TIDMBIRD

RNS Number : 8806K

Blackbird PLC

27 April 2020

27 April 2020

Blackbird plc

(the "Company")

Audited full year results for the year ended 31 December

2019

Blackbird (AIM: BIRD), the developer and seller of the

market-leading cloud video editing platform, Blackbird , announces

its audited full year results for the year ended 31 December

2019.

Ian McDonough, CEO of Blackbird, commented:

"The overriding theme for the Company in 2019 was upwards

momentum. The Company made very good progress against its renewed

strategy and the focus on sports and news led to the Company

booking record revenues for the period. By the end of 2019, our

deferred revenue and contracted order book had trebled when

compared to 31 December 2018.

"During the year Blackbird clearly demonstrated and communicated

that it can be a market-leading product for blue-chip global

Enterprises. In 2020 I look forward to building on these

direct-sale wins and accelerating growth by striking deals with

Original Equipment Manufacturers ("OEMs") where Blackbird will be

sold as an integral part of a larger end-to-end media solution.

This will mean that well-established OEM companies and their

requisite sales teams will be selling Blackbird to a larger volume

of global customers.

"The successful equity fundraise in November 2019 means the

Company is well capitalised for multiple years and gives us the

chance to build market share as more businesses that create video

move to flexible and remote working.

"Finally, during these challenging times with COVID-19, I am

delighted and excited that Blackbird has quickly enabled both

existing and new customers to have their staff working safely and

remotely editing video even at low or variable bandwidths - all

while our own teams are distributed and working remotely

themselves."

Operational highlights (post period end)

-- Expansion of A + E Networks deal, doubling volume edited through Blackbird

o Showing, once again, Blackbird's ability to 'land and expand'

within large organisations

-- Deals signed with Arsenal F.C. and Liverpool F.C. for content

creation and enabling remote working for their editors

o Reaffirming the Company's strategic focus on the Sports

market

-- Partnership announced with Zixi, the award-winning architect

of the Software-Defined Video Platform

o Integral part of the Company's OEM strategy

-- Expansion of TownNews deal, bringing the total to 49 stations across the US

-- 2020 secured revenue* at 31 March 2020 already matches 2019 revenue

-- Contracted but unrecognised revenue of GBP2,045k* at 31 March

2020. GBP757k of this balance is to be recognised in 2020 (included

in 2020 secured revenue), GBP598k in 2021, GBP345k in 2022 and

GBP345k in 2023 and beyond

-- The Company to showcase ultra-efficient video editing with

Zixi, Amazon Web Services and Google at virtual customer events

(replacing the cancelled NAB)

-- Prototype of Blackbird built in Public Cloud to be launched

at virtual customer events

o Demonstrating Blackbird's ability to offer even larger

scalable cloud-based solutions

-- SOC2 Type 1 security accreditation obtained

o Building further trust with existing and new customers

particularly in the US

*Unaudited and subject to exchange rate fluctuations

Operational highlights (during the year)

-- Trebling of deferred revenue and contracted order book compared to 31 December 2018

-- Significant multi-year deal signed in November with a global

news organisation built on the customer's AWS infrastructure

-- Multi-year deal signed with A+E Networks in June to provide

solutions across multiple workflows

-- Long term tender won in September for video production with

U.S. Department of State

-- Eleven Sports chose Blackbird for rapid editing and

publishing of sports content for the next two years

-- Expansion and three-year extension of deal with IMG Media, a

leading global producer and distributor of sports media

-- Extension of contracts with leading media rights companies

Deltatre, MSG Networks and Gfinity

-- Blackbird selected by global fitness technology leader

Peloton to edit its daily virtual spin classes across all four

global studios

-- Two-year contract signed with Australia's National Rugby

League, for live video clipping and publishing

-- Successful equity fundraise generating GBP5,238k to

strengthen the Balance Sheet and help the Company execute its

strategy

-- Implementation of Blackbird Productions Partnership Program

("BP3") with 24 post-production houses signed up to date

-- Achieved Microsoft Azure Co-Sell Partner status

-- Improved Blackbird platform with JavaScript web-based

editing/clipping and enhanced social media publishing

-- Company name change to Blackbird plc

-- Board strengthened with appointment of Andrew Bentley as

Chairman, Dawn Airey as Non-Executive Director and Stephen White as

Chief Operating and Financial Officer. Former Chairman, David Main

remains as a Non-Executive Director

Financial highlights

-- Record revenues of GBP1,078k for the 12 months to 31 December

2019, up 24% year-on-year (12

months to 31 December 2018: GBP870k)

-- Trebling of North American revenues to GBP469k (12 months to

31 December 2018: GBP158k)

-- Contracted but unrecognised revenue increased by 232% to

GBP1,881k from GBP566k at 31 December 2018. GBP797k of the 2019

year-end balance is to be recognised in 2020, GBP462k in 2021,

GBP304k in 2022 and GBP318k in 2023 and beyond.

-- Operating costs of GBP2,689k (12 months to 31 December 2018: GBP2,739k)

-- Net loss after tax GBP2,129k (12 months to 31 December 2018: GBP2,575k)

-- At 31 December 2019 the Company had cash of GBP7,965k (2018: GBP5,032k) and no debt

Enquiries:

Blackbird plc Tel: +44 (0)20 8879

7245

Ian McDonough, Chief Executive Officer

Stephen White, Chief Operating and Financial

Officer

Allenby Capital Limited (Nominated Adviser Tel: +44 (0)20 3328

and Broker) 5656

Nick Naylor

Nicholas Chambers

About Blackbird plc

Blackbird plc operates in the fast-growing SaaS and cloud video

market. It has created Blackbird, the world's most advanced suite

of cloud-native computing applications for video, all underpinned

by its lightning-fast codec. Blackbird plc's patented technology

allows for frame accurate navigation, playback, viewing and editing

in the cloud. Blackbird underpins multiple applications, which are

used by rights holders, broadcasters, sports and news video

specialists, esports, live events and content owners,

post-production houses, other mass market digital video channels

and corporations.

Since it is cloud-native, Blackbird removes the need for costly,

high end workstations and can be used from almost anywhere on

almost any device. It also allows full visibility on multi-location

digital content, improves time to market for live content such as

video clips and highlights for social media distribution, and

ultimately results in much more effective monetisation.

Blackbird(R) is a registered trademark of Blackbird plc.

Websites

www.blackbird.video

Social media

www.linkedin.com/company/blackbird-cloud

www.twitter.com/blackbirdcloud

www.facebook.com/blackbirdplc

Chief Executive Officer's Statement

Even during these uncertain times with the Coronavirus outbreak,

I am very happy that as we look back on 2019 and forward to 2020 we

have much to be proud about and even more to be excited about.

With a 24% increase in revenues we have for the first time

broken through the million pounds level with a total for the year

of GBP1,077,643 (2018: GBP870,310). In 2019 some of the world's

most prestigious and high-profile entities including the US

Government and A+E Networks chose Blackbird to improve or even

replace workflows provided by long established and much larger

competitors.

North America has been a focus of our strategy since I joined

the Company and this year happily saw almost a trebling in business

there. Revenues are up 197% to GBP468,714 and now make up almost

half of total revenues in the year. This is up from just 18% of

revenues last year.

The highlights of a transformational year in the US start with

expansion of our TownNews business from 20 local news stations at

the end of 2018 to the impressive 49 we have today. TownNews have

deployed Blackbird in every single video customer they have and

continue to be a very satisfied with the Blackbird workflow. We

will continually seek to expand our services with them. As a

result, our news business has leapt a massive 285% to

GBP233,547.

We also closed a three-year deal with A+E Networks which at the

time was our largest single deal. This deal was a step change for

the business not only in scale and length but also in the

associated improvements we made to our company and product in terms

of security that have made us so much fitter and stronger to make

inroads into this US media sector. A+E use us for many different

workflows including live clipping to social, where we replaced

SnappyTV for assembling Live PD - the most watched TV programme on

US TV - and adding value to their enormous archive, where we are

enhancing traditional on-premise workflows.

That was followed by us winning another long-term contract with

the US State Department in a publicly contested tender, beating

other established industry players. The Office of Global Affairs

will use Blackbird to turn all of their fast-turnaround news, news

conferences and events to social and OTT - and there has been an

eventful news cycle for them.

We capped off the year by closing a very exciting long-term deal

with a global provider of financial news based in New York. Working

through this deal has again driven Blackbird to new standards of

speed and functionality. Our ability to integrate seamlessly with

AWS (Amazon Web Services) public cloud is increasingly a factor in

larger deals.

A significant change I have brought to the business is moving

from annual or project deals to multiyear or long-term deals. The

fact that our customers have been happy to agree to this

demonstrates a great deal of faith in Blackbird and our ability to

stay ahead of our competition over a sustained period. It has also

meant our contracted but unrecognised revenue is at its highest

level ever - up by 232% to GBP1,881,133 since this time last

year.

Outlook

While 2019 was a fantastic year for demonstrating the attraction

of Blackbird to large scale global customers, the true scale

opportunity for our world leading software will be our OEM

opportunity - the 'Blackbird inside' model. In April 2020, we

announced a partnership with Zixi, the award-winning architect of

the Software-Defined Video Platform, and industry leader for live

broadcast-quality video over any IP network. The global public

clouds have positioned us in this area and we are also in

discussions with some other large global infrastructure companies

who are very interested to wholesale Blackbird for themselves for

strategic reasons.

These strategic reasons are built around the following two

tenets.

1. Firstly, Blackbird allows end users to work with their

original high-quality content in situ, without the need to upload

or download as happens with traditional on-premise systems. This

means infrastructure companies can retain this high-quality content

within their eco-system and generate further monetisation.

2. Secondly, we provide the leading climate friendly solution.

The fact that high resolution content does not need to be uploaded,

downloaded or transported in order to be edited means no heavy-duty

bandwidth is required; and because end users can work remotely

without bespoke hardware, they can reduce travel, so we help to

make them energy efficient. Overall, we are an incredibly green

technology - and this contributes to the customers' sustainability

credentials. This is something that the team are working on in more

detail now but will undoubtedly be a factor that grows in

importance in the coming years for partners and customers

alike.

Finally, in these challenging times with the COVID-19 outbreak,

I am delighted that Blackbird has assisted both existing and new

customers to have their staff working safely and remotely editing

video even at low or variable bandwidths. In the last month, we

have been able to aid A+E Networks in enabling their New York based

editors to safely work from home. This has resulted in a doubling

of capacity and increased revenue from A+E Networks in 2020.

Additionally, we have also signed new deals with Arsenal helping

their team work collaboratively and remotely from multiple

locations and turning around high-quality content quickly and cost

effectively and with Liverpool F.C. to access their centrally

stored file-based archives from any browser or laptop and to

continue to engage their global fanbase.

Ian McDonough

Chief Executive Officer

Chairman's Statement

2019 was an eventful year for the Company as sales momentum

behind our growth strategy started to yield results. Even more

exciting than the 24% year on year revenue growth was ending the

year with contracted but unrecognised revenue up 232% compared to

31 December 2018. This demonstrates our growth momentum. Targeted

sales and marketing efforts, focusing on the real competitive

advantages of the Blackbird platform, delivered important contract

wins from several major broadcasters. Most notably, one of the

world's foremost financial news organisations transitioned to the

Blackbird platform on a significant multi-year deal. Other notable

deals included a major US broadcast network, and the US Department

of State. Each of these important contract wins offers a major

endorsement of the proprietary technology that powers the Blackbird

platform and the credibility of Blackbird's client solutions.

Our strategy is working. We have been strengthening our focus on

News and Sports clients, where our objective is to be a key

component in our end customers technology stacks (via direct B2B

sales) as well as establishing ourselves as a vital component in

the technology stacks of solutions providers (Original Equipment

Manufacturers or OEMs). OEMs provided real leverage to our sales

strategy as they sell our solution as part of their total service.

The net effect of this SaaS business model is a significant growth

in our average deal size and contract length, growth in our average

revenue per client and growth in our repeatable revenue per

client.

The Board believes that our successful and oversubscribed net

equity fundraising of GBP5,217,390 towards the end of last year

will ensure the ongoing growth of the company by providing the

resources to execute against our strategy and to continue to win

meaningful contracts.

Our results for the year show the early outcomes of these

activities. The Company recorded revenues growth of 24% to

GBP1,077,643 (2018: GBP870,310). We also grew the size of our North

American business, which now comprises 43% of our revenues. Our

revenue mix continues to improve and 94% of revenues (2018: 54%)

came from infrastructure (37%) and OEM sales (57%).

Our contracted but unrecognised revenue at the end of the year

was GBP1,881,133 up 232% vs GBP566,104 in 2018. This clearly

demonstrates the improved quality of our business and the strength

and growth potential of our business as we entered 2020.

Finally, we finished the year with a loss for the year of

GBP2,128,638 (2018: loss of GBP2,574,618), in a year where good

progress was made against our strategy.

The Board believes that the Company is now well positioned to

grow and succeed in the large, high-growth, cloud video market. We

have put the core organisation, technology and capabilities in

place and have started to build growth momentum.

Consolidated income statement and consolidated statement of

financial position

In the year ended 31 December 2019, the Company recorded revenue

of GBP1,077,643 (2018: GBP870,310), which represented an increase

of 24% year on year. Deferred revenue increased year on year by 28%

to GBP295,221 from GBP230,361 at 31 December 2018, while contracted

but uninvoiced revenue increased year on year by 472% to

GBP1,585,912 from GBP335,743 as at 31 December 2018.

Operating costs during the year to 31 December 2019 were down 2%

to GBP2,688,821 compared to GBP2,738,515 in the corresponding

period in 2018. This decrease was the result of higher development

costs capitalised to support the platform development partially

offset by an increase in staff costs from strengthening the

management team and higher legal costs to close new deals and

change the company name.

The loss before interest, taxation, depreciation and

amortisation was GBP1,771,822 (2018: GBP1,993,284). The net loss

for the year of GBP2,128,639 compares to a loss of GBP2,574,618 in

2018.

Board changes

In April we welcomed Stephen White to the Board in the newly

created Chief Operating and Financial Officer role. Stephen joined

us from Comcast's NBC Universal where he spent five years in senior

finance roles in their EMEA Networks division. Stephen took over

from Jonathan Lees who has left the Company to pursue other

opportunities and the Board would like to thank Jonathan for his

invaluable service. At the AGM in May, I was delighted to be

appointed Chairman, taking over from David Main. I would like to

thank David, for his valuable contribution as Chairman over the

past three years. David continues to serve on the Board and we

continue to benefit from his vast experience.

In May 2019 the Company welcomed Dawn Airey as a new

Non-Executive Director to the Board. Dawn has extensive experience

in the media and entertainment industry having held senior board

positions in several major broadcasters and content businesses.

Dawn is also an experienced NED in both public and private

companies. Towards the end of the year, the board said goodbye to

Jim Irving, who stepped down from his role as Non-Executive

Director to concentrate on his own business Fanview. The Board

would like to welcome Dawn to the company and to thank Jim for his

years of service.

Blackbird platform development

The core focus of our development efforts is the continuous

improvement of the Blackbird platform to support our infrastructure

and OEM strategy. This focus combines improving performance, adding

new functionality, increasing the ease of adoption and upgrading

the user interface. Integral to this has been the shift of our web

applications to JavaScript. JavaScript allows access and use of

Blackbird products on virtually any device without configuration.

This transition is significant as configuration has been one of the

big obstacles to wider adoption of our services. Rolling out

JavaScript applications is essential for delivering a successful

OEM strategy.

We are committed to maintaining the superiority of our video

production codec including working on the next generation of our

Blackbird codec. Furthermore, we are ensuring that Blackbird can be

integrated with third party functionality such as Artificial

Intelligence ("AI") and data-feeds working with market-leading

specialists in their field.

Current trading and outlook

As noted earlier, we start the year in a strong financial

position, with contracted but unrecognised revenue of GBP1,881,133

at 31 December 2019. GBP797,373 of this balance relates to revenue

to be recognised in 2020, versus a comparative figure of GBP448,488

at 31 December 2018.

During these testing times with the COVID-19 outbreak, I am also

pleased that our platform provides Enterprises with solutions to

work remotely. The expansion of our deal with A+E Networks who will

double the volume edited through the Blackbird platform will both

enable a significant expansion of remote video production

capability, and ensure the overall safety of its editors who will

now be able to work even more effectively, remotely. We have also

secured new deals with Arsenal to assist their team to continue to

produce high-quality output from their team working remotely in

multiple locations and with Liverpool F.C. for remote video editing

and publishing.

Finally, the Board and Management team are confident that with

our excellent team in place, we have the platform and strategy to

grow our business successfully.

Andrew Bentley

Chairman

Consolidated income statement and statements of comprehensive

income for the year ended 31 December 2019

2019 2018

GBP GBP

CONTINUING OPERATIONS

Revenue 1,077,643 870,310

Cost of Sales (161,269) (125,079)

==================================================== ============ ============

GROSS PROFIT 916,374 745,231

Other income 625 -

Operating costs (2,688,821) (2,738,515)

==================================================== ============ ============

EARNINGS BEFORE INTEREST, TAXATION, DEPRECIATION,

AMORTISATION AND EMPLOYEE SHARE OPTION COSTS (1,771,822) (1,993,284)

Depreciation (93,130) (44,432)

Amortisation (267,734) (544,889)

Employee share option costs (46,774) (32,445)

------------ ------------

(407,638) (621,766)

OPERATING LOSS (2,179,460) (2,615,050)

Net Finance income 18,397 15,898

==================================================== ============ ============

LOSS BEFORE INCOME TAX (2,161,063) (2,599,152)

Income tax 32,424 24,534

LOSS FOR THE YEAR (2,128,639) (2,574,618)

Other comprehensive income - -

TOTAL COMPREHENSIVE LOSS FOR THE YEAR (2,128,639) (2,574,618)

Earnings per share expressed in pence per share

Basic - continuing and total operations (0.71p) (1.07p)

Consolidated and company statements of financial position as at

31 December 2019

Group Company

2019 2018 2019 2018

GBP GBP GBP GBP

ASSETS

NON-CURRENT ASSETS

Intangible assets 972,245 748,062 972,245 748,062

Property, plant and

equipment 391,044 32,816 391,044 32,816

Investments - - - 641

------------------------------- ------------- ------------- ------------- -------------

1,363,289 780,878 1,363,289 781,519

CURRENT ASSETS

Trade and other receivables 503,037 301,742 503,037 306,062

Stock 661 - 661 -

Current tax assets 32,424 24,534 32,424 24,534

Cash and bank balances 7,965,491 5,032,087 7,965,491 5,026,622

------------------------------- ------------- ------------- ------------- -------------

8,501,613 5,358,363 8,501,613 5,357,218

------------------------------ ------------- ------------- ------------- -------------

TOTAL ASSETS 9,864,902 6,139,241 9,864,902 6,138,737

=============================== ============= ============= ============= =============

EQUITY AND LIABILITES

CAPITAL AND RESERVES

Issued share capital 2,681,913 2,363,890 2,681,913 2,363,890

Share premium 26,371,502 21,456,572 26,371,502 21,456,572

Capital contribution

reserve 125,000 125,000 125,000 125,000

Retained earnings (20,457,091) (18,375,226) (20,457,091) (18,374,946)

------------------------------- ------------- ------------- ------------- -------------

TOTAL EQUITY 8,721,324 5,570,236 8,721,324 5,570,516

NON-CURRENT LIABILITIES

Lease and other payables 323,134 - 323,134 -

323,135 323,135

CURRENT LIABILITIES

Trade and other payables 820,443 569,005 820,443 568,221

------------------------------- ------------- ------------- ------------- -------------

TOTAL LIABILITIES 1,143,578 569,005 1,143,578 568,221

------------------------------- ------------- ------------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 9,864,902 6,139,241 9,864,902 6,138,737

=============================== ============= ============= ============= =============

Consolidated statement of changes in equity for the year ended

31 December 2019

Issued Retained Share Capital Total

share earnings premium contribution equity

capital reserve

GBP GBP GBP GBP GBP

Balance at 1 January

2018 1,443,890 (15,832,255) 16,935,301 125,000 2,671,936

Changes in equity

Issue of share capital 920,000 - 4,830,000 - 5,750,000

Share issue expenses - - (308,729) - (308,729)

Share based payment - 32,445 - - 32,445

Total comprehensive loss for

the year - (2,575,136) - - (2,575,136)

=============================== ========== ============= =========== ============== ============

Balance at 31 December

2018 2,363,890 (18,374,946) 21,456,572 125,000 5,570,516

Changes in equity

Issue of share capital 318,023 - 5,234,945 - 5,552,968

Share issue expenses - - (320,015) - (320,015)

Share based payment - 46,774 - - 46,774

Total comprehensive loss for

the year - (2,128,919) - - (2,128,919)

=============================== ========== ============= =========== ============== ============

Balance at 31 December

2019 2,681,913 (20,457,091) 26,371,502 125,000 8,721,324

Consolidated and company statements of cash flows for the year

ended 31 December 2019

Group Company

2019 2018 2019 2018

Notes GBP GBP GBP GBP

Cash flows from operating

activities

Cash used in operations A (1,870,521) (1,919,634) (1,865,056) (1,918,863)

Interest paid on lease

liabilities (13,449) - (13,449) -

Tax received 24,534 25,268 24,534 25,268

----------------------------------------- ------------ ------------ ------------ ------------

Net cash from operating

activities (1,859,436) (1,894,366) (1,853,971) (1,893,595)

----------------------------------------- ------------ ------------ ------------ ------------

Cash flows from investing

activities

Payments for intangible

fixed assets (434,167) (254,856) (434,167) (254,856)

Payments for property,

plant and equipment (19,370) (17,498) (19,370) (17,498)

Interest received 30,586 11,036 30,586 11,036

----------------------------------------- ------------ ------------ ------------ ------------

Net cash from investing

activities (422,951) (261,318) (422,951) (261,318)

----------------------------------------- ------------ ------------ ------------ ------------

Cash flows from financing

activities

Share issues (net of expenses) 5,271,478 5,441,271 5,271,478 5,441,271

Payment of lease liabilities (53,250) - (53,250) -

Repayment of finance leases (2,437) (5,849) (2,437) (5,849)

----------------------------------------- ------------ ------------ ------------ ------------

Net cash from financing

activities 5,215,791 5,435,422 5,215,791 5,435,422

----------------------------------------- ------------ ------------ ------------ ------------

Increase in cash and cash

equivalents 2,933,404 3,279,738 2,938,869 3,280,509

Cash and cash equivalents

at beginning of year 5,032,087 1,752,349 5,026,622 1,746,113

----------------------------------------- ------------ ------------ ------------ ------------

Cash and cash equivalents

at end of year 7,965,491 5,032,087 7,965,491 5,026,622

========================================= ============ ============ ============ ============

A. Reconciliation of loss before income tax to cash (used in)/generated from operations

Group Company

2019 2018 2019 2018

GBP GBP GBP GBP

Loss before income tax (2,161,063) (2,599,152) (2,161,342) (2,599,670)

Depreciation 93,130 44,432 93,129 44,432

Amortisation charges 267,734 544,889 267,734 544,889

Employee share option costs 46,774 32,445 46,774 32,445

Finance income (18,397) (15,898) (18,397) (15,898)

-------------------------------- ------------ ------------ ------------ ------------

Earnings before interest,

taxation, depreciation and

amortisation (1,771,822) (1,993,284) (1,772,102) (1,993,802)

-------------------------------- ------------ ------------ ------------ ------------

Movements in working capital:

Decrease in trade and other

receivables (209,845) (75,785) (205,527) (74,452)

Increase in trade and other

payables 111,146 149,435 112,573 149,391

-------------------------------- ------------ ------------ ------------ ------------

Cash (used in)/generated from

operations (1,870,521) (1,919,634) (1,865,056) (1,918,863)

================================ ============ ============ ============ ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR BLGDSXXDDGGL

(END) Dow Jones Newswires

April 27, 2020 02:00 ET (06:00 GMT)

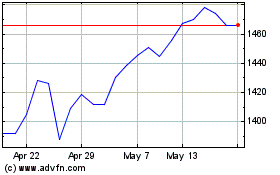

Ft Fbt (LSE:FBT)

Historical Stock Chart

From Feb 2025 to Mar 2025

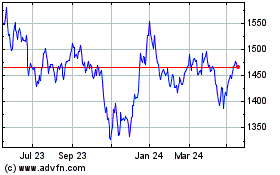

Ft Fbt (LSE:FBT)

Historical Stock Chart

From Mar 2024 to Mar 2025