0001703073

false

0001703073

2023-07-12

2023-07-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported):

July

12, 2023

VIVIC

CORP.

(Exact

Name of Registrant as Specified in its Charter)

| Nevada |

|

000-56198 |

|

80-0948413 |

| (State

or other jurisdiction of |

|

Commission |

|

IRS

Employer |

| Incorporation

or organization) |

|

File

Number |

|

Identification

Number |

187

E. Warm Springs Road

Las

Vegas, Nevada 89119

(Address

of Principal Executive Offices)

Registrant’s

telephone number: (702) 899 0818

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

Registered Pursuant to Section 12(g) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of each Exchange on which Registered |

| Common

Stock, $0.001 Par Value |

|

VIVC |

|

OTCQB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement

On

July 12, 2023, Vivic Corporation (Hong Kong) Co. Limited (“Vivic Hong Kong”), a wholly-owned subsidiary of Vivic

Corp. (the “Company”), entered into a Stock Purchase Agreement with Yun-Kuang Kung (Mr. “Kung”)

pursuant to which Mr. Kung acquired all of the shares of our indirectly wholly-owned subsidiary, Guangdong Weiguan Ship

Tech Co., Ltd. (“Weiguan Ship Tech”). The divestiture of Weiguan Ship Tech is part of the Company’s

plan to concentrate primarily on its business in Taiwan for the immediate future which has shown significant growth in the past three

months to facilitate its efforts to uplist its shares to a recognized stock exchange in the United States.

In

consideration for its interest in Weiguan Ship Tech, the Company received nominal monetary consideration and the agreement of

Mr. Kung to indemnify the Company and its affiliates and hold them harmless from, against and in respect of any and all claims arising

out of or related to the business of Weiguan Ship Tech whether arising before or after the date of the Stock Purchase Agreement,

whether currently known or unknown, including, without limitation any claims for taxes.

In

connection with the sale, the Company commissioned and received an appraisal of Weiguan Ship Tech. In its report the appraiser

noted that although Weiguan Ship Tech had a value of approximately RMB 565,000 on a projected income basis, it had negative

net assets (shareholders’ equity) in excess of RMB 8,200,000 yuan and Vivic Hong Kong and indirectly, the Company,

could be held liable for any liability up to the amount of the subscribed capital contributions in Weiguan Ship Tech. Thus, given

the desire of management to focus on the Company’s Taiwan operations, management concluded it was in the best interest of the Company

to sell Weiguan Ship Tech to Mr. Kung, the son of Shang-Chiai Kung, the Company’s principal shareholder, President

and Chief Executive Officer, in return for his agreement to indemnify the Company against any claims that might arise in respect of the

operations of Weiguan Ship Tech and its subsidiaries.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

July 18, 2023

| |

VIVIC

CORP. |

| |

|

|

| |

By:

|

/s/

Shang-Chiai Kung |

| |

|

Shang-Chiai Kung |

| |

|

President

and Chief Executive Officer |

Exhibit

10.1

STOCK

PURCHASE AGREEMENT

This

STOCK PURCHASE AGREEMENT is entered into as of July 12, 2023 (this “Agreement”) by Yun-Kuang Kung (“Buyer”),

and Vivic Corporation (Hong Kong) Co. Limited, a corporation formed in Hong Kong (“Shareholder”) which is the owner of all

of the outstanding shares of Guangdong Weiguan Ship Tech Co., Ltd., a corporation formed in China (the “Company”).

RECITALS

Shareholder

owns all of the outstanding shares of capital stock of the Company (the “Shares”); and

Buyer

desires to purchase the Shares from Shareholder and Shareholder desires to sell the Shares to Buyer, on the terms and conditions set

forth in this Agreement.

NOW,

THEREFORE, in consideration of the premises and the mutual covenants herein contained, and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

ARTICLE

1

DEFINITIONS

As

used herein the following terms shall have the following meanings and shall include in the singular number the plural and in the plural

number the singular unless the context otherwise requires (capitalized terms not defined in this Article 1 shall have the meanings ascribed

to such terms elsewhere in this Agreement):

“Affiliate”

means, as to a Person, any other Person that, directly or indirectly, through one or more intermediaries controls, is controlled by or

is under common control with the first-mentioned Person.

“Assets”

means all of the assets of the Company.

“Business”

means the business currently being conducted by the Company.

“Contract”

shall mean any agreement, contract, obligation, promise, undertaking, indenture, mortgage, policy, arrangement, or instrument,

including any amendment thereto, fixed or contingent, written or oral, expressed or implied, which cannot be terminated by the

Company without cause on no more than 30 days notice and without liability to the Company in excess of $10,000.

“Governmental

Body” means any federal, state, local, municipal, foreign, or other government, or governmental or quasi-governmental authority

of any nature (including any governmental agency, branch, department, official, or entity and any court or other tribunal).

“Knowledge”

a Person will be deemed to have “Knowledge” of a particular fact or other matter if (a) such person is actually aware of

such fact or other matter or (b) a prudent individual in the position of the Chief Executive Officer or Chief Financial Officer of the

Company could reasonably be expected to become aware of such fact or other matter in the course of performing his duties on behalf of

the Company.

“Legal

Requirement” means any applicable federal, state, local, municipal, foreign, international, multinational, or other administrative

order, constitution, law, ordinance, principle of common law, regulation, statute, or treaty.

“Liability”

means any liability (whether known or unknown, whether asserted or unasserted, whether absolute or contingent, whether accrued or

unaccrued, whether liquidated or unliquidated, and whether due or to become due), including (without limitation) any liability for

Taxes.

“Material

Adverse Change” means any change or effect that, individually or in the aggregate, is materially adverse to the business, financial

condition, or results of operations of the Company, other than changes or effects arising out of (i) general economic conditions; (ii)

general conditions in the aviation and aerospace industry; (iii) financial markets; (iv) the entering into or public disclosure of this

Agreement or the transactions contemplated hereby and (v) changes in the law and applicable rules and regulations.

“Ordinary

Course of Business” means the ordinary course of business of the Company consistent with past practice.

“Permits”

shall mean any and all licenses, permits, orders or approvals of any federal, state, local or foreign governmental or regulatory body

necessary for the operation of the Business by the Company as presently conducted.

“Person”

means an individual, corporation, partnership, limited liability company, association, trust, unincorporated organization or other legal

entity.

“Regulatory

Approvals” shall mean all regulatory approvals, exemptions, lapses of waiting periods, written opinions or other actions by the

federal, state and local governmental authorities necessary for the consummation of the transactions contemplated by this Agreement.

“Security

Interest” means any mortgage, pledge, lien, encumbrance, charge, or other security interest, other than (a) mechanic’s, materialmen’s

and similar liens, (b) liens for Taxes not yet due and payable or for Taxes that the taxpayer is contesting in good faith through appropriate

proceedings, (c) purchase money liens and liens securing rental payments under capital lease arrangements, (d) in the case of real property,

rights of way, building use restrictions, variances and easements, provided the same do not in any material respect interfere with the

Company’s operation of the Business and (e) other liens arising in the Ordinary Course of Business and not incurred in connection

with the borrowing of money.

“Subsidiary”

of an entity shall mean any entity of which more than 50% of the outstanding voting capital stock or the power to elect a majority

of the Board of Directors or other governing body of such entity (irrespective of whether at the time capital stock of any other

class or classes of such entity shall or might have voting power upon the future occurrence of any contingency) is at the applicable

time directly or indirectly owned, controlled or held by such entity, or by such entity and one or more other subsidiaries of such

entity, or by one or more other subsidiaries of such entity.

“Tax

Return” includes any material report, statement, form, return or other document or information required to be supplied by a national,

provincial, local or foreign taxing authority in connection with Taxes.

“Tax”

or “Taxes” means any national, state, local and foreign income or gross receipts tax, alternative or add-on minimum tax,

sales and use tax, customs duty and any other tax, charge, fee, levy or other assessment including property, transfer, occupation,

service, license, payroll, franchise, excise, withholding, ad valorem, severance, stamp, premium, windfall profit, employment, rent

or other tax, governmental fee or like assessment or charge of any kind, together with any interest, fine or penalty thereon,

addition to tax, additional amount, deficiency, assessment or governmental charge imposed by any federal, state, local or foreign

taxing authority.

“Transaction

Documents” means this Agreement and any other agreement executed and delivered in connection herewith.

ARTICLE

2

SALE

AND PURCHASE OF SHARES

Section

2.1. Purchase and Sale of Shares.

In

exchange for the consideration specified herein, and upon and subject to the terms and conditions of this Agreement, Buyer hereby purchases

from Shareholder, and Shareholder hereby sells, assigns, and delivers to Buyer, all right, title and interest in and to the Shares. In

consideration for the Shares, Buyer shall pay to Shareholder the sum of 1,000 RMB and shall indemnify the Seller from and against all

liabilities of the Company and its Affiliates as more fully set forth herein.

Section

2.2. Delivery of Possession and Instruments of Transfer; Purchase Price

Simultaneously

with the execution and delivery hereof, Shareholder shall sell, assign and deliver to Buyer, against (i) payment of 1,000 RMB by wire

transfer to accounts designated by Shareholder prior to execution hereof and (ii) execution and delivery of the Indemnification Agreement

in the form of Exhibit A, certificates representing the Shares, duly endorsed in blank or accompanied by duly executed stock powers with

signatures guaranteed or notarized, and such other instruments of transfer reasonably requested by Buyer for consummation of the transactions

contemplated under this Agreement and as are necessary to vest in Buyer, title in and to the Shares, free and clear of any Security Interest,

claims or restrictions, other than restrictions imposed by federal or applicable state securities laws.

ARTICLE

3

REPRESENTATIONS

AND WARRANTIES OF SHAREHOLDER

As

an inducement to Buyer to enter into this Agreement and perform its obligations hereunder, Shareholder represents and warrants to Buyer

as of the date hereof:

Section

3.1. Organization, Good Standing, Power

The

Company is a corporation duly organized, validly existing and in good standing under the laws of China. The Company has the corporate

power and authority to own, lease and operate its assets and to carry on its Business. The minute books, stock ledgers and stock transfer

records of the Company will be furnished to Buyer.

Section

3.2. Certificate of Incorporation and By-Laws.

Correct

and complete copies of the Certificate of Incorporation (the “Certificate of Incorporation”), By-laws (the “By-laws”)

and other organizational documents of the Company (collectively, the “Organizational Documents”), in each case as amended

to date have been provided to Buyer.

Section

3.3. Capital Stock.

(a)

The Shares being sold to Buyer represent all of the shares of the Company presently outstanding and are duly authorized, validly issued,

fully paid, non-assessable, and were issued in compliance with all national, provincial and local laws. No person to whom any share was

issued and no person claiming through any such person has any claim against the Company in respect of any such issuance, including any

claim based upon an alleged misstatement of fact in connection with such issuance or an omission to state a material fact necessary to

make the statements of fact stated in connection with such issuance not misleading.

(b)

There are no outstanding offers, options, warrants, rights, calls, commitments, obligations (verbal or written), conversion rights,

plans or other agreements (conditional or unconditional) of any character providing for or requiring the sale, purchase or issuance

of the Shares or of any other shares of capital stock or securities of the Company.

Section

3.4. Shares.

Shareholder

has good, valid and marketable title to the Shares, free and clear of any covenant, condition, restriction, voting arrangement, charge,

Security Interest, option or adverse claims. Upon delivery of certificates representing the Shares or duly executed instruments of transfer,

Buyer will acquire good and marketable title to the Shares, free and clear of any Security Interest, restrictions or claims.

Section

3.5. Subsidiaries, Divisions and Affiliates.

The

Company owns all of the issued and outstanding equity of Wenzhou Jiaxu Yacht Company Limited (the “Subsidiary”)

and does not own or have any rights to any equity interest, directly or indirectly, in any other corporation, partnership, joint venture,

firm or other entity.

Section

3.6. Authorization.

Shareholder

possesses the legal right and capacity to execute, deliver and perform this Agreement, without obtaining any approval, authorization,

consent or waiver or giving any notice other than such approvals as are required of its Board of Directors. Shareholder has taken all

action, if any, required by applicable law, its organizational documents and the organizational documents of the Company, required to

be taken to authorize the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby. This

Agreement and all other Transaction Documents to which Shareholder or the Company is a party have been, or will be, duly executed and

delivered by Shareholder or the Company, as the case may be, and constitute the legal, valid and binding obligations of the Shareholder

or the Company, as the case may be, enforceable against such party in accordance with their respective terms, except to the extent such

enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium, receivership, fraudulent conveyance or similar laws

affecting or relating to the enforcement of creditors’ rights generally, and by equitable principles (regardless of whether enforcement

is sought in a proceeding in equity or at law).

Section

3.7. Effect of Agreement.

Except

as set forth in Schedule 4.7, the execution, delivery and performance of this Agreement by Shareholder and the sale of the Shares contemplated

hereby, will not, with or without the giving of notice and the lapse of time, or both, (a) violate any provision of law, statute, rule,

regulation or executive order to which the Company, Shareholders or the Business is subject; (b) violate any judgment, order, writ or

decree of any court applicable to the Company, Shareholders or the Business; or (c) result in the breach of or conflict with any term,

covenant, condition or provision of, or, constitute a default under, or result in the creation or imposition of any Security Interest

upon any of the Assets or Shares pursuant to the Organizational Documents of the Company, or any commitment, contract or other agreement

or instrument, including any of the Contracts, to which the Company is a party or by which any of the Assets or Shares are bound.

Section

3.8. Governmental and Other Consents.

No

notice to, consent, authorization or approval of, or exemption by, any governmental or public body or authority is required in connection

with the execution, delivery and performance by Shareholder of this Agreement or any other Transaction Documents to which Shareholder

or the Company is a party, or the taking of any action herein contemplated; and (ii) no notice to, consent, authorization or approval

of, any Person under any agreement, arrangement or commitment of any nature to which Shareholder is party, or by which the Shares or

Assets are bound by or subject to, or from which the Company receives or is entitled to receive a benefit, is required in connection

with the execution, delivery and performance by Shareholder or the Company of this Agreement or any other Transaction Documents to which

Shareholder or the Company is a party, or the taking of any action herein contemplated. The sale of the Shares as contemplated hereby

will not result in the lapse, termination or forfeiture of any license, customer certification or approval required to be maintained

by the Company in order for it to be a supplier to any of its customers.

Section

3.9. Financial Information.

Buyer

has been given the opportunity to review the financial records of the Company and has agreed to purchase the Company “where-is,

as is” without any representations by the Shareholder as to the financial condition of the Company. Copies of the financial statements

of the Company and all underlying documentation have been or will be provided to Buyer.

Section

3.10. Compliance with Applicable Laws.

The

conduct of its business by the Company does not violate or infringe, and to Shareholder’s Knowledge there is no reasonable

basis for any claims of violation or infringement of, any law, statute, ordinance, regulation or executive order currently in effect

and applicable to the Company, except in each case for violations or infringements which could not be reasonably be expected to

have, individually or in the aggregate, a material adverse effect on the Business, taken as a whole. The Company is not in default

under any Company Permit, under any governmental or administrative order or demand directed to it, or with respect to any order,

writ, injunction or decree of any court applicable to it.

Section

3.11. Litigation.

There

is no claim, action, suit, proceeding, arbitration, reparation, investigation or hearing, pending against the Company or which could

prevent the consummation of the transaction contemplated hereby, before any court or governmental, administrative or other competent

authority or private arbitration tribunal, nor (i) to the Knowledge of Shareholders, is any such claim threatened and (ii) are there

any facts known to Shareholder which could reasonably be expected to give rise to claim, action, suit, proceeding, arbitration, investigation

or hearing, which could result in a Material Adverse Change, or prevent the consummation of the transactions contemplated by this Agreement.

The Company has not waived any statute of limitations or other affirmative defense with respect to any obligation. There is no continuing

order, injunction or decree of any court, arbitrator or governmental, administrative or other competent authority to which the Company

is a party, or to which the Assets or Business is subject. Neither the Company nor any current officer, director, or employee of the

Company has been permanently or temporarily enjoined or barred by order, judgment or decree of any court or other tribunal or any agency

or other body from engaging in or continuing any conduct or practice in connection with the Business.

Section

3.12. Tax Matters.

(a)

The Company has filed all Tax Returns that it was required to file or has obtained valid extensions of time to file such Tax Returns.

All such Tax Returns were correct and complete in all material respects. All Taxes owed by the Company have been paid or adequately reserved

for. The Company is not currently the beneficiary of any extension of time within which to file any Tax Return that has not already been

timely filed (with due regard to such extension). No written claim has ever been made by an authority in a jurisdiction where the Company

does not file Tax Returns that it is or may be subject to taxation by that jurisdiction. There are no Security Interests on any of the

Assets of the Company that arose in connection with any failure (or alleged failure) to pay any Tax (except for Taxes not yet due and

owing).

(b)

The Company has withheld and paid all Taxes (other than taxes of a de minimus amount) required to have been withheld and paid in connection

with amounts paid or owing to any employee, independent contractor, creditor, stockholder, or other third party.

(c)

There is no pending or threatened claim by any authority for additional Taxes for any period for which Tax Returns have been filed. There

have been delivered to Buyer correct and complete copies of all income Tax Returns, examination reports, and statements of deficiencies

assessed against or agreed to by the Company since December 31, 2020.

(d)

The Company has not waived any statute of limitations in respect of Taxes or agreed to any extension of time with respect to a Tax (other

than valid extensions of time to file Tax Returns) assessment or deficiency.

Section

3.13. Brokers and Finders.

Neither

Shareholder nor the Company, nor any of its officers, directors or employees has employed any broker or finder or incurred any liability

for any brokerage fees, commissions or finders’ fees in connection with the transactions contemplated by this Agreement. Shareholder

agrees to indemnify, defend and hold Buyer harmless from any liability, loss, cost, claim and/or demand that any broker or finder may

have in connection with this transaction as a result of actions taken by the Company or Shareholder.

ARTICLE

4

REPRESENTATIONS

AND WARRANTIES OF BUYER

Buyer

hereby represents and warrants to Shareholders as of the date hereof and as of the Closing Date:

Section

4.1. Conflicts; Defaults.

The

execution and delivery of this Agreement and the other agreements and instruments executed or to be executed in connection herewith by

Buyer do not, and the performance by Buyer of its obligations hereunder and thereunder and the consummation by Buyer of the transactions

contemplated hereby or thereby, will not: (i) require any authorization, approval, consent, registration, declaration or filing with,

from or to any governmental authority; (ii) violate any law, statute, judgment, decree, injunction, order, writ, rule or applicable to

Buyer; or (iii) conflict with or result in a breach of, create an event of default (or event that, with the giving of notice or lapse

of time or both, would constitute an event of default) under, or give any third party the right to terminate, cancel or accelerate any

obligation under, any contract, agreement, note, bond, guarantee, deed of trust, loan agreement, mortgage, license, lease, indenture,

instrument, order, arbitration award, judgment or decree to which Buyer is a party or by which such party is bound and which would affect

the consummation of the transactions contemplated hereby. There is no pending or, to the Knowledge of Buyer, threatened action, suit,

claim, proceeding, inquiry or investigation before or by any governmental authorities, involving or that could reasonably be expected

to restrain or prevent the consummation of the transactions contemplated by this Agreement.

Section

4.2. Brokers, Finders and Agents.

Neither

Buyer nor any agent of Buyer has employed any broker or finder or incurred any liability for any brokerage fees, commissions or finders’

fees in connection with the transactions contemplated by this Agreement and Buyer agrees to indemnify, defend and hold the Shareholders

harmless from any liability, loss, cost, claim and/or demand that any broker or finder may have in connection with this transaction as

a result of actions taken by Buyer or any of its officers, directors or employees.

Section

4.3 No Consents Required.

No

notice to, consent, authorization or approval of, or exemption by, any governmental or public body or authority is required in connection

with the execution, delivery and performance by Buyer of this Agreement or any other Transaction Documents to which Buyer is a party,

or the taking of any action herein contemplated. No notice to, consent, authorization or approval of, any Person under any agreement,

arrangement or commitment of any nature which Buyer is party to or which the assets of Buyer are bound by or subject to, or from which

Buyer receives or is entitled to receive a benefit, is required in connection with the execution, delivery and performance by Buyer of

this Agreement or any other Transaction Documents to which Buyer is a party, or the taking of any action by Buyer herein contemplated.

ARTICLE

5

FURTHER

ASSURANCES

Shareholder

and Buyer covenant and agree to deliver and acknowledge and cause to be filed with the appropriate governmental authorities (or cause

to be executed, delivered, acknowledged and filed), from time to time, at the request of any other party and without further consideration,

all such further instruments and take all such further actions as may be reasonably necessary or appropriate to carry out the provisions

and intent of this Agreement.

ARTICLE

6

AGREEMENTS

REGARDING TAXES

Section

6.1. Tax Returns.

Buyer

will prepare or cause to be prepared any Tax Returns of the Company that are due or may be filed by the Company from and after the date

hereof. Buyer will provide Shareholder with drafts of any such Tax Returns that include any period ending on or prior to the date hereof

no later than 30 days before their due date (with regard to extensions actually granted) and will permit Shareholder to review, comment

on and approve such draft Tax Returns. Shareholder will not unreasonably withhold or delay his approval to any such draft Tax Returns.

For the avoidance of doubt, Shareholders shall be responsible for payment of all taxes attributed to the activities of the Company up

to the date hereof.

Section

6.2. Cooperation on Tax Matters.

Buyer

and Shareholder shall cooperate fully, as and to the extent reasonably requested, in connection with the filing of Tax Returns pursuant

to this Article and any audit, litigation or other proceeding with respect to Taxes. Such cooperation shall include the retention and

(upon another party’s request) the provision of records and information which are reasonably relevant to any such audit, litigation

or other proceeding and making employees available on a mutually convenient basis to provide additional information and explanation of

any material provided hereunder. Buyer and Shareholders shall, and shall cause the Company to, retain all books and records with respect

to Tax matters pertinent to the Company relating to any taxable period beginning before the Closing Date until the expiration of the

statute of limitations of the respective taxable periods, and to abide by all record retention agreements entered into with any taxing

authority.

ARTICLE

7

SURVIVAL

OF REPRESENTATIONS AND WARRANTIES; INDEMNIFICATION

Section

7.1. Survival.

The

representations and warranties, set forth in this Agreement, in any Exhibit or Schedule hereto and in any certificate or instrument delivered

in connection herewith shall survive for a period of eighteen (18) months after the date hereof (the “Warranty Period”) and

shall thereupon terminate and expire and shall be of no force or effect thereafter, except (i) with respect to any claim, written notice

of which shall have been delivered to Buyer or the Shareholder, as the case may be, in accordance with Section 7.6 and prior to the end

of the Warranty Period, such claim shall survive the termination of such Warranty Period for as long as such claim is unsettled, and

(ii) with respect to any litigation which shall have been commenced to resolve such claim on or prior to such date. Notwithstanding the

foregoing, solely with respect to the representations and warranties regarding Taxes the applicable Warranty Period shall be the applicable

statute of limitations.

Section

7.2. Indemnification by Shareholder.

Subject

to the provisions of Section 7.5 below, Shareholder hereby covenants and agrees with Buyer that Shareholder shall indemnify the Company

and Buyer and Affiliates of Buyer, and each of their successors and assigns (individually, a “Buyer Indemnified Party”),

and hold them harmless from, against and in respect of any and all costs, losses, claims, liabilities (including for Taxes), fines, penalties,

damages and expenses (including interest, if any, imposed in connection therewith, court costs and reasonable fees and disbursements

of counsel) (collectively, “Damages”) incurred by any of them resulting from any breach of any representation or warranty

in this Agreement or the non-fulfillment in any material respect of any agreement, covenant or obligation by Shareholder made in this

Agreement (including without limitation any Exhibit or Schedule hereto and any certificate or instrument delivered in connection herewith).

Section

7.3. Indemnification by Buyer.

Buyer

hereby covenants and agrees with Shareholder that Buyer shall indemnify Shareholder and its Affiliates (individually, a “Shareholder

Indemnified Party”) and hold them harmless from, against and in respect of any and all Damages incurred by the Shareholder Indemnified

Parties resulting from any misrepresentation, breach of any representation or warranty in this Agreement or the non-fulfillment in any

material respect of any agreement, covenant or obligation by Buyer made in this Agreement (including without limitation any Exhibit or

Schedule hereto and any certificate or instrument delivered in connection herewith).

Section

7.4. Right to Defend.

If

the facts giving rise to any such indemnification shall involve any actual claim or demand by any third party against a Buyer Indemnified

Party or Shareholder Indemnified Party (referred to herein as an “Indemnified Party”), then the Indemnified Party will give

prompt written notice of any such claim to the indemnifying party, which notice shall set forth in reasonable detail the nature, basis

and amount of such claim (the “Notice of Third Party Claim”). It is a condition precedent to the applicable indemnifying

party’s obligation to indemnify the applicable Indemnified Party for such claim that such Indemnified Party timely provide to such

indemnifying party the applicable Notice of Third Party Claim, provided that the failure to provide such Notice of Third Party Claim

shall relieve such indemnifying party of its or his obligation to indemnify for such claim only to the extent that such indemnifying

party has been prejudiced by such Indemnified Party’s failure to give the Notice of Third Party Claim as required. The indemnifying

party receiving such Notice of Third Party Claim may (without prejudice to the right of any Indemnified Party to participate at its own

expense through counsel of its own choosing) undertake the defense of such claims or actions at its expense with counsel chosen and paid

by its giving written notice (the “Election to Defend”) to the Indemnified Party within thirty (30) days after the date the

Notice of Third Party Claim is deemed received; provided, however, that the indemnifying party receiving the Notice of Third Party Claim

may not settle such claims or actions without the consent of the Indemnified Party, which consent will not be unreasonably withheld or

delayed, except if the sole relief provided is monetary damages to be borne solely by the indemnifying party; and, provided further,

if the defendants in any action include both the indemnifying party and the Indemnified Party, and the Indemnified Party shall have reasonably

concluded that counsel selected by the indemnifying party has a conflict of interest because of the availability of different or additional

defenses to the parties, the Indemnified Party shall cooperate in the defense of such claim and shall make available to the indemnifying

party pertinent information under its control relating thereto, but the Indemnified Party shall have the right to retain its own counsel

and to control its defense and shall be entitled to be reimbursed for all reasonable costs and expenses incurred in such separate defense.

In no event will the provisions of this Article reduce or lessen the obligations of the parties under this Article, if prior to the expiration

of the foregoing thirty (30) day notice period, the Indemnified Party furnishing the Notice of Third Party Claim responds to a third

party claim if such action is reasonably required to minimize damages or avoid a forfeiture or penalty or because of any requirements

imposed by law. If the indemnifying party receiving the Notice of Third Party Claim does not duly give the Election to Defend as provided

above, then it will be deemed to have irrevocably waived its right to defend or settle such claims, but it will have the right, at its

expense, to attend, but not otherwise to participate in, proceedings with such third parties; and if the indemnifying party does duly

give the Election to Defend, then the Indemnified Party giving the Notice of Third Party Claim will have the right at its expense, to

attend, but not otherwise to participate in, such proceedings. The parties to this Agreement will not be entitled to dispute the amount

of any Damages (including reasonable attorney’s fees and expenses) related to such third party claim resolved as provided above.

Section

7.5 Limitation on Rights of Indemnification.

(a)

No Buyer Indemnified Party shall have the right to indemnification under this Agreement unless and until the aggregate amount of any

and all such indemnification claims made by Buyer Indemnified Party under this Agreement exceeds $100,000 (the “Basket”).

If Buyer Indemnified Party claims exceed the Basket, Buyer Indemnified Parties shall be entitled to receive one and one-half ($1.50)

dollars in respect of each one dollar of indemnified claims in excess of the Basket until Buyer Indemnified Parties shall have received

an amount equal to the sum of the reimbursed indemnified claims plus the Basket in respect of indemnified claims. If Buyer Indemnified

Parties are entitled to any further payments in respect of indemnifications claims, they shall be made on a dollar for dollar basis subject

to any limitations contained herein.

(b)

The aggregate liability of Shareholder pursuant to this Article X shall not exceed $100,000.

(c)

Except in the event of fraud, the remedies provided in Sections 7.2 and 7.3 hereof shall be the sole and exclusive remedies of Buyer

Indemnified Party and Shareholder Indemnified Party from and after the Closing in connection with any breach of representation or warranty

or non-performance, partial or total, of any covenant or agreement contained in this Agreement; provided, that, nothing contained herein

shall prevent any party from seeking equitable remedies (including specific performance or injunctive relief) in connection therewith.

ARTICLE

8

MISCELLANEOUS

Section

8.1. Expenses.

Except

as and to the extent otherwise provided in this Agreement, if the transactions contemplated by this Agreement are not consummated, Shareholder

and Buyer shall each pay their own respective expenses and the fees and expenses of their respective counsel and other experts.

Section

8.2. Binding Effect; Benefits.

This

Agreement shall inure to the benefit of the parties hereto and shall be binding upon the parties hereto and their respective successors

and assigns. Except as otherwise set forth herein, nothing in this Agreement, expressed or implied, is intended to confer on any person

other than the parties hereto, Buyer Indemnified Party, the Shareholder Indemnified Party or their respective successors and assigns,

any rights, remedies, obligations, or liabilities under or by reason of this Agreement.

Section

8.3. Assignment; Delegation.

No

party to this Agreement may assign its rights or delegate its obligations hereunder without the prior written consent of all of the other

parties.

Section

8.4. Notices.

All

notices, requests, demands and other communications which are required to be or may be given under this Agreement shall be in writing

and shall be deemed to have been duly given when delivered in person or after dispatch by recognized overnight courier to the party to

whom the same is so given or made:

If

to Buyer, to:

or

at such other address as Buyer may have advised the other parties hereto

in

writing; and

If

to Shareholder, to:

or

at such other address as the Shareholder may have advised Buyer in writing; and

All

such notices, requests and other communication shall be deemed to have been received on the date of delivery thereof (if delivered by

hand) and on the next business day after the sending thereof (if by recognized overnight courier).

Section

8.5. Entire Agreement.

This

Agreement (including the Schedules and Exhibits hereto) and the other Transaction Documents constitute the entire agreement and supersede

all prior agreements, statements, representations or promises, oral and written, among the parties hereto with respect to the subject

matter hereof. No party hereto shall be bound by or charged with any written or oral arguments, representations, warranties, statements,

promises or understandings not specifically set forth in this Agreement or in any Schedule or Exhibits hereto or any other Transaction

Documents.

Section

8.6. Governing Law.

This

Agreement, and the rights and obligations of the parties hereto under this Agreement, shall be governed by, construed and enforced in

accordance with the laws of Hong Kong, without giving effect to the choice of law principles thereof. Any action arising out of the breach

or threatened breach of this Agreement shall be commenced ina proper court located in Hong Kong and each of the parties hereby submits

to the jurisdiction of such courts for the purpose of enforcing this Agreement.

Section

8.7. Amendments.

This

Agreement may not be modified or changed except by an instrument or instruments in writing signed by the party or parties against whom

enforcement of any such modification or amendment is sought.

Section

8.8. Transaction Taxes.

Buyer

shall pay any and all transfer taxes arising out of the transfer of the Shares to Buyer and imposed upon the Shareholder regarding the

sale of the Business and transfer of ownership thereof to Buyer.

IN

WITNESS WHEREOF, the parties hereto have caused their duly authorized representatives to execute and deliver this Agreement as of the

first date written above.

| BUYER: |

|

SELLER: |

| |

|

|

| |

|

Vivic

Corporation (Hong Kong) Co. Limited |

| |

|

|

|

| /s/

Yun-Kuang Kung |

|

By:

|

/s/

Zhenhong Zhuang |

| Yun-Kuang

Kung |

|

|

An

Authorized Officer |

EXHIBIT

A

INDEMNIFICATION

AGREEMENT

IN

CONSIDERATION OF the transfer by Vivic Corporation (Hong Kong) Co. Limited (“Seller”) to the undersigned, Yun-Kuang Kung

(“Buyer”) of all of the outstanding capital stock of Guangdong Weiguan Ship Tech Co., Ltd. (the “Company”)

for the consideration agreed upon and in recognition of Buyer’s agreement to purchase the Company on an “as is” basis

after conducting such due diligence as Buyer deemed appropriate and to indemnify Seller and its Affiliates and hold them harmless from

any claims related to the business of the Company, Buyer hereby covenants and agrees with Seller that Buyer shall indemnify Seller and

its Affiliates including without limitation, Vivic Corp. (each an “Indemnified Party”), and hold them harmless

from, against and in respect of any and all claims arising out of or related to the Business of the Company whether arising before or

after the date hereof and whether currently known or unknown, including, without limitation any claims for Taxes.

If

any claim shall be made against an Indemnified Party in respect of which it intends to seek indemnification hereunder, the Indemnified

Party will give prompt written notice of any such claim to Buyer, which notice shall set forth in reasonable detail the nature, basis

and amount of such claim (the “Notice of Claim”). It is a condition precedent to Buyer’s obligation to indemnify an

Indemnified Party for such claim that such Indemnified Party timely provide to Buyer, provided that the failure to provide such Notice

of Claim on a timely basis shall relieve Buyer of his obligation to indemnify for such claim only to the extent Buyer has been prejudiced

by such Indemnified Party’s failure to give the Notice of Claim as required. Buyer may (without prejudice to the right of any Indemnified

Party to participate at its own expense through counsel of its own choosing) undertake the defense of such claims or actions at its expense

with counsel chosen and paid by its giving written notice (the “Election to Defend”) to the Indemnified Party within thirty

(30) days after the date the Notice of Claim is deemed received; provided, however, that Buyer may not settle such claims or actions

without the consent of the Indemnified Party, which consent will not be unreasonably withheld or delayed, except if the sole relief provided

is monetary damages to be borne solely by Buyer; and, provided further, if the defendants in any action include both Buyer or the Company

and the Indemnified Party, and the Indemnified Party shall have reasonably concluded that counsel selected by the Buyer has a conflict

of interest because of the availability of different or additional defenses to the parties, the Indemnified Party shall cooperate in

the defense of such claim and shall make available to the indemnifying party pertinent information under its control relating thereto,

but the Indemnified Party shall have the right to retain its own counsel and to control its defense and shall be entitled to be reimbursed

for all reasonable costs and expenses incurred in such separate defense. In no event will the provisions of this Agreement reduce or

lessen the obligations of the Buyer under this Agreement, if prior to the expiration of the foregoing thirty (30) day notice period,

the Indemnified Party furnishing the Notice of Claim responds to a third party claim if such action is reasonably required to minimize

damages or avoid a forfeiture or penalty or because of any requirements imposed by law. If the Buyer does not duly notify the Indemnified

Party of its Election to Defend as provided above, then it will be deemed to have irrevocably waived its right to defend or settle such

claims, but it will have the right, at its expense, to attend, but not otherwise to participate in, proceedings with such third parties;

and if the Buyer does duly give the Election to Defend, then the Indemnified Party giving the Notice of Third Party Claim will have the

right at its expense, to attend, but not otherwise to participate in, such proceedings. The parties to this Agreement will not be entitled

to dispute between themselves with respect to the amount of any damages (including reasonable attorney’s fees and expenses) related

to such any Claim for which indemnification is sought hereunder.

IN

WITNESSS WHEREOF, the parties have executed this Indemnification Agreement as of this July , 2023.

| |

|

Vivic

Corporation (Hong Kong) Co. Limited |

| |

|

|

|

| |

|

By: |

|

| Yun-Kuang

Kung |

|

|

An

Authorized Officer |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

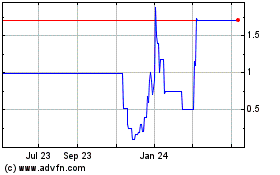

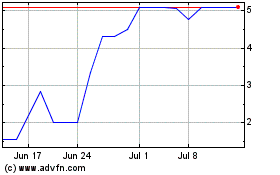

Vivic (QB) (USOTC:VIVC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vivic (QB) (USOTC:VIVC)

Historical Stock Chart

From Nov 2023 to Nov 2024