Kingswood Holdings Limited Kingswood agrees additional funding facility (1556D)

October 17 2022 - 10:56AM

UK Regulatory

TIDMKWG

RNS Number : 1556D

Kingswood Holdings Limited

17 October 2022

Kingswood Holdings Limited

("Kingswood" or the "Group")

Additional Funding Facility

Kingswood Holdings Limited (AIM: KWG), the international, fully

integrated wealth and investment management group, is pleased to

announce that it has entered into a new debt facility with a

leading global financial institution to provide committed funding

of GBP50M with the ability to increase the commitment to GBP150M

should it be needed (the "New Debt Facility").

The New Debt Facility will accelerate Kingswood's strategic

growth plans and provide additional capital to fund future

acquisitions as well as fund existing deferred consideration. The

New Debt Facility has a maturity of seven years.

David Lawrence, Kingswood Group CEO, commented:

"I am absolutely delighted that we have secured this material

commitment from a leading global financial institution. Following

our appointment last week of two new independent Non-Executive

Directors to increase our board capability, the New Debt Facility

is clear and demonstrable evidence of market confidence in

Kingswood's progress in the last two years and also signals a

strong commitment to our future growth and strategic direction. We

continue to invest in the Group across all dimensions and in terms

of future acquisitions, we continue to have a strong pipeline with

eight further transactions in exclusive due diligence."

For further details, please contact:

Kingswood Holdings Limited +44 (0)20 7293 0730

David Lawrence www.kingswood-group.com

finnCap Ltd (Nomad & Broker) +44 (0)20 7220 0500

Simon Hicks / Abigail Kelly

GreenTarget (for Kingswood media) +44 (0)20 7324 5498

Jamie Brownlee / Alice Gasson / Ellie Jamie.Brownlee@greentarget.co.uk

Basle

About Kingswood

Kingswood Holdings Limited (trading as Kingswood) is an

AIM-listed (AIM: KWG) international fully integrated wealth

management group with circa GBP9 billion of assets under advice and

management. It services circa 19k clients from a growing network of

offices across the UK with overseas offices in South Africa and the

US.

Kingswood offers a range of trusted investment solutions to its

clients, which range from private individuals to some of the UK's

largest universities and institutions, including investment advice

and management, personal and company pensions and wealth planning.

Kingswood is focused on building on its position as a leading

player in the wealth and investment management market through

targeted acquisitions, creating a global business through strategic

partnerships.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBKOBPQBDDQKD

(END) Dow Jones Newswires

October 17, 2022 10:56 ET (14:56 GMT)

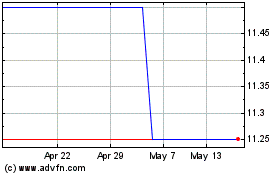

Kingswood (LSE:KWG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Kingswood (LSE:KWG)

Historical Stock Chart

From Feb 2024 to Feb 2025