TIDMONE

RNS Number : 7923M

One Delta PLC

29 August 2013

29 August 2013

One Delta plc

(the "Company")

Condensed unaudited interim financial statements for the six

months ended 31 May 2013

Chairman's Statement

I am pleased to present the unaudited results for the six months

ended 31 May 2013.

Restructuring

I can report that the proposals made in the Annual Report for

the fourteen months ended 30 November 2012 (the "Report") were

passed at the Extraordinary General Meeting of the Company held on

23 April 2013. The Buyback Contract (as defined in the Report) has

therefore been executed and the Company's holding in the UK trading

subsidiary, One Delta Limited (the "subsidiary" or "ODL"), is now

approximately 51.5%. As a consequence the Company has taken

15,000,005 Ordinary no par value shares into treasury.

The Company maintains a keen interest in the operation of ODL,

and an agreement between the Company, ODL, Phil Dale, Richard

Ludford and Sean Reel governs how the subsidiary is now run.

Financial Performance

The Company continues to be operated on a tight budget and the

Board has maintained costs at a minimal level. No director or

consultant has received any remuneration (other than the shares

referred to in the reverse documentation published in December

2011) since the acquisition of ODL.

The results for the six months to 31 May 2013 show sales

revenues of GBP14,383 and losses for the period of GBP109,578,

resulting in a remaining cash balance of GBP56,317.

The level of revenue generated by the subsidiary continues to be

disappointing. Whilst enquiries are being received for the supply

of product and ODL's pricing structure appears to be competitive,

the conversion of quotations into sales remains slow.

The subsidiary's fencing and construction products have been

well received by the relevant industries and feedback in respect of

the limited amount of product sold is positive but ODL continues to

miss its own sales targets.

The acoustic qualities of the Dale Fence are above industry

standard and have attracted interest from utility and transport

companies. However, the decision-making process in relation to new

product within these industries appears to be lengthy.

That said, the subsidiary's sales team remains active and is

hopeful of generating improved sales revenues in the near future.

Indeed, pursuing its strategy of joining with existing fencing

companies ODL's products have recently been included in the

brochure of a nationwide fencing company and are being marketed by

other more localised entities.

Outlook

The restructuring of the Company, referred to above, has

provided it with the capacity to consider other opportunities into

which it might wish to diversify.

The Board has looked at a number of potential transactions and

business opportunities that would allow the Company to expand its

activities but to date these have not proved satisfactory.

The Board is also mindful of the financial position of the

Company and, given the monthly burn rate of approximately

GBP10,400, is working on a strategy to raise further capital to

maintain the Company's liquidity as a going concern and the working

capital at an acceptable level.

Roger Maddock

Chairman

Enquiries:

One Delta plc

Roger Maddock, Executive Chairman Tel: +44 (0) 7841

Roger King, Executive Director 672 621

Tel: +44 (0) 1534

753 400

Sanlam Securities UK Limited (Nominated

Adviser and Broker)

Simon Clements/Virginia Bull Tel: +44 (0) 20

7628 2200

Consolidated statement of comprehensive income

Audited

Unaudited fourteen

six months Unaudited months

ended six months ended 30

31 May ended 31 November

2013 May 2012 2012

Notes GBP GBP GBP

Sales income 4 14,383 1,624 33,318

Cost of sales (1,016) - (39,773)

------------ ------------ ------------

Gross profit/(loss) 13,367 1,624 (6,455)

Rental income 4 5,667 - -

Rental expenses - - (11,054)

Other income 4 - - 478

Other expenses (124,832) (311,241) (753,571)

Impairment of goodwill - - (1,135,755)

Amortisation of intangible asset (5,000) - (10,000)

Net loss on ordinary activities

before taxation (110,798) (309,617) (1,916,357)

Taxation - - -

Net (loss) and total comprehensive

income (110,798) (309,617) (1,916,357)

============ ============ ============

Attributable to:

Owners of the Company 2 (109,578) (309,617) (1,916,357)

Non-controlling interest (1,220) - -

------------ ------------ ------------

(110,798) (309,617) (1,916,357)

============ ============ ============

Basic (loss) per share (pence) 2 (0.39) (1.4) (7.3)

------------ ------------ ------------

Notes

The Company has no recognised gains or losses other than those

disclosed in the Consolidated statement of comprehensive

income.

Statement of Financial Position

(unaudited) (unaudited) (audited)

31 May 31 May 30 November

2013 2012 2012

Notes GBP GBP GBP

Non-current assets

Goodwill 300,000 1,468,981 300,000

Intangible asset 35,000 - 40,000

335,000 1,468,981 340,000

Current assets

Inventory 17,415 13,351 16,818

Other receivables 21,158 90,258 15,708

Cash and cash equivalents 56,317 303,904 149,750

------------ ------------ -------------

94,890 407,513 182,276

Creditors - amounts falling

due within one year

Other payables (72,611) (49,101) (54,199)

Net current assets 22,279 358,412 128,077

Total net assets 357,279 1,827,393 468,077

------------ ------------ -------------

Equity

Stated capital 5 5,326,952 5,117,660 5,326,952

Capital reserve (706,395) (706,395) (706,395)

Issue costs reserve (679,868) (679,868) (679,868)

Revenue reserve (3,565,304) (1,904,004) (3,472,612)

Equity attributable to owners

of the Company 375,385 1,827,393 468,077

Non-controlling interest (18,106) - -

Total equity 357,279 1,827,393 468,077

------------ ------------ -------------

Statement of Cash Flows

(unaudited) (unaudited) (audited)

Fourteen

Six months Six months months

ended ended ended

31 May 31 May 30 November

2013 2012 2012

GBP GBP GBP

Cash flow from operating activities

Sales income 14,383 1,624 33,548

Cost of sales (1,016) - -

Rental income 5,667 5,102 478

Purchase/(depletion) of stock (597) - (15)

Rental expenses - - (10,445)

Other expenses (111,870) (296,447) (603,233)

------------ ------------ ------------

Net cash (outflow) from operating

activities (93,433) (289,721) (579,667)

Taxation paid - - -

Cash flow from investing activities

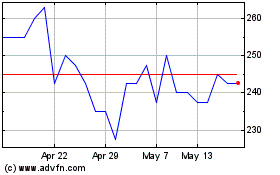

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

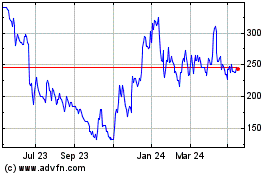

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jul 2023 to Jul 2024