TIDMKLR

RNS Number : 3140Q

Keller Group PLC

02 August 2010

Monday, 2 August 2010

Keller Group plc

Interim Results for the six months ended 30 June 2010

Keller Group plc ("Keller" or "the Group"), the international ground engineering

specialist, is pleased to announce its interim results for the six months ended

30 June 2010.

+---------------------------+-----------+-----------+

| Results summary: | | |

+---------------------------+-----------+-----------+

| | 2010 | 2009 |

+---------------------------+-----------+-----------+

| Revenue | GBP496.9m | GBP552.6m |

| | | |

+---------------------------+-----------+-----------+

| Operating profit | GBP13.7m | GBP42.8m |

+---------------------------+-----------+-----------+

| Profit before tax | GBP11.3m | GBP41.0m |

+---------------------------+-----------+-----------+

| Earnings per share | 12.5p | 42.1p |

+---------------------------+-----------+-----------+

| Cash from operations | GBP15.0m | GBP40.1m |

+---------------------------+-----------+-----------+

| Total dividend per share | 7.6p | 7.25p |

+---------------------------+-----------+-----------+

Highlights include:

· Results in line with expectations at the time of the IMS in May

· Benefits of geographic diversification, with 35% of revenue now from

Australia and the Group's developing markets

· June acquisitions in Australia and the US mark further progress in the

Group's long-term growth strategy

· Order book increases every month since December 2009; now 1% ahead of this

time last year

· Cash generated from operations over the last 12 months represents 113% of

EBITDA, reflecting continued focus on cash collection and working capital

· Net debt of GBP121.5m (1.4x annualised EBITDA); substantial covenant

headroom

· Interim dividend of 7.6p per share (2009: 7.25p), a 5% increase

· Expectations for the full year remain within the current range of market

expectations

Justin Atkinson, Keller Chief Executive said:

"The first half has been a challenging period for the Group particularly in the

US, where the construction market continued to deteriorate.

"However, we have been encouraged by the progress made in our developing

markets, where we have continued our success of recent years in profitably

growing our business. This demonstrates the benefit of our strategy of

geographic diversification, to which we remain fully committed.

"Given the Group's financial strength and the Board's confidence in its long

term growth prospects, we are continuing our unbroken record of increasing the

dividend every year since the flotation in 1994."

For further information, please contact:

+------------------------------+-----------------------------+---------------------------------------------+

| Keller Group plc | www.keller.co.uk |

+------------------------------+---------------------------------------------------------------------------+

| Justin Atkinson, Chief | 020 7616 7575 |

| Executive | |

+------------------------------+---------------------------------------------------------------------------+

| James Hind, Finance Director | |

| | |

+------------------------------+---------------------------------------------------------------------------+

| Finsbury |

+----------------------------------------------------------------------------------------------------------+

| James Leviton, Clare Hunt, Alison Kay | 020 7251 3801 |

+------------------------------------------------------------+---------------------------------------------+

| | | |

+------------------------------+-----------------------------+---------------------------------------------+

A presentation for analysts will be held at 9.15 for 9.30am at the Theatre &

Gallery,

London Stock Exchange, 10 Paternoster Square, London, EC4M 7LS

An audio webcast will be available from 2.00 pm at

http://www.axisto.com/webcasting/investis/keller/interim-results-2010/register.

tm

Notes to Editors:

Keller is the world's largest independent ground engineering specialist,

providing technically advanced and cost-effective foundation solutions to the

construction industry. With 2009 revenue of GBP1,038m, Keller is a member of the

FTSE-250. It has around 6,000 staff world-wide, with offices in over 30

countries on five continents.

Keller is the market leader in the US and Australia; it has prime positions in

most established European markets; and a strong profile in many developing

markets.

Chairman's Statement

Financial overview

I am pleased to report our results for the six months ended 30 June 2010. As

expected, the first half has been a challenging period for the Group

particularly in the US, where the construction market continued to deteriorate.

However, we have been encouraged by the progress made in our developing

markets1, where we have continued our success of recent years in profitably

growing our business. This demonstrates the benefit of our strategy of

geographic diversification, to which we remain fully committed.

Group revenue was down 10% at GBP496.9m (2009: GBP552.6m) and down 11% on a

constant currency basis. The first-half operating profit was GBP13.7m (2009:

GBP42.8m) with an operating margin of 2.8%, compared with last year's 7.7%.

Following a small loss in the first quarter as a result of severe weather

impacting our US and European businesses, the second quarter saw a significant

improvement in the Group's results.

Profit before tax was GBP11.3m (2009: GBP41.0m) and earnings per share were

12.5p (2009: 42.1p).

Cash generated from operations was GBP15.0m, down on last year's GBP40.1m,

reflecting the lower profit and the usual, seasonal first-half working capital

outflow. Over the last 12 months, cash generated from operations was GBP98.1m,

representing 113% of EBITDA. Cash collection and minimising working capital

continue to be key priorities.

Net debt at 30 June 2010 was GBP121.5m, which compares to GBP95.3m at the end of

June 2009. This increase is stated after total expenditure on acquisitions over

the past year of GBP49.3m. Capital expenditure in the first half totalled

GBP12.7m (2009: GBP23.2m), a reduction of 45%.

Net debt at 30 June 2010 represented 1.4 times annualised EBITDA and annualised

EBITDA interest cover was 27 times. The Group continues to have sufficient

available financing to meet its strategic and operational goals and operates

comfortably within all its covenant limits. The Group's GBP65m revolving

credit facility, which was due to expire in July 2010, has been extended to

March 2011 to allow a single refinancing of the Group's two central banking

facilities later this year.

1 Our markets in Eastern Europe, North Africa, the Middle East and Asia

Dividend

Given the Group's financial strength and the Board's confidence in its long term

growth prospects, we are continuing our unbroken record of increasing the

dividend every year since the flotation in 1994.

Accordingly, the Board has declared an interim dividend of 7.6p per share (2009:

7.25p), an increase of 5%. The dividend will be paid on 1 November 2010 to

shareholders on the register at the close of business on 8 October 2010.

Operational overview

US

From a market perspective, the value of US non-residential construction spending

in the year to date was down by 17% from the 2009 level. A fall of 36% in the

commercial sector2 was even more severe than we had anticipated at the start of

the year, following a 26% year-on-year decline in 2009. This was accompanied

by a slowdown in investment in power and, in particular, the industrial sector,

whilst total public expenditure on construction fell by 5% compared to the same

period last year. Although there was some benefit from federal stimulus

spending, this seems to have been offset by a corresponding reduction in state

spending. The improvement in the residential sector in the first few months of

the year has recently faltered with the removal of federal tax credits for

first-time home buyers at the end of April.

Overall, our US operations reported revenue of GBP198.0m (2009: GBP268.0m) and

an operating loss of GBP1.0m (2009: GBP18.6m profit). On a constant currency

basis, total US revenue was 24% down on last year. The continued market

deterioration has not only driven down volumes, but has also created an

intensely competitive pricing environment as a result of which margins have been

severely constricted.

As a result of this further decline in the total US construction market, coupled

with the impact of the adverse weather conditions in the first quarter, our US

foundation companies have been severely challenged in the first half of this

year. All five companies have made significant reductions in staffing levels,

with total headcount, adjusted for acquisitions, now down by about 25% from the

peak of two years ago, broadly in line with the reduction in volume. This

downsizing has been achieved despite the greater demands created by a sustained

high level of bidding and a protraction of the work-winning process in this

buyers' market.

Public work now accounts for almost 50% of our work in the US, up from around

one third two years ago. Public infrastructure contracts on which we have

worked in the first half of this year include several bridge projects, such as

the Nicodemus Road bridge project in Maryland, where Case constructed eight

large caissons in 40 feet of water adjacent to an existing road bridge. Public

work in the New York area has also provided some good opportunities, such as a

contract associated with a large tunnelling project in the Borough of Queens,

where Hayward Baker has undertaken deep jet grouting works in preparation for

the construction of four new rail tunnels.

The US order book at the end of June was 13% higher than at the same time last

year, which encourages our belief that activity levels in our US foundation

businesses will pick up through the second half of the year. However, we

remain of the view that margins will not improve materially until there is

confidence in a sustained recovery in US construction.

Despite current market conditions, our long term confidence in this key market

is undiminished and we will continue our strategy of consolidating our

market-leading position in the US where we find high value or good growth

opportunities. In furtherance of this strategy, in June we acquired the wick

drain business of Nilex, the leading wick drain contractor in the US and Canada,

for an initial cash consideration of $7.2m (GBP4.7m), together with a deferred

consideration of up to $1.0m (GBP0.7m) based on profits over the next two years.

Over the four years ended 2009, the Nilex business reported average revenue of

around $15.5m (GBP10.1m). Wick drains are used for accelerating the

consolidation of compressible soils and they are often used alongside Hayward

Baker's other ground improvement products. The acquisition gives scale to

Hayward Baker's existing wick drains business, extending and complementing the

company's ground improvement product range.

With the residential market showing no sustained improvement, demand for

high-rise products deteriorating and further increases in the cost of steel

strand, the Suncoast business has continued to struggle, resulting in a loss in

the first half of the year. Headcount has now been reduced from just over

1,000 at its peak in 2006 to around 300 and four regional offices have been

closed, including two this year. Management continues to adapt the business as

necessary to the unprecedented changes that have occurred in this sector, whilst

maintaining the ability to respond to any pick-up in demand.

2 Office, Commercial, Leisure and Lodging, US Census Bureau of the Department of

Commerce, 1 July 2010.

Continental Europe, Middle East & Asia (CEMEA)

CEMEA reported revenue of GBP190.1m (2009: GBP191.1m) and operating profit of

GBP9.3m (2009: GBP20.4m). On a constant currency basis, revenue was 2% ahead

of last year, whilst operating profit was 53% lower.

Most of our Continental European businesses were severely impacted by the

adverse weather conditions in the first few months of the year.

Despite the weather, the dearth of major projects and strong competition for a

reduced volume of small and medium-sized contracts, trading in our German

subsidiary again held up reasonably well. Our Austrian company had a more

difficult first half, although its ability to redesign customers' proposals and

to offer more cost-effective, packaged solutions has helped it to secure some

good opportunities for the second half of the year.

As expected, the French and Spanish construction markets contracted further; in

the case of Spain, considerably more than the contraction in the general

economy. As a result, we have continued to focus on reorganising these

businesses and in Spain, further reductions in headcount have been accompanied

by an agreement with the remaining workforce to reduce salaries and wages by 5%.

With public spending cuts announced across these and other European countries,

these markets are expected to remain difficult for some time.

In Eastern Europe, Poland's infrastructure upgrades continued to be a major

source of work, with several more such contracts still in the pipeline, of which

we should win our share. However, whilst our Polish company should be busy for

the rest of the year, its margins will remain under pressure, reflecting the

current competitive environment. Elsewhere in the region, we embarked on our

first work in Russia at the site of the new ice skating arena for the 2014

Winter Olympics at Sochi, where we undertook vibro compaction and jet grouting

works, with good results. Separately, we are working with a local partner on a

slope stabilisation contract, also at Sochi. We will continue to target

carefully selected contracts in the Russian market.

In the Middle East, our company in Saudi Arabia worked on a variety of small and

medium sized contracts in the first half and the business remained profitable.

However, the award of several major contracts for the petrochemical industry has

been hampered by delays. Elsewhere in the region, despite much reduced volumes,

good operational performance and tight cost control have enabled our business to

report a modest profit.

All of our key markets in Asia - India, Malaysia and Singapore - remained

buoyant and our companies there performed very well in the first half.

Resource Holdings, acquired in October 2009, made a good contribution and

continues to work in close co-operation with Keller's existing business in

Singapore.

Our Malaysian company continued its work on the Ipoh to Penang railway project,

where it currently has 11 rigs in operation and expects to remain busy for the

remainder of this year.

In India, where revenue was more than double that of last year's first half,

headcount has now reached 270 and we are looking to extend our current network

of four offices by the end of the year. The extension of the product range

from the original ground improvement and grouting products to include ground

anchors and bored piling has gained momentum and we will continue to target jobs

which are particularly suited to our competitive advantages: our design and

build capability, advanced techniques and specialist equipment which are not

generally available in the local market. One of our largest piling projects in

India to date, at a petrochemical terminal in Chennai, was successfully

completed in the first half and we have now secured a second contract for the

same client.

Our new subsidiary in Vietnam has secured its first contract, vibro replacement

works at a petrochemical site in Vung Tau, which will be undertaken in the

second half of this year with support from Keller in Malaysia.

Australia

In Australia, market conditions remain very strong, fuelled by demand for

resources from China and the rest of Asia, increased infrastructure needs and a

growing population. The recent political compromise in respect of the proposed

resources tax has helped to buoy confidence in this important sector.

Australian revenue was GBP80.7m (2009: GBP62.8m) and operating profit was

GBP8.0m, compared to GBP6.2m in the first half last year. On a constant

currency basis, both revenue and operating profit were up 5% on last year.

This first-half result reflects a strong operating performance across a range of

larger infrastructure projects, such as the Ipswich Minefill project and the

Eastern Busway project, both in Queensland. A good contribution also came from

a number of resources-related contracts in Western Australia, such as the

foundations for new mine infrastructure at Marradong.

In June, we acquired a Sydney-based near-shore marine foundation contractor

trading as Waterway Constructions ("Waterway") for an initial cash payment of

A$37.0m (GBP21.7m), including A$7.5m (GBP4.4m) of acquired net cash, together

with a maximum deferred cash consideration of A$16.5m (GBP9.7m), based on

profits in the three years to 30 June 2013.

Waterway specialises in the construction of foundations for wharves, jetties and

other marine structures and the maintenance and extension of existing

structures. With a leading position in its New South Wales home market,

Waterway also has an opportunity to increase its penetration of the Queensland

and Victoria markets. Over the medium term, there are good prospects for

expansion into Western Australia, where planned minerals and energy projects are

expected to generate strong demand for both land and near-shore marine based

foundation services. The acquisition also offers strong potential for synergy

with the Group's existing foundation businesses, uniquely positioning Keller

Australia to offer combined packages of land and near-shore marine foundation

solutions.

With a good order book and several sizeable projects in the pipeline, the

prospects for our Australian business are looking strong for the remainder of

the year.

UK

The UK business reported revenue of GBP28.1m (2009: GBP30.7m) and an operating

loss of GBP0.1m (2009: loss of GBP0.4m).

The UK market remains very challenging and our UK business has been further

downsized to reflect this. Where possible, skilled people are being considered

for transfer to other parts of the Group, such as Australia, where demand

remains high.

As part of the Crossrail project, we are currently working on a piling contract

at London's Tottenham Court Road tube station and we are hopeful that the

continuation of investment in Crossrail, together with other planned

infrastructure projects which will call for specialist geotechnical and

monitoring services, will underpin an improvement in our UK business in 2011.

Outlook

Since our May 2010 interim management statement, we have not seen any real

change in our key construction markets. In recent weeks, general sentiment in

our mature markets has turned rather more cautious, influenced by lacklustre

economic data, fears over European sovereign debt and the resultant plans to

curtail public expenditure in much of the western world.

Against this backdrop of uncertain times, we are encouraged that contract awards

in the first half were 12% above last year and the Group's order book has

increased every month since December 2009. On a constant currency basis, the

order book is now 1% ahead of this time last year, including a small benefit

from the June acquisitions, compared with 14% below at the end of January 2010.

However, the general economic uncertainty and intense competition in our mature

markets are expected to continue to put pressure on margins until such time as

there is confidence in a sustained recovery.

Elsewhere, the increasing contribution from our developing markets and Australia

is set to continue, as indicated by projects in the pipeline in Asia and

Australia and the recent award of contracts in markets which are relatively new

to Keller, such as Russia, Brazil and Vietnam.

Overall, the expected results for the full year remain within the current range

of market expectations. Longer term, the Group's geographic diversification

and strong financial position mean that it is well placed to take advantage of

growth opportunities in both existing and new markets.

Roy Franklin, OBE

Chairman

2 August 2010

Consolidated Income Statement

for the half year ended 30 June 2010

+-----------------------------------------+--------+---------+---------+----------+

| | | Half | Half | Year |

| | | year | year | to 31 |

| | | to 30 | to 30 | December |

| | | June | June | 2009 |

| | | 2010 | 2009 | |

+-----------------------------------------+--------+---------+---------+----------+

| | Note | GBPm | GBPm | GBPm |

+-----------------------------------------+--------+---------+---------+----------+

| Revenue | 3 | 496.9 | 552.6 | 1,037.9 |

+-----------------------------------------+--------+---------+---------+----------+

| Operating costs | | (483.2) | (509.8) | (960.6) |

+-----------------------------------------+--------+---------+---------+----------+

| Operating profit | 3 | 13.7 | 42.8 | 77.3 |

+-----------------------------------------+--------+---------+---------+----------+

| Finance income | | 0.8 | 0.8 | 3.7 |

+-----------------------------------------+--------+---------+---------+----------+

| Finance costs | | (3.2) | (2.6) | (6.3) |

+-----------------------------------------+--------+---------+---------+----------+

| Profit before taxation | | 11.3 | 41.0 | 74.7 |

+-----------------------------------------+--------+---------+---------+----------+

| Taxation | 5 | (3.2) | (13.1) | (22.6) |

+-----------------------------------------+--------+---------+---------+----------+

| Profit for the period | | 8.1 | 27.9 | 52.1 |

+-----------------------------------------+--------+---------+---------+----------+

| | | | | |

+-----------------------------------------+--------+---------+---------+----------+

| Attributable to: | | | | |

+-----------------------------------------+--------+---------+---------+----------+

| Equity holders of the parent | | 8.0 | 26.9 | 50.4 |

+-----------------------------------------+--------+---------+---------+----------+

| Minority interests | | 0.1 | 1.0 | 1.7 |

+-----------------------------------------+--------+---------+---------+----------+

| | | 8.1 | 27.9 | 52.1 |

+-----------------------------------------+--------+---------+---------+----------+

| | | | | |

+-----------------------------------------+--------+---------+---------+----------+

| Earnings per share | | | | |

+-----------------------------------------+--------+---------+---------+----------+

| Basic earnings per share | 7 | 12.5p | 42.1p | 78.8p |

+-----------------------------------------+--------+---------+---------+----------+

| Diluted earnings per share | 7 | 12.3p | 41.3p | 77.4p |

+-----------------------------------------+--------+---------+---------+----------+

Consolidated Statement of Comprehensive Income

for the half year ended 30 June 2010

+-----------------------------------------+--------+--------+--------+----------+

| | | Half | Half | Year |

| | | year | year | to 31 |

| | | to 30 | to 30 | December |

| | | June | June | 2009 |

| | | 2010 | 2009 | |

+-----------------------------------------+--------+--------+--------+----------+

| | | GBPm | GBPm | GBPm |

+-----------------------------------------+--------+--------+--------+----------+

| | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| Profit for the period | | 8.1 | 27.9 | 52.1 |

+-----------------------------------------+--------+--------+--------+----------+

| | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| Other comprehensive income | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| Exchange differences on translation of | | (15.5) | (31.0) | (14.5) |

| foreign operations | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| Net investment hedge (losses)/gains | | (0.7) | 8.9 | 6.1 |

+-----------------------------------------+--------+--------+--------+----------+

| Cash flow hedge (losses)/gains taken to | | (6.2) | 15.5 | 11.3 |

| equity | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| Cash flow hedge transfers to income | | 6.2 | (15.5) | (11.3) |

| statement | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| Actuarial gains/(losses) on defined | | 0.1 | (5.1) | (7.9) |

| benefit pension schemes | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| Tax on actuarial losses on defined | | - | 1.4 | 2.2 |

| benefit pension schemes | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| Other comprehensive income for the | | (16.1) | (25.8) | (14.1) |

| period, net of tax | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| Total comprehensive income for the | | (8.0) | 2.1 | 38.0 |

| period | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| Attributable to: | | | | |

+-----------------------------------------+--------+--------+--------+----------+

| Equity holders of the parent | | (7.1) | 2.4 | 37.2 |

+-----------------------------------------+--------+--------+--------+----------+

| Minority interests | | (0.9) | (0.3) | 0.8 |

+-----------------------------------------+--------+--------+--------+----------+

| | | (8.0) | 2.1 | 38.0 |

+-----------------------------------------+--------+--------+--------+----------+

Consolidated Balance Sheet

as at 30 June 2010

+-----------------------------------------+--------+---------+----------+----------+

| | | As at | As at | As at |

| | | 30 | 30 | 31 |

| | | June | June | December |

| | | 2010 | 2009 | 2009 |

+-----------------------------------------+--------+---------+----------+----------+

| | Note | GBPm | GBPm | GBPm |

+-----------------------------------------+--------+---------+----------+----------+

| Assets | | | | |

+-----------------------------------------+--------+---------+----------+----------+

| Non-current assets | | | | |

+-----------------------------------------+--------+---------+----------+----------+

| Intangible assets | | 128.0 | 99.9 | 119.1 |

+-----------------------------------------+--------+---------+----------+----------+

| Property, plant and equipment | | 261.3 | 237.5 | 264.4 |

+-----------------------------------------+--------+---------+----------+----------+

| Deferred tax assets | | 8.8 | 8.0 | 8.1 |

+-----------------------------------------+--------+---------+----------+----------+

| Other assets | | 16.2 | 12.0 | 12.7 |

+-----------------------------------------+--------+---------+----------+----------+

| | | 414.3 | 357.4 | 404.3 |

+-----------------------------------------+--------+---------+----------+----------+

| Current assets | | | | |

+-----------------------------------------+--------+---------+----------+----------+

| Inventories | | 37.8 | 41.8 | 37.4 |

+-----------------------------------------+--------+---------+----------+----------+

| Trade and other receivables | | 313.6 | 328.6 | 299.9 |

+-----------------------------------------+--------+---------+----------+----------+

| Current tax assets | | 7.2 | 1.7 | 5.9 |

+-----------------------------------------+--------+---------+----------+----------+

| Cash and cash equivalents | 8 | 30.2 | 27.4 | 35.3 |

+-----------------------------------------+--------+---------+----------+----------+

| | | 388.8 | 399.5 | 378.5 |

+-----------------------------------------+--------+---------+----------+----------+

| Total assets | | 803.1 | 756.9 | 782.8 |

+-----------------------------------------+--------+---------+----------+----------+

| Liabilities | | | | |

+-----------------------------------------+--------+---------+----------+----------+

| Current liabilities | | | | |

+-----------------------------------------+--------+---------+----------+----------+

| Loans and borrowings | 8 | (79.2) | (9.7) | (7.9) |

+-----------------------------------------+--------+---------+----------+----------+

| Current tax liabilities | | (4.3) | (11.3) | (9.0) |

+-----------------------------------------+--------+---------+----------+----------+

| Trade and other payables | | (248.5) | (266.3) | (252.3) |

+-----------------------------------------+--------+---------+----------+----------+

| Provisions | | (6.8) | (6.7) | (6.3) |

+-----------------------------------------+--------+---------+----------+----------+

| | | (338.8) | (294.0) | (275.5) |

+-----------------------------------------+--------+---------+----------+----------+

| Non-current liabilities | | | | |

+-----------------------------------------+--------+---------+----------+----------+

| Loans and borrowings | 8 | (72.5) | (113.0) | (106.2) |

+-----------------------------------------+--------+---------+----------+----------+

| Retirement benefit liabilities | | (19.0) | (17.2) | (20.2) |

+-----------------------------------------+--------+---------+----------+----------+

| Deferred tax liabilities | | (20.9) | (14.4) | (19.6) |

+-----------------------------------------+--------+---------+----------+----------+

| Provisions | | (5.0) | (4.4) | (4.2) |

+-----------------------------------------+--------+---------+----------+----------+

| Other liabilities | | (40.9) | (21.8) | (33.8) |

+-----------------------------------------+--------+---------+----------+----------+

| | | (158.3) | (170.8) | (184.0) |

+-----------------------------------------+--------+---------+----------+----------+

| Total liabilities | | (497.1) | (464.8) | (459.5) |

+-----------------------------------------+--------+---------+----------+----------+

| Net Assets | | 306.0 | 292.1 | 323.3 |

+-----------------------------------------+--------+---------+----------+----------+

| Equity | | | | |

+-----------------------------------------+--------+---------+----------+----------+

| Share capital | | 6.6 | 6.6 | 6.6 |

+-----------------------------------------+--------+---------+----------+----------+

| Share premium account | | 38.0 | 37.8 | 38.0 |

+-----------------------------------------+--------+---------+----------+----------+

| Capital redemption reserve | | 7.6 | 7.6 | 7.6 |

+-----------------------------------------+--------+---------+----------+----------+

| Translation reserve | | 21.2 | 23.1 | 36.4 |

+-----------------------------------------+--------+---------+----------+----------+

| Retained earnings | | 223.2 | 206.8 | 224.1 |

+-----------------------------------------+--------+---------+----------+----------+

| Equity attributable to equity holders | | 296.6 | 281.9 | 312.7 |

| of the parent | | | | |

+-----------------------------------------+--------+---------+----------+----------+

| Minority interests | | 9.4 | 10.2 | 10.6 |

+-----------------------------------------+--------+---------+----------+----------+

| Total equity | | 306.0 | 292.1 | 323.3 |

+-----------------------------------------+--------+---------+----------+----------+

Condensed Consolidated Statement of Changes in Equity

for the half year ended 30 June 2010

+--------------------+---------+---------+------------+-------------+----------+----------+--------+

| | Share | Share | Capital | Translation | Retained | Minority | Total |

| | capital | premium | redemption | reserve | earnings | interest | equity |

| | | account | reserve | | | | |

+--------------------+---------+---------+------------+-------------+----------+----------+--------+

| | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm |

+--------------------+---------+---------+------------+-------------+----------+----------+--------+

| At 30 June 2009 | 6.6 | 37.8 | 7.6 | 23.1 | 206.8 | 10.2 | 292.1 |

+--------------------+---------+---------+------------+-------------+----------+----------+--------+

| At 31 December | 6.6 | 38.0 | 7.6 | 36.4 | 224.1 | 10.6 | 323.3 |

| 2009 | | | | | | | |

+--------------------+---------+---------+------------+-------------+----------+----------+--------+

| Total | - | - | - | (15.2) | 8.1 | (0.9) | (8.0) |

| comprehensive | | | | | | | |

| income | | | | | | | |

+--------------------+---------+---------+------------+-------------+----------+----------+--------+

| Share-based | - | - | - | - | 0.3 | - | 0.3 |

| payments | | | | | | | |

+--------------------+---------+---------+------------+-------------+----------+----------+--------+

| Dividends | - | - | - | - | (9.3) | (0.3) | (9.6) |

+--------------------+---------+---------+------------+-------------+----------+----------+--------+

| At 30 June 2010 | 6.6 | 38.0 | 7.6 | 21.2 | 223.2 | 9.4 | 306.0 |

+--------------------+---------+---------+------------+-------------+----------+----------+--------+

Consolidated Cash Flow Statement

for the half year ended 30 June 2010

+----------------------------------------------+------+--------+--------+----------+

| | | Half | Half | Year |

| | | year | year | to |

| | | to 30 | to | 31 |

| | | June | 30 | December |

| | | 2010 | June | 2009 |

| | | | 2009 | |

+----------------------------------------------+------+--------+--------+----------+

| | Note | GBPm | GBPm | GBPm |

+----------------------------------------------+------+--------+--------+----------+

| Cash flows from operating activities | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Operating profit | | 13.7 | 42.8 | 77.3 |

+----------------------------------------------+------+--------+--------+----------+

| Depreciation of property, plant and | | 19.4 | 16.8 | 34.4 |

| equipment | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Amortisation of intangible assets | | 0.3 | 0.5 | 1.5 |

+----------------------------------------------+------+--------+--------+----------+

| Loss/(profit) on sale of property, plant and | | 0.1 | - | (1.2) |

| equipment | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Other non-cash movements | | 0.3 | - | 0.5 |

+----------------------------------------------+------+--------+--------+----------+

| Foreign exchange losses/(gains) | | 0.6 | (1.8) | (0.1) |

+----------------------------------------------+------+--------+--------+----------+

| Operating cash flows before movements in | | 34.4 | 58.3 | 112.4 |

| working capital | | | | |

+----------------------------------------------+------+--------+--------+----------+

| (Increase)/decrease in inventories | | (1.0) | 4.4 | 10.2 |

+----------------------------------------------+------+--------+--------+----------+

| (Increase)/decrease in trade and other | | (17.2) | (0.8) | 50.2 |

| receivables | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Decrease in trade and other payables | | (0.9) | (24.5) | (52.5) |

+----------------------------------------------+------+--------+--------+----------+

| Change in provisions, retirement benefit and | | (0.3) | 2.7 | 2.9 |

| other non-current liabilities | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Cash generated from operations | | 15.0 | 40.1 | 123.2 |

+----------------------------------------------+------+--------+--------+----------+

| Interest paid | | (1.5) | (2.4) | (4.8) |

+----------------------------------------------+------+--------+--------+----------+

| Income tax paid | | (7.3) | (14.5) | (30.0) |

+----------------------------------------------+------+--------+--------+----------+

| Net cash inflow from operating activities | | 6.2 | 23.2 | 88.4 |

+----------------------------------------------+------+--------+--------+----------+

| | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Cash flows from investing activities | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Interest received | | 0.5 | 0.2 | 0.3 |

+----------------------------------------------+------+--------+--------+----------+

| Proceeds from sale of property, plant and | | 0.3 | 0.6 | 4.5 |

| equipment | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Acquisition of subsidiaries, net of cash | | (22.2) | (7.6) | (34.7) |

| acquired | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Acquisition of property, plant and equipment | | (12.7) | (23.2) | (39.3) |

+----------------------------------------------+------+--------+--------+----------+

| Acquisition of intangible assets | | - | (0.5) | (0.7) |

+----------------------------------------------+------+--------+--------+----------+

| Acquisition of other non-current assets | | (0.4) | (2.0) | (0.8) |

+----------------------------------------------+------+--------+--------+----------+

| Net cash outflow from investing activities | | (34.5) | (32.5) | (70.7) |

+----------------------------------------------+------+--------+--------+----------+

| | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Cash flows from financing activities | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Proceeds from the issue of share capital | | - | 0.2 | 0.4 |

+----------------------------------------------+------+--------+--------+----------+

| Repurchase of own shares | | - | (1.6) | (1.6) |

+----------------------------------------------+------+--------+--------+----------+

| New borrowings | | 41.5 | 11.5 | 7.0 |

+----------------------------------------------+------+--------+--------+----------+

| Repayment of borrowings | | (10.0) | (10.5) | (12.7) |

+----------------------------------------------+------+--------+--------+----------+

| Payment of finance lease liabilities | | - | (0.7) | (5.6) |

+----------------------------------------------+------+--------+--------+----------+

| Dividends paid | | (9.7) | (11.3) | (17.4) |

+----------------------------------------------+------+--------+--------+----------+

| Net cash inflow/(outflow) from financing | | 21.8 | (12.4) | (29.9) |

| activities | | | | |

+----------------------------------------------+------+--------+--------+----------+

| | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Net decrease in cash and cash equivalents | | (6.5) | (21.7) | (12.2) |

+----------------------------------------------+------+--------+--------+----------+

| Cash and cash equivalents at beginning of | | 29.3 | 46.5 | 46.5 |

| period | | | | |

+----------------------------------------------+------+--------+--------+----------+

| Effect of exchange rate fluctuations | | (2.1) | (4.0) | (5.0) |

+----------------------------------------------+------+--------+--------+----------+

| Cash and cash equivalents at end of period | 8 | 20.7 | 20.8 | 29.3 |

+----------------------------------------------+------+--------+--------+----------+

Responsibility Statement

We confirm that to the best of our knowledge:

a) the condensed set of financial statements has been prepared in accordance

with IAS 34 - Interim Financial Reporting;

b) the interim management report includes a fair review of the information

required by DTR 4.2.7R - indication of important events during the first six

months and description of principal risks and uncertainties for the remaining

six months of the year; and

c) the interim management report includes a fair review of the information

required by DTR 4.2.8R - disclosure of related party transactions and changes

therein.

By order of the Board

J R Atkinson Chief Executive

J W G Hind Finance Director

Notes to the Condensed Financial Statements

Half year ended 30 June 2010

1. Basis of preparation

The condensed financial statements included in this interim financial report

have been prepared in accordance with IAS 34 - Interim Financial Reporting, as

adopted by the European Union. They do not include all of the information

required for full annual financial statements, and should be read in conjunction

with the consolidated financial statements of the Group as at and for the year

ended 31 December 2009. The same accounting policies and presentation are

followed in the financial statements that were applied in the preparation of the

Company's published consolidated financial statements for the year ended 31

December 2009 apart from the following:

The Company has adopted the following revision and amendments to standards: IFRS

3 Business Combinations; IAS 27 Consolidated and Separate Financial Statements;

and IFRS 2 Group Cash-settled Share-based Payment Transactions. The adoption of

this revision and amendments did not have a material impact on the condensed

consolidated financial statements. IFRS 3 (revised) may have a significant

impact on future operating profits due to the requirement to take any

differences between actual and originally estimated deferred payments relating

to acquisitions made after 1 January 2010 into the income statement, following

the measurement period.

The figures for the year ended 31 December 2009 are not statutory accounts but

have been extracted from the Group's statutory accounts for that financial year.

The auditor's report on those accounts was not qualified and did not contain

statements under section 498(2) or (3) of the Companies Act 2006. A copy of the

statutory accounts for that year has been delivered to the Registrar of

Companies and has been made available on the Company's website at

www.keller.co.uk.

The financial information in this interim financial report for the half years

ended 30 June 2010 and 30 June 2009 has neither been reviewed, nor audited.

The key risks and uncertainties facing the Group, as explained in the Group's

Annual Report for the year ended 31 December 2009, continue to be: market

cycles, acquisitions, technical risk and people.

2. Foreign currencies

The exchange rates used in respect of principal currencies are:

+------------------------+--------+--------+----------+--------+--------+----------+

| | Average for Period | Period End |

+------------------------+----------------------------+----------------------------+

| | Half | Half | Year | Half | Half | Year |

| | year | year | to | year | year | to |

| | to | to | 31 | to | to | 31 |

| | 30 | 30 | December | 30 | 30 | December |

| | June | June | 2009 | June | June | 2009 |

| | 2010 | 2009 | | 2010 | 2009 | |

+------------------------+--------+--------+----------+--------+--------+----------+

| US dollar: | 1.53 | 1.49 | 1.57 | 1.51 | 1.65 | 1.59 |

+------------------------+--------+--------+----------+--------+--------+----------+

| Euro: | 1.15 | 1.12 | 1.12 | 1.23 | 1.18 | 1.11 |

+------------------------+--------+--------+----------+--------+--------+----------+

| Australian dollar: | 1.71 | 2.10 | 1.99 | 1.76 | 2.05 | 1.78 |

+------------------------+--------+--------+----------+--------+--------+----------+

3. Segmental analysis

The Group is managed as four geographical divisions and has only one major

product or service: specialist ground engineering services. This is reflected in

the Group's management structure and in the segment information reviewed by the

Chief Operating Decision Maker. There have been no material changes to the

assets of these segments since the year end other than in Australia as disclosed

in note 4. Revenue and operating profit of the four reportable segments is given

below:

+------------------------+--------+--------+----------+--------+--------+----------+

| | Revenue | Operating profit |

+------------------------+----------------------------+----------------------------+

| | Half | Half | Year | Half | Half | Year |

| | year | year | to | year | year | to |

| | to | to | 31 | to | to | 31 |

| | 30 | 30 | December | 30 | 30 | December |

| | June | June | 2009 | June | June | 2009 |

| | 2010 | 2009 | | 2010 | 2009 | |

+------------------------+--------+--------+----------+--------+--------+----------+

| | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm |

+------------------------+--------+--------+----------+--------+--------+----------+

| UK | 28.1 | 30.7 | 57.6 | (0.1) | (0.4) | 0.5 |

+------------------------+--------+--------+----------+--------+--------+----------+

| US | 198.0 | 268.0 | 467.0 | (1.0) | 18.6 | 32.2 |

+------------------------+--------+--------+----------+--------+--------+----------+

| CEMEA 1 | 190.1 | 191.1 | 386.4 | 9.3 | 20.4 | 33.6 |

+------------------------+--------+--------+----------+--------+--------+----------+

| Australia | 80.7 | 62.8 | 126.9 | 8.0 | 6.2 | 16.6 |

+------------------------+--------+--------+----------+--------+--------+----------+

| | 496.9 | 552.6 | 1,037.9 | 16.2 | 44.8 | 82.9 |

+------------------------+--------+--------+----------+--------+--------+----------+

| Central items and | - | - | - | (2.5) | (2.0) | (5.6) |

| eliminations | | | | | | |

+------------------------+--------+--------+----------+--------+--------+----------+

| | 496.9 | 552.6 | 1,037.9 | 13.7 | 42.8 | 77.3 |

+------------------------+--------+--------+----------+--------+--------+----------+

1 Continental Europe, Middle East and Asia.

4. Acquisitions

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| | Waterway | Nilex | Total |

+----------------+-------------------------------+-------------------------------+-------------------------------+

| | Carrying | Fair | Fair | Carrying | Fair | Fair | Carrying | Fair | Fair |

| | amount | value | value | amount | value | value | amount | value | value |

| | | adjustment | | | adjustment | | | adjustment | |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Net assets | | | | | | | | | |

| acquired | | | | | | | | | |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Intangible | 0.1 | 1.2 | 1.3 | 0.1 | 0.3 | 0.4 | 0.2 | 1.5 | 1.7 |

| assets | | | | | | | | | |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Property, | 8.0 | 2.9 | 10.9 | 1.4 | (0.2) | 1.2 | 9.4 | 2.7 | 12.1 |

| plant and | | | | | | | | | |

| equipment | | | | | | | | | |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Cash and cash | 9.3 | - | 9.3 | - | - | - | 9.3 | - | 9.3 |

| equivalents | | | | | | | | | |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Receivables | 2.4 | - | 2.4 | 3.2 | - | 3.2 | 5.6 | - | 5.6 |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Other assets | 0.5 | - | 0.5 | 0.6 | - | 0.6 | 1.1 | - | 1.1 |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Loans and | (4.9) | - | (4.9) | - | - | - | (4.9) | - | (4.9) |

| borrowings | | | | | | | | | |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Other | (4.7) | (0.4) | (5.1) | (0.7) | - | (0.7) | (5.4) | (0.4) | (5.8) |

| liabilities | | | | | | | | | |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| | 10.7 | 3.7 | 14.4 | 4.6 | 0.1 | 4.7 | 15.3 | 3.8 | 19.1 |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Goodwill | | | 9.1 | | | - | | | 9.1 |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Total | | | 23.5 | | | 4.7 | | | 28.2 |

| consideration | | | | | | | | | |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| | | | | | | | | | |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Satisfied by: | | | | | | | | | |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Initial cash | | | 21.7 | | | 4.7 | | | 26.4 |

| consideration | | | | | | | | | |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| Deferred | | | 1.8 | | | - | | | 1.8 |

| consideration | | | | | | | | | |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

| | | | 23.5 | | | 4.7 | | | 28.2 |

+----------------+----------+------------+-------+----------+------------+-------+----------+------------+-------+

On 10 June 2010 the Group acquired 100% of the share capital of Waterfront

Services Pty Limited, Australia, with subsidiaries, trading as Waterway

Constructions ('Waterway'). The provisional fair value of the intangible assets

acquired represents the fair value of customer contracts at the date of

acquisition. The goodwill arising on acquisition is attributable to the

knowledge and expertise of the assembled workforce and the operating synergies

that arise from the Group's strengthened market position. Deferred consideration

of up to GBP9.7m (A$16.5m) is payable based on total earnings before interest

and tax in the three year-period to 30 June 2013.

On 14 June 2010 the Group acquired selected assets and businesses of Nilex

Construction LLC and other entities (collectively 'Nilex'), the leading wick

drain contractor in the United States and Canada. The acquisition provides a

good strategic fit, complementing the Group's existing ground improvement

offering. Deferred consideration of up to GBP0.7m ($1.0m) is payable based on

total earnings before interest and tax in the two year-period to 30 June 2012.

The fair value of the total receivables in both acquisitions is not materially

different from the gross contractual amounts receivable and is expected to be

recovered in full. In the period to 30 June 2010 Waterway and Nilex made no

contribution to the net profit of the Group. Had both acquisitions taken place

on 1 January 2010, total Group revenue would have been GBP518.0m and total net

profit would have been GBP9.6m.

5. Taxation

Taxation from continuing operations, representing management's best estimate of

the average annual effective income tax rate expected for the full year, based

on the profit before tax is: 28% (half year ended 30 June 2009: 32%; year ended

31 December 2009: 30%).

6. Dividends paid to equity holders of the parent

Ordinary dividends on equity shares:

+--------------------------------------------------+--------+--------+----------+

| | Half | Half | Year |

| | year | year | to |

| | to 30 | to 30 | 31 |

| | June | June | December |

| | 2010 | 2009 | 2009 |

+--------------------------------------------------+--------+--------+----------+

| | GBPm | GBPm | GBPm |

+--------------------------------------------------+--------+--------+----------+

| Amounts recognised as distributions to equity | | | |

| holders in the period: | | | |

+--------------------------------------------------+--------+--------+----------+

| Final dividend for the year ended 31 December | - | 8.8 | 8.8 |

| 2008 of 13.8p per share | | | |

+--------------------------------------------------+--------+--------+----------+

| Interim dividend for the year ended 31 December | | | |

| 2009 of 7.25p (2008: 6.9p) per share | - | - | 4.7 |

+--------------------------------------------------+--------+--------+----------+

| Second interim dividend for the year ended 31 | | | |

| December 2009 of 14.5p per share in lieu of a | 9.3 | - | - |

| final dividend | | | |

+--------------------------------------------------+--------+--------+----------+

| | 9.3 | 8.8 | 13.5 |

+--------------------------------------------------+--------+--------+----------+

In addition to the above, an interim ordinary dividend of 7.6p per share (2009:

7.25p) will be paid on 1 November 2010 to shareholders on the register at 8

October 2010. This proposed dividend has not been included as a liability in

these financial statements and will be accounted for in the period in which it

is paid.

7. Earnings per share

Earnings for the purposes of calculating the basic and diluted earnings per

share were GBP8.0m (half year ended 30 June 2009: GBP26.9m; year ended 31

December 2009: GBP50.4m).

The weighted average number of shares for the purposes of calculating the basic

and diluted earnings per share was 64.2m (half year ended 30 June 2009: 63.9m;

year ended 31 December 2009: 64.0m) and 65.3m (half year ended 30 June 2009:

65.1m; year ended 31 December 2009: 65.1m) respectively.

The total number of shares held in Treasury was 2.2m (30 June 2009: 2.3m; 31

December 2009: 2.2m).

During 2009, the Company purchased 330,000 shares specifically to satisfy

Performance Share Plan awards. The average cost of purchased shares in 2009 was

GBP4.81. No shares were purchased in the half year ended 30 June 2010. All

shares issued related to share options exercised.

8. Analysis of closing net debt

+-----------------------------------------+--------+---------+---------+----------+

| | | As at | As at | As at |

| | | 30 | 30 | 31 |

| | | June | June | December |

| | | 2010 | 2009 | 2009 |

+-----------------------------------------+--------+---------+---------+----------+

| | | GBPm | GBPm | GBPm |

+-----------------------------------------+--------+---------+---------+----------+

| Bank balances | | 25.9 | 25.7 | 34.7 |

+-----------------------------------------+--------+---------+---------+----------+

| Short-term deposits | | 4.3 | 1.7 | 0.6 |

+-----------------------------------------+--------+---------+---------+----------+

| Cash and cash equivalents in the | | 30.2 | 27.4 | 35.3 |

| balance sheet | | | | |

+-----------------------------------------+--------+---------+---------+----------+

| Bank overdrafts | | (9.5) | (6.6) | (6.0) |

+-----------------------------------------+--------+---------+---------+----------+

| Cash and cash equivalents in the cash | | 20.7 | 20.8 | 29.3 |

| flow statement | | | | |

+-----------------------------------------+--------+---------+---------+----------+

| Bank and other loans | | (135.5) | (113.1) | (105.9) |

+-----------------------------------------+--------+---------+---------+----------+

| Finance leases | | (6.7) | (3.0) | (2.2) |

+-----------------------------------------+--------+---------+---------+----------+

| Closing net debt | | (121.5) | (95.3) | (78.8) |

+-----------------------------------------+--------+---------+---------+----------+

9. Related party transactions

Transactions between the parent, its subsidiaries and jointly controlled

operations, which are related parties, have been eliminated on consolidation and

are not disclosed in this note.

During the period the Group undertook various contracts with a total value of

GBP1.5m (half year to 30 June 2009: GBP3.8m; year ended 31 December 2009:

GBP9.0m) for GTCEISU Construcción, S.A., a connected person of Mr López Jiménez,

a Director of the Company. An amount of GBP1.4m (30 June 2009: GBP5.7m; 31

December 2009: GBP6.9m) is included in trade and other receivables in respect of

amounts outstanding as at 30 June 2010. During the period the Group made

purchases from GTCEISU Construcción, S.A with a total value of GBP2.0m (half

year to 30 June 2009: GBP2.7m; year ended 31 December 2009: GBP6.0m). An amount

of GBP4.0m (30 June 2009: GBP5.1m; 31 December 2009: GBP3.8m) is included in

trade and other payables in respect of amounts outstanding as at 30 June 2010.

All amounts outstanding from related parties are unsecured and will be settled

in cash. No guarantees have been given or received. No provisions have been made

for doubtful debts in respect of the amounts owed by related parties.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR URUBRRAABOAR

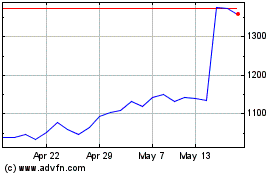

Keller (LSE:KLR)

Historical Stock Chart

From Jun 2024 to Jul 2024

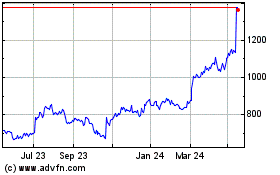

Keller (LSE:KLR)

Historical Stock Chart

From Jul 2023 to Jul 2024