Barings Emerging EMEA Opportunities Plc - Portfolio Update

December 07 2023 - 10:40AM

PR Newswire (US)

BARINGS EMERGING EMEA

OPPORTUNITIES PLC (the

“Company”)

PORTFOLIO

UPDATE

The Company announces that

at close of business 30 November 2023

its ten largest investments were as

follows:

%

of Total Assets

|

Al Rajhi

Bank |

7.18% |

|

Naspers

Limited |

6.14% |

|

OTP

Bank |

4.18% |

|

The Saudi National

Bank |

3.95% |

|

Saudi Basic

Industries |

3.92% |

|

Firstrand |

3.87% |

|

Qatar National

Bank |

3.67% |

|

PKO Bank

Polski |

3.34% |

|

Saudi

Telecom |

3.15% |

|

Capitec |

2.96% |

The geographic

breakdown at close of business 30 November

2023 was as follows:

|

Saudi

Arabia |

27.40% |

|

South

Africa |

24.38% |

|

United Arab

Emirates |

11.46% |

|

Poland |

8.01% |

|

Qatar |

5.45% |

|

Turkey |

5.26% |

|

Hungary |

4.89% |

|

Greece |

4.40% |

|

Kuwait |

3.26% |

|

Czechia |

0.94% |

|

Romania |

0.26% |

|

Russia |

0.00% |

|

Cash and other net

assets |

4.29% |

|

TOTAL |

100.00% |

|

For any enquiries please

contact: |

|

|

Quill

PR |

+44 (0)20 7466

5050 |

|

Nick

Croysdill, Andreea Caraveteanu |

|

About Barings Emerging

EMEA Opportunities

PLC

“Finding quality companies from Emerging Europe,

the Middle East and

Africa.”

Barings Emerging EMEA Opportunities PLC (the

“Company”) is a UK based investment trust that was launched on

18 December 2002 and is managed by

Baring Fund Managers

Limited.

In November 2020, the

Company broadened its investment policy to focus on growth and

income from quality companies in the Emerging Europe, Middle East and Africa ("EMEA") region. It also changed its

name from Baring Emerging Europe PLC to Barings Emerging EMEA

Opportunities PLC at the same

time.

For more information, and to sign up for regular

updates, please visit the Company’s

website: www.bemoplc.com

Legal Entity Identifier

("LEI"):213800HLE2UOSVAP2Y69

Portfolio Holdings Nov 2023 |

Copyright r 07 PR Newswire

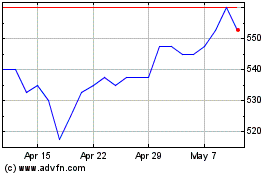

Barings Emerging Emea Op... (LSE:BEMO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Barings Emerging Emea Op... (LSE:BEMO)

Historical Stock Chart

From Nov 2023 to Nov 2024