Date: 11th September 2008

On behalf of: London Finance & Investment Group P.L.C ("Lonfin", "the Company"

or "the Group")

|For immediate release

LONDON FINANCE & INVESTMENT GROUP P.L.C.

Preliminary announcement of audited results for the year ended 30th June 2008

London Finance & Investment Group P.L.C. (LSE: LFI, JSE: LNF), the investment

company whose assets primarily consist of three Strategic Investments and a

General Portfolio, today announces its Preliminary Results for the year ended

30th June 2008.

Highlights:

* Profit before exceptional items of �319,000

* Total dividend 1.20p per share, up over 9% (2007 - 1.10p)

* �481,000 available for further investment when the Board feels appropriate

David Marshall, Chairman of Lonfin commented:

"After a volatile year in the markets, we are confident that our high quality

investments will provide capital growth in the medium term. We are maintaining

our annual dividend and look forward to bringing growth in value to our

shareholders."

- Ends -

Enquiries to:

London Finance & Investment Group Via Redleaf Communications

David Marshall

Redleaf Communications 020 7822 0200

Emma Kane/Sanna Sumner/Rebecca

Sanders-Hewett

Notes to Editors:

* London Finance is an investment company whose assets primarily consist of

three Strategic Investments and a General Portfolio. Strategic Investments

are significant investments in smaller UK quoted companies and these are

balanced by a General Portfolio, which consists mainly of investments in

major U.K. and European equities.

* Its strategic investments comprise: Western Selection P.L.C., Marylebone

Warwick Balfour Group Plc and Finsbury Food Group plc. Western Selection

P.L.C. has strategic investments in Creston plc, Swallowfield plc,

Northbridge Industrial Services plc and Industrial & Commercial Holdings

P.L.C. The General Portfolio has material interests in Food and Beverages,

Oil, Natural Resources, Chemicals, and Tobacco.

Chairman's statement

Lonfin is an investment company whose assets primarily consist of three

Strategic Investments and a General Portfolio. Strategic Investments are

significant investments in smaller UK quoted companies and these are balanced

by a General Portfolio, which consists mainly of investments in major U.K. and

European equities.

At 30th June 2008, the three Strategic Investments, in which we have board

representation, were our associated company Western Selection P.L.C., MWB Group

Holdings Plc and Finsbury Food Group plc. Detailed comments on our Strategic

Investments are given below.

Our objective is to achieve capital growth in real terms over the medium term,

while maintaining a progressive dividend policy.

Results

The Group made a profit before exceptional items of �319,000 (2007 - �

1,217,000). Our operating income last year was higher due to profits realised

on sales of investments, particularly the disposal of one third of the Group's

holding in MWB Group Holdings Plc. Fee income received by City Group reduced

from last year which was boosted by one-off activities by clients not repeated

in the current year. After the Group share of an exceptional impairment charge

in Western of �1,322,000, tax and minority interests, the Group loss was �

1,003,000 (2007 - profit - �489,000) giving a loss per share of 3.21p (2007 -

earnings - 1.60p).

To reflect our progressive dividend policy, the Board has decided to propose a

final dividend of 0.65p. With the maiden interim dividend of 0.55p the total

for the year is 1.20p per share from 1.10p last year, an increase of over 9%.

Our net assets per share, after provision for deferred taxation, have decreased

41% to 39p from 66p last year, reflecting the reduction in value of the

Strategic Investments. These have declined in value by 56% and our General

Portfolio by 4% after taking into account additions and disposals of

investments. This compares with the decreases in the FTSE 100 index of 14.9%

and the FTSE Eurotop 300 index of 25.16% over the year.

Strategic Investments

Western Selection P.L.C. ("Western")

On 16th July 2007 Western invited its shareholders to subscribe for warrants in

the company, the funds raised from this subscription and from exercise of the

warrants to be used to increase the assets under management, improving the

ratio of assets invested to operating expenses.

The offer, which was fully subscribed, raised �872,000 in September 2007 and

all of the Warrants were exercised in December 2007 raising a further �

1,693,000. A further �3,848,000 could be raised from the remaining warrants

which are exercisable in the period 2008-2010 at 50p each.

The Company owns 7,864,412 shares, being 43.8% of the issued share capital of

Western. The Company took up its entitlement to 1,261,940 warrant units issued

by Western for �429,000 and exercised 2,597,191 of 2008 warrants in December

for �853,000. The cost to the Group of these investments was financed under a

specific new facility with the Group's bankers. At 30 June 2008 the Company

held 3,785,820 of the 2010 warrants.

On 8th September 2008, Western announced a profit before associates and

exceptional items of �378,000 for its year to 30th June 2008 (2007 - �355,000).

In view of the current market value of itsinvestment in Creston plc, Western

was forced under IFRS to make a provision for the difference between the cost

and market value of that investment, amounting to �3,019,000. This provision

does not reduce Western's distributable profits. Including associates and after

exceptional items and tax, and on its increased share capital, losses per share

were 16.4p (2007 - earnings 0.51p). The company announced an increased dividend

on the increased share capital of 2.60p (2007 - 2.55p). Western's net assets at

market value were �10,419,000, equivalent to 58p per share, a decrease of 42%

from 100p last year. The decrease in value was principally due to the fall in

value of its strategic investments.

The market value of the Company's investment in Western at 30th June 2008 was �

2,468,900 and the book value was �6,082,000. At market value this represents

20% of the net assets of Lonfin. The underlying value of the Company's

investment in Western, valuing Western's investments at market value, was �4.6

million (2007 - �5.27 million).

Mr. Marshall is the Chairman of Western and Mr. Robotham is a non-executive

director. Western has strategic investments in Creston plc, Northbridge

Industrial Services plc, Swallowfield plc and Hartim Limited. An extract from

Western's announcement of its strategic investments is set out below:

Creston plc

Creston is a marketing services group whose strategy is to grow within its

sector both by organic growth and through selective acquisition to become

a substantial, diversified marketing services group. The audited results

for the year to 31st March 2008, show a profit after tax of �4,782,000

(2007 - �4,445,000), equivalent to earnings of 8.65p per share (2007 -

8.50p). Western maintained its holding of 3,000,000 shares in Creston

(5.4%) during the year. The value of this investment at 30th June 2008 was

�1,425,000 (2007 - �4,890,000) being 14% (2007 - 38%) of Western's assets.

Creston appears, on a historical basis, to be significantly undervalued,

as it is now yielding 5.7% at a P/E of 5.7. At its recent AGM held on 1st

September, Creston's directors expressed their confidence in current

trading conditions being experienced by the enlarged group.

Northbridge Industrial Services PLC

Northbridge announced profits of �1,154,000 for the year ended 31st

December 2007 (2006 - �731,000) and declared a final dividend of 2p per

share, making 3p for the year (2006 - 2p). Western maintained its holding

of 1,500,000 shares in Northbridge (19.66%). The value of the investment

at 30th June 2008 was �2,558,000 (2007 - �2,768,000) being 25% (2007- 22%)

of Western's assets.

Northbridge was formed for the purpose of acquiring companies that hire

and sell specialist industrial equipment such as load banks, generators,

pumps, air compressors, heaters and chillers. Northbridge's first

acquisition was Crestchic Limited, one of the largest electrical load bank

equipment manufacturers in the world. The company's customers are leading

national and international companies in the oil, energy and shipping

industries.

Swallowfield plc

Swallowfield has a long history of developing and producing aerosol,

cosmetic and toiletry products stretching back to 1950. As one of Europe's

premier contract manufacturers of toiletries and cosmetics it has the

ability to produce a wide range of products. Its skill in design,

developing and producing gift packs and themed product ranges compliments

its production capability.

Swallowfield's latest published results were for the 28 weeks to 12th

January 2008 and showed a profit of �1,592,000 (2007 - �255,000).

Western has increased its holding in Swallowfield during the year and now

owns 1,156,000 shares which is 10.27% of the issued share capital. The

market value of Western's holding in Swallowfield on 30th June 2008 was �

971,000 (2007 - �455,000), being 9% (2007 - 6%) of Westerns' net assets.

Hartim Limited

On 28th March 2008 Western invested �728,000 to acquire 49.5% of Hartim

Limited, the holding company of Tudor Rose International Limited ("TRI").

Western's share of the consolidated profit after tax in the three month

period to 30th June 2008 was �68,000 and the book value of the investment

at 30th June 2008 was �797,000, being 8% of Western's assets.

TRI, which was founded in 1984, works closely with a number of leading UK

branded fast moving consumer goods companies, offering a complete sales,

marketing and logistical service. Based in Stroud, Gloucestershire, TRI

has a turnover in excess of �15 million and sells into 78 countries

worldwide including USA, Spain, Portugal, Italy, Czech Republic, Russia,

Turkey, South Africa, Saudi Arabia, UAE, Malaysia, Australia and China.

MWB Group Holdings Plc ("MWB")

The Company's holding in MWB was unchanged from the 2 million shares held at

June 2007, representing 2.58% of MWB's issued share capital. The market value

at 30th June 2008 was �2.5 million, compared with the book value of �1.7

million, and represents 20% of the net assets of Lonfin.

MWB is in the process of maturing and realising its assets for the benefit of

all stakeholders through an orderly disposal programme. Mr. Marshall is a

non-executive director of MWB and the board constantly reviews the programme of

disposal.

Finsbury Food Group plc ("Finsbury")

The Company holding in Finsbury remains at 8,000,000 shares, representing

15.55% of their share capital. The market value of the holding was �3.9 million

on 30th June 2008 (cost - �1.9 million) and represents 32% of the net assets of

Lonfin.

Finsbury has fast become one of the largest suppliers of premium cakes, bread

and morning goods in the UK. The acquisitive Group currently has seven

subsidiaries which supply most of the UK's major supermarket chains, including

Asda, Morrisons, Sainsbury, Somerfield, Tesco and Waitrose.

A recent announcement from Finsbury confirmed that despite a tough trading

environment the Group's growth prospects remained positive.

Mr. Marshall is the non-executive chairman and Mr. Beale, the Chief Executive

of our subsidiary City Group P.L.C., is a non-executive director of Finsbury.

General Portfolio

The General Portfolio is diverse with material interests in Food and Beverages,

Oil, Natural Resources, Chemicals, and Tobacco. We believe that the portfolio

of quality companies we hold has the potential to outperform the market in the

medium to long term, especially in respect our Western European holdings.

The number of holdings in the General Portfolio has decreased to 35 from 39. We

have decreased the amount invested in the General Portfolio by �188,000 (2007:

increased by �694,000) over the year.

We have a �2 million bank facility in addition to the facility to cover the

increased investment in Western, and at 30th June 2008 had drawn down �1.519

million. This leaves �481,000 available for further investment when the Board

feels appropriate.

Dividend

The recommended dividend is 0.65p per share, making 1.20p for the year (2007 -

1.10p). Subject to member's approval, the dividend will be paid on 10th October

2008 to those members registered at the close of business on 26th September

2008. Shareholders on the South African register will receive their dividend in

South African Rand converted from sterling at the closing rate of exchange on

9th September 2007.

Warrants

The Directors propose to issue, free of charge, Warrants to subscribe for

ordinary shares in the Company. The Warrants will be exercisable at a fixed

price of 28p each on the last day of each month from November 2008 until the

Final Exercise Date which will be on or about 30th September 2010. The Warrants

will be issued on the basis of 12 Warrants for every 100 shares held at the

close of business on 6th October 2008, but fractions of warrants will not be

issued. Warrant certificates will be posted at the holders risk on or about 17

October 2008. The Warrants will not be listed.

Outlook

Despite very volatile markets around the world the recurring dividend income

from our high quality portfolio should enable us to at least maintain our

annual dividend.

By Order of the Board

CITY GROUP P.L.C.

Secretaries

11th September 2008

Consolidated Income Statement

For the year ended 30th June 2008 2007

�000 �000

Operating Income

Investment operations 645 1,713

Management services 516 662

Administrative expenses

Investment operations (373) (344)

Management services (507) (594)

Exceptional - (597)

---------- ----------

Operating profit 281 840

Share of result of associated undertaking - normal 216 206

Share of result of associated undertaking - exceptional (1,322) (131)

Interest payable (170) (150)

---------- ----------

(Loss)/Profit on ordinary activities before taxation (995) 765

Tax on result of ordinary activities (2) (245)

---------- ----------

(Loss)/Profit on ordinary activities after taxation (997) 520

Equity minority interest (6) (31)

---------- ----------

(Loss)/Profit for the financial year attributable to (1,003) 489

members of the holding company

====== ======

Reconciliation of headline earnings per share

Basic (loss)/earnings per share (3.2)p 1.6p

Adjustment for exceptional items net of tax and minorities 4.2 p 2.4p

--------- ---------

Headline earnings per share 1.0 p 4.0p

--------- ---------

Consolidated Statement of Changes in Shareholders' Equity

Ordinary Share Fair

share premium Revaluation value Retained Total

capital account reserve earnings

reserve

�000 �000 �000 �000 �000 �000

Year ended 30th June

2007

Balances at 1st July 1,500 1,854 330 4,914 7,033 15,631

2006

---------- ---------- ---------- --------- ---------- ---------

Profit attributable - - - - 489 489

to shareholders

Fair value adjustment - - - 4,181 - 4,181

on listed

undertakings, net of

profits realised

during the year and

reflected in the

income statement

---------- ---------- ---------- --------- ---------- ---------

Total income and - - - 4,181 489 4,670

expense for the

period

---------- ---------- ---------- --------- ---------- ---------

New shares issued 60 474 - - - 534

Dividends paid in - - - - (315) (315)

respect of the

previous year

---------- ---------- ---------- --------- ---------- ---------

Total transactions 60 474 - - (315) 219

with shareholders for

the year

---------- ---------- ---------- --------- ---------- ---------

Balances at 30th June 1,560 2,328 330 9,095 7,207 20,520

2007

====== ====== ====== ===== ====== =====

Year ended 30thJune

2008

Balances at 1st July 1,560 2,328 330 9,095 7,207 20,520

2007

---------- ---------- ---------- --------- ---------- ---------

Loss attributable to - - - - (1,003) (1,003)

shareholders

Fair value adjustment - - - (6,942) - (6,942)

on listed

undertakings, net of

profits realised

during the year and

reflected in the

income statement

---------- ---------- ---------- --------- ---------- ---------

Total income and - - - (6,942) (1,003) (7,945)

expense for the

period

---------- ---------- ---------- --------- ---------- ---------

Dividends paid in - - - - (343) (343)

respect of the

previous year

Interim dividend paid - - - - (172) (172)

---------- ---------- ---------- --------- ---------- ---------

Total transactions - - - - (515) (515)

with shareholders for

the year

---------- ---------- ---------- --------- ---------- ---------

Balances at 30thJune 1,560 2,328 330 2,153 5,689 12,060

2008

====== ====== ====== ===== ====== =====

Consolidated Balance Sheet

at 30th June 2008 2007

�000 �000

Non-current Assets

Tangible assets 403 416

Investments 8,784 18,305

---------- ----------

9,187 18,721

Current Assets ---------- ----------

Listed investments 5,726 6,564

Accounts receivable 319 184

Bank balance and deposits 36 87

---------- ----------

6,081 6,835

Current Liabilities

Accounts payable: falling due within one year (3,107) (1,777)

---------- ----------

Net Current Assets 2,974 5,058

---------- ----------

Total Assets less Current Liabilities 12,161 23,779

Deferred taxation - (3,164)

---------- ----------

Total Assets less Current Liabilities 12,161 20,615

====== ======

Capital and Reserves

Called up share capital 1,560 1,560

Share premium account 2,328 2,328

Reserves 2,483 9,425

Profit and loss account 5,689 7,207

---------- ----------

Equity shareholders' funds 12,060 20,520

Minority equity interests 101 95

---------- ----------

12,161 20,615

====== ======

Consolidated Cash Flow Statement

For the year ended 30th June 2008 2007

�000 �000

Cash inflow/(outflow) on operating activities

Cash generated/(absorbed) by operations, including General 4 (1,311)

Portfolio investment

Dividends receivable 458 380

Interest paid (148) (100)

Interest received 5 12

Taxation paid (235) (13)

---------- ----------

Net cash generated/(absorbed) by operations 84 (1,032)

Investing activities

Proceeds on sale of non-current asset investments - 2,080

Non-current asset investments - purchased (1,297) (948)

---------- ----------

Net cash (outflow)/inflow from investment activities (1,297) 1,132

---------- ----------

Financing

Share capital issued - 534

Equity dividends paid (515) (315)

Net drawdown/( repayment) of loan facilities 1,677 (403)

---------- ----------

Net cash inflow from financing 1,162 (184)

---------- ----------

Decrease in cash (51) (84)

=====

Notes

1. The final dividend for the year of 0.65p per share (2007 - 1.10p) will be

paid on 10th October 2008 to shareholders on the register on 26th

September 2008.

2. Earnings per share are based on the profit on ordinary activities after

taxation and minority interests and on 30,631,233 shares (2006 -

28,672,672) being the weighted average of the number of shares in issue

during the year.

3. The net assets attributable to shareholders, taking investments at market

value, are before providing for any tax that may arise on realisation.

4. The financial information in this preliminary announcement of unaudited

group results, which has been reviewed and agreed by the auditors, does

not constitute statutory accounts within the meaning of section 240(5) of

the Companies Act 1985. The accounts have been prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted by the

European Union and with those parts of the Companies Acts 1985 applicable

to companies reporting under IFRS. The accounts are prepared on the

historical cost basis, except for certain assets and liabilities which are

measured at fair value, in accordance with IFRS. The audited accounts of

the group for the year ended 30th June 2007 have been reported on with an

unqualified audit report in accordance with section 235 of the Companies

Act 1985 and have been delivered to the Registrar of Companies.

END

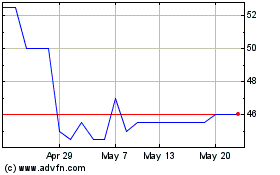

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jun 2024 to Jul 2024

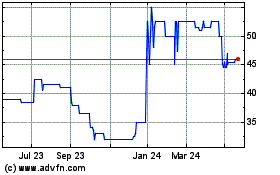

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jul 2023 to Jul 2024