TIDMKEFI

RNS Number : 4024L

Kefi Gold and Copper PLC

05 September 2023

5 September 2023

KEFI Gold and Copper plc

("KEFI" or the "Company")

Ethiopia Operational Update

Tulu Kapi Gold Project Nears Construction Startup

KEFI Gold and Copper Plc (AIM: KEFI), the gold and copper

exploration and development company, has focused on the

Arabian-Nubian Shield since 2008, assembling a pipeline of projects

in the Federal Democratic Republic of Ethiopia and in the Kingdom

of Saudi Arabia. We are pleased to provide this operational update

covering developments in Ethiopia since the release of the

Company's Quarterly Operational Update on 9 August 2023.

The period between now and the end of 2023 is particularly

important for KEFI and regular updates will be announced. This

update encompasses the activities of KEFI, as well as wholly owned

KEFI Minerals (Ethiopia) Ltd ("KME") and majority-owned Tulu Kapi

Gold Mines Share Company ("TKGM") also in Ethiopia . A further

update on the Company's activities in Saudi Arabia is expected to

be announced shortly.

Ethiopia

Tulu Kapi Gold Project

KEFI is focused primarily on developing the advanced Tulu Kapi

Gold Project in Ethiopia. Tulu Kapi has a Probable Ore Reserve of

1.05 million ounces and Mineral Resources totalling 1.7 million

ounces. Average planned gold production at Tulu Kapi is forecast to

be over 140,000 ounces/year at an All-in Sustaining Cost of

approximately US$950/ounce. Almost all the pre-requisites to begin

construction are now in place. We remain focused on final credit

and board approvals for the project financing, ahead of project

launch in Q4 2023, with first production expected by the end of

2025.

Government Facing Agreements

The necessary Ethiopian laws and regulations continue to be

revised in conjunction with the finalisation of the syndicate's

definitive agreements amongst itself and with Government agencies.

This week's activities include:

-- Syndicate lenders meeting with the Company in Addis Ababa

finalising details with the National Bank of Ethiopia ("NBE", being

the Ethiopian central bank) as regards capital controls. A recent

development was the publication of a new NBE Directive on 14 August

2023 in respect of foreign exchange controls, which is now being

combined with TKGM specific project details. The changes within the

Directive are positive for the country and KEFI is incorporating

for its own situation. This is one of the final action points

remaining to completion of the Tulu Kapi financing package. The

meeting will address the specific details and documentation

requirements flowing from these changes with respect to the Tulu

Kapi development;

-- Other project finance syndicate members are meeting with the

Company and the Ethiopian Ministry of Mines ("EMM") in Perth

Australia, addressing the few remaining loose-ends with EMM-facing

agreements. These parties have also been taking part in instructive

mine and processing plant inspections while in Australia. A recent

development was the publication by the EMM of a draft new Mining

Proclamation, which is now being compared with TKGM specific

project details; and

-- Field teams meeting local government in zonal government

centre Ghimbi and municipal government centre Genji, planning the

launch of community programmes.

Technical and Organisational Preparations

-- Independent technical expert to the lenders, Behre Dolbear

International ("BDI") has reported and confirmed TKGM's readiness

for development launch;

-- Elevation of security protection in the district around the

project site and our offices with regular independent monitoring by

security expert Constellis, whose recent report concluded that

TKGM's approach to securing the mining licence area, its other

sites and the routes in and out are sensible, pragmatic and in-line

with security best management practice; and

-- Grade-control drill-planning for 2024 open-pit operational

readiness programmes and resource-extensional drilling-planning for

the 2024-2025 underground mine feasibility study.

Regional Project Financing

-- Historical pre-development expenditure of c.US$90 million was

funded via equity and sourced from stock markets in the UK,

Australia and Canada;

-- Over the past month, details of the US$390 million

development funding have been further refined within the finance

syndicate, all members of which are active in the region and plan

to inject funds at the subsidiary level, as follows:

o Mining services contractor provides US$70 million mining fleet

against TKGM mining services agreement;

o Project finance US$320 million:

-- debt-risk capital (senior and subordinated) represents

approximately 60% (US$190 million of US$320 million) to be injected

at the TKGM level by our co-lenders;

-- equity-risk capital of US$130M to be injected as:

-- US$40 million share capital to local partners in subsidiary companies;

-- US$90 million from major international corporations in the form of Equity Risk Notes ("ERN"):

o Some of the ERN's are non-convertible and repayable in cash

only out of future revenue; and

o Some of the ERN's are potentially convertible into KEFI shares

as from the end of the third year after funds drawdown (at the

higher of the price at funds drawdown and the then market prices

based on VWAP) unless, at KEFI's election, it is repaid in cash

(which is considered feasible given the estimated healthy surplus

cash generation from the Project at or near current long-term

consensus gold price of US$1,850/ounce).

Group Development Sequencing

The critical first step is the Tulu Kapi project finance

closing. With the existing pipeline of advanced projects, the

targeted project sequencing is as follows:

-- Ethiopia:

o 2023: Launch development of Tulu Kapi open-pit in Ethiopia for

first production end-2025;

o 2024: PFS on the Tulu Kapi underground mine for commencement

of development after open pit production has settled down; and

o 2025: DFS on the Tulu Kapi underground mine.

-- Saudi Arabia:

o 2024: complete DFS, permitting, financing and launch of

development at Jibal Qutman Gold in Saudi Arabia; and

o 2025: complete DFS, permitting, financing and launch of

development at Hawiah Copper-Gold in Saudi Arabia.

-- Regional Exploration:

o We have a large pipeline of additional exploration projects,

with 15 recently granted Exploration Licences in Saudi Arabia and

many applications pending in Ethiopia.

Investor Webinar

The quarterly open-forum webinar will be held at 12.00 noon,

London time, on Friday 8 September 2023, via the Investor Meet

Company platform.

The presentation is open to all existing and potential

shareholders. Questions can be submitted pre-event via your

Investor Meet Company dashboard up until 9am the day before the

meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet KEFI Gold and Copper plc via:

https://www.investormeetcompany.com/kefi-gold-and-copper-plc/register-investor

Investors who already follow KEFI Gold and Copper plc on the

Investor Meet Company platform will automatically be invited.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries

KEFI Gold and Copper plc

Harry Anagnostaras-Adams (Managing Director) +357 99457843

John Leach (Finance Director) +357 99208130

SP Angel Corporate Finance LLP (Nominated

Adviser) +44 (0) 20 3470 0470

Jeff Keating, Adam Cowl

Tavira Securities Limited (Lead Broker) +44 (0) 20 7100 5100

Oliver Stansfield, Jonathan Evans

IFC Advisory Ltd (Financial PR and IR) +44 (0) 20 3934 6630

Tim Metcalfe, Florence Chandler

3PPB LLC International (Institutional IR)

Patrick Chidley +1 (917) 991 7701

Paul Durham + 1 (203) 940 2538

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFZGGLKKFGFZG

(END) Dow Jones Newswires

September 05, 2023 02:00 ET (06:00 GMT)

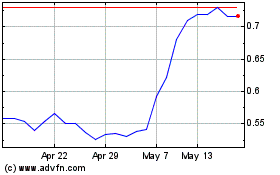

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Nov 2023 to Nov 2024