Notifiable Interest (2327D)

March 18 2011 - 9:19AM

UK Regulatory

TIDMAXS

RNS Number : 2327D

Accsys Technologies PLC

18 March 2011

AIM: AXS

NYSE Euronext Amsterdam: AXS

18 March 2011

ACCSYS TECHNOLOGIES PLC ("Accsys" or "the Company")

Notifiable Interest

The Company announces that it received the following

notification on 18 March 2011:

TR-1: NOTIFICATION OF MAJOR INTEREST IN SHARESi

--------------------------------------------------------------------------

1. Identity of the issuer or the

underlying issuer of existing shares to

which voting rights are attached: (ii) Accsys Technologies PLC

----------------------------------------- -------------------------------

2 Reason for the notification (please tick the appropriate box or boxes):

--------------------------------------------------------------------------

An acquisition or disposal of voting

rights

----------------------------------------- -------------------------------

An acquisition or disposal of qualifying

financial instruments which may result

in the acquisition of shares already

issued to which voting rights are

attached

----------------------------------------- -------------------------------

An acquisition or disposal of

instruments with similar economic effect

to qualifying financial instruments

----------------------------------------- -------------------------------

An event changing the breakdown of

voting rights

----------------------------------------- -------------------------------

Other (please specify): Open Offer x

----------------------------------------- -------------------------------

3. Full name of person(s) subject

to the

notification obligation: (iii) OP-FUND MANAGEMENT COMPANY LTD

----------------------------------------- -------------------------------

4. Full name of shareholder(s)

(if different from 3.):(iv) OP-EUROPE EQUITY FUND (UCITS)

----------------------------------------- -------------------------------

5. Date of the transaction and date

on

which the threshold is crossed or

reached: (v) 23 February 2011

----------------------------------------- -------------------------------

6. Date on which issuer notified: 18 March 2011

----------------------------------------- -------------------------------

7. Threshold(s) that is/are crossed

or

reached: (vi, vii) 7%

----------------------------------------- -------------------------------

8. Notified details:

-----------------------------------------------------------------------------------------------------------------------

A: Voting rights attached to shares (viii, ix)

-----------------------------------------------------------------------------------------------------------------------

Class/type

of shares if

possible Situation previous

using the to the triggering Resulting situation after the triggering

ISIN CODE transaction transaction

------------- -------------------------------------------- ----------------------------------------------------------

Number

Number of Number

of Voting of Number of voting % of voting rights

Shares Rights shares rights (x)

------------- -------------------------- ---------------- --------- -------------------- -------------------------

Direct Indirect

Direct (xi) (xii) Direct Indirect

------------- --------- ----------- ------------ --------- --------- --------- ------------ -----------

Ord Euro 22 358

0.01 14 905 690 - 534 - 5.55% -

-------------------------- ---------------- --------- --------- --------- ------------ -----------

GB00BOLMC530

------------- --------- ----------- ------------ ------- ------- --------- -------- ---------

B: Qualifying Financial Instruments

-----------------------------------------------------------------------------------------------------------------------

Resulting situation after the triggering transaction

-----------------------------------------------------------------------------------------------------------------------

Number of voting

rights that may be

acquired if the

Type of Exercise/ instrument is

financial Expiration Conversion Period exercised/ % of voting

instrument date (xiii) (xiv) converted. rights

----------------- ------------------------ --------------------------- ---------------------- ---------------------

C: Financial Instruments with similar economic effect to Qualifying Financial

Instruments (xv, xvi)

-----------------------------------------------------------------------------------------------------------------------

Resulting situation after the triggering transaction

-----------------------------------------------------------------------------------------------------------------------

Exercise/

Type of Conversion Number of voting

financial Exercise Expiration period rights instrument % of voting rights

instrument price date (xvii) (xviii) refers to (xix, xx)

--------------- ----------- --------------- -------------- ------------------------------- -----------------------

Nominal Delta

--------------- ----------- --------------- -------------- ------------------------------- ------------ ---------

Total (A+B+C)

-----------------------------------------------------------------------------------------------------------------------

Number of voting rights Percentage of voting rights

------------------------------------------------------------- --------------------------------------------------------

22 358 534 5.55%

------------------------------------------------------------- --------------------------------------------------------

9. Chain of controlled undertakings through which the voting rights and/or

the

financial instruments are effectively held, if applicable: (xxi)

------------------------------------------------------------------------------

OP-Pohjola Group Central Cooperative (Central Cooperative) is Central

institution of OP-Pohjola Group. As a central institution, it is in charge of

Group steering and control. One of the main subsidiaries of Central

Cooperative is OP Fund Management Company Ltd (hereinafter 'the Fund

Management Company'), which manages the OP-Pohjola Group's mutual funds. Both

the Fund Management Company and the Central Cooperative are separate legal

entities and the Fund Management Company is one hundred per cent (100%) owned

subsidiary of the Central Cooperative (the Parent Company). The corporate

form of 'The Central Cooperative' is co-operative (society). The regulatory

authority of both corporations is the Financial Supervisory Authority

(FIN-FSA) in Finland. OP- Europe Equity Fund (hereinafter 'the Fund') is

UCITS -fund and the regulation of 'The Fund' is based on the Finnish Act on

Common Funds 29.1.1999/48 which has been enacted pursuant to Council

Directive 85/611/EEC of 20 December 1985 on the coordination of laws,

regulations and administrative provisions relating to undertakings for

collective investment in transferable securities (UCITS) and its amendments

Directive 2001/107/EC and Directive 2001/108/EC of the European Parliament.

'The Fund' is not a separate legal entity (i.e. legal persons).'The Fund' is

a mutual fund and it invest it's assets primarily shares listed and the

unitholders (i.e. investors) are legal owners of the fund units, but not the

shares. The Fund Management Company ( UCITS Management Company) is

responsible for the management of the funds and it represents the funds in

its own name and acts on their behalf in matters concerning the funds and

exercises the rights associated with the funds' assets (i.e. shares). The

majority of Board of Directors of the Fund Management Company is appointed by

the Central Cooperative.

Proxy Voting:

------------------------------------------------------------------------------

10. Name of the proxy holder: Not named

------------------------------------------------ ----------------------------

11. Number of voting rights proxy holder will

cease

to hold:

------------------------------------------------ ----------------------------

12. Date on which proxy holder will cease to

hold

voting rights:

------------------------------------------------ ----------------------------

OP-Pohjola Group Central Cooperative

OP Fund Management Company Ltd

Address: Teollisuuskatu 1b, 00100

13. Additional information: Helsinki, Finland

------------------------------------ ----------------------------------------

Merja Pollanen

14. Contact name: Fund Assisant

------------------------------------ ----------------------------------------

15. Contact telephone number: +358 10 252 2354

------------------------------------ ----------------------------------------

Ends

For further information, please contact:

Accsys Technologies Paul Clegg, CEO via Citigate Dewe

PLC Hans Pauli, CFO Rogerson

Stephen Mischler

Matrix Corporate Capital Nick Stone

LLP Edmund Glover +44 20 3206 7000

Numis Securities Limited Christopher Wilkinson +44 20 7260 1347

Ben Stoop +44 20 7260 1410

Citigate Dewe Rogerson Ginny Pulbrook +44 20 7282 2945

Malcolm Robertson +44 20 7282 2867

Suzanne Bakker +31 20 575 4023

Notes to editors:

Accsys Technologies PLC (www.accsysplc.com) is an environmental

science and technology company whose primary focus is on the

production of Accoya(R) wood and technology licensing via its 100%

owned subsidiary, Titan Wood Limited, which has manufacturing

operations in Arnhem, the Netherlands, a European office in London

and an Americas office in Dallas, Texas. Accsys Technologies'

operations comprise three principal business units: (i) the

Accoya(R) wood production facility located in Arnhem, The

Netherlands; (ii) technology development, focused on a programme of

continuous improvements to the process engineering and operating

protocols for the acetylation of wood which are currently under

development and the development of technology for the acetylation

of wood fibre; and (iii) the licensing of technology for the

production of Accoya(R) wood and Tricoya(R) wood elements across

the globe.

Accoya(R) Wood (www.accoya.info) is produced by using a

proprietary, non-toxic process that effectively converts

sustainably grown softwoods and non-durable hardwoods into what is

best described as a "high technology wood" via acetylation.

Distinguished by its durability, dimensional stability and, perhaps

most importantly of all, its reliability (in terms of consistency

of both supply and quality), Accoya(R) wood is particularly suited

to exterior applications where performance and appearance are

valued. Unlike most woods, its colour does not degrade when exposed

to sunlight. Moreover, the Accoya(R) wood production process does

not compromise the wood's strength or machinability. The

combination of UV resistance, dimensional stability, increased

coatings life, durability and retained strength means that

Accoya(R) wood offers a wealth of new opportunities to architects,

designers and specifiers. Leading applications include external

doors and windows, shutters/shading, siding and cladding, decking,

outdoor furniture/equipment and glulam beams for structural

use.

Tricoya(R) Wood Elements (www.tricoya.com) is Accsys

Technologies' proprietary technology for the acetylation of wood

fibres, chips, and particles for use in the fabrication of wood

based composites, including panel products. These composites

demonstrate enhanced durability and dimensional stability which

allow them to be used in a variety of applications which were once

limited to solid wood or man-made products. Tricoya(R) Wood

Elements is lauded as the first major innovation in the wood

composites industry in more than 30 years.

Wood Acetylation is a process, which increases the amount of

'acetyl' molecules in wood, thereby changing its physical

properties. The environmentally responsible process protects wood

from rot by making it "inedible" to most micro-organisms and

insects, without - unlike conventional treatments - making it

toxic. It also greatly reduces the wood's tendency to swell and

shrink, making it less prone to cracking and ensuring that, when

painted, it requires dramatically reduced maintenance. Acetylated

wood's increased durability offers major carbon sequestration

advantages, compared to other woods and man-made building materials

such as steel, vinyl, and plastic.

Wood Composites include a range of derivative wood products

which are manufactured by binding together the strands, particles,

fibres, or veneers of wood together with adhesives to form

composite materials. These products are engineered to precise

design specifications which are tested to meet national or

international standards.

Accsys Technologies is the trading name of Titan Wood Limited.

ACCOYA(R) , TRICOYA(R) and the Trimarque Device are registered

trademarks owned by Titan Wood Limited and may not be used or

reproduced without written permission.

This information is provided by RNS

The company news service from the London Stock Exchange

END

HOLGGUMGWUPGGWR

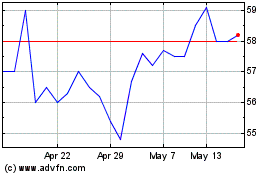

Accsys Technologies (LSE:AXS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Accsys Technologies (LSE:AXS)

Historical Stock Chart

From Jul 2023 to Jul 2024