TIDMBRK

RNS Number : 0166P

Brooks Macdonald Group PLC

18 March 2009

Brooks Macdonald Group plc

Interim results for the six months ended 31 December 2008

Brooks Macdonald Group plc (the "Group"), the fee-based integrated private

client discretionary asset management and financial advisory group, today

announces its interim results for the six months ended 31 December 2008.

Highlights

+-------------------+-----------+-----------+---------+-----------+

| | Six | Six | % | Year |

| | months to | months to | Change | ended |

| | 31.12.08 | 31.12.07 | | 30.06.08 |

+-------------------+-----------+-----------+---------+-----------+

| Revenue | GBP9.65m | GBP7.8m | Up 23% | GBP12.07m |

| | | | | |

+-------------------+-----------+-----------+---------+-----------+

| Pre-tax profits | GBP1.26m | GBP0.86m | Up 46% | GBP1.60m |

| | | | | |

+-------------------+-----------+-----------+---------+-----------+

| Basic earnings | 8.35p | 6.74p | Up 24% | 11.85p |

| per share | | | | |

+-------------------+-----------+-----------+---------+-----------+

| Diluted earnings | 8.22p | 6.54p | Up 26% | 10.99p |

| per share | | | | |

+-------------------+-----------+-----------+---------+-----------+

* Funds under management rose by over 3% during the period to GBP1.218 billion

(30.6.08 GBP1.18 billion), despite weak investment markets

* Strong growth in SIPPs market

* Continued investment in building the business

Commenting on the results, Chris Macdonald, CEO, said:

"These results reflect not only the continued excellent progress made by the

Group but also the robust nature of our business model. Whilst the current

economic environment remains very challenging, the Group is well positioned to

build on its recent growth both organically and through opportunities that may

arise."

Enquiries to:

Brooks Macdonald Group plc +44 (0)20 7499 6424

Chris Macdonald, Chief Executive

Simon Jackson, Finance Director

Collins Stewart Europe Limited +44 (0)20 7523 8350

Bruce Garrow

Bankside Consultants +44 (0)20 7367 8888

Simon Rothschild

Oliver Winters

Notes to Editors

There are three trading companies within the Group. Brooks Macdonald Asset

Management Limited and Brooks Macdonald Financial Consulting Limited are both

authorised and regulated by the Financial Services Authority and offer a fee

based service to a range of clients. Brooks Macdonald Services Limited which is

not regulated provides custody and nominee services to our clients.

Brooks Macdonald Asset Management provides a bespoke, personalised fund

management service mainly to individuals but also to trusts and charities.

Brooks Macdonald Financial Consulting advises individuals, families and

businesses of all sizes on a long term-basis on a broad range of services

including pensions, mortgages and employee benefits.

Chairman's Statement

I am pleased to report a strong set of results for the first half of our

financial year, the six months ended 31 December 2008.

On turnover of GBP9.65million, an increase of 23.4% over the corresponding

period last year, we have achieved pre-tax profits of GBP1.26million, a rise of

46%. Earnings per share have increased from 6.74p to 8.35p.

Funds under management at 31 December 2008 were GBP1.21 billion, compared with

GBP1.18 billion at 30 June 2008. This increase is a considerable achievement

when viewed in the context of the sharp decline in global markets over that

time. Our new business efforts have continued to be very successful,

particularly in the SIPPs market and through various strategic alliances. Our

two regional offices, in Winchester and Manchester, have performed well: we

intend to expand our regional presence in the coming months. We have continued

to recruit high quality experienced fund managers, and to invest in the further

development of the business. Our performance continues to be robust, which

coupled with high cash weightings should lead to increased profitability in the

second half of the financial year.

Reflecting the continued growth of the business, Nicholas Holmes and Andrew

Shepherd were appointed Joint Managing Directors of Brooks Macdonald Asset

Management in September 2008.

Brooks Macdonald Services also had a strong six months. It gives the Group

considerable operational leverage and enables expansion of our asset management

business without the back office constraints.

Brooks Macdonald Financial Consulting has inevitably been affected by the

economic downturn and did well to achieve a turnover only slightly below that of

last year.

The economic outlook continues to be highly challenging, and is clearly a

significant threat to investment assets. Equally we believe that it presents us

with a number of opportunities, given our effective distribution channels and

the quality of our staff.

Christopher Knight

Chairman

17 March 2009

Brooks Macdonald Group plc

Consolidated income statement for the six months ended 31 December 2008

+---------------------------+------+-----------------+----------------+---------------+

| | Note | 31 December | 31 December | 30 June |

| | | 2008(unaudited) | 2007(unaudited | 2008(audited) |

| | | | & restated) | |

+---------------------------+------+-----------------+----------------+---------------+

| | | GBP | GBP | GBP |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Revenue | | 9,646,264 | 7,810,900 | 16,786,350 |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Administrative costs | | (8,530,789) | (7,114,561) | (15,074,405) |

+---------------------------+------+-----------------+----------------+---------------+

| Operating profit | | 1,115,475 | 696,339 | 1,711,945 |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Finance income | | 144,004 | 166,616 | 315,530 |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Profit before taxation | | 1,259,479 | 862,955 | 2,027,475 |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Taxation | | (425,703) | (201,079) | (808,384) |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Profit for the period | | 833,776 | 661,876 | 1,219,091 |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Earnings per share | 3 | | | |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Basic earnings per share | | 8.35p | 6.74p | 12.41p |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Diluted earnings per | | 8.22p | 6.54p | 12.08p |

| share | | | | |

+---------------------------+------+-----------------+----------------+---------------+

Consolidated interim balance sheet as at 31 December 2008

+---------------------------+------+-----------------+----------------+---------------+

| | Note | 31 December | 31 | 30 June |

| | | 2008(unaudited) | December | 2008(audited) |

| | | | 2007(unaudited | |

| | | | & restated) | |

+---------------------------+------+-----------------+----------------+---------------+

| | | GBP | GBP | GBP |

+---------------------------+------+-----------------+----------------+---------------+

| Assets | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Non current assets | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Property, plant and | | 1,192,982 | 631,093 | 876,941 |

| equipment | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Intangible assets | 5 | 517,401 | 444,189 | 605,271 |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Total non current assets | | 1,710,383 | 1,075,282 | 1,482,212 |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Current assets | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Trade and other | | 2,435,492 | 2,407,387 | 2,840,270 |

| receivables | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Deferred taxation | | - | 98,883 | 20,980 |

+---------------------------+------+-----------------+----------------+---------------+

| Available- for sale | 6 | 804,975 | 37 | - |

| financial assets | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Cash and cash equivalents | | 5,813,752 | 5,205,122 | 5,923,712 |

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Total current assets | | 9,054,219 | 7,711,429 | 8,784,962 |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Total assets | | 10,764,602 | 8,786,711 | 10,267,174 |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Current liabilities | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Trade and other payables | | (3,679,835) | (2,970,924) | (4,037,849) |

+---------------------------+------+-----------------+----------------+---------------+

| Current tax liabilities | | (403,490) | (781,720) | (310,482) |

+---------------------------+------+-----------------+----------------+---------------+

| Total current liabilities | | (4,083,325) | (3,752,644) | (4,348,331) |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Non current liabilities | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Provisions | 7 | (189,930) | (194,800) | (53,607) |

+---------------------------+------+-----------------+----------------+---------------+

| Other non current | | (17,188) | (23,439) | (20,313) |

| liabilities | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Total non current | | (207,118) | (218,239) | (73,920) |

| liabilities | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Net assets | | 6,474,159 | 4,815,828 | 5,844,923 |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Financed by: | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Equity | | | | |

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Share capital | | 99,875 | 98,131 | 99,850 |

+---------------------------+------+-----------------+----------------+---------------+

| Share premium account | | 1,574,506 | 1,365,910 | 1,571,031 |

+---------------------------+------+-----------------+----------------+---------------+

| Other reserves | | 955,340 | 548,863 | 813,903 |

+---------------------------+------+-----------------+----------------+---------------+

| Retained earnings | | 3,844,438 | 2,802,924 | 3,360,139 |

+---------------------------+------+-----------------+----------------+---------------+

| | | | | |

+---------------------------+------+-----------------+----------------+---------------+

| Total equity | | 6,474,159 | 4,815,828 | 5,844,923 |

+---------------------------+------+-----------------+----------------+---------------+

Consolidated interim cash flow statement for the six months ended 31 December

2008

+-------------------------------+-------+-----------------+----------------+---------------+

| | Note | Six months | Six months | Year ended |

| | | ended 31 | ended 31 | 30 June |

| | | December | December | 2008(audited) |

| | | 2008(unaudited) | 2007(unaudited | |

| | | | & restated) | |

+-------------------------------+-------+-----------------+----------------+---------------+

| | | GBP | GBP | GBP |

+-------------------------------+-------+-----------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Cash inflow from operating | | | | |

| activities | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Cash generated from | 8 | 1,632,909 | 769,005 | 2,642,457 |

| operations | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Taxation paid | | (330,079) | - | (836,285) |

+-------------------------------+-------+-----------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Net cash from operating | | 1,302,830 | 769,005 | 1,806,172 |

| activities | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Cash flow from investing | | | | |

| activities | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Purchase of property, plant | | (451,518) | (254,030) | (605,519) |

| and equipment | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Purchase of intangible assets | | (20,906) | (211,794) | (534,636) |

+-------------------------------+-------+-----------------+----------------+---------------+

| Purchase of investment | | (738,393) | - | - |

| securities | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Interest received | | 144,004 | 166,616 | 315,530 |

+-------------------------------+-------+-----------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Net cash used in investing | | (1,066,813) | (299,208) | (824,625) |

| activities | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Cash flows from financing | | | | |

| activities | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Proceeds of issue of shares | | 3,500 | - | 206,840 |

+-------------------------------+-------+-----------------+----------------+---------------+

| Dividends paid to | | (349,477) | (220,795) | (220,795) |

| shareholders | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Net cash used in financing | | (345,977) | (220,795) | (13,955) |

| activities | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Net (decrease)/ increase in | | (109,960) | 249,002 | 967,592 |

| cash and cash equivalents | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Cash and cash equivalents at | | 5,923,712 | 4,956,120 | 4,956,120 |

| start of period | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| Cash and cash equivalents at | | 5,813,752 | 5,205,122 | 5,923,712 |

| end of period | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+-----------------+----------------+---------------+

Consolidated statement of changes in equity from 1 July 2007 to 31 December 2008

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| | Share | Share | Share | Merger | Available | Retained | Total |

| | capital | premium | option | | | earnings | |

| | | account | reserve | reserve | for sale | (restated-note | |

| | | | (restated- | | reserve | a) | |

| | | | note a) | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| | GBP | GBP | GBP | GBP | GBP | GBP | GBP |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| At 1 July 2007 | 98,131 | 1,365,910 | 357,322 | 191,541 | - | 2,361,843 | 4,374,747 |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Profit for the | - | - | - | - | - | 661,876 | 661,876 |

| period | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Dividends paid | - | - | - | - | - | (220,795) | (220,795) |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Share option | - | - | - | - | - | - | - |

| movement | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| At 31 December | 98,131 | 1,365,910 | 357,322 | 191,541 | - | 2,802,924 | 4,815,828 |

| 2007 | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Issue of | 1,719 | 205,121 | - | - | - | - | 206,840 |

| shares for | | | | | | | |

| cash | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Profit for the | - | - | - | - | - | 557,215 | 557,215 |

| period | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Deferred | - | - | 27,071 | - | - | - | 27,071 |

| tax-share | | | | | | | |

| options | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Share option | - | - | 237,969 | - | - | - | 237,969 |

| movement | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| At 30 June | 99,850 | 1,571,031 | 622,362 | 191,541 | - | 3,360,139 | 5,844,923 |

| 2008 | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Issue of | 25 | 3,475 | - | - | - | - | 3,500 |

| shares for | | | | | | | |

| cash | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Profit for the | - | - | - | - | - | 833,776 | 833,776 |

| year | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Fair value | - | - | - | - | 66,582 | - | 66,582 |

| gain on | | | | | | | |

| available-for-sale | | | | | | | |

| assets | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Dividends paid | - | - | - | - | - | (349,477) | (349,477) |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Deferred | - | - | (18,367) | - | - | - | (18,367) |

| tax-share | | | | | | | |

| options | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| Share option | - | - | 93,222 | - | - | - | 93,222 |

| movement | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

| At 31 December | 99,875 | 1,574,506 | 697,217 | 191,541 | 66,582 | 3,844,438 | 6,474,159 |

| 2008 | | | | | | | |

+--------------------+---------+-----------+------------+---------+-----------+----------------+-------------+

Note (a) The figures for 31 December 2007 have been restated resulting from the

adjustments made in the year ended 30 June 2007 in respect of presenting the

Group's financial statements under IFRS.

Brooks Macdonald Group plc

Notes to the consolidated interim accounts

for the six months ended 31 December 2008

1 Basis of preparation

These interim accounts are presented in accordance with IAS 34 "Interim

Financial Reporting". The interim accounts have been prepared on basis of the

accounting policies, methods of computation and presentation set out in the

Group's consolidated accounts for the year ended 30 June 2008 except as stated

below. The interim accounts should be read in conjunction with the Group's

audited accounts for the year ended 30 June 2008.

There is an additional accounting policy in respect of available for sale

financial assets. These financial assets are initially recognised at fair value

with any subsequent changes in fair value recognised directly in equity. When an

asset is disposed of or impaired, any cumulative gain or loss previously

recognised in equity is transferred to the income statement.

The information in this announcement does not comprise statutory accounts within

the meaning of section 240 of the Companies Act 1985. The Group's accounts for

the year ended 30 June 2008 have been reported on by the auditors and delivered

to the Registrar of Companies. The report of the auditors was unqualified and

did not draw attention to any matters by way of emphasis. They also did not

contain a statement under section 237(2) of the Companies Act 1985.

2 Segmental information

For management purposes the Group's activities are organised into two operating

divisions, investment management and financial planning. The Group's other

activity, offering nominee and custody services to clients, has been included in

investment management. These divisions are the basis on which the Group reports

its primary segmental information.

Revenues and expenses are allocated to the business segment that originated the

transaction. Revenues and expenses that are not directly originated by a

business segment are reported as unallocated. Centrally incurred expenses are

allocated to business segments on an appropriate pro-rata basis. Segmental

assets and liabilities comprise operating assets and liabilities, being the

majority of the balance sheet.

+---------------------+--+------------+------------+------------+

| Period ended 31 | | Investment | Financial | Total |

| December | | management | planning | |

| 2008(unaudited) | | | | |

+---------------------+--+------------+------------+------------+

| | | GBP | GBP | GBP |

+---------------------+--+------------+------------+------------+

| Total revenues | 8,591,624 | 1,300,903 | 9,892,527 |

+------------------------+------------+------------+------------+

| Inter company revenues | (246,263) | - | (246,263) |

+------------------------+------------+------------+------------+

| External revenues | 8,345,361 | 1,300,903 | 9,646,264 |

+------------------------+------------+------------+------------+

| | | |

+-------------------------------------+------------+------------+

| Segmental result | | 1,463,693 | 57,079 | 1,520,772 |

+---------------------+--+------------+------------+------------+

| Unallocated items | | | | (261,293) |

+---------------------+--+------------+------------+------------+

| Profit before tax | | | | 1,259,479 |

+---------------------+--+------------+------------+------------+

| Taxation | | | | (425,703) |

+---------------------+--+------------+------------+------------+

| Profit for the | | | | 833,776 |

| period | | | | |

+---------------------+--+------------+------------+------------+

| | | | | |

+---------------------+--+------------+------------+------------+

| At 31 December 2008 | | | | |

+---------------------+--+------------+------------+------------+

| Segment assets | | 8,893,783 | 1,870,395 | 10,764,178 |

+---------------------+--+------------+------------+------------+

| Unallocated assets | | | | 424 |

+---------------------+--+------------+------------+------------+

| Total assets | | | | 10,764,602 |

+---------------------+--+------------+------------+------------+

| | | | | |

+---------------------+--+------------+------------+------------+

| Segment liabilities | | 2,160,307 | 1,741,862 | 3,902,169 |

| | | | | |

+---------------------+--+------------+------------+------------+

| Unallocated | | | | 388,274 |

| liabilities | | | | |

+---------------------+--+------------+------------+------------+

| Total liabilities | | | | 4,290,443 |

+---------------------+--+------------+------------+------------+

| Capital expenditure | | - | 451,516 | 451,516 |

| | | | | |

+---------------------+--+------------+------------+------------+

| Depreciation | | - | 244,250 | 244,250 |

+---------------------+--+------------+------------+------------+

| Provisions charged | | 147,500 | 57,430 | 204,930 |

+---------------------+--+------------+------------+------------+

| Provisions utilised | | 21,607 | 47,000 | 68,607 |

| | | | | |

+---------------------+--+------------+------------+------------+

| | | | | |

+---------------------+--+------------+------------+------------+

+---------------------+--+------------+------------+-----------+

| Period ended 31 | | Investment | Financial | Total |

| December | | management | planning | |

| 2007(unaudited & | | | | |

| restated) | | | | |

+---------------------+--+------------+------------+-----------+

| | | GBP | GBP | GBP |

+---------------------+--+------------+------------+-----------+

| Total revenues | 6,461,963 | 1,416,321 | 7,878,284 |

+------------------------+------------+------------+-----------+

| Inter company revenues | (67,384) | - | (67,384) |

+------------------------+------------+------------+-----------+

| External revenues | 6,394,579 | 1,416,321 | 7,810,900 |

+------------------------+------------+------------+-----------+

| | | |

+-------------------------------------+------------+-----------+

| Segmental result | | 885,080 | 55,785 | 940,865 |

+---------------------+--+------------+------------+-----------+

| Unallocated items | | | | (77,910) |

+---------------------+--+------------+------------+-----------+

| Profit before tax | | | | 862,955 |

+---------------------+--+------------+------------+-----------+

| Taxation | | | | (201,079) |

+---------------------+--+------------+------------+-----------+

| Profit for the | | | | 661,876 |

| period | | | | |

+---------------------+--+------------+------------+-----------+

| | | | | |

+---------------------+--+------------+------------+-----------+

| At 31 December 2007 | | | | |

+---------------------+--+------------+------------+-----------+

| Segment assets | | 7,213,029 | 1,474,514 | 8,687,543 |

+---------------------+--+------------+------------+-----------+

| Unallocated assets | | | | 99,168 |

+---------------------+--+------------+------------+-----------+

| Total assets | | | | 8,786,711 |

+---------------------+--+------------+------------+-----------+

| | | | | |

+---------------------+--+------------+------------+-----------+

| Segment liabilities | | 2,365,812 | 1,384,255 | 3,750,067 |

| | | | | |

+---------------------+--+------------+------------+-----------+

| Unallocated | | | | 220,816 |

| liabilities | | | | |

+---------------------+--+------------+------------+-----------+

| Total liabilities | | | | 3,970,883 |

+---------------------+--+------------+------------+-----------+

| | | | | |

+---------------------+--+------------+------------+-----------+

| Capital expenditure | | - | 465,824 | 465,824 |

| | | | | |

+---------------------+--+------------+------------+-----------+

| Depreciation | | - | 221,749 | 221,749 |

+---------------------+--+------------+------------+-----------+

| Provisions charged | | 18,000 | 19,500 | 37,500 |

+---------------------+--+------------+------------+-----------+

| Provisions utilised | | 30,000 | 17,690 | 47,690 |

| | | | | |

+---------------------+--+------------+------------+-----------+

+---------------------+--+--------------+-----------+------------+

| Year ended 30 June | | Investment | Financial | Total |

| 2008 (audited) | | management | planning | |

+---------------------+--+--------------+-----------+------------+

| | | GBP | GBP | GBP |

+---------------------+--+--------------+-----------+------------+

| Total revenues | 14,404,098 | 2,648,611 | 17,052,709 |

+------------------------+--------------+-----------+------------+

| Inter company revenues | (266,359) | - | (266,359) |

+------------------------+--------------+-----------+------------+

| External revenues | 14,137,739 | 2,648,611 | 16,786,350 |

+------------------------+--------------+-----------+------------+

| | | |

+---------------------------------------+-----------+------------+

| Segmental result | | 2,163,496 | 127,021 | 2,290,517 |

+---------------------+--+--------------+-----------+------------+

| Unallocated items | | | | (263,042) |

+---------------------+--+--------------+-----------+------------+

| Profit before tax | | | | 2,027,475 |

+---------------------+--+--------------+-----------+------------+

| Taxation | | | | (808,384) |

+---------------------+--+--------------+-----------+------------+

| Profit for the year | | | | 1,219,091 |

| | | | | |

+---------------------+--+--------------+-----------+------------+

| | | | | |

+---------------------+--+--------------+-----------+------------+

| At 30 June 2008 | | | | |

+---------------------+--+--------------+-----------+------------+

| Segment assets | | 7,711,961 | 1,426,073 | 9,138,034 |

+---------------------+--+--------------+-----------+------------+

| Unallocated assets | | | | 1,129,140 |

+---------------------+--+--------------+-----------+------------+

| Total assets | | | | 10,267,174 |

+---------------------+--+--------------+-----------+------------+

| | | | | |

+---------------------+--+--------------+-----------+------------+

| Segment liabilities | | 2,299,596 | 1,495,319 | 3,794,915 |

| | | | | |

+---------------------+--+--------------+-----------+------------+

| Unallocated | | | | 627,336 |

| liabilities | | | | |

+---------------------+--+--------------+-----------+------------+

| Total liabilities | | | | 4,422,251 |

+---------------------+--+--------------+-----------+------------+

| | | | | |

+---------------------+--+--------------+-----------+------------+

| Capital expenditure | | - | 605,519 | 605,519 |

| | | | | |

+---------------------+--+--------------+-----------+------------+

| Depreciation | | - | 489,150 | 489,150 |

+---------------------+--+--------------+-----------+------------+

| Provisions charged | | 9,607 | 23,000 | 32,607 |

+---------------------+--+--------------+-----------+------------+

| Provisions utilised | | 66,000 | 117,990 | 183,990 |

| | | | | |

+---------------------+--+--------------+-----------+------------+

Geographical segments

The Group's operations are all located in the United Kingdom.

3.Earnings per share

+--------------------------------+----------------+----------------+----------------+

| | Six months | Six months | Year ended |

| | ended 31 | ended 31 | 30 June 2008 |

| | December | December | (audited) |

| | 2008 | 2007 | |

| | (unaudited) | (unaudited & | |

| | | restated) | |

+--------------------------------+----------------+----------------+----------------+

| | GBP | GBP | GBP |

+--------------------------------+----------------+----------------+----------------+

| Earnings attributable to | 833,776 | 661,876 | 1,219,091 |

| ordinary shareholders | | | |

+--------------------------------+----------------+----------------+----------------+

| | No. | No. | No. |

+--------------------------------+----------------+----------------+----------------+

| Weighted average number of | 9,982,942 | 9,813,100 | 9,813,100 |

| shares | | | |

+--------------------------------+----------------+----------------+----------------+

| Share issues | 2,500 | - | 10,209 |

+--------------------------------+----------------+----------------+----------------+

| Basic earnings per share | 9,985,442 | 9,813,100 | 9,823,309 |

| denominator | | | |

+--------------------------------+----------------+----------------+----------------+

| Issuable on exercise of | 154,357 | 308,334 | 268,504 |

| options | | | |

+--------------------------------+----------------+----------------+----------------+

| Diluted earnings per share | 10,139,799 | 10,121,434 | 10,091,813 |

| denominator | | | |

+--------------------------------+----------------+----------------+----------------+

| | | | |

+--------------------------------+----------------+----------------+----------------+

| Basic earnings per share | 8.35p | 6.74p | 12.41p |

+--------------------------------+----------------+----------------+----------------+

| Diluted earnings per share | 8.22p | 6.54p | 12.08p |

+--------------------------------+----------------+----------------+----------------+

4.Dividends

+--------------------------------+--------------+----------------+---------------+

| | Six months | Six months | Year ended |

| | ended 31 | ended 31 | 30 June 2008 |

| | December | December 2007 | (audited) |

| | 2008 | (unaudited) | |

| | (unaudited) | | |

+--------------------------------+--------------+----------------+---------------+

| | GBP | GBP | GBP |

+--------------------------------+--------------+----------------+---------------+

| | | | |

+--------------------------------+--------------+----------------+---------------+

| Paid final dividend on | 349,477 | 220,795 | 220,795 |

| ordinary shares | | | |

+--------------------------------+--------------+----------------+---------------+

5 Intangible assets

Intangible assets relate to payments made to key fee earners in return for an

alternative commission structure and deferred payments in respect of the

acquisition of new teams of fund managers.

6.Available- for sale financial assets

+--------------------------------+--------------+--------------+-------------+

| | Six months | Six months | Year ended |

| | ended 31 | ended 31 | 30 June |

| | December | December | 2008 |

| | 2008 | 2007 | (audited) |

| | (unaudited) | (unaudited) | |

+--------------------------------+--------------+--------------+-------------+

| | GBP | GBP | GBP |

+--------------------------------+--------------+--------------+-------------+

| At 1 July 2008 | - | 37 | 37 |

+--------------------------------+--------------+--------------+-------------+

| Additions - UK Government Gilt | 738,393 | - | - |

+--------------------------------+--------------+--------------+-------------+

| Gains from changes in fair | 66,582 | - | - |

| value | | | |

+--------------------------------+--------------+--------------+-------------+

| Provision for the period | - | - | (37) |

+--------------------------------+--------------+--------------+-------------+

| At 31 December 2008 | 804,975 | 37 | - |

+--------------------------------+--------------+--------------+-------------+

7Non-current provisions

+----+----------------------------+--------------+--------------+-------------+

| | | 31 December | 31 December | 30 June |

| | | 2008 | 2007 | 2008 |

| | | (unaudited) | (unaudited) | (audited) |

+----+----------------------------+--------------+--------------+-------------+

| | | GBP | GBP | GBP |

+----+----------------------------+--------------+--------------+-------------+

| | At 1 July 2008 | 53,607 | 204,990 | 204,990 |

+----+----------------------------+--------------+--------------+-------------+

| | Charged to income | 204,930 | 37,500 | 32,607 |

| | statement | | | |

+----+----------------------------+--------------+--------------+-------------+

| | Paid during the period | (68,607) | (47,690) | (183,990) |

+----+----------------------------+--------------+--------------+-------------+

| | At 31 December 2008 | 189,930 | 194,800 | 53,607 |

+----+----------------------------+--------------+--------------+-------------+

Provisions relate to the potential liability resulting from client complaints

against the Group. The complaints are assessed on a case by case basis and

provisions for compensation are made where judged necessary. Complaints are on

average settled within eight months from the date of notification of the

complaint.

8.Reconciliation of operating profit and net cash inflow from operating

activities

+------------------------------------+-----------------+--------------+--------------+

| | 31 December | 31 December | 30 June 2008 |

| | 2008(unaudited) | 2007 | (audited) |

| | | (unaudited & | |

| | | restated) | |

+------------------------------------+-----------------+--------------+--------------+

| | GBP | GBP | GBP |

+------------------------------------+-----------------+--------------+--------------+

| Operating profit | 1,115,475 | 696,339 | 1,711,945 |

+------------------------------------+-----------------+--------------+--------------+

| Depreciation | 135,474 | 88,707 | 194,347 |

+------------------------------------+-----------------+--------------+--------------+

| Amortisation of intangible assets | 108,776 | 133,042 | 294,803 |

+------------------------------------+-----------------+--------------+--------------+

| Financial assets written down | - | - | 37 |

+------------------------------------+-----------------+--------------+--------------+

| Decrease/(increase) in debtors | 404,778 | 333,106 | (99,777) |

+------------------------------------+-----------------+--------------+--------------+

| (Decrease)/increase in creditors | (358,014) | (612,409) | 454,516 |

+------------------------------------+-----------------+--------------+--------------+

| Increase/(decrease) in provisions | 133,198 | (10,190) | (151,383) |

+------------------------------------+-----------------+--------------+--------------+

| Share based payments | 93,222 | 140,410 | 237,969 |

+------------------------------------+-----------------+--------------+--------------+

| | | | |

+------------------------------------+-----------------+--------------+--------------+

| Net inflow | 1,632,909 | 769,005 | 2,642,457 |

+------------------------------------+-----------------+--------------+--------------+

Independent Review Report to Brooks Macdonald Group Plc

Introduction

We have been instructed by the company to review the condensed set of financial

statements in the half-yearly financial report for the six months ended 31

December 2008 set out on pages 2 to 9. We have read the other information

contained in the half-yearly financial report and considered whether it contains

any apparent misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The half-yearly financial report, including the financial information contained

therein, is the responsibility of, and has been approved by the directors. The

AIM Rules of the London Stock Exchange require that the accounting policies and

presentation applied to the interim figures should be consistent with those

applied in preparing the preceding annual accounts except where any changes, and

the reasons for them, are disclosed.

This half-yearly financial report has been prepared in accordance with the

International Accounting Standard 34, "Interim Financial Reporting".

The maintenance and integrity of the company's website is the responsibility of

the directors; the work we have carried out does not involve consideration of

these matters and, accordingly, we accept no responsibility for any changes that

may have occurred to the condensed set of financial statements presented on the

website.

Legislation in the United Kingdom governing the preparation and dissemination of

financial information may differ from legislation in other jurisdictions.

Our responsibility

Our responsibility is to express to the company a conclusion on the condensed

set of financial statements in the half-yearly financial report based on our

review.

Scope of review

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410, "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity" issued by the Auditing

Practices Board for use in the United Kingdom. A review of interim financial

information consists principally of making enquiries of management and applying

analytical procedures to the financial information and underlying financial data

and based thereon, assessing whether the accounting policies and presentation

have been consistently applied unless otherwise disclosed. A review excludes

audit procedures such as tests of controls and verification of assets,

liabilities and transactions. It is substantially less in scope than an audit

performed in accordance with International Standards on Auditing (UK and

Ireland) and therefore provides a lower level of assurance than an audit.

Accordingly we do not express an audit opinion on the financial information.

Review conclusion

Based on our review, nothing has come to our attention that causes us to believe

that the condensed set of financial statements in the half-yearly financial

report for the six months ended 31 December 2008 is not prepared, in all

material respects, in accordance with International Accounting Standard 34 as

adopted by the European Union.

St Paul's House

Warwick Lane Moore Stephens LLP

LONDON EC4M 7BP

Registered

Auditors

Chartered Accountants

17 March 2009

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DDLFFKXBEBBX

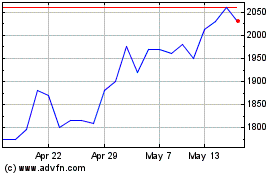

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Jul 2023 to Jul 2024