TIDMJDW

RNS Number : 4110U

Wetherspoon (JD) PLC

17 January 2017

18 January 2017

J D WETHERSPOON PLC

Q2 Trading Update

J D Wetherspoon plc ('J D Wetherspoon' or 'the Company')

announces an update on current trading, before entering its close

period for its interim results, for the six months ending 22

January 2017, which are expected to be announced on 10 March

2017.

Current trading

For the first 12 weeks of the second quarter (to 15 January

2017), like-for-like sales increased by 3.2% and total sales by

0.7%. In the year to date (25 weeks to 15 January 2017),

like-for-like sales increased by 3.4% and total sales increased by

1.6%.

We expect the operating margin (before any exceptional items)

for the half year ending 22 January 2017 to be around 8.0%, 1.7%

higher than the same period last year.

Property

The Company has opened two new pubs, since the start of the

financial year, and has sold 21. We intend to open 10 to 15 pubs in

the current financial year. We have now sold the majority of those

pubs which had been put on the market in 2016, with a remaining

small number which is either 'under offer' and going through the

sales process or being marketed by our agents.

Financial position

The Company remains in a sound financial position. Net debt at

the end of this financial year is currently expected to be around

GBP50m higher than the level at the last financial year end, partly

as a result of the purchase of an increased number of freehold

reversions.

Outlook

The chairman of J D Wetherspoon, Tim Martin, said:

"In recent weeks, I have been asked frequently by the media to

comment on the difference between the apocalyptic predictions by

most economists for the economy and the actual outcome, following

the referendum.

"The Bank of England's chief economist, Andy Haldane, called

these predictions a 'Michael Fish' moment for economists, but his

comments demonstrate a deep misunderstanding of the situation.

"Michael Fish's predictions were a misinterpretation of data on

one evening, under great time pressure. In contrast, the majority

of economists, economic institutions, politicians and intellectuals

has consistently misunderstood the implications of the euro, its

predecessor the exchange rate mechanism and the implications of

leaving the EU, over a period of about 30 years.

"The underlying reason for their catastrophically poor judgement

is a semi-religious belief in a new type of political and economic

system, represented by the EU, which lacks both proper democratic

institutions and the basic ingredient for a successful currency - a

government.

"It also lacks any genuine commitment to free trade, other than

to countries which are in, or on the borders of, the EU. Unless

these lessons are learned and acknowledged by economists, their

historic mistakes will be repeated.

"As regards the other frequently asked question about the

government's stance on dealing with the EU, the golden rule in any

negotiations, ignored by David Cameron, is the willingness to walk

away.

"Most people now understand that the mutual imposition of World

Trade Organisation (WTO) tariffs would create a windfall for the

UK, so a sensible basic mantra for the UK is 'free trade or World

Trade Organisation rules - the EU can choose'.

"As previously indicated, the Company anticipates significantly

higher costs in the second half of the financial year. On an

annualised basis, these are expected to rise by about 4% for wages,

by GBP7m for business rates and by GBP2m for the Apprenticeship

Levy, in addition to cost increases at around the level of

inflation in other areas. As previously announced, the Company

intends to increase the level of capital investment in existing

pubs from GBP34m in 2015/6 to around GBP60m in the current

year.

"In view of these additional costs and our expectation that

like-for-like sales will be lower in the next six months, the

Company remains cautious about the second half of the year.

Nevertheless, as a result of modestly better-than-expected

year-to-date sales, we currently anticipate a slightly improved

trading outcome for the current financial year, compared with our

expectations at the last update."

Enquiries:

John Hutson Chief Executive Officer 01923 477777

Ben Whitley Finance Director 01923 477777

Eddie Gershon Company Spokesman 07956 392234

Notes to editors

1. J D Wetherspoon owns and operates pubs throughout the UK. The Company aims

to provide customers with good-quality food and drink, served by

well-trained and friendly staff, at reasonable prices. The pubs are

individually designed, and the Company aims

to maintain them in excellent condition.

2. Visit our website: www.jdwetherspoon.com

3. This announcement has been prepared solely to provide

additional information to the shareholders of J D Wetherspoon, to

meet the requirements of the FCA's Disclosure and Transparency

Rules. It should not be relied on by any other party, for any other

purposes. Forward-looking statements have been made by the

directors in good faith, using information available up until the

date on which they approved this statement. Forward-looking

statements should be regarded with caution, because of the inherent

uncertainties in economic trends and business risks.

4. This announcement contains inside information on J D Wetherspoon plc.

5. The current financial year comprises 53 trading weeks to 30 July 2017.

6. The next trading update is expected to be the Company's interim results statement

on 10 March 2017.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTMMGMMGNGGNZZ

(END) Dow Jones Newswires

January 18, 2017 02:00 ET (07:00 GMT)

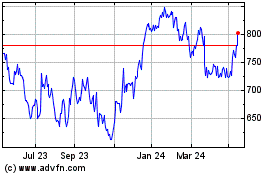

Wetherspoon ( J.d.) (LSE:JDW)

Historical Stock Chart

From Feb 2025 to Mar 2025

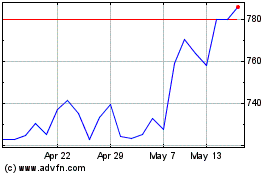

Wetherspoon ( J.d.) (LSE:JDW)

Historical Stock Chart

From Mar 2024 to Mar 2025