TIDMIHP

RNS Number : 6610I

IntegraFin Holdings plc

20 April 2022

LEI Number: 213800CYIZKXK9PQYE87

IntegraFin Holdings plc

Q2 Funds Under Direction Update

Funds Under Direction Update

20 April 2022

IntegraFin Holdings plc today announces the quarterly Funds

Under Direction (FUD) update for Transact - the award-winning

platform providing services to UK clients and their financial

advisers.

Highlights

-- We achieved record inflows for H1 of financial year 2022,

surpassing GBP4bn of inflows for the first time.

-- Our net inflows for H1 of financial year 2022 were our best

ever at GBP2.7bn, an increase of 16% on the comparative period in

financial year 2021.

-- Our FUD was GBP53.5bn as at 31 March 2022, representing a

decrease of 1.9% over the quarter. Over the same period, the MSCI

World Index (Large & Mid Cap) fell by 3.8%.

Quarter ended Quarter ended H1 ended H1 ended

--------------------

31 March 2022 31 March 2021 31 March 2022 31 March 2021

GBPm GBPm GBPm GBPm

Opening FUD 54,539 44,824 52,112 41,093

Inflows 2,092 2,153 4,068 3,734

Outflows -697 -686 -1,385 -1,427

Net Flows 1,395 1,467 2,683 2,307

Market movements -2,376 694 -1,169 3,632

Other movements(1) -58 -56 -126 -103

Closing FUD 53,500 46,929 53,500 46,929

--------------------

Notes:

(1) Includes fees, taxes and investment income.

Alex Scott, CEO, said:

I am pleased to report another strong quarter of inflows on to

our platform. Our gross inflows for the first half year of the

financial year were our best ever at GBP4.07bn, with outflows

remaining low, and lower than the first half of financial year

2021. This resulted in a 16% increase in net inflows for the first

half of the financial year 2022 (GBP2.68bn), compared to the first

half of financial year 2021 (GBP2.31bn).

Our net inflows for the quarter (GBP1.40bn) were 4% lower than

the same quarter in financial year 2021 (GBP1.47bn). However, the

net flows for this quarter were impacted by the timing of Easter

and the resultant number of days prior to tax year end in April

2022 when compared to the prior year. Overall, these results

demonstrate the resilience of our platform business model through

different market conditions.

Despite strong net inflows, our FUD reduced overall to

GBP53.50bn. This is the result of unexpected, and continuing,

geo-political events impacting stock markets. This has a

corresponding impact on our revenue.

We are mindful of the challenging economic outlook and the

impact of inflationary pressures on our cost base. However, we

continue to invest in our people and to develop our market leading

proprietary software for the Transact platform and the Time4Advice

adviser back office system, in order to deliver the high quality

service standards for which we are renowned.

We look forward to reporting our half year results on 26 May

2022.

Historical Flow and FUD data by quarter

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

FY20 FY20 FY21 FY21 FY21 FY21 FY22 FY22

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Opening FUD 34,990 39,711 41,093 44,824 46,929 50,310 52,112 54,539

Inflows 1,225 1,291 1,581 2,153 1,994 1,967 1,976 2,092

Outflows -428 -560 -741 -686 -657 -660 -688 -697

Net Flows 797 731 840 1,467 1,337 1,307 1,288 1,395

Market movements 3,958 690 2,938 694 2,112 553 1,207 -2,376

Other movements

(1) -34 -39 -47 -56 -68 -59 -68 -58

Closing FUD 39,711 41,093 44,824 46,929 50,310 52,112 54,539 53,500

Notes:

(1) Includes fees, taxes and investment income.

Enquiries

Investors

Luke Carrivick +44 020 7608 5463

Media

Lansons

Tim Naylor +44 (0)79 83612919

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTILMFTMTIBBAT

(END) Dow Jones Newswires

April 20, 2022 02:00 ET (06:00 GMT)

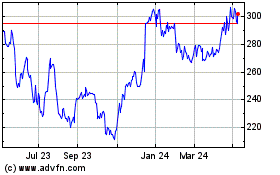

Integrafin (LSE:IHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

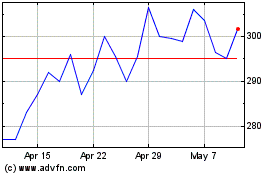

Integrafin (LSE:IHP)

Historical Stock Chart

From Jul 2023 to Jul 2024