Yara Hopes To Restart Libyan Fertilizer Plant Venture In 2012

February 07 2012 - 8:41AM

Dow Jones News

The Norwegian fertilizer company Yara International ASA (YAR.OS)

said Tuesday that Libyan gas infrastructure must be intact for it

to be able to start up the jointly controlled Lifeco plant in Libya

in 2012. The company hopes to start production in the third quarter

and increase to full capacity by the end of the year.

It is "very important" that the country's infrastructure is

working, and that gas deliveries to the plant are possible, said

Chief Financial Officer Hallgeir Storvik in an interview.

The startup is "contingent on site preparations" commencing in

February 2012 and natural gas supplies being available by summer,

Yara said in its fourth quarter report.

Production at the Lifeco plant was suspended in February 2011

due to the Libyan unrest. Yara said its share of Lifeco's loss was

NOK31 million in the fourth quarter of 2011 and its year-to-date

loss was NOK131 million. The carrying value of Yara's investment in

the plant is NOK1.44 billion at the end of 4Q 2011, Yara said.

Storvik said "it's very hard to find the best practice" on how

to handle a situation like the one in Libya, "which doesn't happen

very often." But uncertainty is "somewhat reduced" compared to the

situation in the third quarter of 2011, he added.

The Libyan Norwegian Fertilizer Company, or Lifeco, is located

in Marsa El Brega on the Mediterranean coast of Libya, 700

kilometers east of the capital Tripoli. It is a joint venture

between Yara, 50%, and the National Oil Corporation of Libya and

the Libyan Investment Authority, both 25%.

Before the unrest, the National Oil Corporation was supplying

natural gas to Lifeco, while Yara was handling the exports from the

urea and ammonia plant.

Yara's CFO said the Libyan situation is challenging, but he

believes Lifeco production can be ramped up.

Storvik said that "no fundamental parts of the plant have been

damaged," and that Yara has people at the facility who are able to

assess the possibilities of starting it up. But "the challenge is

to be able to assess properly" the infrastructure surrounding the

facility, such as gas pipelines, Storvik said.

The Lifeco plant is insured by a Libyan insurance company. The

policy does not cover damage caused by war, civil war, revolution

or terrorism, Yara said in its fourth quarter report.

-By Kjetil Malkenes Hovland, Dow Jones Newswires: +47 902 27

908; kjetilmalkenes.hovland@dowjones.com

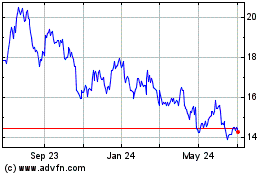

Yara International ASA (PK) (USOTC:YARIY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Yara International ASA (PK) (USOTC:YARIY)

Historical Stock Chart

From Jul 2023 to Jul 2024