Kenmare Resources Proposed Capital Reduction And Notice Of Extraordinary General Meeting

November 06 2018 - 2:00AM

UK Regulatory

TIDMIRSH

Kenmare Resources plc ("Kenmare" or "the Company")

6 November 2018

Proposed Capital Reduction

and

Notice of Extraordinary General Meeting

Kenmare Resources plc ("Kenmare" or the "Company") announces that it

will later today post a circular (the "Circular") to shareholders of the

Company ("Shareholders") detailing a proposed capital reduction of the

Company's share premium account (the "Capital Reduction") and convene a

general meeting of the Company (the "General Meeting"), the purpose of

which is to enable shareholders to approve the Capital Reduction.

The General Meeting will be held at Conrad Dublin, Earlsfort Terrace,

Dublin 2, D02 V562 on Wednesday, 5 December 2018 at 12.30 p.m.

Background to and reasons for the proposed capital reduction

Following a period of continued growth and operational development,

Kenmare announced on 16 October 2018 a dividend policy to return a

minimum of 20% of profit after tax on an annual basis to Shareholders as

part of our objective to create and deliver shareholder value. This

policy is subject to prevailing product market conditions and ensuring

that the Company retains a prudent level of cash to fund debt and

capital requirements.

In light of the capital required for development projects, the Company

expects (subject to Shareholder and High Court approval of the Capital

Reduction) to pay modest dividends during the next two years, starting

with an interim dividend based on H1 2019 results, payable in H2 2019.

Following completion of these development projects, the Company expects

to be in a position to make higher capital returns from 2021.

As we stated in our October announcement, the Company, in order to be in

a position to pay any dividend, must first eliminate its historic losses

by reduction of its capital. The Company carries an accumulated deficit

on its balance sheet (US$185,252,950 at 30 June 2018) reflecting

accumulated losses on its activities since its incorporation. Under

Irish company law, the Company is precluded from paying dividends, or

(subject to certain exceptions) redeeming or repurchasing its shares,

while it carries an accumulated deficit. A reduction of the Company's

capital to eliminate historic losses requires the approval of

Shareholders and the consent of the High Court.

Accordingly, the Board proposes the Capital Reduction to eliminate that

deficit and to provide the Company with the flexibility to pay dividends,

or to redeem or repurchase its shares, in the future and in line with

its dividend policy.

The Capital Reduction will not, of itself, create distributable reserves

that would allow the Company to pay a dividend (or redeem or repurchase

its shares). However, it would put the Company in a position to pay a

dividend (or redeem or repurchase its shares) in circumstances where

distributable reserves are created in future financial years and the

Board determines that such reserves, when assessed alongside the ongoing

financial performance of the Company and the interests of the Company

generally at such time, are of such an amount as to justify payment of a

dividend or other distribution.

If approved by Shareholders, and subsequently confirmed by the High

Court of Ireland, the Capital Reduction will result in the partial

cancellation of the Company's share premium account and will eliminate

the deficit on the Company's profit and loss account as at 30 June 2018.

The Circular (including the notice of EGM) will be shortly available on

the Company's website, www.kenmareresources.com.

Copies of the Circular (including the notice of EGM) have been submitted

to Euronext Dublin and the National Storage Mechanism from where it may

also be obtained.

Capitalised terms used but not otherwise defined in this announcement

will have the same meanings given to them within the Circular.

For further information, please contact:

Kenmare Resources plc

Michael Carvill, Managing Director

Tel: +353 1 671 0411

Tony McCluskey, Financial Director

Tel: +353 1 671 0411

Jeremy Dibb, Corporate Development and Investor Relations Manager

Tel: +353 1 671 0411

Mob: + 353 87 943 0367

Murray

Joe Heron / Aimee Beale

Tel: +353 1 498 0300

Mob: +353 87 690 9735

Buchanan

Bobby Morse / Chris Judd

Tel: +44 207 466 5000

Forward Looking Statements

This announcement contains some forward-looking statements that

represent Kenmare's expectations for its business, based on current

expectations about future events, which by their nature involve risks

and uncertainties. Kenmare believes that its expectations and

assumptions with respect to these forward-looking statements are

reasonable. However, because they involve risk and uncertainty, which

are in some cases beyond Kenmare's control, actual results or

performance may differ materially from those expressed or implied by

such forward-looking information.

(END) Dow Jones Newswires

November 06, 2018 02:00 ET (07:00 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

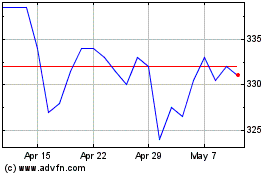

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Apr 2024 to May 2024

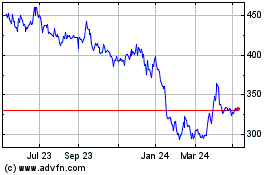

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From May 2023 to May 2024