TIDMUSG

RNS Number : 7082N

Ultimate Sports Group PLC

26 September 2019

Ultimate Sports Group PLC

("USG" or the "Company")

26 September 2019

Interim Results

Ultimate Sports Group plc ("USG" or the "Company"), the AIM

listed investment company, is pleased to announce its interim

results for the six months ended 30 June 2019.

CHAIRMAN'S STATEMENT AND CHIEF EXECUTIVE'S REVIEW

For the six months ended 30 June 2019 we are reporting a total

comprehensive loss of GBP15,258 (30 June 2018: loss GBP45,552).

USG's cash balances as at 30 June 2019 were GBP440,233, falling

GBP95,096 during the period (31 December 2018: GBP535,329) mainly

due to an increase in trade receivables of GBP163,340, offset in

part by a GBP75,092 increase in trade payables.

The directors are not recommending the payment of a

dividend.

FUNDRAISE

Subsequent to the half year end, we reported on 15 July 2019,

that the Company had raised GBP290,000 (before legal expenses) by

the issue of 2,000,000 new shares at 14.5p per share.

SUBSTANTIAL SHAREHOLDERS

The Company continues to welcome the involvement of Mr. Richard

Bernstein as a strategic shareholder following the fundraising

announced in February 2018 and appreciates the additional

confidence he has shown in the Company as reflected by recent

purchases in the open market that increased his shareholding from

27.02% to 29.82% of the total issued share capital of the

Company.

APPOINTMENT OF A NEW CHIEF EXECUTIVE

The Company was also pleased to announce the appointment of

Matthew Farnum-Schneider as Chief Executive Officer effective from

1 August 2019. The Board considers that his appointment will

spearhead the corporate development of the Group.

PANTHEON LEISURE PLC ("PANTHEON")

USG holds 85.87% of the issued share capital of Pantheon which

in turn owns 100% of the operating business of Pantheon's Sport and

Leisure division. Pantheon's sport and leisure division is the

owner of Sport in Schools Limited also known as The Elms Sport in

Schools ("ESS").

Pantheon as a group made a profit of GBP62,533 for the six

months ended 30 June 2019 (30 June 2018: GBP43,913).

SPORT IN SCHOOLS LIMITED ("SSL")

SSL increased turnover in the period by 18% to GBP943,392 (30

June 2018: GBP800,705). The increase is attributable to business

expansion. This increased turnover resulted in an improved profit

margin due to operational gearing and a divisional 41% increase in

profit to GBP113,130 (30 June 2018: GBP80,059).

CORPORATE GOVERNANCE CODE

In accordance with the AIM Rules regarding corporate governance

our website reflects our compliance with (and explains any

departures from) the guidance set out in the QCA Corporate

Governance Code.

PROSPECTS

As outlined in the Report and Accounts for the year ended 31

December 2018, we continue to pursue, from a firm financial base, a

strategy of developing SSL and to carefully appraise any and all

acquisition opportunities, including those proposed by Mr.

Bernstein. Led by Matthew Farnum-Schneider, the Board is currently

reviewing a number of acquisition opportunities operating in high

growth markets. These opportunities are at various stages of

discussion and there is no guarantee that they will result in a

transaction. The Company will provide further updates as and when

appropriate.

R.L. Owen (Chairman) 25 September 2019

Unaudited Unaudited Audited

6 months 6 months Year ended

ended 30 ended 30 31 December

June 2019 June 2018 2018

GBP GBP GBP

Revenues 943,433 800,836 1,547,006

Cost of revenues (464,540) (385,274) (725,638)

478,893 415,562 821,368

Administrative expenses (494,734) (461,285) (965,943)

Operating loss (15,841) (45,723) (144,575)

Finance income 583 171 718

Finance costs - - (628)

Loss before taxation (15,258) (45,552) (144,485)

Taxation - - -

-----------

Loss after taxation (15,258) (45,552) (144,485)

=========== =========== =============

Attributable to:

Owners of the company (24,091) (51,755) (149,121)

Non- controlling interests 8,833 6,203 4,636

---------- ---------- ----------

(15,258) (45,552) (144,485)

========== ========== ==========

Total comprehensive loss attributable

to:

Owners of the company (24,091) (51,755) (149,121)

Non- controlling interests 8,833 6,203 4,636

---------- ---------- ----------

(15,258) (45,552) (144,485)

---------- ---------- ----------

Basic and diluted total comprehensive

loss per share (0.0007)p (0.0018)p (0.0051p)

========== ========== ==========

Unaudited Unaudited Audited

as at 30 as at 30 As at 31

June June December

2019 2018 2018

GBP GBP GBP

Non- current assets

Goodwill and patents 59,954 60,054 59,954

Property, Plant and equipment 89,158 13,713 13,168

Total non-current assets 149,112 73,767 73,122

------------ ------------ ------------

Current assets

Trade and other receivables 253,100 205,684 89,760

Cash and cash equivalents 440,233 479,722 535,329

------------ ------------ ------------

Total current assets 693,333 685,406 625,089

------------ ------------ ------------

Total assets 842,445 759,173 698,211

Current liabilities

Trade and other payables 325,871 218,397 239,911

Borrowings - 1,000 -

------------ ------------ ------------

Total current liabilities 325,871 219,397 239,911

Non-current liabilities

Trade and other payables 65,208 - -

------------ ------------ ------------

Total liabilities 391,079 219,397 239,911

------------ ------------ ------------

Net assets 451,366 539,776 458,300

============ ============

Equity

Share capital 2,388,664 2,388,664 2,388,664

Share premium 782,031 775,374 782,031

Merger reserve 325,584 325,584 325,584

Retained earnings (2,994,883) (2,892,550) (2,979,116)

Equity attributable to owners of the

company 501,396 597,072 517,163

Non-controlling interest (50,030) (57,296) (58,863)

Total Equity 451,366 539,776 458,300

============ ============ ============

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2019 2018 2018

GBP GBP GBP

Total equity at the beginning

of period/year 458,300 95,908 95,908

Issue of shares - 489,420 537,500

Share issue costs - - (41,423)

Share based payments 5,400 - 10,800

Loss for the period/year (15,258) (45,552) (144,485)

Impact of change in accounting

policy 2,924 - -

At end of period/year 451,366 539,776 458,300

=========== =========== =============

Six months Six months Year ended

ended ended 31 December

30 June 2019 30 June 2018 2018

GBP GBP GBP

Cash flow from all activities:

Loss before taxation (15,258) (45,552) (144,485)

Adjustments for:

Depreciation and amortisation 4,105 3,557 7,607

Finance income (583) (171) (718)

Finance costs - - 628

Share based payments 5,400 - 10,800

Loss on disposed tangible assets - - 1

Operating cash flow before working

capital movements (6,336) (42,166) (126,167)

Increase in receivables (163,340) (136,703) (20,779)

Increase in payables 75,092 44,736 66,250

Net cash absorbed by operations (94,584) (134,133) (80,696)

--------------

Cash flow from Investing activities

Property, plant and equipment acquired (1,095) (4,347) (7,753)

Finance income 583 171 718

Net cash used in investing activities (512) (4,176) (7,035)

-------------- -------------- -------------

Financing activities

Proceeds from share issues - 489,420 496,077

Finance costs - - (628)

Repayment of borrowings - (1,000) (2,000)

Net cash from financing activities - 488,420 493,449

-------------- -------------- -------------

Net (decrease)/increase in cash and

cash equivalents (95,096) 350,111 405,718

Cash and cash equivalents and bank

overdraft at the beginning of the

period/year 535,329 129,611 129,611

Cash and cash equivalents at the

end of the period/year 440,233 479,722 535,329

============== ============== =============

1. General information

Ultimate Sports Group plc (the "Company") is a company domiciled

in England and its registered office address is 30 City Road,

London EC1Y 2AB. The condensed consolidated interim financial

statements of the Company for the six months ended 30 June 2019

comprise the Company and its subsidiaries (together referred to as

the "Group").

The condensed consolidated interim financial statements do not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006.

The financial information for the year ended 31 December 2018

has been extracted from the statutory accounts. The auditors'

report on those statutory accounts was unqualified and did not

contain a statement under Section 498(2) or (3) of the Companies

Act 2006. A copy of those accounts has been filed with the

Registrar of Companies.

The Group has presented its results in accordance with the

measurement principles set out in International Financial Reporting

Standards as adopted by the EU ("IFRS") using the same accounting

policies and methods of computation as were used in the annual

financial statements for the year ended 31 December 2018 with

exception of the application of new accounting standards. As

permitted, the interim report has been prepared in accordance with

the AIM rules for companies but is not compliant in all respects

with IAS34 'Interim Financial Statements'.

In the current financial year, the Group has adopted IFRS 16

Leases which has resulted in the Group recognising a right-of-use

asset and lease liability for all contracts that are or contain a

lease. The Group has applied the modified retrospective adoption

method, with no restatement of prior year comparatives. Full

disclosure of the accounting policy in respect of IFRS 16 will be

made in the consolidated annual financial statements of the Group

for the year ending 31 December 2019. The impact of the adoption of

IFRS 16 has resulted in an increase in opening tangible fixed

assets of GBP79,000, offset by an increase in opening liabilities

of GBP79,000, due to the recognition of the lease assets and

liabilities.

The condensed consolidated interim financial statements do not

include all the information required for full annual financial

statements and therefore cannot be construed to be in full

compliance with IFRS.

The condensed consolidated interim financial statements were

approved by the board and authorised for issue on 25 September

2019.

2. Business segment analysis

Six months ended 30 June

2019

Sports and Social

leisure media website Consolidated

Results from operations GBP GBP GBP

Revenue 943,392 41 943,433

=========== =============== =============

Segment operating profit/(loss) 113,130 (12,493) 100,637

=========== ===============

Group operating expenses (116,478)

-------------

Operating loss (15,841)

Finance income 583

-------------

Loss before tax from all

activities (15,258)

Taxation -

-------------

Operating loss after tax (15,258)

=============

Six months ended 30 June

2018

Sports and Social

leisure media website Consolidated

Results from operations GBP GBP GBP

Revenue 800,705 131 800,836

=========== =============== =============

Segment operating profit/(loss) 80,059 (20,079) 59,980

=========== ===============

Group operating expenses (105,703)

-------------

Operating loss (45,723)

Finance income 171

-------------

Loss before tax from all

activities (45,552)

=============

Year Ended 31 December

2018

Sports and Social

leisure media website Consolidated

Results from operations GBP GBP GBP

Revenue 1,546,733 273 1,547,006

=========== =============== =============

Segment operating profit/(loss) 100,754 (32,399) 68,355

=========== ===============

Group operating expenses (212,930)

Operating loss (144,575)

Finance revenues 718

Finance costs (628)

Loss before tax from all

activities (144,485)

=============

3. Basic and diluted loss per share

Comprehensive loss per share for the six months period ended 30

June 2019 has been calculated on the comprehensive loss

attributable to owners of the company of GBP24,091 and on the

weighted average number of shares in issue during the period of

33,561,639.

Comprehensive loss per share for the six months period ended 30

June 2018 has been calculated on the comprehensive loss

attributable to owners of the company of GBP51,755 and on the

weighted average number of shares in issue during the period of

29,344,788.

Comprehensive loss per share for the year ended 31 December 2018

has been calculated on the comprehensive loss attributable to

owners of the company of GBP149,121 and on the weighted average

number of shares in issue during the year of 29,174,996.

For the six month period ended 30 June 2019, six month period

ended 30 June 2018 and for the year ended 31 December 2018, share

options and warrants to subscribe for shares in the company are

anti-dilutive and therefore diluted earnings per share information

is the same as the basic loss per share.

* *S * *

For further information, please visit www.ultimatesportsgroup.me

or contact:

Ultimate Sports Group PLC

Richard Owen (Executive Chairman) +44 (0)7721 613613

St Brides (Financial PR)

Catherine Leftley, Gaby Jenner +44 (0)20 7236 1177

Cantor Fitzgerald Europe (Nomad and Broker)

David Foreman +44 (0)20 7894 7000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LFFFFARIEFIA

(END) Dow Jones Newswires

September 26, 2019 02:02 ET (06:02 GMT)

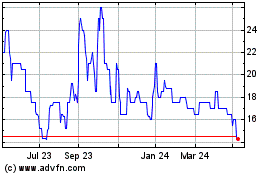

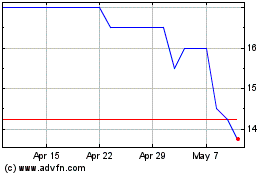

Insig Ai (LSE:INSG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Insig Ai (LSE:INSG)

Historical Stock Chart

From Jul 2023 to Jul 2024