TIDMMCON

RNS Number : 9287H

Mincon Group Plc

09 August 2021

Mincon Group plc

("Mincon" or the "Group")

2021 Half Year Financial Results

Mincon Group plc (Euronext:MIO AIM:MCON), the Irish engineering

Group specialising in the design, manufacture, sale and servicing

of rock drilling tools and associated products, announces its half

year results for the six months ended 30 June 2021.

H1 2021 Highlights (comparison to H1 2020):

* Revenue up 4% to EUR67.0 million

* Gross Profit down 2% to EUR22.9 million

* Profit Before Tax up 4% to EUR8.0 million

* Growth of 4% in both revenue and profit before tax in

H1 2021 despite the previously announced pandemic

challenges interrupting production in Shannon at the

beginning of the year, as well as increases in

transport costs and lead times during the period;

* Trading and production has continued to strengthen

into H2 2021 and the Group's pipeline and order books

remain strong as additional projects are expected to

commence in H2 2021.

Joe Purcell, Chief Executive Officer, commenting on the results,

said:

"Our sales growth during the first six months of 2021 reflected

a very strong performance from a number of our regions and

industries, however this was offset somewhat by the continuing

impact of the pandemic in two of our regions. Our operating margins

were impacted due to pandemic issues in our production at the

beginning of the year, particularly in Shannon, increased transport

costs and start-up costs on a new contract in South America.

The European region performed strongly, particularly in the

mining and construction industries, while the North American mining

industry also performed very well during the period. Australasia,

Southern Africa and South America remain impacted by the pandemic.

In the case of Australia, in the area of new business developments,

there were a number of trials that were curtailed. There were no

large-scale construction projects in North America during the

period, however we have a strong pipeline of tenders and remain

positive about the outlook for the industry in the second six

months of the year.

The Group is quickly adapting to some of the challenges

presented in the current market. We have experienced significant

increases in transit times and costs in relation to sea freight,

while raw material availability and prices have also been a

challenge. As a result of these issues, we made a conscious

decision to increase inventory levels, to ensure that we can

continue to supply our customers on time. We are also passing on

price increases where we can and that will have a positive result

on our margins in H2 2021.

Our regional management structure has continued to deliver, and

our strong global coverage has meant that we have been able to run

the business with a minimum level of international travel to try

and mitigate any Covid-19 risks and we will continue to review our

travel policies as the global situation develops.

These results for the first six months of 2021 have further

demonstrated that we are embedded in a wide range of cultures and

communities across our global operations and markets. As a

significant employer in these communities, Mincon has a meaningful

role to play and we are committed to increasing opportunities for

our employees as well as for the wider communities. As local

governments imposed restrictions to contain the Covid-19 pandemic,

our businesses in those markets have responded with the health and

safety of our workforce as the primary concern.

As a result of the disruption caused by Covid-19, progress in

product development has been challenging. Our Greenhammer system is

still waiting to get onsite in Australia where there is a very

strict site access policy across the mining industry. When this

situation eases, we are ready to get onsite and start drilling to

commercialise this exciting opportunity for Mincon and the hard

rock mining industry. Several other product development projects

are on hold waiting on an easing of travel/site access

restrictions. Despite these delays in delivering these projects,

our ambition has not waned. If anything, it is growing and a good

example of this is the disruptive innovation fund grant that was

awarded in May for the development of mooring systems for offshore

wind installations. This is an exciting new opportunity for Mincon

and marks our entry into the exciting and expanding renewables

market.

Part of our acquisition strategy has been to build out our

product offering to deliver a complete consumable package to the

various markets that we are targeting. In January 2021, we

completed the acquisition of Hammer Drilling Rigs, a US based

business involved in the design and manufacture of bespoke drilling

rigs and attachments for a variety of geotechnical applications.

The products are characterised by elegant, user friendly and robust

design with added benefits of serviceability and readily available

spare parts. They add to our offering in the geotechnical space by

giving us the ability to offer the full package to several

specialist applications such as limited access drilling and solar

field anchoring.

Prior to acquisition of Hammer Drilling Rigs, all the rig

manufacturing was outsourced. That has now been integrated with our

plant in Benton, Illinois bringing the manufacturing margin

inhouse. As part of the manufacturing integration in Benton, we

acquired one of the outsourced contractors that the Hammer Drilling

Rigs team worked with, Campbell's Welding & Fabrication. This

business has now been relocated to Benton to run the manufacturing

operations for the product line. An added benefit of the

acquisition is that the grout plant product line that the

contractor produces can be used extensively in construction

applications, including solar field installations. The experienced

team that has joined us with this acquisition will also form an

integral part of our development team for the offshore mooring

project, as well as bringing novel and highly efficient

installation technology to the terrestrial solar field sector.

Another important part of our acquisition strategy has been to

add talented and strategically located customer service businesses

to increase our direct customer access and help to promote revenue

growth for our Mincon manufactured products. As part of this

strategy, in July 2021 we acquired Attakroc, a distributor based in

Quebec City, Canada. We have built a strong relationship with

Attakroc over a number of years and have been impressed with its

customer service ethos as well as the growth potential in the

Eastern Canadian market for our products in mining, construction

and waterwell/geothermal drilling. This follows on from our

successful acquisition in 2019 of Pacific Bit in Western Canada and

gives us a more comprehensive customer service footprint to assist

our growth in this important area for Mincon.

Our focus on the engineering efficiency of our products has

meant that we have always looked to minimise our carbon footprint.

This is more obvious on projects such as Greenhammer and will be

further emphasised by our move into renewables with solar field and

offshore wind installations. We are also looking at production

efficiencies and are investing in new technologies to further

reduce our impact on the environment.

Concluding comments

Since our IPO in 2013, we have been on a journey that has filled

out our product offering so that we can now supply the full range

of consumables to the mining, construction, and

waterwell/geothermal markets. Our engineering capacity has been

transformed by adding to our team through acquisition and strategic

hiring. Our undertaking of ambitious and challenging product

development projects that are now poised to deliver, has built a

knowledge base and honed our abilities. These engineering skillsets

can now be deployed for new product development in existing markets

as well as new areas such as the renewables space. This expertise,

combined with the global spread of our manufacturing and customer

service centres, means that we have created a platform for future

growth. Indeed, with very strong order books and the additional

opportunities that we see for the second six months of 2021, we

believe that platform is now starting to deliver. Of course, we

must always be aware of the variable environment which Covid-19

presents and endeavour to mitigate the effect on our people. On

that note I would like to thank all my colleagues for their work,

vigilance and perseverance through these challenging times and,

together, we look forward to better days ahead."

Joseph Purcell

Chief Executive Officer

Market Industries and Product Mix

Our revenue has continued to grow during the period, albeit the

pandemic has created some difficulties for growth in some regions

where we operate.

Industry mix (by revenue)

H1 2021 H1 2020

* Mining 52% 52%

* Construction 30% 29%

* Waterwell / Geothermal 18% 19%

Our largest growth in revenue during the first six months of

2021 was into the construction industry where we grew by 10%,

though we did not invoice any large construction projects in North

America during the period. Construction revenue grew through

winning smaller projects in Europe and North America as Covid-19

restrictions eased in these regions during the period and gave us

the opportunity to gain more access with our partners in the

industry.

Our revenue into the mining industry grew by 2%, but this growth

was not spread evenly across all our regions. We grew in areas

where Covid-19 restrictions have eased or did not have a material

impact on the industry, mostly in our Europe Middle East region and

North America. The impact of Covid-19 was a major challenge for the

industry in South America, Southern Africa, and Southeast Asia. The

mining industry in Australia remains buoyant, but mine operators

continue to ban non-essential access to their sites. This allows

incumbent suppliers to continue supplying and has thus prevented

our growth with new customers in this region during the period.

The waterwell/geothermal industry is recovering from the initial

effects of the pandemic, and our revenue in the industry was flat

for the first six months of 2021. This industry is mostly made up

of smaller drilling companies, and we have observed that a number

of these businesses in central Europe, where Covid-19 restrictions

impacted the industry heavily in 2020, have not returned to

trade.

Our sales mix of Mincon manufactured products and non-Mincon

manufactured products changed in the period as revenue was

generated from different projects and from other mining activity.

Revenue from large construction projects supplied in H1 2020 in the

Americas region had a sales mix close to 100% of Mincon

manufactured products whereas, as noted above, we have not invoiced

any similar large construction projects in the first half of this

year. The increase in mining revenue in certain regions gave us an

increase in non-Mincon manufactured revenue due to the nature of

mining in that region.

Earnings

At the beginning of the year, including all of January and most

of February, we experienced interruption in our manufacturing in

some of our plants due to the pandemic. The largest impact was at

our hammer factory in Shannon. Our capacity in the Shannon plant

was severely disrupted, with a 35% reduced manufacturing workforce

during those initial months of this year. This was mostly due to

employees deemed to be in close contact with people who tested

positive for Covid-19 outside the factory and in the wider

community, with the effect being that those employees were

instructed to self-isolate in their homes for a period of time

before returning to the Shannon factory.

The reduced manufacturing workforce in Shannon resulted in the

plant producing significantly less product for our customer centres

during the period and this has had a negative impact on our gross

margin during the first half of the year. However, during March the

Covid situation improved in Shannon, and by Q2 2021 the plant was

manufacturing at a much higher monthly run-rate than had been

achieved in the past and this should help to improve gross margin

in the second half of the year.

At the beginning of this year, when we were impacted hardest due

to the pandemic, we were often compelled to use expensive air

freight to ensure on-time deliveries to our customers. During the

period, we also incurred sharp increases in raw materials and sea

freight costs, and these led to increased pressure on our gross

margin during the period. We have passed on the raw material price

increases to customers where it is appropriate to do so. Our sea

freight costs increased considerably during the period as ocean

carriers capitalised on the congestion at seaports and overall sea

freight market conditions.

Our operating profit for the first six months was down 9% versus

the same period in 2020. This was primarily due to the lower gross

margin, as noted above, while the prior year comparable period also

reflected the invoicing of the large construction projects in North

America which earn a much higher operating profit margin than our

other businesses.

Balance sheet and cash

Cash generated through the business increased slightly on the

prior period. We have used the cash generated to further increase

capacity and modernise our factories to ensure that we support our

customers operations with on-time deliveries, and we are also

pleased to have resumed the payment of dividends to our

shareholders.

During the second half of 2020 and Q1 2021 we witnessed longer

lead times and less on-time delivery of raw materials. To reduce

the risks to our supply chain, we purchased greater quantities of

raw material to allow us to hold larger volumes at our factories to

ensure our manufacturing is not affected by supply shortages.

In the past twelve months, all industries have had to deal with

sea freight challenges. We continue to see longer shipping times

from our factories to our customer centres or customers due to

vessel capacity and congestion at seaports and, in some cases,

shipping times have doubled over the past twelve months. This has

had a direct impact on our inventory, as we have witnessed a

significant increase of inventory in transit from our factories to

our customer centres and unreliable dates of seaport arrivals.

During the period, we decided to invest cash into holding larger

stocks of finished goods at our customer centres to ensure supply

to local customers.

We have also borrowed a further EUR5.1 million during the period

and invested this in property, plant and equipment. During the

period a net EUR2.5 million of plant and equipment has been

commissioned at our factories, and EUR3 million has been prepaid to

increase future capacity and to modernise manufacturing techniques

at our factories.

We have paid EUR1.8 million of deferred consideration for past

acquisitions and EUR0.4 million for current year acquisitions. We

also paid a full year dividend for 2020 of EUR4.5 million in June

2021.

The Board of Mincon Group plc has recommended the payment of an

interim dividend in the amount of 1.05 cent per ordinary share,

which will be paid on the 10 September 2021 to shareholders on the

register at

the close of business on the 20 August 2021.

Covid-19

The Group continues to adhere to local government advice and

restrictions to curb the spread of Covid-19. All employees follow

our own health and safety policies that incorporate the relevant

national health guidelines in relation to the pandemic.

The majority of our business partners have managed to operate

their businesses during the pandemic, though not all our regions

are at the same level of recovery from the pandemic. New strains of

the virus and other local issues can compound the damage the

pandemic has caused. We are striving to find new methods to

overcome these challenges and improve our businesses locally to

work with our partners, and our regional structure within Mincon

has been key to developing these methods.

09 AUGUST 2021

For further information, please contact:

Mincon Group plc Tel: +353 (61) 361

099

Joe Purcell CEO

Mark McNamara CFO

Davy Corporate Finance (Nominated Adviser, Tel: +353 (1) 679

Euronext Growth Adviser and Joint Broker) 6363

Anthony Farrell

Daragh O'Reilly

Shore Capital (Joint Broker) Tel: +44 (0) 20 7408

4090

Malachy McEntyre

Mark Percy

Daniel Bush

Mincon Group plc

2021 Half Year Financial Results

Condensed consolidated income statement

For the 6 months ended 30 June 2021

Unaudited Unaudited

2021 2020

Notes EUR'000 EUR'000

----------------------------- ------- ------------ ----------------

Continuing operations

Revenue 6 67,000 64,654

Cost of sales 8 (44,094) (41,197)

------------ ----------------

Gross profit 22,906 23,457

Operating costs 8 (15,402) (15,194)

------------ ----------------

Operating profit 7,504 8,263

Finance income 15 18

Finance cost (406) (412)

Foreign exchange gain/(loss) 868 (227)

Contingent consideration (1) 13

------------ ----------------

Profit before tax 7,980 7,655

----------------------------- ------------ ----------------

Income tax expense (1,623) (1,297)

----------------------------- ------- ------------ ----------------

Profit for the period 6,357 6,358

----------------------------- ------- ------------ ----------------

Profit attributable to:

- owners of the Parent 6,357 6,198

- non-controlling interests - 160

----------------------------- ------- ------------ ----------------

Earnings per Ordinary Share

Basic earnings per share, 12 2.99 2.93

Diluted earnings per share, 12 2.91 2.86

----------------------------- ------- ------------ ----------------

Condensed consolidated statement of comprehensive income

For the 6 months ended 30 June 2021

Unaudited Unaudited

2021 2020

H1 H1

EUR'000 EUR'000

--------------------------------------------------------- --------- ----------

Profit for the period 6,357 6,358

Other comprehensive income/(loss):

Items that are or may be reclassified subsequently to

profit or loss:

Foreign currency translation - foreign operations 1,340 (3,734)

Other comprehensive profit / (loss) for the period 1,340 (3,734)

--------------------------------------------------------- --------- ----------

Total comprehensive income for the period 7,697 2,624

--------------------------------------------------------- --------- ----------

Total comprehensive income attributable to:

- owners of the Parent 7,697 2,464

- non-controlling interests - 160

--------------------------------------------------------- --------- ----------

The accompanying notes are an integral part of these financial

statements.

Consolidated statement of financial position

As at 30 June 2021

Unaudited

30 June 31 December

2021 2020

Notes EUR'000 EUR'000

---------------------------------------------- ----- --------------------- --------------------

Non-Current Assets

Intangible assets and goodwill 14 40,293 36,987

Property, plant and equipment 15 47,492 45,820

Deferred tax asset 10 615 1,093

Total Non-Current Assets 88,400 83,900

----------------------------------------------- ----- --------------------- --------------------

Current Assets

Inventory and capital equipment 16 58,214 53,017

Trade and other receivables 17 22,248 20,640

Prepayments and other current assets 7,532 4,186

Current tax asset 10 248 311

Cash and cash equivalents 11,684 17,045

Total Current Assets 99,926 95,199

----------------------------------------------- ----- --------------------- --------------------

Total Assets 188,326 179,099

----------------------------------------------- ----- --------------------- --------------------

Equity

Ordinary share capital 11 2,125 2,117

Share premium 67,647 67,647

Undenominated capital 39 39

Merger reserve (17,393) (17,393)

Share based payment reserve 13 2,418 2,259

Foreign currency translation reserve (6,693) (8,033)

Retained earnings 88,195 86,300

----------------------------------------------- ----- --------------------- --------------------

Equity attributable to owners of Mincon Group

plc 136,338 132,936

----------------------------------------------- ----- --------------------- --------------------

Total Equity 136,338 132,936

Non-Current Liabilities

Loans and borrowings 18 16,738 14,789

Deferred tax liability 10 1,034 1,832

Deferred contingent consideration 19 5,054 4,723

Other liabilities 645 503

Total Non-Current Liabilities 23,471 21,847

----------------------------------------------- ----- --------------------- --------------------

Current Liabilities

Loans and borrowings 18 8,981 6,822

Trade and other payables 12,640 10,457

Accrued and other liabilities 5,655 5,529

Current tax liability 10 1,241 1,508

Total Current Liabilities 28,517 24,316

----------------------------------------------- ----- --------------------- --------------------

Total Liabilities 51,988 46,163

----------------------------------------------- ----- --------------------- --------------------

Total Equity and Liabilities 188,326 179,099

----------------------------------------------- ----- --------------------- --------------------

The accompanying notes are an integral part of these financial

statements.

Condensed consolidated statement of cash flows

For the 6 months ended 30 June 2021

--------------------------------------------------------- ---------------------

Unaudited Unaudited

H1 H1

2021 2020

EUR'000 EUR'000

--------------------------------------------------------- --------- ----------

Operating activities:

Profit for the period 6,357 6,358

Adjustments to reconcile profit to net cash provided

by operating activities:

Depreciation and amortisation 3,587 3,149

Fair value movement on deferred contingent consideration 1 (13)

Finance cost 406 412

Finance income (15) (18)

Gain on sale of property, plant & equipment (78) -

Income tax expense 1,623 1,297

Other non-cash movements (881) (244)

--------------------------------------------------------- --------- ----------

11,000 10,941

Changes in trade and other receivables (1,193) 422

Changes in prepayments and other assets (3,274) 3,160

Changes in inventory (4,179) (3,440)

Changes in trade and other payables 2,085 189

--------------------------------------------------------- --------- ----------

Cash provided by operations 4,439 11,272

Interest received 15 18

Interest paid (406) (412)

Income taxes paid (2,146) (1,153)

--------------------------------------------------------- --------- ----------

Net cash provided by operating activities 1,902 9,725

--------------------------------------------------------- --------- ----------

Investing activities

Purchase of property, plant and equipment (2,501) (4,469)

Investment in intangible assets (419) (459)

Proceeds from the issuance of share capital 8 7

Payment of deferred contingent consideration (1,832) (1,023)

Acquisitions, net of cash required (359) (7,225)

Proceeds from sale of discontinued operations 111 -

Net cash provided used in investing activities (4,992) (13,169)

--------------------------------------------------------- --------- ----------

Financing activities

Dividends paid (4,462) -

Repayment of loans and finance leases (3,126) (1,984)

Drawdown of loans 5,137 5,441

Net cash provided (used in)/by financing activities (2,451) 3,457

--------------------------------------------------------- --------- ----------

Effect of foreign exchange rate changes on cash 180 (346)

--------------------------------------------------------- --------- ----------

Net decrease in cash and cash equivalents (5,361) (333)

--------------------------------------------------------- --------- ----------

Cash and cash equivalents at the beginning of the

year 17,045 16,368

--------------------------------------------------------- --------- ----------

Cash and cash equivalents at the end of the period 11,684 16,035

--------------------------------------------------------- --------- ----------

The accompanying notes are an integral part of these financial

statements.

Condensed consolidated statement of changes in equity for the 6

months ended 30 June 2021

Share Foreign

based currency Unaudited

Share Share Merger Un-denominated payment translation Retained Non-controlling Total

capital premium reserve capital reserve reserve earnings Total interests equity

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

---------------- ------- ------- -------- -------------- ------- ----------- -------- ------- --------------- ---------

Balances at 1

July 2020 2,117 67,647 (17,393) 39 1,945 (7,602) 81,064 127,817 1,275 129,092

---------------- ------- ------- -------- -------------- ------- ----------- -------- ------- --------------- ---------

Comprehensive

income:

Profit for the

period - - - - - - 8,022 8,022 5 8,027

Other

comprehensive

income/(loss):

Foreign currency

translation - - - - - (431) - (431) - (431)

Other - - - - - - 156 156 - 156

----------- -------- ------- --------------- ---------

Total

comprehensive

income (431) 8,178 7,747 5 7,752

----------- -------- ------- --------------- ---------

Transactions

with

Shareholders:

Share-based

payments - - - - 314 - - 314 - 314

Dividend payment - - - - - - (2,222) (2,222) - (2,222)

Acquisition of

non-controlling

interest

without a

change

in control - - - - - - (720) (720) (1,280) (2,000)

Balances at 31

December

2020 2,117 67,647 (17,393) 39 2,259 (8,033) 86,300 132,936 - 132,936

---------------- ------- ------- -------- -------------- ------- ----------- -------- ------- --------------- ---------

Comprehensive

income:

Profit for the

period - - - - - - 6,357 6,357 - 6,357

Other

comprehensive

income/(loss):

Foreign currency

translation - - - - - 1,340 - 1,340 - 1,340

----------- -------- ------- --------------- ---------

Total

comprehensive

income 1,340 6,357 7,697 - 7,697

----------- -------- ------- --------------- ---------

Transactions

with

Shareholders:

Equity-settled

share-based

payment 8 - - - - - - 8 - 8

Share-based

payments - - - - 159 - - 159 - 159

Dividend payment - - - - - - (4,462) (4,462) - (4,462)

Balances at 30

June 2021 2,125 67,647 (17,393) 39 2,418 (6,693) 88,195 136,338 - 136,338

---------------- ------- ------- -------- -------------- ------- ----------- -------- ------- --------------- ---------

The accompanying notes are an integral part of these financial

statements.

Notes to the consolidated interim financial statements

1 Description of business

Mincon Group plc ("the Company") is a company incorporated in

the Republic of Ireland. The unaudited consolidated interim

financial statements of the Company for the six months ended 30

June 2021 (the "Interim Financial Statements") include the Company

and its subsidiaries (together referred to as the "Group"). The

Interim Financial Statements were authorised for issue by the

Directors on 9 August 2021.

2. Basis of preparation

The Interim Financial Statements have been prepared in

accordance with IAS 34, 'Interim Financial Reporting', as adopted

by the EU. The Interim Financial Statements do not include all of

the information required for full annual financial statements and

should be read in conjunction with the Group's consolidated

financial statements for the year ended 31 December 2020 as set out

in the 2020 Annual Report (the "2020 Accounts"). The Interim

Financial Statements do, however, include selected explanatory

notes to explain events and transactions that are significant to an

understanding of the changes in the Group's financial position and

performance since the last annual financial statements.

The Interim Financial Statements do not constitute statutory

financial statements. The statutory financial statements for the

year ended 31 December 2020, extracts from which are included in

these Interim Financial Statements, were prepared under IFRS as

adopted by the EU and will be filed with the Registrar of Companies

together with the Company's 2020 annual return. They are available

from the Company website www.mincon.com and, when filed, from the

registrar of companies. The auditor's report on those statutory

financial statements was unqualified.

The Interim Financial Statements are presented in Euro, rounded

to the nearest thousand, which is the functional currency of the

parent company and also the presentation currency for the Group's

financial reporting.

The financial information contained in the Interim Financial

Statements has been prepared in accordance with the accounting

policies applied in the 2020 Accounts.

3. Use of estimates and judgements

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income, and expenses. The

judgements, estimates and associated assumptions are based on

historical experience and other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making the judgements about the carrying values of assets

and liabilities that are not readily apparent from other sources.

Actual results may differ materially from these estimates. In

preparing the Interim Financial Statements, the significant

judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the

same as those that applied to the 2020 Financial Statements.

4. Changes in significant accounting policies

There have been no changes in significant accounting policies

applied in these interim financial statements, they are the same as

those applied in the last annual audited financial statements.

5. Financial Reporting impact due to the Covid-19 Pandemic:

a. Government Grants

The Group received government grants in certain countries where

the Group operates. These grants differ in structure from country

to country but primarily relate to personnel costs. During the six

months ended 30 June 2021, when the terms attached to the grants

were complied with, the grant was recognised in Administration

expenses in the consolidated income statement.

b. Expected Credit losses

The Group has not witnessed any trends in its analysis of its

customers that would indicate an adjustment to its trade

receivables as at the 30 June 2021 due to the Covid-19

pandemic.

c. Inventory

The Group has not experienced any material impact on its

valuation of inventory as of 30 June 2021, that can be directly

attributable to the Covid-19 pandemic.

d. Risk Assessment

The Mincon Group's operations are spread globally. This brings

various exposures, such as trading and financial, and strategic

risks. The primary trading risks would encompass operational,

legal, regulatory and compliance. Strategic risks would cover long

term risks effecting the business such as evolving industry trends,

technological advancements, and global economic developments.

Financial risks extend to but are not limited to pricing risks,

currency risks, interest rate volatility and taxation risks. The

risk of managing Covid-19 is encompassed with the abovementioned

risks and therefore the Group considers its management of these

risks as a whole.

6. Revenue

H1 H1

2021 2020

EUR'000 EUR'000

---------------------------- ------- --------

Product revenue:

Sale of Mincon product 57,390 55,565

Sale of third-party product 9,610 9,089

Total revenue 67,000 64,654

---------------------------- ------- --------

7. Operating Segments

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker

(CODM). Our CODM has been identified as the Board of Directors.

Having assessed the aggregation criteria contained in IFRS 8

operating segments and considering how the Group manages its

business and allocates resources, the Group has determined that it

has one reportable segment. In particular the Group is managed as a

single business unit that sells drilling equipment, primarily

manufactured by Mincon manufacturing sites.

Entity-wide disclosures

The business is managed on a worldwide basis but operates

manufacturing facilities and sales offices in Ireland, Sweden,

Finland, South Africa, UK, Australia, the United States and Canada

and sales offices in other locations including Australia, South

Africa, Finland, Spain, Namibia, France, Sweden, Canada, Chile and

Peru. In presenting information on geography, revenue is based on

the geographical location of customers and non-current assets based

on the location of these assets.

7. Operating Segments (continued)

Revenue by region (by location of customers):

H1 H1

2021 2020

EUR'000 EUR'000

----------------------------------------- ------- -------------

Region:

Europe, Middle East, Africa 38,340 32,573

Americas 20,010 21,509

Asia Pacific 8,650 10,572

Total revenue from continuing operations 67,000 64,654

----------------------------------------- ------- -------------

Non-current assets by region (location of assets):

30 June 31 December

2021 2020

EUR'000 EUR'000

Region:

Europe, Middle East, Africa 64,072 60,159

Americas 12,795 11,310

Asia Pacific 10,918 11,338

Total non-current assets(1) 87,785 82,807

---------------------------------------------------- ------- -----------

(1) Non-current assets exclude deferred tax assets.

8. Cost of Sales and operating expenses

Included within cost of sales, selling and distribution expenses

and general and administrative expenses were the following major

components:

Cost of sales

H1 H1

2021 2020

EUR'000 EUR'000

---------------------------------------- -------- --------

Raw materials 18,651 17,517

Third party product purchases 7,111 7,122

Employee costs 9,751 8,438

Depreciation 2,259 2,024

Impairment of finished goods inventory - 257

Other 6,322 5,839

---------------------------------------- -------- --------

Total cost of sales 44,094 41,197

---------------------------------------- -------- --------

The level of finished goods inventory impairment within cost of

sales amounted to EURNIL (30 June 2020: EUR257,000).

General and selling expenses

H1 H1

2021 2020

EUR'000 EUR'000

--------------------------------- --------

Employee costs 9,343 8,880

Depreciation 1,183 1,125

Acquisition and related costs - 343

Other 4,876 4,846

---------------------------------- -------- ---------

Total other operating costs 15,402 15,194

---------------------------------- -------- ---------

The Group provides for all receivables where there is objective

evidence, including historical loss experience, that amounts are

irrecoverable. The Group considers all receivables fully

recoverable.

Employee information

H1 H1

2021 2020

EUR'000 EUR'000

--------------------------------------------- -------- --------

Wages and salaries 16,255 14,591

Social security costs 1,935 1,648

Pension costs of defined contribution plans 745 763

Share based payments (note 13) 159 316

--------------------------------------------- -------- --------

Total employee costs 19,094 17,318

--------------------------------------------- -------- --------

The Group capitalised payroll costs of EUR295,000 in H1 2021 in

relation to research and development.

The average number of employees was as follows:

H1 H1

2021 2020

Number Number

--------------------------------------------------- ------- -------

Sales and distribution 126 126

General and administration 71 61

Manufacturing, service and development 370 340

--------------------------------------------------- ------- -------

Average number of persons employed 567 527

--------------------------------------------------- ------- -------

9. Acquisitions and disposals

Acquisitions

In January 2021, Mincon acquired Hammer Drilling Rigs (HDR), a

specialist in supply of hard rock drilling attachments based in the

USA, for a consideration of EUR2.1 million This was made up of a

cash consideration of EUR275,000 and deferred consideration of

EUR1.8 million.

In June 2021, Mincon acquired Campbell's Welding &

Fabrication, for a consideration of EUR421,000. This was made up of

a cash consideration of EUR84,000 and deferred consideration of

EUR337,000.

A. Consideration transferred for Intellectual Property

HDR Campbell's Total

Welding

& Fabrication

EUR'000 EUR'000 EUR'000

----------------------------------- -------- --------------- --------

Cash 275 84 359

Deferred contingent consideration 1,785 337 2,122

----------------------------------- -------- --------------- --------

Total consideration transferred 2,060 421 2,481

----------------------------------- -------- --------------- --------

10. Income Tax

The Group's consolidated effective tax rate in respect of

operations for the six months ended 30 June 2021 was 20% (30 June

2020: 17%). The effective rate of tax is forecast at 20% for 2021.

The tax charge for the six months ended 30 June 2021 of EUR1.6

million (30 June 2020: EUR1.3 million) includes deferred tax

relating to movements in provisions, net operating losses forward

and the temporary differences for property, plant and equipment

recognised in the income statement.

The net current tax liability at period-end was as follows:

30 June 31 December

2021 2020

EUR'000 EUR'000

------------------------ ------- ------------

Current tax prepayments 248 311

Current tax payable (1,241) (1,508)

------------------------ ------- ------------

Net current tax (993) (1,197)

------------------------ ------- ------------

The net deferred tax liability at period-end was as follows:

30 June 31 December

2021 2020

EUR'000 EUR'000

----------------------- ------- ------------

Deferred tax asset 615 1,093

Deferred tax liability (1,034) (1,832)

----------------------- ------- ------------

Net deferred tax (419) (739)

----------------------- ------- ------------

11. Share capital

Allotted, called- up and fully paid up shares Number EUR000

---------------------------------------------- ----------- ------

01 January 2021 211,675,024 2,117

Allotted in March 2021 516,128 5

Allotted in April 2021 281,261 3

---------------------------------------------- ----------- ------

30 June 2021 212,472,413 2,125

---------------------------------------------- ----------- ------

Share issuances

On 26 November 2013, Mincon Group plc was admitted to trading on the

Enterprise Securities Market (ESM) of the Euronext Dublin and the

Alternative Investment Market (AIM) of the London Stock Exchange.

In March 2021, 516,128 Restricted Share Awards (RSAs) met the

vesting conditions set down by the board of directors and were

allotted to the recipients of the awards.

In April 2021, a further 281,261 Restricted Share Awards (RSAs)

met the vesting conditions set down by the board of directors and

were allotted to the recipients of the awards.

12. Earnings per share

Basic earnings per share (EPS) is computed by dividing the

profit for the period available to ordinary shareholders by the

weighted average number of Ordinary Shares outstanding during the

period. Diluted earnings per share is computed by dividing the

profit for the period by the weighted average number of Ordinary

Shares outstanding and, when dilutive, adjusted for the effect of

all potentially dilutive shares. The following table sets forth the

computation for basic and diluted net profit per share for the

years ended 30 June:

H1 2021 H1 2020

Numerator (amounts in EUR'000):

Profit attributable to owners of the Parent 6,357 6,198

Denominator (Number):Basic shares outstanding

Restricted share awards

Restricted share options

Diluted weighted average shares outstanding 212,472,413 211,675,024

----------------------------------------------

- 844,000

6,041,000 3,981,000

218,513,413 216,500,024

---------------------------------------------- ----------- -----------

Earnings per Ordinary Share

Basic earnings per share, EUR 2.99c 2.93c

Diluted earnings per share, EUR 2.91c 2.86c

----------- -----------

13. Share based payment

The vesting conditions of the scheme state that the minimum

growth in EPS shall be CPI plus 5% per annum, compounded annually,

over the relevant three accounting years up to the share award of

100% of the participants basic salary. Where awards have been

granted to a participant in excess of 100% of their basic salary,

the performance condition for the element that is in excess of 100%

of basic salary is that the minimum growth in EPS shall be CPI plus

10% per annum, compounded annually, over the three accounting

years.

Number of

Awards in

Reconciliation of outstanding share awards thousands

-------------------------------------------- ----------

Outstanding on 1 January 2021 844

Forfeited during the period (47)

Exercised during the period (797)

Granted during the period -

Outstanding at 30 June 2021 -

-------------------------------------------- ----------

Number of

Options in

Reconciliation of outstanding share options thousands

--------------------------------------------- -----------

Outstanding on 1 January 2021 3,981

Forfeited during the period -

Exercised during the period -

Granted during the period 2,060

Outstanding at 30 June 2021 6,041

--------------------------------------------- -----------

14. Intangible Assets

Acquisition Product

of intellectual development Goodwill

property Total

EUR'000 EUR'000 EUR'000 EUR'000

----------------------------------------- ----------------- ------------- ----------- -------

Balance at 1 January 2021 - 5,847 31,140 36,987

----------------------------------------- ----------------- ------------- ----------- -------

Investments / Internally developed - 419 - 419

----------------------------------------- ----------------- ------------- ----------- -------

Acquisitions 2,481 - - 2,481

----------------------------------------- ----------------- ------------- ----------- -------

Disposals - - -

----------------------------------------- ----------------- ------------- ----------- -------

Amortisation of intellectual property (145) (145)

----------------------------------------- ----------------- ------------- ----------- -------

Impairment of goodwill - - - -

----------------------------------------- ----------------- ------------- ----------- -------

Foreign currency translation differences 42 - 509 551

----------------------------------------- ----------------- ------------- ----------- -------

Balance at 30 June 2021 2,378 6,266 31,649 40,293

----------------------------------------- ----------------- ------------- ----------- -------

15. Property, Plant and Equipment

Capital expenditure in the first half-year amounted to EUR4.5

million (30 June 2020 EUR9.8 million), of which EUR2.5 million was

invested in plant and equipment (30 June 2020 EUR4.5 million) and

EUR2 million in ROU assets (30 June 2020 EUR5.3 million). The

depreciation charge for property, plant and equipment is recognised

in the following line items in the income statement:

H1 H1

2021 2020

EUR'000 EUR'000

-------------------------------------------------- ------- --------

Cost of sales 2,259 2,024

Operating Costs 1,183 1,125

Total depreciation charge for property, plant and

equipment 3,442 3,149

-------------------------------------------------- ------- --------

16. Inventory

30 June 31 December

2021 2020

EUR'000 EUR'000

------------------------------------ ------- ------------

Finished goods and work-in-progress 46,339 42,326

Capital equipment 532 504

Raw materials 11,343 10,187

------------------------------------ ------- ------------

Total inventory 58,214 53,017

------------------------------------ ------- ------------

The Group recorded an impairment of EURNIL against inventory to

take account of net realisable value during the period ended 30

June 2021 (30 June 2020: EUR257,000).

17. Trade and other receivables

30 June 31 December

2021 2020

EUR'000 EUR'000

-------------------------------- ------- ----------------

Gross receivable 23,553 21,830

Provision for impairment (1,305) (1,190)

Net trade and other receivables 22,248 20,640

-------------------------------- ------- ----------------

Provision

for impairment

EUR'000

----------------------------------------- ------------------

Balance at 1 January 2021 (1,190)

Additions (115)

Balance at 30 June 2021 (1,305)

----------------------------------------- ------------------

30 June 31 December

2021 2020

EUR'000 EUR'000

Less than 60 days 20,499 17,878

61 to 90 days 1,271 1,350

Greater than 90 days 478 1,412

-------------------------------- ------- ------------

Net trade and other receivables 22,248 20,640

-------------------------------- ------- ------------

At 30 June 2021, EUR1.7 million (8%) of trade receivables

balance were past due but not impaired (31 December 2020, EUR3.8

million (13%).

18. Loans, borrowings and lease liabilities

30 June 31 December

2021 2020

Maturity EUR'000 EUR'000

--------------------------------------------------------- ------- ------------

Loans and borrowings 2021-2034 14,231 11,090

Lease liabilities 2021-2026 5,407 5,494

ROU lease liability 2021-2029 6,081 5,027

---------------------------------------------- ----------

Total Loans, borrowings and lease liabilities 25,719 21,611

------- ------------

Current 8,981 6,822

------- ------------

Non-current 16,738 14,789

------- ------------

The Group has a number of bank loans and lease liabilities in

Ireland, the United Kingdom, USA, Sweden, Peru, Australia, Namibia

and Chile with a mixture of variable and fixed interest rates. The

Group has been in compliance with all debt agreements during the

periods presented. The loan agreements in Ireland carry restrictive

financial covenants.

19. Financial Risk Management

The Group is exposed to various financial risks arising in the

normal course of business. Our financial risk exposures are

predominantly related to changes in foreign currency exchange rates

as well as the creditworthiness of our financial asset

counterparties.

The half-year financial statements do not include all financial

risk management information and disclosures required in the annual

financial statements and should be read in conjunction with the

2020 Annual Report. There have been no changes in our risk

management policies since year-end and no material changes in our

interest rate risk.

a) Liquidity and Capital

The Group defines liquid resources as the total of its cash,

cash equivalents and short term deposits. Capital is defined as the

Group's shareholders' equity and borrowings.

The Group's objectives when managing its liquid resources are:

* To maintain adequate liquid resources to fund its

ongoing operations and safeguard its ability to

continue as a going concern, so that it can continue

to create value for investors;

* To have available the necessary financial resources

to allow it to invest in areas that may create value

for shareholders; and

-- To maintain sufficient financial resources to mitigate against

risks and unforeseen events.

Liquid and capital resources are monitored on the basis of the

total amount of such resources available and the Group's

anticipated requirements for the foreseeable future. The Group's

liquid resources and shareholders' equity at 30 June 2021 and 31

December 2020 were as follows:

30 June 31 December

2021 2020

EUR'000 EUR'000

-------------------------- -------- -----------

Cash and cash equivalents 11,684 17,045

Loans and borrowings 25,719 21,611

Shareholders' equity 136,338 132,936

-------------------------- -------- -----------

19. Financial Risk Management (continued)

b) Foreign currency risk

The Group is a multinational business operating in a number of

countries and the euro is the presentation currency. The Group,

however, does have revenues, costs, assets and liabilities

denominated in currencies other than euro. Transactions in foreign

currencies are recorded at the exchange rate prevailing at the date

of the transaction. The resulting monetary assets and liabilities

are translated into the appropriate functional currency at exchange

rates prevailing at the reporting date and the resulting gains and

losses are recognised in the income statement. The Group manages

some of its transaction exposure by matching cash inflows and

outflows of the same currencies. The Group does not engage in

hedging transactions and therefore any movements in the primary

transactional currencies will impact profitability. The Group

continues to monitor appropriateness of this policy.

The Group's global operations create a translation exposure on

the Group's net assets since the financial statements of entities

with non-euro functional currencies are translated to euro when

preparing the consolidated financial statements. The Group does not

use derivative instruments to hedge these net investments.

The principal foreign currency risks to which the Group is

exposed relate to movements in the exchange rate of the euro

against US dollar, South African rand, Australian dollar, Swedish

krona, British Pound and Canadian dollar.

The Group has material subsidiaries with a functional currency

other than the euro, such as US dollar, Australian dollar, South

African rand, Canadian dollar, British pound and Swedish krona.

In 2021, 56% (2020: 67%) of Mincon's revenue EUR67 million (30

June 2020: EUR64 million) was generated in AUD, SEK and USD. The

majority of the Group's manufacturing base has a Euro, US dollar or

Swedish krona cost base. While Group management makes every effort

to reduce the impact of this currency volatility, it is impossible

to eliminate or significantly reduce given the fact that the

highest grades of our key raw materials are either not available or

not denominated in these markets and currencies. Additionally, the

ability to increase prices for our products in these jurisdictions

is limited by the current market factors.

Currency also has a significant transactional impact on the

Group as outstanding balances in foreign currencies are

retranslated at closing rates at each period end. The changes in

the South African Rand, Australian Dollar, Swedish Krona and

British Pound have either weakened or strengthened, resulting in a

foreign exchange loss being recognised in other comprehensive

income and a significant movement in foreign currency translation

reserve.

Average and closing exchange rates for the Group's primary

currency exposures were as disclosed in the table below for the

period presented.

30 June 31 December

2021 H1 2021 2020 H1 2020

Euro exchange rates Closing Average Closing Average

-------------------- --------------- -------- ------------ --------

US Dollar 1.19 1.20 1.22 1.12

Australian Dollar 1.58 1.56 1.59 1.65

Canadian Dollar 1.47 1.50 1.56 1.53

Great British Pound 0.86 0.87 0.89 0.90

South African Rand 16.98 17.51 17.91 18.31

Swedish Krona 10.13 10.12 10.06 10.48

-------------------- --------------- -------- ------------ --------

There has been no material change in the Group's currency

exposure since 31 December 2020. Such exposure comprises the

monetary assets and monetary liabilities that are not denominated

in the functional currency of the operating unit involved.

19. Financial Risk Management (continued)

c) Fair values

Financial instruments carried at fair value

The deferred contingent consideration payable represents

management's best estimate of the fair value of the amounts that

will be payable, discounted as appropriate using a market interest

rate. The fair value was estimated by assigning probabilities,

based on management's current expectations, to the potential

pay-out scenarios. The fair value of deferred contingent

consideration is not dependent on the future performance of the

acquired businesses against predetermined targets and on

management's current expectations thereof.

Movements in the year in respect of Level 3 financial

instruments carried at fair value

The movements in respect of the financial assets and liabilities

carried at fair value in the period ended to 30 June 2021 are as

follows:

Deferred

contingent

consideration

EUR'000

----------------------------------------- --------------

Balance at 1 January 2021 4,723

----------------------------------------- --------------

Arising on acquisition 2,122

----------------------------------------- --------------

Cash payment (1,832)

----------------------------------------- --------------

Fair value movement 1

----------------------------------------- --------------

Foreign currency translation differences 40

----------------------------------------- --------------

Balance at 30 June 2021 5,054

----------------------------------------- --------------

20. Commitments

The following capital commitments for the purchase of property,

plant and equipment had been authorised by the directors at 30 June

2021:

Total

EUR'000

------------------- --------

Contracted for 2,705

Not contracted for 2,227

------------------- --------

Total 4,932

------------------- --------

21. Litigation

The Group is not involved in legal proceedings that could have a

material adverse effect on its results or financial position.

22. Related Parties

The Group has relationships with its subsidiaries, directors and

senior key management personnel. All transactions with subsidiaries

eliminate on consolidation and are not disclosed.

As at 30 June 2021, the share capital of Mincon Group plc was

56.32% owned by Kingbell Company (31 December 2020 56.54%), this

company is ultimately controlled by Patrick Purcell and members of

the Purcell family. Patrick Purcell is also a director of the

Company. The Group paid the final dividend for 2020 in June 2021,

Kingbell Company receive EUR2.5 million.

There were no other related party transactions in the half year

ended 30 June 2021 that affected the financial position or the

performance of the Company during that period and there were no

changes in the related party transactions described in the 2020

Annual Report that could have a material effect on the financial

position or performance of the Company in the same period.

23. Events after the reporting date

Dividend

On 5 August 2021, the Board of Mincon Group plc approved the

payment of an interim dividend in the amount of EUR0.0105 (1.05

cent) per ordinary share. This amounts to a dividend payment of

EUR2.2 million which will be paid on 10 September 2021 to

shareholders on the register at the close of business on 20 August

2021.

Acquisition of Attakroc Inc

On the 28th July 2021, the Group completed the acquisition of

Attakroc Inc., a reseller of drilling consumables for a

consideration of CAD$2.7 million. The goodwill arising on

acquisition is circa EUR700,000 million, with expected 2021 revenue

of CAD$1.2 million.

24. Approval of financial statements

The Board of Directors approved the interim condensed

consolidated financial statements for the six months ended 30 June

2021 on 09 August 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFFITFITIIL

(END) Dow Jones Newswires

August 09, 2021 02:00 ET (06:00 GMT)

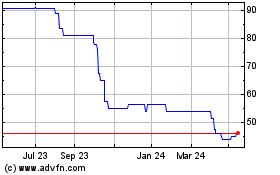

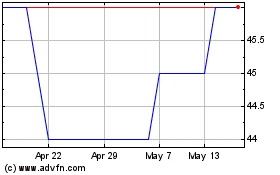

Mincon (LSE:MCON)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mincon (LSE:MCON)

Historical Stock Chart

From Jul 2023 to Jul 2024