RNS Number:7859V

Gooch & Housego PLC

14 December 2000

FOR IMMEDIATE RELEASE 14 December 2000

GOOCH & HOUSEGO PLC

PRELIMINARY RESULTS FOR THE YEAR ENDED 30 SEPTEMBER 2000

Gooch & Housego PLC, the specialist manufacturer of precision optical

components and bespoke glass engineering items, acousto-optic devices and

instruments for measuring optical radiation, today announces preliminary

results for the year ended 30 September 2000.

Highlights

* Record order book for optics and acousto optics including a new

component for telecommunications.

* Completion in September 2000 of the US strategic acquisition of NEOS

Technologies Inc for #4.3m

* Successful placing of 1,095,000 ordinary shares

* Profit before tax increased by 40%

* Increase in earnings per share of 51%

* Recommended increase in final dividend making a total of 2.3p for the

year

Archie Gooch, Chairman of Gooch & Housego commented, "In the past year we have

seen considerable development in all areas of the Groups activities. I

believe that we have never been better positioned, or stronger commercially,

than we are now. If we can seize the opportunities now open to us, we can

look forward to the future with great confidence".

For further information :

Archie Gooch/Ian Bayer 01460 52271

Gooch & Housego PLC

Tim Thompson 0207 466 500

Buchanan Communications

GOOCH & HOUSEGO PLC

CHAIRMAN'S STATEMENT 2000

I am pleased to report a year of substantial progress for the Gooch & Housego

Group. For the twelve months ended 30th September 2000, there has been

considerable improvement in all areas of the Group's activities with turnover,

profits, earnings per share and dividends all increasing significantly.

Results and Dividends

In the year to 30 September 2000 profit before tax rose by 40% to #2.59m (1999

: #1.85m) and earnings per share increased by 51% to 9.8p (1999 : 6.5p).

Turnover was up 20% at #12.51m (1999 : #10.38m).

In view of these excellent results, your Board is recommending an increased

final dividend of 1.55p per Ordinary Share (1999 : 1.3p) which, together with

the interim paid, totals 2.3p an increase of 21% on last years 1.9p. Subject

to approval at the Annual General Meeting the final dividend will be payable

on 8th February 2001 to all shareholders on the register on 3rd January 2001.

Acquisitions

As already reported the Group completed the US acquisition of NEOS

Technologies Inc (NEOS) on 22nd September 2000 for # 4.3m. The acquisition

was financed by a vendor placing of 1,095,000 new Ordinary 20p Shares raising

# 2.6m and the balance from new loans and existing cash resources. I am

pleased to report that NEOS has made a very positive and profitable start

since joining the Group. However due to the proximity of the acquisition date

to the Group's year end no profit has been consolidated in these accounts.

Operating Performance

United Kingdom

In the UK sales for Gooch and Housego were #5.82m (1999 #4.80m), an increase

of 21.3%. The well-established precision Optics business continued to grow

strongly and we also enjoyed an exceptional increase in orders and sales of

our Acousto-Optic products in the second half of the year. In particular the

increase in sales of Q-Switches into China emphasised the worldwide nature of

our Acousto Optic business.

Since the end of the financial year we have received the two major defence

contracts I referred to in my last Interim statement, one of which is worth

over #1m across a five year period. We continue to benefit from the trend of

our major defence customers to concentrate on their core skills and outsource

an increasing amount of their optics production. As a result of these factors

and our strong Acousto Optics business we currently have a record order book

totalling #4.6m.

Following my statement of 18 September 2000 our expertise in crystal quartz

waveplates has been rewarded by increased orders from a major US company

supplying components and subsystems into the rapidly growing fibre optic

telecommunications market. We are committed to fully exploiting the

opportunity while accepting this is a fast moving market with rapidly changing

technology. To meet this demand we have set up a dedicated manufacturing cell,

equipped with standard optics production equipment and staffed by a mixture of

existing staff and new recruits.

In the longer term we will support the strong growth of all parts of the UK

based business by building a new factory in the locality. We are currently

completing negotiations to purchase a suitable site in the Ilminster area. The

facility will initially incorporate 30,000 sq ft of production capacity,

together with sufficient additional adjacent land for future expansion.

United States

Cleveland Crystals Inc has reported a further year of excellent sales at #4.1m

(1999 for 8 mths : #3.3m ) and operating profits of #1.1m ( 1999 for 8 mths :

#0.9m ) Their work on the growth and fabrication of crystals for the US

Department of Energy's National Ignitions Facility (NIF) continues with

further substantial investment now being undertaken by NIF at our Cleveland

factory. This confirms our optimism for further major contracts to be placed

with us. The development of the new range of crystals has now culminated in

commercial sales, while the original core business of Electro-optics has also

reported improved revenues.

Optronic Laboratories Inc have also seen an increase in profits compared to

last year but their contribution to overall Group profits remains

disappointing. Turnover for the year was up by 12% at #2.9m (1999 : #2.6m) and

operating profits up at #133,000 (1999 : #66,000). However their core business

of light measurement devices remains relatively flat. Your Board continues to

take steps to remedy this position with the planned implementation of a new

technical organisation to broaden the range of products to appeal to a wider

range of customers. As I reported in my statement last year the new optics

facility is fully operational and the benefits of this will be seen in

increased profits in the coming year.

NEOS is proving to be an excellent purchase. For the two months since

acquisition there have been substantial increases in sales and profits as

compared to the same period last year. The purchase of NEOS included an

important patent for the future development of a Q-switch, which contains

crystal quartz for use in diode pumped laser systems. There is a new and

growing demand for this type of switch which, together with our leading global

position in Q-switch production, gives us confidence as to the future growth

of this product.

Financial Position

The Group's financial position remains strong. Gearing at the year end stood

at 31% (1999: 59%) and interest was covered 12.5 times (1999; 13.3 times).

Through prudent management of our resources our balance sheet remains in a

strong position for future growth and development.

Management and Staff

Your Board believes that the Group has reached the stage where it will be very

beneficial to appoint a Chief Scientist covering technical matters in all the

subsidiaries. Several potentially valuable projects have been identified for

this individual, who may be domiciled in the US, and we have already started

the recruitment process.

It is not possible to achieve outstanding results such as are set out above

without quite remarkable ability, effort and dedication at every level within

the Group. I would like to express my most sincere thanks and appreciation to

everyone who has contributed to this success.

Prospects

I believe that we have never been better positioned, or stronger commercially,

than we are now. If we can seize the opportunities now open to us, we can

look forward to the future with great confidence.

Archie Gooch MBE JP

Chairman and Chief Executive

Gooch & Housego PLC

GROUP PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 30 SEPTEMBER 2000

2000 1999

#'000 #'000

Turnover 12,510 10,377

Trading expenditure (9,695) (8,376)

Operating profit 2,815 2,001

Other interest receivable and similar income 33 41

Interest payable and similar charges (259) (191)

Profit on ordinary activities before taxation 2,589 1,851

Tax on profit on ordinary activities (926) (756)

Profit on ordinary activities after taxation 1,663 1,095

Dividends on equity shares (406) (321)

Retained profit for the financial year 1,257 774

Earnings per 20p ordinary share 9.8p 6.5p

All of the amounts above are in respect of continuing

operations.

Gooch & Housego PLC

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

FOR THE YEAR ENDED 30 SEPTEMBER 2000

2000 1999

#'000 #'000

Profit for the financial year 1,663 1,095

Currency translation difference on foreign currency net 143 16

investments

Taxation on retranslation gains/losses on foreign currency

loans hedged against foreign currency net investments 56 _

Total recognised gains and losses for the financial year 1,862 1,111

No note of historical cost profit for the group or the company has been

presented as the difference between the reported profit and the historical

cost profit is immaterial.

Gooch & Housego PLC

GROUP BALANCE SHEET

AS AT 30 SEPTEMBER 2000

2000 1999

#'000 #'000 #'000 #'000

FIXED ASSETS

Intangible assets 5,629 3,336

Tangible assets 3,624 3,497

9,253 6,833

CURRENT ASSETS

Stocks 3,225 1,440

Debtors 3,401 3,238

Cash at bank and in hand 1,930 269

8,556 4,947

CREDITORS : amounts falling due (3,808) (2,806)

within one year

NET CURRENT ASSETS 4,748 2,141

TOTAL ASSETS LESS CURRENT LIABILITIES 14,001 8,974

CREDITORS : amounts falling due after (3,977) (2,916)

more than one year

10,024 6,058

CAPITAL AND RESERVES

Called up share capital 3,600 3,381

Share premium account 3,404 1,113

Revaluation reserve 308 308

Profit and loss account 2,712 1,256

EQUITY SHAREHOLDERS' FUNDS 10,024 6,058

Gooch & Housego PLC

GROUP CASH FLOW STATEMENT

FOR THE YEAR ENDED 30 SEPTEMBER 2000

Note 2000 1999

#'000 #'000 #'000 #'000

Cash flow from operating (i) 4,142 1,592

activities

Returns on investments

and servicing of finance

Interest received 38 41

Interest paid (276) (173)

Interest element of hire (2) (1)

purchase contracts

Debt issue costs (77) -

Net Cash (outflow) from

returns on investments

and servicing of finance (317) (133)

Taxation

UK tax paid (301) (522)

Overseas tax paid (511) (251)

Cash outflow from (812) (773)

taxation

Capital expenditure and

financial investment

Purchase of tangible (404) (612)

fixed assets

Sale of tangible fixed - 15

assets

Net cash outflow from

capital expenditure and

financial investment (404) (597)

Acquisition

Acquisition of subsidiary (4,401) (4,272)

Cash acquired on 388 55

acquisition

Net cash outflow from (4,013) (4,217)

acquisition

Equity dividends paid (347) (304)

Cash inflow before (1,751) (4,432)

financing

Financing

New bank loans 5,103 3,411

Repayment of bank loan (3,984) (202)

Capital element of hire (13) (49)

purchase contracts

Issue of share capital 2,628 -

Net cash inflow from 3,734 3,160

financing

Increase/(decrease) in (iii) 1,983 (1,272)

cash in the year

NOTES TO THE CASH FLOW STATEMENT

(i) Reconciliation of operating profit to operating cash flows

2000 1999

#'000 #'000

Operating profit 2,815 2,001

Amortisation of goodwill 172 115

Amortisation of debt issue costs 11 -

Depreciation 433 362

(Increase)/decrease in stock (326) 203

Decrease/(increase) in debtors 262 (1,290)

Increase in creditors 775 201

4,142 1,592

(ii) Reconciliation of net cash inflow/(outflow) to movement in

net funds/(debt)

2000 1999

#'000 #'000

Increase/(decrease) in cash in the year 1,983 (1,272)

Cash (inflow)/outflow from (increase)/decrease in

debt and lease financing (1,106) (3,159)

Changes in net debt resulting from cash flows 877 (4,431)

New hire purchase contracts (25) (66)

Movement in debt issue costs 67 -

Translation difference (404) 22

Movement in net debt in the year 515 (4,475)

Net (debt)/funds at 1 October 1999 (3,582) 893

Net (debt)/funds at 30 September 2000 (3,067) (3,582)

(iii) Analysis of net (debt)/funds

At 1 At 30

October Cash Exchange Non-cash September

1999 flow Movement Movement 2000

#'000 #'000 #'000 #'000 #'000

Cash in hand and at 269 1,869 (208) - 1,930

bank

Overdrafts (114) 114 - - -

1,983

Debt due after 1 (2,900) (921) (161) 40 (3,942)

year

Debt due within 1 (763) (198) (43) 27 (977)

year

Hire Purchase (74) 13 8 (25) (78)

(1,106)

(3,582) 877 (404) 42 (3,067)

NOTES TO THE PRELIMINARY ANNOUNCEMENT

FOR THE YEAR ENDED 30 SEPTEMBER 2000.

1. Basis of preparation.

The unaudited financial information contained in this preliminary

announcement report does not comprise statutory accounts within the

meaning of Section 240 of the Companies Act 1985.

The figures in this preliminary announcement have been prepared under

generally accepted accounting policies in the United Kingdom. The

accounting policies adopted are those set out in the Annual Report and

Accounts for the year ended 30 September 1999 which includes the

unqualified report of the auditors and which have been filed with the

Registrar of Companies.

2. Segmental Reporting.

The analysis of turnover by destination is as follows :

2000 1999

#' 000 #' 000

United Kingdom 2,852 2,337

North America 6,567 5,805

Continental Europe 1,606 1,272

Other 1,485 963

12,510 10,377

The results by geographical origin are as follows :

United Kingdom North America

Group

2000 1999 2000 1999 2000 1999

#'000 #'000 #'000 #'000 #'000 #'000

Turnover

- Continuing 5,821 4,798 7,040 5,809 12,861 10,607

Inter-segment sales - (6) (351) (224) (351) (230)

Sales to third parties 5,821 4,792 6,689 5,585 12,510 10,377

Operating Profit

- Continuing 1,677 1,008 1,138 993 2,815 2,001

Segment profit before

Interest and taxation 1,677 1,008 1,138 993 2,815 2,001

Net interest (226) (150)

Group profit before taxation 2,589 1,851

3. Taxation.

The charge for taxation on the profit for the year is made up as follows:

2000 1999

#' 000 #' 000

Current year

UK corporation tax 425 275

Overseas taxation 501 481

926 756

4. Earnings per share.

The calculation of earnings per 20p Ordinary Share is based on the

profit on ordinary activities after taxation using as a divisor the

weighted average number of Ordinary Shares in issue during the year. For

2000 the weighted average number of Ordinary Shares in issue is

16,934,080 (1999 : 16,904,162)

5. The final dividend will be paid on 8th February 2001 to shareholders

on the register at close of business on 3rd January 2001.

6. Copies of the Statement will be despatched to shareholders during the

week commencing 8th January 2001 and will also be available from the

Company Secretary, Gooch & Housego PLC, The Old Magistrates Court,

Ilminster, Somerset. TA19 0AB.

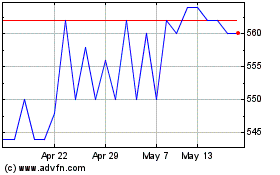

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From May 2024 to Jun 2024

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jun 2023 to Jun 2024