TIDMING

RNS Number : 5864F

Ingenta PLC

29 July 2016

Ingenta plc interim results

Ingenta plc (AIM: PTO), ("Ingenta", the "Company" or the

"Group") a leading provider of world-class software and services to

the global publishing industry, today announces its unaudited

interim results for the six months to 30 June 2016.

The Board believes the business is on track to meet market

expectations for the year.

Financial Key Points

-- Group revenues GBP7.57m (2015: GBP7.59m)

-- Costs before tax GBP6.8m (2015: GBP8.5m)

-- EBITDA GBP345K (2015: loss GBP(320)K)

-- Profit before tax GBP368K (2015: loss before tax GBP(1.15)m)

-- Profit per share 2.08p (2015: loss per share (6.76)p)

-- Cash at 30 June 2016: GBP1.3m (as at 30 December 2015: GBP2.1m)

Operational Key Points

-- Restructuring in second half of 2015 reduced the cost base by GBP1.6m year on year.

-- Signed 3 new contracts in 2016 across Ingenta CMS, Ingenta

CMS GO! and Ingenta Commercial Contracts and Rights worth an

aggregate of GBP1.5m, contrasting with no new wins in 2015.

-- Business returned to profitability at both EBITDA and pre-tax levels.

-- Cash consumption significantly reduced as working capital cycle normalised

Post Balance Sheet Events

-- Agreed to acquire 5 fifteen Limited to extend the Group's product set into advertising.

o The acquisition is expected to return positive EBITDA in 2016

and 2017 and be cash generative and earnings enhancing from

2017.

o Details of the acquisition are contained in a separate market

announcement.

-- Two new Non-Executive Directors to be appointed to the Board.

David Montgomery, Chief Executive of Ingenta plc, commented:

Since I became Chief Executive Officer in September 2015 we have

moved decisively to put Ingenta on to a stronger footing. Within

weeks we removed GBP1.6m of annual costs and reorganised some key

staff and management positions within the Group while at the same

time maintaining our momentum to deliver on existing contracts and

make new sales.

I am delighted that at the half year we have returned the Group

to profitability with a GBP0.7m improvement in EBITDA and a GBP1.5m

improvement in profit before tax. We have also improved our sales

performance with three new wins, and significantly reduced our cash

outflows which now reflect the normal trading pattern across the

year.

Furthermore, we have announced today the acquisition of 5

fifteen which not only is a business I know well, but which I also

view from both a market expansion and technology standpoint as an

important strategic step.

Our priorities now focus on building our sales pipeline, fully

exploiting the potential that 5 fifteen gives us, continuing to

control our costs and building further on our profitability.

In recognition of our expanding horizons and to bring greater

depth of experience to the management of the business, I am

delighted to welcome Max Royde and Henrik Holmström to the Board as

Non-Executive Directors with effect from the beginning of

August.

This has been a challenging but exciting time during which I

believe the balance and momentum of the business has been

fundamentally shifted and the true potential of the Company to

become a growing and profitable world class software and services

provider to the content industries has begun to be demonstrated. I

look forward to the future with confidence.

For further information please contact:

Ingenta plc Tel: 01865 397 800

David Montgomery / Alan Moug

Cenkos Securities plc Tel: 0207 397 8900

Nicholas Wells / Elizabeth Bowman

Chief executive's statement

I am pleased to report our first half results for the year to 31

December 2016. The first 6 months of the financial year are marked

by stable revenue and a significantly reduced cost base leading to

a return to profitability for the Group.

Our strategy has been to restore profitability, move the

business quickly to cash generation and then use our unique

position within the media industry to acquire complimentary

businesses to strengthen the Group for the future.

I am therefore pleased to announce today the purchase of 5

fifteen Limited, a software development company which owns the

'AdDEPOT' advertising workflow software for publishers. The

addition of the 5 fifteen products to the Ingenta stable enhances

our offering to existing customers and extends the Group's reach

into the wider media market including newspapers and magazines with

a cloud based software as a service (SaaS) model.

After an initial down payment the consideration for 5 fifteen is

staggered to reflect its future performance for the remainder of

2016 and 2017. The purchase is expected to be immediately earnings

enhancing and expected to generate a positive cash flow from 2017

after a short term working capital requirement in 2016.

The purchase will be satisfied in cash, and the Directors are

please to say that we are undertaking a subscription with

institutional investors through the issue of 388,450 new ordinary

10p shares at 130p. In addition, Directors Martyn Rose and Neil

Kirton intend to subscribe GBP275,015 in total for new shares on

the same basis. The subscription is within the authority granted by

resolutions passed at our AGM in May and I am delighted that a

number of our existing shareholders have taken this opportunity to

acquire more stock.

A more detailed announcement regarding this acquisition is being

made separately today.

Ingenta business

Revenue for the first half of 2016 has improved compared to the

same period last year for Ingenta CMS (previously known as pub2web)

and Ingenta Commercial (previously known as advance), our

enterprise level replacement for the Vista product suite. The

uplift in Ingenta Commercial in particular has more than covered

the anticipated reduction in Vista revenue.

In the last 6 months, we have launched Ingenta CMS GO!, an out

of the box content management solution which uses standard

functionality to roll out a fast and efficient solution for mid-

sized publishers. We have already had some success in selling the

concept with 2 ongoing implementations and a number of other sales

opportunities in the pipeline.

We intend to roll out the concept of a GO! implementation which

has no development or bespoke elements to the Ingenta Commercial

suite in the next few months. Ingenta Commercial has four ongoing

projects currently and we expect to go live on two of these around

the end of 2016, with the others maintaining time based revenues

into 2017.

We have closed three new deals in 2016 so far aggregating around

GBP1.5m of future revenue. These include:

-- signing a new multi-year deal with the OECD to build their

next generation web presence on Ingenta CMS which will allow, not

just the OECD, but also other International Government

Organisations, to host their content with their own branding and

domain through the site;

-- an Ingenta CMS GO! for Sabinet, a South African publisher; and,

-- an Ingenta Commercial contract and rights sale to SAGE publishers.

This contrasts with no new deals in 2015.

Vista still remains almost 50% of the Group's revenue and

produces a 50% profit before tax margin and will remain core to the

Group's activities for a number of years to come.

Elsewhere there was a small reduction in the first half of 2016

against the same period in 2015 for PCG and Ingenta Connect

revenues, with Ingenta Connect expected to grow into 2017 and with

PCG expected to recover in the second half with 2016 revenue

expected to exceed 2015.

Ingenta Connect is about to launch 'Ingenta Open' an online

portal for open access data. This has so far had a good response

among customers and will fully launch in October 2016. In addition,

from the end of Q3, Ingenta Connect will charge libraries for

previously free access services under a Library Memberships scheme.

This is expected to improve the Ingenta Connect results in 2017 and

bring this division back to growth.

PCG has undergone significant change in 2016, with a re-emphasis

on the elements of the business which earn the highest margin,

concentrating on the sales representation parts of the business

model and has been PCG win new clients across US, Latin America and

India.

Financial review

First half revenue was stable from the first half of 2015, with

the expected decrease in revenue from the Vista product being

replaced by revenue from the new Ingenta Commercial product suite.

Other revenues remained relatively stable.

The cost base before interest, tax and foreign exchange has

reduced by GBP1.6m on an annualised basis.

The cost base realignment has returned the Group to profit with

a first half Profit before tax of GBP368K.

Cash Flow

Cash reduced by GBP0.8m in the 6 months to 30 June 2016 as part

of the expected cash flow. The working capital cash cycle is now

normalising after 18 months of restructuring and amortising

provisions associated with the beta implementations of Ingenta

Commercial.

Compared to the same period in 2015, working capital cash

movements are similar, the main cash variances are the differential

on the trading account and the capital raising in June 2015.

Interest paid in the first half of 2016 was GBP13K (2015:

GBP331K).

As in the prior year, the R&D tax credit of GBP405K (2015:

GBP467K) was received in July and did not impact the first half

cash flow.

D R Montgomery

Chief Executive Officer

Condensed Consolidated Interim Statement of Comprehensive

Income

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2016 2015

Note GBP'000 GBP'000

Group revenue 7,573 7,587

Less: revenue from equity

accounted investment 4 398 300

------------ ------------

Group revenue excluding equity

accounted investment 7,175 7,287

Cost of sales (4,614) (5,119)

------------ ------------

Gross profit 2,561 2,168

Sales and marketing expenses (665) (835)

Administrative expenses (1,555) (2,214)

Profit / (loss) from operations 341 (881)

Share of profit from equity

accounted investment 4 40 20

Profit / (loss) from operations

including equity accounted

investment 381 (861)

Analysis of profit / (loss)

from operations

Profit / (loss) before net

finance costs, tax, depreciation

and foreign exchange gains

and losses (EBITDA) 345 (320)

Depreciation (90) (124)

Foreign exchange gain / (loss) 177 (117)

Restructuring costs (51) (300)

------------ ------------

Profit / (loss) from operations 381 (861)

Finance costs (13) (290)

------------ ------------

Profit / (loss) before tax 368 (1,151)

Tax (2) 49

Retained profit / (loss)

for the period 366 (1,102)

------------ ------------

Other comprehensive expenses

which will be reclassified

subsequently to profit or

loss:

Exchange differences on translating

foreign operations (27) (1)

Total comprehensive income

/ (expense) for the period 339 (1,103)

------------ ------------

Profit / (loss) attributable

to owners of the parent 366 (1,102)

============ ============

Total comprehensive income

/ (expense) attributable

to owners of the parent 339 (1,103)

============ ============

Basic profit / (loss) per

share - pence 5 2.08p (6.76)p

Diluted profit / (loss) per

share - pence 5 2.01p (6.76)p

Condensed Consolidated Interim Statement of Financial

Position

Unaudited Unaudited

30 June 30 June

2016 2015

Note GBP'000 GBP'000

Non current assets

Goodwill 3,737 3,737

Property, plant & equipment 213 333

Investments accounted for

using the equity method 4 238 318

---------- ----------

4,188 4,388

Current assets

Trade and other receivables 6 3,711 3,750

Cash and cash equivalents 7 1,293 2,606

5,004 6,356

Total assets 9,192 10,744

---------- ----------

Equity

Share capital 1,632 1,632

Share Premium 8,294 8,291

Merger reserve 11,055 11,055

Reverse Acquisition reserve (5,228) (5,228)

Translation reserve (914) (905)

Investment in own shares (1) (6)

Share option reserve 19 -

Retained earnings (10,873) (10,909)

3,984 3,930

Current liabilities

Trade and other payables 8 5,208 6,814

5,208 6,814

Total liabilities 5,208 6,814

Total equity and liabilities 9,192 10,744

---------- ----------

Unaudited condensed consolidated interim statement of changes in

equity

Share Share Merger Reverse Translation Investment Share Retained Total

capital premium reserve acquisition reserve in option Earnings

reserve own reserve

shares

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance

at 1 January

2016 1,632 8,294 11,055 (5,228) (887) (1) - (11,239) 3,626

Profit for

the period - - - - - - 366 366

Share based

payment

expense - - - - - - 19 - 19

Other

comprehensive

income:

Exchange

differences

on

translation

of foreign

operations - - - - (27) - - (27)

-------- -------- -------- ------------ ------------ ----------- --------- --------- --------

Total

comprehensive

income /

(expense)

for the

period - - - - (27) - 19 366 358

Balance

at 30 June

2016 1,632 8,294 11,055 (5,228) (914) (1) 19 (10,873) 3,984

Reverse Investment

Share Share Merger acquisition Translation in own Retained

capital premium reserve reserve reserve shares Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at

1 January

2015 841 - 11,055 (5,228) (904) (6) (9,807) (4,049)

Loss for the

period - - - - - - (1,102) (1,102)

Share issue 791 8,291 - - - - - 9,082

Other comprehensive

income:

Exchange differences

on translation

of foreign

operations - - - - (1) - - (1)

--------- --------- --------- ------------- ------------ ----------- ---------- --------

Total comprehensive

expense for

the period 791 8,291 - - (1) - (1,102) 7,979

Balance at

30 June 2015 1,632 8,291 11,055 (5,228) (905) (6) (10,909) 3,930

--------- --------- --------- ------------- ------------ ----------- ---------- --------

Condensed Consolidated Interim Statement of Cash Flows

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2016 2015

Note GBP'000 GBP'000

Profit / (loss) before tax 368 (1,151)

Adjustments for:

Share of profit from equity

accounted investment 4 (40) (20)

Depreciation 90 124

Share based payment expense 19 -

Interest expense 13 291

Unrealised foreign exchange

differences (27) (1)

Decrease in trade and other

receivables 961 1,064

Decrease in trade and other

payables (2,056) (2,081)

Cash (outflow) from operations (672) (1,774)

Tax Paid (2) (1)

Net cash (outflow) from operating

activities (674) (1,775)

Cash flows from financing

activities

Share issue - 9,082

Payment of finance leases (90) (86)

Loans received - 400

Loans repaid - (2,950)

Interest paid (13) (331)

------------ ------------

Net cash used in financing

activities (103) 6,115

Cash flows from investing

activities

Purchase of property, plant

and equipment (7) (6)

Net cash used in investing

activities (7) (6)

Net (decrease) / increase

in cash and cash equivalents (784) 4,334

Cash and cash equivalents

at beginning of period 2,077 (1,728)

Cash & cash equivalents at

end of period 7 1,293 2,606

------------ ------------

Notes to the Unaudited Interim Report for the six months ended

30 June 2016

1. Nature of operations and general information

Ingenta plc (the "Company") and its subsidiaries (together 'the

Group') is a provider of technology and supporting services to

content providers and publishers. The nature of the Group's

operations and its principal activities are set out in the full

annual financial statements.

The Company is incorporated in the United Kingdom under the

Companies Act 2006. The Company's registration number is 837205 and

its registered office is 8100 Alec Issigonis Way, Oxford OX4 2HU.

The condensed consolidated interim financial statements were

authorised for issue by the Board of Directors on 28 July,

2016.

The financial information set out in this interim report does

not constitute statutory accounts as defined in section 404 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 31 December 2015, prepared under IFRS as adopted by

the European Union, have been filed with the Registrar of

Companies. The auditor's report on those financial statements was

unqualified and did not contain a statement under section 498 (2)

or section 498 (3) of the Companies Act 2006.

2. Basis of preparation

These unaudited condensed consolidated interim financial

statements are for the six months ended 30 June 2016. They have

been prepared following the recognition and measurement principles

of IFRS as adopted by the European Union. They do not include all

of the information required for full annual financial statements,

and should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2015.

These condensed consolidated interim financial statements have

been prepared on the going concern basis under the historical cost

convention and have been prepared in accordance with the accounting

policies adopted in the last annual financial statements for the

year ended 31 December 2015.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of these

consolidated interim financial statements.

A detailed set of accounting policies can be found in the annual

accounts available on our website, www.ingenta.com or by writing to

the Company Secretary at the registered office as above.

3. Share based payment

In January 2016, 526,000 share options were granted to senior

executives under the Company's EMI (Enterprise Management

Incentive) scheme. The exercise price of the options is GBP1.27,

equal to the market price on the date of grant. The options vest in

3 equal tranches over 3 years on condition that the Group's

reported year end EBITDA level meets market expectation in each

year. The fair value at grant date is estimated using the Black

Scholes pricing model, taking into account the terms and conditions

upon which the options were granted. There is no cash settlement of

options. The fair value of options granted during the 6 months to

30 June 2016 was estimated using the following assumptions:

Expected volatility 21.9%

Risk free interest rate 0.5%

Closing share price at 30 June 2016 GBP1.225

The weighted average fair value of options granted was

GBP147K

For the 6 months ended 30 June 2016 the Group has recognised

GBP19,174 of share based payment expense in the income statement

(2015: GBP0)

4. Equity accounted investment

The Group holds a 49% voting and equity interest in Beijing

Ingenta Digital Publishing Technology Ltd (BIDPT), a joint venture

company registered in the People's Republic of China.

This investment is accounted for under the equity method. BIDPT

has a reporting date of 31 December. The shares are not publicly

listed on a stock exchange and hence published price quotes are not

available. Certain unaudited financial information on BIDPT is as

follows:

30 June 30 June

2016 2015

GBP'000 GBP'000

Assets 1,522 1,602

Liabilities 958 993

Six months Six months

ended ended

30 June 30 June

2016 2015

GBP'000 GBP'000

Revenues 812 600

Profit 81 40

Profit attributable

to the Group 40 20

Changes in equity accounted investment

Six months Six months

ended ended

30 June 30 June

2016 2015

GBP'000 GBP'000

Investment Book Value

as at 1 January 198 298

Profit attributable

to the Group 40 20

Investment Book Value

as at 30 June 238 318

Dividends are subject to the approval of at least 51% of all

shareholders of BIDPT. The Group has received no dividends.

5. Profit / (loss) per share

Basic profit / (loss) per share is calculated by dividing the

profit / (loss) attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during the

period.

For diluted profit / (loss) per share, the weighted average

number of ordinary shares in issue is adjusted to assume conversion

of all dilutive potential ordinary shares.

Six months Six months

ended ended

30 June 30 June

2016 2015

Attributable profit

/ (loss) (GBP'000) 339 (1,103)

Weighted average number

of ordinary basic shares

(basic) 16,319,609 16,319,609

Weighted average number

of ordinary shares

(diluted) 16,845,609 16,319,609

Profit / (loss) per

share (basic) arising

from both total and

continuing operations 2.08p (6.76)p

Profit / (loss) per

share (dilutive) arising

from both total and

continuing operations 2.01p (6.76)p

6. Trade and other receivables

Trade and other receivables comprise the following:

30 June 30 June

2016 2015

GBP'000 GBP'000

Trade receivables -

gross 2,322 2,225

Less: provision for

impairment of trade

receivables (21) (5)

-------- --------

Trade receivables -

net 2,301 2,220

Other receivables 124 176

Prepayments and accrued

income 881 904

Research and development

tax credit 405 450

-------- --------

3,711 3,750

7. Cash and cash equivalents

30 June 30 June

2016 2015

GBP'000 GBP'000

Cash and cash equivalents 6,528 8,116

Bank overdraft (5,235) (5,510)

-------- --------

Cash and cash equivalents

including overdraft 1,293 (2,606)

8. Trade and other payables

Trade payables comprise the following:

30 June 30 June

2016 2015

GBP'000 GBP'000

Trade payables 589 946

Social security and

other taxes 293 343

Other payables 1,265 1,532

Accruals 796 1,092

Deferred income 2,265 2,901

5,208 6,814

9. Contingencies and commitments

There were no contingencies and commitments at the end of this

or the comparative period.

10. Post balance sheet events

On 29 July 2016, the Company agreed to acquire 5 fifteen

Limited, a leading supplier of digital advertising solutions to the

magazine and newspaper industry for a consideration of up to

GBP990K.

At the same time the Company announced a direct subscription

with certain institutional investors and Directors of the Company.

The subscription will raise up to GBP780K through the issue of

600,000 new ordinary shares of 10 pence each at a subscription

price of 130 pence per share.

Details of the acquisition and the subscription are contained in

a separate market announcement.

There were no other material events subsequent to the end of the

interim reporting period that have not been reflected in the

interim financial statements.

11. Copies of the Interim Financial Statements

A copy of the interim statement is available on the Company's

website, www.ingenta.com, and from the Company's registered office,

8100 Alec Issigonis Way, Oxford OX4 2HU.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDRUXDBGLI

(END) Dow Jones Newswires

July 29, 2016 02:00 ET (06:00 GMT)

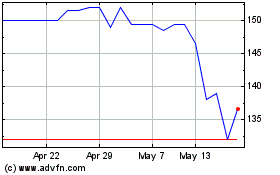

Ingenta (LSE:ING)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ingenta (LSE:ING)

Historical Stock Chart

From Jul 2023 to Jul 2024