TIDMMIRI

RNS Number : 6206V

Mirriad Advertising PLC

11 August 2022

Mirriad Advertising plc

("Mirriad" or the "Company")

Unaudited interim results

Mirriad, the leading in-content advertising company, today

announces unaudited interim results for the six months ended 30

June 2022 (the "Period" or "H1").

H1 2022 highlights:

Strategic developments

-- Improvements recorded across all non-financial KPIs on supply and demand sides

-- Growing client roster in the US, including top tier brands

and active work with all major agency groups

-- Contract signed with Magnite on 30 May 2022 to initiate path

to scale and automation of the in-content advertising format via

programmatic ad campaigns across multiple platforms, channels and

markets

-- Decision to make orderly wind down of Chinese operations by

the end of the Tencent contract in March 2023, which will deliver

annualised cost savings of approximately GBP1m

-- New Non-Executive Directors appointed in June and July 2022

-- Research shows in-content advertising increases campaign

reach compared to conventional spot advertising in March 2022

-- First campaign in Canada in February 2022

Financial headlines

-- Revenue for H1 of GBP577k (H1 2021: GBP1.1m). Due to seasonal

nature of key advertising markets and the sales pipeline, higher

revenues are expected in H2

-- US revenues grew by 57% to GBP418k (H1 2021: GBP266k), now

accounting for 72% of total revenue

-- China revenue down 85% in the Period from GBP820k in H1 2021

to GBP120k, due to stringent lockdowns and a challenging ongoing

macro environment

-- Cost control programme to deliver a total of GBP2.5m

annualised savings, with vast majority to be achieved in 2023

-- Closing cash at the end of June 2022 of GBP17.7m (30 June 2021: GBP29.8m)

-- Cash consumption increased to GBP6.7m (H1 2021: GBP5.5m) as

the Company invests in key US commercial roles and technology

-- Operating loss of GBP8.5m (H1 2021: loss of GBP5.9m)

-- Loss per share 3p (H1 2021: loss 2p)

KPIs

KPI H1 2021 H1 2022 Change

Supply side

1. Active supply partnerships 13 18 +38%

2. Supply partners represented 34 61 +79%

3. Seconds of content available 265,165 337,862 +27%

---------- ---------- ----------

Demand side No change

1. Active agency relationships 9 9 +35%

2. Number of advertisers who have run campaigns 17 23 +50%

3. Strategic and commercial partnership agreements with advertisers and agencies 2 3

---------- ---------- ----------

Stephan Beringer, CEO of Mirriad , said: "Mirriad is continuing

to build a proposition that will be a key pillar for the future of

the video and TV advertising market. Advertisers, content owners

and broadcasters all face significant challenges in their markets

and the ability to better respond to these challenges will shape

the next generation of advertising.

"Mirriad's format offers new revenue opportunities to the media

industry and high performance and returns to advertisers. Our

positive US momentum demonstrates our burgeoning opportunities in

the world's largest advertising market, with campaigns for new and

recurring advertiser clients, and a steadily growing partner

roster. Work is ongoing to further improve conversion and deal

sizes of our pipeline.

"Elsewhere, we have taken action to mitigate disappointing

revenue in China, resulting from stringent lockdowns and a

challenging macro environment overall. We expect this specific

decision will deliver annualised cost savings of approximately

GBP1m from 2023 and ensure we continue to focus on the scale that

will be achieved by integrating effectively into the wider

advertising ecosystem.

"We are tracking strongly against the KPIs and are seeing a very

clear acceleration of interest in the in-content format. As

previously guided, we expect a stronger revenue-generating activity

to be backloaded towards the end of the year, and we are within the

Company's expectations of cash consumption and cash balance."

Enquiries:

For further information please visit www.mirriad.com or

contact:

Mirriad Advertising plc

Stephan Beringer, Chief Executive Officer

David Dorans, Chief Financial Officer

Tel: +44 (0)207 884 2530

Financial Adviser, Nominated Adviser and Broker:

Panmure Gordon

Alina Vaskina / James Sinclair-Ford (Corporate Advisory)

Erik Anderson (Corporate Broking)

Tel: +44 (0)20 7886 2500

Financial Communications:

Charlotte Street Partners

Tom Gillingham Tel: +44 (0) 7741 659021

Andrew Wilson Tel: +44 (0) 7810 636995

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

About Mirriad

Mirriad's award-winning solution unleashes new revenue for

content producers and distributors by creating new advertising

inventory in content. Our patented, AI and computer vision

technology dynamically inserts products and innovative signage

formats after content is produced. Mirriad's market-first solution

seamlessly integrates with existing subscription and advertising

models, and dramatically improves the viewer experience by limiting

commercial interruptions.

Mirriad currently operates in the US, Europe and China.

Chairman's Statement

Our Interim Results underline how, despite a renewed period of

global uncertainty, strategic focus on the US can unlock long-term

future growth for Mirriad. Fully realising the potential of a

market of this size will require further effort, but our

established fundamentals mean the Company is well-placed to scale.

We are tracking strongly against the KPIs agreed by the Board and I

look forward to providing further updates on this important measure

of progress.

As outlined in the 2021 Full Year Results, we have strategically

invested to maximise our strength in the US, and I was pleased to

recently welcome new members to our expanded Board. Nicole

McCormack and JoAnna Foyle both bring high-level US-focused

experience across advertising supply and demand, while Lois Day

brings extensive fundraising and capital markets expertise. I would

also like to thank Kelsey Lynn Skinner for her contribution before

standing down from the Board for maternity reasons, and her

responsibility for Mirriad's ESG approach will pass to Lois

Day.

Hot on the heels of the business challenges born of the

pandemic, we now face another moment of global uncertainty as

inflation looks set to continue to rise for most, with inevitable

knock-on effects on consumer confidence. These conditions - now

reported across the board following inflated growth expectations

from some quarters - are already affecting ad conversion cycles

across the world.

Specifically in China, the stringent Covid-19 lockdowns in key

cities undoubtedly had more of an effect on the advertising

industry than expected, and Mirriad revenues in the first half of

2022 are considerably lower in China than anticipated. We are alive

to the varying considerations in all our markets and have taken the

decision to exit this market when our current Tencent contract ends

in Q1 2023.

Right now, we will continue to focus our spend in the areas

which will have most impact, whilst reducing and reprioritising

expenditure away from areas with less immediate revenue generating

potential.

The advertising market is changing. Global insecurities are

feeding through to advertising budget decisions, the privacy

landscape is altering and consumers are ad-fatigued. Despite this

backdrop, Mirriad delivers something different for marketers. The

results we drive both in consumer preference and brand

consideration are why we have seen key clients return to us.

There is also rising awareness of in-content as an essential and

revolutionary next-generation approach to advertising. We welcome

the fact that Amazon has turned its attention, albeit in a limited

fashion, to in-content within its own platform. While it has taken

that company three years to get to the point they are at now, it

underlines the huge potential of the format where we have extensive

experience, and strong patent protection, as the market leader.

Netflix too is considering how to diversify away from

subscription-only income with the introduction of ads in

partnership with Microsoft. These significant moves by some of the

largest players in the streaming space, combined with the need for

broadcasters and content owners/creators to find new revenue

streams, further highlight the significant $149bn Total Addressable

Market for Mirriad that exists in the 94% of content that is

currently out of reach of traditional ad formats.

We will continue our hard work to convert what is a promising

and high-quality pipeline, whilst further raising awareness of how

our category-leading approach to in-content advertising can make a

crucial difference to brands, content creators and

broadcasters.

John Pearson

Non-executive Chairman

11 August 2022

Chief Executive Officer's Statement

Since our 2021 Final Results announcement in May 2022, we have

continued to execute against our strategy of adoption and

integration of Mirriad 's technology with several important

developments. The new collaboration with Magnite is one of the many

steps towards our ability to activate in-content insertions

programmatically, integrating with the media and content ecosystem

based on a standardised approach.

The new developments come at a time when we are experiencing a

significant rise of interest in the in-content format, evidenced by

Amazon's recent announcement to enter the market. We see Amazon's

move as a pivotal validation of the new ad category that Mirriad is

leading, and we are confident that our platform and our established

roster of quality partnerships put us in a very strong

position.

We are currently performing well against the KPIs the Company

agreed to report against, underlining progress in all key areas

across both the supply and demand sides of the business.

Revenue in the US continues to grow and has increased by 57%

year-on-year, however overall H1 revenue for the Company is

GBP577k, approximately half of the previous year's H1 revenue. The

main cause of this decline is the significant reduction from China

where revenues have fallen by over 85% year-on-year, as the H1 2021

comparator included the final recognition of minimum guaranteed

revenue in the first Tencent contract.

The severe impact of Covid restrictions in China have led to

unprecedented cuts and lingering uncertainty across the entire

advertising market in China, which is combined with a c hallenging

ongoing macro environment. We have therefore taken the strategic

decision to wind down our operations in China at the end of our

current contract which ends on 31 March 2023.

We expect this decision will deliver annualised cost savings of

around GBP1m from 2023, allowing more immediate focus in the

company's other markets and especially in the US, where we're

experiencing the most encouraging developments both on the

supply-partner side and with advertisers and their agencies.

It has become apparent this year that audience attention and ad

relevance are quickly rising as the headline themes for the

advertising and content industry, who are facing the ever-growing

ad escapism as a threat to everyone's growth agendas. In this

context, I firmly believe that content owners and advertisers will

now begin prioritising format diversification to drive higher

campaign ROIs whilst countering the growing ad-aversion. The gains

in reach and impact that Mirriad's in-content approach can deliver,

as extensively proven by Nielsen, BARB and Kantar, offer a decisive

new option at a time of recalibration for the advertising

industry.

Campaigns update

In North America, we successfully deployed dynamic ad insertion

with a leading global food and drink manufacturer, and we have

undertaken several significant campaigns for Lexus, driving a 14%

uptick in headline brand awareness. Alongside this, we worked with

Nissan to promote its current line of electric vehicles (EVs), via

a Mirriad-first SVOD integration on a popular streaming

platform.

Four further high-profile North American campaigns for blue chip

advertisers have been approved and are expected to run imminently.

Each benefit from the growing scale of our inventory and our

platform's ability to deliver campaigns across platforms and

formats with contextual precision to secure higher impact.

We have executed several music campaigns during H1, most notably

an event marking the 50th birthday of deceased artist Biggie

Smalls. This was a highly anticipated event where Mirriad's

solution enabled brands to be digitally integrated into this iconic

celebration that included a procession through Manhattan with a

star-studded entourage.

Agreements in other markets that we announced earlier in the

year have started to bear the fruit of first campaigns. In Japan,

we went live on the FujiTV VOD platform. We expect to roll out

further campaigns across FujiTV's VOD platform and broadcast

television network this Autumn. In Canada we launched with Bell

Media in Q1 running campaigns for blue-chip clients in the

Financial Services and FMCG sectors. These initial campaigns are

the first to run in the Canadian market and have delivered

impressive results for our content and brand partners. We expect a

continued roll out to new partners in Canada in H2.

Pipeline and partners update

In the US, we are seeing growth in revenue, partners and

clients, but Europe and APAC are lagging behind progress achieved

in H1, the latter primarily due to stringent Covid-19 lockdowns in

China.

We are encouraged, however, by the volume of repeat customers,

the presence of high-quality brands across all categories and the

overall strength of our forward-looking pipeline. Notably, we are

currently responding to RFPs for blue-chip brands across all key

categories and working with all major advertising agency groups in

the US. Following the hires of Zac Reeder as Head of Studio

Partnerships, in Los Angeles and Matt Douglas as Head of

Programmatic Partnerships, in New York we are seeing an immediate

uptick of opportunities in both of these growth areas.

To maximise the realisation of this pipeline we will now be

leaning more into digital, in the EU and APAC, to reflect positive

initial progress made on this front in North America.

We are focused on using our vast array of agreements and

partnerships to drive the delivery of more campaigns, but we do

expect a lot of this activity to be backloaded towards the end of

the year, as per industry norms.

Technology and effectiveness update

We are working to build a standardised proposition that will be

a key pillar for the future of the video and TV advertising

industry. At a time of increasing interest in in-content, we must

judiciously communicate key technical capabilities to avoid giving

away competitive advantage. Mirriad currently enjoys the protection

of 35 patents, and we will add to these to ensure we have robust

safeguards as our technology progresses even further.

We continue to make positive progress on developing our dynamic

insertion approach,

and we are continuously improving our end-to-end experience,

enhancing data exchange, and developing self-service

capabilities.

Outlook

Across the business, the team is working hard to successfully

convert and further grow our pipeline, against the backdrop of

macroeconomic uncertainty in many of our markets. As evidenced by

our KPIs, there is positive progress on building both the supply

and demand sides of our pipeline.

Revenue for H1 was not where we would have liked it to have

been, but Company plans always assumed a lot of revenue-generating

activity to be backloaded towards the end of the year.

The Company has a cash balance of GBP17.7m and we are actively

reviewing and prioritising spend to ensure that we manage our cash

use over the second half of the year, factoring in planned-for cost

increases in line with strategic hires. We have taken decisive

action to address currently inescapable market challenges in China,

and at the end of the half year we are within the company's

expectations of cash consumption and cash balance.

Crucially, the calibre of discussions we are having with

top-tier content and technology partners, advertisers and agencies,

underlines how Mirriad is moving from being a novel solution to be

an accepted part of the advertising ecosystem. This is still an

ongoing process, and further enabling the integration process will

be our number one focus for the next twelve months.

Stephan Beringer

Chief Executive

11 August 2022

Chief Financial Officer's Statement

Interim results

In H1 2022, revenues reduced year on year following a material

reduction in revenues from our Chinese business. The comparator

period in 2021 saw the final recognition and unwinding of minimum

guaranteed revenues under the first Tencent contract with no

equivalent in 2022. We had anticipated much higher Chinese revenues

but the complete close down of many Chinese cities including

Shanghai was not expected. Revenue for the Period was GBP577k (H1

2021: GBP1.1m). US revenues grew by 57% to GBP418k (H1 2021:

GBP266k), which was encouraging but not sufficient to offset the

substantial reduction in China. US revenues accounted for 72% of

overall revenue up from 23% in the same period last year.

In Europe, we saw a relatively modest level of activity and

European revenues were not material in either H1 2022 or 2021.

Gross profit for the Period decreased by 56% to GBP430k (H1

2021: GBP978k) as a result of the reduction in revenue. Cost of

sales decreased by 8% period on period to GBP147k (H1 2021:

GBP160k). As previously stated, cost of sales is principally

expenditure on staff and the Company has staffed for peaks of

activity. We anticipate gross margin will continue to increase as

the volume of activity increases.

The Group's operating loss increased by 42% to GBP8.5m (H1 2021:

GBP5.9m) as a result of the reduction in sales and an increase in

Administrative expenses following the continued investment in our

US team and continued investment in our technology function.

Administrative expenses increased by 27% to GBP8.9m (H1 2021:

GBP7.0m). Headcount at 30 June 2022 was 142 (30 June 2021:

109).

At the half year end, we have again reviewed our compliance with

IAS 38 and we continue to believe that the inherent uncertainty of

future revenue generation means that it is not appropriate to

capitalise any of our development cost in the first six months of

the year.

The Group continues to prioritise expenditure on research and

development to ensure that it retains its technological lead and

addresses partner needs. For the period ending June 2022 total

expenditure on research and development increased by 19% to GBP1.8m

(H1 2021: GBP1.5m).

The loss for the period before tax also increased by 42% to

GBP8.4m (H1 2021: GBP5.9m) in line with the increase in operating

loss noted above.

Tax

The Group has not recognised any tax assets in respect of

trading losses arising in the current financial period or

accumulated losses in previous financial years. The tax credit

recognised in the current and previous period arises from the

receipt of R&D tax credits in the UK. The amount receivable for

the Period ended 30 June 2022 is GBP293k (H1 2019: GBP31k) as the

Company has reviewed its current and historic R&D tax

credits.

Earnings per share

The company recorded a loss of 3 pence per share (H1 2021: loss

of 2 pence per share). This calculation is based on the weighted

average number of shares in issue during the period.

Dividend

No dividend has been proposed for the Period ended 30 June 2022

(H1 2021: GBPnil).

Cash flow

Net cash used in operations (defined as the sum of net cash used

in operating activities and the net cash used in investing

activities) during the Period increased in line with the increase

in operating loss by 22% to GBP6.7m (H1 2021: GBP5.5m). During the

period no development costs were capitalised (H1 2021: GBPnil). The

Group also incurred GBP42k (H1 2021: GBP55k) of capital expenditure

on tangible assets.

No Ordinary Shares were issued in the Period (H1 2021:

188,917).

Balance sheet

The Group has a debt-free balance sheet. Net assets decreased by

40% to GBP17.9m (30 June 2021: GBP29.8m) as the Company used cash

balances to fund the Group's ongoing operations. Cash and cash

equivalents at 30 June 2022 were GBP17.7m (30 June 2021:

GBP29.8m).

Accounting policies

On 31 December 2020, IFRS as adopted by the European Union at

that date was brought into UK law and became UK-adopted

international accounting standards, with future changes being

subject to endorsement by the UK Endorsement Board. Mirriad

Advertising Plc transitioned to UK-adopted international accounting

standards in its consolidated financial statements on 1 January

2021. There was no impact and no changes in accounting policies

resulting from the transition. These condensed consolidated interim

financial statements for the half-year reporting period ended 30

June 2022 have been prepared in accordance with the UK-adopted

International Accounting Standard (IAS) 34, 'Interim Financial

Reporting'.

David Dorans

Chief Financial Officer

11 August 2022

Company Information

Directors Independent Auditors

John Pearson PricewaterhouseCoopers LLP

Chairman 7 More London Riverside

Stephan Beringer London

Chief Executive Officer SE1 2RT

David Dorans

Chief Financial Officer Solicitors

Alastair Kilgour Osborne Clarke LLP

Non-Executive Director 6th Floor

Lois Day One London Wall

Non-Executive Director London

Bob Head EC2Y 5EB

Non-Executive Director

Nicole McCormack

Non-Executive Director

JoAnna Foyle

Non-Executive Director

Company registration number Company Secretary

09550311 Jamie Allen

-----------------------------------

Registered Office Nominated Adviser & Broker

6(th) Floor Panmure Gordon (UK) Limited

One London Wall One New Change

London London

EC2Y 5EB EC4M 9AF

-----------------------------------

Company website Financial PR

www.mirriad.com Charlotte Street Partners Limited

16 Alva Street

Edinburgh

EH2 4QG

-----------------------------------

Registrars

Computershare Investor Services

plc

The Pavilions

Bridgwater Road

Bristol

BS99 6ZZ

-----------------------------------

Condensed consolidated statement of profit or loss and condensed

statement of comprehensive income for the six months ended 30 June

2022

Year ended

31 December

Six months Six months 2021

ended 30 June ended 30 June

2022 2021

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

--------------- --------------- --------------

Revenue 5 577,436 1,137,288 2,009,721

Cost of Sales (147,154) (159,614) (293,627)

-------------------------- ------- --------------- --------------- --------------

Gross Profit 430,282 977,674 1,716,094

-------------------------- ------- --------------- --------------- --------------

Administrative expenses (8,880,678) (7,006,277) (13,936,458)

Other operating Income - 85,217 200,982

-------------------------- ------- --------------- --------------- --------------

Operating Loss (8,450,396) (5,943,386) (12,019,382)

-------------------------- ------- --------------- --------------- --------------

Finance Income 23,093 4,288 9,907

Finance costs (18,622) (3,275) (10,768)

-------------------------- ------- --------------- --------------- --------------

Finance income / (costs)

net 4,471 1,013 (861)

Loss before income tax (8,445,925) (5,942,373) (12,020,243)

Income tax credit 293,300 30,949 1,047,771

-------------------------- ------- --------------- --------------- --------------

Loss for the period /

year (8,152,625) (5,911,424) (10,972,472)

-------------------------- ------- --------------- --------------- --------------

Loss per ordinary share - basic

6 (3p) (2p) (4p)

----------------------------------- --------------- --------------- --------------

All activities are classified as continuing.

Year ended

31 December

Six months Six months

ended 30 June ended 30 June

2022 2021 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

--------------- --------------- --------------

Loss for the financial period

/ year (8,152,625) (5,911,424) (10,972,472)

------------------------------------------ --------------- --------------- --------------

Other comprehensive income

/ (loss)

Items that may be reclassified

to profit or loss:

Exchange differences on translation

of foreign operations 276,856 25,992 (216,756)

------------------------------------------ --------------- --------------- --------------

Total comprehensive loss for

the period / year (7,875,769) (5,885,432) (11,189,228)

------------------------------------------ --------------- --------------- --------------

Condensed consolidated balance sheet

At 30 June 2022

As at 31

December

As at 30 As at 30

June 20 22 June 2021 2021

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

----------------------------- ----------- -------------- ---------------- ---------------

Assets

Non-current assets:

Property, plant and

equipment 704,104 470,361 767,396

Trade and other receivables 188,795 185,885 162,962

892,899 656,246 930,358

Current assets

Trade and other receivables 1,307,677 1,738,492 1,892,152

Other current assets 1,135,286 110,293 1,116,320

Cash and cash equivalents 17,714,189 29,764,102 24,501,214

----------------------------- ----------- -------------- ---------------- ---------------

20,157,152 31,612,887 27,509,686

----------------------------- ----------- -------------- ---------------- ---------------

Total assets 21,050,051 32,269,133 28,440,044

----------------------------- ----------- -------------- ---------------- ---------------

Liabilities

Non-current liabilities

Lease liabilities 357,912 29,636 411,993

----------------------------- ----------- -------------- ---------------- ---------------

357,912 29,636 411,993

----------------------------- ----------- -------------- ---------------- ---------------

Current liabilities

Trade and other payables 2,419,427 2,124,607 2,866,773

Current tax liabilities - - 2,481

Lease liabilities 345,196 361,132 217,825

----------------------------- ----------- -------------- ---------------- ---------------

2,764,623 2,485,739 3,087,079

----------------------------- ----------- -------------- ---------------- ---------------

Total liabilities 3,122,535 2,515,375 3,499,072

----------------------------- ----------- -------------- ---------------- ---------------

Net Assets 17,927,516 29,753,758 24,940,972

----------------------------- ----------- -------------- ---------------- ---------------

Equity and Liabilities

Equity attributable

to owners of the parent

Share capital 7 52,690 52,690 52,690

Share premium 65,754,666 65,754,666 65,754,666

Share based payment

reserve 4,527,838 3,174,515 3,665,525

( 83,198 ( 117,306 ( 360,054

Retranslation reserve ) ) )

( 52,324,480 ( 39,110,807 ( 44,171,855

A ccumulated losses ) ) )

----------------------------- ----------- -------------- ---------------- ---------------

Total equity 17,927,516 29,753,758 24,940,972

----------------------------- ----------- -------------- ---------------- ---------------

Condensed consolidated statement of changes in equity

For the six months ended 30 June 2022

Six months ended 30 June 2021

--------------------------------------------------------------------------------------------

Share

Share Share based payment Retranslation Accumulated Total

Capital Premium reserve reserve Losses Equity

Note GBP GBP GBP GBP GBP GBP

------------------- ------- --------- ----------- -------------- -------------- ------------- -------------

Balance as at

1 January 2021 52,688 65,710,297 2,850,571 (143,298) (33,199,383) 35,270,875

------------------- ------- --------- ----------- -------------- -------------- ------------- -------------

Loss for the

period - - - - (5,911,424) (5,911,424)

Other

comprehensive

income for the

period - - - 25,992 - 25,992

------------------- ------- --------- ----------- -------------- -------------- ------------- -------------

Total

comprehensive

loss for the

period - - - 25,992 (5,911,424) (5,885,432)

------------------- ------- --------- ----------- -------------- -------------- ------------- -------------

Proceeds from

shares issued 2 44,369 - - - 44,371

Share based

payments

recognised as

expense - - 323,944 - - 323,944

------------------- ------- --------- ----------- -------------- -------------- ------------- -------------

Total transactions

with shareholders

recognised directly

in equity 2 44,369 323,944 - - 368,315

---------------------------- --------- ----------- -------------- -------------- ------------- -------------

Balance as

at 30 June 2021 52,690 65,754,666 3,174,515 (117,306) (39,110,807) 29,753,758

---------------------------- --------- ----------- -------------- -------------- ------------- -------------

Year ended 31 December 2021 (audited)

-----------------------------------------------------------------------------------

Share based

Share Share payment Retranslation Accumulated Total

Capital Premium reserve reserve Losses Equity

GBP GBP GBP GBP GBP GBP

----------------------- --- --------- ----------- ------------ -------------- ------------- --------------

Balance at 1

January 2021 52,688 65,710,297 2,850,571 (143,298) (33,199,383) 35,270,875

Loss for the

financial year - - - - (10,972,472) (10,972,472)

Other comprehensive

loss for the

year - - - (216,756) - (216,756)

----------------------- --- --------- ----------- ------------ -------------- ------------- --------------

Total comprehensive

loss for the

year - - - (216,756) (10,972,472) (11,189,228)

----------------------- --- --------- ----------- ------------ -------------- ------------- --------------

Proceeds from

shares issued 2 44,369 - - - 44,371

Share based payments

recognised as

expense - - 814,954 - - 814,954

----------------------- --- --------- ----------- ------------ -------------- ------------- --------------

Total transactions

with shareholders

recognised directly

in equity 2 44,369 814,954 - - 859,325

---------------------------- --------- ----------- ------------ -------------- ------------- --------------

Balance as

at 31 December

2021 52,690 65,754,666 3,665,525 (360,054) (44,171,855) 24,940,972

---------------------------- --------- ----------- ------------ -------------- ------------- --------------

Six months ended 30 June 2022

-----------------------------------------------------------------------------------------

Share

based

Share Share payment Retranslation Accumulated Total

Capital Premium reserve reserve Losses Equity

Note GBP GBP GBP GBP GBP GBP

------------------------ ------- --------- ----------- ---------- ---------------- ------------- ------------

Balance as at

1 January 2022 52,690 65,754,666 3,665,525 (360,054) (44,171,855) 24,940,972

------------------------ ------- --------- ----------- ---------- ---------------- ------------- ------------

Loss for the

period - - - - (8,152,625) (8,152,625)

Other comprehensive

income for the

period - - - 276,856 - 276,856

------------------------ ------- --------- ----------- ---------- ---------------- ------------- ------------

Total comprehensive

loss for the

period - - - 276,856 (8,152,625) (7,875,769)

------------------------ ------- --------- ----------- ---------- ---------------- ------------- ------------

Share based payments

recognised as

expense - - 862,313 - - 862,313

------------------------ ------- --------- ----------- -------------- ------------ ------------- ------------

Total transactions

with shareholders

recognised directly

in equity - - 862,313 - - 862,313

--------------------------------- --------- ----------- -------------- ------------ ------------- ------------

Balance as

at 30 June 2022 52,690 65,754,666 4,527,838 (83,198) (52,324,480) 17,927,516

--------------------------------- --------- ----------- -------------- ------------ ------------- ------------

Condensed consolidated statement of cash flows for the six months ended

30 June 2022

Note Year ended

31 December

Six months Six months 2021

ended 30 ended 30

June 2022 June 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

------------------------------ ------ -------------- -------------- --------------

Cash flow used in operating

activities 8 (6,941,442) (5,430,798) (10,450,796)

Tax credit received 274,335 - 72,993

Taxation paid (14,291) (26,261) (46,928)

Interest received 23,093 4,288 9,907

Lease interest paid (18,622) (3,275) (10,768)

------------------------------ ------ -------------- -------------- --------------

Net cash used in operating

activities (6,676,927) (5,456,046) (10,425,592)

------------------------------ ------ -------------- -------------- --------------

Cash flow from investing

activities

Purchase of tangible assets (42,462) (55,133) (159,250)

Proceeds from disposal - - -

of tangible assets

------------------------------ ------ -------------- -------------- --------------

Net cash used in investing

activities (42,462) (55,133) (159,250)

------------------------------ ------ -------------- -------------- --------------

Cash flow from financing

activities

Proceeds from issue of

ordinary share capital

(net of costs of issue) - 44,371 44,371

Payment of lease liabilities (67,636) (190,486) (379,711)

------------------------------ ------ -------------- -------------- --------------

Net cash used in financing

activities (67,636) (146,115) (335,340)

------------------------------ ------ -------------- -------------- --------------

Net decrease in cash and

cash equivalents (6,787,025) (5,657,294) (10,920,182)

Cash and cash equivalents

at the beginning of the

period / year 24,501,214 35,421,396 35,421,396

Cash and cash equivalents

at the end of the period

/ year 17,714,189 29,764,102 24,501,214

------------------------------ ------ -------------- -------------- --------------

Cash and cash equivalents

consists of

Cash at bank and in hand 17,714,189 29,764,102 24,501,214

Cash and cash equivalents 17,714,189 29,764,102 24,501,214

----------------------------------------- ----------- --------------- -------------

1 Basis of preparation

These condensed consolidated interim financial statements for

the half-year reporting period ended 30 June 2022 have been

prepared in accordance with the UK-adopted International Accounting

Standard (IAS) 34, 'Interim Financial Reporting'.

The interim report does not include all of the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 31 December 2021, which has been prepared in accordance

with UK-adopted International Financial Reporting Standards

("IFRS") and IFRS Interpretation Committee ("IFRS IC")

Interpretations in conformity with the requirements of the

Companies Act 2006 applicable to companies reporting under those

standards.

These condensed interim consolidated financial statements for

the six months ended 30 June 2022 and for the six months ended 30

June 2021 do not constitute statutory accounts as defined in

Section 434 of the Companies Act and are unaudited. The financial

information for the six months ended 30 June 2022 presents

financial information for the consolidated Group, including the

financial results of the Company's wholly owned subsidiaries

Mirriad Advertising Private Limited, Mirriad Inc, Mirriad Software

Science and Technology (Shanghai) Co. Ltd, and Mirriad Limited

(dormant). Comparative figures in the condensed interim financial

statements for the year ending 31 December 2021 have been taken

from the Group's audited financial statements on which the Group's

auditors, Pricewaterhouse Coopers LLP, expressed an unqualified

opinion.

The Board approved these interim financial statements on 11

August 2022.

1.1 Going concern

These condensed interim financial statements have been prepared

on the going concern basis, notwithstanding the Group having made a

loss for the period of GBP8.15 million (June 2021: GBP5.91

million). The going concern basis assumes that the Group and

Company will have sufficient funds available to continue to trade

for the foreseeable future and not less than 12 months from the end

of the financial period being reported.

The Directors have prepared financial forecasts including cash

flow forecasts for the period until 31 December 2024 for the Group

and the Company and these indicate that based on raising additional

funding, they will have sufficient funds available to meet their

debts and liabilities as they fall due. The base case forecast

indicates that the Group and Company will require additional funds

within 13 months of the date of approval of these condensed interim

financial statements. Although the Directors believe it is unlikely

that the Group and Company will require additional funds within 12

months of the date of approval of these condensed interim financial

statements, in a more severe but possible downside scenario should

there be unexpected incremental costs there is a risk that the

Group and Company may require funds within the next 12 months. The

Directors have the ability to control costs and mitigate the impact

of any increase in costs, which principally relate to staff, by

slowing expected hiring or flexing staff numbers. The Directors

have previously raised funds in 2019 and 2020 and are confident

that additional funding can be raised most likely through new

equity, debt or customer contracts. As at the date of approval of

these condensed interim financial statements this is not

committed.

As such these conditions indicate the existence of a material

uncertainty that may cast significant doubt on the Group and

Company's ability to continue as a going concern. These condensed

interim financial statements do not include the adjustments that

would arise if the Group or Company were unable to continue as a

going concern.

2 Accounting Policies

The accounting policies applied are consistent with those of the

annual report and accounts for the year ended 31 December 2021, as

described in those financial statements other than standards,

amendments and interpretations which became effective after 1

January 2022 and were adopted by the Group. These have had no

significant impact on the Group's loss for the period or

equity.

Seasonality of Operations

Due to the seasonal nature of the US and UK advertising markets

higher revenues are usually expected in the second half of the year

than the first six months. In the financial year ended 31 December

2021, 30% of US revenues accumulated in the first half of the year,

with 70% accumulating in the second half. For the UK Company 35% of

revenues accumulated in the first half of 2021 and 65% in the

second half.

There are no items affecting assets, liabilities, equity, net

income or cash flows that are unusual because of their nature, size

or incidence which are required to be disclosed under IAS 34 para

16A(c).

There are no events after the interim reporting period which are

required to be reported under IAS 34 para 16A(h).

There are no financial instruments being measured at fair value

which require disclosure under IAS 34 para 16A(j)

3 Group financial risk factors

The condensed interim financial statements do not contain all

financial risk management information and disclosures required in

annual financial statements; the information should be read in

conjunction with the financial information, as at 31 December 2021,

summarized in the 2021 annual report and accounts. There have been

no significant changes in any risk management policies since 31

December 2021.

4 Critical accounting estimates and judgements

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results might differ from these estimates. IAS34(16A)(d) In

preparing these condensed interim financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the consolidated financial

statements for the year ended 31 December 2021.

There are no changes in estimates of amounts reported in prior

financial years.

5 Segment information

Management mainly considers the business from a geographic

perspective since the same services are effectively being sold in

every Group entity. Therefore, regions considered for segmental

reporting are where the Company and subsidiaries are based, namely

the UK, the USA, India and China. The revenue is classified by

where the sales were booked not by the geographic location of the

customer.

In the current reporting period there is no income outside of

the primary business activity. In the prior year there was income

received from grants which was recognised in other operating

income.

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the steering committee that makes

strategic decisions. The steering committee is made up of the Board

of Directors. There are no sales between segments. The revenue from

external parties reported to the strategic steering committee is

measured in a manner consistent with that in the income

statement.

The Parent company is domiciled in the United Kingdom. The

amount of revenue from external customers by location of the Group

billing entity is shown in the tables below.

Revenue

Year ended

Six months Six months 31 December

ended ended

30 June 30 June 2021

2022 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

----------------------- -------------- -------------- --------------

Turnover by geography

USA 418,035 266,440 884,248

China 119,747 819,727 981,164

UK 39,654 51,121 144,309

Total 577,436 1,137,288 2,009,721

----------------------- -------------- -------------- --------------

Loss before tax

The EBITDA is the loss for the year before depreciation,

amortisation, interest and tax. The loss before tax is broken down

by segment as follows:

Year ended

Six months Six months 31 December

ended ended

30 June 30 June 2021

2022 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

-------------------------- -------------- -------------- --------------

UK (7,436,070) (4,886,554) (11,108,631)

USA (129,500) (946,497) ( 19,812 )

India (321,693) (301,783) (572,662)

China (312,332) 412,293 122,113

Total EBITDA (8,199,595) (5,722,541) (11,578,992)

( 440,390

Depreciation (250,801) (220,845) )

Finance income / (costs)

net 4,471 1,013 (861)

-------------------------- -------------- -------------- --------------

Loss before tax (8,445,925) (5,942,373) (12,020,243)

-------------------------- -------------- -------------- --------------

6 Loss per share

(a) Basic

Basic loss per share is calculated by dividing the loss for the

period / year by the weighted average number of ordinary shares in

issue during the period / year. Potential ordinary shares are not

treated as dilutive as the Group is loss making and such shares

would be anti-dilutive.

Group Six months Six months

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

---------------------------------- ------------ ------------ -------------

Loss attributable to owners

of the parent (GBP) (8,152,625) (5,911,424) (10,972,472)

---------------------------------- ------------ ------------ -------------

Weighted average number of

ordinary shares in issue Number 279,180,808 279,001,638 279,091,959

---------------------------------- ------------ ------------ -------------

The loss per share for the period was 3p (six months to 30 June

2021: 2p; year ended 31 December 2021: 4p).

No dividends were paid during the period (six months to 30 June

2021: GBPnil; year ended 31 December 2021: GBPnil).

(b) Diluted

Potential ordinary shares are not treated as dilutive as the

Group is loss making and such shares would be anti-dilutive

7 Share capital

Ordinary shares of GBP0.00001 each

Allotted and fully paid Number

-------------------------- ------------

At 1 January 2022 279,180,808

Issued during the period -

At 30 June 2022 279,180,808

--------------------------- ------------

No Ordinary Shares were issued during the period.

8 Net cash flows used in operating activities

Year ended

Six months Six months

ended ended 31 December

30 June

30 June 2022 2021 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

-------------------------------------- ---- --------------- -------------- --------------

Loss for the financial period

/ year (8,152,625) (5,911,424) (10,972,472)

Adjustments for:

Tax on loss on ordinary activities (293,300) (30,949) (1,047,771)

Interest income (23,093) (4,288) (9,907)

Lease interest costs 18,622 3,275 10,768

Operating loss: (8,450,396) (5,943,386) (12,019,382)

Amortisation of right-of-use

assets 163,550 158,986 299,931

Depreciation of tangible assets 87,251 61,859 140,459

Bad debts (reversed) / written

off (3,732) (524) 1,309

Share based payment charge 862,313 323,944 814,954

Adjustment to tax credit in

respect of previous periods - - (13,628)

Research and development expenditure

credits - (6,351) (27,066)

Foreign exchange variance 276,857 25,992 (216,756)

- Decrease / (increase) in

debtors 562,374 (262,047) (372,221)

- (Decrease) / increase in

creditors (439,659) 210,729 941,604

-------------------------------------------- --------------- -------------- --------------

Cash flow used in operating

activities (6,941,442) (5,430,798) (10,450,796)

-------------------------------------------- --------------- -------------- --------------

9 Related party transactions

The Group is owned by a number of investors the largest being

M&G Investment Management, which owns approximately 13% of the

share capital of the Company. Accordingly there is no ultimate

controlling party.

During the period the Company had the following related party

transactions. No guarantees were given or received for any of these

transactions.

IP2IPO Limited - a company which shares a parent company with

IP2IPO Portfolio (GP) Limited, a major shareholder in the Group,

and which also appoints a Director of the Group charged Mirriad

Advertising plc for the following transactions during the period:

(1) GBP10,000 for the services of Kelsey Lynn Skinner as a Director

from 1 January 2022 until 23 June 2022. Of this amount GBP1,667 was

invoiced and unpaid as at 30 June 2022. (2) GBP3,000 for the

services of the Company Secretary for the period from 1 January

2022 until 31 March 2022.

Parkwalk Advisors Limited - a company which shares a parent

company with IP2IPO Portfolio (GP) Limited, a major shareholder in

the Group, and which also appoints a Director of the Group charged

Mirriad Advertising plc for the following transactions during the

period: (1) GBP10,000 for the services of Alastair Kilgour as a

Director during the period. GBP1,667 of this amount was accrued and

unpaid as at 30 June 2022.

All the related party transactions disclosed above were settled

by 30 June 2022 except where stated.

10 Availability of Interim Report

Electronic copies of this interim financial report will be

available on the Company's website at

www.mirriadplc.com/investor-relations .

S

About Mirriad

Mirriad's award-winning solution unleashes new revenue for

content producers and distributors by creating new advertising

inventory in content. Our patented, AI and computer vision

technology dynamically inserts products and innovative signage

formats after content is produced. Mirriad's market-first solution

seamlessly integrates with existing subscription and advertising

models, and dramatically improves the viewer experience by limiting

commercial interruptions.

Mirriad currently operates in the US, Europe and China.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QBLFFLVLBBBZ

(END) Dow Jones Newswires

August 11, 2022 02:00 ET (06:00 GMT)

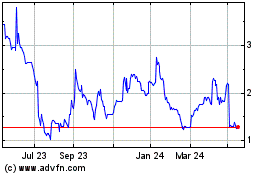

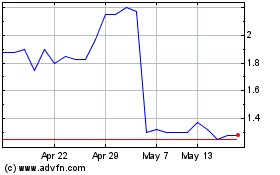

Mirriad Advertising (LSE:MIRI)

Historical Stock Chart

From Jul 2024 to Jul 2024

Mirriad Advertising (LSE:MIRI)

Historical Stock Chart

From Jul 2023 to Jul 2024