TIDMAT2

RNS Number : 5767D

Amati VCT 2 plc

27 April 2017

Amati VCT 2 plc

ANNUAL REPORT & FINANCIAL STATEMENTS

For the year ended 31 January 2017

The Annual Report and Financial Statements ("Annual Report") for

the year ended 31 January 2017 and the Notice of Annual General

Meeting will be posted to shareholders shortly and is available in

electronic format for download on Amati Global Investors website

www.amatiglobal.com. Copies of the Annual Report will be submitted

to the UK Listing Authority's National Storage Mechanism and will

be available at www.hemscott.com/nsm.do.

Page numbers and cross-references in this announcement below

refer to page numbers and cross-references in the PDF of the Annual

Report.

Highlights

-- NAV Total Return for the year 22.0%.

-- Year end NAV 123.72p.

-- Proposed final dividend of 4.25p per share bringing the total

declared in respect of the year to 7.00p per share which is 5.7% of

year end NAV.

-- GBP2.2m invested in qualifying holdings during the year.

-- The Top Up Share Issue launched on 8 November 2016 together

with Amati VCT plc has raised GBP4m for the Company as at 25 April

2017 and was fully subscribed for tax year 2016/17.

Table of investor returns to 31 January 2017

NAV Total FTSE AIM

Return All-Share

with Total

From Date dividends Return

reinvested Index

--------------------------------- ------------ ------------ -----------

Re-launch as Amati VCT 2 9 November

following merger 2011* 63.8% 28.2%

Appointment of Amati Global

Investors ("Amati") as Manager

of Amati VCT 2, which was

known as ViCTory VCT at the 25 March

time 2010 71.9% 33.4%

--------------------------------- ------------ ------------ -----------

*Date of the share capital reconstruction when the NAV was

rebased to approximately 100p per share.

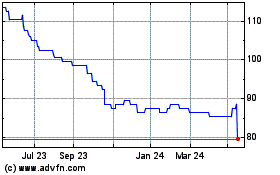

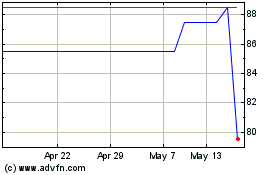

Amati VCT 2 NAV Total Return and FTSE AIM All-Share Total Return

Index from change of Manager on 25 March 2010 to 31 January 2017 is

on page 1 of the Annual Report.

Key data

31/01/17 31/01/16

----------------------------------- ----------- -----------

Net Asset Value ("NAV") GBP40.4m GBP32.4m

Shares in issue 32,643,069 30,259,489

NAV per share 123.7p 107.1p

Bid price 115.5p 102.5p

Mid price 115.8p 102.8p

Market capitalisation GBP37.8m GBP31.1m

Share price discount to NAV 6.4% 4.0%

NAV Total Return for the year

(assuming re-invested dividends) 22.0% 6.1%

FTSE AIM All-Share Total Return

Index 29.3% 1.8%

Ongoing charges* 2.6% 2.6%

----------------------------------- ----------- -----------

Dividends proposed/declared

in respect of the year 7.00p 6.25p

----------------------------------- ----------- -----------

*Ongoing charges calculated in accordance with the Association

of Investment Companies' ("AIC's") guidance.

Dividends declared and recommended since the re-launch following

the merger

Total dividends Cumulative

dividends

per share per share

Year ended 31 p p

January

--------------- ---------------- -----------

2011 4.74 4.74

2012 5.50 10.24

2013 6.00 16.24

2014 6.75 22.99

2015 6.25 29.24

2016 6.25 35.49

2017 7.00 42.49

--------------- ---------------- -----------

Historic performance

Amati VCT 2 NAV Total Return assuming re-invested dividends,

FTSE AIM All-Share Total Return Index and Numis Alternative Markets

Total Return Index is on page 2 of the Annual Report.

Table of Historic Returns from launch to 31 January 2017

attributable to shares issued by VCTs which have been merged into

Amati VCT 2

FTSE

AIM

NAV Total All-Share

Return Total

with

dividends Return

Launch Merger re-invested Index

date date

------------------------- -------------- ------------- ------------ ----------

Singer & Friedlander 4 April 8 December

AIM 3 VCT ('C' shares) 2005 2005 -4.9% -7.4%

Invesco Perpetual 30 July 8 November

AiM VCT 2004 2011 -15.9% 16.5%

Amati VCT 2 (originally

Singer & Friedlander 29 January

AIM 3 VCT*) 2001 n/a -13.3% -28.2%

Singer & Friedlander 29 February 22 February

AIM 2 VCT 2000 2006 -33.6% -62.0%

Singer & Friedlander 28 September 22 February

AIM VCT 1998 2006 -54.7% 23.2%

*Singer & Friedlander AIM 3 VCT changed its name to ViCTory

VCT on 22 February 2006 and to Amati VCT 2 on 8 November 2011.

STRATEGIC REPORT

The purpose of this report is to inform shareholders and help

them to assess how the directors have performed in their duty to

promote the success of the Company. This report has been prepared

by the directors in accordance with the requirements of Section

414A of the Companies Act 2006.

CHAIRMAN'S STATEMENT

Overview

A year ago I wrote about some significant changes to the

Company's policies in respect of both qualifying and non-qualifying

investments. These changes are now beginning to bear fruit and it

is pleasing to be able to report a strong performance for the

portfolio over the last twelve months. In the qualifying portfolio,

the decision to hold shares in successful companies for the longer

term, rather than sell for shorter term profit generation, has

resulted in the Company's portfolio having a greater weighting in

mature, profitable businesses, and this is showing through in the

overall performance. This strategy has also, as expected, led to a

lower turnover in holdings. In parallel, our decision to manage our

non-qualifying holdings primarily through the TB Amati UK Smaller

Companies Fund has also resulted in strong returns. The performance

of the portfolio, and its individual components, is described in

greater detail in the Manager's report.

A year ago we anticipated a fall-off in the number of new

investment opportunities as the new regulations were being

digested. This proved to be the case, but the flow of opportunities

began increasing in the second half and a reasonable number of new

investments have been made towards the end of the year. We also

indicated that we expected that the Manager would be making fewer,

but larger, new qualifying investments, targeting companies at the

more mature end of the spectrum allowed by the VCT regulations.

This ambition has been more difficult to realise, as the new rules

often mean that companies can raise less money from VCTs than

before, and there is therefore high demand for the most attractive

investments, especially while the number of opportunities remains

constrained. This can result in smaller position sizes than we

would have ideally liked for some new investments.

As also reported we have raised some additional funds, and in

doing so we have aimed to match the level of funds raised to the

level of anticipated new qualifying investment opportunities. The

Company is in the fortunate position of being very fully invested

in qualifying holdings so we are under no pressure to make new

investments simply to maintain our VCT status.

Investment Performance and Dividend

The NAV Total Return for the period was 22.0%, which compares to

a rise of 29.3% for the FTSE AIM All-Share Total Return Index.

Having been just ahead of the AIM index at the half year end, the

portfolio lagged the exceptional strength of AIM in the second half

which was led by a resurgence of natural resources stocks and

ongoing demand from investors to own AIM stocks for the tax

benefits, which tends to be focused on the largest companies.

The dividend policy of the Company is to pay between five and

six percent of year-end net asset value, subject to the

availability of liquidity and sufficient distributable reserves. At

31 January 2017 the net asset value was 123.72p per share. In line

with this policy the Board is proposing a final dividend of 4.25p

per share, to be paid on 21 July 2017 to shareholders on the

register on 16 June 2017. This would make total dividends for the

year 7.00p.

The Company has thus far used the FTSE AIM All-Share Total

Return Index as its comparator index. For some years this index has

been the only one available against which to measure performance

for AIM focused investment companies, but unfortunately the cost of

using it has been high. However, Numis have recently decided to

extend their well known range of UK smaller company indices to

include an AIM index, and the Amati VCTs and the Manager have

agreed to subscribe to this index instead, which should result in a

worthwhile saving to the Company, while providing a very similar

comparable measurement index to the FTSE product. The historic

performance chart on page 2 in the Annual Report gives an

indication of how similar the two indices are in practice. Future

reports will use the Numis Alternative Markets Total Return Index

as the comparator for performance.

It is worth noting to shareholders that, following a period of

strong performance, the Company is now benefitting from the Manager

having waived all rights to future performance fees in 2014. Had

this not happened, we would now be accruing for a further

performance fee. The Amati VCTs remain very unusual amongst VCTs in

no longer paying performance fees.

Other Corporate Developments

A further joint top up share issue (the "Share Issues") with

Amati VCT plc ("Amati VCT") was launched in November 2016. The

available capacity under these offers for the 2016/17 tax year was

filled for both VCTs, at around GBP3.6m each. At the time of

writing a small amount of capacity remains available for the

2017/18 tax year. The capacity of each allotment will be subject to

the rules governing non-prospectus offers, which are set out in the

Share Issues document, and the offers will close on 14 July 2017,

or as soon as full capacity is reached if earlier.

Investors wishing to make further investments in the Company may

also wish to consider joining the Dividend Re-investment Scheme

("DRIS"), which remains open to all shareholders. Please contact

the company's registrar, Share Registrars, if you wish to join or

leave the DRIS.

At the Annual General Meeting ("AGM") in June the Company is

seeking shareholders' consent to send or supply documents and

information to them in electronic form and via its website

(www.amatiglobal.com).

Increased use of electronic communications will deliver savings

to the Company in terms of administration, printing and postage

costs, as well as speeding up the provision of information to

shareholders. The reduced use of paper will also have environmental

benefits.

Under the proposal, when new Documents and Information become

available on the website, we will notify you by letter to your

normal address or, if you have consented to email notification and

provided an email address, by email. Shareholders will be able to

opt out of electronic communications and continue to receive

printed documents in the post if they wish.

The Company is also seeking shareholders' approval to amend the

Investment Policy of the Company at the AGM in June; further

information is included in the Directors' Report on page 18 in the

Annual Report and the full text of the proposed new Investment

Policy is detailed on page 49 in the Annual Report.

Outlook

As reported above, the portfolio is now concentrated around the

more successful, mature, holdings and this is proving beneficial to

the Company's performance. We believe that these companies have

scope for significant further growth and will therefore become

attractive to a wider group of investors. The Board has also been

pleased with the new additions to the portfolio during the year,

several of which have already made a positive contribution to

performance. The Company is well placed to add new investments

selectively, without being under any undue pressure to do so.

AGM

The AGM will again be held at the Guildhall School of Music and

Drama, starting at 2.00pm on Wednesday 28 June 2017 at Milton Court

Theatre, The Guildhall School of Music and Drama, Silk Street,

Barbican, London, EC2Y 9BH (the entrance is on the corner of Milton

Street and Silk Street). This will be followed by further events

and presentations, including the fourth Amati Guildhall Creative

Entrepreneurs Award, to which shareholders are invited, details of

which are being sent to you with this report. I do hope that as

many shareholders as possible will be able to join us. Please RSVP

to rachel.lederf@amatiglobal.com if you would like to attend.

Julian Avery

Chairman

27 April 2017

For any matters relating to your shareholding in the Company,

dividend payments, or the Dividend Re-investment Scheme, please

contact Share Registrars on 01252 821390, or by email at

enquiries@shareregistrars.uk.com. For any other matters please

contact Amati Global Investors ("Amati") on 0131 503 9115 or by

email at vct-enquiries@amatiglobal.com. Amati maintains an

informative website for the Company - www.amatiglobal.com - where

monthly investment updates, performance information, and past

company reports can be found.

FUND MANAGER'S REVIEW

Market Review

The year under review was dominated by two major political

events, the UK's vote to leave the European Union and the election

of Donald Trump to the office of US President. In both cases stock

markets stalled ahead of the voting. After the Brexit vote they

fell sharply and then recovered, breaking into new highs, with a

similar pattern and much briefer fall after the US election.

Overall the second half of the year produced strong returns. In our

view, the strong stock markets should be seen as the result of a

long term policy of low interest rates and quantitative easing

("QE") which has had the effect of normalising the bank lending

environment, and forcing money into risk assets, both of which are

strongly stimulative for the economy. In 2016 evidence emerged that

this policy had done its job, but investors delayed entering the

stock market due to the uncertainty created by these political

events. Once they were completed, even though the results were

unexpected and may cause many problems in the future, the cash

awaiting investment waited no longer.

In the case of the EU referendum, the leave result triggered a

dramatic fall in the value of sterling, and it has so far remained

weak. This in turn led to the outperformance of UK larger

companies, which have a bias towards overseas earnings, with the

FTSE 100 enjoying a total return of 21.4% for the period, whilst

the FTSE 250 lagged with a gain of 13.2% due to its heavier

dependence on UK based earnings. Something different was happening

in AIM, however, which beat every Full List index with a gain of

29.3%. The AIM market is increasingly being dominated by a small

group of large companies, which in the main posted strong gains in

2016 and set the tempo for the overall performance of the index.

Together with the recovery in commodity prices (particularly in

sterling terms), which translated into a reversal of the share

price declines in the Oil and Gas and Basic Materials sectors, this

provided a further catalyst for AIM outperformance.

Performance

The Company returned a NAV total return of 22.0% for the year to

31 January 2017. The FTSE AIM All-Share Index enjoyed even stronger

gains, ending the same period up 29.3%.

The greatest contributor to performance was Accesso Technology

Group ("Accesso"). Accesso continued its progress in its main

business segments: electronic queuing, where two new parks were

added, including another LEGOLAND site; and ticketing, where sales

via mobile devices are driving growth. With the bulk of its

revenues earned in US dollars, Accesso was also a beneficiary of

sterling weakness following the Brexit vote. Following a share

price rise of 80%, Accesso grew to represent over 10% of the

portfolio late in the year, and we took the decision to take some

profits, selling around GBP780k worth of shares in order to manage

the position size. At the end of the period it represented 8.4% of

the portfolio, and we remain comfortable with this overweight

position. At the time of writing Accesso's market capitalisation is

now in excess of GBP350 million, and this size acts as a useful

diversifier to the smaller companies that were acquired for the VCT

more recently. The continued success of Accesso, as well as other

long-standing positions in the Company, serve to increase the

overall maturity and liquidity of the portfolio. As well as this,

we believe in 'running our winners' and Accesso has been the most

outstanding of these since we took on the management of the VCT in

2010. Quixant, the designer and manufacturer of hardware and

software for gaming machines, has also been an exceptional stock,

and was the next most significant contributor to performance, with

a further share price rise of 113% during the period. Quixant

upgraded its forecasts with demand from gaming customers exceeding

expectations and a maiden contribution from the acquisition of

Densitron, a supplier of electronic displays. Like Accesso,

Quixant's success has enabled its evolution from a small AIM

business with a limited audience, to a business capitalised at

around GBP230 million at the period end that is attracting the

interest of a large pool of AIM investors. Continuing this theme,

Keywords Studios ("Keywords") climbed 170%. This was the

consequence of two factors. Firstly, Keywords made a series of

earnings enhancing acquisitions, thus driving the forward earnings

per share (based on next twelve months) higher - from 11 pence to

18 pence over the year. Secondly, Keywords has become a favourite

of a wide pool of AIM investors, and has seen a re-rating as a

result, with the price to earnings (P/E) ratios rising from 19x to

29x over the year. Other notable performers were AB Dynamics, the

designer of test equipment for vehicle suspension, steering, noise

and vibration, which ended the year 86% ahead; IDOX, the software

supplier to local authorities, which gained 30%; and Science in

Sport, the supplier of sports nutrition products, which climbed

71%. The TB Amati UK Smaller Companies Fund ("the Fund") also

made a valuable contribution to performance, following a 23%

increase in value over the year.

The most significant detractor from performance was Bilby, the

gas heating, electrical and building services business that was the

prior year's greatest contributor to performance. Unfortunately,

the gains that were enjoyed in 2015 were reversed in 2016 following

a delay to anticipated work with a large, long standing public

sector customer. This was followed by the announcement of a

restatement of its prior year financial statements due to

additional, unrecognised costs and disputed revenues, which had a

material impact on the previously reported profit. The consequence

was a share price fall of 61% over the year. Also weak was Crawshaw

Group, the operator of butcher shops throughout Yorkshire,

Humberside, Nottinghamshire and Lincolnshire. The shares fell 76%

over the year, with most of the damage inflicted following a poor

trading update in September, in which the company blamed adverse

weather, an even more price-focussed consumer post-Brexit, and

aggressive price promotions by supermarket competitors for

sustained reductions in like for like sales. The residual value in

the convertible loan to Polyhedra Group was written down to nil

following the failure of the group to renew a contract with a

customer that represents most of its turnover. Despite attempts to

diversify the business, there appears to be little progress towards

any return of value from this position. TLA Worldwide ("TLA"), the

sports management and marketing agency, fell 45% following the

withdrawal of a takeover bid from a Nasdaq listed cash shell. The

convertible loans in Rame Energy ("RAME") were also written off.

RAME was unable to fulfil its promise of becoming a niche

independent power producer in Latin America and entered

administration, a process that is unlikely to yield much value for

creditors.

Transactions

Qualifying portfolio

The Company completed five material new qualifying investments

during the year under review, investing GBP2.0 million in the

process. The Company participated in the IPO of LoopUp Group

("LoopUp"), a provider of high quality remote meeting technology.

LoopUp addresses the frustrations that are familiar to regular

participants in conference calls such as getting all the right

participants on a call, background noise, sharing content and

security. Amongst its features, LoopUp's software can call each

participant, rather than waiting for them to join, enables screen

sharing and identifies who is talking and who is on the call at any

stage. These features have already attracted nearly 2,000 customers

globally, in a market that is growing at 15% per annum. We took a

position in Faron Pharmaceuticals ("Faron"), which raised capital

in a secondary placing to fund safety trials for the US development

of its lead product, Traumakine, for the treatment of Acute

Respiratory Distress Syndrome (ARDS), a severe lung condition with

a mortality rate of 30-40% and no current cure. The defining moment

for Faron will be the publication of Phase III trials in mid-2017.

The Company also participated in a placing of new funding for

Hardide, a long-standing holding in Amati VCT and, as such, well

known to us since 2007. Hardide has patented several surface

coating technologies based around tungsten carbide which, when

applied to industrial components provides a super-hard coating

which extends life spans and reduces downtime. The primary end

market since inception of the business has been oil and gas but

Hardide has been selling increasingly into other sectors, shortly

to include aerospace, where long sales cycles are compensated for

by long-term, high value contracts. We took part in the IPO of

FreeAgent Holdings ("FreeAgent"), a developer of accounting

software for small businesses. Specifically, FreeAgent has targeted

the freelancer market and companies with up to ten employees. It

has built an intuitive and unintimidating user interface that was

designed by non-accountants for non-accountants. FreeAgent has two

routes to market: direct to the end customer; and sales via

accountancy practices that specialise in advising very small

businesses. Like many software products, revenues are 'sticky',

meaning that customers tend to renew year after year due to

increasing familiarity with the functionality. Revenues have been

growing at over 30% per annum. During the first half, we made a

small investment in Genedrive, a point of care diagnostics

business. Since the Company's investment, Genedrive has made

progress with its Hepatitis C test and CE Marking submission, to

allow the distribution of this product in Europe, which is imminent

following encouraging performance results. However, the

tuberculosis test has so far fared poorly, with end user sales in

India having been challenging and Genedrive is working to address

some issues customers are experiencing around the preparation of

samples, which they believe are holding back repeat orders.

Small follow-on investments totalling GBP0.2 million were made

in Fox Marble Holdings, the Kosovo-based producer of high quality

marble, which recently commissioned its cutting and polishing

factory; Sabien Technology, the designer of boiler efficiency

technology; Microsaic Systems, the developer of smaller-scale mass

spectrometry instruments; and Ilika, the material sciences

business.

A total of GBP1.9 million was realised from the sale of

qualifying investments, predominantly due to the profit taking in

Accesso (see above) and the sale of TLA. During the failed bid

period we were able to reduce the Company's holding in TLA and

continued to sell following the withdrawal of the bid.

Non-qualifying portfolio

We continued to add to the Company's position in the TB Amati UK

Smaller Companies Fund (the "Fund"). The Fund performed well

against its peer group (IA UK Smaller Companies) and its benchmark

(Numis Smaller Companies Index, plus AIM, excluding Investment

Companies) over the year.

The Company's non-qualifying holding in Hiscox, the mid cap

commercial and personal lines insurance group was sold to raise

cash for qualifying investments.

Outlook

The year ahead is likely to be characterised by more volatility

as Article 50 is triggered on this side of the Atlantic and an

unpredictable administration goes about its business stateside.

Investor sentiment will ebb and flow with this volatility and there

is little we can do to respond to it. If we sell a qualifying

holding in a good quality company, we can't buy it back in the

future. As ever, therefore, we need to be confident that the stocks

that we buy, and those that we hold, are in companies that we

believe can perform over the long term.

Alongside volatility, another headwind for 2017 is inflation,

which is already creeping into most areas of the economy but its

full force is yet to be felt by consumers and businesses. If this

does happen, the companies with real pricing power will become

apparent, will endure and should emerge stronger. The chief

underlying threat is of interest rates rising in an uncontrolled

fashion, particularly at the long end of the curve. After such a

long period of ultra low rates, no portfolio can be immune from

this. However, whilst we are cognisant of the macro risks, we

believe that smaller dynamic growth companies remain some of the

most compelling investment propositions, and this is what we seek

to buy and hold for the long term for the Amati VCTs.

Dr Paul Jourdan, Douglas Lawson and David Stevenson

Amati Global Investors

27 April 2017

AMATI GLOBAL INVESTORS

Dr Paul Jourdan is an award winning fund manager, with a strong

track record in small cap investment. He co-founded Amati Global

Investors following the management buyout of Noble Fund Managers

from Noble Group in 2010, having joined Noble in 2007 as Head of

Equities. His fund management career began in 1998 with Stewart

Ivory, which was taken over by First State in 2000 at which time

Paul became manager of what is now TB Amati UK Smaller Companies

Fund. In early 2005 he launched what is now Amati VCT and he also

manages Amati VCT 2 after the investment management contract moved

to Amati Global Investors in 2010. In September 2014 Amati launched

the Amati AIM IHT Portfolio Service, which Paul co-manages with

Douglas Lawson and David Stevenson. Prior to 1998 Paul worked as a

professional violinist, including a four year period with the City

of Birmingham Symphony Orchestra. He is CEO of Amati and a Director

of Sistema Scotland.

Douglas Lawson co-founded Amati Global Investors with Paul

Jourdan. Prior to this he worked in corporate finance and private

equity, initially focusing on middle market UK private equity and

listed company M&A at British Linen Advisors, and latterly as

an investment manager in the private equity team at Noble. Douglas

has co-managed the TB Amati UK Smaller Companies Fund and Amati VCT

since 2009, Amati VCT 2 since 2010 and the Amati AIM IHT Portfolio

Service since 2014. Douglas started his career at Ernst & Young

in London, where he qualified as a Chartered Accountant in 2002. He

is a Director of Amati.

David Stevenson joined Amati in 2012. In 2005 he was a

co-founding partner of investment boutique Cartesian Capital, which

managed a range of retail and institutional UK equity funds in long

only and long/short strategies. Prior to that he was Assistant

Director at SVM, where he also managed equity products including

the UK Opportunities small/midcap fund which was ranked top decile

for the 5 year period from inception to 2005. David started his

career at KPMG where he qualified as a Chartered Accountant. He

latterly specialised in corporate finance, before moving into

private equity with Dunedin Fund Managers. David has co-managed the

TB Amati UK Smaller Companies Fund and the Amati VCTs since 2012

and the Amati AIM IHT Portfolio Service since 2014.

INVESTMENT PORTFOLIO

as at 31 January 2017

Market Dividend

Cost Valuation Cap Yield(NTM) Fund

GBP'000 GBP'000 GBPm Sector Status % %

------------------------ -------- ---------- ------- ------------------- ------------- ------------ ------

TB Amati UK

Smaller Companies

Fund@ 2,815 3,898 - Financials OEIC 1.4 9.7

Accesso Technology

Group plc*@ 221 3,372 339.7 Technology AIM - 8.3

Quixant plc

@ 386 2,757 215.7 Technology AIM 0.7 6.8

IDOX plc*@ 239 2,115 262.8 Technology AIM 1.7 5.2

Keywords Studios

plc @ 437 1,917 293.9 Industrials AIM 0.2 4.7

Brooks Macdonald

Group plc @ 1,154 1,824 277.7 Financials AIM 2.4 4.5

AB Dynamics

plc @ 259 1,638 104.2 Industrials AIM 0.6 4.1

GB Group plc

@ 224 1,575 393.3 Technology AIM 0.9 3.9

Learning Technologies

Group plc*@ 746 1,564 185.2 Industrials AIM 0.6 3.9

Ideagen plc

@ 496 1,517 124.1 Technology AIM 0.3 3.8

Top Ten 6,977 22,177 54.9

Frontier Developments Consumer

plc @ 549 1,418 93.8 goods AIM - 3.5

Tristel plc Health

@ 439 1,370 66.1 care AIM 2.3 3.4

Science in Consumer

Sport plc @ 710 1,178 36.4 goods AIM - 2.9

Universe Group

plc*@ 244 901 19.7 Industrials AIM - 2.2

Anpario plc Health

@ 272 847 62.9 care AIM 2.2 2.1

LoopUp Group

plc*@ 470 808 70.1 Technology AIM - 2.0

SRT Marine

Systems plc*@ 579 741 49.8 Technology AIM - 1.9

Premier Technical

Services Group

plc @ 403 657 75.1 Industrials AIM - 1.6

Fox Marble

Holdings plc

Ordinary shares

& 8% Convertible

Loan Note*@ 818 618 13.1 Basic Materials AIM/Unquoted - 1.5

Consumer

Tasty plc 320 600 77.7 services AIM - 1.5

Top Twenty 11,781 31,315 77.5

FreeAgent Holdings

plc*@ 361 576 54.4 Technology AIM - 1.4

Hardide plc*@ 500 563 13.8 Basic materials AIM - 1.4

Bilby plc @ 574 544 21.8 Industrials AIM - 1.3

Faron Pharmaceuticals Health

Oy*@ 390 484 81.6 care AIM - 1.2

Solid State

plc @ 243 471 39.7 Industrials AIM 2.8 1.2

FairFX Group

plc*@ 463 447 44.1 Financials AIM - 1.1

Water Intelligence

plc @ 170 439 13.3 Industrials AIM - 1.1

Belvoir Lettings

plc*@ 339 395 37.2 Financials AIM 6.3 1.0

Netcall plc 110 355 80.7 Technology AIM 3.6 0.9

Sportsweb.com* 352 317 2.8 Industrials Unquoted - 0.8

MirriAd Advertising

Limited*@ 486 284 34.5 Technology Unquoted - 0.7

Dods (Group) Consumer

plc* 596 270 46.0 services AIM - 0.7

Venn Life Sciences Health

Holdings plc*@ 274 259 12.5 care AIM - 0.6

Synectics plc 342 246 32.0 Industrials AIM 2.5 0.6

Kalibrate Technologies

plc*@ 350 239 18.3 Technology AIM - 0.6

Health

Genedrive plc*@ 299 205 10.3 care AIM - 0.5

Brighton Pier

Group plc (The) Consumer

*@ 292 192 33.4 services AIM - 0.5

EU Supply plc*@ 330 190 8.8 Technology AIM - 0.5

MartinCo plc

@ 141 180 32.4 Financials AIM 6.5 0.5

Crawshaw Group Consumer

plc @ 369 162 14.6 services AIM - 0.4

Ilika plc*@ 192 158 36.8 Oil & Gas AIM - 0.4

Antenova Limited

Ordinary shares

& A Preference

Shares* 100 128 4.2 Telecommunications Unquoted - 0.3

Consumer

Mirada plc*@ 416 88 3.1 services AIM - 0.2

Rosslyn Data

Technologies

plc*@ 365 79 5.5 Technology AIM - 0.2

MyCelx Technologies

Corporation*@ 425 78 3.4 Oil & Gas AIM - 0.2

Sabien Technology

Group plc @ 501 77 1.3 Industrials AIM - 0.2

Allergy Therapeutics Health

plc* 29 68 152.8 care AIM - 0.2

Microsaic Systems

plc*@ 419 60 5.4 Industrials AIM - 0.1

Nujira Limited*@ 117 9 2.3 Technology Unquoted - -

Investments

held at nil

value 3,093 - - - - - -

------------------------ -------- ---------- ------- ------------------- ------------- ------------ ------

Total investments 24,419 38,878 96.3

------------------------ -------- ---------- ------- ------------------- ------------- ------------ ------

Net current

assets 1,507 3.7

------------------------ -------- ---------- ------- ------------------- ------------- ------------ ------

Net assets 24,419 40,385 100.0

------------------------ -------- ---------- ------- ------------------- ------------- ------------ ------

* Qualifying holdings.

Part qualifying holdings.

@ These investments are also held by other funds managed by

Amati.

The Manager rebates the management fee of 0.75% on the TB Amati

UK Smaller Companies Fund and this is included in the yield.

All holdings are in ordinary shares unless otherwise stated.

Investments held at nil value: Polyhedra Group plc*@, China Food

Company plc@; Sorbic International plc@, Rame Energy plc*@,

Conexion Media Group plc*, Rated People Limited*@, Celoxica

Holdings plc*, TCOM Limited*@.

As at the year end, the percentage of the Company's portfolio

held in qualifying holdings for the purposes of Section 274 of the

Income and Corporation Taxes Act 2007 is 90.25%.

(NTM) Next Twelve Months Consensus Estimates (no guidance given

for Bilby plc and Premier Technical Services plc). Source:

FactSet.

OBJECTIVES AND KEY POLICIES

Investment Policy

Below is the current Investment Policy of the Company. The

Company is seeking shareholder authority to amend its Investment

Policy. An explanation for the reasons behind the change in

Investment Policy is included on page 18 in the Annual Report and

the full text of the proposed new Investment Policy is included on

page 49 in the Annual Report.

Investment Objectives

The Investment Objectives of the Company are to generate tax

free capital gains and income on investors' funds through

investment primarily in AIM-traded companies whilst mitigating risk

appropriately within the framework of the structural requirements

imposed on all VCTs.

Risk Diversification

Portfolio risk will be mitigated through appropriate

diversification of holdings within the relevant portfolio.

The Manager may use exchange-traded or over-the-counter

derivatives with a view to reducing overall market risk in the

portfolio as a whole. The Manager shall only seek to hedge a

limited amount of market risk and shall always be covered by the

assets of the portfolio. The use of derivatives is on a strictly

controlled basis only and is part of a total risk mitigation

exercise, not a separate investment policy. The Company's

overriding investment principle in relation to the use of

derivatives is to seek to reduce any potential capital loss in the

equity portions of the Qualifying and Non-Qualifying Investment

portfolios in a falling market. The Manager has not used

exchange-traded or over-the-counter derivatives to date.

Asset Allocation

The Manager intends that by the date from which all funds raised

are required to meet the VCT qualifying rules, the Company's

investment profile (as defined by the valuation methodology set out

in sections 278-9 of the Income Tax Act 2007 in which assets are

valued on the basis of last purchase price rather than by market

price) will be approximately:

(i) Between 70% and 85% in Qualifying Investments, whether

equity or non-equity securities in (a) companies traded on AIM or

on ISDX, or (b) companies likely to seek a quotation on AIM or on

ISDX or (c) likely to be the subject of a trade sale within a 24

month period.

(ii) Between 0% and 30% in Non-Qualifying investments in small

and mid-sized companies where such companies are either (a) quoted

in London (b) constituents of the TB Amati UK Smaller Companies

Fund, (c) likely to seek a

quotation in London within a 24 month period, or (d) likely to

be the subject of a trade sale within a 24 month period.

Investments may also include derivative instruments.

(iii) Between 0% and 30% in cash or cash equivalents (including

money market funds) or government or investment grade bonds.

Consistent with the conditions for eligibility as an investment

company under the Companies Act 2006, any holdings by the Company

in shares or other securities in a company will not represent more

than 15% by value of the Company's investments.

While Qualifying investments are being sourced, the assets of

the portfolio which are not in Qualifying companies will be

actively invested by the Manager in a combination of the above

(always ensuring that no more than 15% of the Company's funds are

invested in any one entity).

As described above, the Manager will also have the facility to

seek to reduce market risk from the equity portfolio held by the

Company through the use of derivatives. The derivatives used will

either be traded on an over-the-counter market or will be

exchange-traded. They will be in highly liquid markets bearing a

reasonable level of correlation to the FTSE AIM All-Share Total

Return index, ensuring that the value is normally transparent, and

enabling positions to be closed rapidly when needed.

Strategy for Achieving Objectives

Qualifying Investments Strategy

The construction of the portfolio of Qualifying Investments is

driven by the availability of suitable opportunities. The Manager

may co-invest in companies in which other funds managed by Amati

Global Investors invest, in accordance with the Qualifying

Investments strategy.

The ability of VCTs to mitigate market risk is restricted by the

requirement to maintain a minimum of 70% of their assets (as

defined by the methodology set out in sections 278-9 of the Income

Tax Act 2007) in Qualifying Investments after an initial three year

period. A VCT's ability to invest and mitigate risk is therefore

restricted in three important respects:

(i) Qualifying Companies are likely to be small, liable to be

highly illiquid and their prospects can improve or deteriorate very

rapidly. The liquidity risk itself cannot be adequately

diversified, because larger, more liquid stocks cannot be purchased

in the qualifying portion of a VCT's portfolio;

(ii) Qualifying Investments have to be purchased as

opportunities arise. This is a long-term process, the pace of which

cannot be determined solely by the Manager; and

(iii) VCTs are less able to respond readily to the changing risk

environment in the market as a whole because the ability to sell

Qualifying Investments may be dependent on the opportunity to

replace that holding with another Qualifying Investment, and an

appropriate opportunity may not be available at the right time.

The Company seeks to address these issues through the

Non-Qualifying Investment strategy set out below. In addition the

Company benefits from an existing Qualifying Investment portfolio

of some maturity, in which, due to strong performance, the most

successful companies have tended to become the largest holdings.

This mature portfolio serves to mitigate the risks for subscribers

for New Ordinary Shares, as new Qualifying Investments purchased

with the proceeds of subscriptions will sit alongside well

established ones.

Non-Qualifying Investments Strategy

While Qualifying Investments are being sourced, the assets of

the portfolio which are not in Qualifying Companies will be

actively invested by the Manager in a combination of the following

(though ensuring that no more than 15% of the Company's funds are

invested in any one entity):

(i) direct equity and non-equity investments in small and

mid-sized companies quoted in London, or likely to seek a quotation

in London or to be sold within a 24 month period;

(ii) investment in the TB Amati UK Smaller Companies Fund;

(iii) government or investment grade corporate bonds; and

(iv) money market funds.

The Manager seeks to adjust the non-qualifying portfolio to

reflect the nature of Qualifying Investments as they are purchased,

such that the portfolio remains well balanced and diversified. If

the Manager holds a negative outlook on the equity markets then

funds may be invested in cash or bonds as outlined above, and, in

addition, the Manager may seek to reduce market risk in the equity

portfolio with the use of suitable derivative instruments. Asset

allocation between these categories will remain flexible.

In relation to the use of derivatives, the directors and the

Manager believe that their use under the controlled and prudent

parameters which have been put in place in relation to the Company

could help to reduce the total risk facing investors in relation to

their investments. The Company has not made use of derivative

investments to date.

The use of derivatives will not prevent the Company from losing

money overall in a falling market. However, insofar as derivatives

are used, the Manager's objective will be partially to reduce

losses and also to provide cash for investment at moments when the

market is weak. The Company will only enter into such transactions

for the purposes of efficient portfolio management in line with

conventional practice.

Strict internal guidelines on the use of derivatives have been

put in place by the Manager. Additionally, such derivatives as are

used are required to offer both good liquidity and, in the

Manager's opinion, reasonable correlation to the AIM market. Your

attention is drawn to the risk factors relating to the use of

derivatives set out on page 11 of the Annual Report.

The Manager is under no obligation to use any one of these

approaches and provides no guarantee that market risk management

will be in place during a falling market. The use of any or all of

these instruments will reflect the Manager's view of the market

risks which may be taken at any time.

Key Performance Indicators

The Board expects the Manager to deliver a performance which

meets the objectives of the Company. A review of the Company's

performance during the financial year, the position of the Company

at the year end and the outlook for the coming year is contained in

the Chairman's Statement and Fund Manager's Review. The Board

monitors on a regular basis a number of key performance indicators

which are typical for VCTs, the main ones being:

-- Compliance with HMRC VCT regulations to maintain the

Company's VCT Status. See page 14 in the Annual Report.

-- Net asset value and total return to shareholders (the

aggregate of net asset value and cumulative dividends paid to

shareholders, assuming dividends re-invested at ex-dividend date).

See graphs on pages 1 and 2 in the Annual Report.

-- Dividend distributions. See table of investor returns on page 2 in the Annual Report.

-- Share price. See key data on page 2 in the Annual Report.

-- Ongoing charges ratio. See key data on page 2 in the Annual Report.

FUND MANAGEMENT AND KEY CONTRACTS

Management Agreement

Amati Global Investors was appointed as Manager to the Company

on 22 March 2010. Under an Investment Management and Administration

Agreement ("IMA") dated 22 March 2010 the Manager has agreed to

manage the investments and other assets of the Company on a

discretionary basis subject to the overall policy of the directors.

The Company will pay to the Manager under the terms of the IMA a

fee of 1.75% of the net asset value of the Company in arrears. In

November 2014, with shareholder consent, the Company amended its

non-qualifying investment policy to permit investment in the TB

Amati UK Smaller Companies Fund, a small and mid cap fund managed

by the Manager. The Company will receive a full rebate on the fees

payable by the Company to the Manager within this fund either

through a reduction of fees payable by the Company or a direct

payment by the Manager.

Annual running costs are capped at 3.5% of the Company's net

assets, any excess being met by the Manager by way of a reduction

in future management fees. The annual running costs include the

directors' and Manager's fees, professional fees and the costs

incurred by the Company in the ordinary course of its business (but

excluding any commissions paid by the Company in relation to any

offers for subscription, irrecoverable VAT and exceptional costs,

including winding-up costs). No performance fee is payable as the

Manager has waived all performance fees from 31 July 2014

onwards.

Administration Arrangements

Under the IMA, the Manager has also agreed to provide

secretarial and administration services for the Company. The

Manager has engaged The City Partnership (UK) Limited to act as

company secretary and Capita Asset Services to act as fund

administrator. The fee in respect of these services payable to the

Manager for the year ended 31 January 2017 is GBP76,000; this fee

is paid annually in arrears and is subject to an annual increase in

line with the retail prices index.

The appointment of the Manager as investment manager and/or

administrator and company secretary may be terminated on one year's

notice.

Fund Manager's Engagement

The Board regularly appraises the performance and effectiveness

of the managerial and secretarial arrangements of the Company. As

part of this process, the Board will consider the arrangements for

the provision of investment management and other services to the

Company on an ongoing basis and a formal review is conducted

annually. In the opinion of the Board, the continuing appointment

of the Manager, on the terms agreed, is in the interests of the

shareholders. The directors are satisfied that the Manager will

continue to manage the Company in a way which will enable the

Company to achieve its objectives.

VCT Status Adviser

Philip Hare & Associates LLP ("Philip Hare &

Associates") are engaged to advise the Company on compliance with

VCT requirements. Philip Hare & Associates reviews new

investment opportunities, as appropriate, and reviews regularly the

investment portfolio of the Company. Philip Hare & Associates

works closely with the Manager but reports directly to the

Board.

OTHER MATTERS

VCT REGULATION

The Company's investment policy is designed to ensure that it

meets the requirements of HM Revenue & Customs to qualify and

to maintain approval as a VCT.

(i) The Company must, within three years of raising funds,

maintain at least 70% of its investments by VCT value (cost, or the

last price paid per share, if there is an addition to the holding)

in shares or securities comprised in qualifying holdings, of which

at least 70% by VCT value must be ordinary shares which carry no

preferential rights (for funds raised prior to April 2011 at least

30% by VCT value must be in ordinary shares which carry no

preferential rights).

(ii) It may not invest more than 15% of its investments in a

single company and it must have at least 10% by VCT value of its

total investments in any qualifying company in qualifying shares

approved by HM Revenue & Customs.

(iii) To be classed as a VCT qualifying holding, companies in

which investments are made must have no more than GBP15 million of

gross assets at the time of investment and GBP16 million after

investment; they must be carrying on a qualifying trade and satisfy

a number of other tests including those outlined below; the

investment must also be made for the purpose of promoting growth or

development.

(iv) VCTs may not invest new capital in a company which has

raised in excess of GBP5 million from all sources of state-aided

capital within the 12 months prior to and including the date of

investment.

(v) No investment may be made by a VCT in a company that causes

that company to receive more than GBP12 million (GBP20 million if

the company is deemed to be a Knowledge Intensive Company) of state

aid investment (including from VCTs) over the company's lifetime. A

subsequent acquisition by the investee company of another company

that has previously received State Aid Risk Finance can cause the

lifetime limit to be exceeded.

(vi) No investment can be made by a VCT in a company whose first

commercial sale was more than 7 years prior to date of investment,

except where previous State Aid Risk Finance was received by the

company within 7 years (10 years in each case for Knowledge

Intensive Company) or where both a turnover test is satisfied and

the money is being used to enter a new product or geographical

market.

(vii) No funds received from an investment into a company can be

used to acquire another existing business or trade.

(viii) Since 6 April 2016 a VCT must not make "non-qualifying"

investments except for certain specified investments held for

liquidity purposes and redeemable within seven days. These include

investments in UCITS (Undertakings for Collective Investments in

Transferable Securities) funds, AIF (Alternative Investment Funds)

and in shares and securities purchased on a Regulated Market. In

each of these cases the restrictions in (iv) - (vii) above are not

applied. Non-qualifying investments in AIM-quoted shares are not

permitted as AIM is not a Regulated Market.

Prior to making any qualifying investment the Manager requests

HMRC VCT clearance letters from investee companies and takes advice

from Philip Hare & Associates to ensure the documentation

regarding the investment does not contravene the qualifying status

of the investment. The Manager monitors compliance with VCT

qualifying rules on a day to day basis through a combination of

automated and manual compliance checks in place within the

business. Philip Hare & Associates also review the portfolio

bi-annually to ensure the Manager has complied with regulations and

has reported to the Board that the VCT has met the necessary

requirements during the year.

PRINCIPAL RISKS AND UNCERTAINTIES

The Board considers that the Company faces the following major

risks and uncertainties:

Investment Risk

A substantial portion of the Company's investments are in small

AIM traded companies as well as some unquoted companies. By their

nature these investments involve a higher degree of risk than

investment in larger fully listed companies. These companies tend

to have limited product lines and niche markets. They can be

reliant on a few key individuals. They can be dependent on securing

further financing. In addition, the liquidity of these shares can

be low and the share prices volatile.

To reduce the risk, the Board places reliance upon the skills

and expertise of the Manager and its strong track record for

investing in this segment of the market. Investments are actively

and regularly monitored by the Manager and the Board receives

detailed reports on the portfolio in addition to the Manager's

report at regular Board meetings. The Manager also seeks to limit

these risks through building a highly diversified portfolio with

companies in different sectors and markets at different stages of

development.

Venture Capital Trust Approval Risk

The current approval as a venture capital trust allows investors

to take advantage of income tax reliefs on initial investment and

ongoing tax-free capital gains and dividend income. Failure to meet

the qualifying requirements could result in investors losing the

income tax relief on initial investment and loss of tax relief on

any tax-free income or capital gains received. In addition, failure

to meet the qualifying requirements could result in a loss of

listing of the shares.

To reduce this risk, the Board has appointed the Manager which

has significant experience in venture capital trust management, and

is used to operating within the requirements of the venture capital

trust legislation. In addition, to provide further formal

reassurance, the Board has appointed Philip Hare & Associates

as taxation adviser to the Company. Philip Hare & Associates

reports every six months to the Board to confirm independently

compliance with the venture capital legislation, to highlight areas

of risk and to inform on changes in legislation.

Compliance Risk

The Company has a premium listing on the London Stock Exchange

and is required to comply with the rules of the UK Listing

Authority, as well as with the Companies Acts, Financial Reporting

Standards and other legislation. Failure to comply with these

regulations could result in a delisting of the Company's shares, or

other penalties under the Companies Acts or from financial

reporting oversight bodies.

In July 2013 the Alternative Investment Fund Directive ("AIFMD")

was implemented, a European directive affecting the regulation of

VCTs. Amati VCT 2 has been entered in the register of small

registered UK AIFMs on the Financial Services register at the

Financial Conduct Authority ("FCA"). As a registered firm there are

a number of regulatory obligations and reporting requirements which

must be met in order to maintain its status as an AIFM.

Board members and the Manager have considerable experience of

operating at senior levels within quoted businesses. In addition,

the Board and the Manager receive regular updates on new regulation

from the auditor, lawyers and other professional bodies.

Internal Control Risk

Failures in key controls within the Board or within the

Manager's business could put assets of the Company at risk or

result in reduced or inaccurate information being passed to the

Board or to shareholders.

The Board seeks to mitigate the internal control risk by setting

policy, regular reviews of performance, enforcement of contractual

obligations and monitoring progress and compliance. Details of the

Company's internal controls are on pages 22 and 23 in the Annual

Report.

Financial Risk

By its nature, as a venture capital trust, the Company is

exposed to market price risk, credit risk, liquidity risk and

interest rate risk. The Company's policies for managing these risks

are outlined in full in notes 19 to 22 to the financial statements

on pages 45 to 47 in the Annual Report.

The Company is financed through equity.

Liquidity Risk

The Company's investments may be difficult to realise. As a

closed-end vehicle the Company does have the long-term funding

appropriate to making investments in illiquid companies. However,

if the underlying investee companies run into difficulties then

their shares can become illiquid for protracted periods of time. In

these circumstances the Manager would work with the investee

company and its advisors to seek appropriate solutions.

Market Risk

Investment in AIM-traded, ISDX-traded and unquoted companies, by

its nature, involves a higher degree of risk than investment in

companies on the main market. In particular, smaller companies

often have limited product lines, markets or financial resources

and may be dependent for their management on a smaller number of

key individuals. At times of adverse market sentiment the shares of

small companies can become very difficult to sell, and values can

fall rapidly. The Company's closed-end structure is important in

this regard, in that it is less likely to become a forced seller at

such points. The Company's investment policy also allows the

Manager to invest in much larger more liquid companies through

non-qualifying holdings. These can provide liquidity in times of

market adversity.

Economic Risk

Events such as economic recession, not only in the UK, but also

in the core markets relevant to our investee companies, together

with a movement in interest rates, can affect investor sentiment

towards liquidity risk, and hence have a negative impact on the

valuation of smaller companies. The Manager seeks to mitigate this

risk by seeking to adopt a suitable investment style for the

current point in the business cycle, and to diversify the exposure

to geographic end markets.

Reputational Risk

Inadequate or failed controls might result in breaches of

regulations or loss of shareholder trust. The Manager operates a

robust risk management system which is reviewed regularly to ensure

the controls in place are effective in reducing or eliminating

risks to the Company. Details of the Company's internal controls

are on pages 22 and 23 in the Annual Report.

Operational Risk

Failure of the Manager's, or other contracted third parties',

accounting systems or disruption to their businesses might lead to

an inability to provide accurate reporting and monitoring or loss

to shareholders. The Manager regularly reviews the performance of

third party suppliers at monthly management meetings and quarterly

board meetings of the Manager.

STATEMENT ON LONG-TERM VIABILITY

In accordance with the revisions to the UK Corporate Governance

Code in 2014 (the "2014 Code"), the directors have carried out a

robust assessment of the prospects of the Company for the period to

January 2022, taking into account the Company's current position

and principal risks, and are of the opinion that, at the time of

approving the financial statements there is a reasonable

expectation that the Company will be able to continue in operation

and meet liabilities as they fall due over that period.

The directors consider that for the purpose of this exercise it

is not practical or meaningful to look forward over a period of

more than five years. This time frame allows for reasonable

forecasts to be made to allow the Board to provide shareholders

with reasonable assurance over the viability of the Company. In

making their assessment the directors have taken into account the

nature of the Company's business and Investment Policy, its risk

management policies, the diversification of its portfolio, the cash

holdings and the liquidity of non-qualifying investments.

OTHER DISCLOSURES

The Company had no employees during the year and has three

non-executive directors, two of which are male and one is female.

The Company, being an investment company with no employees, has no

policies in relation to environmental matters, social, community

and human rights issues.

On behalf of the Board

Julian Avery

Chairman

27 April 2017

BOARD OF DIRECTORS

Julian Avery is Chairman of the Company. He is a solicitor and

was chief executive of Wellington Underwriting plc until September

2004. He was a non-executive director of Aspen Insurance Holdings

Limited until May 2007 and chairman of Equity Insurance Group until

its acquisition by the Australian insurance group, IAG in January

2007. He was a non-executive director of Warner Estate Holdings plc

and Charles Taylor plc. He was also previously a senior adviser to

Fenchurch Advisory Partners. He is a Trustee of the Butler Trust

and President of St. Michael's Hospice, Hastings.

Mike Killingley is a former non-executive chairman of a number

of AIM and listed companies, including Beale plc, Southern Vectis

plc, Conder Environmental plc and Advanced Technology (UK) plc, and

a former non-executive director of AIM-quoted Falkland Islands

Holdings plc. He was a senior partner with KPMG, chartered

accountants, from 1988 until retiring from the firm in 1998; he is

Chairman of the audit committee of the Company and the senior

independent director.

Susannah Nicklin is an investment and financial services

professional with 20 years of experience in executive roles at

Goldman Sachs and Alliance Bernstein in the US, Australia and the

UK. She has also worked in the social impact private equity sector

with Bridges Ventures and the Global Impact Investing Network.

Susannah is a non-executive director and senior independent

director at Pantheon International Plc and a member of the

investment committee of private equity fund Impact Ventures UK. She

is a CFA charterholder and member of STEP.

DIRECTORS' REPORT

Directors

The directors of the Company during the year under review were

Julian Avery, Mike Killingley, Christopher Macdonald, Christopher

Moorsom and Susannah Nicklin. The current directors of the Company

are Julian Avery, Mike Killingley and Susannah Nicklin. The Company

indemnifies its directors and officers and has purchased insurance

to cover its directors.

Dividend

The Board is recommending a final dividend of 4.25p per share

for the year ended 31 January 2017 payable on 21 July 2017.

Share Capital

There were 32,643,069 ordinary shares in issue at the year end.

During the year 3,031,153 shares in the Company were allotted at an

average price of 114.07p per share raising GBP3.4m net of issue

costs. Since the year end, 1,884,298 shares have been issued under

the Top Up Offer, please refer to Note 15 on page 42 in the Annual

Report for further details.

During the year 647,573 shares in the Company with a nominal

value of 5p per share were bought back for an aggregate

consideration of GBP0.7m at an average price of 109.11p per share

(representing 2.1% of the shares in issue at 31 January 2016). All

of the shares were cancelled after purchase. The purpose of the

share buybacks was to satisfy demand from those shareholders who

sought to sell their shares during the period, given that there is

a very limited secondary market for shares in Venture Capital

Trusts generally. It remains the Board's policy to buy back shares

in the market, subject to the overall constraint that such

purchases are in the Company's interest including the maintenance

of sufficient resources for investment in new and existing investee

companies and the continued payment of dividends to shareholders.

At the Company's year end authority remains for the Company to buy

back 4,365,694 shares.

The rights and obligations attached to the Company's ordinary

shares are set out in the Company's Articles of Association, copies

of which can be obtained from Companies House. The Company has one

class of share, ordinary shares, which carry no right to fixed

income. The holders of ordinary shares are entitled to receive

dividends when declared, to receive the Company's report and

accounts, to attend and speak at general meetings, to appoint

proxies and to exercise voting rights. There are no restrictions on

the voting rights attaching to the Company's shares or the transfer

of securities in the Company.

Annual General Meeting

Authority to Allot Shares

At a general meeting of the Company held on 7 March 2013 the

following resolution was passed: The directors were authorised

pursuant to Section 551 of the Companies Act 2006 to allot relevant

securities up to a maximum aggregate nominal value of GBP1,250,000.

This authority expires on 7 March 2018; a resolution to renew this

authority is being proposed at the AGM to be held on 28 June

2017.

New Investment Policy

The Company's current investment policy as set out on page 11 in

the Annual Report dates back to the change of manager to Amati

Global Investors in March 2010, when the policy was made the same

as that of Amati VCT. This policy was drawn up at the launch of

Amati VCT in 2005 and was designed with the initial investment

phase in mind. Since then, and particularly in the last few years,

the VCT legislation has changed profoundly. The changes introduced

during 2015 in particular have meant that some of the original

investment policy is now in conflict with the legislation and is

therefore unsuitable. In particular there are now severely limited

options over what non-qualifying investments VCTs can make. As a

result the Board is proposing a resolution at the AGM that an

updated investment policy be adopted by the Company. The proposed

policy is set out on page 49 in the Annual Report. It is much

simplified and more accurately reflects the current VCT legislation

and the ways in which the Company has adapted to the new rules in

practice.

The formal investment policy has been reduced to two sections,

Investment Policy and Strategy for Achieving Objectives. The

Company's principal activity of making qualifying investments

predominantly in AIM or NEX Exchange ("NEX") traded companies

remains unaltered. The non-qualifying investment policy is now

completely aligned with what is allowed under the VCT legislation,

so that the VCT will be able to make the few types of investment

that the legislation allows for and nothing more. The strategy for

achieving the objectives is set out separately from the formal

investment policy, and may therefore be amended by the Board

without a further AGM resolution being put to shareholders. The

non-qualifying investment policy is mainly reduced in scope from

the previous investment policy, but is more permissive in two

respects: it would potentially allow the Company to invest in UCITS

(Undertakings for Collective Investments in Transferable

Securities) funds other than the TB Amati UK Smaller Companies

Fund; and allows it to invest in any corporate bonds which are

listed on a Recognised Exchange, whereas previously the scope for

investing in corporate bonds was based on the requirement to be

investment grade. The Board does not regard either of these

elements as significant changes.

Electronic Communications

The Company is seeking shareholders' consent to send or supply

documents and information ("Documents and Information") to them in

electronic form and via its website (www.amatiglobal.com).

Increased use of electronic communications will deliver savings to

the Company in terms of administration, printing and postage costs,

as well as speeding up the provision of information to

shareholders. The reduced use of paper will also have environmental

benefits. Under the proposal, when new Documents and Information

become available on the website, we will notify you by letter to

your normal address or, if you have consented to email notification

and provided an email address, by email.

The directors recommend that shareholders vote in favour of this

resolution and sign up to Electronic Communications as described in

further detail on page 50 in the Annual Report by completing the

Consent Form.

Substantial Shareholdings

At the year end and at the date of this report there was no

individual shareholding exceeding 3% of the issued ordinary share

capital.

Auditor

A resolution to re-appoint BDO LLP as auditor will be proposed

at the forthcoming AGM.

Global Greenhouse Gas Emissions

All of the Company's activities are outsourced to third parties.

The Company therefore has no direct greenhouse gas emissions to

report from its operations.

Going Concern

In accordance with FRC Guidance for directors on going concern

and liquidity risk the directors have assessed the prospects of the

Company for the foreseeable future and are of the opinion that, at

the time of approving the financial statements, the Company has

adequate resources to continue in business. In reaching this

conclusion the directors took into account the nature of the

Company's business and Investment Policy, its risk management

policies, the diversification of its portfolio, the cash holdings

and the liquidity of non-qualifying investments. The Company's

business activities, together with the factors likely to affect its

future development, performance and position including the

financial risks the Company is exposed to are set out in the

Strategic Report on pages 14 to 16 in the Annual Report. As a

consequence, the directors have a reasonable expectation that the

Company has sufficient cash and liquid investments to continue to

operate and that together with funds raised after the end of the

financial year under the new offer the Company is well placed to

manage its business risks successfully and meet its liabilities as

they fall due. Thus the directors believe it is appropriate to

continue to apply the going concern basis in preparing the

financial statements.

Accountability and Audit

The independent auditor's report is set out on pages 28 to 30 of

the Annual Report. The directors who were in office on the date of

approval of these Annual Report and Financial Statements have

confirmed that, as far as they were aware, there is no relevant

audit information of which the auditor is unaware. Each of the

directors has taken all the steps they ought to have taken as

directors in order to make themselves aware of any relevant audit

information and to establish that it has been communicated to the

auditor.

Financial Instruments

The Company's financial instruments comprise equity and fixed

interest investments, cash balances and liquid resources including

debtors and creditors. Further details, including details about

risk management, are set out in the Strategic Report and in Notes

18 to 22 on pages 44 to 47 in the Annual Report.

Future Developments

Significant events which have occurred after the year end are

detailed in Note 15 on page 42 in the Annual Report. Future

developments which could affect the Company are discussed in the

outlook sections of the Chairman's Statement and Fund Manager's

Review.

On behalf of the Board

Julian Avery

Chairman

27 April 2017

STATEMENT OF CORPORATE GOVERNANCE

Background

The Board of Amati VCT 2 plc has considered the principles and

recommendations of the AIC Code of Corporate Governance ("AIC

Code") by reference to the AIC Corporate Governance Guide for

Investment Companies ("AIC Guide") available on the AIC website

www.theaic.co.uk. The AIC Code, as explained by the AIC Guide,

addresses all the principles set out in the UK Corporate Governance

Code (the "Code"), as well as setting out additional principles and

recommendations on issues which are of specific relevance to the

Company. The Board considers that reporting against the principles

and recommendations of the AIC Code, and by reference to the AIC

Guide (which incorporates the Code), will provide better

information to shareholders.

The Company has complied with the recommendations of the AIC

Code and the relevant provisions of the Code except as set out

below.

The Code includes provisions relating to:

-- the role of the chief executive

-- executive directors' remuneration

-- the need for an internal audit function

For the reasons set out in the AIC Guide, and in the preamble to

the Code, the Board considers these provisions are not relevant to

the position of the Company, being an investment company. The

Company has therefore not reported further in respect of these

provisions.

Board of Directors

The Company has a Board of three directors, all of whom are

considered independent non-executive directors under the AIC Code.

As all directors have acted in the interests of the Company

throughout the period of their appointment and demonstrated

commitment to their roles the Board recommends they be re-elected

at the AGM.

The Company may by ordinary resolution appoint any person who is

willing to act as a director, either to fill a vacancy or as an

additional director. No director has a contract of service with the

Company. All of the directors have been provided with letters of

appointment which are available for inspection by shareholders

immediately before and after the Company's annual general

meeting.

Directors are provided with key information on the Company's

activities including regulatory and statutory requirements and

internal controls by the Manager. The Manager, in the absence of

explicit instructions from the Board, is empowered to exercise

discretion in the use of the Company's voting rights. All

shareholdings are voted, where practical, in accordance with the

Manager's own corporate governance policy, which is to seek to

maximise shareholder value by constructive use of votes at company

meetings and by endeavouring to use its influence as an investor

with a principled approach to corporate governance.

The AIC Code states that the Board should have a formal schedule

of matters specifically reserved to it for decision, to ensure that

it has firm direction and control of the Company. This is achieved

by a management agreement between the Company and the Manager,

which sets out the matters over which the Manager has authority and

the limits above which Board approval must be sought. All other

matters including strategy, investment and dividend policies,

gearing and corporate governance proceedings are reserved for the

approval of the Board of directors. All the directors are equally

responsible for the proper conduct of the Company's affairs. In

addition, the directors are responsible for ensuring that the

policies and operations are in the best interests of all the

Company's shareholders and that the best interests of creditors and

suppliers to the Company are properly considered. The chairman and

the company secretary establish the agenda for each Board meeting.

The necessary papers for each meeting are distributed well in

advance of each meeting ensuring all directors receive

accurate, timely and clear information.

Independence of Directors

The Board regularly reviews the independence of each director

and of the Board as a whole in accordance with the guidelines in

the AIC Code. Directors' interests are noted at the start of each

Board meeting and any director would not participate in the

discussion concerning any investment in which he had an interest.

The Board does not consider that length of service will necessarily