TIDMCCP

RNS Number : 8183M

Celtic PLC

18 September 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Celtic PLC

Announcement of Results for the year ended 30 June 2023

SUMMARY OF THE RESULTS

Key Operational Items

-- Winners of the Domestic Treble in season 2022/23 for a world record 8(th) time.

-- Qualification for the group stages of the UEFA Champions League for season 2023/24.

-- Participation in the group stages of the UEFA Champions League in season 2022/23.

-- 26 home matches played at Celtic Park (2022: 31 games).

Key Financial Items

-- Group revenue increased by 35.8% to GBP119.9m (2022: GBP88.2m).

-- Operating expenses including labour increased by 4.0% to GBP95.4m (2022: GBP91.7m).

-- Gain on sale of player registrations of GBP14.4m (2022: GBP29.0m).

-- Acquisition of player registrations of GBP13.0m (2022: GBP38.4m).

-- Profit before taxation of GBP40.7m (2022: GBP6.1m).

-- Year-end cash net of bank borrowings of GBP72.3m (2022: GBP30.2m).

For further information contact:

Celtic plc

Peter Lawwell, Celtic Tel: 0141 551

plc 4235

Iain Jamieson, Celtic

plc

Canaccord Genuity Limited, Nominated

Adviser

Simon Bridges Tel: 0207 523

8000

CHAIRMAN'S STATEMENT

I open by welcoming back Brendan Rodgers to the Club following

his successful spell as First Team Manager between May 2016 and

February 2019. Following the departure of Ange Postecoglou, we

assessed the market and concluded that Brendan was both the natural

choice and the overwhelmingly best candidate to succeed Ange and

take Celtic forward. We thank Ange for all he achieved at the Club

and wish him all the best for the future and look forward to

working with Brendan once again to deliver success for Celtic. My

own appointment took effect from January 1(st) following the

retirement of Ian Bankier. I take this opportunity to reiterate the

Club's appreciation to Ian for his distinguished service in the

role.

The results for the year ended 30 June 2023 show an increase in

revenue to GBP119.9m (2022: GBP88.2m) with a corresponding profit

before tax of GBP40.7m (2022: GBP6.1m profit before tax). This

represents a record set of financial results for the Club due to a

combination of factors as detailed below, including some material

items of a one off nature.

The GBP31.7m increase in revenue reflects the participation in

the UEFA Champions League in season 2022/23, when compared to the

UEFA Europa League in the previous season, resulting in greater

ticket and media rights income. In addition to this, our tour of

Australia and a record year for our retail business were also

significant contributors to the increase. The GBP34.6m increase in

profit before tax resulted from the significant revenue increase

outlined above along with a GBP14.4m gain on sale of player

registrations, predominantly from the sales of Jota, Juranovic and

Giakoumakis. In addition, we recorded GBP13.5m of other income that

came from a combination of compensation received following the

departure of Ange Postecoglou and a business interruption insurance

recovery in relation to Covid-19, with the two items mentioned

being one off in nature and typically non-recurring.

In terms of funding and liquidity, o ur year end cash, net of

bank borrowings, was GBP72.3m (2022: GBP30.2m). The increase this

year was principally due to the translation into cash of the strong

trading environment and the typically non-recurring items mentioned

previously. These reserves were used to fund the summer 2023

transfer window and will be used for settling outstanding sums due

from transfers over the last two seasons, which are typically paid

in instalments. This sum also contains the cash required to fund

the significant investment that the Club is planning to make in

developing our Barrowfield training facility. It is important to

highlight that, given the increasing gap between the sums able to

be earned between the Champions League and the Europa League, it is

vital that we retain a cash buffer in reserve. History tells us

that we will not always qualify for the Champions League and the

benefit of holding cash reserves affords us the optionality of

managing through seasons where we participate in the Europa League

with the ability to retain our squad as opposed to selling key

players to bridge the income shortfall between both competitions.

The Financial sustainability rules are also a key feature of UEFA

licencing and we need to be cognisant of running our club

accordingly.

Building on the investment in player registrations of GBP38.4m

in the previous financial year ended 30 June 2022, the Club made

further significant investment in the year by committing an

additional GBP13.0m, taking our total spend to GBP51.4m over the

two financial years to 30 June 2023. Since the year end and up to

1(st) September 2023 we have invested a further GBP15.0m into

player registrations taking our total spend over this period to

GBP66.4m. The assembly of a strong squad was a key factor in

retaining the SPFL title for the second consecutive year and

ultimately securing a domestic Treble. The investment will serve us

well for the season ahead. Last year's trophies brought our total

Trebles to eight in our history and this landmark represented a new

world record and one that all connected with our Club should be

rightly proud of.

Securing the SPFL title once again in 2022/23 led to automatic

Champions League qualification. Following the draw, we have been

matched against Feyenoord, Lazio and Atletico Madrid in what is

sure to be an exciting Champions League Group Stage. Automatic

qualification allowed us to make further football investment with a

focus on building greater strength into the playing squad. In the

summer 2023 transfer window, we have acquired Hyeok-kyu Kwon, Marco

Tilio, Hyun-jun Yang, Odin Holm, Maik Nawrocki, Gustaf Lagerbielke,

Luis Palma and brought in Paulo Bernardo and Nathaniel Phillips on

loan. The present squad also gives real potential for development

with the average age being 24. We parted company with Aaron Mooy,

Carl Starfelt, Albian Ajeti, Ismaila Soro, Osaze Urhoghide,

Vasilios Barkas, Conor Hazard and Jota. We wish all our former

players the best for the future.

Our successfully proven strategy has delivered stability and

footballing success over many years and remains the same. We must

balance the signing of players that can be developed and sold when

conditions are optimal alongside the need to sign players who are

able to make an immediate impact and deliver footballing success.

The execution of this strategy is increasingly challenging owing to

wage and transfer inflation, but this formula has underpinned both

our footballing success and financial stability over a number of

years now and it is vital that we adhere to it.

Following on from the League and Scottish Cup double in the

prior season, our Women's team had another strong performance in

season 2022/23. Following the disappointment of losing the SWPL

title by just two points to a last-minute winner on the season's

final day resulting in a second place finish, we went on to retain

the Scottish Cup with a victory against Rangers Women at Hampden.

Whilst finishing second in the league was a disappointment this

facilitated access to the Women's Champions League qualifiers.

After defeating Brondby in the first qualifying match, our Women's

team then faced a match against Valerenga for progression to the

final play-off round prior to the group stages. The match ended 2-2

after extra time and was ultimately lost in penalties. Whilst this

was hugely disappointing, we take pride in the fact that this is

the furthest our Women's team have progressed in the tournament and

they will take much from the experience.

As we look forward, European club competition continues to

develop and further integrate. Relationships between the European

Club Association ('ECA') along with UEFA and FIFA have never been

stronger and ECA membership continues to expand. This is a positive

development for European football clubs and will strengthen

governance and ultimately add value to the European Football

landscape. Celtic are committed to the ECA and fully endorse its

objectives as we move towards the new European Club Competition

format from 2024 onwards. In my role as Vice Chairman of the ECA,

member of the executive committee and Board Member, I will continue

to promote the interests of Celtic, Scottish football and European

football as a whole.

Finally, I wish to extend my thanks to all our Celtic colleagues

for their contribution to delivering another Treble and of course

to all our supporters who continue to support the Club year after

year in enormous numbers.

Peter T Lawwell, Chairman

18 September 2023

CHIEF EXECUTIVE'S REVIEW

The year to 30 June 2023 will go down as a landmark year in the

history of Celtic, when the Club achieved a world record breaking

8(th) Treble. I thank and congratulate all of our colleagues, our

players, our former manager Ange Postecoglou, and of course our

supporters for this remarkable achievement.

The objective for the season was to build upon the previous

year's success, when we had secured the SPFL Premiership title and

the League Cup. Having invested in the first team squad, we entered

the Champions League Group Stages for the first time in five years.

The challenging draw set us against RB Leipzig, Shakhtar Donetsk

and 14 times Champions League winners Real Madrid. Despite

achieving only two points, the performance levels and valuable

experience gained by our young squad were promising and will

provide a base on which to build again into this season and the

forthcoming Champions League Group Stages campaign.

Our domestic campaign got off to a strong start and by the

halfway mark on 31 December 2022, we had lost just one game;

winning 18 games of the 19 played. The 2022 World Cup gave us an

opportunity to take part in a hugely successful international tour

of Australia, where we played Everton F.C. and Sydney F.C. This

gave the opportunity to bring Celtic to our supporters in Australia

and the southern hemisphere, and demonstrated the scale of the Club

on the international stage. In February 2023, we retained the

Scottish League Cup with a victory over Rangers setting the tone

for the title run in. We went on to secure the SPFL Premiership

title in early May 2023, before defeating Inverness Caledonian

Thistle F.C. to win the Scottish Cup and our eighth domestic

Treble. Following the Scottish Cup Final, Ange Postecoglou left the

Club to become the manager of Tottenham Hotspur F.C. Ange leaves

with the Club's best wishes, and with our appreciation for his

contribution to our Club.

During the 2023/24 close season, the immediate focus was the

recruitment of a First Team Manager to replace Ange. Following a

thorough assessment, we were delighted to bring Brendan Rodgers

back to Celtic. Brendan was the standout candidate for the job.

Bringing back a manager of Brendan's quality is crucial to our

strategic objectives to dominate domestic football and to compete

regularly in the Champions League. During the summer transfer

window, we worked with Brendan to continue to strengthen our squad,

and we look to the season ahead with optimism and a determination

to continue to build our Club for the short, medium and long term.

Our immediate priority is to retain the SPFL Premiership title and

the Scottish Cup, and to build on our performances in the Champions

League.

Celtic F.C. Women enjoyed another successful season, winning the

Women's Scottish Cup against Rangers. Manager, Fran Alonso, our

players, led by Captain Kelly Clark, and all of our colleagues are

to be congratulated for the continued development and improvement

of our Women's team, with a terrific league campaign ending by

narrowly finishing second in the last game of the season in

dramatic circumstances. We also saw a record attendance for a

Celtic F.C. Women's game at Celtic Park, where the support given to

the team was outstanding. We will continue to invest in the

development of Celtic F.C. Women and our Girls Academy.

Celtic F.C. B Team completed their second full season in the

Lowland League, finishing third for the second consecutive season.

We look forward to our third season in the Lowland League, with

further opportunities for player development this season in the

UEFA Youth League and the Premier League International Cup. Player

development remains at the core of the Club's strategy and it is

vitally important that we continue to invest in developing our own

Academy players. We will work with the Scottish football

authorities to maximise the opportunities for the development of

young players in Scotland.

Continuous improvement remains a key objective. During the year

we invested in our facilities at Celtic Park and Lennoxtown, to

take our Club forward. At Celtic Park, we opened a new sports bar

and a new viewing platform for disabled supporters. At Lennoxtown,

we completed work on a new performance gym for the First Team and B

Team, together with a new First Team canteen and lounge facility.

In the year ahead, we will complete a significant investment in new

First Team and B Team changing facilities, along with enhanced

medical and sports science facilities, to seek to ensure that our

technical functions are aligned to meet the needs of a modern

football club and players.

Last week we were delighted to announce a major investment in

the re-development of our Barrowfield training facility. This is a

very exciting project. Our objective is to create a first class

training and development environment for the Academy and Women's

football team at an iconic venue that has played such an important

part in the history of our Club.

This year saw the redevelopment of some facilities at Celtic

Park for the use of Celtic F.C. Foundation. Charity continues to be

a fundamental part of our Club, with Celtic F.C. Foundation at the

very heart of everything we do, as highlighted by the current

banners on the main stand at Celtic Park, ensuring that the Club's

commitment to our charitable ethos is front and centre for all to

see. Everyone at the Club is extremely proud of the important work

delivered by Celtic F.C. Foundation, including, for example,

Paradise Pit Stop, where twice a week we open our doors at Celtic

Park and Celtic F.C. Foundation provides hot food for those in need

in our community, in a safe and welcoming environment. Thank you to

all who support Celtic F.C. Foundation including our colleagues who

volunteer every week to help at the Paradise Pit Stop.

As we continue to develop our Club for the future, we are aware

of the ongoing turbulence and uncertainty in the economy and the

challenges presented for our business, our partners and our

supporters. Our model seeks to balance our commitment to football

success with the crucial importance of financial sustainability. We

thank our partners and sponsors, including adidas, Dafabet and

Magners for your continued support. We are also very fortunate to

have fantastic colleagues at Celtic, who work tirelessly to support

all of the Club's operations and to support the teams on the pitch

throughout the season. I would also like to thank Ian Bankier, who

retired during the financial year, for his contribution to the Club

and his support and advice to the Board as Chairman.

Finally, our thanks go to our supporters for your commitment and

invaluable contribution to the Club. Your continued support is

vital in delivering the success that we all strive for each

year.

Michael Nicholson, Chief Executive

18 September 2023

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 June 2023

2023 2022

Notes GBP000 GBP000

Revenue 2 119,851 88,235

Operating expenses (before intangible asset transactions and exceptional items) (95,432) (91,728)

Profit/(loss) from trading before intangible asset transactions and exceptional

items 24,419 (3,493)

Exceptional operating expenses 3 (131) (6,262)

Amortisation of intangible assets (12,088) (13,045)

Profit on disposal of intangible assets 14,441 29,029

Other income 13,500 -

Operating profit 40,141 6,229

Finance income 2,041 876

Finance expense (1,485) (969)

Profit before tax 40,697 6,136

Tax expense 5 (7,365) (287)

--------- ---------

Profit and total comprehensive profit for the year 33,332 5,849

Basic profit per Ordinary Share for the year 6 35.26p 6.19p

Diluted profit per Share for the year 6 24.79p 4.69p

CONSOLIDATED BALANCE SHEET

As at 30 June 2023

2023 2022

GBP000 GBP000

Assets

Non-current assets

Property, plant and equipment 55,725 56,265

Intangible assets 28,039 35,489

Trade receivables 15,113 13,000

98,877 104,754

======== ========

Current assets

Inventories 3,426 2,987

Trade and other receivables 45,700 38,367

Cash and cash equivalents 72,285 31,869

--------

121,411 73,223

======== ========

Total assets 220,288 177,977

======== ========

Equity

Issued share capital 27,168 27,166

Share premium 14,990 14,951

Other reserve 21,222 21,222

Accumulated profits 44,810 11,478

--------

Total equity 108,190 74,817

======== ========

Non-current liabilities

Borrowings - 314

Debt element of Convertible Cumulative Preference Shares 4,174 4,174

Trade and other payables 12,320 16,806

Lease liabilities 432 318

Provisions 96 114

Deferred tax liabilities 3,215 2,982

20,237 24,708

======== ========

Current liabilities

Trade and other payables 50,764 36,758

Lease liabilities 330 539

Borrowings 96 1,336

Provisions 6,898 8,350

Deferred income 33,773 31,469

--------

91,861 78,452

======== ========

Total liabilities 112,098 103,160

======== ========

Total equity and liabilities 220,288 177,977

======== ========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 30 June 2023

Share Share Other Accumulated

Group capital premium reserve profit Total

GBP000 GBP000 GBP000 GBP000 GBP000

Equity shareholders'

funds

as at 1 July 2021 27,166 14,914 21,222 5,629 68,931

Share capital issued - 37 - - 37

Profit and total comprehensive

profit

for the year - - - 5,849 5,849

Equity shareholders'

funds

-------- -------- -------- ------------ --------

as at 30 June 2022 27,166 14,951 21,222 11,478 74,817

-------- -------- -------- ------------ --------

Share capital issued 2 39 - - 41

Profit and total comprehensive

profit

for the year - - - 33,332 33,332

Equity shareholders'

funds

-------- -------- -------- ------------ --------

as at 30 June 2023 27,168 14,990 21,222 44,810 108,190

-------- -------- -------- ------------ --------

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 30 June 2023

2023 2022

GBP000 GBP000

Cash flows from operating activities Notes

Profit for the year 33,332 5,849

Taxation charge 7,365 287

Depreciation 2,883 2,736

Amortisation of intangible assets 12,088 13,045

Impairment of intangible assets and other

prepaid costs - 7,235

Reversal of prior period impairment charge - (1,094)

Profit on disposal of intangible assets (14,441) (29,029)

Finance income (2,041) (876)

Finance costs 1,485 969

--------- ---------

40,671 (878)

(Increase) / decrease in inventories (439) 873

Increase in receivables (2,649) (1,856)

Increase in payables and deferred income 9,092 12,302

--------- ---------

Cash from operations 46,675 10,441

Tax paid 5 (4,297) -

Interest received 1,175 64

Interest paid (48) (77)

--------- ---------

Net cash flow from operating activities 43,505 10,428

--------- ---------

Cash flows from investing activities

Purchase of property, plant and equipment (1,775) (1,034)

Purchase of intangible assets (24,349) (20,566)

Proceeds from sale of intangible assets 25,781 26,044

--------- ---------

Net cash (used in) / from investing

activities (343) 4,444

--------- ---------

Cash flows used in financing activities

Repayment of debt (1,604) (1,280)

Payments on leasing activities (669) (693)

Dividend on Convertible Cumulative Preference

Shares (473) (489)

--------- ---------

Net cash used in financing activities (2,746) (2,462)

--------- ---------

Net increase in cash equivalents 40,416 12,410

Cash and cash equivalents at 1 July 2022 31,869 19,459

--------- ---------

Cash and cash equivalents at 30 June

2023 72,285 31,869

========= =========

NOTES TO THE FINANCIAL STATEMENTS

1. BASIS OF PREPARATION

The principal accounting policies applied in the preparation of

these Financial Statements are set out below. These policies hav e

been consistently applied to financial years 2023 and 2022,

presented, for both the Group and the Company.

Going Concern

The Group has adequate financial resources available to it,

including currently undrawn bank facilities, together with

established contracts with a number of customers and suppliers.

Additionally, the Group continues to perform a detailed

budgeting process each year which is reviewed and approved by the

Board. The Group also performs regular re-forecasts and these

projections, which include profit/loss and cash flow forecasts, are

distributed to the Board. As a consequence, the Directors believe

that the Group is well placed to manage its business risks

successfully over the medium term.

In consideration of the above, the Directors have a reasonable

expectation that the Group and Company has adequate resources to

continue in operational existence for the foreseeable future. Thus

they continue to adopt the going concern basis of accounting in

preparing the annual Financial Statements and have not identified a

material uncertainty in this regard.

2. REVENUE

2023 2022

GBP000 GBP000

The Group's revenue comprised:

Football and Stadium Operations 51,483 42,782

Merchandising 29,072 24,925

Multimedia and Other Commercial Activities 39,296 20,528

--------- ---------

119,851 88,235

========= =========

3. EXCEPTIONAL OPERATING EXPENSES

The exceptional operating expenses of GBP0.1m (2022: GBP6.3m)

can be analysed as follows:

2023 2022

GBP000 GBP000

Impairment of intangible assets and other prepaid

costs - 7,235

Reversal of prior period impairment charges - (1,094)

Settlement agreements on unforeseen contract

termination 131 121

-------- --------

131 6,262

======== ========

The impairment of intangible assets in the prior year relates to

adjustments required as a result of management's assessment of the

carrying value of certain player registrations relative to their

current market value. The carrying value of intangible assets are

reviewed against criteria indicative of impairment and, where the

carrying value exceeds their current market value, impairment is

recognised. Where events subsequent to this initial assessment give

rise to a reversal of any impairments, such as a transfer or a

significant turnaround in performance, an impairment reversal is

recognised.

Settlement agreements on unforeseen contract termination are

costs in relation to exiting certain employment contracts.

These events are deemed to be unusual in relation to what

management consider to be normal operating conditions as the

occurrence of these events is sufficiently irregular enough to

warrant it as exceptional.

4. DIVIDEND ON CONVERTIBLE CUMULATIVE PREFERENCE SHARES

A 6% non-equity dividend of GBP0.53m (2022: GBP0.53m) was paid

on 31 August 2023 to those holders of Convertible Cumulative

Preference Shares on the share register at 28 July 2023. A number

of shareholders elected to participate in the Company's scrip

dividend reinvestment scheme for the financial year to 30 June

2023. Those shareholders have received new Ordinary Shares in lieu

of cash. No dividends were payable or proposed to be payable on the

Company's Ordinary Shares.

During the year, the Company reclaimed GBPnil (2022: GBPnil) in

respect of statute barred preference dividends in accordance with

the Company's Articles of Association.

5. TAX ON ORDINARY ACTIVITIES

The corporation tax payable as at 30 June 2023 was GBP2.3m

(2022: receivable of GBP0.5m). The current year tax charge was

GBP7.4m (2022: GBP0.3m) and total tax payments in the year were

GBP4.3m (2022: GBPnil). The available capital allowances pool is

approximately GBP4.3m (2022: GBP5.1m). These estimates are subject

to the agreement of the current year's corporation tax computations

with H M Revenue and Customs.

The standard rate of corporation tax for the year in the United

Kingdom is currently 25% (2022: 19%). The tax rate of 25% came into

effect on 1(st) April 2023 and therefore the annualised rate for

the financial year end 30 June 2023 is 20.496%.

2023 2022

GBP000 GBP000

Current tax expense

UK corporation tax 7,132 99

Adjustments in respect of prior periods - -

-------- --------

Total current tax expense 7,132 99

======== ========

Deferred tax expense

Origination of temporary timing differences 191 143

Adjustments in respect of prior periods - -

Effects of changes in tax rates 42 45

-------- --------

Total deferred tax 233 188

-------- --------

Total tax expense 7,365 287

======== ========

6. EARNINGS PER SHARE

Reconciliation of basic earnings to diluted 2023 2022

earnings:

GBP000 GBP000

Basic earnings 33,332 5,849

Non-equity share dividend 569 569

Diluted earnings 33,901 6,418

========== ==========

No.'000 No.'000

Reconciliation of basic weighted average

number of ordinary shares to

diluted weighted average number of ordinary

shares:

Basic weighted average number of ordinary

shares 94,531 94,457

Dilutive effect of convertible shares 42,226 42,252

---------- ----------

Diluted weighted average number of ordinary

shares 136,757 136,709

========== ==========

Earnings per share of 35.26p (2022: 6.19p) has been calculated

by dividing the total comprehensive profit for the period of

GBP33.3m (2022: GBP5.8m) by the weighted average number of Ordinary

Shares of 94.5m (2022: 94.5m) in issue during the year.

Diluted earnings per share of 24.79p (2022: 4.69p) has been

calculated by dividing the diluted earnings for the period of

GBP33.9m (2022: GBP6.4m) by the weighted average number of Ordinary

Shares, Convertible Cumulative Preference Shares and Convertible

Preferred Ordinary Shares in issue, assuming conversion at the

Balance Sheet date, if dilutive. When considering a loss per share

scenario, no adjustment is made for the preference share dividend

and therefore the diluted loss per share is equal to the basic loss

per share.

7. ANNUAL REPORT & FINANCIAL STATEMENTS

Copies of the Annual Report & Financial Statements together

with the Notice and Notes of the 2023 AGM will be issued to all

shareholders in due course.

The financial information set out above does not constitute the

Company's statutory financial statements for the years ended 30

June 2023 or 30 June 2022. The Independent Auditor's Reports on the

statutory financial statements for 2023 and 2022 were unqualified,

did not draw attention to any matters by way of emphasis, and did

not contain a statement under 498(2) or 498(3) of the Companies Act

2006. The statutory financial statements for 2022 have been filed

with the Registrar of Companies and those for 2023 will be

delivered to the Registrar of Companies in due course.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR LPMATMTABBPJ

(END) Dow Jones Newswires

September 18, 2023 12:30 ET (16:30 GMT)

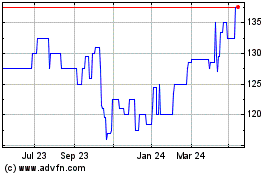

Celtic (LSE:CCP)

Historical Stock Chart

From Nov 2024 to Dec 2024

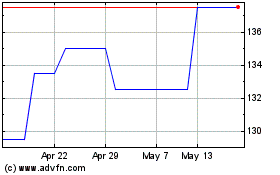

Celtic (LSE:CCP)

Historical Stock Chart

From Dec 2023 to Dec 2024