false

0001463208

0001463208

2024-10-09

2024-10-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): October 9, 2024

Transportation

and Logistics Systems, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-34970 |

|

26-3106763 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

5500

Military Trail, Suite 22-357

Jupiter,

Florida 33458

(Address

of Principal Executive Offices)

(833)

764-1443

(Issuer’s

telephone number)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

October 9, 2024, Transportation and Logistics Systems, Inc. (OTC PINK: TLSS) (“TLSS” or the “Company”) entered

into two (2) unsecured non-convertible promissory notes (the “Notes”) in the aggregate amount of $100,000, with interest

at the rate of 10% per annum accruing and due at maturity in six months (“Loans”), with Mercer Street Global Opportunity

Fund and Cavalry Fund I LP, who are holders of shares of the Company’s Convertible Preferred Stock (“Lenders”) for

the primary purpose of funding all or a portion of the costs related to: (i) the Company’s 2023 audit and quarterly reviews for

2024; (ii) regaining compliance with required SEC filings; (iii) maintaining the Company’s OTC listing; (iv) keeping the Company

in good standing with requisite taxing authorities; and (v) fees for routine litigation matters in the ordinary course of business.

At

any time after issuance of the Notes, the Company may repay the Notes upon maturity or mutual agreement with the Lenders. The Notes also

contain customary events of default, which include, without limitation, failure to pay principal, interest or other charges in respect

of the Notes when due at maturity or otherwise, failure to satisfy any covenant in the Notes or other agreements between the Company

and the Lender or any other creditor, breach of representations and warranties set forth in the Notes or any transaction document executed

contemporaneously with the Notes, and certain judgment defaults, events of bankruptcy or insolvency of the Company. Upon the occurrence

of such an event of default under the Notes, the Lenders have the right to demand repayment of the Notes in full upon five (5) business

days’ notice to the Company. In the event that full payment is not made upon the expiry of a thirty (30) day period, a default

penalty equal to 5.0% per month during the period of default in excess of the 10% interest rate will apply to the entire amount of the

Note outstanding, including any accrued but unpaid interest. The Lender may then, at its sole discretion, declare the entire then-outstanding

principal amount of the Note and any accrued but unpaid interest due thereunder immediately due and payable, in which event the Lender

may, at its sole discretion, take any action it deems necessary to recover amounts due under the Note.

Concurrently

with the issuance of the Notes, the Company also entered into a letter agreement of even date (the “Letter Agreement”) with

the Lenders setting forth, among other items, the intended use of proceeds of the Loans.

The

foregoing does not purport to be a complete description of each of the Notes and the Letter Agreement, and each such description is qualified

in its entirety by reference to the full text of each such document, which are attached as Exhibits 10.1, 10.2 and 10.3 to this Current

Report on Form 8-K (this “Form 8-K”) and are incorporated by reference herein.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth in Item 1.01 hereof with respect to the Notes is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

| Exhibit

No. |

|

Description |

| 10.1 |

|

Letter Agreement, dated October 9, 2024, among the Company and Mercer Street Global Opportunity Fund and Cavalry Fund I LP. |

| 10.2 |

|

Promissory Note dated October 9, 2024, between the Company, as borrower, and Mercer Street Global Opportunity Fund, as lender. |

| 10.3 |

|

Promissory Note dated October 9, 2024, between the Company, as borrower, and Cavalry Fund I LP, as lender. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

October 15, 2024 |

TRANSPORTATION

AND LOGISTICS SYSTEMS, INC. |

| |

|

|

| |

By: |

/s/

Sebastian Giordano |

| |

Name:

|

Sebastian

Giordano |

| |

Title:

|

Chief

Executive Officer |

Exhibit

10.1

Transportation

and Logistics Systems, Inc.

5500

Military Trail, Suite 22-357

Jupiter,

FL 33458

October

9, 2024

Mercer

Street Global Opportunity Fund

c/o

Mercer Street Capital Partners

1111

Brickell Avenue | Suite 2920 | Miami, FL 33131

Cavalry

Fund I LP

c/o

C/M Capital Partners, LP

1111

Brickell Avenue | Suite 2920 | Miami, FL 33131

Attention:

Thomas Walsh

| |

Re: |

Transportation

and Logistics Systems, Inc. |

Ladies

and Gentleman:

Reference

is made to that certain letter agreement, dated August 12, 2024, by and between the Borrower and the Lenders, as defined herein. Reference

is also made to those certain promissory notes, each dated at or about the date hereof (collectively, the “Notes”

and individually, a “Note”), issued by Transportation and Logistics Systems, Inc., a Nevada corporation (and together

with its successors and assigns, collectively, the “Borrower”), payable to the order of the Lender identified in the

applicable Note (collectively, the “Lenders” and individually, a “Lender”). Capitalized terms used

but not defined herein have the respective meanings ascribed to them in the Notes.

By

way of this letter agreement, the Borrower and the Lenders continue to acknowledge and agree as follows:

(a)

The Lenders are providing the loans under the Notes as an accommodation and reserve the right to have the Borrower enter into definitive

transaction documents containing such customary terms and conditions, schedules, and exhibits as appropriate for a transaction of this

sort, as Lenders may reasonably determine.

(b)

The proceeds from the Notes shall be used solely for the following purposes, in each case subject to prior written approval of Frank

Knuttel or a Lender, which approval shall be timely and not unreasonably withheld:

| (i) |

Preparation

of the Company’s 2023 audit and 2024 first, second and third quarter reviews; |

| (ii) |

Preparation

and submission of any requisite Company SEC and OTC filings; |

| (iii) |

Such

tax-related and other activities as may be necessarily and legally required from time to time to restore the Company to good standing

from applicable tax and compliance perspectives; and |

| (iv) |

Fees

for routine litigation matters in the ordinary course of business. |

(c)

the Notes are junior, subordinate, and second to those notes set forth on Exhibit A hereto and in parity to those notes set forth

on Exhibit B hereto.

The

Borrower and the Lenders shall each use all good faith efforts to take, or cause to be taken, all actions, and to do, or cause to be

done, and to assist and cooperate in doing, all things necessary, proper or advisable to carry out the intent and purposes of this letter

agreement.

This

letter agreement and the Notes shall constitute the entire agreement between the parties hereto pertaining to the subject matter hereof.

This letter agreement may be amended by a written instrument signed by the parties hereto. All rights and obligations hereunder will

be governed by the laws of the State of Nevada, without regard to the conflicts of law provisions of such jurisdiction. This letter agreement

may be executed, including by means of electronic signature or pdfs, in two or more counterparts, each of which shall be deemed an original

but all of which together shall constitute one and the same instrument.

[Signature

Page Follows]

| Sincerely, |

|

| |

|

|

| TRANSPORTATION

AND LOGISTICS SYSTEMS, INC. |

|

| |

|

| By: |

/s/

Sebastian Giordano |

|

| Name: |

Sebastian

Giordano |

|

| Title: |

CEO |

|

Acknowledged,

Agreed and Accepted:

| Mercer

Street Global Opportunity Fund |

|

| |

|

|

| By: |

/s/

Jonathan Juchno |

|

| Name: |

Jonathan

Juchno |

|

| Title: |

|

|

| |

|

|

| Cavalry

Fund I LP |

|

| |

|

|

| By: |

/s/

Thomas Walsh |

|

| Name: |

Thomas

Walsh |

|

| Title: |

Managing

Member |

|

[Signature

Page to Side Letter]

Exhibit

A

List

of Notes that are First, Prior, and Senior to the Notes

| NOTES PAYABLE | |

Orig Date | |

Date of maturity | |

| | |

| | |

| | |

| |

| | |

| |

| |

| | |

| | |

| | |

| |

| Sebastian Giordano 4/21/2023 | |

4/21/23 | |

12/31/23 | |

$ | 100,000.00 | | |

| | | |

$ | 100,000.00 | | |

$ | 100,000.00 | |

| John Mercadante 4/17 & 10/3/2023 500k each | |

4/17/23 & 10/3/23 | |

12/31/23 | |

$ | 1,000,000.00 | | |

| | | |

$ | 1,000,000.00 | | |

$ | 1,000,000.00 | |

| John Mercadante -(Wendy Cabral) 11/28/2023 | |

11/28/23 | |

11/27/24 | |

$ | 60,000.00 | | |

| | | |

$ | 60,000.00 | | |

$ | 60,000.00 | |

| Norman Newton 2/21/2024 | |

2/21/24 | |

9/30/24 | |

$ | - | | |

$ | 1,000.00 | | |

$ | 1,000.00 | | |

$ | 1,000.00 | |

| Charlie Benton 2/23/2024 | |

2/23/24 | |

9/30/24 | |

$ | - | | |

$ | 3,109.00 | | |

$ | 3,109.00 | | |

$ | 3,109.00 | |

| John Mercadante - misc AP directed to add to loan 2/6/2024 | |

2/6/24 | |

2/6/25 | |

$ | - | | |

$ | 64,534.96 | | |

$ | 64,534.96 | | |

$ | 64,534.96 | |

| John Mercadante - to pay off CXP loans | |

2/15/24 | |

2/14/25 | |

$ | - | | |

$ | 319,194.00 | | |

$ | 319,194.00 | | |

$ | 319,194.00 | |

| | |

| |

| |

| | | |

| | | |

| | | |

| | |

| Total notes payable | |

| |

| |

$ | 1,160,000.00 | | |

$ | 387,837.96 | | |

$ | 1,547,837.96 | | |

$ | 1,547,837.96 | |

Exhibit

B

List

of Notes that are in Parity to the Notes

| NOTES PAYABLE | |

Orig Date | |

Date of maturity | |

| |

| | |

| |

| |

| |

| Cavalry Fund I Management, LLC | |

8/12/2024 | |

2/12/2025 | |

$ | 75,000.00 | |

| Mercer Street Global Opportunity Fund | |

8/12/2024 | |

2/12/2025 | |

$ | 75,000 | |

| Total notes payable | |

| |

| |

$ | 150,000.00 | |

Exhibit

10.2

TRANSPORTATION

AND LOGISTICS SYSTEMS, INC.

Promissory

Note (the “Note”)

| Face Amount: $50,000.00 |

October 9, 2024 |

| |

Jupiter,

Florida |

FOR

VALUE RECEIVED, the undersigned TRANSPORTATION AND LOGISTICS SYSTEMS, INC., a Nevada corporation (the “Borrower”),

promises to pay to the order of MERCER STREET GLOBAL OPPORTUNITY FUND, its successors or assigns (the “Lender”), FIFTY

THOUSAND DOLLARS ($50,000) (the “Face Amount”) by the 6 month anniversary of the date hereof (the “Maturity

Date”), together with simple interest on the principal amount outstanding from time to time at the interest rate of 10% per

annum, calculated on the basis of actual days elapsed and a 365-day year (the “Interest Rate”), as provided herein

or on such earlier date as this Note is required or permitted to be repaid as provided hereunder.

Section

1. Maturity; Interest. The Face Amount, together with accrued interest thereupon, shall become due and payable and shall be repaid

in cash in a single installment at the Maturity Date; provided, that this Note may be prepaid in whole or in part at any time and from

time-to-time upon three (3) prior business days’ written notice, without penalty.

Section

2. Repayment. Repayment of the Note may occur as follows: (a) at the Maturity Date or (b) at such time as the Borrower and the

Lender may agree to effect repayment. So long as no Event of Default has occurred, such repayment shall satisfy Borrower’s obligations

pursuant to this Note in full and this Note shall be of no further force and effect. This Note is not a convertible instrument and

has no contractual rights to convert into equity or any other securities of the Borrower.

Section

3. Transferability. This Note and any of the rights granted hereunder are freely transferable or assignable by the Lender, in

whole or in part, in its sole discretion; provided, Lender shall have provided prior written notice to the Borrower.

Section

4. Event of Default.

(a)

In the event that any one of the following events shall occur (whatever the reason and whether it shall be voluntary or involuntary or

effected by operation of law or pursuant to any judgment, decree or order of any court, or any order, rule or regulation of any administrative

or governmental body), it shall be deemed an Event of Default:

(i)

Any default in the payment of the principal of, interest on or other charges in respect of this Note, or any other note issued by the

Borrower for the benefit of the Lender or any other creditor, as and when the same shall become due and payable;

(ii)

Borrower shall fail to observe or perform any other material covenant, agreement or warranty contained in, or otherwise commit any breach

or default of any provision of this Note or any other agreement between the Borrower and the Lender or any other creditor;

(iii)

There shall be a breach of any of the representations and warranties set forth in this Note or any transaction document executed contemporaneously

herewith, including without limitation, the Borrower’s express representation that the purpose of this Note is to fund the Borrower’s

direct costs to its auditor to enable such auditor to complete its review of the Company’s quarterly securities filings, payment

to financial printers for Edgar filings, payment to the Company’s transfer agent, and accounting; or

(iv)

Borrower, shall commence, or there shall be commenced against Borrower any applicable bankruptcy or insolvency laws as now or hereafter

in effect or any successor thereto, or Borrower commences any other proceeding under any reorganization, arrangement, adjustment of debt,

relief of debtors, dissolution, insolvency or liquidation or similar law of any jurisdiction whether now or hereafter in effect relating

to Borrower or there is commenced against Borrower any such bankruptcy, insolvency or other proceeding which remains undismissed for

a period of sixty (60) days; or Borrower is adjudicated insolvent or bankrupt; or any order of relief or other order approving any such

case or proceeding is entered; or Borrower suffers any appointment of any custodian, private or court appointed receiver or the like

for it or any substantial part of its property which continues undischarged or unstayed for a period of sixty (60) days; or Borrower

makes a general assignment for the benefit of creditors; or Borrower shall fail to pay or shall state that it is unable to pay or shall

be liable to pay, its debts as they become due or by any act or failure to act expressly indicate its consent to, approval of or acquiescence

in any of the foregoing; or any corporate or other action is taken by the Borrower for the purpose of effecting any of the foregoing.

(b)

Upon the occurrence of an Event of Default, the Lender shall give the Borrower notice of such occurrence, at which time the Borrower

shall have five (5) business days from receipt of such notice to pay the outstanding amount of the Note in full. In the event that full

payment is not made upon the expiry of a thirty (30) day period, a default penalty equal to 5.0% in excess of the Interest Rate hereunder

of the Face Amount per month during the period of Default (the “Default Penalty”) shall apply to the entire amount

of the Note outstanding, including any accrued but unpaid interest. The Lender may then, at its sole discretion, declare the entire then-outstanding

Face Amount of this Note and any accrued but unpaid interest due hereunder immediately due and payable (a “Default Declaration”),

in which event the Lender may, at its sole discretion, take any action it deems necessary to recover amounts due under this Note.

(c)

Upon the occurrence of an Event of Default, the Lender shall be entitled to receive, in addition to the Face Amount of the Note and any

accrued but unpaid interest due hereunder, all of Lender’s costs, fees (including without limitation, reasonable attorney’s

fees and disbursements), and expenses relating to collection and enforcement Note, including all costs and expenses incurred by it in

enforcing its rights under the Note and any transaction documents entered into contemporaneously herewith.

(d)

The failure of the Lender to exercise any of its rights hereunder in any particular instance shall not constitute a waiver of the same

or of any other right in that or any subsequent instance with respect to the Lender or any subsequent holder. BORROWER ACKNOWLEDGES

THAT THE LOAN EVIDENCED BY THIS NOTE IS A COMMERCIAL TRANSACTION. BORROWER FURTHER WAIVES DILIGENCE, DEMAND, PRESENTMENT FOR PAYMENT,

NOTICE OF NONPAYMENT, PROTEST AND NOTICE OF PROTEST, AND NOTICE OF ANY RENEWALS OR EXTENSIONS OF THIS NOTE. BORROWER ACKNOWLEDGES THAT

IT MAKES THIS WAIVER KNOWINGLY, VOLUNTARILY, WITHOUT DURESS AND ONLY AFTER CONSIDERATION OF RAMIFICATION THIS WAIVER WITH ITS ATTORNEYS.

The Lender may immediately and without expiration of any grace period enforce any and all of its rights and remedies hereunder and

all other remedies available to it under applicable law. The remedies available to the Lender upon the occurrence of an Event of Default

shall be cumulative. This Note is intended to be a negotiable instrument in accordance with Section 3-104 of the Uniform Commercial Code.

Section

5. Notices. Any and all notices, service of process or other communications or deliveries required or permitted to be given or

made pursuant to any of the provisions of this Note shall be deemed to have been duly given or made for all purposes when hand delivered

or sent by certified or registered mail, return receipt requested and postage prepaid, overnight mail or courier as follows:

If

to the Lender, at:

1111

Brickell Avenue, Suite 2920

Miami,

FL 33131

Attention:

Jonathan Juchno

E-mail:

JJUCHNO@mercerstcap.com

Or

such other address as may be given to the Borrower from time to time

If

to Borrower, at:

5500

Military Trail Ste 22-357

Jupiter,

FL 33458

Attention:

Sebastian Giordano

Email:

sebastian.giordano@tlss-inc.com

Or

such other address as may be given to the Lender from time to time

Section

6. Usury. This Note is hereby expressly limited so that in no event whatsoever, whether by reason of acceleration of maturity

of the loan evidenced hereby or otherwise, shall the amount paid or agreed to be paid to the Lender hereunder for the loan, use, forbearance

or detention of money exceed that permissible under applicable law. If at any time the performance of any provision of this Note or of

any other agreement or instrument entered into in connection with this Note involves a payment exceeding the limit of the interest that

may be validly charged for the loan, use, forbearance or detention of money under applicable law, then automatically and retroactively,

ipso facto, the obligation to be performed shall be reduced to such limit, it being the specific intent of the Borrower and the Lender

that all payments under this Note are to be credited first to interest as permitted by law, but not in excess of (i) the agreed

rate of interest set forth herein or therein or (ii) that permitted by law, whichever is the lesser, and the balance toward the

reduction of principal. The provision of this Section 6 shall never be superseded or waived and shall control every other provision of

this Note and all other agreements and instruments between the Borrower and the Lender entered into in connection with this Note. To

the extent permitted by applicable law, Borrower waives any right to assert the defense of usury.

Section

7. Governing Law; Waiver of Jury Trial. This Note and the provisions hereof are to be construed according to and are governed

by the laws of the State of Nevada, without regard to principles of conflicts of laws thereof. Borrower agrees that the state and federal

courts sitting in Clark County, Nevada shall have exclusive jurisdiction in connection with any dispute concerning or arising out of

this Note or otherwise relating to the parties’ relationship. In any action, lawsuit or proceeding brought to enforce or interpret

the provisions of this Note and/or arising out of or relating to any dispute between the parties, the Lender shall be entitled to recover

all of its costs and expenses relating collection and enforcement of this Note (including without limitation, reasonable attorney’s

fees and disbursements) in addition to any other relief to which the Lender may be entitled and all costs of collection, including any

legal fees associated with this Note will be paid by the Borrower. Each party agrees that any process or notice to be served or delivered

in connection with any action, lawsuit or proceeding brought hereunder may be accomplished in accordance with the notice provisions set

forth above or as otherwise provided by applicable law. BORROWER HEREBY WAIVES TRIAL BY JURY IN ANY ACTION, PROCEEDING, CLAIM OR COUNTERCLAIM,

WHETHER IN CONTRACT OR TORT, AT LAW OR IN EQUITY, ARISING OUT OF OR IN ANY WAY RELATING TO THIS NOTE.

Section

8. Successors and Assigns. Subject to applicable laws, this Note and the rights and obligations evidenced hereby shall inure to

the benefit of and be binding upon the successors of Borrower and the successors and assigns of the Lender.

Section

9. Amendment. This Note may be modified or amended or the provisions hereof waived only with the written consent of the Lender.

Section

10. Severability. Wherever possible, each provision of this Note shall be interpreted in such manner as to be effective and valid

under applicable law, but if any provision of this Note shall be prohibited by or invalid under applicable law, such provision shall

be ineffective to the extent of such prohibition or invalidity, without invalidating the remainder of such provisions or the remaining

provisions of this Note.

[SIGNATURE

PAGE TO FOLLOW]

IN

WITNESS WHEREOF, Borrower has caused this Promissory Note to be duly executed by its authorized officer and/or such individual borrower

as of the date first above indicated.

| |

TRANSPORTATION

AND LOGISTICS SYSTEMS, INC. |

| |

|

| |

By: |

/s/

Sebastian Giordano |

| |

Name:

|

Sebastian

Giordano |

| |

Title:

|

CEO |

Exhibit

10.3

TRANSPORTATION

AND LOGISTICS SYSTEMS, INC.

Promissory

Note (the “Note”)

| Face Amount:

$50,000.00 |

October 9, 2024 |

| |

Jupiter, Florida |

FOR

VALUE RECEIVED, the undersigned TRANSPORTATION AND LOGISTICS SYSTEMS, INC., a Nevada corporation (the “Borrower”),

promises to pay to the order of CAVALRY FUND I LP, its successors or assigns (the “Lender”), FIFTY THOUSAND DOLLARS

($50,000) (the “Face Amount”) by the 6 month anniversary of the date hereof (the “Maturity Date”),

together with simple interest on the principal amount outstanding from time to time at the interest rate of 10% per annum, calculated

on the basis of actual days elapsed and a 365-day year (the “Interest Rate”), as provided herein or on such earlier

date as this Note is required or permitted to be repaid as provided hereunder.

Section

1. Maturity; Interest. The Face Amount, together with accrued interest thereupon, shall become due and payable and shall be repaid

in cash in a single installment at the Maturity Date; provided, that this Note may be prepaid in whole or in part at any time and from

time-to-time upon three (3) prior business days’ written notice, without penalty.

Section

2. Repayment. Repayment of the Note may occur as follows: (a) at the Maturity Date or (b) at such time as the Borrower and the

Lender may agree to effect repayment. So long as no Event of Default has occurred, such repayment shall satisfy Borrower’s obligations

pursuant to this Note in full and this Note shall be of no further force and effect. This Note is not a convertible instrument and

has no contractual rights to convert into equity or any other securities of the Borrower.

Section

3. Transferability. This Note and any of the rights granted hereunder are freely transferable or assignable by the Lender, in

whole or in part, in its sole discretion; provided, Lender shall have provided prior written notice to the Borrower.

Section

4. Event of Default.

(a)

In the event that any one of the following events shall occur (whatever the reason and whether it shall be voluntary or involuntary or

effected by operation of law or pursuant to any judgment, decree or order of any court, or any order, rule or regulation of any administrative

or governmental body), it shall be deemed an Event of Default:

(i)

Any default in the payment of the principal of, interest on or other charges in respect of this Note, or any other note issued by the

Borrower for the benefit of the Lender or any other creditor, as and when the same shall become due and payable;

(ii)

Borrower shall fail to observe or perform any other material covenant, agreement or warranty contained in, or otherwise commit any breach

or default of any provision of this Note or any other agreement between the Borrower and the Lender or any other creditor;

(iii)

There shall be a breach of any of the representations and warranties set forth in this Note or any transaction document executed contemporaneously

herewith, including without limitation, the Borrower’s express representation that the purpose of this Note is to fund the Borrower’s

direct costs to its auditor to enable such auditor to complete its review of the Company’s quarterly securities filings, payment

to financial printers for Edgar filings, payment to the Company’s transfer agent, and accounting; or

(iv)

Borrower, shall commence, or there shall be commenced against Borrower any applicable bankruptcy or insolvency laws as now or hereafter

in effect or any successor thereto, or Borrower commences any other proceeding under any reorganization, arrangement, adjustment of debt,

relief of debtors, dissolution, insolvency or liquidation or similar law of any jurisdiction whether now or hereafter in effect relating

to Borrower or there is commenced against Borrower any such bankruptcy, insolvency or other proceeding which remains undismissed for

a period of sixty (60) days; or Borrower is adjudicated insolvent or bankrupt; or any order of relief or other order approving any such

case or proceeding is entered; or Borrower suffers any appointment of any custodian, private or court appointed receiver or the like

for it or any substantial part of its property which continues undischarged or unstayed for a period of sixty (60) days; or Borrower

makes a general assignment for the benefit of creditors; or Borrower shall fail to pay or shall state that it is unable to pay or shall

be liable to pay, its debts as they become due or by any act or failure to act expressly indicate its consent to, approval of or acquiescence

in any of the foregoing; or any corporate or other action is taken by the Borrower for the purpose of effecting any of the foregoing.

(b)

Upon the occurrence of an Event of Default, the Lender shall give the Borrower notice of such occurrence, at which time the Borrower

shall have five (5) business days from receipt of such notice to pay the outstanding amount of the Note in full. In the event that full

payment is not made upon the expiry of a thirty (30) day period, a default penalty equal to 5.0% in excess of the Interest Rate hereunder

of the Face Amount per month during the period of Default (the “Default Penalty”) shall apply to the entire amount

of the Note outstanding, including any accrued but unpaid interest. The Lender may then, at its sole discretion, declare the entire then-outstanding

Face Amount of this Note and any accrued but unpaid interest due hereunder immediately due and payable (a “Default Declaration”),

in which event the Lender may, at its sole discretion, take any action it deems necessary to recover amounts due under this Note.

(c)

Upon the occurrence of an Event of Default, the Lender shall be entitled to receive, in addition to the Face Amount of the Note and any

accrued but unpaid interest due hereunder, all of Lender’s costs, fees (including without limitation, reasonable attorney’s

fees and disbursements), and expenses relating to collection and enforcement Note, including all costs and expenses incurred by it in

enforcing its rights under the Note and any transaction documents entered into contemporaneously herewith.

(d)

The failure of the Lender to exercise any of its rights hereunder in any particular instance shall not constitute a waiver of the same

or of any other right in that or any subsequent instance with respect to the Lender or any subsequent holder. BORROWER ACKNOWLEDGES

THAT THE LOAN EVIDENCED BY THIS NOTE IS A COMMERCIAL TRANSACTION. BORROWER FURTHER WAIVES DILIGENCE, DEMAND, PRESENTMENT FOR PAYMENT,

NOTICE OF NONPAYMENT, PROTEST AND NOTICE OF PROTEST, AND NOTICE OF ANY RENEWALS OR EXTENSIONS OF THIS NOTE. BORROWER ACKNOWLEDGES THAT

IT MAKES THIS WAIVER KNOWINGLY, VOLUNTARILY, WITHOUT DURESS AND ONLY AFTER CONSIDERATION OF RAMIFICATION THIS WAIVER WITH ITS ATTORNEYS.

The Lender may immediately and without expiration of any grace period enforce any and all of its rights and remedies hereunder and

all other remedies available to it under applicable law. The remedies available to the Lender upon the occurrence of an Event of Default

shall be cumulative. This Note is intended to be a negotiable instrument in accordance with Section 3-104 of the Uniform Commercial Code.

Section

5. Notices. Any and all notices, service of process or other communications or deliveries required or permitted to be given or

made pursuant to any of the provisions of this Note shall be deemed to have been duly given or made for all purposes when hand delivered

or sent by certified or registered mail, return receipt requested and postage prepaid, overnight mail or courier as follows:

If

to the Lender, at:

c/o

C/M Capital Partners, LP

1111

Brickell Avenue | Suite 2920 | Miami, FL 33131

Attention:

Thomas Walsh

E-mail:

thomas@cm-funds.com

Or

such other address as may be given to the Borrower from time to time

If

to Borrower, at:

5500

Military Trail Ste 22-357

Jupiter,

FL 33458

Attention:

Sebastian Giordano

Email:

sebastian.giordano@tlss-inc.com

Or

such other address as may be given to the Lender from time to time

Section

6. Usury. This Note is hereby expressly limited so that in no event whatsoever, whether by reason of acceleration of maturity

of the loan evidenced hereby or otherwise, shall the amount paid or agreed to be paid to the Lender hereunder for the loan, use, forbearance

or detention of money exceed that permissible under applicable law. If at any time the performance of any provision of this Note or of

any other agreement or instrument entered into in connection with this Note involves a payment exceeding the limit of the interest that

may be validly charged for the loan, use, forbearance or detention of money under applicable law, then automatically and retroactively,

ipso facto, the obligation to be performed shall be reduced to such limit, it being the specific intent of the Borrower and the Lender

that all payments under this Note are to be credited first to interest as permitted by law, but not in excess of (i) the agreed

rate of interest set forth herein or therein or (ii) that permitted by law, whichever is the lesser, and the balance toward the

reduction of principal. The provision of this Section 6 shall never be superseded or waived and shall control every other provision of

this Note and all other agreements and instruments between the Borrower and the Lender entered into in connection with this Note. To

the extent permitted by applicable law, Borrower waives any right to assert the defense of usury.

Section

7. Governing Law; Waiver of Jury Trial. This Note and the provisions hereof are to be construed according to and are governed

by the laws of the State of Nevada, without regard to principles of conflicts of laws thereof. Borrower agrees that the state and federal

courts sitting in Clark County, Nevada shall have exclusive jurisdiction in connection with any dispute concerning or arising out of

this Note or otherwise relating to the parties’ relationship. In any action, lawsuit or proceeding brought to enforce or interpret

the provisions of this Note and/or arising out of or relating to any dispute between the parties, the Lender shall be entitled to recover

all of its costs and expenses relating collection and enforcement of this Note (including without limitation, reasonable attorney’s

fees and disbursements) in addition to any other relief to which the Lender may be entitled and all costs of collection, including any

legal fees associated with this Note will be paid by the Borrower. Each party agrees that any process or notice to be served or delivered

in connection with any action, lawsuit or proceeding brought hereunder may be accomplished in accordance with the notice provisions set

forth above or as otherwise provided by applicable law. BORROWER HEREBY WAIVES TRIAL BY JURY IN ANY ACTION, PROCEEDING, CLAIM OR COUNTERCLAIM,

WHETHER IN CONTRACT OR TORT, AT LAW OR IN EQUITY, ARISING OUT OF OR IN ANY WAY RELATING TO THIS NOTE.

Section

8. Successors and Assigns. Subject to applicable laws, this Note and the rights and obligations evidenced hereby shall inure to

the benefit of and be binding upon the successors of Borrower and the successors and assigns of the Lender.

Section

9. Amendment. This Note may be modified or amended or the provisions hereof waived only with the written consent of the Lender.

Section

10. Severability. Wherever possible, each provision of this Note shall be interpreted in such manner as to be effective and valid

under applicable law, but if any provision of this Note shall be prohibited by or invalid under applicable law, such provision shall

be ineffective to the extent of such prohibition or invalidity, without invalidating the remainder of such provisions or the remaining

provisions of this Note.

[SIGNATURE

PAGE TO FOLLOW]

IN

WITNESS WHEREOF, Borrower has caused this Promissory Note to be duly executed by its authorized officer and/or such individual borrower

as of the date first above indicated.

| |

TRANSPORTATION

AND LOGISTICS SYSTEMS, INC. |

| |

|

| |

By:

|

/s/

Sebastian Giordano |

| |

Name:

|

Sebastian

Giordano |

| |

Title:

|

CEO |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

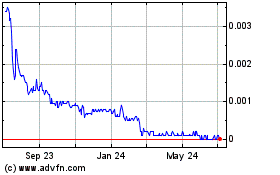

Transportation and Logis... (CE) (USOTC:TLSS)

Historical Stock Chart

From Dec 2024 to Jan 2025

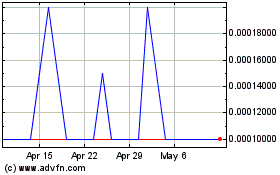

Transportation and Logis... (CE) (USOTC:TLSS)

Historical Stock Chart

From Jan 2024 to Jan 2025