Cash from acquisition of subsidiary - 107,832 107,832

Interest income received - - -

Deposit recovered - - -

------------ ------------ ------------

Net cash inflow from investing

activities - 107,832 107,832

------------ ------------ ------------

(Decrease) in cash before financing (93,433) (181,889) (471,835)

------------ ------------ ------------

Cash flow from financing activities

Shares issued - 213,750 223,750

Loan payments received - 78 87,739

Redemption of shares - - -

------------ ------------ ------------

Net cash inflow from financing

activities - 213,828 311,489

------------ ------------ ------------

Net (decrease) / increase in

cash and cash equivalents (93,433) 31,939 (160,346)

Cash and cash equivalents at

the start of the period 149,750 271,964 310,096

Cash and cash equivalents at

the end of the period 56,317 303,903 149,750

------------ ------------ ------------

Statement of changes in equity

Issue Non-

Stated Capital costs Revenue controlling Total

capital reserves reserve reserve Total interest equity

GBP GBP GBP GBP GBP GBP GBP

For the six months

ended 31 May 2013

(unaudited)

At 1 December 2012 5,326,952 (706,395) (679,868) (3,472,612) 468,077 - 468,077

Loss for the period - - - (109,578) (109,578) (1,220) (110,798)

Transfer to

non-controlling

interest - - - 16,886 16,886 (16,886) -

---------- ---------- ---------- ------------ ------------ ------------ ------------

At 31 May 2013 5,326,952 (706,395) (679,868) (3,565,304) 375,385 (18,106) 357,279

---------- ---------- ---------- ------------ ------------ ------------ ------------

For the six months

ended 31 May 2012

(unaudited)

At 1 December 2011 3,208,910 (706,395) (679,868) (1,594,387) 228,260 - 228,260

Loss for the period - - - (309,617) (309,617) - (309,617)

Issue of consolidation

shares 1,700,000 - - - 1,700,000 - 1,700,000

Issue of participation

shares 208,750 - - - 208,750 - 208,750

At 31 May 2012 5,117,660 (706,395) (679,868) (1,904,004) 1,827,393 - 1,827,393

---------- ---------- ---------- ------------ ------------ ------------ ------------

For the fourteen

months ended 30

November 2012 (audited)

At 1 October 2011 3,208,910 (706,395) (679,868) (1,556,255) 266,392 - 266,392

Loss for the period - - - (1,916,357) (1,916,357) - (1,916,357)

Issue of fee shares 209,292 - - - 209,292 - 209,292

Issue of consolidation

shares 1,700,000 - - - 1,700,000 - 1,700,000

Issue of participation

shares 208,750 - - - 208,750 - 208,750

At 30 November

2012 5,326,952 (706,395) (679,868) (3,472,612) 468,077 - 468,077

---------- ---------- ---------- ------------ ------------ ------------ ------------

Notes to the financial statements

1. Accounting Policies

(a) Basis of preparation

The consolidated interim financial statements have been prepared

under the historical cost convention, as modified to include the

revaluation of quoted investments and investment properties and in

accordance with applicable Accounting Standards as adopted by the

European Union. Applicable Accounting Standards for these purposes

are International Financial Reporting Standards ("IFRS"), as

adopted by the European Union.

The interim financial information has been prepared in

accordance with IAS 34 "Interim financial reporting" as adopted by

the European Union.

The accounting policies and methods of computation used in the

condensed consolidated financial information for the six months

ended 31 May 2013 are the same as those followed in the preparation

of the Group's annual financial statements for the fourteen months

ended 30 November 2012 and are those the Group expect to apply into

financial statements for the year ending 30 November 2013.

The seasonality or cyclicality of operations does not impact on

the interim financial information.

(b) Basis of consolidation

The accompanying financial statements and related notes present

the consolidated financial position as of 31 May 2013 and the

consolidated results of the operations, cash flows and changes in

equity, for the period ended 31 May 2013. All significant

intercompany transactions have been eliminated.

2. (Loss) per share

Basic earnings per share amounts are calculated by dividing the

net loss for the period attributable to ordinary equity holders of

the Company by the weighted average number of participating

ordinary shares outstanding during the year.

Diluted earnings per share are not applicable to the Company,

since there is only one participating class of share issued by the

Company.

The following reflects the income and share data used in the

basic earnings per share computation:

31 May 31 May 30 November

2013 2012 2012

Loss attributable to (GBP109,578) (GBP309,617) (GBP1,916,357)

ordinary shareholders

Weighted average number

of shares in issue 28,442,487 22,735,657 26,366,056

Basic (loss) per share (0.39p) (1.4p) (7.3p)

3. Operating segment

The Company is currently in the early stages of developing its

technology and hence only has one operating segment.

4. Income

Six months Six months Fourteen months

ended ended ended

31 May 31 May 30 November

2013 2012 2012

GBP GBP GBP

Sales income 14,383 1,624 33,318

Rental income 5,667 - -

Other income - - 478

----------- ----------- ----------------

20,050 1,624 33,796

----------- ----------- ----------------

5. Stated capital

The Company is a no par value ('NPV') company

31 May 31 May 30 November

2013 2012 2012

Authorised: Number Number Number

Founder shares 10 10 10

99,999,990 Participating

shares 99,999,990 99,999,990 99,999,990

100,000,000 100,000,000 100,000,000

------------ ------------ ------------

Issued and fully paid: Number Number Number

Founder shares 2 2 2

Participating shares 31,574,356 31,574,356 31,574,356

------------ ------------ ------------

All costs associated with the issue of shares have been taken to

the issue costs reserve.

6. Copies of the interim results

Copies of the half-yearly results will be available from the

Company's registered office PO Box 264, JP Morgan House, Grenville

Street, St. Helier, Jersey JE4 8QT, and will be available from the

Company's website www.onedeltaplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UKVSROKAWUAR

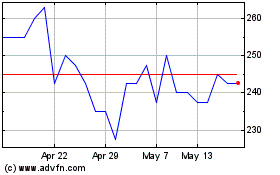

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

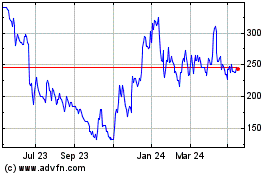

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jul 2023 to Jul 2024