (112,026)

Other operating expenses 7 (106,055) (98,289)

Depreciation of owned assets 14 (48,473) (46,631)

Depreciation of right-of-use assets 15 (13,573) (12,063)

Amortisation of intangible assets 16 (2,389) (2,718)

Gain/(loss) on disposal of property, plant and equipment and intangible assets 100 (499)

Foreign exchange gains/(losses) on monetary items 1,620 (3,100)

------------------------------------------------------------------------------- ---- ----------------- ---------

Operating profit 112,051 97,014

Share of results of joint ventures and associates 13 3,165 (5,029)

Returns on investment portfolio at fair value through profit or loss 5 (47,947) 49,474

Investment portfolio performance and management fees (3,047) (4,954)

Other investment income 5 8,421 4,113

Finance costs 8 (34,509) (30,227)

------------------------------------------------------------------------------- ---- ----------------- ---------

Profit before tax 38,134 110,391

Tax expense 9 (26,656) (27,925)

------------------------------------------------------------------------------- ---- ----------------- ---------

Profit for the year 11,478 82,466

------------------------------------------------------------------------------- ---- ----------------- ---------

Other comprehensive income:

Items that will not be reclassified subsequently to profit or loss

Post-employment benefits remeasurement 21 93 108

Purchase price adjustment of associate 13 159 -

Items that will be or may be reclassified subsequently to profit or loss

Exchange differences arising on translation of foreign operations 7,128 (7,459)

Effective portion of changes in fair value of derivatives 9 158

------------------------------------------------------------------------------- ---- ----------------- ---------

Other comprehensive income/(loss) for the year 7,389 (7,193)

------------------------------------------------------------------------------- ---- ----------------- ---------

Total comprehensive income for the year 18,867 75,273

------------------------------------------------------------------------------- ---- ----------------- ---------

(Loss)/profit for the year attributable to:

Equity holders of the Company (18,675) 63,687

Non-controlling interests 26 30,153 18,779

------------------------------------------------------------------------------- ---- ----------------- ---------

11,478 82,466

------------------------------------------------------------------------------- ---- ----------------- ---------

Total comprehensive (loss)/income for the year attributable to:

Equity holders of the Company (14,484) 59,604

Non-controlling interests 26 33,351 15,669

------------------------------------------------------------------------------- ---- ----------------- ---------

18,867 75,273

------------------------------------------------------------------------------- ---- ----------------- ---------

Earnings per share:

Basic and diluted 28 (52.8)c 180.1c

------------------------------------------------------------------------------- ---- ----------------- ---------

The accompanying notes are an integral part of these

consolidated financial statements.

Consolidated Statement of Financial Position

At 31 December 2022

(Expressed in thousands of US Dollars)

Note 2022 2021

------------------------------------------------------- ---- ----------------- ---------

Current assets

Cash and cash equivalents 75,724 28,565

Financial assets at fair value through profit and loss 10 275,080 392,931

Recoverable taxes 9 34,515 25,380

Trade and other receivables 11 67,136 59,350

Inventories 12 17,579 12,297

------------------------------------------------------- ---- ----------------- ---------

470,034 518,523

------------------------------------------------------- ---- ----------------- ---------

Non-current assets

Other trade receivables 11 1,456 1,580

Related party loans receivable 23 11,176 10,784

Other non-current assets 22 3,506 3,582

Recoverable taxes 9 15,143 12,816

Investment in joint ventures and associates 13 81,863 61,553

Deferred tax assets 9 21,969 22,332

Property, plant and equipment 14 589,629 563,055

Right-of-use assets 15 178,699 157,869

Other intangible assets 16 14,392 14,981

Goodwill 17 13,420 13,272

------------------------------------------------------- ---- ----------------- ---------

931,253 861,824

------------------------------------------------------- ---- ----------------- ---------

Total assets 1,401,287 1,380,347

------------------------------------------------------- ---- ----------------- ---------

Current liabilities

Trade and other payables 19 (58,337) (58,513)

Tax liabilities 9 (10,290) (8,057)

Lease liabilities 15 (24,728) (19,449)

Bank loans 20 (59,881) (45,287)

------------------------------------------------------- ---- ----------------- ---------

(153,236) (131,306)

------------------------------------------------------- ---- ----------------- ---------

Net current assets 316,798 387,217

------------------------------------------------------- ---- ----------------- ---------

Non-current liabilities

Bank loans 20 (262,010) (256,312)

Post-employment benefits 21 (1,737) (1,562)

Deferred tax liabilities 9 (49,733) (50,194)

Provisions for legal claims 22 (8,997) (8,907)

Lease liabilities 15 (171,448) (148,394)

------------------------------------------------------- ---- ----------------- ---------

(493,925) (465,369)

------------------------------------------------------- ---- ----------------- ---------

Total liabilities (647,161) (596,675)

------------------------------------------------------- ---- ----------------- ---------

Capital and reserves

Share capital 24 11,390 11,390

Retained earnings 634,910 678,006

Translation and hedging reserve (91,692) (95,739)

------------------------------------------------------- ---- ----------------- ---------

Equity attributable to equity holders of the Company 554,608 593,657

------------------------------------------------------- ---- ----------------- ---------

Non-controlling interests 26 199,518 190,015

------------------------------------------------------- ---- ----------------- ---------

Total equity 754,126 783,672

------------------------------------------------------- ---- ----------------- ---------

Signed on behalf of the Board

F. Beck A. Berzins

Director Director

The accompanying notes are an integral part of these

consolidated financial statements.

Consolidated Statement of Changes in Equity

For the year ended 31 December 2022

(Expressed in thousands of US Dollars)

Attributable to

Share Hedging and equity holders of Non-controlling

capital Retained earnings Translation reserve the Company interests Total equity

---------------- ------- ------------------- -------------------- -------------------- -------------------- --------------------

Balance at 1

January 2021 11,390 635,987 (91,595) 555,782 187,925 743,707

---------------- ------- ------------------- -------------------- -------------------- -------------------- --------------------

Currency

translation

adjustment - - (4,234) (4,234) (3,225) (7,459)

Effective

portion of

changes in fair

value of

derivatives - - 90 90 68 158

Post-employment

benefits (note

21) - 61 - 61 47 108

Profit for the

year - 63,687 - 63,687 18,779 82,466

---------------- ------- ------------------- -------------------- -------------------- -------------------- --------------------

Total

comprehensive

income/(loss)

for the year - 63,748 (4,144) 59,604 15,669 75,273

Dividends (notes

26, 27) - (24,754) - (24,754) (17,808) (42,562)

Equity

transactions in

subsidiaries

(note 25) - 3,025 - 3,025 4,229 7,254

---------------- ------- ------------------- -------------------- -------------------- -------------------- --------------------

Balance at 31

December 2021 11,390 678,006 (95,739) 593,657 190,015 783,672

---------------- ------- ------------------- -------------------- -------------------- -------------------- --------------------

Balance at 1

January 2022 11,390 678,006 (95,739) 593,657 190,015 783,672

---------------- ------- ------------------- -------------------- -------------------- -------------------- --------------------

Currency

translation

adjustment - - 4,042 4,042 3,086 7,128

Effective

portion of

changes in fair

value of

derivatives - - 5 5 4 9

Post-employment

benefits (note

21) - 54 - 54 39 93

Purchase price

adjustment of

associate (note

13) - 90 - 90 69 159

(Loss)/profit

for the year - (18,675) - (18,675) 30,153 11,478

---------------- ------- ------------------- -------------------- -------------------- -------------------- --------------------

Total

comprehensive

(loss)/income

for the year - (18,531) 4,047 (14,484) 33,351 18,867

Dividends (notes

26, 27) - (24,754) (24,754) (25,173) (49,927)

Equity

transactions in

subsidiaries

(note 25) - 189 - 189 1,325 1,514

---------------- ------- ------------------- -------------------- -------------------- -------------------- --------------------

Balance at 31

December 2022 11,390 634,910 (91,692) 554,608 199,518 754,126

---------------- ------- ------------------- -------------------- -------------------- -------------------- --------------------

Hedging and translation reserve

The hedging and translation reserve arises from exchange

differences on the translation of operations with a functional

currency other than US Dollars and effective movements on

designated hedging relationships.

Amounts in the statement of changes in equity are stated net of

tax where applicable.

The accompanying notes are an integral part of these

consolidated financial statements.

Consolidated Statement of Cash Flows

For the year ended 31 December 2022

(Expressed in thousands of US Dollars)

Notes 2022 2021

------------------------------------------------------------------------------- -------- --------- --------

Operating activities

Profit for the year 11,478 82,466

Adjustment for:

Depreciation & amortisation 14,15,16 64,435 61,412

(Gain)/loss on disposal of property, plant and equipment and intangible assets (100) 499

Share of results of joint ventures and associates 13 (3,165) 5,029

Returns on investment portfolio at fair value through profit or loss 5 47,947 (49,474)

Other investment income 5 (8,421) (4,113)

Finance costs 8 34,509 30,227

Foreign exchange (gains)/losses on monetary items (1,620) 3,100

Share based payment expense 25 334 369

Post-employment benefits 21 (170) 136

Tax expense 9 26,656 27,925

Changes in:

Inventories 12 (5,282) (533)

Trade and other receivables 11, 23 (8,054) (13,629)

Other current and non-current assets 9,22 (11,386) (3,388)

Trade and other payables 9,19 2,057 19,158

Provisions for legal claims 22 90 (653)

Taxes paid (22,070) (27,256)

Interest paid (30,143) (25,161)

Net cash inflow from operating activities 97,095 106,114

------------------------------------------------------------------------------- -------- --------- --------

Investing activities

Income received from trading investments 16,348 5,700

Purchase of trading investments (70,864) (72,811)

Proceeds on disposal of trading investments 128,959 73,064

Purchase of property, plant and equipment 14 (63,268) (47,352)

Proceeds on disposal of property, plant and equipment 726 304

Purchase of intangible assets 16 (1,386) (1,375)

Proceeds on disposal of intangible assets - 517

Investment in joint ventures and associates 13 (17,016) (20,016)

Net cash used in investing activities (6,501) (61,969)

------------------------------------------------------------------------------- -------- --------- --------

Financing activities

Dividends paid to equity holders of the Company 27 (24,754) (24,754)

Dividends paid to non-controlling interests in subsidiary 26 (25,173) (17,808)

Repayments of borrowings 20 (49,349) (57,926)

Payments of lease liabilities 15 (8,591) (8,473)

New bank loans drawn down 20 59,793 19,438

Shares repurchased in subsidiary 25 (2,549) -

Issue of new shares in subsidiary under employee share option plan 25 3,729 6,885

------------------------------------------------------------------------------- -------- --------- --------

Net cash used in financing activities (46,894) (82,638)

------------------------------------------------------------------------------- -------- --------- --------

Net increase/(decrease) in cash and cash equivalents 43,700 (38,493)

------------------------------------------------------------------------------- -------- --------- --------

Cash and cash equivalents at beginning of year 28,565 63,255

------------------------------------------------------------------------------- -------- --------- --------

Effect of foreign exchange rate changes 3,459 3,803

------------------------------------------------------------------------------- -------- --------- --------

Cash and cash equivalents at end of year 75,724 28,565

------------------------------------------------------------------------------- -------- --------- --------

The accompanying notes are an integral part of these

consolidated financial statements.

Notes to the Consolidated Financial Statements

For the year ended 31 December 2022

(Expressed in thousands of US Dollars)

1 General Information

Ocean Wilsons Holdings Limited ("Ocean Wilsons" or the

"Company") is a Bermuda investment holding company which, through

its subsidiaries, operates a maritime services company in Brazil

and holds a portfolio of international investments. The Company is

incorporated in Bermuda under the Companies Act 1981 and the Ocean

Wilsons Holdings Limited Act, 1991. The Company's registered office

is Clarendon House, 2 Church Street, Hamilton, Bermuda. These

consolidated financial statements comprise the Company and its

subsidiaries (the "Group").

These consolidated financial statements were approved by the

Board 23 March 2023.

2 Significant accounting policies and critical accounting judgements

Basis of accounting

These consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards

("IFRSs") and are presented in US Dollars, which is the Company's

functional currency. All amounts have been rounded to the nearest

thousand, unless otherwise indicated.

These consolidated financial statements have been prepared on

the historical cost basis, except for the revaluation of financial

instruments, share-based payments liabilities and defined health

benefit plan liabilities that are measured at fair value.

Basis of consolidation

These consolidated financial statements incorporate the

financial statements of the Company and entities controlled by the

Company. The Group controls an entity when it is exposed to, or has

the rights to, variable returns from its involvement with the

entity and has the ability to affect those returns through its

power over the entity. The financial statements of subsidiaries are

included in the consolidated financial statements from the date on

which control commences until the date on which control ceases. The

financial statements of subsidiaries are prepared in accordance

with the accounting policies set out in note 2. All intra-group

transactions and balances are eliminated on consolidation.

Non-controlling interests consist of the amount of those

interests at the date of the original business combination and the

non-controlling interests' share of changes in equity since the

date of the combination. Where a change in percentage of interests

in a controlled entity does not result in a change of control, the

difference between the consideration paid for the additional

interest and the book value of the net assets in the subsidiary at

the time of the transaction is taken directly to equity. When the

Group loses control over a subsidiary, it derecognises the assets

and liabilities of the subsidiary, and any related non-controlling

interests and other components of equity. Any resulting gain or

loss is recognised in profit or loss. Any interest retained in the

former subsidiary is measured at fair value when control is

lost.

Joint ventures and associates

A joint venture is a contractual agreement where the Group has

joint control and has rights to the net assets of the contractual

arrangement, rather than being entitled to specific assets and

liabilities arising from the agreement. An associate is an entity

in which the Group has significant influence, but not control or

joint control, over the financial and operating policies.

Investments in joint ventures and associates are accounted for

using the equity method and are initially recognised at cost. The

Group's share in the profit or loss and other comprehensive income

of the joint ventures and associates is included in these

consolidated financial statements, until the date that significant

influence or joint control ceases.

Foreign currency

The functional currency of each entity of the Group is

established as the currency of the primary economic environment in

which it operates. Transactions other than those in the functional

currency of the entity are translated at the exchange rate

prevailing at the date of the transaction.

Monetary assets and liabilities denominated in foreign

currencies are translated into the functional currency at the

exchange rate at the reporting date. Non-monetary items that are

measured based on historical cost in a foreign currency are

translated at the exchange rate at the date of the transaction.

Exchange differences arising on the settlement and on the

translation of monetary items are included in profit or loss for

the period.

On consolidation, the statement of profit or loss and

comprehensive income of entities with a functional currency other

than US Dollars are translated into US Dollars, at the average

exchange rates for the period. Statement of financial position

items are translated into US Dollars at the exchange rate at the

reporting date. Exchange differences arising on consolidation of

entities with functional currencies other than US Dollars are

recognised in other comprehensive income and accumulated in the

translation reserve, less the translation difference allocated to

non-controlling interest.

Revenue

Revenue is measured at the fair value of the consideration

received or receivable for goods and services provided in the

normal course of business net of trade discounts and sales related

taxes.

Ship agency and logistics revenues

Revenue from providing agency and logistics services is

recognised when the agreed services have been performed.

Towage and port terminals revenues

Revenue from providing towage services, vessel turnarounds,

container movement and associated services is recognised on the

date that the services have been performed.

Shipyard revenue

Revenue related to services and construction contracts is

recognised throughout the period of the project when the work in

proportion to the stage of completion of the transaction contracted

has been performed.

Employee Benefits

Short-term employee benefits

Short-term employee benefits are expensed as the related service

is provided. A liability is recognised for the amount expected to

be paid if the Group has a present legal or constructive obligation

to pay this amount as a result of past service provided by the

employee and the obligation can be estimated reliably.

Share option plan

For equity settled share-based payment transactions, the Group

measures the options granted, and the corresponding increase in

equity, directly at the fair value of the option grant. Subsequent

to initial recognition and measurement, the estimate of the number

of equity instruments for which the service and non-market

performance conditions are expected to be satisfied is revised

during the vesting period. The cumulative amount recognised is

based on the number of equity instruments for which the service and

non-market related vesting conditions are expected to be satisfied.

No adjustments are made in respect of market related vesting

conditions.

Defined contribution plan

Obligations for contributions to defined contribution plans are

expensed as the related service is provided. Prepaid contributions

are recognised as an asset to the extent that a cash refund or a

reduction in future payments is available.

Defined health benefit plans

The Group's net obligation regarding defined health benefit

plans is calculated separately for each plan by estimating the

amount of future benefit that employees receive in return for their

service in the current period and prior periods. That health

benefit is discounted to determine its present value. The

calculation of the liability of the defined health benefit plan is

performed annually by a qualified actuary using the projected unit

credit method. Remeasurements of the net defined health benefit

obligation, which include actuarial gains and losses, are

immediately recognised in other comprehensive income.

The Group determines the net interest expense on the net defined

benefit liabilities for the period by multiplying them by the

discount rate used to measure the defined health benefit

obligations. Defined health benefit liabilities for the period take

into account any changes during the period due to the payment of

contributions and benefits. Net interest and other expenses related

to defined health benefit plans are recognised in profit or loss.

When the benefits of a health plan are changed, the portion of the

change in benefits relating to past services rendered by employees

is recognised immediately in profit or loss. The Group recognised

gains and losses on the settlement of a defined health benefit plan

when settlement occurs.

Termination benefits

Termination benefits are recognised as an expense when the Group

can no longer withdraw the offer of such benefits. If payments are

settled after 12 months from the reporting date, then they are

discounted to their present values.

Finance income and finance costs

The Group's finance income and finance costs include interest

income, interest expense and the net gain or loss on the disposal

on financial assets at fair value through profit or loss. Interest

income or expense is recognised in profit or loss using the

effective interest method.

Taxation

Tax expense comprises current and deferred tax. It is recognised

in profit or loss except to the extent that it relates to items

recognised directly in equity or in other comprehensive income, in

which case the tax is also recognised directly in equity or in

other comprehensive income.

Current tax is based on taxable profit for the year. Taxable

profit differs from profit as reported in the consolidated

statement of profit or loss and other comprehensive income because

it excludes or includes items of income or expense that are taxable

or deductible in other years and it further excludes items that are

never taxable or deductible. The Group's current tax expense is

calculated using tax rates that have been enacted or substantively

enacted by the end of the reporting period.

Deferred tax is recognised in respect of temporary differences

between the carrying amounts of assets and liabilities for

financial reporting purposes and the amounts used for taxation

purposes. Deferred tax is generally recognised for all taxable

temporary differences except for when the Group is able to control

the reversal of the temporary difference and it is probable that

the temporary difference will not reverse in the foreseeable

future. Deferred tax is not recognised if the temporary difference

arises from goodwill or from the initial recognition of assets or

liabilities in a transaction that is not a business combination and

that affects neither accounting nor taxable profit or loss.

Deferred tax assets are recognised for unused tax losses, unused

tax credits and deductible temporary differences to the extent that

it is probable that future taxable profits will be available

against which they can be used. The carrying amount of deferred tax

assets is reviewed at the end of each reporting period and reduced

to the extent that it is no longer probable that the related tax

benefit will be realised. Prior reductions are reversed when the

probability of future taxable profits improves.

Deferred tax assets and liabilities are measured at the tax

rates that are expected to apply in the period in which the

liability is settled or the asset is recognised, based on tax rates

and tax laws that have been enacted or substantively enacted by the

end of the reporting period. The measurement of deferred tax

reflects the tax consequences that would follow from the manner in

which the Group expects, at the reporting date, to recover or

settle the carrying amount of its assets and liabilities.

The Company offsets current tax assets against current tax

liabilities when these items are in the same entity and relate to

taxes levied by the same taxation authority and the taxation

authority permits the Company to make or receive a single net

payment.

Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and other

short-term highly liquid cash equivalents.

Financial instruments

Recognition and initial measurement

Trade and other receivables are initially recognised when they

are originated. All other financial assets and financial

liabilities are initially recognised when the Group becomes a party

to the contractual provisions of the instruments. Trade and other

receivables are initially measured at the transaction price which

reflects fair value. All other financial assets and financial

liabilities are initially measured at fair value plus transaction

costs that are directly attributable to their acquisition or

issue.

Classification and subsequent measurement

Management determines the classification of its financial

instruments at the time of initial recognition. The classification

depends on the purpose for which the financial instruments were

acquired or issued, their characteristics and the Group's

designation of such instruments.

Financial assets

A financial asset is classified as measured at amortised cost if

it is not designated as at fair value through profit and loss and

if it is held within a business model whose objective is to hold

assets to collect contractual cash flows and if its contractual

terms give rise on specified dates to cash flows that are solely

payments of principal and interest on the principal amount

outstanding. These assets are subsequently measured at amortised

cost using the effective interest method, reduced by any impairment

losses. Interest income, foreign exchange gains and losses and

impairment are recognised in profit or loss. Any gain or loss on

derecognition is recognised in profit or loss.

A financial asset is classified as measured at fair value

through other comprehensive income if it is not designated as at

fair value through profit and loss and if it is held within a

business model whose objective is to both hold assets to collect

contractual cash flows and to sell financial assets, and if its

contractual terms give rise on specified dates to cash flows that

are solely payments of principal and interest on the principal

amount outstanding. These assets are subsequently measured at fair

value. Interest income calculated using the effective interest

method, dividends, foreign exchange gains and losses and impairment

are recognised in profit or loss. Other net gains and losses are

recognised in other comprehensive income. On derecognition, gains

and losses accumulated in other comprehensive income are

reclassified to profit or loss.

A financial asset is classified as measured at fair value

through profit and loss if it is not classified as measured at

amortised cost or at fair value through other comprehensive income,

or if it is designated as such by management on initial

recognition. Financial assets held for trading are classified as

measured at fair value through profit and loss. These assets are

subsequently measured at fair value. Net gains and losses,

including any interest or dividend income, are recognised in profit

or loss.

The Group makes an assessment of the objective of the business

model in which a financial asset is held at a portfolio level

because this best reflects the way the business is managed and

information is provided to management. The information considered

includes the stated policies and objectives for the portfolio, how

the performance of the portfolio is evaluated and reported to the

Group's management and the risks that affect the performance of the

business model and how those risks are managed. In assessing

whether the contractual cash flows are solely payments of principal

and interest, the Group considers the contractual terms of the

instrument, including assessing whether the financial asset

contains a contractual term that could change the timing or amount

of contractual cash flows such that it would not meet this

condition.

Financial liabilities

Financial liabilities are classified as at fair value through

profit and loss when the financial liability is either held for

trading or it is designated as such by management on initial

recognition. These liabilities are measured at fair value and net

gains and losses, including any interest expense, are recognised in

profit or loss.

Financial liabilities that are not classified as at fair value

through profit and loss are classified as other financial

liabilities and are subsequently measured at amortised cost using

the effective interest method. Interest expense and foreign

exchange gains and losses are recognised in profit or loss. Any

gain or loss on derecognition is also recognised in profit or

loss.

The following summarises the classification the Group applies to

each of its significant categories of financial instruments:

Category Classification

Trade and other receivables Amortised cost

Financial assets at fair value through profit and loss At fair value through profit and loss

Cash and cash equivalents Amortised cost

Trade and other payables Other financial liabilities

Bank loans Other financial liabilities

Derecognition

The Group derecognises a financial asset when the contractual

rights to the cash flows from the asset expire or when it transfers

the rights to receive the contractual cash flows in a transaction

in which the Group either substantially transfers all of the risks

and rewards of ownership of the financial asset or in which the

Group neither transfers nor retains substantially all of the risks

and rewards of ownership and it does not retain control of the

financial asset.

The Group derecognises a financial liability when its

contractual obligations are discharged, cancelled or expire. The

Group also derecognises a financial liability when its terms are

modified and the cash flows of the modified liability are

substantially different, in which case a new financial liability

based on the modified terms is recognised at fair value.

Hedge Accounting

When a derivative is designated as the hedging instrument in a

hedge of the variability in cash flows attributable to a particular

risk associated with a recognised asset or liability or a highly

probable forecast transaction that could affect profit or loss, the

effective portion of changes in the fair value of the derivative is

recognised in other comprehensive income and presented in the

hedging reserve in equity. Any ineffective portion of changes in

the fair value of the derivative is recognised immediately in

profit or loss.

When the forecast transaction that is hedged results in the

recognition of a non-financial asset or a non-financial liability,

the gains and losses previously deferred in other comprehensive

income are transferred from equity and included in the measurement

of the initial carrying amount of the asset or liability. Any

ineffective portion of changes in the fair value of the derivative

is recognised immediately in profit or loss.

Impairment of financial assets

The Group recognises an allowance for expected credit losses

("ECLs") for all debt instruments not held at fair value through

profit or loss. ECLs are based on the difference between the

contractual cash flows due in accordance with the contract and all

the cash flows that the Group expects to receive, discounted at an

approximation of the original effective interest rate.

ECLs are recognised in two stages. For credit exposures for

which there has not been a significant increase in credit risk

since initial recognition, ECLs are provided for credit losses that

result from default events that are possible within the next

12-months (a 12-month ECL). For those credit exposures for which

there has been a significant increase in credit risk since initial

recognition, a loss allowance is required for credit losses

expected over the remaining life of the exposure, irrespective of

the timing of the default (a lifetime ECL).

For financial assets measured at amortised cost, the Group

applies a simplified approach in calculating ECLs. Therefore, the

Group does not track changes in credit risk, but instead recognises

a loss allowance based on lifetime ECLs at each reporting date. The

Group has established a provision matrix that is based on its

historical credit loss experience, adjusted for forward-looking

factors specific to the receivables and the economic

environment.

The Group considers a financial asset in default when

contractual payments are 180 days past due. However, in certain

cases, the Group may also consider a financial asset to be in

default when internal or external information indicates that the

Group is unlikely to receive the outstanding contractual amounts in

full before. A financial asset is written off when there is no

reasonable expectation of recovering the contractual cash

flows.

Impairment losses are recognised in profit and loss and

reflected in an allowance account against trade and other

receivables. If, in a subsequent period, an event causes the amount

of impairment loss to decrease, the decrease in impairment loss is

reversed through profit and loss.

Inventories

Inventories are measured at the lower of cost and net realisable

value. Cost comprises direct materials, spare parts and, where

applicable, direct labour costs and those overheads that have been

incurred in bringing the inventories to their present location and

condition. Net realisable value represents the estimated selling

price less all estimated costs of completion and costs to be

incurred in marketing, selling and distribution.

Property, plant and equipment

Property, plant and equipment is measured at cost, which

includes capitalised borrowing costs, less accumulated depreciation

and any accumulated impairment losses. Subsequent expenditure is

recognised only when it is probable that the future economic

benefits associated with the expenditure will flow to the

Group.

Depreciation is calculated to write off the cost less the

estimated residual value of items of property, plant and equipment,

other than freehold land or assets under construction, over their

estimated useful lives, using the straight-line method. Land is not

depreciated, and assets under construction are not depreciated

until they are transferred to the appropriate category of property,

plant and equipment when the assets are ready for intended use.

Depreciation is recognised in profit or loss.

The estimated useful life of the different categories of

property, plant and equipment are as follows:

Freehold Buildings: 25 to 35 years

Leasehold Improvements: 5 to 52 years, shorter of the rental period or the useful life of the underlying asset

Floating Craft: 25 years

Vehicles: 5 to 10 years

Plant and Equipment: 10 to 20 years

The estimated useful lives, residual values and depreciation

method are reviewed at the end of each reporting period with the

effect of any changes in estimate accounted for on a prospective

basis.

An item of property, plant and equipment is derecognised upon

disposal or when no future economic benefits are expected to arise

from the continued use of the asset. The gain or loss arising on

disposal or retirement of property, plant and equipment is

determined as the difference between the sales proceeds and the

carrying amount of the asset and is recognised in profit or

loss.

Leased assets

At inception of a contract, the Group assesses whether it is a

lease or contains a lease component, which it is if the contract

conveys the right to control the use of an identified asset for a

period of time in exchange for consideration.

At the lease commencement date, the Group recognises a

right-of-use asset and a lease liability. The right-of-use asset is

measured at cost, which comprises the initial amount of the lease

liability adjusted for any lease payments made at or before the

commencement date, plus any initial direct costs incurred and an

estimate of costs to dismantle and remove the underlying asset,

less any incentives received.

The lease liability is initially measured at the present value

of the lease payments unpaid at the commencement date using the

interest rate implicit in the lease, or, if that rate cannot be

readily determined, the Group's incremental borrowing rate.

Generally, the Group applies the incremental borrowing rate. For a

portfolio of leases with similar characteristics, lease liabilities

are discounted using a single discount rate.

Lease payments included in the measurement of the lease

liability comprises fixed payments, variable payments based on an

index or rate, amounts expected to be payable under a residual

value guarantee, and payments arising from options reasonably

certain to be exercised. Variable lease payments not related to an

index or rate are recognised in profit or loss as incurred.

Right-of-use assets are depreciated using the straight-line

method, from the lease commencement date to the earlier of the end

of their useful life or the end of the lease term, over their

expected useful lives, on the same basis as owned assets except

when there is no reasonable certainty that the Group will obtain

ownership by the end of the lease term, in which case the

right-of-use asset shall be fully depreciated over the shorter of

the lease term and its useful life. Right-of-use assets are reduced

by impairment losses, if any, and adjusted for remeasurements of

the lease liability.

Subsequent to the initial measurement, the carrying amount of

the liability is reduced to reflect the lease payments made and

increased to reflect the interest payable. If there is a change in

the expected cash flows arising from and index or rate, the lease

liability is recalculated. If the modification is related to a

change in the amounts to be paid, the discount rate is not revised.

Otherwise, if a modification is made to a lease, the Group revises

the discount rate as if a new lease arrangement had been made.

The Group has elected not to recognise right-of-use assets and

lease liabilities for short-term leases and leases of low-value

assets. The Group recognises the lease payments associated with

these leases as an expense on a straight-line basis over the lease

term.

Intangible assets

Intangible assets that are acquired by the Group and have finite

useful lives are measured at cost less accumulated amortisation and

any accumulated impairment losses. Subsequent expenditure is

recognised only when it is probable that the future economic

benefits associated with the expenditure will flow to the

Group.

Amortisation is calculated to write off the cost less the

estimated residual values of intangible assets, using the

straight-line method. Amortisation is recognised in profit or

loss.

The estimated useful life of the different category of

intangible assets are as follows:

Concession rights: 30 to 33 years

Computer software: 5 years

The estimated useful life, residual values and amortisation

method are reviewed at the end of each reporting period, with the

effect of any changes in estimate accounted for on a prospective

basis.

An intangible asset is derecognised upon disposal or when no

future economic benefits are expected to arise from the continued

use of the asset. The gain or loss arising on disposal or

retirement of an intangible asset is determined as the difference

between the sales proceeds and the carrying amount of the asset and

is recognised in profit or loss.

Goodwill

Goodwill arising on an acquisition of a business is measured at

cost as established at the date of acquisition of the business less

accumulated impairment losses. Goodwill is not amortised.

Impairment of non-financial assets

The carrying amounts of the Group's non-financial assets, other

than inventories and deferred tax assets, are reviewed at each

reporting date to determine whether there is any indication of

impairment. If any such indication exists, then the asset's

recoverable amount is estimated. Goodwill is tested annually for

impairment.

For impairment testing, assets are grouped together into the

smallest group of assets that generate cash inflows from continuing

use that are largely independent of the cash inflows of other

assets or cash-generating units (CGUs). Goodwill acquired in a

business combination is allocated to groups of CGUs that are

expected to benefit from the synergies of the combination.

The recoverable amount of an asset or CGU is the greater of its

value in use and its fair value less costs to sell. In assessing

value in use, the estimated future cash flows are discounted to

their present value using a pre-tax discount rate that reflects

current market assessments of the time value of money and the risks

specific to the asset or CGU.

An impairment loss is recognised if the carrying amount of an

asset or a CGU exceeds its recoverable amount. Impairment losses

are recognised in profit or loss. Impairment losses recognised in

respect of CGUs are allocated first to reduce the carrying amount

of any goodwill allocated to the CGU, and then to reduce the

carrying amounts of the other assets in the CGU on a pro rata

basis.

An impairment loss in respect of goodwill is not reversed. For

other assets, an impairment loss is reversed only to the extent

that the asset's carrying amount does not exceed the carrying

amount that would have been determined, net of depreciation or

amortisation, if no impairment loss had been recognised.

Provisions

Provisions are recognised when the Group has a present

obligation as a result of a past event, it is probable that an

outflow of economic benefits will be required to settle that

obligation and a reliable estimate can be made of the amount of the

obligation. The amount recognised as a provision is the best

estimate of the expenditure required to settle the present

obligation at the end of the reporting period taking into account

the risks and uncertainties surrounding the obligation.

Use of judgements, estimates and assumptions

The preparation of these consolidated financial statements

requires management to make judgements, estimates and assumptions

that affect the application of the Group's accounting policies and

the reported amounts of assets, liabilities, income and expenses.

Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimates are revised and in any future periods

affected.

In the process of applying the Group's accounting policies, the

following judgements, estimates and assumptions made by management

have the most significant effect on the amounts recognised in these

consolidated financial statements:

a. Provisions for tax, labour and civil risks - Judgement

Provisions for legal cases are made when the Group's management,

together with their legal advisors, consider the probable outcome

is a financial settlement against the Group. Provisions are