Cora Gold Limited USD70m Debt Mandate Letter for Sanankoro Project (1178E)

June 28 2023 - 2:00AM

UK Regulatory

TIDMCORA

RNS Number : 1178E

Cora Gold Limited

28 June 2023

Cora Gold Limited / EPIC: CORA.L / Market: AIM / Sector:

Mining

28 June 2023

Cora Gold Limited

('Cora' or 'the Company')

US$70m debt Mandate Letter signed to support

Sanankoro Gold Project Construction

Cora Gold Limited, the West African focused gold company, is

pleased to announce that it has entered into a mandate letter to

appoint Atlantique Finance to act as sole adviser in the

structuring and mobilisation of a medium-term loan of US$70 million

in CFA franc ('XOF') to support funding the development of Cora's

flagship Sanankoro Gold Project in south Mali.

Atlantique Finance is the investment banking and advisory arm of

Groupe Banque Atlantique and a member of the Banque Centrale

Populaire Group ('BCP Group'), the 6th largest banking group in

Africa in terms of equity and the leading banking institution in

Morocco. The appointment of Atlantique Finance is for a minimum

term of six months and on an exclusive basis.

Bert Monro, Chief Executive Officer of Cora, commented, "We look

forward to working with Atlantique Finance to deliver debt finance

for the construction of Cora's flagship Sanankoro Gold Project. The

Banque Atlantique group has extensive experience of debt financing

in West Africa.

"This US$70 million debt mandate is building on our fundraising

activities earlier this year, where we raised US$3.9m in equity and

US$15.9m in Convertible Loan Notes. Once the definitive binding

agreements in respect of senior debt are concluded, and such

agreements become unconditional, then the Convertible Loan Notes

are subject to mandatory conversion. The Company looks forward to

giving further updates on fully financing Sanankoro into production

in due course as it progresses with Atlantique Finance."

Habib Kone, Chief Executive Officer of Atlantique Finance,

commented, "Atlantique Finance and BCP Group ha ve a track record

of successfully helping businesses secure debt funding for various

purposes including, in 2021, US$122m to support the construction of

a gold mine in Guinea. Over the past five years Atlantique Finance

and BCP Group have raised over US$8,500m on the banking and capital

markets. We are confident in our ability to support Cora through

our expertise and breadth of knowledge of the market, and we are

available to seek the expected debt financing for the Sanankoro

Gold Project."

Further information on the Sanankoro Gold Project

Following completion of a Definitive Feasibility Study and

Maiden Reserves on Sanankoro the Company announced, on 21 November

2022, the following Optimised Project Economics (post tax, based on

a gold price of US$1,750/oz) and a Maiden Probable Reserve of

422koz @ 1.3 g/t Au:

-- 52.3% internal rate of return ('IRR')

-- 1.2 year payback period

-- US$71.8m first full year free cash flow ('FCF')

-- US$234m FCF over life of mine ('LOM')

-- US$997/oz all-in sustaining costs ('AISC')

-- 6.8 years Reserve mine life

-- 56,000oz pa average production

-- US$90m pre-production capital (including mining pre-production & contingencies)

Market Abuse Regulation ('MAR') Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) No 596/2014 ('MAR'), which is part of

UK law by virtue of the European Union (Withdrawal) Act 2018, until

the release of this announcement .

**ENDS**

For further information, please visit http://www.coragold.com or

contact:

Bert Monro Cora Gold Limited info@coragold.com

Craig Banfield

Christopher Raggett finnCap Ltd

Charlie Beeson (Nomad & Broker) +44 (0)20 7220 0500

--------------------- ---------------------

Susie Geliher St Brides Partners pr@coragold.com

Isabel de Salis (Financial PR)

Will Turner

--------------------- ---------------------

Notes

Cora is a West African gold developer with de-risked project

areas within two known gold belts in Mali and Senegal. Led by a

team with a proven track record in making multi-million-ounce gold

discoveries that have been developed into operating mines, its

primary focus is on developing the Sanankoro Gold Project in the

Yanfolila Gold Belt, southern Mali, into an open pit oxide mine.

Based on a gold price of US$1,750/oz and a Maiden Probable Reserve

of 422 koz at 1.3 g/t Au the project has strong economic

fundamentals, including 52% IRR, US$234 million Free Cash Flow over

life of mine and all-in sustaining costs of US$997/oz.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBDLLLXQLXBBX

(END) Dow Jones Newswires

June 28, 2023 02:00 ET (06:00 GMT)

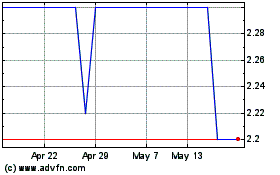

Cora Gold (LSE:CORA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cora Gold (LSE:CORA)

Historical Stock Chart

From Dec 2023 to Dec 2024