TIDMLLAI

RNS Number : 5390A

LungLife AI, INC

26 September 2022

LungLife AI, Inc.

(the "Company" or "LungLife")

Half-year Report

LungLife AI (AIM: LLAI), a developer of clinical diagnostic

solutions for the early detection of lung cancer announces its

unaudited half-year report for the six months ended 30 June

2022.

Summary and Highlights (including post-period end):

-- Cash as of 30 June 2022 of $10.63m

-- Loss before tax of $4.47m and EBITDA loss of $4.31m

-- Six sites participating in the Company's LungLB(R) validation

study, up from three at time of preliminary results in March, with

more in the pipeline

-- New York Clinical Laboratory Evaluation Programme ("CLEP") permit awarded

-- CPT(R) Proprietary Laboratory Analyses (PLA code), a key

component towards reimbursement in the US market, awarded and

became effective on 1 April 2022

-- Appointment of Dr Drew Moghanaki, an internationally

recognised lung cancer specialist, to the Company's Scientific

Advisory Board

-- With the existing sites participating in the validation study

and the additional sites already in the pipeline, there is a

continued expectation that we will complete enrolment of our

validation study by end of March 2023 and initial commercialisation

with nominal revenues of LungLB(R) later in 2023

Commenting on outlook, Paul Pagano, Chief Executive Officer of

LungLife, said : "I am proud of the progress that the team has made

over this six-month period. Our validation study is well underway,

having enrolled our first participant in February, and we are where

we expected to be at this time point to be able to complete

enrolment by the end of Q1 2023.

"Beyond the continued enrolment of participants into the LungLB

(R) validation study, over the remainder of the year we are focused

on progressing towards commercial reimbursement. Following the

grant of a CPT(R) PLA code in January, we now look ahead to the

processes of pricing and coverage for the LungLB(R) test."

For further information please contact:

LungLife AI, Inc. www.lunglifeai.com

Paul Pagano, CEO Via Walbrook PR

David Anderson, CFO

Investec Bank plc (Nominated Adviser Tel: +44 (0)20 7597 5970

& Broker)

Daniel Adams / Virginia Bull / Cameron

MacRitchie

Walbrook PR Limited Tel: +44 (0)20 7933 8780 or LungLifeAI@walbrookpr.com

Paul McManus / Alice Woodings / Phillip Mob: 07980 541 893 / 07407 804 654 /

Marriage 07867 984 082

About LungLife

LungLife AI is a developer of clinical diagnostic solutions

designed to make a significant impact in the early detection of

lung cancer, the deadliest cancer globally. Using a minimally

invasive blood draw, the Company's LungLB(R) test is designed to

deliver additional information to clinicians who are evaluating

indeterminate lung nodules. For more information visit

www.lunglifeai.com

CHAIRMAN'S STATEMENT

The six months ended 30 June 2022 was a period of good progress

for LungLife, as we achieved several milestones to keep us on track

with our mission to make a significant impact in the early

detection of lung cancer through our LungLB(R) test.

Our LungLB(R) test

LungLB(R) is a blood-based test that uses circulating tumour

cells to stratify indeterminant lung nodules as either cancerous or

benign following their identification by CT scan. Biopsy is

currently part of the standard of care pathway for lung nodules,

but it has significant drawbacks. Approximately 40% of biopsies

result in a benign nodule, and an adverse event rate of

approximately 20% means that many patients are unnecessarily put at

risk. The LungLB(R) test is designed to support the physician's

decision to biopsy only when necessary, or to monitor

non-invasively using additional imaging.

In 2021, we completed a 149-participant pilot study in which we

observed a well-balanced performance and a Positive Predictive

Value ("PPV") of 89% by LungLB(R). This PPV value means that in the

case of a positive result from the LungLB(R) test, the subject's

indeterminate nodule was cancerous 89% of the time. We have now

embarked on our clinical validation study and hope those results

will mirror those found in our pilot study.

There are estimated to be over 1.5 million indeterminant lung

nodules identified each year in the United States(1) by CT scan and

LungLife's estimated one week turnaround from receipt of the blood

sample to results can save a significant amount of stressful

waiting time for the patient as well as avoid unnecessary costly,

and often dangerous, procedures.

Progress in the period

In February 2022, we enrolled the first participant into our

multi-centre clinical validation study for LungLB(R). The

validation study will enrol up to 425 participants across multiple

US sites, including MD Anderson Cancer Center, Mount Sinai Hospital

in New York City and multiple medical centres of the Veterans

Affairs, taking participants who present with indeterminate lung

nodules.

Since my last report in March, we have added a further three

sites to our validation study, including a further two medical

centres of the Veterans Affairs ("VA") and most recently,

University of California, Los Angeles ("UCLA"). There are a number

of further sites currently in the pipeline and which are expected

to come onstream in the coming weeks and months.

The VA has the United States' largest integrated health care

system, providing care at nearly 1,300 facilities and serving nine

million veterans each year. Lung cancer is the leading cause of

cancer-related deaths among US veterans, and it is believed that

veterans are at higher risk in part due to environmental exposures

during military service. An estimated 900,000 US veterans are

at-risk for lung cancer, and VA hospitals diagnose around 7,700 new

lung cancer cases each year, making the three VA sites in our study

population an important addition.

Earlier this month we were delighted to be awarded the New York

Clinical Laboratory Evaluation Programme ("CLEP") permit following

their audit. The CLEP permit allows LungLife to perform clinical

utility studies and offer the LungLB(R) test commercially in New

York state, in addition to the 46 other states permitted by the

Company's existing Clinical Laboratory Improvement Amendments

("CLIA") certification. The audit was performed to ensure that the

premises, laboratory practice, equipment, personnel, and

record-keeping methods meet state requirements. Issuance of the

CLEP permit follows a rigorous, independent scientific review of

both analytical and clinical data for LungLB(R), as well as

evaluation of adherence to the Company's quality management

system.

This is an important step in LungLife's commercialisation plan,

given our relationship with the Icahn School of Medicine at Mount

Sinai in New York, a key site in the ongoing pivotal validation

trial, and from which the Company is now able to accept study

participants in future utility studies.

In January 2022, we announced that we had been successfully

granted a Proprietary Laboratory Analyses (PLA) CPT(R) code by the

American Medical Association, marking the first step on the path

for commercial reimbursement. CPT(R) codes offer healthcare

professionals a uniform language for coding medical services and

procedures and allows clinical laboratories to more specifically

identify their tests when billing Medicare and commercial insurers.

The Centers for Medicare & Medicaid Services ("CMS") recently

issued their Calendar Year 2023 Clinical Laboratory Fee Schedule

(CLFS) preliminary payment determination for the LungLB(R) as

crosswalk . There is now a public comment period for 30 days and

the final determination will be announced in November 2022. There

is no guarantee the final payment determination will be

crosswalk.

As a reminder, crosswalk applies if the new test is comparable

to an existing test (that may use a similar technology but for a

different indication, for example), in which case it is assigned

the market-based payment rate of that comparable existing test.

Gapfill applies if there are no comparable existing tests, in which

case the Medicare Administrative Contractor determines the

pricing.

People

In March, we announced the appointment of Dr Drew Moghanaki, MD,

MPH, an internationally recognised lung cancer specialist, to our

Scientific Advisory Board. Dr Moghanaki is Professor and Chief of

Thoracic Oncology at the UCLA Department of Radiation Oncology. He

has brought extensive leadership to our Scientific Advisory Board

as the Director of the VA Partnership to increase Access to Lung

Cancer Screening programme (VA-PALS), and the co-chair of the VA

Lung Cancer Surgery or Stereotactic Radiotherapy (VALOR) Phase III

study, investigating treatment options for stage I lung cancer.

Outlook

Our key focus is meeting our enrolment target by end of March

2023. Once enrolment is complete, we will then start the process of

evaluating the results which we expect to be concluded by June

2023. With our CLIA license and CLEP permit, we expect to be able

to begin commercialisation of LungLB(R) in parallel with our

preparation and submission to the FDA.

We continue to carefully manage our cash resources with an

anticipated cash runway to first half of 2024.

I would like to thank our shareholders, staff and partners for

their support over this period, and look ahead to the remainder of

2022 and beyond, which is set to bring further progress for the

Company.

Roy Davis

Non-Executive Chairman

26 September 2022

(1) Gould MK et al. Am J Respir Crit Care Med. 2015 PMID:

26214244.

FINANCIAL REVIEW

In the period total cash outflow was $4.0m (six months to 30

June 2021 - $0.07m), of which $3.8m was consumed by operating

activities (six month to 30 June 2021 - $1.6m) with the balance

mainly being repayment of lease liabilities, which includes the

rent on our CLIA laboratory. The prior period was before our IPO on

8 July 2021 whereupon the business was funded by the issue of

convertible loan notes, all of which, principal and interest, were

subsequently converted into new common shares.

Revenues of $10k related to royalties earned under our

arrangement with our partner in China. In the six months to 30 June

2021 revenue was $107k which related wholly to the sale of

consumable items to our partner in China. The EBITDA loss for the

period was $4.31m (six months to 30 June 2021 - $2.2m), which

includes the share-based payment charge of $0.4m (six months to 30

June 2021 - $0.16m). The biggest contributors to the EBITDA loss

were employment costs of $1.3m (six months to 30 June 2021 -

$0.43m) and research and development of $1.3m (six months to 30

June 2021 - $0.19m). The research and development costs are those

incurred on our clinical validation study and continued development

of the AI algorithm. In the period we increased our headcount, and

we now have 14 full time employees.

STATEMENT OF COMPREHENSIVE INCOME

For the period ended 30 June 2022

Note 6 months 6 months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

US$'000 US$'000 US$'000

Unaudited Unaudited Audited

Revenue (3) 10 107 195

Cost of sales - (92) (96)

----------- ----------- -------------

Gross profit 10 15 99

Administrative expenses (4,322) (2,247) (5,904)

Exceptional costs - costs

of listing - (2,084) (1,101)

Depreciation (155) (139) (323)

----------- ----------- -------------

Operating loss (4,467) (4,455) (7,229)

Other operating income - 206 206

Finance income 26 - 12

Finance charges (27) (317) (417)

----------- ----------- -------------

Loss before taxation (4,468) (4,566) (7,428)

Taxation (1) - (16)

----------- ----------- -------------

Loss for the period / year (4,469) (4,566) (7,444)

Other comprehensive income - - -

----------- ----------- -------------

Total comprehensive loss

for the period / year (4,469) (4,566) (7,444)

----------- ----------- -------------

Loss per share from continuing

activities attributable

to the ordinary equity holders

of the Company

Basic and diluted (US Dollars

per share) (4) (0.175) (0.960) (0.469)

----------- ----------- -------------

STATEMENT OF FINANCIAL POSITION

As at 30 June 2022

Note 30 June 30 June 31 December

2022 2021 2021

US$'000 US$'000 US$'000

Unaudited Unaudited Audited

Assets

Non-current assets

Property, plant and

equipment 693 309 766

Intangible assets 5,818 - 5,818

Other receivables (5) 13 13 13

----------- ----------- ------------

Total non-current

assets 6,524 322 6,597

----------- ----------- ------------

Current assets

Trade and other receivables (5) 526 137 741

Cash and cash equivalents 10,633 121 14,628

----------- ----------- ------------

Total current assets 11,159 258 15,369

Total assets 17,683 580 21,966

Equity and liabilities

Equity

Called up share capital 3 9 3

Share premium 91,264 52,194 91,264

Other equity - 942 -

Share based payment

reserve 1,358 714 960

Accumulated losses (76,566) (69,469) (72,097)

----------- ----------- ------------

Total equity 16,059 (15,610) 20,130

Non-current liabilities

Lease liabilities 477 75 601

Provisions 50 50 50

----------- ----------- ------------

527 125 651

----------- ----------- ------------

Current liabilities

Trade and other payables (7) 706 3,810 804

Lease liabilities 217 172 207

Discontinued operations 174 174 174

Convertible notes - 11,909 -

Total current liabilities 1,097 16,065 1,185

----------- ----------- ------------

Total liabilities 1,624 16,190 1,836

----------- ----------- ------------

Total equity and liabilities 17,683 580 21,966

----------- ----------- ------------

STATEMENT OF CHANGES IN EQUITY

As at 30 June 2022

Share

based

Share Share Other payment Accumulated Total

capital premium equity reserve losses equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Balance at 1

January 2021 9 52,194 843 551 (64,903) (11,306)

Comprehensive

income:

Loss for the

period - - - - (4,566) (4,566)

Transactions

with owners:

Convertible debt - - 99 - - 99

Share based payments - - - 163 - 163

---------- ---------- ---------- --------- -------------- -----------

Balance at 30

June 2021 9 52,194 942 714 (69,469) (15,610)

---------- ---------- ---------- --------- -------------- -----------

Balance at 30

June 2021 9 52,194 942 714 (69,469) (15,610)

Comprehensive

income:

Loss for the

period - - - - (2,878) (2,878)

Transactions

with owners:

Reverse stock

split (8) 8 - - - -

Issue of common

stock 2 40,062 - - - 40,064

Conversion of

Loan Notes - - (942) - 250 (692)

Share issue costs - (1,000) - - - (1,000)

Share based payments - - - 246 - 246

---------- ---------- ---------- --------- -------------- -----------

Balance at 31

December 2021 3 91,264 - 960 (72,097) 20,130

---------- ---------- ---------- --------- -------------- -----------

Balance at 1

January 2022 3 91,264 - 960 (72,097) 20,130

Comprehensive

income:

Loss for the

period - - - - (4,469) (4,469)

Transactions

with owners:

Share based payments - - - 398 - 398

---------- ---------- ---------- --------- -------------- -----------

Balance at 30

June 2022 3 91,264 - 1,358 (76,566) 16,059

---------- ---------- ---------- --------- -------------- -----------

STATEMENT OF CASH FLOWS

For the period ended 30 June 2022

6 months 6 months Year ended

ended 30 ended 30 31 December

June June 2021

2022 2021 US$'000

US$'000 US$'000 Audited

Unaudited Unaudited

Cash flows from operating

activities

Loss for the period / year (4,469) (4,566) (7,444)

Adjustments for non-cash/non-operating

items:

Depreciation 155 139 323

Gain on sale of tangible assets - (36) (36)

Other operating income - (206) (206)

Finance income (26) - (12)

Finance expense 27 317 417

Taxation 1 - 16

Share based compensation 398 163 409

------------------ ----------- -------------

(3,914) (4,189) (6,533)

Changes in working capital

(Increase)/ decrease in trade

and other receivables 221 32 (569)

(Decrease)/increase in trade

and other payables (98) 2,585 (422)

------------------ ----------- -------------

Cash outflow from operations (3,791) (1,572) (7,524)

Taxation paid (1) - (16)

------------------ ----------- -------------

Net cash outflow from operating

activities (3,792) (1,572) (7,540)

------------------ ----------- -------------

Cash inflow / (outflows)

from investing activities

Proceeds from sale of tangible

assets - 36 36

Purchase of tangible assets (82) - (47)

Landlord improvement contribution - 15 15

Purchase of intangible assets - - (1,800)

Net cash flows from investing

activities (82) 51 (1,796)

Cash flows from financing

activities

Issue of Convertible Notes - 1,612 1,612

Issue of common stock - - 23,444

Expenses of issue of common

stock - - (1,000)

Interest received 20 - 10

Interest paid (27) - (107)

Repayment of lease liabilities (114) (98) (123)

------------------ ----------- -------------

Net cash inflow from financing

activities (121) 1,514 23,836

------------------ ----------- -------------

Net increase/(decrease) in

cash and cash equivalents (3,995) (7) 14,500

Cash and cash equivalents

brought forward 14,628 128 128

------------------ ----------- -------------

Cash and cash equivalents

carried forward 10,633 121 14,628

1. GENERAL INFORMATION

LungLife AI, Inc, (the "Company") is a company based in Thousand

Oaks, California which is developing a diagnostic test for the

early detection of lung cancer. The Company was incorporated under

the laws of the state of Delaware on 30 December 2009.

Basis of preparation

The accounting policies adopted in the preparation of the

interim consolidated financial information are consistent with

those of the preparation of the Group's annual consolidated

financial statements for the period ended 31 December 2021. No new

IFRS standards, amendments or interpretations became effective in

the six months to 30 June 2022.

Statement of compliance

This interim consolidated financial information for the six

months ended 30 June 2022 has been prepared in accordance with UK

adopted International Accounting Standards (UK IFRS) IAS 34,

'Interim financial reporting' as adopted by the European Union and

the AIM Rules for UK Companies. This interim consolidated financial

information is not the Group's statutory financial statements and

should be read in conjunction with the annual financial statements

for the period ended 31 December 2021, which have been prepared in

accordance with UK IFRS and have been delivered to the Registrar of

Companies. The auditors have reported on those accounts; their

report was unqualified, did not include references to any matters

to which the auditors drew attention by way of emphasis of matter

without qualifying their report and did not contain any statements

of emphasis or other matters.

The interim consolidated financial information for the six

months ended 30 June 2022 is unaudited. In the opinion of the

Directors, the interim consolidated financial information presents

fairly the financial position, and results from operations and cash

flows for the period. Comparative numbers for the six months ended

30 June 2021 are unaudited.

Measurement convention

The financial information has been prepared under the historical

cost convention. Historical cost is generally based on the fair

value of the consideration given in exchange for assets.

The preparation of the financial information in compliance with

UK IFRS requires the use of certain critical accounting estimates

and management judgements in applying the accounting policies. The

significant estimates and judgements that have been made and their

effect is disclosed in note 2.

2. CRITICAL ACCOUNTING JUDGEMENTS AND ESTIMATES

The preparation of the Company's historical financial

information under UK IFRS requires the directors to make estimates

and assumptions that affect the reported amounts of assets and

liabilities and the disclosure of contingent assets and

liabilities. Estimates and judgements are continually evaluated and

are based on historical experience and other factors including

expectations of future events that are believed to be reasonable

under the circumstances. Actual results may differ from these

estimates.

The directors consider that the following estimates and

judgements are likely to have the most significant effect on the

amounts recognised in the financial information.

Carrying value of intangible assets, property, plant and

equipment

In determining whether there are indicators of impairment of the

Company's intangible assets, the directors take into consideration

various factors including the economic viability and expected

future financial performance of the asset and when it relates to

the intangible assets arising on a business combination, the

expected future performance of the business acquired.

3. SEGMENT ANALYSIS

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Company that are

regularly reviewed by the chief operating decision maker (which

takes the form of the Board of Directors) as defined in IFRS 8, in

order to allocate resources to the segment and to assess its

performance.

The chief operating decision maker has determined that LungLife

AI, Inc has one operating segment, the development and

commercialisation of its lung cancer early detection test. Revenues

are reviewed based on the products and services provided.

The Company operates in the United States of America. Revenue by

origin of geographical segment is as follows:

Revenue 6 months 6 months Year ended

ended 30 ended 30 31 December

June June 2021 2021

2022 US$'000 US$'000

US$'000 Unaudited Audited

Unaudited

People's Republic of China 10 107 195

10 107 195

----------- ----------- -------------

Non-current assets 30 June 30 June 31 December

2022 2021 2021

US$'000 US$'000 US$'000

Unaudited Unaudited Audited

United States of America 6,524 322 6,597

6,524 322 6,597

----------- ----------- ------------

Product and service revenue 6 months 6 months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

US$'000 US$'000 US$'000

Unaudited Unaudited Audited

Consumable items - 107 107

Royalty income 10 - 88

10 107 195

----------- ----------- -------------

4. LOSS PER SHARE

The basic loss per share from continuing activities is based on

a loss for the year attributable to equity holders of the Parent

Company of $4,469,915 for the 6 months ended 30 June 2022 (6 months

ended 30 June 2021 loss $4,566,267; year ended 31 December 2021:

loss $7,444,188) and the weighted average number of shares in issue

for the 6 months to 30 June 2022 of 25,480,790 (6 months to 30 June

2021: 4,758,434 and year to 31 December 2021: 15,870,143).

The Company has one category of dilutive potential ordinary

share, being share options. The potential shares were not dilutive

in the period as the Company made a loss per share in line with IAS

33. Prior to the listing of its shares, between 2 July 2021 and 7

July 2021 the Company implemented a pre-Admission reorganisation of

its capital which included the conversion of Series A and B

Preferred Shares into Common Shares and a reverse share split by

way of the issue of one new Common Share and Preferred Share for

every 18 old Common Shares and Preferred Shares held.

As required by IAS33, the number of shares presented as the

denominator in calculating loss per share has been adjusted from 1

January 2021, the beginning of the earliest period for which loss

per share information is presented in order to maintain

comparability.

5. TRADE AND OTHER RECEIVABLES

Amounts falling due within 30 June 30 June 31 December

one year 2022 2021 2021

US$'000 US$'000 US$'000

Unaudited Unaudited Audited

Trade receivables 69 67 -

Other receivables 99 - 49

Prepayments 358 70 692

526 137 741

----------- ----------- ------------

Amounts falling due after

one year

Rent deposit 13 13 13

13 13 13

--- --- ---

All receivables are denominated in US dollars

6. SHARE BASED PAYMENTS

The following is an analysis of movement in options issued and

outstanding to purchase shares in the Company:

Total Weighted

options average

Number exercise

price US$

At 1 January 2021 14,499,482

Reverse share split (13,693,990)

-------------- ----------------------

Revised balance at 1 January 2021 805,492 0.74

Exercised or expired (13,913) 0.74

Granted 1,260,035 2.19

At 31 December 2021 - Exercisable 2,065,527 1.74

Granted 75,000 2.37

Expired (18,356) 1.80

At 30 June 2022 - Exercisable 2,122,171 1.76

-------------- ----------------------

7. TRADE AND OTHER PAYABLES

30 June 30 June 31 December

2022 2021 2021

US$'000 US$'000 US$'000

Unaudited Unaudited Audited

Trade payables 368 1,225 212

Other payables - tax and

social security 2 - 21

Accruals and other payables 336 2,585 571

706 3,810 804

----------- ----------- ------------

Trade and other payables comprise amounts outstanding for trade

purchases and on-going costs. All trade and other payables are due

in less than a year.

8. SUBSEQUENT EVENTS

There have been no events which require disclosure in these

unaudited interim financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKPBNCBKDBCB

(END) Dow Jones Newswires

September 26, 2022 02:01 ET (06:01 GMT)

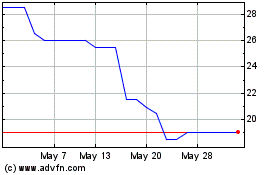

Lunglife Ai (LSE:LLAI)

Historical Stock Chart

From May 2024 to Jun 2024

Lunglife Ai (LSE:LLAI)

Historical Stock Chart

From Jun 2023 to Jun 2024