YANGAROO Announces Private Placement

May 05 2014 - 3:00PM

Marketwired

YANGAROO Announces Private Placement

Proceeds to eliminate debt and accelerate advertising division

growth

TORONTO, ONTARIO--(Marketwired - May 5, 2014) - YANGAROO Inc.

(TSX-VENTURE:YOO)(OTCBB:YOOIF), the industry's leading secure

digital media distribution company, is pleased to announce, subject

to regulatory approvals, a brokered private placement (the "Private

Placement") to raise a minimum of $1,500,000 (the "Minimum Amount")

and up to $3,000,000 through the issuance of a minimum of 5,000,000

and up to 10,000,000 common shares ("Shares") at a price of $0.30

per Share.

The proceeds of the Private Placement (the "Proceeds") will be

used primarily for the retirement of the entire outstanding

indebtedness of YANGAROO under previously issued debentures (the

"Debentures"). The outstanding principal and accrued interest as

calculated on the Final Closing Date will be $2,320,687.94. The

balance of the Proceeds will be used for working capital and

focused on accelerating growth in the advertising division.

The Private Placement is expected to close in two stages, with

the final closing date anticipated to be May 23rd, 2014 (the "Final

Closing Date"). The initial closing will occur on or about the date

on which the Minimum Amount has been raised, or as otherwise

determined by the Board of Directors of YANGAROO. YANGAROO has

received expressed interest from potential subscribers in the event

of a private placement amounting to between $2,100,000 and

$2,300,000.

YANGAROO has engaged Global Maxfin Capital Inc. (the "Agent") to

act as lead agent in connection with the Private Placement.

YANGAROO will pay to the Agent, and any and all sub-agents and/or

finders, a total of 7% cash compensation and 7% in compensation

options (the "Compensation Options"), based on that portion of the

Proceeds raised by the Agent, sub-agent and/or finders, the

Compensation Options entitling the holder to subscribe for common

shares of the corporation on the same terms as the Private

Placement, being $0.30 per Share, for a period of 24 months from

closing.

All the securities issuable will be subject to a four-month hold

period from the date of issuance. The Private Placement is subject

to the approval of the TSX Venture Exchange.

About YANGAROO:

YANGAROO is a company dedicated to digital media management.

YANGAROO's patented Digital Media Distribution System (DMDS) is a

leading secure B2B digital cloud based solution focused on the

music and advertising industries. The DMDS solution provides more

accountable, effective, and far less costly digital management of

broadcast quality media via the Internet. It replaces the physical,

satellite and closed network distribution and management of audio

and video content, for music, music videos, and advertising to

television, radio, media, retailers, and other authorized

recipients. The YANGAROO Awards platform is now the industry

standard and powers most of North America's major awards shows.

YANGAROO has offices in Toronto, New York, and Los Angeles.

YANGAROO trades on the TSX Venture Exchange (TSX-V) under the

symbol YOO and in the U.S. under OTCBB: YOOIF. For further

information, please contact Gary Moss at 416-534-0607 ext.111 or

visit www.yangaroo.com.

The statements contained in this release that are not purely

historical are forward-looking statements and are subject to risks

and uncertainties that could cause such statements to differ

materially from actual future events or results. Such

forward-looking statements are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

For Investor Inquiries:The Howard Group Inc.Dave Burwell1 (403)

221-0915dave@howardgroupinc.com

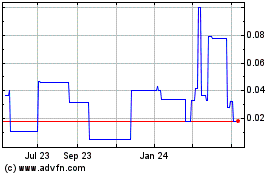

Yangaroo (PK) (USOTC:YOOIF)

Historical Stock Chart

From Dec 2024 to Jan 2025

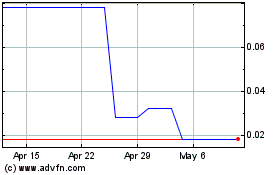

Yangaroo (PK) (USOTC:YOOIF)

Historical Stock Chart

From Jan 2024 to Jan 2025