Proxy Statement - Other Information (preliminary) (pre 14c)

August 02 2022 - 10:23AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement

Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box::

| | ☒ | Preliminary Information Statement |

| | ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| | ☐ | Definitive Information Statement |

| YINFU GOLD CORPORATION |

| (Name of Registrant As Specified In Its Charter) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: Common stock, $0.001 par value |

| (2) | Aggregate number of securities to which transaction applies: 9,917,592 |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): N/A |

| (4) | Proposed maximum aggregate value of transaction: N/A |

| (5) | Total fee paid: N/A |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

YINFU GOLD CORPORATION

Suite 2408, Dongfang Science and Technology Mansion, Nanshan District, Shenzhen,

China 518000) Tel: (86)755-8316-0998

July 29, 2022

Dear Stockholder:

We are furnishing the enclosed information statement to you in connection with a proposal to complete a reverse split of our issued and outstanding common stock, par value $0.001, at the ratio of one (1) new share for every five (5) existing shares (the “Reverse Split”). Upon the completion of the Reverse Split, our issued and outstanding common stock is expected to decrease from 9,917,592 shares to approximately 1,983,518 shares, with each fractional share being rounded up to the nearest whole share. Our authorized capital of 3,000,000,000 common shares will not be affected by the reverse split.

WE ARE NOT ASKING FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Our Board of Directors reviewed and unanimously approved the Reverse Split by consent resolutions dated July 6, 2022. The holders of a majority of our issued and outstanding stock also approved the Reverse Split by written consent dated July 6, 2022. However, pursuant to applicable securities laws the Reverse Split will not be affected until at least 20 days after this information statement has been provided to our stockholders who did not previously consent to the Reverse Split.

By Order of the Board of Directors:

| /s/ Jiang Libin | | |

| Jiang Libin President, Secretary, Treasurer, Director | | |

INFORMATION STATEMENT

Introduction

The holders of a majority of our issued and outstanding stock on a fully-converted basis have taken an action by written consent without a meeting, pursuant to the Wyoming Business Corporation Act, to approve a reverse split of our issued and outstanding common stock, par value $0.001, at the ratio of one (1) new share for every five (5) existing shares (the “Reverse Split”). The purpose of the Reverse Split is to reorganize our capital structure, which management believes will better position us to attract financing.

This information statement is being filed pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and provided to our stockholders pursuant to Rule 14c-2 under the Exchange Act.

WE ARE NOT ASKING FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

We are a fully reporting Exchange Act company incorporated under the laws of the State of Wyoming. Our common stock is currently quoted on the OTC Bulletin Board and OTCQB under the trading symbol ELRE. Information about us can be found in our most recent quarterly report on Form 10-Q for the period ended December 31, 2021 and our annual report on Form 10-K for the fiscal year ended March 31, 2022, both filed with the Securities and Exchange Commission (the “SEC”). Additional information about us can be found in our public filings that can be accessed electronically by means of the SEC’s home page on the Internet at http://www.sec.gov, as well as by other means from the offices of the SEC.

We will incur all costs associated with preparing, printing and mailing this information statement.

Item 1. Information Required by Items of Schedule 14A

Date, Time and Place Information

There will not be a meeting of our stockholders to approve the Reverse Split and we are not required to hold a meeting under the Wyoming Business Corporation Act, when a corporate action has been approved by the written consent of holders of a majority of our stock entitled to vote on the matter.

Dissenters’ Right of Appraisal

Under the Wyoming Business Corporation Act, our stockholders do not have dissenters’ rights in connection with the Reverse Split.

Voting Securities and Principal Holders Thereof

The record date for the determination of stockholders entitled to consent to the Reverse Split was July 6, 2022 (the “Record Date”). As of that date, we had 9,917,592 issued and outstanding shares of common stock, par value $0.001. Each share of our common stock entitles the holder thereof to one vote on each matter that may come before a meeting or vote of our stockholders.

The Reverse Split was approved by the holders of a majority of our stock entitled to vote on the Record Date. The vote required to approve the Reverse Split was 50% of the shares entitled to vote plus one vote, a simple majority. The actual affirmative vote was 59.30% of the issued shares.

Under applicable securities laws, we are not permitted to effect the Reverse Split until at least 20 days after we distribute a definitive information statement to our stockholders who have not previously consented to the corporate action.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding our common stock beneficially owned as of the Records Date for (i) each stockholder known to be the beneficial owner of 5% or more of our outstanding shares of common stock, (ii) each of our officers and directors and (iii) our officers and directors as a group. A person is considered to beneficially own any shares over which such person, directly or indirectly, exercises sole or shared voting or investment power, or over which such person has the right to acquire beneficial ownership at any time within 60 days through an exercise of stock options or warrants or otherwise. Unless otherwise indicated, voting and investment power relating to the shares shown in the table for our officers and directors is exercised solely by the beneficial owner thereof.

For the purposes of this table, a person or group of persons is deemed to have “beneficial ownership” of any shares of our common stock that such person has the right to acquire within 60 days of the date of this information statement. For the purposes of computing the percentage of outstanding shares of our common stock held by each person or group of persons named above, any shares that such person or persons has the right to acquire within 60 days of the date hereof is deemed to be outstanding, but is not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. The inclusion herein of any shares listed as beneficially owned does not constitute an admission of beneficial ownership .

| Name and Address of Beneficial Owner(1) | Amount of Beneficial Ownership | Nature of Beneficial Ownership | Percentage (2) of Class |

| Jiang Libin | 400,000 | Common shares(direct) | 4.03% |

| Wu Fengqun | 887,478 | Common shares(direct) | 8.95% |

| Huang Jing | 861,199 | Common shares(direct) | 8.68% |

| Chen Guowei | 760,112 | Common shares(direct) | 7.66% |

| Lai Jinhui | 448,930 | Common shares(direct) | 4.53% |

| Chen Yuefang | 402,472 | Common shares(direct) | 4.06% |

| Ye Jianu | 402,005 | Common shares(direct) | 4.05% |

| Mai Jieling | 233,651 | Common shares(direct) | 2.36% |

| Wang Yuguang | 200,000 | Common shares(direct) | 2.02 |

| Zhang Hong | 153,170 | Common shares(direct) | 1.54% |

| Yan FungKam | 137,900 | Common shares(direct) | 1.39% |

| Yu Xiaoping | 105,000 | Common shares(direct) | 1.06% |

| Xue Hanwei | 62,350 | Common shares(direct) | 0.63% |

| Qu Cuie | 55,000 | Common shares(direct) | 0.55% |

| Tsang Yuk Chuen | 50,000 | Common shares(direct) | 0.50% |

| Li Jinmei | 40,810 | Common shares(direct) | 0.41% |

| Wang Xian | 30,000 | Common shares(direct) | 0.30% |

| Ma Ning | 100,000 | Common shares(direct) | 1.01% |

| Sun Ming | 51,375 | Common shares(direct) | 0.52% |

| Zhang Jing | 29,700 | Common shares(direct) | 0.30% |

| He Maoyuan | 40,000 | Common shares(direct) | 0.40% |

| Deng Weilang | 40,000 | Common shares(direct) | 0.40% |

| Zheng Yang | 30,000 | Common shares(direct) | 0.30% |

| Ma Ying Ying | 30,000 | Common shares(direct) | 0.30% |

| Cheng Jie | 52,380 | Common shares(direct) | 0.53% |

| Zhang Hongfa | 47,878 | Common shares(direct) | 0.48% |

| Hu Guang | 43,073 | Common shares(direct) | 0.43% |

| Yang Xuhong | 31,948 | Common shares(direct) | 0.32% |

| Zhao Jing | 45,627 | Common shares(direct) | 0.46% |

| Shi Xiangyan | 21,645 | Common shares(direct) | 0.22% |

| Wu Jiande | 21,645 | Common shares(direct) | 0.22% |

| Liang Liufeng | 19,784 | Common shares(direct) | 0.20% |

| Gao Shuiqing | 15,455 | Common shares(direct) | 0.16% |

| Lu Zhongqin | 17,316 | Common shares(direct) | 0.17% |

| Sun Weixiang | 15,411 | Common shares(direct) | 0.16% |

| Total | 5,883,314 | Common shares(direct) | 59.30% |

| (1) | The persons named above known to be a beneficial owner of 5% or more of the Company’s stock may be deemed to be a “parent” and “promoter” of the Company, within the meaning of such terms under the Securities Act of 1933, as amended, by virtue of his direct holdings in the Company. |

| | |

| (2) | Based on 9,917,592 shares issued and outstanding as of July 6, 2022. |

TOTAL SHARES VOTING: 5,883,314

Amendment of Charter, Bylaws or Other Documents

Not applicable.

Item 2. Statement that Proxies are not Solicited

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Item 3. Interest of Certain Persons in or in Opposition to Matters to be Acted Upon

Our current officers and directors have an interest in the Reverse Split as a result of their ownership of shares of our issued and outstanding common stock. However, we do not believe that they have any interest that differs from or is greater than that of our other stockholders.

Item 4. Proposals by Security Holders

None.

Item 5. Delivery of Documents to Security Holders

We undertake to deliver promptly upon written or oral request a separate copy of this information statement to any stockholder at a shared address to which a single copy of the document was delivered. A stockholder can notify us that he or she wishes to receive a separate copy of this information statement or any future information statement by writing to us at Suite 2313, Dongfang Science and Technology Mansion, Nanshan District, Shenzhen, China 518000)

Stockholders sharing the same address can also request delivery of a single copy of annual reports to security holders, information statements or Notices of Internet Availability of Proxy Materials if they are receiving multiple of such documents in the same manner.

By Order of the Board of Directors:

| By: | /s/ Jiang Libin | |

| | Jiang Libin | |

| | President, Secretary, Treasurer, Director | |

Dated: August 2, 2022

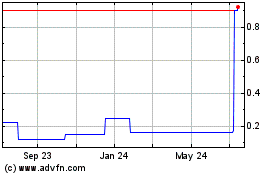

Yinfu Gold (PK) (USOTC:ELRE)

Historical Stock Chart

From Dec 2024 to Jan 2025

Yinfu Gold (PK) (USOTC:ELRE)

Historical Stock Chart

From Jan 2024 to Jan 2025