TIDMAMAT

RNS Number : 6666C

Amati AIM VCT PLC

02 October 2018

Amati AIM VCT plc

HALF-YEARLY REPORT

For the six months ended 31 July 2018

Amati AIM VCT plc announces that its 2018 Half-Yearly Report has

been published. The full report will be made available on the

National Storage Mechanism website:

http://www.morningstar.co.uk/uk/NSM and can be accessed via the

Company's website at http://amatiglobal.com/amat_literature.php. It

will be circulated to shareholders shortly.

Page numbers and cross-references in this announcement below

refer to page numbers and cross-references in the PDF of the

Half-yearly Report.

OVERVIEW

Corporate Objective

The investment objectives of Amati AIM VCT plc (the "Company")

are to generate tax free capital gains and regular dividend income

for its shareholders, primarily through qualifying investments in

AIM-traded companies and through non-qualifying investments as

allowed by the VCT legislation. The Company will manage its

portfolio to comply with the requirements of the rules and

regulations applicable to VCTs from time to time. The Company's

policy is to hold a diversified portfolio across a broad range of

sectors to mitigate risk.

Key Data

6 months Year 6 months

ended ended

31/07/18 ended 31/07/17

(unaudited) 31/01/18 (unaudited)

(audited)

Net Asset Value ("NAV") GBP141.5m* GBP61.6m GBP50.4m

Shares in issue 80,513,669* 36,057,095 34,585,493

NAV per share 175.7p 170.7p 145.8p

Share price 165.5p 157.5p 134.8p

Market capitalisation GBP133.3m GBP56.8m GBP46.6m

Share price discount to NAV 5.8% 7.7% 7.5%

NAV Total Return (assuming re-invested

dividends) 5.9% 45.2% 21.5%

Numis Alternative Markets Total Return

Index 2.3% 23.2% 13.5%

Ongoing charges** 2.0% 2.3% 2.4%

Dividends in respect of the period 3.50p 8.50p 3.25p

---------------------------------------- ------------- ----------- -------------

*On 4 May 2018 the Company merged with Amati VCT plc and the

assets and liabilities of Amati VCT were acquired. Further details

are set out in note 12 of this report.

** Ongoing charges calculated in accordance with the Association

of Investment Companies' ("AIC's") guidance.

Table of Investor Returns to 31 July 2018

Numis Alternative

NAV Total Markets Total

Return with Return

dividends Index

Date re-invested

--------------------------------------- ----------------- -------------- ------------------

Re-launch of the VCT under management 9 November

of Amati Global Investors 2011* 151.9% 55.7%

--------------------------------------- ----------------- -------------- ------------------

Appointment of Amati Global Investors

as Manager of the VCT, which was

known as ViCTory VCT at the time 25 March 2010 164.3% 60.0%

--------------------------------------- ----------------- -------------- ------------------

*Date of the share capital reconstruction when the NAV was

re-based to approximately 100p per share.

A table of historic returns is included on page 32.

CHAIRMAN'S STATEMENT

Overview

The NAV Total Return for the Company for the six month period

under review was 5.9%, which compares to a rise of 2.3% for the

Numis Alternative Markets Total Return Index. A total of GBP10.5 m

was invested in qualifying holdings during this first half of the

year (GBP1.0m of which was invested by Amati VCT prior to the

merger), with investments being made in five companies new to the

portfolio. This is a higher rate of investment than we have seen

over the last few years. Full details are given in the Fund

Manager's Review.

In May, the Company merged with Amati VCT and changed its name

from Amati VCT 2 to Amati AIM VCT. The increased scale as a result

of the merger is expected to lower the expense ratio which has been

reducing over the last few years as the Company has grown.

A joint Prospectus for share offers was launched by the two

Amati VCTs in October 2017, seeking to raise up to GBP20m and also

catering for the shares issued to Amati VCT holders as part of the

merger. The Prospectus also allowed for an over-allotment option

for a further GBP10m fund raising following the merger. With the

GBP20m target having been reached prior to the merger, the Board

took the decision in June to make use of the over-allotment option

when it became clear that the Company's rate of new investment in

the first half was higher than anticipated. All of the GBP10m of

the over-allotment facility has now been raised, allowing the

Company more scope to take advantage of new qualifying investment

opportunities as they arise.

Other Corporate Developments

As part of the merger, the directors of the two VCTs formed a

new Board and, as the newly appointed Chairman, I would like to

thank the two retiring directors for many years of outstanding

service to the Amati VCTs. Julian Avery chaired the board of

Invesco Perpetual AIM VCT from its inception in 2004 and became

Chairman of Amati VCT 2 in 2011 when it was formed on the merger of

ViCTory VCT with Invesco Perpetual AIM VCT. Charles Pinney was a

director of Amati VCT since its inception in 2005. Both gave

extraordinary care and diligence to their roles and I would like to

express gratitude on behalf of both the Board and Manager.

There have also been changes in the fund management team at

Amati Global Investors, with Douglas Lawson having left in August

to manage a data analytics company in which he was a founder

investor and Anna Wilson having joined in February. I believe I

speak for all shareholders in expressing thanks to Douglas for his

many years of dedication and service to Amati, where he contributed

greatly to building the strength of the current portfolio, and also

in welcoming Anna to the management team. Anna joins with many

years of experience in managing funds focused on AIM.

Investment Performance and Dividend

The dividend policy of the Company continues to be to pay

between five and six percent of year-end net asset value, subject

to the availability of liquidity and sufficient distributable

reserves. In line with this the Board is declaring an interim

dividend for the year to 31 January 2019 of 3.50p per share, to be

paid on 23 November 2018 to shareholders on the register on 19

October 2018.

Evolution of the VCT Legislation

From April 2019 onwards, the required minimum level of

qualifying investments held by the Company rises from 70% of tested

assets to 80%. In addition there is a new requirement that 30% of

funds raised must be invested in qualifying holdings by the end of

the financial year after the year in which the funds are raised. At

the end of the period under review the Company was 86.05% invested

in qualifying holdings under the first of these tests and the

Company has been running above the 80% level for many years. The

second test has also already been met in respect of the GBP20m

raised under the Prospectus offers. The Board continues to monitor

the Company's progress under these all important tests with

vigilance.

HMRC's ambition to bring down the waiting time for the issue of

pre-clearance letters from three months to three weeks for

prospective fund raisings has thus far not resulted in the

bottle-neck easing, which is often frustrating and can result in

some difficult dilemmas over investments which have to complete

before a response is received. HMRC have encouraged managers to

rely on their independent advisors in these situations and

therefore the Manager has taken this course on certain

occasions.

The higher annual investment limit for "Knowledge Intensive

Companies" which was proposed in the April budget has now been

ratified by the EU and passed into the regulations by Parliament.

This means certain companies can now raise GBP10m from tax

incentivised sources in a 12 month period, increased from GBP5m.

Part of the Company's recent investment in Creo Medical was

dependent on this new rule being ratified and this has now been

able to proceed, allowing us to gain a more substantial holding

than we could have done under the previous rules. This new rule

will be supportive of the strong level of new investment made by

the Company during the first half being continued.

Outlook

As the deadline approaches for agreeing terms with the European

Union for the exit of the United Kingdom, uncertainty remains a

concern for the investing community. The effects of the more recent

weakening of sterling may be advantageous for some exporting

companies in our portfolio, which is now spread among some 66

companies, with further diversification through the 8.9% of the

investment portfolio held in the TB Amati UK Smaller Companies Fund

which is itself invested in 68 companies. I remain optimistic that

our VCT will find a positive path through the turmoil that may lie

ahead.

Peter Lawrence

Chairman

2 October 2018

For any matters relating to your shareholding in the Company,

dividend payments, or the Dividend Re-investment Scheme, please

contact Share Registrars on 01252 821390, or by email at

enquiries@shareregistrars.uk.com. For any other matters please

contact Amati Global Investors ("Amati") on 0131 503 9115 or by

email at info@amatiglobal.com. Amati maintains an informative

website for the Company - www.amatiglobal.com - on which monthly

investment updates, performance information, and past company

reports can be found.

FUND MANAGER'S REVIEW

Market Review

The six months under review proved to be a test period for the

two major questions troubling markets after such a prolonged bull

run: what might prompt a correction and what would be the response

in the aftermath? At the start of 2018, the consensus view was for

sustained, synchronised global growth across the US, Europe and

Asia. Whilst it was recognised that the US was likely to continue

with its leadership in the normalisation of interest rates, it was

thought that the Federal Reserve would not require a more radical

cooling of the economy. This comfortable assumption was called into

question in January with a surprise spike in US earnings inflation,

which translated into rapidly rising bond yields. A US market

sell-off then sparked global volatility. Weakness continued into

late March, causing a 10% correction to the UK market from its

January peak, as wider concerns gripped investors such as

geo-political risks in the Middle East and Asia, and President

Trump's escalating rhetoric. Meanwhile, Trump's tax reliefs were

inflating the US economy by way of rate cuts boosting near term

earnings and also by allowing corporates to use repatriated

overseas cash to fund share buybacks, thereby underpinning the

stock market. This in turn generated a robust results season for US

corporates, and a series of strong data points for US economic

growth. Despite growing concerns about a slowing European economy,

risks in emerging economies and an escalating global trade war,

investor appetite returned and the UK stock market recovered all of

its losses by mid-May, even if this strong momentum cooled somewhat

by the end of the period. Over the period, smaller companies lagged

behind the performance of larger stocks, as the weakness in

sterling provided a sentiment boost towards international earnings,

led by pharmaceutical, oil & gas and industrial stocks.

Performance

The VCT's NAV Total Return for the six month period was 5.9%.

This compares to the benchmark Numis Alternative Markets Total

Return Index, which gained 2.3% over the same period.

The most significant contributor to performance in the six month

period was AB Dynamics ("ABD"), the specialist automotive

engineering group, its shares gaining 53%. ABD has been riding on

the coat-tails of the car industry's drive to develop driver

assistance technologies as part of the journey towards

mass-produced fully autonomous vehicles. The vehicle safety

organisations in Europe and the US are rapidly adapting regulations

to keep pace with the autonomous movement, which is translating

into increased development and testing requirements and therefore

demand for ABD's Advanced Driver Assistance Systems (ADAS) and

Guided Soft Targets (GST). Accesso Technology Group ("Accesso"),

the leading supplier of technology solutions to the theme park and

visitor attraction industries, was the second greatest contributor

to performance, with a price gain of 20% over the six months. A

number of milestones were achieved by Accesso, including the

signing of its first partnership in the healthcare industry to

supply a hospital group in Detroit with its digital experience and

personalisation platform. Accesso's technology will be used to

build unique patient profiles which can be integrated with

electronic medical records. Keywords Studios ("Keywords"), the

technical services provider to the video games industry, delivered

another strong performance, gaining 23% over the period. Keywords

continued its acquisition strategy, completing six further

acquisitions, including its first in the provision of Hollywood

production services for the video games industry. This acquired

business, Blindlight, focuses on procuring specialist talent for

services including voiceover production for video games. Water

Intelligence, the provider of leak detection and remediation

services, advanced 125% over the six months, following a sequence

of positive updates and the acquisitions of its Kentucky and South

Florida franchises. Other strong performers over the period

include: Learning Technologies Group, the provider of e-learning

technologies and services, which completed the acquisition of

PeopleFluent, a provider of cloud-based integrated recruitment,

talent management and compensation management solutions; GB Group,

the identity management software and data specialist, which

announced strong organic growth and an upgrade to its earnings

estimates; LoopUp Group, the Software-as-a-Service (SaaS) provider

for remote meetings, which acquired Meetingzone, another UK

conferencing services provider. The investment in TB Amati UK

Smaller Companies Fund also delivered a strong return, rising 12%

during the period against a rise in its benchmark of 2.0%.

The greatest detractor from performance was Faron

Pharmaceuticals ("Faron"), a clinical stage biopharmaceutical

company that is developing novel treatments for medical conditions

with significant unmet needs. Faron fell 87% over the period,

reminding investors of the downside when drug discovery companies

fail to live up to expectations. Traumakine, Faron's lead drug

candidate, was claimed to prevent vascular leakage and organ

failures. Unfortunately, the results of the Phase III clinical

study failed to indicate that the treatment offered significant

benefits over existing drugs. We did not view the company's other

products as sufficiently mature in their development cycle to merit

holding Faron and exited the position. Despite the losses suffered

on Faron over the six months under review, the share price had

increased by over 250% since the stock was first added to the

portfolio, allowing us to take some early profits, which reduced

the impact of the disappointing news on the portfolio. Frontier

Developments ("Frontier"), the developer of video games, including

the first based on the Jurassic Park film series, saw its shares

fall back by 16% over the period. This followed the extraordinary

gains witnessed over the previous six months which were led by the

announcement of Jurassic World as Frontier's third game franchise.

Brooks Macdonald Group ("Brooks"), the national wealth management

group, fell 15% over the period. This was a reaction to news that

short-term profits at Brooks will be tempered by an increase in

provisions to deal with legacy matters at its Spearpoint business,

which was acquired in 2012. While Brooks accepts no legal liability

for these matters it is making redress in the interests of treating

customers fairly.

We believe the merger of Amati VCT and Amati VCT 2 in May

represents a positive development for shareholders; the portfolio

gained slightly in diversification and the expense ratio has fallen

with the greater scale of the VCT. Given how similar the VCTs were

before the merger in all other respects the transition to a single

Amati AIM VCT has been seamless.

Portfolio Activity

The Company made six significant new qualifying investments

during the period.

The first new investment during the period was in a placing for

Diurnal Group ("Diurnal"), a developer of hormone therapeutics to

treat adrenal insufficiency, where adrenal glands produce

insufficient amounts of cortisol (a steroid hormone), causing low

blood pressure and fatigue. Diurnal has two mature products in its

pipeline that are both reformulated versions of hydro-cortisone -

the first (Alkindi) was approved in Europe in early 2018 and the

second (Chronocort) will have a Phase III European trial read out

later this year. Alkindi is a sugar-coated, low dose formulation

for children, whilst Chronocort is a time-lapsed release version of

the drug, which matches the dosing to the patient's sleep pattern.

The second investment in which the VCT participated was IXICO, the

developer of a digital imaging platform called Trial Tracker, which

helps to identify changes in brain scans that may be invisible to

the human eye. IXICO raised GBP5.5 million in an oversubscribed

placing in order to extend its product range into other therapeutic

areas such as Multiple Sclerosis. Block Energy ("Block"), a

UK-based oil exploration and production company operating in the

Republic of Georgia, was a rare opportunity to invest in a

VCT-qualifying resources company. Block has acquired three

producing blocks, each with a substantial resource base but mixed

reservoir quality. The investment thesis rests on Block's ability

to apply new drilling technology to improve production at these

sites. The opportunity to invest in Block came at an attractive

valuation and, whilst execution of the opportunity will have its

challenges, the upside could be significant. The Company invested

in the Initial Public Offering ("IPO") of i-nexus Global

("i-nexus"), a SaaS provider to large enterprises to manage

business improvement and change. i-nexus' software supports Hoshin,

a strategy development methodology introduced in Japan in the

1960s. Hoshin is a planning, implementation and review methodology

which is seeing increasing adoption amongst large corporates to

ensure that strategic goals are being communicated to all employees

and actioned at all levels of an organisation. A position was also

added in ANGLE, a leading liquid biopsy company, as part of a GBP12

million placing. ANGLE is commercialising a platform technology

that can capture rare cells (such as cancer cells) circulating in

the blood when they are relatively limited in number and collect

these cells for analysis. ANGLE's cell separation technology is

known as the Parsortix system and collects cells through a liquid

biopsy. The final material

VCT qualifying investment was made in Creo Medical Group, a

medical device company focused on surgical endoscopy. Its lead

product, the Speedboat RS2, enables non-invasive bowel surgery,

replacing high risk major surgery with a simple outpatient

procedure. The device has been approved in both Europe and the US

and has already been used in operations with exceptional

results.

The Company's holding in IDOX, the provider of document

management software to Local Authorities and the engineering

sector, was sold during the period. We concluded that IDOX's

problems on which we reported in the Company's 2018 annual report,

were myriad and complex and that the Company's capital would be

better deployed elsewhere. Crawshaw Group, the chain of butchers,

was also sold due to an ongoing difficult trading environment and

the departure of the CEO and CFO. A small, residual position in

Tasty, owner of the London-focused Italian restaurant chain

Wildwood, was also sold.

Outlook

"Challenging" may have become an over-popular, almost devalued,

term in recent times, not only in company outlook statements but

also within fund manager commentaries. However, its use is

particularly pertinent at this point. A strong global economy,

fuelled by ten years of stimulation, now faces the twin dangers of

monetary policy reversal and an increasingly hostile trading and

geo-political environment. The UK, as an open economy, has

benefited from recent global growth but now faces its own

individual risks as the Brexit deadline approaches. The last six

months suggest there may still be an appetite amongst investors to

"buy the dips," but it may also prove to have been an artificial,

unrepeatable environment created by the impact of Trump's cuts to

corporation tax. Investors feel that more challenging times are

inevitably coming, but few want to speculate as to when.

As we stated in our last review, the portfolio can never be

immune to wider market forces. Our aim is to keep the portfolio

dominated by a range of long term holdings in innovative and high

quality companies serving specific niches in attractive growth

markets, which is both the core objective of Amati AIM VCT and, we

believe, the best defence against increasingly disconcerting

geo-political uncertainties.

Dr Paul Jourdan, David Stevenson and Anna Wilson

Amati Global Investors

2 October 2018

INVESTMENT PORTFOLIO

as at 31 July 2018

Market Dividend

Cap Yield(NTM)

Cost Valuation GBPm % Fund

GBP'000 GBP'000 Sector Status %

TB Amati UK Smaller

Companies Fund 9,274 12,601 - Financials OEIC 1.3 8.9

---------- ----------- -------- ------------------- --------- ------------ ------

Keywords Studios

plc(1,3) 5,785 10,376 1,160.6 Industrials AIM 0.1 7.3

---------- ----------- -------- ------------------- --------- ------------ ------

AB Dynamics plc(2,3) 3,753 8,038 240.3 Industrials AIM 0.3 5.7

---------- ----------- -------- ------------------- --------- ------------ ------

Learning Technologies

Group plc(1,3) 5,078 7,815 675.7 Industrials AIM 0.4 5.5

---------- ----------- -------- ------------------- --------- ------------ ------

Quixant plc(2,3) 4,196 7,494 285.3 Technology AIM 0.8 5.3

---------- ----------- -------- ------------------- --------- ------------ ------

Frontier Developments Consumer

plc(1) 4,698 7,044 437.8 goods AIM - 5.0

---------- ----------- -------- ------------------- --------- ------------ ------

Ideagen plc(2) 3,303 6,282 267.7 Technology AIM 0.2 4.4

---------- ----------- -------- ------------------- --------- ------------ ------

GB Group plc(2,3) 3,203 6,085 825.1 Technology AIM 0.5 4.3

---------- ----------- -------- ------------------- --------- ------------ ------

Accesso Technology

Group plc(1,3) 221 5,882 719.9 Technology AIM - 4.2

---------- ----------- -------- ------------------- --------- ------------ ------

Tristel plc(2) 3,290 5,348 126.7 Health care AIM 1.5 3.8

---------- ----------- -------- ------------------- --------- ------------ ------

Top Ten 42,801 76,965 54.4

---------- ----------- -------- ------------------- --------- ------------ ------

Craneware plc(2) 3,899 4,554 565.2 Technology AIM 1.1 3.2

---------- ----------- -------- ------------------- --------- ------------ ------

LoopUp Group plc(1,3) 2,577 4,320 246.3 Technology AIM - 3.1

---------- ----------- -------- ------------------- --------- ------------ ------

Water Intelligence

plc(2) 1,218 3,340 62.5 Industrials AIM - 2.4

---------- ----------- -------- ------------------- --------- ------------ ------

Hardide plc(1) 2,361 3,256 30.5 Basic materials AIM - 2.3

---------- ----------- -------- ------------------- --------- ------------ ------

Premier Technical

Services Group

plc(2,3) 2,141 3,115 204.3 Industrials AIM 0.8 2.2

---------- ----------- -------- ------------------- --------- ------------ ------

Anpario plc(2) 1,829 2,872 101.9 Health care AIM 1.7 2.0

---------- ----------- -------- ------------------- --------- ------------ ------

Bilby plc(2) 1,681 2,715 50.8 Industrials AIM 2.2 1.9

---------- ----------- -------- ------------------- --------- ------------ ------

i-nexus Global

plc(1) 2,500 2,532 23.7 Technology AIM - 1.8

---------- ----------- -------- ------------------- --------- ------------ ------

Science in Sport Consumer

plc(2) 1,956 2,129 48.1 goods AIM - 1.5

---------- ----------- -------- ------------------- --------- ------------ ------

FairFX Group plc(1) 1,137 2,082 217.5 Financials AIM - 1.5

---------- ----------- -------- ------------------- --------- ------------ ------

Top Twenty 64,100 107,880 76.3

---------- ----------- -------- ------------------- --------- ------------ ------

Angle plc(1) 1,615 1,712 66.5 Health care AIM - 1.2

---------- ----------- -------- ------------------- --------- ------------ ------

Brooks Macdonald

Group plc(2) 1,154 1,672 257.6 Financials AIM 2.7 1.2

---------- ----------- -------- ------------------- --------- ------------ ------

Creo Medical Group

plc(1) 1,612 1,613 120.0 Health care AIM - 1.1

---------- ----------- -------- ------------------- --------- ------------ ------

Ixico plc(1) 1,409 1,610 15.0 Health care AIM - 1.1

---------- ----------- -------- ------------------- --------- ------------ ------

Fusion Antibodies

plc(1) 1,444 1,583 26.1 Health care AIM - 1.1

---------- ----------- -------- ------------------- --------- ------------ ------

Amryt Pharma plc(1,3) 1,563 1,530 49.5 Health care AIM - 1.1

---------- ----------- -------- ------------------- --------- ------------ ------

Block Energy plc(1) 1,500 1,313 9.1 Oil & Gas AIM - 0.9

---------- ----------- -------- ------------------- --------- ------------ ------

Diurnal Group plc(1) 1,440 1,313 107.3 Health care AIM - 0.9

---------- ----------- -------- ------------------- --------- ------------ ------

Rosslyn Data Technologies

plc(1) 947 1,017 12.4 Technology AIM - 0.7

---------- ----------- -------- ------------------- --------- ------------ ------

SRT Marine Systems

plc(1) 1,174 982 35.6 Technology AIM - 0.7

---------- ----------- -------- ------------------- --------- ------------ ------

Oncimmune Holdings

plc(1) 1,013 942 69.6 Health care AIM - 0.7

---------- ----------- -------- ------------------- --------- ------------ ------

appScatter Group

plc(1) 1,228 923 43.1 Technology AIM - 0.7

---------- ----------- -------- ------------------- --------- ------------ ------

Byotrol plc(1) 859 900 14.5 Basic materials AIM - 0.6

---------- ----------- -------- ------------------- --------- ------------ ------

Belvoir Lettings

plc(1) 783 828 36.3 Financials AIM 6.6 0.6

---------- ----------- -------- ------------------- --------- ------------ ------

MaxCyte Inc(1) 820 750 36.6 Health care AIM - 0.5

---------- ----------- -------- ------------------- --------- ------------ ------

Consumer

Escape Hunt plc(1) 752 695 23.1 services AIM - 0.5

---------- ----------- -------- ------------------- --------- ------------ ------

Velocity Composites

plc(1) 820 646 19.7 Industrials AIM - 0.5

---------- ----------- -------- ------------------- --------- ------------ ------

Universe Group

plc(1) 488 598 11.6 Industrials AIM - 0.4

---------- ----------- -------- ------------------- --------- ------------ ------

Solid State plc(2) 520 558 22.9 Industrials AIM 4.4 0.4

---------- ----------- -------- ------------------- --------- ------------ ------

MyCelx Technologies

Corporation(1) 645 505 23.5 Oil & Gas AIM - 0.4

---------- ----------- -------- ------------------- --------- ------------ ------

Brady plc(2) 395 428 55.0 Technology AIM - 0.3

---------- ----------- -------- ------------------- --------- ------------ ------

MirriAd Advertising Consumer

plc(1) 834 421 34.7 services AIM - 0.3

---------- ----------- -------- ------------------- --------- ------------ ------

Netcall plc(2) 110 416 97.2 Technology AIM 1.7 0.3

---------- ----------- -------- ------------------- --------- ------------ ------

Property Franchise

Group plc (The)(2) 352 413 36.2 Financials AIM 5.5 0.3

---------- ----------- -------- ------------------- --------- ------------ ------

FireAngel Safety

Technology Group

plc(1) 690 389 28.5 Industrials AIM - 0.3

---------- ----------- -------- ------------------- --------- ------------ ------

Brighton Pier Group Consumer

plc (The) (1) 489 379 35.7 services AIM - 0.3

---------- ----------- -------- ------------------- --------- ------------ ------

EU Supply plc(1) 532 331 7.9 Technology AIM - 0.2

---------- ----------- -------- ------------------- --------- ------------ ------

Synectics plc(2) 342 273 35.6 Industrials AIM 2.4 0.2

---------- ----------- -------- ------------------- --------- ------------ ------

Genedrive plc(1) 442 211 5.1 Health care AIM - 0.2

---------- ----------- -------- ------------------- --------- ------------ ------

Consumer

Dods (Group) plc(1) 596 210 35.9 services AIM - 0.2

---------- ----------- -------- ------------------- --------- ------------ ------

Venn Life Sciences

Holdings plc(1) 356 160 4.3 Health care AIM - 0.1

---------- ----------- -------- ------------------- --------- ------------ ------

Sportsweb.com(1) 352 158 2.8 Industrials Unquoted - 0.1

---------- ----------- -------- ------------------- --------- ------------ ------

Fox Marble Holdings

plc Ordinary shares(1) 249 156 18.3 Industrials AIM - 0.1

---------- ----------- -------- ------------------- --------- ------------ ------

Ilika plc(1) 265 147 21.2 Oil & Gas AIM - 0.1

---------- ----------- -------- ------------------- --------- ------------ ------

Antenova Limited

Ordinary shares

& A Preference

Shares(1) 100 128 4.2 Telecommunications Unquoted - 0.1

---------- ----------- -------- ------------------- --------- ------------ ------

Allergy Therapeutics

plc(1) 29 70 168.6 Health care AIM - -

---------- ----------- -------- ------------------- --------- ------------ ------

Sabien Technology

Group plc(1) 441 43 0.6 Industrials AIM - -

---------- ----------- -------- ------------------- --------- ------------ ------

Investments held

at nil value 2,085 - - - - - -

---------- ----------- -------- ------------------- --------- ------------ ------

Total investments 94,545 133,903 94.7

---------- ----------- -------- ------------------- --------- ------------ ------

Net current assets 7,550 5.3

---------- ----------- -------- ------------------- --------- ------------ ------

Net assets 141,453 100.0

---------- ----------- -------- ------------------- --------- ------------ ------

1 Qualifying holdings.

2 Part qualifying holdings.

3 These investments are also held by other funds managed

by Amati.

(NTM) Next twelve months consensus estimate (Source: FactSet

and Fidessa).

The Manager rebates the management fee of 0.75% on the TB

Amati UK Smaller Companies Fund and this is included in the

yield.

All holdings are in ordinary shares unless otherwise stated.

Investments held at nil value: China Food Company plc, Conexion

Media Group plc(1) , Polyhedra Group plc(1) , Rated People

Limited(1) , Sorbic International plc

As at the period end, the percentage of the Company's portfolio

held in qualifying holdings for the purposes of Section 274

of the Income and Corporation Taxes Act 2007 is 86.05%.

PRINCIPAL RISKS AND UNCERTAINTIES

The Company's assets consist of equity and fixed interest

investments and cash. Its principal risks include market risk,

interest rate risk, credit risk and liquidity risk. Other risks

faced by the Company include economic, investment and strategic,

regulatory, reputational, operational and financial risks as well

as the potential for loss of approval as a VCT. These risks, and

the ways in which they are managed, are described in more detail in

Notes 19 to 22 to the Financial Statements in the Company's Report

and Financial Statements for the year ended 31 January 2018. The

Company's principal risks and uncertainties have not changed

materially since the date of that report.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

in respect of the Half-yearly financial report

We confirm that to the best of our knowledge:

-- the condensed set of financial statements which has been

prepared in accordance with FRS 104 "Interim Financial Reporting"

gives a true and fair view of the assets, liabilities, financial

position and profit or loss of the Company;

-- the Chairman's Statement and Fund Manager's Review

(constituting the interim management report) include a true and

fair review of the information required by DTR4.2.7R of the

Disclosure Guidance and Transparency Rules, being an indication of

important events that have occurred during the first six months of

the financial year and their impact on the condensed set of

financial statements;

-- the Statement of Principal Risks and Uncertainties on page 13

is a fair review of the information required by DTR4.2.7R, being a

description of the principal risks and uncertainties for the

remaining six months of the year; and

-- the financial statements include a fair review of the

information required by DTR4.2.8R of the Disclosure Guidance and

Transparency Rules, being related party transactions that have

taken place in the first six months of the current financial year

and that have materially affected the financial position or

performance of the Company during that period, and any changes in

the related party transactions described in the last annual report

that could do so.

For and on behalf of the Board

Peter Lawrence

Chairman

2 October 2018

INCOME STATEMENT

for the six months ended 31 July 2018

Six months ended Six months ended Year ended

31 July 2018 31 July 2017 31 January 2018

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Gain on

investments - 6,682 6,682 - 9,259 9,259 - 19,511 19,511

Income 9 268 - 268 226 - 226 403 - 403

Investment

management fee (218) (654) (872) (104) (311) (415) (227) (681) (908)

Other expenses (182) - (182) (146) - (146) (289) - (289)

(Loss)/profit on

ordinary

activities

before taxation (132) 6,028 5,896 (24) 8,948 8,924 (113) 18,830 18,717

Taxation on 11 - - -

ordinary

activities - - - - - -

(Loss)/profit

and total

comprehensive

income

attributable to

shareholders (132) 6,028 5,896 (24) 8,948 8,924 (113) 18,830 18,717

Basic and

diluted

(loss)/earnings

per Ordinary

share 7 (0.23)p 10.32p 10.10p (0.07)p 26.39p 26.32p (0.33)p 54.85p 54.52p

----------------- ----- ---------- --------- --------- ---------- --------- --------- ---------- --------- ---------

The "Total" column of this Income Statement represents the

profit and loss account of the Company in accordance with Financial

Reporting Standards ("FRS"). The supplementary revenue and capital

columns have been prepared in accordance with The Association of

Investment Companies' Statement of Recommended Practice ("AIC

SORP"). There is no other comprehensive income other than the

results for the period discussed above. Accordingly a statement of

total comprehensive income is not required.

All the items above derive from continuing operations of the

Company.

The accompanying notes are an integral part of the

statement.

STATEMENT OF CHANGES IN EQUITY

For the six months ended 31 July 2018 (unaudited)

Non-distributable reserves Distributable reserves*

Capital Capital reserve

Share Share Merger redemption (non-distributable) Special Capital reserve Revenue Total

capital premium reserve reserve GBP'000 reserve (distributable) reserve reserves

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ------ --------- ----------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

Opening

balance

as at 1

February

2018 1,804 19,359 425 418 33,359 10,386 (4,073) (127) 61,551

--------------- ------ --------- ----------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

Profit/(loss)

and total

comprehensive

income for

the

period - - - - 7,265 - (1,237) (132) 5,896

--------------- ------ --------- ----------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

Total

comprehensive

income for

the

period 1,804 19,359 425 418 40,624 10,386 (5,310) (259) 67,447

--------------- ------ --------- ----------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

Contributions

by and

distributions

to

shareholders:

Repurchase of

shares (54) - - 54 - (1,710) - - (1,710)

Shares issued 215 7,256 - - - - - - 7,471

Shares issued

in connection

with merger 2,062 70,688 - - - - - - 72,750

Merger costs - (243) - - - (38) - - (281)

Other costs

charged

to capital - - - - - (1) - - (1)

Dividends paid - - - - - (4,223) - - (4,223)

Cancellation

of share

premium 3 - (96,397) - - - 96,397 - - -

--------------- ------ --------- ----------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

Total

contributions

by and

distributions

to

shareholders 2,223 (18,696) - 54 - 90,425 - - 74,006

--------------- ------ --------- ----------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

Closing

balance

as at 31 July

2018 4,027 663 425 472 40,624 100,811 (5,310) (259) 141,453

--------------- ------ --------- ----------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

* Of the distributable reserves GBP36,510,000 is currently

unavailable for distribution as it is within the three year

restricted period (Income and Corporation Taxes Act 2007, as

amended).

The accompanying notes are an integral part of the

statement.

For the six months ended 31 July 2017 (unaudited)

Non-distributable reserves Distributable reserves

Capital Capital reserve

Share Share Merger redemption (non-distributable) Special Capital reserve Revenue Total

capital premium reserve reserve GBP'000 reserve (distributable) reserve reserves

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- --------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

Opening

balance as

at 1 February

2017 1,633 13,044 425 364 16,487 14,477 (6,031) (14) 40,385

Profit/(loss)

and total

comprehensive

income

for the

period - - - - 8,732 - 216 (24) 8,924

--------------- --------- --------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

Total

comprehensive

income for

the period 1,633 13,044 425 364 25,219 14,477 (5,815) (38) 49,309

--------------- --------- --------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

Contributions

by and

distributions

to

shareholders:

Repurchase of

shares (22) - - 22 - (559) - - (559)

Shares issued 119 3,049 - - - - - - 3,168

Share issue

costs - (40) - - - - - - (40)

Dividends paid - - - - - (1,462) - - (1,462)

--------------- --------- --------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

Total

contributions

by and

distributions

to

shareholders 97 3,009 - 22 - (2,021) - - 1,107

--------------- --------- --------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

Closing

balance as

at 31 July

2017 1,730 16,053 425 386 25,219 12,456 (5,815) (38) 50,416

--------------- --------- --------- --------- ----------- -------------------- ---------- ----------------- ---------- ----------

The accompanying notes are an integral part of the

statement.

For the year ended 31 January 2018 (audited)

Non-distributable reserves Distributable reserves

Capital Capital reserve Capital reserve

Share Share Merger redemption (non-distributable) Special (distributable) Revenue Total

capital premium reserve reserve GBP'000 reserve GBP'000 reserve reserves

Audited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- --------- --------- --------- ----------- -------------------- ---------- ---------------- ----------- ----------

Opening balance as at

1

February 2017 1,633 13,044 425 364 16,487 14,477 (6,031) (14) 40,385

Profit/(loss) and

total

comprehensive income

for

the period - - - - 16,872 - 1,958 (113) 18,717

----------------------- --------- --------- --------- ----------- -------------------- ---------- ---------------- ----------- ----------

Total comprehensive

income

for the period 1,633 13,044 425 364 33,359 14,477 (4,073) (127) 59,102

----------------------- --------- --------- --------- ----------- -------------------- ---------- ---------------- ----------- ----------

Contributions by and

distributions

to shareholders:

Repurchase of shares (54) - - 54 - (1,514) - - (1,514)

Shares issued 225 6,439 - - - - - - 6,664

Share issue costs - (49) - - - - - - (49)

Merger costs - (75) - - - - - - (75)

Dividends paid - - - - - (2,577) - - (2,577)

----------------------- --------- --------- --------- ----------- -------------------- ---------- ---------------- ----------- ----------

Total contributions by

and distributions to

shareholders 171 6,315 - 54 - (4,091) - - 2,449

----------------------- --------- --------- --------- ----------- -------------------- ---------- ---------------- ----------- ----------

Closing balance as at

31

January 2018 1,804 19,359 425 418 33,359 10,386 (4,073) (127) 61,551

----------------------- --------- --------- --------- ----------- -------------------- ---------- ---------------- ----------- ----------

The accompanying notes are an integral part of the

statement.

CONDENSED BALANCE SHEET

as at 31 July 2018

31 July 31 July 31 January

2018 2017 2018 (audited)

(unaudited) (unaudited)

Note GBP'000 GBP'000 GBP'000

Fixed assets

Investments held at fair value 13 133,903 48,389 58,273

Current assets

Debtors 105 47 867

Cash at bank 9,744 2,358 2,823

Total current assets 9,849 2,405 3,690

Current liabilities

Creditors: amounts falling due within

one year (2,299) (378) (412)

Net current assets 7,550 2,027 3,278

Total assets less current liabilities 141,453 50,416 61,551

--------------------------------------- ----- ------------- ------------- ---------------

Capital and reserves

Called up share capital 4,027 1,730 1,804

Share premium account 3 663 16,053 19,359

Reserves 3 136,763 32,633 40,388

Equity shareholders' funds 141,453 50,416 61,551

--------------------------------------- ----- ------------- ------------- ---------------

Net asset value per share 8 175.69p 145.77p 170.70p

--------------------------------------- ----- ------------- ------------- ---------------

The accompanying notes are an integral part of the balance

sheet.

STATEMENT OF CASH FLOWS

for the six months ended 31 July 2018

Six months Six months Year

ended ended ended

31 July 31 July 31 January

2018 2017 2018

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------------- --- ------------- ------------- -----------

Cash flows from operating activities

Income received 197 200 408

Investment management fees (547) (372) (818)

Other operating costs (207) (160) (287)

Net cash outflow from operating activities (557) (332) (697)

Cash flows from investing activities

Purchases of investments (7,957) (1,858) (5,466)

Disposals of investments 4,014 1,703 5,679

Net cash (outflow)/inflow from investing

activities (3,943) (155) 213

Net cash outflow before financing (4,500) (487) (484)

Cash flows from financing activities

Cash received as part of asset acquisition 9,462 - -

of Amati VCT

Net cash paid in respect of assets (88) - -

and liabilities of Amati VCT

Merger costs of the Company (281) - (75)

Net proceeds of share issues and

buybacks 6,551 3,052 4,704

Equity dividends paid (4,223) (1,462) (2,577)

Net cash inflow from financing activities 11,421 1,590 2,052

Increase in cash 6,921 1,103 1,568

------------------------------------------------- ------------- ------------- -----------

Reconciliation of net cash flow to movement in

net cash

Net cash at start of period 2,823 1,255 1,255

Net cash at end of period 9,744 2,358 2,823

Increase in cash during the period 6,921 1,103 1,568

------------------------------------------------- ------------- ------------- -----------

Reconciliation of profit on ordinary activities

before taxation to net cash outflow from operating

activities

Profit on ordinary activities before

taxation 5,896 8,924 18,717

Net gain on investments (6,682) (9,259) (19,511)

Increase in creditors 315 32 91

(Increase)/decrease in debtors (86) (29) 6

Net cash outflow from operating activities (557) (332) (697)

------------------------------------------------- ------------- ------------- -----------

The accompanying notes are an integral part of the

statement.

NOTES TO THE FINANCIAL STATEMENTS

for the six months ended 31 July 2018

1. Basis of Accounting

The Half-yearly financial report covers the six months ended 31

July 2018. The Company applies FRS 102 and the AIC's Statement of

Recommended Practice issued in November 2014 and consequential

amendments as adopted for its financial year ended 31 January 2018.

The financial statements for this six month period have been

prepared in accordance with FRS 104 and on the basis of the same

accounting policies as set out in the Company's Annual Report and

Financial Statements for the year ended 31 January 2018.

The comparative figures for the financial year ended 31 January

2018 have been extracted from the latest published audited Annual

Report and Financial Statements. Those accounts have been reported

on by the Company's auditor and lodged with the Registrar of

Companies. The report of the auditor was (i) unqualified, (ii) did

not include a reference to any matters to which the auditors drew

attention by way of emphasis without qualifying their report, and

(iii) did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006.

The financial information set out in this report has not been

audited and does not comprise full financial statements within the

meaning of Section 434 of the Companies Act 2006. No statutory

accounts in respect of any period after 31 January 2018 have been

reported on by the Company's auditors. Interim accounts prepared

for the period to 14 June 2018 in respect of the cancellation of

the company's share premium account (see note 3) were delivered to

the Registrar of Companies.

2. Merger of Company with Amati VCT plc (AVCT) - Basis of Accounting

On 4 May 2018 the merger took place between the Company and

Amati VCT plc. The method of accounting for this was that the

Company acquired the assets and liabilities of AVCT in exchange for

shares in the Company. The transaction was accounted for as an

asset acquisition and further details are set out in note 12 of

this report. The income and costs for the period to 3 May 2018 and

the comparable periods to 31 July 2017 and 31 January 2018, reflect

the activities of the Company before the acquisition and after that

date reflect those of the enlarged company.

Amati VCT 2 plc was renamed Amati AIM VCT plc with effect from 4

May 2018.

3. Cancellation of share premium

On 12 June 2018, the share premium account was cancelled by

Order of Court following the passing of a Special Resolution. The

credit arising of GBP96,397,000 has been applied in creating a

special reserve, within the capital reserve, which will be able to

be applied in any manner in which the Company's profits available

for distribution (as determined in accordance with Section 649 of

the Companies Act 2006) are able to be applied.

4. Going concern

In accordance with FRC Guidance for directors on going concern

and liquidity risk the directors are of the opinion that, at the

time of approving the Half-yearly Report, the Company has adequate

resources to continue in business for the foreseeable future. In

reaching this conclusion the directors took into account the nature

of the Company's business and Investment Policy, its risk

management policies, the diversification of its portfolio, the cash

holdings and the liquidity of non-qualifying investments. Thus the

directors believe it is appropriate to continue to apply the going

concern basis in preparing the financial statements.

5. Segmental reporting

The directors are of the opinion that the Company is engaged in

a single segment of business, being investment business.

6. Copies of the Half-yearly report are being made available to

all shareholders. Further copies are available free of charge from

Amati Global Investors by telephoning 0131 503 9115 or by email to

info@amatiglobal.com.

7. Earnings per share

Earnings per share is based on the gain attributable to

shareholders for the six months ended 31 July 2018 of GBP5,896,000

(six months ended 31 July 2017: GBP8,924,000, year ended 31 January

2018: GBP18,717,000) and the weighted average number of shares in

issue during the period of 58,395,967 (31 July 2017: 33,907,246, 31

January 2018: 34,329,245). There is no difference between basic and

diluted earnings per share.

8. Net Asset Value

The net asset value per share at 31 July 2018 is based on net

assets of GBP141,453,000 (31 July 2017: GBP50,416,000, 31 January

2018: GBP61,551,000) and the number of shares in issue on 31 July

2018 of 80,513,669 (31 July 2017: 34,585,493, 31 January 2018:

36,057,095). There is no difference between basic and diluted net

asset value per share.

9. Income

Six months Six months ended Year ended

ended

31 July 2018 31 July 2017 31 January

2018

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ------------------------ ---------------------------- ----------------------

Income:

Dividends from UK

companies 262 198 353

UK loan stock interest - 25 44

Interest from deposits 6 3 6

268 226 403

-------------------------------------- ------------------------ ---------------------------- ----------------------

10. Dividends paid

Six months Six months Year

ended ended ended

31 January

31 July 2018 31 July 2017 2018

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ------------- ------------- -----------

Second interim dividend for the

year ended 31 January 2018 of 5.25p

per share paid on 27 July 2018 4,223* - -

-------------------------------------- ------------- ------------- -----------

First interim dividend for the

year ended 31 January 2018 of 3.25p

per share paid on 24 November 2017 - - 1,115

-------------------------------------- ------------- ------------- -----------

Final dividend for the year ended

31 January 2017 of 4.25p per share

paid on 21 July 2017 - 1,462 1,462

-------------------------------------- ------------- ------------- -----------

4,223 1,462 2,577

-------------------------------------- ------------- ------------- -----------

*Based on the shares in issue of the enlarged company on the

ex-dividend date 21 June 2018.

11. The effective rate of tax for the six months ended 31 July

2018 is 0% (31 July 2017: 0%, 31 January 2018: 0%).

12. Asset acquisition of Amati VCT plc

On 4 May 2018 the Company acquired the assets and liabilities of

AVCT in accordance with the supplementary prospectus and circular

published on 9 March 2018 ("the Scheme"). The assets and

liabilities of AVCT were transferred to the Company on 4 May 2018

and in exchange the assenting shareholders of AVCT were allotted

41,231,436 ordinary shares in the Company, being 5.98787 ordinary

shares for each 10 ordinary shares of 10p each held in the capital

of AVCT.

The assets and liabilities of AVCT as at 4 May 2018 which were

acquired are set out below:-

GBP'000

--------------------------------------- --------

Fixed assets -

--------------------------------------- --------

Investments held at fair value 63,393

--------------------------------------- --------

Current assets

--------------------------------------- --------

Debtors 142

--------------------------------------- --------

Cash at bank 9,462

--------------------------------------- --------

Current liabilities

--------------------------------------- --------

Creditors: amounts falling due within

one year 247

--------------------------------------- --------

Net current assets

--------------------------------------- --------

Total assets less current liabilities 72,750

--------------------------------------- --------

13. Investments

Level 1 Level 2 Level 3

--------

Traded Unquoted Unquoted

on

AIM investments investments Total

GBP'000 GBP'000 GBP'000 GBP'000

-------- ------------ ------------ --------

Cost as at 1 February 2018 23,364 - 2,816 26,180

-------- ------------ ------------ --------

Opening unrealised appreciation/(depreciation) 34,760 - (1,401) 33,359

------------------------------------------------ -------- ------------ ------------ --------

Opening unrealised loss recognised

in realised reserve (296) - (970) (1,266)

-------- ------------ ------------ --------

Opening valuation as at 1 February

2018 57,828 - 445 58,273

-------- ------------ ------------ --------

Movements in the period:

-------- ------------ ------------ --------

Purchases 7,956 1,613 - 9,569

-------- ------------ ------------ --------

Stocks received as part of asset

acquisition* 63,393 - - 63,393

-------- ------------ ------------ --------

Sales - proceeds (3,735) - (279) (4,014)

-------- ------------ ------------ --------

Realised loss on sales (2,072) - - (2,072)

-------- ------------ ------------ --------

Unrealised gain in the period 8,633 - 121 8,754

------------------------------------------------ -------- ------------ ------------ --------

Valuation as at 31 July 2018 132,003 1,613 287 133,903

-------- ------------ ------------ --------

Cost at 31 July 2018 90,395 1,613 2,537 94,545

-------- ------------ ------------ --------

Unrealised appreciation/ (depreciation)

as at 31 July 2018 41,904 - (1,280) 40,624

------------------------------------------------ -------- ------------ ------------ --------

Closing unrealised loss recognised

in realised reserve (296) - (970) (1,266)

-------- ------------ ------------ --------

Valuation as at 31 July 2018 132,003 1,613 287 133,903

-------- ------------ ------------ --------

Equity shares 132,003 1,613 240 133,856

-------- ------------ ------------ --------

Preference shares - - 47 47

-------- ------------ ------------ --------

Loan stock - - - -

-------- ------------ ------------ --------

Valuation as at 31 July 2018 132,003 1,613 287 133,903

-------- ------------ ------------ --------

* The investments of AVCT were transferred into the Company at

fair value on the date of the asset acquisition. The original book

cost of these assets in AVCT was GBP28,157,000 being GBP35,236,000

less than the transfer at fair value shown above.

In order to provide further information on the valuation

techniques used to measure assets carried at fair value, the

measurement basis has been categorised into a "fair value

hierarchy" as follows:

- Quoted market prices in active markets - "Level 1"

Inputs to Level 1 fair values are quoted prices in active

markets. An active market is one in which transactions occur with

sufficient frequency and volume to provide pricing information on

an ongoing basis. The Company's investments classified within this

category are AIM traded companies and fully listed companies.

- Valued using models with significant observable market

parameters - "Level 2"

Inputs to Level 2 fair values are inputs other than quoted

prices included within Level 1 that are observable for the asset,

either directly or indirectly.

- Valuation technique - "Level 3"

Level 3 fair values are measured using a valuation technique

that is based on data from an unobservable market.

14. Related parties

The Company holds 652,687 shares in Anpario plc, an AIM traded

company, of which Mr Peter Lawrence is a non-executive director. Mr

Lawrence's charitable trust holds 27,950 shares in Anpario plc.

The Company retains Amati Global Investors as its Manager. The

number of ordinary shares (all of which are held beneficially) by

certain members of the management team of the Manager are:

31 July 2018

shares held

Paul Jourdan 483,648

David Stevenson 17,583

----------------- -------------

Related party transaction

Save as disclosed in this paragraph there is no conflict of

interest between the Company, the duties of the directors, the

duties of the directors of the Manager and their private interests

and other duties.

Shareholder Information

Share price

The Company's shares are listed on the London Stock Exchange.

The bid price of the Company's shares can be found on Amati Global

Investors' website: http://www.amatiglobal.com/amat.php.

Net Asset Value per Share

The Company normally announces its net asset value on a weekly

basis. Net asset value per share information can be found on Amati

Global Investor's website: http://www.amatiglobal.com/amat.php.

Financial calendar

October 2018 Half-yearly report for the six months to 31 July

2018 published

31 January 2019 Year end

May 2019 Announcement of final results for the year ended 31

January 2019

June 2019 Annual General Meeting

Dividends

Shareholders who wish to have future dividends re-invested in

the Company's shares or wish to have dividends paid directly into

their bank account rather than sent by cheque to their registered

address should contact Share Registrars Limited on 01252 821390 or

email enquiries@shareregistrars.uk.com.

Table of Historic Returns from launch to 31 July 2018

attributable to shares issued by VCTs which have been merged into

Amati AIM VCT

NAV Total Numis Alternative

Return Markets

NAV Total with dividends Total Return

Return not re-invested Index

with dividends

Launch date Merger date re-invested

--------------------- ---------------- ------------------- ----------------- ----------------- ------------------

Singer & Friedlander

AIM 3 VCT ('C'

shares) 4 April 2005 8 December 2005 46.2% 22.3% 30.6%

Amati VCT plc 24 March 2005 4 May 2018 134.1% 74.8% 25.9%

Invesco Perpetual

AIM VCT 30 July 2004 8 November 2011 29.4% -7.7% 60.0%

Amati AIM VCT

(originally Singer

& Friedlander 29 January

AIM 3 VCT*) 2001 n/a 33.3% 11.0% -6.2%

Singer & Friedlander 29 February 22 February

AIM 2 VCT 2000 2006 2.2% -15.1% -52.1%

Singer & Friedlander 28 September 22 February

AIM VCT 1998 2006 -30.3% -20.8% 45.7%

--------------------- ---------------- ------------------- ----------------- ----------------- ------------------

*Singer & Friedlander AIM 3 VCT changed its name to ViCTory

VCT on 22 February 2006, to Amati VCT 2 on 8 November 2011 and to

Amati AIM VCT on 4 May 2018.

Corporate Information

Directors Registrar

Peter Lawrence Share Registrars Limited

Julia Henderson The Courtyard

Mike Killingley 17 West Street

Susannah Nicklin Farnham, Surrey

Brian Scouler GU9 7DR

all of:

27/28 Eastcastle Street Auditor

London BDO LLP

W1W 8DH 55 Baker Street

London

Secretary W1H 7EH

The City Partnership (UK) Limited

110 George Street Solicitors

Edinburgh Rooney Nimmo

EH2 4LH 8 Walker Street

Edinburgh

EH3 7LH

Fund Manager Bankers

Amati Global Investors Limited The Bank of New York Mellon

SA/NV

8 Coates Crescent London Branch

Edinburgh 160 Queen Victoria Street

EH3 7AL London

EC4V 4LA

VCT Tax Adviser

Philip Hare & Associates LLP

Suite C, First Floor

4-6 Staple Inn

Holborn, London

WC1V 7QH

For enquiries relating to share certificates, share holdings,

dividends or the Dividend Re-investment Scheme, please contact:

Share Registrars Limited

on +44 (0) 1252 821390

or email: enquiries@shareregistrars.uk.com

For enquiries relating to subscriptions and for general

enquiries, please contact:

Amati Global Investors

on +44 (0) 131 503 9115

or email: info@amatiglobal.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FSUSWEFASEES

(END) Dow Jones Newswires

October 02, 2018 03:38 ET (07:38 GMT)

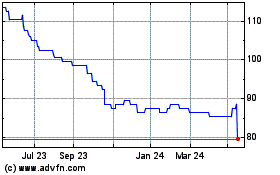

Amati Aim Vct (LSE:AMAT)

Historical Stock Chart

From Jul 2024 to Aug 2024

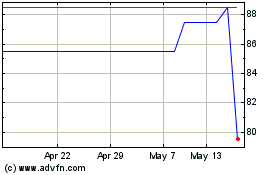

Amati Aim Vct (LSE:AMAT)

Historical Stock Chart

From Aug 2023 to Aug 2024