Anemoi International Ltd (AMOI)

Anemoi International Ltd: Interim Report (30 June 2023)

29-Sep-2023 / 09:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Anemoi International Ltd

Anemoi International Ltd

(Reuters: AMOI.L, Bloomberg: AMOI:LN)

("Anemoi" or the "Company")

Interim Results for the period ended 30 June 2023

The Company is pleased to announce its results for the six months ended 30 June 2023. The interim results have been

submitted to the FCA and will shortly be available on the Company's website: www.anemoi-international.com

Chairman's Statement

Anemoi is pleased to announce its unaudited interim results for the six months to 30 June 2023.

I am pleased to report a significant increase in H1 Revenues (+75%) and Gross Profit (+246%), however, Revenue is not

yet sufficient to support the cost of running a public company, notwithstanding a 15% reduction in General and

Administrative Costs, resulting in a 31% reduction in Operating Loss for the period under review. Initiatives taken in

the first half of 2023 should further reduce costs in H2 2023 and the Board will continue to explore avenues to enhance

shareholder value.

Duncan Soukup

Chairman

Anemoi International Ltd

28 September 2023

Responsibility Statement

We confirm that to the best of our knowledge:

a) the condensed set of financial statements has been prepared in accordance with IAS 34 'Interim Financial

Reporting';

b) the interim management report includes a fair review of the information required by DTR 4.2.7R (indication of

important events during the first six months and description of principal risks and uncertainties for the remaining six

months of the year); and

c) the interim management report includes a fair review of the information required by DTR 4.2.8R (disclosure of

related parties' transactions and changes therein).

Cautionary statement

This Interim Management Report (IMR) has been prepared solely to provide additional information to shareholders to

enable them to assess the Company's strategy and the potential for that strategy to succeed. The IMR should not be

relied on by any other party or for any other purpose.

Duncan Soukup

Chairman

Anemoi International Ltd

28 September 2023

Unaudited Condensed Statement of Income

For the six months ended 30 June 2023

6 Months to 6 Months to Year Ended

Jun 2023 Jun 2022 Dec 2022

GBP GBP GBP

Note Unaudited Unaudited Audited

Continuing Operations

Revenue 79,563 45,355 137,288

Cost of sales (5,869) (24,070) (60,765)

Gross profit 73,694 21,285 76,523

Administrative expenses excluding exceptional costs (314,601) (371,399) (750,192)

Exceptional administration costs (49,441) (58,166) (58,166)

Total administrative expenses (364,042) (429,565) (808,358)

Operating loss before depreciation (290,348) (408,280) (731,835)

Depreciation and Amortisation 5 (63,392) (42,131) (95,994)

Operating loss (353,740) (450,411) (827,829)

Net financial income/(expense) 3 1,912 (384) (504)

Share of profits of associated entities - - 4,541

Profit/(loss) before taxation (351,828) (450,795) (823,762)

Taxation (220) (685) (685)

Profit/(loss) for the period (352,048) (451,480) (824,477)

Earnings per share - GBP pence (using weighted average number of shares)

Basic and Diluted (0.22) (0.29) (0.53)

Basic and Diluted 4 (0.22) (0.29) (0.53)

The notes on pages 11 to 15 form an integral part of this

consolidated interim financial information. Unaudited Condensed

Statement of Comprehensive Income

For the six months ended 30 June 2023

6 Months to 6 Months to Year Ended

Jun 2023 Jun 2022 Dec 2022

GBP GBP GBP

Unaudited Unaudited Audited

Loss for the six months to 30 June 2023 (352,048) (451,480) (824,477)

Other comprehensive income:

Exchange differences on re-translating foreign operations (12,426) 197,530 171,836

Total comprehensive income (364,474) (253,950) (652,641)

Attributable to:

Equity shareholders of the parent (364,474) (253,950) (652,641)

Total Comprehensive income (364,474) (253,950) (652,641)

The notes on pages 11 to 15 form an integral part of this

consolidated interim financial information.

Unaudited Condensed Statement of Financial Position

As at 30 June 2023

As at As at As at

Jun 2023 Jun 2022 Dec 2022

GBP GBP GBP

Note Unaudited Unaudited Audited

Assets

Non-current assets

Goodwill 5 1,462,774 1,462,774 1,462,774

Intangible assets 5 1,505,970 1,429,975 1,482,645

Property, plant and equipment 5 9,881 10,439 10,406

Investment in associated entities 4,541 - 4,541

Total non-current assets 2,983,166 2,903,188 2,960,366

Current assets

Trade and other receivables 348,356 333,461 386,005

Cash and cash equivalents 1,869,952 2,464,317 2,189,610

Total current assets 2,218,308 2,797,778 2,575,615

Liabilities

Current liabilities

Trade and other payables 701,589 526,991 652,057

Total current liabilities 701,589 526,991 652,057

Net current assets 1,516,719 2,270,787 1,923,558

Net assets 4,499,885 5,173,975 4,883,924

Shareholders' Equity

Share capital 6 117,750 117,750 117,750

Share premium 5,773,031 5,768,771 5,773,031

Preference shares 246,096 246,096 246,096

Other Reserves 70,070 74,330 70,070

Foreign exchange reserve 268,290 217,335 300,281

Retained earnings (1,975,352) (1,250,307) (1,623,304)

Total shareholders' equity 4,499,885 5,173,975 4,883,924

Total equity 4,499,885 5,173,975 4,883,924

The notes on pages 11 to 15 form an integral part of this

consolidated interim financial information..

These financial statements were approved by the board 28

September 2023

Signed on behalf of the board by:

Duncan Soukup Unaudited Condensed Statement of Cash Flows

For the six months ended 30 June 2023

6 Months to 6 Months to Year ended

Jun 2023 Jun 2022 Dec 2022

GBP GBP GBP

Notes Unaudited Unaudited Audited

Cash flows from operating activities

Profit/(Loss) for the period (353,740) (450,411) (827,829)

(Increase)/decrease in trade and other receivables 25,162 295,175 242,631

(Decrease)/increase in trade and other payables 62,018 (202,733) (77,607)

Net exchange differences 3,104 (35,837) (130,723)

Depreciation and amortisation 5 63,392 42,131 95,994

Cash generated by operations (200,064) (351,675) (697,534)

Taxation (220) (685) (685)

Net cash flow from operating activities (200,284) (352,360) (698,219)

Cash flows from investing activities

Sale/(Purchase) of intangible assets 5 (105,802) (115,456) (149,371)

Net cash flow in investing activities - continuing operations (105,802) (115,456) (149,371)

Cash flows from financing activities

Interest paid - (44) (42)

Interest received 1,960 14 -

Repayment of loans and borrowings - - (60)

Net cash flow from financing activities 1,960 (30) (102)

Net increase in cash and cash equivalents (304,126) (467,846) (847,692)

Cash and cash equivalents at the start of the period 2,189,610 2,734,633 2,734,633

Effects of foreign exchange rate changes (15,532) 197,530 302,669

Cash and cash equivalents at the end of the period 1,869,952 2,464,317 2,189,610

The notes on pages 11 to 15 form an integral part of this

consolidated interim financial information.

Unaudited Condensed Statement of Changes in Equity

For the six months ended 30 June 2023

Total

Share Share Preference Other Foreign Retained Shareholders

Exchange

Capital Premium Shares Reserves Reserves Earnings Equity

GBP GBP GBP GBP GBP GBP GBP

Balance as at 31 December 2021 117,750 5,768,771 246,096 74,330 (2,389) (798,827) 5,405,731

Foreign Exchange on translation - - - - 22,194 - 22,194

Total comprehensive income for the - - - - 197,530 (451,480) (253,950)

period

Balance as at 30 June 2022 117,750 5,768,771 246,096 74,330 217,335 (1,250,307) 5,173,975

Other Reserves - Options - 4,260 - (4,260) - - -

Foreign Exchange on translation - - - - 82,946 - 82,946

Total comprehensive income for the - - - - - (372,997) (372,997)

period

Balance as at 31 December 2022 117,750 5,773,031 246,096 70,070 300,281 (1,623,304) 4,883,924

Foreign Exchange on translation - - - - (19,565) - (19,565)

Total comprehensive income for the - - - - (12,426) (352,048) (364,474)

period

Balance as at 30 June 2023 117,750 5,773,031 246,096 70,070 268,290 (1,975,352) 4,499,885

The notes on pages 11 to 15 form an integral part of this

consolidated interim financial information. Notes to the Condensed

Financial Information 1. General information

Anemoi International Ltd (the "Company") is a British Virgin

Island ("BVI") International business company ("IBC"), incorporated

and registered in the BVI on 6 May 2020. The Company is a holding

company actively seeking investment opportunities.

id4 AG is a wholly owned subsidiary of Anemoi and was formed as

part of the merger of the former id4 AG ("id4") with and into its

parent, Apeiron Holdings AG on 14 September 2021. id4 was

incorporated and registered in the Canton of Lucerne in Switzerland

in April 2019 whilst Apeiron Holdings AG was incorporated and

registered in December 2018. Following the merger, Apeiron Holdings

AG was renamed id4 AG.

On the 17th December 2021, the entire share capital of id4 AG

was purchased by Anemoi International Ltd.

Id4 CLM (UK) Ltd is a wholly owned subsidiary of Anemoi,

incorporated on 26 November 2021 in England and Wales. Id4 CLM (UK)

Ltd is a private limited company, limited by shares.

2 .Significant Accounting policies

The Group financial statements consolidate those of the Company

and its subsidiaries (together referred to as the "Group").

The Group prepares its accounts in accordance with applicable UK

Adopted International Accounting Standards "IFRS".

The financial statements are expressed in GBP.

The accounting policies applied by the Company in this unaudited

consolidated interim financial information are the same as those

applied by the Company in its consolidated financial statements as

at 31 December 2022.

The financial information has been prepared under the historical

cost convention, as modified by the accounting standard for

financial instruments at fair value. 2.1. Basis of preparation

The condensed consolidated interim financial information for the

six months ended 30 June 2023 has been prepared in accordance with

International Accounting Standard No. 34, 'Interim Financial

Reporting'. They do not include all of the information required for

full annual financial statements and should be read in conjunction

with the consolidated financial statements of the Company as at and

for the year ended 31 December 2022.

These condensed interim financial statements for the six months

ended 30 June 2023 are unaudited and do not constitute full

accounts. The independent auditor's report on the 2022 financial

statements was not qualified. 2.2. Going concern

The financial information has been prepared on the going concern

basis as management consider that the Company has sufficient cash

to fund its current commitments for the foreseeable future.

Notes to the Condensed Financial Information Continued 3. Net

Financial Expense

Six months Six months Year

ended ended ended

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

GBP GBP GBP

Loan interest expense - 44 45

Bank interest expense 35 - (3)

Bank interest income - (14) -

Loan interest income (1,995) - -

Foreign currency (gains)/losses 48 354 462

(1,912) 384 504 4. Earnings per share

Six months Six months Year

ended ended ended

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

GBP GBP GBP

The calculation of earnings per share is based on

the following loss attributable to ordinary shareholders and number of shares:

Loss for the period (352,048) (451,480) (824,477)

Weighted average number of shares of the Company 157,041,665 157,041,665 157,041,665

Earnings per share:

Basic and Diluted (pence) (0.22) (0.29) (0.53)

Number of shares outstanding at the period end: 157,041,665 157,041,665 157,041,665

Number of shares in issue

Opening Balance 157,041,665 157,041,665 157,041,665

Issuance of Share Capital - - -

Basic number of shares in issue 157,041,665 157,041,665 157,041,665

Notes to the Condensed Financial Information Continued 5.

Non-current assets

Plant

Intangible and

Total Goodwill Assets Equipment

Cost GBP GBP GBP GBP

Cost at 1 January 2023 3,077,345 1,462,774 1,601,492 13,079

FX movement (21,482) - (21,308) (174)

3,055,863 1,462,774 1,580,184 12,905

Additions 105,802 - 105,802 -

Cost at 30 June 2023 3,161,665 1,462,774 1,685,986 12,905

Depreciation/Amortisation

Depreciation/Amortisation at 1 January 2023 121,521 - 118,847 2,674

FX movement (1,617) - (1,581) (36)

119,904 - 117,266 2,638

Charge for the period on continuing operations 63,392 - 63,004 388

FX movement (256) - (254) (2)

Depreciation/Amortisation at 30 June 2023 183,040 - 180,016 3,024

Closing net book value at 30 June 2023 2,978,625 1,462,774 1,505,970 9,881

For impairment testing purposes, management considers the

operations of the Company to represent a single cash generating

unit (CGU), providing software and digital solutions to the

financial services industry. The directors have assessed the

recoverable amount of goodwill which in accordance with IAS 36 is

the higher of its value in use and its fair value less costs to

sell (fair value), in determining whether there is evidence of

impairment.

Notes to the Condensed Financial Information Continued 6. Share

Capital

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

GBP GBP GBP

Authorised share capital:

Unlimited ordinary shares of USD0.001 each - - -

Fully subscribed shares

29,950,000 ordinary shares of USD0.04 each 1,200,000 1,200,000 1,200,000

Exchange rate adjustment

1.3649 1.3649 1.3649

29,950,000 ordinary shares in GBP 879,185 879,185 879,185

Placing 5,999,999 ordinary shares of GBP0.04 240,000 240,000 240,000

Conversion of shares to par value of USD.0001 at rate of (1,092,810) (1,092,810) (1,092,810)

1.3649

Issuance of 66,666,666 shares for acquisition of id4 AG 50,387 50,387 50,387

Placing of 54,375,000 shares of USD0.001 40,988 40,988 40,988

Less fair value of options and warrants - - -

Total 117,750 117,750 117,750

Number Number Number

of shares of shares of shares

Fully subscribed shares 157,041,665 157,041,665 157,041,665

Balance at close of period 157,041,665 157,041,665 157,041,665

Under the Company's articles of association, the Board is

authorised to offer, allot, grant options over or otherwise dispose

of any unissued shares. Furthermore, the Directors are authorised

to purchase, redeem or otherwise acquire any of the Company's own

shares for such consideration as they consider fit, and either

cancel or hold such shares as treasury shares. The directors may

dispose of any shares held as treasury shares on such terms and

conditions as they may from time to time determine. Further, the

Company may redeem its own shares for such amount, at such times

and on such notice as the directors may determine, provided that

any such redemption is pro rata to each shareholders' then

percentage holding in the Company.

On the 14th April 2021, a total of 5,999,999 new DIs (the

"Placing DIs") were placed by at a price of GBP0.04 per Placing DIs

(the "Placing") with existing and new investors ("Placees") raising

gross proceeds of approximately GBP240,000. The Placing DIs

represent Ordinary Shares representing 20 per cent. of the Ordinary

Share capital of the Company prior to the Placing.

On the 16th August 2021 the Board announced that the par value

of its issued and outstanding ordinary shares of no par value had

changed to USUSD0.001 per Ordinary Share. The total number of

issued shares with voting rights remained unchanged at 35,999,999

Ordinary Shares. Aside from the change in nominal value, the rights

attaching to the Ordinary Shares (including all voting and dividend

rights and rights on a return of capital) remained unchanged.

On the 17th December 2021, following the acquisition of id4 AG,

66,666,666 New Ordinary Shares of USD0.001 were issued to the

shareholders of id4 in settlement of consideration for the

acquisition and the Company was readmitted to trading on the London

Stock Exchange.

On the 17th December 2021, alongside the acquisition of id4 AG,

54,375,000 New Ordinary Shares of USD0.001 were issued in a further

placing with existing and new investors, raising a total of

GBP2,175,000.

Notes to the Condensed Financial Information Continued 7.

Related Party Transactions

Thalassa Holdings Ltd, which holds shares in the Company is

related by common control through the Chairman, Duncan Soukup.

Thalassa Holdings Ltd invoiced the Company for administration costs

totalling GBP4,236 (June 2022: GBP8,709, Dec 2022: GBP6,378)). At

the period end the balance owed to Thalassa totalled GBP4,236 (June

2022: GBP340,768, Dec 2022: GBP2,894).

Consultancy and administrative services were accrued on behalf

of a company, Fleur De Lys, in which the Chairman has a beneficial

interest, the Company accrued GBP61,399 of fees in the period (Jun

2022: GBP77,556. Dec 2022:GBP134,953).

Athenium Consultancy Ltd, a company in which the Company owns

shares invoiced the Company for financial and corporate

administration services totalling GBP82,500 for the period (Jun

2022: GBP75,000, Dec 2022: GBP150,000). 8. Subsequent events

There were no subsequent events to report 9. Copies of the

Interim Report

The interim report is available on the Company's website:

www.anemoi-international.com.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: VGG0419A1057

Category Code: IR

TIDM: AMOI

LEI Code: 213800MIKNEVN81JIR76

OAM Categories: 1.2. Half yearly financial reports and audit reports/limited reviews

Sequence No.: 274695

EQS News ID: 1737261

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1737261&application_name=news

(END) Dow Jones Newswires

September 29, 2023 04:00 ET (08:00 GMT)

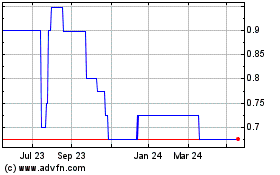

Anemoi (LSE:AMOI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Anemoi (LSE:AMOI)

Historical Stock Chart

From Feb 2024 to Feb 2025