false

0001740797

0001740797

2024-01-26

2024-01-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): January

26, 2024

AVANT TECHNOLOGIES INC.

(f/k/a TREND INNOVATIONS HOLDING INC.)

(Exact name of registrant as specified in its charter)

| |

|

|

| |

|

|

|

Nevada

(State or other jurisdiction of incorporation

or organization)

|

333-225433

(Commission File Number)

|

38-4053064

(I.R.S. Employer Identification Number)

|

c/o Eastbiz.com, Inc 5348 Vegas Drive, Las Vegas,

NV 89108

(Address and telephone number of principal executive

offices)

(Issuer’s telephone number)

(702) 509-1747

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an

emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section 12(b) of

the Act: Not applicable.

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Not applicable |

|

|

|

|

Item 1.01 Entry into a Material Definitive Agreement

On January 26, 2024, the Avant Technologies, Inc.

(the “Company”) entered into an Employment Agreement (the "Agreement") with Angela Harris and appointed Mrs. Harris

to assume the role of Chief Operating Officer (the “COO”) for the Company. Angela Harris is not a relative of any director

or executive officer of the Company and does not own more than 5% of the Company's outstanding common stock. Angela Harris will undertake

the responsibilities of COO, starting February 1, 2024 (the “Start Date”) without concurrent membership on the board but as

a member of the Senior Management Team.

Item 5.02 Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

In consideration for serving

as COO, Mrs. Harris will receive an annual base cash salary of $275,000 plus an annual cash bonus up to 35% of the annual base salary,

to be paid no later than March 15th of the year immediately following the year in which the bonus was earned. In addition, Mrs. Harris

will be eligible to equity compensation as follows:

| (i) | Incentive Stock Options (ISOs): Effective upon the Start Date, Mrs. Harris

shall receive an initial options grant in the form of an ISO, in a quantity equivalent to 2.0% of the total outstanding common stock of

the Company at that date, subject to the following key terms: (a) 4-year vesting, with 1-year cliff (25% to vest immediately on the 1-yr

anniversary of the Start Date, the remaining 75% to ratably vest monthly (1/36 each month) thereafter); |

| (ii) | Restricted Stock Awards (RSAs): The Company shall grant Mrs. Harris a bonus

to Employee in an amount equal to the estimated tax owed by Employee in connection to the RSA Issuance. The number of shares of common

stock to be issued in such case will be determined by dividing that portion of the RSA payable in Stock by 85% of the Company’s

ten-day Volume Weighted Average Price (“VWAP”) of the Company’s shares of common stock, for the ten-day period immediately

prior to the date of issuance. This represents a 15% discount to the relevant VWAP, which discount shall at no point be less than $0.10

per share. |

Notwithstanding the foregoing,

if the Company is listed on Nasdaq or any other National Stock Exchange while Mrs. Harris is employed by, or performing advisory services

for, the Company in any capacity, the Company shall pay a one-time up-listing bonus of $500,000 in the form of an RSA, which shall be

payable within ten days of the effective date of the listing. Payment shall be made in shares of common stock of the Company.

Mrs. Harris will assume the role of COO at the Company

on February 1, 2024. The compensation arrangements described above were approved by the Board of Directors and do not exceed the standards

for executive compensation disclosed in the Company's most recent annual report on Form 10-K. The Exhibit 10.1 attached hereto includes

the Employment Agreement, encompassing terms and conditions, base salary, bonuses, equity compensation, benefits, confidentiality, and

termination details.

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits.

| Exhibit No. |

Description |

| 10.1 |

Employment Agreementbetween Avant Technologies Inc. and Angela Harris dated January 26, 2023 |

SIGNATURES

In accordance with the requirements of the Securities Act of 1933, the registrant

caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

|

| |

|

|

|

| Dated: January 31, 2023 |

AVANT TECHNOLOGIES, INC. |

| |

|

| |

By: |

/s/ |

Vitalis Racius |

| |

|

Name: |

Vitalis Racius |

| |

|

Title: |

Chief Financial Officer, Director & Treasurer |

| |

|

|

|

EMPLOYMENT

AGREEMENT

THIS EMPLOYMENT

AGREEMENT ("Agreement"), dated as of the 26th day of January, 2024 ("Effective Date"),

is between Avant Technologies, Inc., a Nevada corporation whose principal address is c/o Eastbiz.com 5348 VEGAS DRIVE, LAS VEGAS, NV,

89108, USA ("Company"), and Angela Harris, an individual resident of the State of Wisconsin whose principal address is

2036 N. Prospect Ave., #1905, Milwaukee WI 53202 (“Employee"). The Company and Employee are sometimes hereinafter collectively

referred to in this Agreement as the "Parties" and individually as a “Party.”

WHEREAS,

the Company desires to employ Employee, and Employee desires to accept terms of employment, as set forth in this Agreement;

NOW

THEREFORE, in consideration of the mutual covenants expressed below and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the Parties agree as follows:

1.

Employment The Company agrees to employ

the Employee as the Company’s Chief Operating Officer (COO) governed by the detailed terms, conditions, and provisions of

this Agreement. Upon being effective as dictated by Start Date, this Agreement will replace any prior agreements and/or verbal understandings.

Nothing contained herein shall be deemed to create a relationship of partnership or joint venture between the Parties, and the relationship

between the Company and Employee shall remain as Company and employee.

2.

Duties Company and Employee agree that

Employee shall serve as the Company’s COO and shall have the duties, responsibilities, and authority customary for such a position

in an organization of the size and nature of the Company, subject to the Company’s ability to set such duties, responsibilities,

and authority to be mutually agreed between the Company and Employee.

Duties Company and Employee agree that

Employee shall serve as the Company’s COO and shall have the duties, responsibilities, and authority customary for such a position

in an organization of the size and nature of the Company, subject to the Company’s ability to set such duties, responsibilities,

and authority to be mutually agreed between the Company and Employee.

As the

COO, Employee shall be responsible for the day-to-day operations of the business including, but not limited to, supply chain and logistics,

project planning and execution, human capital management, data center operations, corporate IT, quality and regulatory compliance, and

environmental, social and governance (ESG). Employee shall provide direct and indirect support as needed across the business, in such

areas as customer success, product management, and sales operations. As a member of the Senior Management Team, Employee shall contribute

in a meaningful way to analyzing market trends, setting appropriate operational and go-to market strategies, supporting customer success/satisfaction/retention

initiatives, investor relations, supporting fundraising and other capital markets/M&A activities, and preparation/communication for

the Board of Directors.

3.

Reporting Employee shall report directly to the President, Chief Executive Officer and Chief Financial

Officer, and shall devote her best efforts to the business and affairs of the Company and its subsidiaries, whether currently existing

or hereafter acquired or formed. Employee shall perform her duties and responsibilities to the best of her abilities in a diligent, trustworthy,

businesslike, and efficient manner.

4.

Start Date The start of employment will be February 1, 2024 (the “Start Date”).

5.

Devices and Living Location

(a)

Employee will use her own laptop and/or cell phone. The Company does not provide the Employee with a laptop computer and

cell phone to be used by Employee during the Term of this Agreement.

(b)

Employee shall have no obligation to relocate her residence.

(c)

Employee shall agree to business travel up to 30%. As a member of the Senior Management Team, for business flights greater

than 3 hours in duration Employee will be allowed to upgrade to Economy Plus or equivalent seating so long as the aggregate expenses remain

within the Company’s approved travel budget and individual bookings are compliant with the Company’s approved executive travel/expense

policy.

6.

Compensation, Benefits, and Other Provisions

See Exhibit A

7.

Employee acknowledges and agrees that:

| (a) | During the course of Employee’s employment with Company, Employee will |

learn about, will

develop and help to develop, and will be entrusted in strict confidence with confidential and proprietary information and trade secrets

that are owned by Company and that are not available to the general public or Company’s competitors, including (1) its business

operations, finances, balance sheets, financial projections, tax information, accounting systems, value of properties, internal governance,

structures, plans (including strategic plans and marketing plans), shareholders, directors, officers, employees, contracts, client characteristics,

idiosyncrasies, identities, needs, and credit histories, referral sources, suppliers, development, acquisition, and sale opportunities,

employment, personnel, and compensation records and programs, confidential planning and/or policy matters, and/or other matters and materials

belonging to or relating to the internal affairs and/or business of Company, (2) information that Company is required to keep confidential

in accordance with confidentiality obligations to third parties, (3) communications between Company, its officers, directors, shareholders,

members, partners, or employees, on the one hand, and any attorney retained by Company for any purpose, or any person retained or employed

by such attorney for the purpose of assisting such attorney in her or her representation of Company, on the other hand, and (4) other

matters and materials belonging to or relating to the internal affairs and/or business of Company, including information recorded on any

medium that gives it an opportunity to obtain an advantage over its competitors who do not know or use the same or by which Company derives

actual or potential value from such matter or material not generally being known to other persons or entities who might obtain economic

value from its use or disclosure (all of the foregoing being hereinafter collectively referred to as the “Confidential Information”);

| (b) | Company has developed or purchased or will develop or purchase the Confidential

Information at substantial expense in a market in which Company faces intense competitive pressure, and Company has kept and will keep

secret the Confidential Information; |

| (c) | Nothing in the Agreement shall be deemed or construed to limit or take away any

rights or remedies Company may have, at any time, under statute, common law or in equity or as to any of the Confidential Information

that constitutes a trade secret under applicable law. |

8.

Confidentiality Covenants. To the extent that Employee developed or had access to Confidential Information before

entering into the Agreement, Employee represents and warrants that she has not used for her own benefit or for the benefit of any other

person or entity other than Company, and Employee has not disclosed, directly or indirectly, to any other person or entity, any of the

Confidential Information. Unless and until the Confidential Information becomes publicly known through legitimate means or means not involving

any act or omission by Employee:

(a)

The Confidential Information is, and at all times shall remain, the sole and exclusive property of Company;

(b)

Except as otherwise permitted by the Agreement, Employee shall use commercially reasonable efforts to guard and protect

the Confidential Information from unauthorized disclosure to any other person or entity;

(c)

Employee shall not use for Employee’s own benefit, or for the benefit of any other person or entity other than Company,

and shall not disclose, directly or indirectly, to any other person or entity, any of the Confidential Information; and

(d)

Except in the ordinary course of Company’s businesses, Employee shall not seek or accept any of the Confidential Information

from any former, present, or future employee of any of the Company.

9.

Intellectual Property Rights.

(a) As

used in the Agreement, the term “Inventions” means all procedures, systems, formulas, recipes, algorithms,

methods, processes, uses, apparatuses, compositions of matter, designs or configurations, computer programs of any kind, discovered,

conceived, reduced to practice, developed, made, or produced, or any improvements to them, and shall not be limited to the meaning

of “invention” under the United States patent laws. Employee agrees to disclose promptly to Company any and all

Inventions, whether or not patentable and whether or not reduced to practice, conceived, developed, or learned by Employee during

the Employee’s employment with Company or during a period of one hundred eighty (180) days after the effective date of

termination of Employee’s employment with Company for any reason, either alone or jointly with others, which relate to or

result from the actual or anticipated business, work, research, investigations, products, or services of Company, or which result,

to any extent, from use of the premises or property of Company (each a “Company Invention”). Employee

acknowledges and agrees that Company is the sole owner of any and all property rights in all such Company Inventions, including the

right to use, sell, assign, license, or otherwise transfer or exploit Company Inventions, and the right to make such changes in them

and the uses thereof as Company may from time to time determine. Employee agrees to disclose in writing and to assign, and Employee

hereby assigns, to Company, without further consideration, Employee’s entire right, title, and interest (throughout the United

States and in all foreign countries) free and clear of all liens and encumbrances, in and to all such Company Inventions, which

shall be the sole property of Company, whether or not patentable. This Section 9 does not apply to any Inventions: (1) for which no

equipment, supplies, facility, or Confidential Information of Company were used; (2) that were developed entirely on

Employee’s own time; and (3) that do not relate at the time of conception or reduction to practice to the current business of

Company or its actual or demonstrably anticipated research or development, or which do not result from any work performed by

Employee for Company.

(b)

Employee acknowledges and agrees that all materials of Company, including slides, PowerPoint or Keynote presentations, books,

pamphlets, handouts, audience participation materials and other data and information pertaining to the business and clients of Company,

either obtained or developed by Employee on behalf of Company or furnished by Company to Employee, or to which Employee may have access,

shall remain the sole property of Company and shall not be used by Employee other than for the purpose of performing under the Agreement,

unless a majority of the Board (“Majority Board”) provides their prior written consent to the contrary.

(c)

Unless the Majority Board otherwise agrees in writing, Employee acknowledges and agrees that all writings and other works

which are copyrightable or may be copyrighted (including computer programs) which are related to the present or planned businesses of

Company and which are or were prepared by Employee during Employee’s employment with Company are, to the maximum extent permitted

by law, deemed to be works for hire, with the copyright automatically vesting in Company. To the extent that such writings and works are

not works for hire, Employee hereby disclaims and waives any and all common law, statutory, and “moral” rights in such writings

and works, and agrees to assign, and hereby does assign, to Company all of Employee’s right, title and interest, including copyright,

in such writings and works.

(d)

Nothing contained in the Agreement grants, or shall be deemed or construed to grant, Employee any right, title, or interest

in any trade names, service marks, or trademarks owned by the Company (all such trade names, service marks, and trademarks being hereinafter

collectively referred to as the “Marks”). Employee may use the Marks solely for the purpose of performing her duties under

the Agreement. Employee agrees that she shall not use or permit the use of any of the Marks in any other manner whatsoever without the

prior written consent of the Majority Board.

(e)

Employee further agrees to reasonably cooperate with Company hereafter in obtaining and enforcing patents, copyrights,

trademarks, service marks, and other protections of Company’s rights in and to all Company Inventions, writings and other works.

Without limiting the generality of the foregoing, Employee shall, at any time during and after her employment with Company, at Company’s

reasonable request, execute specific assignments in favor of Company, or its nominee, of Employee’s interest in any of Company Inventions,

writings or other works covered by the Agreement, as well as execute all papers, render all reasonable assistance, and perform all lawful

acts which Company reasonably considers necessary or advisable for the preparation, filing, prosecution, issuance, procurement, maintenance

or enforcement of patents, trademarks, service marks, copyrights and other protections, and any applications for any of the foregoing,

of the United States or any foreign country for any Company Inventions, writings or other works, and for the transfer of any interest

Employee may have therein. Employee shall execute any and all papers and documents required to vest title in Company or its nominees in

any Company Inventions, writings, other works, patents, trademarks, service marks, copyrights, applications and interests to which Company

is entitled under the Agreement.

10.

Remedies. Without limiting any of the other rights or remedies available to Company at law or in equity,

Employee agrees that any actual or threatened violation of any of the provisions of Sections 8, 9, or 10 may be immediately restrained

or enjoined by any court of competent jurisdiction, and that any temporary restraining order or emergency, preliminary, or final injunctions

may be issued in any court of competent jurisdiction without notice and without bond. As used in the Agreement, the term “any

court of competent jurisdiction” shall include the state and federal courts sitting, or with jurisdiction over actions arising,

in Los Angeles County, in the State of Wisconsin the jurisdiction, venue, and convenient forum of which are hereby expressly CONSENTED

TO by Employee and Company, all objections thereto being expressly WAIVED by Employee and Company.

11.

No Violation of Other Obligations.

Each

Party represents and warrants that neither that Party's execution, delivery,

and

performance of this Agreement nor that Party's execution, delivery, and performance of any agreement, instrument, or other document or

obligation contemplated under this Agreement will result in a violation of any provision of, or constitute a default under, any contract,

agreement, instrument, or obligation to which that Party is a party or by which that Party is bound.

12. Indemnification.

Company agrees to defend and indemnify and hold Employee harmless from and against any past, present or future claim, action,

demand, loss, cost, expense, liability or other damage arising from, and including reasonable attorney’s fees and costs,

amounts, expenses, incurred by or imposed against Employee and arising out of or relating to any past, present or future claim,

action, demand, loss, cost, expense, liability or other damage due to Employee’s employment pursuant to this Agreement.

Company agrees to put in place an appropriate Directors and Officers (D&O) liability insurance plan which covers the employment

of Employee.

13.

Miscellaneous.

a.

Notices. Any notice, consent, demand, request, approval, or other

communication

to be given under this Agreement by one Party to the other ("Notice") must be in writing and must be either (i) personally

delivered, (ii) mailed by registered or certified mail, postage prepaid with return receipt requested, (iii) delivered by same-day or

overnight courier service, or (iv) delivered by facsimile transmission, in any event to the address or number set forth in the introductory

paragraph of this Agreement or to such other address or number as may be designated by either or both of the Parties from time to time.

Notices

delivered personally or by courier service shall be deemed given and received as of actual receipt. Notices mailed as described above

shall be deemed given and received three business days after mailing or upon actual receipt, whichever is earlier. Notices delivered by

facsimile transmission shall be deemed given and received upon receipt by the sender of the transmission confirmation so long as facsimile

transmissions are also accompanied by overnight delivery as set forth above.

b.

Entire Agreement. This Agreement supersedes any and all other

agreements

and understandings of any kind, either oral or written, between the Parties with respect to the subject matter of this Agreement and contains

all of the covenants and agreements between the Parties with respect to the subject matter of this Agreement.

c.

Modification. Except as stated in the next sentence, no change or

modification

of this Agreement shall be valid or binding upon the Parties, nor shall any waiver of any term or condition be so binding, unless the

change or modification or waiver is in writing and signed by the Parties. Employee acknowledges that Company may from time to time establish,

maintain, and distribute employee handbooks or policy manuals, and officers or other representatives of Company may make written or oral

statements relating to personnel policies and procedures. Such handbooks, manuals, and statements are intended only for general guidance

and shall not be deemed to change or modify this Agreement or to create any liability of Company to Employee under this Agreement.

d. GOVERNING

LAW; CONSENT TO FORUM. THIS AGREEMENT HAS BEEN NEGOTIATED, EXECUTED, AND DELIVERED AT, AND SHALL BE DEEMED TO HAVE BEEN MADE

IN, NEVADA. THIS AGREEMENT SHALL BE GOVERNED BY, ENFORCED UNDER, AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEVADA.

AS PART OF THE CONSIDERATION FOR THIS AGREEMENT, AND REGARDLESS OF ANY PRESENT OR FUTURE DOMICILE OR PRINCIPAL PLACE OF BUSINESS OF

Employee, Employee HEREBY CONSENTS AND AGREES THAT THE COURTS OF WISCONSIN SHALL HAVE JURISDICTION TO HEAR AND DETERMINE ANY

JUDICIAL DISPUTES BETWEEN THE PARTIES OR OTHER MATTERS EXPRESSLY PERMITTED BY THIS AGREEMENT TO BE LITIGATED IN A COURT. Employee

EXPRESSLY SUBMITS AND CONSENTS IN ADVANCE TO SUCH JURISDICTION IN ANY ACTION OR SUIT COMMENCED IN ANY SUCH COURT AND HEREBY WAIVES

ANY OBJECTION WHICH Employee MAY HAVE BASED UPON LACK OF PERSONAL JURISDICTION, IMPROPER VENUE, OR FORUM NON CONVENIENS.

e.

Counterparts. This Agreement may be executed in counterparts, each of which constitutes an original, but all

of which constitute one document.

f.

Gender. Whenever the context requires, words in this Agreement denoting gender shall include the masculine,

feminine, and neuter.

g.

Waiver of Breach. Any waiver by a Party of a breach of any provision of this Agreement by the other Party

shall not operate or be construed as a waiver of any other or any subsequent breach.

h.

Certain Defined Terms. As used in this Agreement, (i) "Person" means an individual or any

corporation, partnership, trust, unincorporated association, or other legal entity, whether acting in an individual, fiduciary, or other

capacity, and any government, court, or other governmental agency, (ii) "include" and "including" shall not denote

or signify any limitation, (iii) "business day" means any Monday through Friday other than any such weekday on which the offices

of the Company are closed, and (iv) "Section" is a reference to a Section in this Agreement, unless otherwise stated. In addition,

the use herein of “annual” or “monthly” (or similar terms) to indicate a measurement period shall not itself be

deemed to grant rights to Employee for employment or compensation for such period.

i.

Captions and Section Headings. Captions and Section or subsection

headings used

herein are for convenience only and are not a part of this Agreement and shall not be used in any construction of this Agreement.

j.

Expenses. Each of the Parties shall bear such Party’s respective expenses, including the fees and expenses

of its counsel, incurred in negotiating and preparing this Agreement.

k.

Interpretation. Each Party to this Agreement acknowledges that they have participated in the negotiation of

this Agreement, and that no provision of this Agreement shall be construed against or interpreted to the disadvantage of any party hereto

by any court or any government or judicial authority by reason of such person having been deemed to have structured, dictated or drafted

such provision.

Exhibit

A

Compensation,

Benefits, Expenses and Other Provisions

Cash Compensation:

Employee shall be paid a base salary of per year $275,000. Employee shall also be eligible for an annual cash bonus up to 35% of the annual

base salary, to be paid no later than March 15th of the year immediately following the year in which the bonus was earned (e.g., performance

bonus earned for the 2024 calendar year would be paid on or before March 15, 2025). Cash bonus earning will be based on attainment of

mutually agreed upon annual performance criteria. Performance criteria will be expressed in tangible and clear major business objectives,

which may include targets related to sales, overall business performance, stock performance, fundraising, and relevant operational key

performance indicators, and shall be set on or before March 30 of each calendar year.

For calendar year

2024, Employee may also be eligible for commission on sales commiserate with the terms of the annual sales plan, which shall be mutually

agreed upon no later than January 15th of the plan year.

Cash compensation

and cash bonuses will be paid upon the Company raising funds to support it. Until such time, the cash compensation and the cash bonuses,

will be accrued. Any such accruals or deferrals will be carried out in a manner compliance with 409A regulations. Any such accruals will

be paid to Employee incrementally when possible or in full within 5 business days of Company receiving sufficient funds to support payment.

In the event of termination by either party for any reason, Company shall pay all accrued, unpaid cash compensation, including base compensation,

bonus, and healthcare benefits coverage to Employee within 10 business days of the effective date of termination.

Cash compensation

will be reviewed and adjusted annually, and mutually agreed upon by the Parties, commensurate with Company size, growth, and performance,

as well as individual performance.

Equity Compensation:

In addition to the above, the Company shall provide to Employee an equity incentive in the form of the following:

| 1. | Incentive Stock Options (ISOs): Effective upon the Start Date, Employee shall receive an initial

options grant in the form of an ISO, in a quantity equivalent to 2.0% of the total outstanding common stock of the Company at that date,

subject to the following key terms. |

| a. | 4-year vesting, with a 1-year cliff (25% to vest immediately on the 1-yr anniversary of the Start Date,

the remaining 75% to ratably vest monthly – 1/36 each month, thereafter.) |

| b. | The strike price shall be $.01 per share. |

| 2. | Restricted Stock Award (RSA): If the Stock is listed on Nasdaq or any other National Stock Exchange

while Employee is employed by, or performing advisory services for, the Company in any capacity, the Company shall pay a one-time up-listing

bonus of $500,000 in the form of an RSA, which shall be payable within ten days of the effective date of the listing. Payment shall be

made in shares of common stock of the Company (“Stock”). |

To the

extent that any portion of the RSA is paid in Stock, shares of Stock shall be fully earned and vested upon issuance. The number of shares

of Stock to be issued in such case will be determined by dividing that portion of the RSA payable in Stock by 85% of the Company’s

ten-day Volume Weighted Average Price (“VWAP”) of the Stock, for the ten-day period immediately prior to the date of issuance.

This represents a 15% discount to the relevant VWAP, which discount shall at no point be less than $0.10 per share of Stock.

| 3. | In connection with the issuance of any RSA (the “RSA Issuance”), the Company shall pay

a bonus to Employee in an amount equal to the estimated tax owed by Employee in connection to the RSA Issuance (including a grossed-up

amount to reflect the tax impact of such bonus). Such bonus shall be payable within ten days of the issuance. |

| 4. | Upon a Change in Control of the Company, defined as the sale of at least 50% of the shares of the Company,

any non-vested ISOs and/or RSAs shall immediately vest. |

Expenses:

The Company shall reimburse Employee for all expenses incurred on behalf of the Company within 30 days of Employee submitting expenses

for reimbursement. Such expenses shall be eligible for reimbursement as long as they are reasonable and compliant with the Company expense

policies.

Benefits:

The Company shall provide health (vision, dental, medical) and other relevant benefits for the Executive and their family in accordance

with the then current Company benefit plans as part of the Executive’s compensation package. If, as of the Start Date, the Company

does not offer health benefits, the Company shall reimburse Employee for the cost of maintaining COBRA coverage under her former employer

or sufficient for purchasing comparable health benefits on the public exchange up to a maximum amount of $701 per month until the date

that Company sponsored health benefits become available. At the appropriate time, Company will add a 401k benefit with Company matching

contributions.

Vacation

& Sick Leave: Where permitted by state law, Company agrees to adopt an open PTO policy, which Employee shall be able to partake

in, along with other Company executives and staff.

Liability,

D&O Insurance: Prior to the Start Date, the Company shall obtain and demonstrate it has an active general liability and D&O

insurance policies in place with limits consistent with Company size, business plan, and activities, which shall protect Executive from

any claims, demands, or litigation arising out of or in connection with the performance of Executive’s duties and obligations pursuant

to the Employment Agreement and any other activities undertaken on behalf of the Company. Such insurance shall provide coverage for Executive’s

legal defense, settlement, and judgment costs, including attorneys’ fees and other related expenses, without any limitation to the

duration or amount of such coverage, regardless of Executive’s association with the Company at the time such claims or litigation

are initiated.

In addition

to the aforementioned insurance, the Company shall indemnify and hold Executive harmless from and against any and all liabilities,

losses, damages, costs, and expenses, including reasonable attorneys’’ fess, incurred by Executive, resulting from or

arising out of any claims, demand, or litigation involving the Company, its affiliates and/or their businesses, whether such claims

or litigation are brought during the term of the Employment Agreement or thereafter. This indemnification obligation shall be

binding upon the Company and its successors and assigns, jointly and severally, and shall continue in perpetuity, regardless of any

changes in Executive’s association with the Company or any termination of the Employment Agreement. The Company’s

obligation to indemnify the Executive shall not be subject to any limitation of time, amount, or scope, and shall extend to all

matters, past, present, and future, involving Executive’s association with the Company.

By Executive:

Executive may terminate the Agreement for any reason with 30 days’ notice.

By Company

Without Cause: Company can terminate the Employment Agreement Without Cause with immediate effect, providing that the following provisions

are adhered to:

| - | Pays 3 months’ severance, inclusive of base salary and full prorated bonus compensation. |

| - | Immediately vests all outstanding ISOs and earned RSAs. |

| - | Covers the cost of health benefits under COBRA for 6 months. |

| - | Employee shall agree to a non-compete/non-solicitation stipulation, which shall expire 1 year from employment

termination date. |

| - | Company and Employee agree to enter into a mutual non-disparagement agreement. |

By Company

With Cause: Company may terminate the Employment Agreement effective immediately for Cause if Company can provide written documentation/proof

of (a) personal dishonesty, (b) incompetence, (c) willful misconduct, (d) breach of fiduciary duty involving personal profit, (e) intentional

failure to perform stated duties, or (f) willful violation of any law, rule, or regulation; provided, however, prior to termination Cause

pursuant to (b) or (e), the Company must have provided Executive with written notice of such issue and 30 days to cure, and in all aspects,

such action by Executive must have a material, negative affect on Company prior to being considered Cause.

General

Tax/409A: The Company and Executive intend to structure the Employment Agreement such that is efficient to the Executive in all

cases while also complying with Section 409A of the Internal Revenue Code requirements. Company shall administer and interpret this term

sheet in accordance with such requirements.

Arbitration:

Executive and Company agree that they will resolve all matters in dispute between them by binding arbitration conducted by JAMS, Inc.

[Signatures

on following page]

IN

WITNESS WHEREOF, the Parties have executed this Agreement as of the date

first above

written.

The

Company: Avant Technologies, Inc.,

a Nevada Corporation

By_/s/__________

Timothy Lantz

Printed Name:

Timothy Lantz

Title: Chief

Executive Officer

Employee:

By /s/ _________

Angela Harris

Print Name: Angela

Harris

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

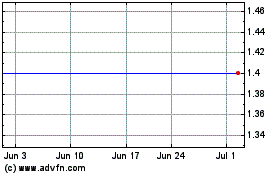

Trend Innovations (QB) (USOTC:TREN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Trend Innovations (QB) (USOTC:TREN)

Historical Stock Chart

From Jul 2023 to Jul 2024