TIDMKWG

RNS Number : 5145Z

Kingswood Holdings Limited

15 September 2022

Half-year Report

Kingswood Holdings Limited ("Kingswood") continues to make

strong progress against strategic objectives and is well positioned

to accelerate the delivery of medium-term targets

-- Following record results in 2021, revenue has further grown

by 31% in H1'22 (vs H1'21) and operating profit by 47% increasing

by GBP1.5m to GBP4.5m confirming the resilience of the business

with a highly scalable platform

-- UK trading in line with expectations and has completed 6

acquisitions so far in 2022, adding GBP2.8m annual operating profit

and c.GBP0.9bn Assets under Management and Advice (AUM/A) to the

Group. Kingswood has also signed Heads of Terms or is in exclusive

discussions with a further 8 UK & Ireland businesses, most of

which it expects to conclude in this financial and calendar

year

-- Kingswood US increased the number of registered

representatives in its Registered Investment Adviser (RIA) and

Independent Broker Dealer (IBD) business by 6% in the first six

months of the year, supporting growth in AUM/A by $0.2bn to

c.$2.7bn

-- A complementary focus on organic growth is now delivering a

positive trajectory across all operating segments in H1'22

-- Kingswood now manages GBP9.3bn of client assets, an increase

of 37% compared to December 2021

Kingswood Holdings Limited (AIM: KWG), the international, fully

integrated wealth and investment management group, is pleased to

announce its unaudited interim financial results for the half year

ended 30 June 2022.

David Lawrence, Kingswood Chief Executive Officer, commented :

"We delivered record levels of revenue and operating profit in all

3 of our Divisions in 2021 and I am delighted to report further

growth in the first half of 2022. Whilst the business continues to

build momentum through 2022, revenue and operating profit have been

impacted by unfavourable market conditions, mainly from lower than

expected capital market activity in the US. Despite this, our

business continues to grow organically in both the UK and US and

our acquisition strategy continues to progress as planned.

We have continued to implement our buy, build and grow strategy

in the UK, successfully completing the acquisition of 6 UK IFA

businesses and have a strong pipeline for future UK acquisitions. I

would like to welcome our 6 recently acquired businesses to the

Kingswood Group and wish them every success with us moving

forwards. Under the leadership of Mike Nessim, we have also

continued to expand our US footprint adding 12 new registered

representatives and growing our AUM by $0.2bn.

Whilst the external environment is less certain in the

short-term, the strategy and trajectory of the business continues

as planned. We have a strong leadership team that is driving

tangible results and realising our ambition to become a leading

fully integrated international wealth & investment management

business and I would like to thank all colleagues and stakeholders

for their effort, focus and commitment."

Strategic Highlights

-- UK AUM/A increased by GBP2.2bn to GBP7.1bn in H1'22 largely

driven by inorganic growth and positive net flows of assets under

our management and advice (AUM/A)

-- We completed the acquisition of 6 UK IFA businesses in the

first half of the year which have been successfully integrated into

the Group's operations within 4 months

-- 8 UK acquisitions are currently in exclusive due diligence,

comprising a total of GBP8.7m annual operating profit and GBP1.9bn

AUM/A. These are expected to conclude in the fourth quarter of

2022

-- Kingswood places the client at the heart of everything we do

and we are extremely proud to have 4.8 stars out of 5 on

VouchedFor, home to the UK's most trusted advisers

-- Technology has been successfully deployed in the business to

improve the client experience and productivity. Following the

launch of our market leading 'Kingswood Go' app in March 2022, over

1,300 clients have now registered providing them with easier access

to their investment portfolio. Further investments in technology

will deliver an enhanced experience for the client including

digital fact finds and new propositions that will provide both a

face to face and a digitally delivered service

-- As we build a business more representative of our society,

good progress has been made to address diversity imbalances across

the organisation - 60% of UK adviser hires in 2022 were female

compared to an adviser community where c.15% of our advisers are

female

-- Kingswood US has continued to grow organically through the

accelerated recruitment of registered representatives, which

supported an 8% increase in AUM/A to $2.7bn

-- The US business continues to build on the exceptional growth

experienced in its Investment Banking operating segment during

2021, recruiting two new high quality IB groups in H1'22 focussed

on mid-market equity capital markets

Financial Highlights

-- Group revenue of GBP80.4m increased by GBP18.8m, or 31%,

compared to H1'21 reflecting the impact of acquisitions and healthy

organic growth across both the UK and US

-- Wealth Planning revenue of GBP12.9m increased by 55% compared

to H1'21 reflecting the impact of our recent acquisitions and

organic revenue growth from higher new volumes of new business.

Investment Management revenue of GBP3.6m also increased by 55%

compared to the prior year due to the acquisition of IBOSS Asset

Management, with positive net inflows also seen in our Fixed Income

business

-- US revenue of GBP63.9m increased by 26% compared to H1'21.

Recurring revenues increased from 7% in 2021 to 13% in H1 2022. The

Registered Investment Adviser (RIA) and Independent Broker Dealer

(IBD) business reported revenue was GBP8.0m, 189% higher than

H1'21, as an increase in the number of registered representatives

by 12 to 223 supported growth in AUM by $0.2bn to $2.7bn.

Investment Banking (IB) revenue of GBP55.9m increased by 16%

compared to H1'21 reflecting a strong performance in the first

quarter. IB revenue in the second quarter fell by 20%

year-over-year as macro-economic headwinds and market volatility

led to a slowdown in capital market activity, as demonstrated by a

fall in the number of IPOs in the Americas region by 73% compared

to H1'21. On a like for like currency basis, US revenue increased

by 17% to $82.7m compared to H1'21

-- Operating Expenditure of GBP15.6m increased by 46% compared

to H1'21 largely reflecting the impact of acquisitions in the UK

(GBP2.9m) and higher costs in Kingswood US (GBP1.5m) due to higher

legal, compliance and regulatory costs. Central costs increased by

(GBP0.5m) to GBP2.8m reflecting investment to support a growing

business and higher professional fees

-- Operating Profit of GBP4.5m was GBP1.5m higher than H1'21

reflecting the additional contributions from the recently acquired

businesses. The Kingswood Board believes Operating Profit is the

most appropriate indicator to explain the underlying performance of

the Group. The definition of Operating Profit is profit before

finance costs, amortisation and depreciation, gains and losses, and

exceptional costs (business re-positioning and transaction

costs)

-- Profit before Tax for the period was a Loss of GBP1.7m

reflecting a net GBP6.3m acquisition related deferred consideration

release offset by GBP1.9m amortisation and depreciation, GBP1.5m

finance (interest related) costs, GBP2.8m business re-positioning

and transaction costs and a goodwill adjustment of GBP6.4m

-- The Group had GBP20.7m of cash as at June 2022, a decrease of

GBP22.2m since December 2021, largely driven by acquisition related

payments in the UK and timing of the settlement of Investment

Banking commission payments in the US

GBP'000 (unless otherwise Change

stated) H1'22 H1'21 %

--------------------------- -------- -------- -------

Wealth Management 12,864 8,307 55%

Investment Management 3,588 2,312 55%

Kingswood US 63,937 50,922 26%

Total Revenue 80,389 61,541 31%

Recurring Revenue 28% 19% n/a

Kingswood UK (WM + IM) 5,810 2,830 105%

Kingswood US 1,529 2,519 (39)%

Division Operating Profit 7,339 5,349 37%

Central Costs (2,834) (2,294) 24%

Operating Profit 4,505 3,055 47%

GBP'000 (unless otherwise Change

stated) H1'22 FY'21 %

--------------------------- -------- -------- -------

Total Equity 75,608 76,898 (2)%

Total Cash 20,693 42,933 (52)%

Key Metrics

AUM/A (GBPm) 9,288 6,772 37%

# of UK Advisers 87 70 24%

# of US RIA/IBD reps 223 211 6%

Change of Auditor

During H1 2022 Kingswood Holdings Limited embarked on a tender

process to undertake future audit activity. Our existing auditor

BDO LLP ("BDO") did not participate in this process. BDO LLP

("BDO") have subsequently resigned as the Group's auditor and the

Board has approved the appointment of PKF Littlejohn ("PKF") as the

Group's new external auditor. PKF will conduct the audit of the

Group's financial statements for the financial period to 31

December 2022. BDO has submitted to the Company, in accordance with

Companies (Guernsey) Law, 2008, a letter stating its reason for

resigning. A copy of BDO's letter has, in accordance with section

274 of the Companies (Guernsey) Law, 2008, today been shared with

all shareholders on the Company's website, along with an

explanatory letter from Kingswood Holdings Limited.

Outlook

Our near-term target remains to build our UK AUM/A to in excess

of GBP10bn and GBP12.5bn globally, and we are building a pipeline

to deliver a proforma GBP20m Operating Profit through a combination

of acquisitions and organic growth.

Whilst external factors continue to impact the business,

Kingswood's resilience has been demonstrated through a solid

performance in the first half of the year. We have made good

progress against our UK inorganic growth strategy and have

generated pleasing organic revenue growth across the Group. The UK

business has proven to have sticky, long-term recurring revenues

that are not directly correlated to market performance. In the

second half of the year, we expect further organic growth and

positive net inflows and it remains well positioned as financial

markets recover. The transactional nature of US Investment Banking

revenues means that its revenue and profit will be dependent on the

levels of capital market activity.

Looking ahead we remain confident in the success of our

ambitious long-term growth strategy grounded in supporting our

clients to protect and grow their wealth.

Company Registration No. 42316 (Guernsey)

KINGSWOOD HOLDINGS LIMITED

CONSOLIDATED INTERIM UNAUDITED FINANCIAL STATEMENTS

FOR THE SIX MONTH PERIODED 30 JUNE 2022

KINGSWOOD HOLDINGS LIMITED

CONTENTS

Page

Financial and Operational Review 1 - 2

Interim Consolidated Statement of Comprehensive Income 3 - 4

Interim Consolidated Statement of Financial Position 5 - 6

Interim Consolidated Statement of Changes in Equity 7 - 8

Interim Consolidated Statement of Cash Flows 9

Notes to the Interim Consolidated Financial Statements 10 - 26

KINGSWOOD HOLDINGS LIMITED

FINANCIAL AND OPERATIONAL REVIEW

FOR THE PERIODED 30 JUNE 2022

Group Review:

The business has continued to build momentum in 2022 and revenue

and operating profit have grown despite unfavourable market

conditions. Our business continues to grow organically in both the

UK and US and our acquisition strategy continues to progress as

planned. We have a strong leadership team that is driving tangible

results and realising our ambition to become a leading fully

integrated International wealth & investment management

business.

Finance Review:

Despite the continued macro-economic uncertainty and volatility,

Kingswood has delivered double-digit revenue and operating profit

growth in the first half of the year. AUM/A is now GBP9.3bn and we

are reporting organic revenue growth in the business.

We continue to see the benefits of our buy, build and grow

strategy, completing a further 6 acquisitions in 2022 that will

continue the growth trajectory into 2023 and beyond. The Kingswood

Board continues to focus on ensuring that they maintain and deliver

a robust Balance Sheet with a view to ensuring no deferred

liability remains uncovered from a funding perspective. Our focus

is to maximise shareholder returns through Operating Profit growth

combined with minimising our weighted average cost of capital.

Group revenue of GBP80.4m increased by 31% compared to H1'21,

with double digit growth across all operating segments. Wealth

Planning revenue increased by 55% to GBP12.9m and Investment

Management revenue increased by 55% to GBP3.6m, driven by GBP4.5m

and GBP1.1m growth through acquisitions respectively. Organic

revenue growth across the UK segments demonstrates the synergies

generated through our vertically integrated growth strategy.

US revenues of GBP63.9m increased by 26% compared to H1'21.

Recurring revenues increased from 7% in 2021 to 13% in H1 2022. The

Registered Investment Adviser (RIA) and Independent Broker Dealer

(IBD) business reported revenue was GBP8.0m, 189% higher than

H1'21, as an increase in the number of registered representatives

by 12 to 223 supported growth in AUM by $0.2bn to $2.7bn.

Investment Banking (IB) revenue of GBP55.9m increased by 16%

compared to H1'21 reflecting a strong performance in the first

quarter. IB revenue in the second quarter fell by 20%

year-over-year as macro-economic headwinds and market volatility

led to a slowdown in capital market activity, as demonstrated by a

fall in the number of IPOs in the Americas region by 73% compared

to H1'21.

Operating Profit for the period was GBP4.5m, an increase of

GBP1.5m compared to the prior year, reflecting the impact of

acquisitions the underlying business dynamics. An increase in

central costs of GBP0.5m to GBP2.8m largely reflects an increase in

the central resources required to support a larger business and

one-off professional fees.

Profit before Tax for the period was a Loss of GBP1.7m

reflecting a net GBP6.3m acquisition related deferred consideration

release offset by GBP1.9m amortisation and depreciation, GBP1.5m

finance (interest related) costs, GBP2.8m business re-positioning

and transaction costs and a goodwill adjustment of GBP6.4m.

The Group had GBP20.7m of cash as at June 2022, a decrease of

GBP22.2m compared to December 2021. This is largely driven by

acquisition related payments and a timing impact of the settlement

of Investment Banking commission payments in the US. Net Assets as

at 30 June 2022 were GBP75.6m, a decrease of GBP1.3m compared to

December 2021.

Our near-term target remains to build our UK AUM/A in excess of

GBP10bn and GBP12.5bn globally, and we are building a pipeline to

deliver a proforma GBP20m Operating Profit through a combination of

acquisitions and organic growth. Although we continue to operate

within an uncertain macroeconomic environment looking ahead, we

remain confident in the success of our ambitious long-term growth

strategy grounded in supporting our clients to protect and grow

their wealth.

UK Highlights:

Kingswood UK has delivered a solid financial performance in

H1'22, with revenue and operating profit increasing by 55% and 105%

year-over year respectively.

We successfully completed the acquisition of 6 UK IFA

businesses, with all 2022 acquisitions now fully integrated into

the Group's operations and there is a healthy pipeline of future

acquisition opportunities at various stages of study and

negotiation, including 8 currently in exclusive due diligence

comprising a total of GBP8.7m annual operating profit and GBP1.9bn

AUM/A. These transactions are expected to conclude in the fourth

quarter of 2022.

Total UK revenue of GBP16.5m in H1'22, was GBP5.8m higher

compared to the same period last year and with 86% of revenues

being recurring in nature this provides the strong, annuity style

fee stream required to deliver sustainable, long term returns to

our shareholders.

We expect organic growth in both initial and ongoing fees post

integration through accretive assets under influence and, despite

the first half of 2022 bringing with it both a decline in global

markets and inflationary pressures, the UK business generated

positive organic revenue growth in H1'22. Organic growth is

delivered through agreements with professional introducers who

recommend Kingswood to their clients, digital channels including

SEO and Google ads, a greater share of wallet through

adviser-client meetings and vertical integration.

The Advisory model demonstrated resilience during COVID and

remains resilient in the current period. Clients tend to seek

advice in periods of market volatility and the adviser-client

relationship is the stickiest part of the value chain. Despite a

decline in global markets our clients are typically invested for

the long term, with assets tied up in diversified portfolios.

The hard work and dedication of all our staff has enabled us to

continually deliver against our buy, build and grow strategy at

pace whilst maintaining the highest levels of service and

experience for our clients, as reflected in our most recent

'Vouchedfor' rating of 4.8 / 5.0.

US Highlights:

We maintain a robust recruitment pipeline of new advisers, with

a particular focus on developing predictable and recurring revenue

streams from the advice and management of our client assets and the

first half of 2022 we further expanded our US footprint by adding

12 new registered representatives and growing our AUM/A by $0.2bn.

Our brand recognition continues to develop within the market, and

we are seeing increasing levels of referrals from within our

current adviser base. This has enabled us to continually build a

strong pipeline of new advisers and we expect to onboard a further

10 reps managing c.$300m AUM/A in 2022.

Kingswood US revenue of $82.7m in the first half of the year

increased by $12.0m or 17% compared to the same period last year.

Operating profit decreased by $1.5m to $2.0m compared to H1'21. The

decrease in operating profit has largely been driven by an increase

in operating expenses related to non-recurring professional fees

and higher staff commission payments for the recruitment of reps,

which we will begin to see revenue generation from over H2'22.

In the second half of the year, we expect our financial

performance to continue to be impacted by market movements and

capital market activity in the US. The transactional nature of US

Investment Banking revenues means that they will be dependent on

the levels of capital market activity. Through investment in the

business we remain well positioned as financial markets begin to

recover.

We remain confident in the success of our long term growth

strategy of acquiring small to medium size IBD/RIA firms and

recruiting independent financial advisers through a superior wealth

management platform, supporting practice offering and by removing

the management and regulatory burden to enable advisers to focus on

growing their client base. In turn this will continue to increase

our levels of recurring revenues and drive improved margins.

Six months Six months Year ended

to to

30 June 2022 30 June 31 Dec 2021

2021

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Revenue 3 80,389 61,541 149,716

Direct expenses (60,330) (47,824) (120,497)

Gross profit 20,059 13,717 29,219

Operating staff costs (10,283) (7,631) (15,157)

Other operating costs (5,271) (3,031) (7,735)

Total operating costs (15,554) (10,662) (22,892)

Operating profit 4,505 3,055 6,327

Non-operating costs:

Business re-positioning costs (1,202) (407) (1,564)

Finance costs (1,455) (840) (4,927)

Amortisation and depreciation (1,863) (1,117) (2,399)

Acquisition-related items:

Other (losses) / gains 4 - - (3,056)

Remuneration charge (deferred

consideration) 10 6,309 (4,145) (7,009)

Goodwill adjustment 8 (6,364) - -

Transaction costs (1,621) (274) (1,836)

Loss before tax (1,691) (3,728) (14,464)

Tax (139) 3 (761)

Loss after tax (1,830) (3,725) (15,225)

Other comprehensive income /

(loss)

Items that may not be reclassified to profit

or loss

Exchange differences on translation

of foreign operations (417) 368 367

Total comprehensive loss (2,247) (3,357) (14,858)

Six months Six months Year ended

to to

30 June 2022 30 June 31 Dec 2021

2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

- Owners of the parent company (2,545) (4,857) (17,432)

- Non-controlling interests 715 1,132 2,207

Total comprehensive loss is attributable

to:

- Owners of the parent company (2,962) (4,489) (17,065)

- Non-controlling interests 715 1,132 2,207

Loss per share:

- Basic loss per share 5 GBP (0.01) GBP (0.02) GBP (0.08)

- Diluted loss per share 5 GBP (0.00) GBP (0.02) GBP (0.08)

The notes on pages 10 - 26 form an integral part of the financial

statements.

30 Jun 30 Jun 31 Dec

2022 2021 2021

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 6 916 915 941

Right-of-use assets 7 3,071 2,583 2,719

Goodwill and other intangible

assets 8 97,231 46,943 80,255

Investments - 20 -

Deferred tax asset - 392 -

101,218 50,853 83,915

Current assets

Short term investments 72 - 65

Trade and other receivables 7,207 5,067 5,749

Cash and cash equivalents 20,693 24,733 42,933

27,972 29,800 48,747

Total assets 129,190 80,653 132,662

Current liabilities

Trade and other payables 18,515 20,077 26,084

Deferred consideration payable 10 14,286 900 7,706

32,801 20,977 33,790

Non-current liabilities

Deferred consideration payable 10 10,304 3,810 14,482

Other non-current liabilities 2,956 9,834 2,915

Deferred tax liability 7,521 1,889 4,577

Total liabilities 53,582 36,510 55,764

Net assets 75,608 44,143 76,898

Equity

Share capital 11 10,846 10,846 10,846

Share premium 11 8,224 8,224 8,224

Preference share capital 12 70,150 37,550 70,150

Other reserves 11,597 (487) 11,041

Foreign exchange reserve 417 (459) (488)

Retained (loss) (27,638) (12,359) (23,800)

Equity attributable to the owners of

the Parent Company 73,596 43,315 75,973

Non-controlling interests 2,012 828 925

Total equity 75,608 44,143 76,898

The notes on pages 10 - 26 form an integral part of the financial

statements.

The financial statements of Kingswood Holdings Limited (registered

number 42316) were approved and authorised for issue by the Board

of Directors, and signed on its behalf by:

Chairman

Date:

KINGSWOOD HOLDINGS LIMITED

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2022

Share Deferred Preference Other Foreign Retained Equity Non-controlling Total

capital share share reserves exchange earnings attributable interests

and capital capital reserve to the

share owners

premium of the

parent

Company

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2021 19,070 - 37,550 (519) (855) (6,159) 49,087 1,065 50,152

Loss for the

period - - - - - 4,857 4,857 (1,132) 3,725

Amounts

attributable

to NCI - - - - - - - 32 (32)

Elimination of

local

goodwill

on

consolidation - - - - - (1,343) 1,343 (1,337) (2,680)

Foreign

exchange gain - - - - 368 - 368 - 368

Share based

remuneration - - - 60 - - 60 - 60

Balance at 30

June 2021

(unaudited) 19,070 - 37,550 (459) 487 (12,359) 43,315 828 44,143

(Loss) /

profit for

the period - - - - - (12,575) (12,575) 1,075 (11,500)

Dividends due

to NCI - - - - - - - (1,033) (1,033)

Other

adjustment - - - - - 1,134 1,134 - 1,134

Issue of

preference

share capital - - 32,600 - - 32,600 - 32,600

Share based

remuneration - - - 34 - - 34 - 34

Preference

share capital

reserve 11,466 11,466 - 11,466

Foreign

exchange loss - - - - (1) - (1) 55 54

Balance at 31

December 2021

(audited) 19,070 - 70,150 11,041 (488) (23,800) 75,973 925 76,898

Share Deferred Preference Other Foreign Retained Equity Non-controlling Total

capital share share reserves exchange earnings attributable interests

and capital capital reserve to the

share owners

premium of the

parent

Company

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

(Loss) /

profit for

the period - - - - - (2,545) (2,545) 715 (1,830)

Movement on

NCI - - - - - - - 372 372

Consolidation

adjustment - - - - - (1,293) (1,293) - (1,293)

Foreign

exchange

movement - - - - 905 - 905 - 905

Share based

remuneration - - - 556 - - 556 - 556

Foreign

exchange gain - - - - - - - - -

Balance at 30

June 2022

(unaudited) 19,070 - 70,150 11,597 417 (27,638) 73,596 2,012 75,608

Note 11 provides further details of, and the split between, Share Capital and Share

Premium.

Additional reserves consist of foreign exchange translation, other reserves including share-based

remuneration and expenses charged against reserves.

The notes on pages 10 - 26 form an integral part of the financial statements.

KINGSWOOD HOLDINGS LIMITED

INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE PERIODED 30 JUNE 2022

Period Period Year ended

30 Jun 30 Jun 31 Dec

2022 2021 2021

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Net cash generated from

/ (used in) operating activities 13 (8,989) 1,679 1,741

Investing activities

Property, plant and equipment

purchased (50) (529) (127)

Acquisition of investments (13,180) - (12,720)

Remuneration charge (deferred

consideration) (173) - (738)

Net cash used in investing

activities (13,403) (529) (13,585)

Financing activities

Proceeds from issue of

shares - 20,000 52,600

Interest paid (11) (12) (58)

Lease payments (454) (304) (650)

Dividends paid to non-controlling

interests - - (1,272)

New loans (repaid) / loans

received (156) - 18

Net cash (used in)/generated

from financing activities (621) 19,684 50,638

Net (decrease)/increase

in cash and cash equivalents (23,013) 20,834 38,794

Cash and cash equivalents at beginning

of Period 42,933 3,899 3,899

Effect of foreign

exchange rates 771 - 240

Cash and cash equivalents

at end of Period 20,691 24,733 42,933

Prior period financials have been restated to correctly recognise

contingent deferred consideration payments, linked to the continued

employment of the acquiree's employees, as an operating cash outflow

in the Consolidated Statement of Cash Flows. Previously all deferred

consideration payments related to acquisitions were included in the

deferred consideration line within net cash used in investing activities.

In 30 June 2021, the cash outflow reclassified from investing activities

to operating activities was GBP3,974,702.

The notes on pages 10 - 26 form an integral part of the financial

statements.

KINGSWOOD HOLDINGS LIMITED

NOTES TO THE INTERIM FINANCIAL STATEMENTS

FOR THE PERIODED 30 JUNE 2022

1 Accounting policies

General information

Kingswood Holdings Limited is a company incorporated in Guernsey

under The Companies (Guernsey) Law, 2008. The shares of the Company

are traded on the AIM market of the London Stock Exchange (ticker

symbol: KWG). The nature of the Group's operations and its principal

activities are set out in the Strategic Report. Certain subsidiaries

in the Group are subject to the FCA's regulatory capital requirements

and therefore required to monitor their compliance with credit,

market and operational risk requirements, in addition to performing

their own assessment of capital requirements as part of the ICAAP.

1.1 Basis of accounting

The Group's interim condensed consolidated financial statements

are prepared and presented in accordance with IAS 34 'Interim

Financial Reporting'. The accounting policies adopted by the

Group in the preparation of its 2022 interim report are consistent

with those disclosed in the annual financial statements for the

year ended 31 December 2021.

The information relating to the six months ended 30 June 2022

and the six months ended 30 June 2021 do not constitute statutory

financial statements and has not been audited. The interim condensed

consolidated financial statements do not include all the information

and disclosures required in the annual financial statements and

should be read in conjunction with the Group's most recent annual

financial statements for the year ended 31 December 2021.

1.2 Changes in significant accounting policies

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements

as in its 2021 annual financial statements.

There are a number of standards and interpretations which have

been issued by the International Accounting Standards Board that

are effective for periods beginning subsequent to 31 December

2022 (the date on which the company's next annual financial statements

will be prepared up to) that the Group has decided not to adopt

early. The Group does not believe these standards and interpretations

will have a material impact on the financial statements once

adopted.

1.3 Significant accounting policies

Going concern

The Directors review the going concern position of the Group

on a regular basis as part of the monthly reporting process which

includes consolidated management accounts and cash flow projections

and have, at the time of approving the financial statements,

a reasonable expectation that the Group has adequate resources

to continue in operational existence for the foreseeable future.

Accordingly, the Directors continue to adopt the going concern

basis of accounting in preparing the financial statements.

Revenue recognition

Performance obligations and timing of revenue recognition

The majority of the Group's UK revenue, being investment management

fees and ongoing wealth advisory, is derived from the value of

funds under management / advice, with revenue recognised over

the period in which the related service is rendered. This method

reflects the ongoing portfolio servicing required to ensure the

Group's contractual obligations to its clients are met. This

also applies to the Group's US Registered Investment Advisor

("RIA") business.

For certain commission, fee-based and initial wealth advisory

income, revenue is recognised at the point the service is completed.

This applies in particular to the Group's US Independent Broker

Dealer ("IBD") services, and its execution-only UK investment

management. There is limited judgement needed in identifying

the point such a service has been provided, owing to the necessity

of evidencing, typically via third-party support, a discharge

of pre-agreed duties.

1 Accounting policies

The US division also has significant Investment Banking operations,

where commission is recognised on successful completion of the

underlying transaction.

Determining the transaction price

Most of the Group's UK revenue is charged as a percentage of

the total value of assets under management or advice. For revenue

earned on a commission basis, such as the US broker dealing business,

a set percentage of the trade value will be charged. In the case

of one-off or ad hoc engagements, a fixed fee may be agreed.

Allocating amounts to performance obligations

Owing to the way in which the Group earns its revenue, which

is largely either percentage-based or fixed for discrete services

rendered, there is no judgement required in determining the allocation

of amounts received. Where clients benefit from the provision

of both investment management and wealth advisory services, the

Group is able to separately determine the quantum of fees payable

for each business stream.

Further details on revenue, including disaggregation by operating

segment and the timing of transfer of service(s), are provided

in note 3 below.

2 Critical accounting judgements and key sources of estimation

uncertainty

In the application of the Group's accounting policies, which

are described in note 1, the Directors are required to make judgements,

estimates and assumptions about the carrying amounts of assets

and liabilities that are not readily apparent from other sources.

The estimates and associated assumptions are based on historical

experience and other factors that are considered to be relevant.

Actual results may differ from these estimates.

Critical judgements in applying the Group's accounting policies

The following are the critical judgements that the Directors

have made in the process of applying the Group's accounting policies

that had the most significant effect on the amounts recognised

in the financial statements.

Assessment of control

Control is considered to exist where an investor has power over

an investee, or else is exposed, and has rights, to variable

returns. The Group determines control to exist where its own

direct and implicit voting rights relative to other investors

afford KHL - via its board and senior management - the practical

ability to direct, or as the case may be veto, the actions of

its investees. KHL holds 50.1% of voting rights in MHC and its

subsidiaries, as well as a majority stake in the US division's

advisory board when grouped with affiliated entities. The Group

has thus determined that the Company has the practical ability

to direct the relevant activities of MHC and its subsidiaries,

and has consolidated the sub-group as subsidiaries with a 49.9%

non-controlling interest.

Estimates and Assumptions

Intangible assets:

Expected duration of client relationships

The Group makes estimates as to the expected duration of client

relationships to determine the period over which related intangible

assets are amortised. The amortisation period is estimated with

reference to historical data on account closure rates and expectations

for the future. During the period, client relationships were

amortised over a 10-20 year period.

2 Critical accounting judgements and key sources of estimation

uncertainty

Goodwill

The amount of goodwill initially recognised as a result of a

business combination is dependent on the allocation of the purchase

price to the fair value of the identifiable assets acquired and

the liabilities assumed. The determination of the fair value

of the assets and liabilities is based, to a considerable extent,

on management's judgement. Goodwill is reviewed annually for

impairment by comparing the carrying amount of the CGUs to their

expected recoverable amount, estimated on a value-in-use basis.

Share-based remuneration:

Share based payments

The calculation of the fair value of share-based payments requires

assumptions to be made regarding market conditions and future

events. These assumptions are based on historic knowledge and

industry standards. Changes to the assumptions used would materially

impact the charge to the Statement of Comprehensive Income.

Deferred tax:

Recoverability of deferred tax assets

The amount of deferred tax assets recognised requires assumptions

to be made to the financial forecasts that probable sufficient

taxable profits will be available to allow all or part of the

asset to be recovered.

Leases:

Estimating the incremental borrowing rate

The Group cannot readily determine the interest rate implicit

in leases where it is the lessee, therefore, it uses its incremental

borrowing rate to measure lease liabilities. This is the rate

of interest that the Group would have to pay to borrow over a

similar term, and with a similar security, the funds necessary

to obtain an asset of a similar value to the right-of-use asset

in a similar economic environment.

The incremental borrowing rate therefore reflects what the Group

'would have to pay', which requires estimation when no observable

rates are available or when they need to be adjusted to reflect

the terms and conditions of the lease (for example, when leases

are not in the subsidiary's functional currency). The Group estimates

the incremental borrowing rate using observable inputs (such

as market interest rates) when available and is required to make

certain entity-specific estimates (such as the subsidiary's stand-alone

credit rating).

Deferred consideration:

Payment of deferred consideration

The Group structures acquisitions such that consideration is

split between initial cash or equity settlements and deferred

payments. The initial value of the contingent consideration is

determined by EBITDA and/or revenue targets agreed on the acquisition

of each asset. It is subsequently remeasured at its fair value

through the Statement of Comprehensive Income, based on the Directors'

best estimate of amounts payable at a future point in time, as

determined with reference to expected future performance. Forecasts

are used to assist in the assumed settlement amount.

3 Business and geographical segments

Information reported to the Group's Non-Executive Chairman for

the purposes of resource allocation and assessment of segment

performance is focused on the category of customer for each type

of activity.

The Group's reportable segments under IFRS 8 are as follows:

investment management, wealth planning and US operations.

The Group has disaggregated revenue into various categories in

the following table which is intended to depict how the nature,

amount, timing and uncertainty of revenue and cash flows are

affected by economic date and enable users to understand the

relationship with revenue segment information provided below.

The following is an analysis of the Group's revenue and results

by reportable segment for the year to 31 December 2021. The table

below details a full year's worth of revenue and results for

the principal business and geographical divisions, which has

then reconciled to the results included in the Statement of Comprehensive

Income:

Investment Wealth US operations Group Total

management planning

Perioded Ended 30

June 2022

Continuing operations: GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue (disaggregated by

timing):

Point in time 465 1,776 55,944 - 58,185

Over time 3,123 11,088 7,993 - 22,204

External sales 3,588 12,864 63,937 - 80,389

Direct expenses (717) (519) (59,094) - (60,330)

Gross profit 2,871 12,345 4,843 - 20,059

Operating profit

/ (loss) 685 5,125 1,529 (2,834) 4,505

Business re-positioning

costs (140) (336) (397) (329) (1,202)

Finance costs (1) (70) (3) (1,381) (1,455)

Amortisation and

depreciation - (687) 42 (1,218) (1,863)

Remuneration charge

(deferred consideration) - (42) - 6,351 6,309

Transaction costs - - - (1,621) (1,621)

Goodwill adjustment - - - (6,364) (6,364)

Profit / (loss)

before tax from continuing

operations 544 3,990 1,171 (7,396) (1,691)

Tax - (129) 11 (21) (139)

Profit / (loss)

after tax from continuing

operations 544 3,861 1,182 (7,417) (1,830)

3 Business and geographical segments

Perioded Ended 30 Investment Wealth US operations Group Total

June 2021 management planning

Continuing operations: GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue (disaggregated by

timing):

Point in time 513 953 48,162 - 49,628

Over time 1,799 7,354 2,760 - 11,913

External sales 2,312 8,307 50,922 - 61,541

Direct expenses (790) (460) (46,574) - (47,824)

Gross profit 1,522 7,847 4,348 - 13,717

Operating (loss)

/ profit 56 2,774 2,519 (2,294) 3,055

Business re-positioning

costs (76) (112) (184) (35) (407)

Finance costs - (50) 5 (795) (840)

Amortisation and

depreciation - (522) (15) (580) (1,117)

Remuneration charge

(deferred consideration) - (2,128) - (2,017) (4,145)

Transaction costs - (8) - (266) (274)

Profit / (loss)

before tax from continuing

operations (20) (46) 2,325 (5,987) (3,728)

Tax - - (40) 43 3

Profit / (loss)

after tax from continuing

operations (20) 46 2,285 (5,944) (3,725)

3 Business and geographical segments

Year Ended Investment Wealth US operations Group Total

31 December management planning

2021

(audited) 2021 2021 2021 2021 2021

Continuing operations: GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue (disaggregated by

timing):

Point in time 881 2,045 118,396 - 121,322

Over time 3,771 15,169 9,431 23 28,394

External sales 4,652 17,214 127,827 23 149,716

Direct expenses (1,476) (913) (118,108) - (120,497)

Gross profit 3,176 16,301 9,719 23 29,219

Operating (loss)

/ profit 365 5,779 5,123 (4,940) 6,327

Business re-positioning

costs (177) (239) (263) (885) (1,564)

Finance costs - (72) 2 (4,857) (4,927)

Amortisation and

depreciation - (1,197) (212) (990) (2,399)

Other gains - - - (3,056) (3,056)

Remuneration charge

(deferred consideration) - (3,691) - (3,318) (7,009)

Transaction costs - (4) - (1,832) (1,836)

(Loss) / profit

before tax from

continuing

operations 188 576 4,650 (19,878) (14,464)

Tax - (16) (317) (428) (761)

(Loss) / profit

after tax from continuing

operations 188 560 4,333 (20,306) (15,225)

4 Other (losses) / gains

Six months Six months Year Ended

to to

30 June 30 June 31 December

2022 2021 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Additional payments due on acquired

businesses - - (2,983)

Unrealised gain/(loss) on stock - - (73)

- - (3,056)

5 Earnings per share

Six months Six months Year ended

to to

30 Jun 30 Jun 31 Dec 2021

2022 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Loss from continuing operations

for the purposes of basic loss

per share, being net loss attributable

to owners of the Group (2,545) (4,857) (17,432)

Number of shares

Weighted average number of ordinary

shares for the purposes of basic

loss per share 216,920,719 216,920,719 216,920,724

Effect of dilutive potential ordinary

shares:

Share options 8,580,094 14,979,244 5,702,567

Convertible preference shares

in issue 469,263,291 271,687,533 271,986,413

Weighted average number of ordinary

shares for the purposes of diluted

loss per share 694,764,104 503,587,496 494,609,704

Continous operations:

Basic loss per share GBP(0.02) GBP(0.02) GBP(0.08)

Diluted loss per share GBP(0.01) GBP(0.02) GBP(0.04)

Total loss:

Basic loss per share GBP(0.02) GBP(0.02) GBP(0.08)

Diluted loss per share GBP(0.01) GBP(0.02) GBP(0.04)

6 Tangible Assets

Fixtures

and equipment

GBP'000

Cost

At 1 January 2021 1,380

Additions 79

At 30 June 2021 1,459

Additions 196

At 31 December 2021 1,655

Additions 147

At 30 June 2022 1,802

Accumulated depreciation

At 1 January 2021 453

Depreciation charged in the Period 91

At 30 June 2021 544

Depreciation charged in the Period 170

At 31 December 2021 714

Acquisitions during the year 42

Depreciation charged in the Period 130

At 30 June 2022 886

Net book value

At 30 June 2022 916

At 31 December 2021 941

At 30 June 2021 915

7 Right-of-use assets

Land and

buildings

GBP'000

Cost

At 1 January 2021 3,569

Prior year reclassification (35)

Additions 65

At 30 June 2021 3,599

Additions 490

At 31 December 2021 4,089

Movement due to FX 8

Additions 742

At 30 June 2022 4,831

Accumulated depreciation

At 1 January 2021 741

Prior year reclassification 35

Depreciation charged in the Period 310

At 30 June 2021 1,016

Depreciation charged in the Period 354

At 31 December 2021 1,370

Depreciation charged in the Period 398

At 30 June 2022 1,768

Net book value

At 30 June 2022 3,071

At 31 December 2021 2,719

At 30 June 2021 2,583

8 Goodwill and other intangible assets

Goodwill Other intangible Total

assets

GBP'000 GBP'000 GBP'000

Cost

At 1 January 2021 25,684 27,968 53,652

Additions 35 - 35

At 30 June 2021 - - 53,687

Additions - - -

At 30 June 2021 25,719 27,968 53,687

Additions 19,404 14,647 34,051

Movement due to FX 67 - 67

Disposals (40) - (40)

Impairment

At 31 December 2021 45,150 42,615 87,765

Additions 11,226 13,449 24,675

Movement due to FX - - -

Disposals - - -

Impairment (6,364) (6,364)

At 30 June 2022 50,012 56,064 106,076

Accumulated amortisation

At 1 January 2021 2,279 3,757 6,036

Amortisation charged for the Period - - -

Disposals

Charge for period - 708 708

At 30 June 2021 2,279 4,465 6,744

Disposals

Charge for period - 767 767

At 31 December 2021 2,279 5,232 7,511

Disposals

Charge for period 1,335 1,335

At 30 June 2022 2,279 6,567 8,846

8 Goodwill and other intangible assets (continued)

Net book value

As at 30 June 2022 47,733 49,498 97,231

As at 31 December 2021 42,871 37,384 80,255

As at 30 June 2021 23,440 23,503 46,943

For the half year ended 30 June 2022, the Group recorded a goodwill

adjustment charge of GBP6.4m in respect of the acquisition of

iBoss in 2021 linked to the reduction of the growth earn-out

liability (see note 10).

9 Lease liabilities

The lease liabilities are included in trade and other payables

and other non-current liabilities in the statement of financial

position.

Land and

buildings

GBP'000

At 1 January 2021 3,234

Additions 65

Interest expense 92

Lease payments (315)

At 30 June 2021 3,076

Additions 517

Interest expense 16

Lease payments (335)

At 31 December 2021 3,274

Additions 735

Interest expense 95

Lease payments (451)

At 30 June 2022 3,653

The Group recognises a right-of-use asset and a lease liability

at the lease commencement date. The right-of-use asset is initially

measured at cost, and subsequently at cost less any accumulated

depreciation and impairment losses and adjusted for certain

re-measurements of the lease liability.

9 Lease liabilities (continued)

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement

date, discounted using the Group's incremental borrowing rate.

The lease liability is subsequently increased by the interest

cost on the lease liability and decreased by lease payment made.

The Group has applied judgement to determine the lease term

for some lease contracts in which it is a lessee that includes

renewal options. The assessment of whether the Group is reasonably

certain to exercise such options impacts the lease term, which

significantly affects the amount of lease liabilities and right-of-use

assets recognised.

10 Deferred consideration payable

Six Months Six Months Year Ended

to to

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Deferred consideration payable on acquisitions: 24,590 4,710 22,188

- falling due within one year 14,286 900 7,706

- due after more than one year 10,304 3,810 14,482

The deferred consideration payable on acquisitions is due to

be paid in cash.

The deferred consideration liability is contingent on performance

requirements during the deferred consideration period. The value

of the contingent consideration is determined by EBITDA and/or

revenue targets agreed on the acquisition of each asset, as defined

under the respective Share or Business Purchase Agreement. As

at the reporting date, the Group is expecting to pay the full

value of its deferred consideration as all acquisitions are on

target to meet the requirements.

Previously all deferred consideration payable on acquisitions

was recorded as a deferred liability and included in the fair

value of assets. However, in circumstances where the payment

of deferred consideration is contingent on the seller remaining

within the employment of the Group during the deferred period,

the contingent portion of deferred consideration is not included

in the fair value of consideration paid, rather is treated as

remuneration and accounted for as a charge against profits over

the deferred period.

During the year, deferred consideration as remuneration was a

credit through profit or loss of GBP6,309,121, mainly due to

a reduction in growth earn-out liabilities for the iBoss business

(2021: GBP7,008,600 expense).

11 Share capital

Six months Six months Year ended Six months Six months Year ended

to to to to

30 June 30 June 31 Dec 30 June 30 June 31 Dec

2022 2021 2021 2022 2021 2021

(unaudited) (unaudited) (audited) (unaudited) (unaudited) (audited)

Shares Shares Shares GBP'000 GBP'000 GBP'000

Ordinary

shares

issued:

Fully paid 216,920,719 216,920,719 216,920,719 10,846 10,846 10,846

216,920,719 216,920,719 216,920,719 10,846 10,846 10,846

Share capital and share premium

Number Par value Share Total

of ordinary premium

shares

'000 GBP'000 GBP'000 GBP'000

At 1 January 2020 216,921 10,846 8,224 19,070

Issued during year - - - -

As at 30 June 2021 216,921 10,846 8,224 19,070

At 31 December 2021 216,921 10,846 8,224 19,070

Issued during year - - - -

At 30 June 2022 216,921 10,846 8,224 19,070

Ordinary shares have a par value of GBP0.05 per share. They entitle

the holder to participate in dividends, and to share in the proceeds

of winding up the company in proportion to the number of, and

amounts paid on, shares held. On a show of hands, every holder

of ordinary shares present at a meeting in person or by proxy,

is entitled to one vote and upon a poll each share is entitled

to one vote.

Kingswood Holdings Limited does not have a limit on the amount

of authorised capital.

As at 31 December 2021, KPI (Nominees) Limited held 143,720,906

Ordinary Shares, representing 66.3 per cent of ordinary shares

in issue at year end.

12 Preference share capital

Six Months Six Months Year Ended Six Months Six Months Year Ended

to to to to

30 June 30 June 31 Dec 2021 30 June 30 June 31 Dec

2022 2021 2022 2021 2021

(unaudited) (unaudited) (audited) (unaudited) (unaudited) (audited)

Shares Shares Shares GBP'000 GBP'000 GBP'000

Convertible preference shares

issued:

Fully paid 77,428,443 44,828,443 77,428,443 77,428 44,828 77,428

77,428,443 44,828,443 77,428,443 77,428 44,828 77,428

Preference share capital movements are

as follows:

Number Par value

of shares

'000 GBP'000

At 1 January 2021 5,728 5,728

Issued during year 39,100 39,100

At 30 June 2021 44,828 44,828

Issued during year 32,600 32,600

At 31 December 2021 77,428 77,428

Issued during year - -

At 30 June 2022 77,428 77,428

Six Months Six Months Year Ended

to to

30 June 30 June 31 Dec

2022 2021 2021

(unaudited) (unaudited) (audited)

Equity component 70,150 37,550 70,150

Liability component - 7,469 -

70,150 45,019 70,150

12 Preference share capital (continued)

On 12 September 2019, Kingswood Holdings Limited entered into

a subscription agreement with HSQ INVESTMENT LIMITED, a wholly

owned indirect subsidiary of funds managed and/or advised by Pollen

Street, to subscribe for up to 80 million irredeemable convertible

preference shares, at a subscription price of GBP1 each (the Subscription).

Pollen Street is a global, independent alternative asset investment

management company, established in 2013 with currently GBP3.2

billion gross AUM across private equity and credit strategies,

focused on the financial and business services sectors, with significant

experience in speciality finance.

All irredeemable convertible preference shares convert into new

ordinary shares at Pollen Street Capital's option at any time

from the earlier of an early conversion trigger or a fundraising,

or automatically on 31 December 2023. Preferential dividends on

the irredeemable convertible preference shares accrue daily at

a fixed rate of five per cent per annum from the date of issue.

Effective 17 December 2021 onwards, these will be settled via

the issue of additional ordinary shares, thereby extinguishing

the liability component.

13 Notes to the cash flow statement

Cash and cash equivalents comprise cash and cash equivalents

with an original maturity of three months or less. The carrying

amount of these assets is approximately equal to their fair value.

Six Months Six Months Year Ended

to to

30 June 30 June 31 Dec 2021

2022 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Loss before tax (1,691) (3,728) (14,464)

Depreciation and amortisation 1,863 1,117 2,399

Goodwill adjustment 6,364 - -

Finance costs 1,455 840 4,927

Remuneration charge (deferred consideration) (7,399) 170 234

Share-based payment expense 556 60 94

Other losses / (gains) - - 1,281

Foreign exchange gain 12 4 (6)

Tax paid (139) (40) (318)

Operating cash flows before movements

in working capital 1,021 (1,577) (5,853)

(Increase)/decrease in receivables 786 (863) (449)

Increase/(decrease) in payables (10,796) 4,119 8,043

Net cash inflow / (outflow) from operating

activities (8,989) 1,679 1,741

14 Financial instruments

The following table states the classification of financial instruments

and is reconciled to the Statement of Financial Position:

30 Jun 30 Jun 31 Dec

2022 2021 2021

Carrying Carrying Carrying

amount amount amount

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Financial assets measured at amortised

cost

Trade and other receivables 5,846 3,790 4,308

Cash and cash equivalents 20,693 24,733 42,933

Financial liabilities measured at

amortised cost

Trade and other payables (16,530) (17,495) (23,826)

Other non-current liabilities (222) - (318)

Lease liability (3,653) (3,076) (3,274)

Preference share liability - (7,469) -

Financial liabilities measured at

fair value through profit and loss

Deferred consideration payable (24,590) (4,710) (22,188)

(18,456) (4,227) (2,365)

Financial instruments not measured at fair value includes cash

and cash equivalents, trade and other receivables, trade and

other payables, and other non-current liabilities.

Due to their short-term nature, the carrying value of cash and

cash equivalents, trade and other receivables, and trade and

other payables approximates fair value.

Item Fair value Valuation technique Fair value

hierarchy

level

GBP'000

Deferred 24,590 Fair value of Level 3

consideration deferred

payable consideration

payable

is estimated by

discounting the

future cash flows

using the IRR

inherent

in the company's

acquisition price.

15 Related party transactions

Remuneration of key management personnel

The remuneration of the Directors, who are the key management

personnel of the Group, is set out below in aggregate for each

of the categories specified in IAS 24 Related Party Disclosures.

Six months Six months Year ended

to to

30 June 30 June 31 Dec

2022 2021 2021

(unaudited) (unaudited) (audited)

2022 2021 2021

GBP'000 GBP'000 GBP'000

Short-term employee benefits 103 371 340

Termination benefits - - -

Share based payments - 34 -

103 405 340

Other related parties

During the period, KHL incurred fees of GBP58,333 (30 June 2021:

GBP62,500; 31 December 2021: GBP137,500) from KPI (Nominees)

Limited in relation to Non-Executive Director remuneration. At

30 June 2022, GBPnil of these fees remained unpaid (30 June 2021:

GBP37.500; 31 December 2021: GBPnil).

Fees received from Moor Park Capital Partners LLP, in which Gary

Wilder holds a beneficial interest, relating to property related

services provided by KHL totalled GBP23,708 for the period ended

30 June 2022 (30 June 2021: GBP23,708; 31 December 2021: GBP23,090),

of which GBPnil (30 June 2021: GBPnil; 31 December 2021: GBPnil)

was outstanding at 30 June 2021.

Fees paid for financial and due diligence services to Kingswood

LLP and Kingswood Corporate Finance Limited, in which Gary Wilder

and Jonathan Massing hold a beneficial interest, totalled GBP420,807

for the period to 30 June 2022 (30 June 2021: GBP201,829; 31

December 2021: GBP384,750), of which GBPnil (30 June 2021: GBP5,430;

31 December 2021: GBPnil) was outstanding at 30 June 2022.

16 Ultimate controlling party

As at the date of approving the financial statements, the ultimate

controlling party of the Group was KPI (Nominees) Limited.

17 Events after the reporting date

Acquisition of Smith Pearman & Associates

On 29th July 2022, Kingswood completed the acquisition of Smith

Pearman & Associates, an independent financial advice company

based in Hampshire. Established for over 35 years, Smith Pearman

& Associates look after over 240 clients with over GBP70m AUA

in the Hampshire region. They offer tailored services to high

net-worth individuals with an existing portfolio, or new investment

requirements, based on personal goals and aspirations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFETAFISLIF

(END) Dow Jones Newswires

September 15, 2022 02:00 ET (06:00 GMT)

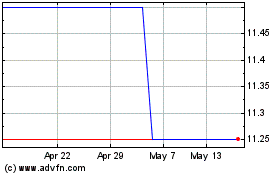

Kingswood (LSE:KWG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Kingswood (LSE:KWG)

Historical Stock Chart

From Feb 2024 to Feb 2025