TIDMHSD

RNS Number : 8727N

Hansard Global plc

26 January 2023

26 January 2023

Hansard Global plc

New business results for the six months ended 31 December

2022

Hansard Global plc ("Hansard" or "the Group"), the specialist

long-term savings provider, issues its new business results for the

six months ended 31 December 2022. The three months ended 31

December 2022 are referred to as "Q2 2023" where applicable.

Summary

-- New business for the Group for the three months ended 31

December 2022 was GBP18.6m in PVNBP ("Present Value of New Business

Premiums") terms (three months ended 31 December 2021:

GBP33.5m);

-- New business for the six months ended 31 December 2022 was

GBP43.4m (six months ended 31 December 2021: GBP64.9m);

-- Assets under administration were GBP1.10 billion at 31

December 2022 (30 June 2022: GBP1.10 billion);

-- We continue to make good progress towards launching a new

proposition in the Middle East to assist growing our business in

that market and have also made encouraging progress with

distribution opportunities for our Japanese proposition.

Graham Sheward, Group Chief Executive Officer, commented:

"The overall environment has remained challenging for investment

and long-term savings plans. However, we continue to make good

progress developing new product and distribution opportunities.

In our largest region, Middle East and Africa, new business was

down 13.7% for the six months ended 31 December 2022. Having

recruited additional sales management for this region, we have been

working closely with both new and existing distribution partners to

expand our proposition, targeting for example pensions and higher

net worth clients. In addition, we continue to make good progress

towards launching a set of products for the Middle East that will

leverage our new administration system and incorporate a new best

in breed fund range.

New business in Latin America was down 4.9%. Similar to the

Middle East and Africa region, we are working on building business

with new distribution partners to supplement our existing

distribution.

The Rest of World region was down 64.1% due to a decline in

single premium business and business acceptance restrictions

arising out of the Russia-Ukraine conflict.

The 61.6% reduction in Far East business reflects a fluctuating

smaller base of new business which experienced a spike in the prior

year comparative. We have recently relocated a regional sales

manager to our branch in Malaysia to drive business growth in this

region.

In addition to our new proposition developed for the Middle

East, we also continue to make encouraging progress with

distribution opportunities for our Japanese proposition and remain

optimistic for future new business in that jurisdiction.

The Group also remains on track for replacing its policy

administration systems to support its next generation of products

whilst realising associated cost and efficiency gains. "

For further information:

Hansard Global plc +44 (0) 1624 688 000

Graham Sheward, Group Chief Executive Officer

Tim Davies, Chief Financial Officer

Email: investor-relations@hansard.com

Camarco LLP +44 (0) 7990 653 341

Ben Woodford, Hugo Liddy

Hansard Global plc

New business results for the six months ended 31 December

2022

OVERVIEW

The Group continues to focus on the distribution of regular and

single premium savings and investment products in a range of

jurisdictions around the world.

The ongoing uncertainty in global economic conditions continues

to adversely impact our new business levels. In Present Value of

New Business Premiums ("PVNBP") terms, new business for the quarter

ended 31 December 2022 was 44.5% lower than the prior year

equivalent and 33.1% lower for the six months to 31 December

2022.

Annualised Premium Equivalent ("APE") for the quarter ended 31

December 2022 was 40.4% lower than the prior year equivalent and

27.3% lower for the six months to 31 December 2022 .

The lower proportion of single premiums written has a greater

impact to the PVNBP metric compared to the APE metric.

New Business Flows

New business flows for the quarter and the half-year are

summarised as follows:

Three months Six months ended

ended

31 December 31 December

2022 2021 % 2022 2021 %

Basis GBPm GBPm change GBPm GBPm change

------------------------------- ----- ----- -------- --------- -------- --------

Present Value of New Business

Premiums 18.6 33.5 (44.5%) 43.4 64.9 (33.1%)

Annualised Premium Equivalent 2.8 4.7 (40.4%) 6.4 8.8 (27.3%)

------------------------------- ----- ----- -------- --------- -------- --------

Present Value of New Business Premiums ("PVNBP")

New business flows on the basis of PVNBP are broken down as

follows:

Three months ended Six months ended

31 December 31 December

2022 2021 % 2022 2021 %

PVNBP by product type GBPm GBPm change GBPm GBPm change

----------------------- ------ ------ --------- ----- ----- --------

Regular premium 13.8 21.7 (36.4%) 30.8 40.6 (24.1%)

Single premium 4.8 11.8 (59.3%) 12.6 24.3 (48.1%)

----------------------- ------ ------ --------- ----- ----- --------

Total 18.6 33.5 (44.5%) 43.4 64.9 (33.1%)

----------------------- ------ ------ --------- ----- ----- --------

Three months ended Six months ended

31 December 31 December

2022 2021 % 2022 2021 %

PVNBP by geographical GBPm GBPm change GBPm GBPm change

area

----------------------- ------ ----- -------- ----- ----- --------

Middle East & Africa 8.5 11.9 (28.6%) 19.5 22.6 (13.7%)

Latin America 5.7 7.6 (25.0%) 13.7 14.4 (4.9%)

Rest of World 3.6 11.2 (67.9%) 7.4 20.6 (64.1%)

Far East 0.8 2.8 (71.4%) 2.8 7.3 (61.6%)

Total 18.6 33.5 (44.5%) 43.4 64.9 (33.1%)

----------------------- ------ ----- -------- ----- ----- --------

Assets under Administration ("AUA")

The composition and value of AuA is based upon the assets

selected by or on behalf of contract holders to meet their savings

and investment needs. Reflecting the wide geographical spread of

the Group's customer base, the majority of premium contributions

and of AuA are designated in currencies other than sterling. Over

60% of Group AuA are denominated in US dollars.

The total of such assets is affected by the level of new premium

contributions received from new and existing policy contracts, the

amount of assets withdrawn by contract holders, charges and the

effect of investment market and currency movements. These factors

ultimately affect the level of fund-based income earned by the

Group. Net withdrawals are typically experienced in Hansard Europe

dac ("Hansard Europe") as it closed to new business in 2013.

AuA saw an increase of GBP1.9m to GBP1.10 billion during the

three months ended 31 December 2022. For the six months ended 31

December 2022 AuA increased by GBP8.0m.

The following analysis shows the components of the movement in

AuA during the quarter:

Three months Six months

ended ended

31 December 31 December

2022 2021 2022 2021

GBPm GBPm GBPm GBPm

----------------------------------------- -------- -------- -------- --------

Deposits to investment contracts

- regular premiums 22.6 22.4 44.2 43.3

Deposits to investment contracts

- single premiums 4.9 12.0 12.7 24.6

Withdrawals from contracts and

charges (32.7) (42.2) (71.9) (83.7)

Effect of market and currency movements 7.1 19.2 23.0 22.4

----------------------------------------- -------- -------- -------- --------

Increase / (decrease) in period 1.9 11.4 8.0 6.6

Opening balance 1,098.4 1,219.4 1,092.3 1,224.2

----------------------------------------- -------- -------- -------- --------

Assets under Administration at

31 December 1,100.3 1,230.8 1,100.3 1,230.8

----------------------------------------- -------- -------- -------- --------

The movement in AuA is split as follows between Hansard

International (incorporating business reinsured from Hansard

Worldwide) and Hansard Europe:

Six months ended

31 December

2022 2021

GBPm GBPm

--------------------------------- --- --------------- ------

Hansard International 9.4 11.7

Hansard Europe (1.4) (5.1)

---------------------------------------- --------------- ------

Increase / (decrease) in period 8.0 6.6

---------------------------------------- --------------- ------

FINANCIAL Results for the half-year ENDED 31 December 2022

Financial results for the half-year are expected to be announced

on 9 March 2023.

Outlook

We expect sales of long-term savings products through

Independent Financial Advisors to continue to be impacted by global

economic headwinds. Looking forward however we are confident that

our new product pipeline will lead to increased sales and long term

growth in the business.

Notes to editors:

-- Hansard Global plc is the holding company of the Hansard

Group of companies. The Company was listed on the London Stock

Exchange in December 2006. The Group is a specialist long-term

savings provider, based in the Isle of Man.

-- The Group offers a range of flexible and tax-efficient

investment products within a life assurance policy wrapper,

designed to appeal to affluent, international investors.

-- The Group utilises a controlled cost distribution model via a

network of independent financial advisors and the retail operations

of certain financial institutions who provide access to their

clients in more than 170 countries. The Group's distribution model

is supported by Hansard OnLine, a multi-language internet platform,

and is scalable.

-- The principal geographic markets in which the Group currently

services contract holders and financial advisors are the Middle

East & Africa, the Far East and Latin America. These markets

are served by Hansard International Limited and Hansard Worldwide

Limited.

-- Hansard Europe dac previously operated in Western Europe but

closed to new business with effect from 30 June 2013.

-- The Group's objective is to grow by attracting new business

and positioning itself to adapt rapidly to market trends and

conditions. The scalability and flexibility of the Group's

operations allow it to enter or develop new geographic markets and

exploit growth opportunities within existing markets without the

need for significant further investment.

Forward-looking statements:

This announcement may contain certain forward-looking statements

with respect to certain of Hansard Global plc's plans and its

current goals and expectations relating to future financial

condition, performance and results. By their nature forward-looking

statements involve risk and uncertainties because they relate to

future events and circumstances which are beyond Hansard Global

plc's control. As a result, Hansard Global plc's actual future

condition, performance and results may differ materially from the

plans, goals and expectations set out in Hansard Global plc's

forward-looking statements. Hansard Global plc does not undertake

to update forward-looking statements contained in this announcement

or any other forward-looking statement it may make. No statement in

this announcement is intended to be a profit forecast or be relied

upon as a guide for future performance.

This announcement contains inside information which is disclosed

in accordance with the Market Abuse Regime.

Legal Entity Identifier: 213800ZJ9F2EA3Q24K05

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBUGDBBBDDGXU

(END) Dow Jones Newswires

January 26, 2023 02:00 ET (07:00 GMT)

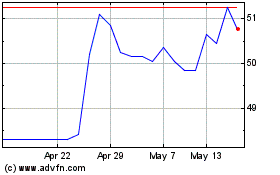

Hansard Global (LSE:HSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Hansard Global (LSE:HSD)

Historical Stock Chart

From Nov 2023 to Nov 2024