TIDMKWG

RNS Number : 1458F

Kingswood Holdings Limited

03 November 2022

Kingswood Holdings Limited

("Kingswood" or the "Group")

Following the announcement of the acquisition of JCH today,

Kingswood Holdings Limited ("Kingswood") announces the acquisition

and completion of Employee Benefit Solutions Ltd (EBS)

These transactions boost Kingswood's UK client facing advisory

team to over 100 people and increases UK funds under

advice/management to GBP8 billion

Kingswood Group assets under administration ("AuA") will total

over GBP10 billion from a combination of both global retail and

institutional clients matching our ambition to grow globally as an

international integrated full service wealth and investment

manager

Kingswood Holdings Limited (AIM: KWG), the international, fully

integrated wealth and investment management group, is pleased to

announce it has exchanged and completed on the acquisition of EBS,

a financial planning firm based in Buckinghamshire.

David Lawrence, UK CEO at Kingswood, commented: "I'm delighted

by the ever expanding footprint of Kingswood into new counties, as

well as announcing the acquisition of JCH today, the completion of

EBS also takes us into a new county. For over 30 years, EBS have a

long-established presence in Buckinghamshire. They have a simple

aim; to make complicated financial matters as simple as possible to

help clients meet their goals and make their life as easy as

possible. This mirrors what we strive for at Kingswood.

"We have a strong pipeline of activity, with a further five

potential acquisitions in exclusive due diligence. Our near-term

target is to build our UK AUA/M in excess of GBP10bn in the U.K.

and GBP14bn globally."

About EBS

EBS offers a wide range of financial planning services

including; retirement planning, savings and investment advice,

protection, and inheritance tax planning. With three lead advisers

and seven colleagues in total, EBS hold over GBP135m AUA. In the

year ending March 2022 EBS generated revenue of GBP1.56m and profit

before tax of GBP806k.

The business will be acquired for total cash consideration of up

to GBP5.08m, payable over a five-year period. GBP2.75m will be paid

at closing and the balance paid on a deferred basis.

Miles Burr, Director at EBS commented : "We are delighted to be

joining Kingswood. We have invested a huge amount of time in

carefully investigating our options for a possible sale, looking to

find the most suitable 'partner' that would enable us to take our

business forward in a way that benefits our clients and staff.

Kingswood, as a leading advice and wealth management business, have

the team, culture and resources to enable us to do this.

"We have been very impressed with Kingswood's proposition, their

systems and senior management. They are a great fit for EBS and we

firmly believe we will be able to achieve our ambition of

delivering the best possible long-term outcomes for our business,

staff and, most importantly, our clients."

Consideration

Kingswood will satisfy the consideration due to the shareholders

of EBS through a draw down of its new funding facility, as

announced on 17 October 2022.

For further details, please contact:

Kingswood Holdings Limited +44 (0)20 7293 0730

David Lawrence www.kingswood-group.com

finnCap Ltd (Nomad & Broker) +44 (0)20 7220 0500

Simon Hicks / Abigail Kelly

GreenTarget (for Kingswood media) +44 (0)20 7324 5498

Jamie Brownlee / Alice Gasson / Ellie Jamie.Brownlee@greentarget.co.uk

Basle

About Kingswood

Kingswood Holdings Limited (trading as Kingswood) is an

AIM-listed (AIM: KWG) international fully integrated wealth

management group with circa GBP9.5bn billion of Assets under Advice

and Management. It services circa 19,000 clients from a growing

network of offices in the UK including Abingdon, Beverley,

Conisbrough, Darlington, Derby, Eastleigh, Grimsby, Harrogate,

Hull, Lincoln, London, Maidstone, Newcastle, Penn, Sheffield (2),

Worcester and York with overseas offices in Johannesburg, South

Africa and Atlanta, New York and San Diego in US.

Kingswood offers a range of trusted investment solutions to its

clients, which range from private individuals to some of the UK's

largest universities and institutions, including investment advice

and management, personal and company pensions and wealth planning.

Kingswood is focused on becoming a leading player in the wealth and

investment management market through targeted acquisitions in the

UK and US, creating a global business through strategic

partnerships.

Registered office address: Mont Crevelt House, Bulwer Avenue,

St. Sampson, Guernsey, GY2 4LH

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQDDBDBLSGDGDD

(END) Dow Jones Newswires

November 03, 2022 03:00 ET (07:00 GMT)

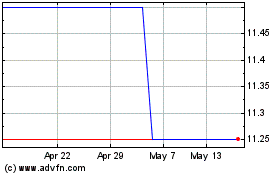

Kingswood (LSE:KWG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Kingswood (LSE:KWG)

Historical Stock Chart

From Feb 2024 to Feb 2025