TIDMARGO

RNS Number : 9342I

ARGO Group Limited

10 August 2023

Argo Group Limited

("Argo" or the "Company")

Interim Results for the six months ended 30 June 2023

Argo today announces its interim results for the six months

ended 30 June 2023.

Key highlights for the six months period ended 30 June 2023

This report sets out the results of Argo Group Limited (the

"Company") and its subsidiaries (collectively "the Group" or

"Argo") covering the six months ended 30 June 2023.

- Revenues US$1.5 million (six months to 30 June 2022: US$1.3 million)

- Operating loss US$0.7 million (six months to 30 June 2022: US$1.5 million)

- Profit before tax US$0.1 million (six months to 30 June 2022: loss before tax US$3.5 million)

- Net assets US$19.7 million (31 December 2022: US$19.6 million)

Commenting on the results and outlook, Kyriakos Rialas, Chief

Executive of Argo said:

"Argo Group was profitable for the first six months of 2023

mainly due to a positive performance of its investment in The Argo

Fund and continuous control of expenses. The group maintains good

liquidity and its operational and investment team has the capacity

to take on a third first loss managed account in the second half of

2023. During the first half of 2023, the two first loss managed

accounts were up 15%. Emerging markets continue to be adversely

affected by inflation and higher interest rates but there are signs

that disinflation and lower rates has already started ahead of

developed markets. As a result, our macro strategy has outperformed

distressed debt with many sovereigns still negotiating and waiting

for IMF approvals. Finally, the situation in Ukraine remains

unstable with the shopping mall in Odessa now opened but only up to

60% capacity."

Enquiries

Argo Group Limited

Andreas Rialas

020 7016 7660

Panmure Gordon

Dominic Morley

020 7886 2500

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018.

CHAIRMAN'S STATEMENT

Key highlights for the six months ended 30 June 2023

This report sets out the results of Argo Group Limited (the

"Company") and its subsidiaries (collectively "the Group" or

"Argo") covering the six months ended 30 June 2023.

- Revenues US$1.5 million (six months to 30 June 2022: US$1.3 million)

- Operating loss US$0.7 million (six months to 30 June 2022: US$1.5 million)

- Profit before tax US$0.1 million (six months to 30 June 2022: loss before tax US$3.5 million)

- Net assets US$19.7 million (31 December 2022: US$19.6 million)

The Group and its investment objective

Argo's investment objective is to provide investors with

absolute returns in the funds that it manages by investing in multi

strategy investments in emerging markets.

Argo was listed on the AIM market in November 2008 and has a

performance track record dating back to 2000.

Business and operational review

For the six months ended 30 June 2023 the Group generated

revenues of US$1.5 million (six months to 30 June 2022: US$1.3

million) with management fees accounting for US$1.1 million (six

months to 30 June 2022: US$1.1 million).

Total operating costs for the period, ignoring bad debt

provisions, are US$1.8 million compared to US$2.5 million for the

six months to 30 June 2022 . The Group has provided against

management fees of US$0.4 million due from the Designated share

class in The Argo Fund ("TAF") (six months to 30 June 2022: US$0.3

million). In the Directors' view these amounts are fully

recoverable however they have concluded that it would only be

appropriate to recognise income without provision from these

investment management services once a liquidity event occurs in

this share class.

Overall, the financial statements show an operating loss for the

period of US$0.7 million (six months to 30 June 2022: US$1.5

million) and a profit before tax of US$0.1 million (six months to

30 June 2022: loss before tax of US$3.5 million). Net profit on

investments of US$0.3 million (six months to 30 June 2022: net loss

on investments US$2.5 million) and interest income of US$0.5

million (six months to 30 June 2022: US$0.5 million).

At the period end, the Group had net assets of US$19.7 million

(31 December 2022: US$19.6 million) and net current assets of

US$5.4 million (31 December 2022: US$6.0 million) including cash

reserves of US$1.2 million (31 December 2022: US$1.6 million).

Net assets include investments in The Argo Fund ("TAF") at fair

values of US$4.5 million (31 December 2022: US$4.4 million).

At the period end TAF owed the Group total fees of US$2.4

million ( 31 December 2022 : US$2.1 million). At 30 June 2023, a

provision for US$2.3 million was made against this amount as the

timing of the receipt of the fees from the designated share class

in TAF is unknown.

TAF ended the period with Assets under Management ("AUM") at

US$110.5 million (31 December 2022: US$109.8 million). The current

level of AUM remains below that required to ensure sustainable

profits on a recurring management fee basis in the absence of

performance fees. This has necessitated an ongoing review of the

Group's cost basis. Nevertheless, the Group has ensured that the

operational framework remains intact and that it retains the

capacity to manage additional fund inflows as and when they

arise.

The average number of permanent employees of the Group for the

six months to 30 June 2023 was 20 ( 30 June 2022 : 20).

Fund performance

The Argo Funds

30 June 30 June 2022

Launch 2023 2022 year Sharpe Down

Since Annualised

Fund date 6 months 6 months total inception performance ratio months

% % % % CAGR %

-------- ---------- ---------- ------- ---------- ------------ ------- ---------

The Argo Fund 92 of

- A class Oct-00 1.46 -14.25 -12.54 219.78 6.00 0.39 273

-------- ---------- ---------- ------- ---------- ------------ ------- ---------

The Argo Fund 12 of

- X2 class Feb21 -1.16 -21.39 -16.83 -8.05 -3.42 -0.22 29

-------- ---------- ---------- ------- ---------- ------------ ------- ---------

The Argo Fund

- DI Class Jan-20 1.96 -6.20 -2.82 92.88 N/A N/A N/A

-------- ---------- ---------- ------- ---------- ------------ ------- ---------

In the first half of 2023, global macroeconomic trends continued

to have a significant impact on the outlook for and performance of

emerging market ("EM") assets. Ongoing uncertainty over the path of

inflation and policy trajectory led to false dawns around a peak in

US rates. The Federal Reserve raised rates three times in the

period and although left fed funds unchanged at 5 -5.25% at the

meeting in June, it increased the fed funds rate to a target range

of 5.25%-5.5% at its meeting in late July. By contrast, ten-year US

Treasury yields were much more volatile, starting the period at

3.9% before dropping below 3.4% by mid-January only to exceed 4% in

early March. After falling back to 3.3% in early April they had

moved up to over 4% in early July.

After a strong post-pandemic recovery, concern over the

evolution of China's economic growth picked up through the second

quarter of 2023, as macroeconomic data began to disappoint. This

has led to speculation around stimulus measures in recent weeks,

although the consensus does not expect a major announcement, even

if some targeted support may come through.

However, against this backdrop both EM equities and bonds

broadly advanced. The former, as measured by the MSCI Emerging

Markets Index, returned close to 5% in the first half of 2023,

lagging the MSCI World which was up just over 15%. As mentioned

previously, China, which is the largest index market in EM, has

been a drag. However, the stunning rally from March onwards of the

Super-7 stocks (Apple, Microsoft, Alphabet, Amazon, Tesla, Meta,

Nvidia) in the MSCI World has been a factor.

EM bonds and currencies have generated positive returns

year-to-date. In sovereign and corporate credit, the impact of

higher US Treasury yields was offset by credit spread compression,

while EM local debt continued to outperform core fixed income

markets almost entirely driven by lower yields. The global

inflation surge in 2021-2022 caught the attention of central banks

worldwide. However, EM central banks were quicker to respond to

this inflationary shock, initiating a remarkable series of rate

hikes in the first quarter of 2021 that continued until late

2022/early 2023.

This swift action allowed EM countries to witness falling core

inflation in recent months, unlike the developed world, which

continues to grapple with entrenched core inflation.

Emerging markets currencies were roughly flat against the US

dollar, although Latin American currencies have seen the most

appreciation relative to the US dollar year to-date. Turkey and

South Africa have seen the greatest currency depreciation.

Meanwhile, market access has remained a concern for high yield

EM issuers. While investment grade EM issuance is almost in line

with the average over the past few years, for high yield sovereigns

and corporates the equivalent figure is around a third. Inevitably,

this increases the likelihood of restructurings particularly if

world growth proves disappointing.

The NAV of the Class A shares of the TAF increased by 1.46 % in

the first half of 2023, compared to the drop of 14.25% in the same

period of the previous year. The fund benefited from a recovery in

Argentine bond prices, though they remained volatile. There were

also positive contributions from long positions in local currency

bonds (mainly Latin American and East European). The main

detractors were corporates in the throes of restructuring and

generic credit hedges. Class A shares issued by TAF continue to be

invested in diversified sovereign and corporate debt and macro

positions which seek to capture alpha through long and short

investment. In addition, there are other share classes within the

TAF master/feeder structure which offer investors exposure to a

distressed debt portfolio (Class X2 launched in 2021); macro

strategies (Class X3, launched last year) and also special

situations where the timeline to investment realisation will be

longer.

Loan to Argo Real Estate Limited Partnership

On 21(st) March 2023, the back to back loans from the Group to

Argo Real Estate Limited Partnership to Novi Biznes Poglyady LLC

were replaced by a direct loan from the Group to Novi Biznes

Poglyaddy LLC. The Shopping Centre partially reopened in November

2022. As the loan receivable is still exposed to the performance of

this investment property held in Ukraine, the Group continues to

hold an IFRS 9 valuation adjustment for US$0.5 million for expected

losses at the reporting date (note 10).

Dividends and share purchase programme

The Group did not pay a dividend during the current or prior

period . The Directors intend to restart dividend payments as soon

as the Group's performance provides a consistent track record of

profitability.

Outlook

The Board remains optimistic about the Group's prospects based

on the transactions in the pipeline and the Group's initiatives to

increase AUM. A significant increase in AUM is still required to

ensure sustainable profits on a recurring management fee basis and

the Group is well placed with capacity to absorb such an increase

in AUM with negligible impact on operational costs.

Boosting AUM will be Argo's top priority in the next six months.

The Group's marketing efforts continue to focus on TAF which has a

22-year track record as well as identifying acquisitions that are

earnings enhancing.

Over the longer term, the Board believes there is significant

opportunity for growth in assets and profits and remains committed

to ensuring the Group's investment management capabilities and

resources are appropriate to meet its key objective of achieving a

consistent positive investment performance in the emerging markets

sector.

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2023

Six months Six months

ended ended

30 June 30 June

2023 2022

Note US$'000 US$'000

Management fees 1,111 1,140

Performance fees - -

Other income 400 125

============================================= ===== =========== ===========

Revenue 1,511 1,265

============================================= ===== =========== ===========

Legal and professional expenses (119) (128)

Management fees payable (141) (180)

Operational expenses (402) (362)

Employee costs (1,108) (1,752)

9,

Bad debt provision 10 (367) (320)

Foreign exchange (loss)/profit (9) 9

Depreciation 7 (48) (71)

Operating loss (683) (1,539)

============================================= ===== =========== ===========

Interest income 496 499

Realised and unrealised gain/(loss)

on investments 308 (2,507)

============================================= ===== =========== ===========

Profit/(loss) on ordinary activities

before taxation 121 (3,547)

============================================= ===== =========== ===========

Taxation 5 - -

============================================= ===== =========== ===========

Profit/(loss) for the period after

taxation attributable to members of

the Company 6 121 (3,547)

Other comprehensive income

Items that may be reclassified subsequently

to profit or loss:

Exchange differences on translation

of foreign operations 6 (107)

============================================= ===== =========== ===========

Total comprehensive income for the

period 127 (3,654)

============================================= ===== =========== ===========

Six months Six months

Ended Ended

30 June 30 June

2023 2022

US$ US$

Earnings per share (basic) 6 0.003 (0.09)

============================================= ===== =========== ===============

Earnings per share (diluted) 6 0.003 (0.08)

============================================= ===== =========== ===============

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

30 June 31 December

2023 2022

Note US$'000 US$'000

Assets

Non-current assets

Land, fixtures, fittings and

equipment 7 571 607

Loans and advances receivable 10 14,147 13,416

================================ ===== ========== ============

Total non-current assets 14,718 14,023

================================ ===== ========== ============

Current assets

Financial assets at fair value

through profit or loss 8 4,451 4,387

Loan and advances receivable 10 9 -

Trade and other receivables 9 309 413

Cash and cash equivalents 1,241 1,642

Total current assets 6,010 6,442

================================ ===== ========== ============

Total assets 20,728 20,465

================================ ===== ========== ============

Equity and liabilities

Equity

Issued share capital 11 390 390

Share premium 25,353 25,353

Retained earnings (2,856) (2,977)

Foreign currency translation

reserve (3,203) (3,209)

================================ ===== ========== ============

Total equity 19,684 19,557

================================ ===== ========== ============

Current liabilities

Trade and other payables 15 662 497

Total current liabilities 662 497

-------------------------------- ----- ---------- ------------

Non-current liabilities

Trade and other payables 15 382 411

-------------------------------- ----- ---------- ------------

Total non-current liabilities 382 411

-------------------------------- ----- ---------- ------------

Total equity and liabilities 20,728 20,465

-------------------------------- ----- ---------- ------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

FOR THE SIX MONTHSED 30 JUNE 2023

Foreign

Issued currency

share Share Retained translation

capital premium earnings reserve Total

2022 2022 2022 2022 2022

US$'000 US$'000 US$'000 US$'000 US$'000

As at 1 January 2022 390 25,353 420 (3,086) 23,077

Total comprehensive

income

Loss for the period

after taxation - - (3,547) - (3,547)

Other comprehensive

income - - - (107) (107)

As at 30 June 2022 390 25,353 (3,127) (3,193) 19,423

====================== ========== ========== =========== ================ ========

Foreign

Issued currency

share Share Retained translation

capital premium earnings reserve Total

2023 2023 2023 2023 2023

US$'000 US$'000 US$'000 US$'000 US$'000

As at 1 January 2023 390 25,353 (2,977) (3,209) 19,557

Total comprehensive income

Profit for the period after

taxation - - 121 - 121

Other comprehensive income - - - 6 6

As at 30 June 2023 390 25,353 (2,856) (3,203) 19,684

============================= ========== ========== =========== ================ ========

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2023

Six months Six months

ended ended

30 June 30 June

2023 2022

Note US$'000 US$'000

Net cash outflow from operating

activities 12 (387) (332)

======================================= ===== =========== ===========

Cash flows used in investing

activities

Purchase of fixtures, fittings

and equipment 7 (3) (4)

Net cash (used)/ generated from

investing activities (3) (4)

======================================= ===== =========== ===========

Cash flows from financing activities

Payment of lease liabilities - (78)

Net cash used in financing activities - (78)

======================================= ===== =========== ===========

Net decrease in cash and cash

equivalents (390) (414)

Cash and cash equivalents at 1

January 2023 and

1 January 2022 1,642 1,709

Foreign exchange loss on cash

and cash equivalents (11) (63)

Cash and cash equivalents as

at 30 June 2023 and 30 June 2022 1,241 1,232

======================================= ===== =========== ===========

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

For the six months ended 30 June 2023

1. CORPORATE INFORMATION

The Company is domiciled in the Isle of Man under the Companies

Act 2006. Its registered office is at 33-37 Athol Street, Douglas,

Isle of Man, IM1 1LB. The condensed consolidated interim financial

statements of the Group as at and for the six months ended 30 June

2023 comprise the Company and its subsidiaries (together referred

to as the "Group").

The consolidated financial statements of the Group as at and for

the year ended 31 December 2022 are available upon request from the

Company's registered office or at www.argogrouplimited.com.

The principal activity of the Company is that of a holding

company and the principal activity of the wider Group is that of an

investment management business. The functional currency of the

Group undertakings are US dollars, Sterling and Romanian Lei. The

presentational currency is US dollars.

Wholly owned subsidiaries Principal activity Country of incorporation

Argo Capital Management Limited Investment United Kingdom

management

Argo Property Management Srl Property management Romania

2. ACCOUNTING POLICIES

(a) Basis of preparation

These condensed consolidated interim financial statements have

been prepared in accordance with IAS 34 Interim Financial

Reporting. They do not include all the information required for

full annual financial statements and should be read in conjunction

with the consolidated financial statements of the Group as at and

for the year ended 31 December 2022.

The accounting policies applied by the Group in these condensed

consolidated interim financial statements are the same as those

applied by the Group in its consolidated financial statements as at

and for the year ended 31 December 2022.

These condensed consolidated interim financial statements were

approved by the Board of Directors on 9 August 2023.

b) Financial instruments and fair value hierarchy

The following represents the fair value hierarchy of financial

instruments measured at fair value in the Condensed Consolidated

Statement of Financial Position. The hierarchy groups financial

assets and liabilities into three levels based on the significance

of inputs used in measuring the fair value of the financial assets

and liabilities. The fair value hierarchy has the following

levels:

Level 1: quoted prices (unadjusted) in active markets for

identical assets or liabilities;

Level 2: inputs other than quoted prices included within Level 1

that are observable for the asset or liability, either directly

(i.e. as prices) or indirectly (i.e. derived from prices); and

Level 3: inputs for the asset or liability that are not based on

observable market data (unobservable inputs).

The level within which the financial asset or liability is

classified is determined based on the lowest level of significant

input to the fair value measurement

3. SEGMENTAL ANALYSIS

The Group operates as a single asset management business.

The operating results of the companies are regularly reviewed by

the Directors of the Group for the purposes of making decisions

about resources to be allocated to each company and to assess

performance. The following summary analyses revenues, profit or

loss, assets and liabilities:

Argo Argo Capital Argo Property Six months

Group Management Management ended

Ltd Ltd Srl 30 June

2023 2023 2023 2023

US$'000 US$'000 US$'000 US$'000

Total revenues for

reportable segments

customers - 1,111 400 1,511

Intersegment revenues - - -

-

Total profit/(loss)

for reportable segments 687 (602) 36 121

Intersegment loss - - - -

Total assets for

reportable segments

assets 19,059 1,428 241 20,728

Total liabilities

for reportable segments 6 675 363 1,044

========================== ======== =============== ================ ===========

Revenues, profit or loss, assets and liabilities Six months

may be reconciled as follows:

Ended

30 June

2023

US$'000

Revenues

Total revenues for reportable segments 1,511

Elimination of intersegment revenues -

================================================== ===========

Group revenues 1,511

================================================== ===========

Profit or loss

Profit for reportable segments 121

Elimination of intersegment loss -

Other unallocated amounts -

================================================== ===========

Loss on ordinary activities before taxation -

================================================== ===========

Assets

Total assets for reportable segments 20,728

Elimination of intersegment receivables -

Group assets 20,728

================================================== ===========

Liabilities

Total liabilities for reportable segments 4,321

Elimination of intersegment payables (3,277)

================================================== ===========

Group liabilities 1,044

================================================== ===========

Argo Argo Capital Argo Property Six months

Group Management Management ended

Ltd Ltd Srl 30 June

2022 2022 2022 2022

US$'000 US$'000 US$'000 US$'000

Total revenues for

reportable segments

customers - 1,140 125 1,265

Intersegment revenues - - -

-

Total profit/(loss)

for reportable segments (2,329) (1,215) (211) (3,755)

Intersegment loss 208 - - 208

Total assets for

reportable segments

assets 18,046 1,279 207 19,532

Total liabilities

for reportable segments 6 77 26 109

========================== ======== =============== ================ ===========

Revenues, profit or loss, assets and liabilities Six months

may be reconciled as follows:

Ended

30 June

2022

US$'000

Revenues

Total revenues for reportable segments 1,265

Elimination of intersegment revenues -

================================================== ===========

Group revenues 1,265

================================================== ===========

Profit or loss

Loss for reportable segments (3,755)

Elimination of intersegment loss 208

Other unallocated amounts -

================================================== ===========

Loss on ordinary activities before taxation (3,547)

================================================== ===========

Assets

Total assets for reportable segments 19,536

Elimination of intersegment receivables (4)

Group assets 19,532

================================================== ===========

Liabilities

Total liabilities for reportable segments 3,466

Elimination of intersegment payables (3,357)

================================================== ===========

Group liabilities 109

================================================== ===========

4. SHARE-BASED INCENTIVE PLANS

To incentivise personnel and to align their interests with those

of the shareholders of Argo Group Limited, Argo Group Limited has

granted share options to directors and employees under The Argo

Group Limited Employee Stock Option Plan. The options are

exercisable within 10 years of the grant date.

The fair value of the options granted during the period was

measured at the grant date using a Black-Scholes model that takes

into account the effect of certain financial assumptions, including

the option exercise price, current share price and volatility,

dividend yield and the risk-free interest rate. The fair value of

the options granted is spread over the vesting period of the scheme

and the value is adjusted to reflect the actual number of shares

that are expected to vest.

The principal assumptions for valuing the options are:

Exercise price (pence) 21.0

Weighted average share price

at grant date (pence) 19.0

Average option life at date

of grant (years) 10.0

Expected volatility (% p.a.) 15.0

Dividend yield (% p.a.) 10.0

Risk-free interest rate (%

p.a.) 2

The fair value of options granted is recognised as an employee

expense with a corresponding increase in equity. The total charge

to employee costs in respect of this incentive plan is GBPnil

(2022: GBPnil).

The number and weighted average exercise price of the share

options during the period is as follows:

Weighted average No. of share

exercise price options

Outstanding at beginning of

period 21.2p 3,895,998

Granted during the period - -

Forfeited during the period - -

============================== ================= =============

Outstanding at end of period 21.2p 3,895,998

============================== ================= =============

Exercisable at end of period 21.2p 3,895,998

============================== ================= =============

Outstanding share options are contingent upon the option holder

remaining an employee of the Group.

The weighted average fair value of the options issued during the

period was GBPNil (2022: GBPNil).

No share options were issued during the period.

5. TAXATION

Taxation rates applicable to the parent company and the UK and

Romanian subsidiaries range from 0% to 25% (2022: 0% to 19%).

Consolidated statement of profit or

loss Six months Six months

ended Ended

30 June 30 June

2023 2022

US$'000 US$'000

Taxation charge for the period on Group - -

companies

========================================= =========== ===========

The charge for the period can be reconciled to the profit shown

on the Condensed Consolidated Statement of profit or loss as

follows:

Six months Six months

Ended Ended

30 June 30 June

2023 2022

US$'000 US$'000

Profit/(loss) before tax 121 (3,547)

================================================ ============= ===========

Applicable Isle of Man tax rate for - -

Argo Group Limited of 0%

Timing differences - -

Non-deductible expenses - -

Other adjustments - -

Tax effect of different tax rates of - -

subsidiaries operating in other jurisdictions

================================================ ============= ===========

Tax charge - -

================================================ ============= ===========

Consolidated statement of financial

position

30 June 31 December

2023 2022

US$'000 US$'000

Corporation tax payable - -

===================================== ======== ============

6. EARNINGS PER SHARE

Earnings per share is calculated by dividing the net profit for

the period by the weighted average number of shares outstanding

during the period.

Six months Six months

ended Ended

30 June 30 June

2023 2022

US$'000 US$'000

Net profit/( loss) for the period after

taxation attributable to members 121 (3,547)

========================================= ============= =============

No. of No. of

shares shares

Weighted average number of ordinary

shares for basic earnings per share 38,959,986 38,959,986

Effect of dilution (Note 4) 3,895,998 3,895,998

========================================= ============= =============

Weighted average number of ordinary

shares for diluted earnings per share 42,855,984 42,855,984

========================================= ============= =============

Six months Six months

Ended ended

30 June 30 June

2023 2022

US$ US$

Earnings per share (basic) 0.003 (0.09)

Earnings per share (diluted) 0.003 (0.08)

============================== =========== ===========

7. LAND, FIXTURES, FITTINGS AND EQUIPMENT

Fixtures,

Right fittings

of use and equipment Total

assets Land

USD'000000 US$'000 US$'000 US$'000

Cost

At 1 January 2022 732 201 182 1,115

Additions 455 7 - 462

Disposals (732) (3) - (735)

Foreign exchange movement - (17) (10) (27)

=========================== ============= =============== ======== =======================

At 31 December 2022 455 188 172 815

Additions - 3 - 3

Disposals - (31) - (31)

Foreign exchange movement 22 5 (7) 20

=========================== ============= =============== ======== =======================

At 30 June 2023 477 165 165 807

=========================== ============= =============== ======== =======================

Accumulated Depreciation

At 1 January 2022 634 191 - 825

Depreciation charge for

period 120 5 - 125

Disposals (732) (3) - (735)

Foreign exchange movement 8 (16) - (8)

=========================== ============= =============== ======== =======================

At 31 December 2022 30 177 - 207

Depreciation charge for

period 46 2 - 48

Disposals - (31) - (31)

Foreign exchange movement 3 9 - 12

=========================== ============= =============== ======== =======================

At 30 June 2023 79 157 - 236

=========================== ============= =============== ======== =======================

Net book value

At 31 December 2022 425 11 172 608

=========================== ============= =============== ======== =======================

At 30 June 2023 398 8 165 571

=========================== ============= =============== ======== =======================

8. FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

30 June 30 June

2023 2023

Holding Investment in management Total cost Fair value

shares

US$'000 US$'000

10 The Argo Fund Ltd - -

- -

======== ========================= ============= =============

Holding Investment in ordinary Total cost Fair value

shares

US$'000 US$'000

13,920 The Argo Fund Ltd* 4,648 4,451

4,648 4,451

======== ======================= ============= =============

31 December 31 December

2022 2022

Holding Investment in management Total cost Fair value

shares

US$'000 US$'000

10 The Argo Fund Ltd - -

- -

==================================== ============== ==============

Holding Investment in ordinary Total cost Fair value

shares

US$'000 US$'000

13,920 The Argo Fund Ltd* 3,824 4,387

3,824 4,387

======== ======================= ============= =============

*Classified as current in the consolidated statement of

Financial Position

9. TRADE AND OTHER RECEIVABLES

At 30 June At 31 December

2023 2022

US$ '000 US$ '000

Trade receivables - Gross 2,500 2,255

Less: provision for impairment

of trade receivables (2,358) (1,980)

-------------------------------- ------------- -----------------

Trade receivables - Net 142 275

Other receivables 34 41

Prepayments and accrued income 133 97

================================ ============= =================

309 413

================================ ============= =================

The Directors consider that the carrying amount of trade and

other receivables approximates their fair value. All trade

receivable balances are recoverable within one year from the

reporting date except as disclosed below.

The movement in the Group's provision for impairment of trade

and loan receivables is as follow:

At 30 June At 31 December

2023 2022

US$ '000 US$ '000

As at 1 January 14,019 14,252

Bad debt recovered - (125)

Charged during the period 368 636

Foreign exchange movement 209 (744)

=========================== ============= =================

Closing balance 14,596 14,019

=========================== ============= =================

10. LOANS AND ADVANCES RECEIVABLE

At 30 June At 31 December

2023 2022

US$'000 US$'000

Deposits on leased premises - current 9 -

Deposits on leased premises - non-current

(see below) 89 96

9

Other loans and advances receivable

- non-current (note 14) 14,058 13,320

============================================ ========= ==========================

14,156 13,416

============================================ ========= ==========================

The deposits on leased premises relate to the Group's offices in

London and Romania.

The Group also has a balance receivable for $12.2 million

(EUR11.2 million) from Argo Real Estate Limited Partnership that

was assigned from Argo Real Estate Opportunities Fund Limited

during 2021. The carrying value of this balance is $nil.

11. SHARE CAPITAL

The Company's authorised share capital is unlimited with a

nominal value of US$0.01.

30 June 30 June 31 December 31 December

2023 2023 2022 2022

No. US$'000 No. US$'000

Issued and fully paid

Ordinary shares of

US$0.01 each 38,959,986 390 38,959,986 390

======================= ============= ========== ============= ============

38,959,986 390 38,959,986 390

======================= ============= ========== ============= ============

The Directors did not recommend the payment of a final dividend

for the year ended 31 December 2022 and do not recommend an interim

dividend in respect of the current period.

12. RECONCILIATION OF NET CASH INFLOW/(OUTFLOW) FROM OPERATING

ACTIVITIES TO PROFIT/(LOSS) ON ORDINARY ACTIVITIES BEFORE

TAXATION

Six months Six months

ended ended

30 June 30 June

2023 2022

US$'000 US$'000

Profit/(loss) on ordinary activities

before taxation 121 (3,547)

Interest income (496) (499)

Depreciation on fixtures, fittings

and equipment 2 3

Depreciation on right of use asset 46 68

Realised and unrealised (profit)/loss

on investments (308) 2,507

Net foreign exchange loss/(profit) 9 (9)

Increase/(decrease) in payables 136 (49)

Decrease in receivables, loans and

advances 103 1,194

Corporation tax paid - -

Net cash outflow from operating

activities (387) (332)

======================================= ============= =============

13. FAIR VALUE HIERARCY

The table below analyses financial instruments measured at fair

value at the end of the reporting period by the level of the fair

value hierarchy (note 2b).

At 30 June 2023

Level 1 Level 2 Level Total

3

US$ '000 US$ '000 US$ '000 US$ '000

Financial assets

at fair value through

profit or loss - 4,451 - 4,451

======================== ========== ========= ========= =========

At 31 December 2022

Level 1 Level 2 Level Total

3

US$ '000 US$ '000 US$ '000 US$ '000

Financial assets

at fair value through

profit or loss - 4,387 - 4,387

======================== ========== ========= ========= =========

14. RELATED PARTY TRANSACTIONS

All of the Group revenues derive from The Argo Fund in which two

of the Company's directors, Kyriakos Rialas and Kenneth Watterson,

have influence through directorships and the provision of

investment management services.

At the reporting date the Company holds investments in The Argo

Fund Limited. These investments are reflected in the accounts at

fair value of US$4.5 million (31 December 2022: $4.4 million).

At the period end, the Group was owed $14.6 million (note 10) by

Novi Biznes Poglyady LLC, an entity that is 100% ultimately owned

by Andreas Rialas. The adjusted IFRS 9 valuation of the loan after

providing for expected losses was US$14.1 million. This balance

relates to a loan that was originally made to ARE LP in February

2020 that was lent onwards to Novi Biznes Poglyady LLC for the

refinancing of Riviera Shopping City in Odessa, Ukraine. During the

period, the original back to back loans were replaced by a direct

loan from Argo Group Limited to Novi Biznes Poglyady LLC.

The Group is also owed US$12.2 million (EUR11.2 million) (31

December 2022: US$12.0 million (EUR11.2 million)) by ARE LP, which

were previously owed by the now liquidated Argo Real Estate

Opportunities Fund Limited. These balances are carried at US$ nil

(31 December 2020: US$ nil) in the financial statements.

15. TRADE AND OTHER PAYABLES

At 30 June At 31 December

2023 2022

US$ '000 US$ '000

Trade creditors 72 26

Other creditors and accruals 590 471

=============================== =========== ===============

Total current trade and other

payables 662 497

=============================== =========== ===============

Trade creditors are normally settled on 30-day terms.

At 30 June At 31 December

2023 2022

US$ '000 US$ '000

Other creditors and accruals 382 411

=================================== =========== ===============

Total non-current trade and other

payables 382 411

=================================== =========== ===============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KZGMRNGNGFZG

(END) Dow Jones Newswires

August 10, 2023 04:00 ET (08:00 GMT)

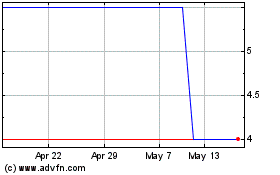

Argo (LSE:ARGO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Argo (LSE:ARGO)

Historical Stock Chart

From Feb 2024 to Feb 2025