Cora Gold Limited Update on Convertible Loan Notes (9264L)

September 11 2023 - 2:00AM

UK Regulatory

TIDMCORA

RNS Number : 9264L

Cora Gold Limited

11 September 2023

Cora Gold Limited / EPIC: CORA.L / Market: AIM / Sector:

Mining

11 September 2023

Cora Gold Limited

('Cora' or 'the Company')

Update on Convertible Loan Notes

Cora Gold Limited, the West African focused gold company, is

pleased to confirm the extension of certain convertible loan rights

due to mature on 09 September 2023.

On 13 March 2023 the Company issued convertible loan notes

('CLN') pursuant to a Convertible Loan Note Instrument dated 28

February 2023 (the 'CLNI'). The CLN were for a total of

US$15,875,000 to be convertible into ordinary shares in the capital

of the Company and with a maturity date of 09 September 2023, being

the date 180 days from the date of issue of the CLN. Holders of CLN

(the 'Noteholders') have now approved a number of amendments to the

CLNI, including, among others, the extension to the maturity date

to 12 March 2024, being 365 days from the date of issue of the

CLN.

Certain Noteholders requested the early repayment of outstanding

CLN for a total principal amount of US$625,000 plus 5%.

Accordingly, as at the date of this announcement, these amendments

have resulted in the Company having an unsecured obligation in

relation to issued and outstanding CLN for a total of

US$15,250,000, being convertible into ordinary shares in accordance

with the CLNI as amended.

Bert Monro, Chief Executive Officer of Cora, commented, "I am

very pleased with the ongoing support received from Cora's

Noteholders and long-term shareholders. The Company currently has

balances of cash and cash equivalents in excess of US$17.25

million. Following the recent promulgation of a new Mining Code in

Mali, we look forward to the government's lifting of its moratorium

on issuing new mining permits such that we may, in due course,

progress application for a mining permit over Cora's flagship

Sanankoro Gold Project. In addition, we look forward to providing

progress updates on the funding of the Sanankoro Gold Project

following the appointment of Atlantique Finance to act as sole

adviser in the structuring and mobilisation of a medium-term loan

of US$70 million in CFA franc ('XOF') to support funding the

development of the project (see RNS dated 28 June 2023)."

Amendments to Convertible Loan Note Instrument dated 28 February

2023

Prior to the maturity date of 09 September 2023 for the CLN, the

Noteholders approved the following amendments to the CLNI (see RNS

dated 06 February 2023):

- Maturity Date: 365 days following the date of issue of the CLN;

- Mandatory Conversion Price: after the date falling 180 days

after the date of issue of the CLN, at the lower of (a) US$0.0487

per ordinary share, (b) the market price per ordinary share as at

the date of the Mandatory Conversion and (c) the price of any

equity issuance by the Company in the prior 60 days (excluding

shares issued pursuant to the Company's Share Option Scheme or

pursuant to terms of any other agreement entered into prior to the

issue date of the CLN);

- Voluntary Conversion Price: after the date falling 180 days

after the date of issue of the CLN, at US$0.0487 per ordinary

share; and

- Early Repayment: prior to the date falling 180 days after the

date of issue of the CLN, Noteholders may elect to request the

early repayment of outstanding CLN, which shall be redeemed by the

Company for par value of the principal amount of the CLN plus five

per cent (5%) of the principal amount of the CLN.

Change of Name of Nominated Adviser and Broker

The Company also announces that its Nominated Adviser and Broker

has changed its name to Cavendish Capital Markets Ltd following

completion of its own corporate merger.

Market Abuse Regulation ('MAR') Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) No 596/2014 ('MAR'), which is part of

UK law by virtue of the European Union (Withdrawal) Act 2018, until

the release of this announcement.

**ENDS**

For further information, please visit http://www.coragold.com or

contact:

Bert Monro Cora Gold Limited info@coragold.com

Craig Banfield

Cavendish Capital Markets

Christopher Raggett Ltd

Charlie Beeson (Nomad & Broker) +44 (0)20 7220 0500

---------------------------- ---------------------

Susie Geliher St Brides Partners pr@coragold.com

Isabelle Morris (Financial PR)

Isabel de Salis

---------------------------- ---------------------

Notes

Cora is a West African gold developer with de-risked project

areas within two known gold belts in Mali and Senegal. Led by a

team with a proven track-record in making multi-million-ounce gold

discoveries that have been developed into operating mines, its

primary focus is on developing the Sanankoro Gold Project in the

Yanfolila Gold Belt, south Mali, into an open pit oxide mine. Based

on a gold price of US$1,750/oz and a Maiden Probable Reserve of 422

koz at 1.3 g/t Au, the Project has strong economic fundamentals,

including 52% IRR, US$234 million Free Cash Flow over life of mine

and all-in sustaining costs of US$997/oz.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDLPMRTMTTMBBJ

(END) Dow Jones Newswires

September 11, 2023 02:00 ET (06:00 GMT)

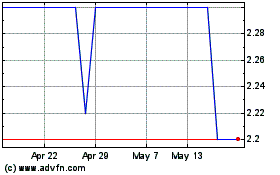

Cora Gold (LSE:CORA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cora Gold (LSE:CORA)

Historical Stock Chart

From Dec 2023 to Dec 2024