Rolls-Royce Bets on Second-Half Performance -- 2nd Update

May 05 2016 - 5:02AM

Dow Jones News

By Robert Wall

LONDON--Shares in British aircraft engine maker Rolls-Royce

Holdings slumped Thursday after it signaled that first-half results

would only be "close to break-even."

Rolls-Royce, which makes engines for Boeing Co. and Airbus Group

SE long-range jetliners, reported that profit before financing

charges and tax would be near break-even in the first six months

and that achieving free cash flow targets also was heavily

dependent on the outcome of the second half.

Shares in Rolls-Royce, which previously said profit would

primarily come in the second half of this year, retreated more than

4.8% in early London trading. Analysts worried about the scale of

performance the company would have to deliver in the final months

of the year.

"Rolls normally has a heavy weighting to the second half in its

results, though the scale of the 2016 skew is particularly stark,"

RBC analyst Robert Stallard said. The company also is betting on

strong performance from improved aircraft engine aftermarket

business when some older Rolls-Royce-powered planes are flying less

than forecast, he said.

Rolls-Royce is recovering from a series of profit warnings that

led it to cut its dividend for the first time since 1992 after

profits slumped. The company has seen lower demand for some of its

most profitable products and struggled with the impact on demand

from low crude prices on its marine and power-systems

operations.

"Despite steady market conditions for most of our businesses,

2016 continues to be a challenging year overall as we sustain

investment and start to transition major products in Civil

Aerospace, and tackle weak markets in Marine," Chief Executive

Warren East said.

The company confirmed its full-year outlook ahead of its annual

shareholder meeting. Rolls-Royce also said earnings this year could

benefit from weakness in the British currency versus the dollar. If

currency exchange rates remain at the level seen to date, reported

revenue would improve by GBP450 million ($654 million) and reported

profit before tax by around GBP50 million. Many of Rolls-Royce's

sales are dollar denominated.

The shareholder meeting, Mr. East's first as CEO at Rolls-Royce,

comes after months of turmoil for the company that has seen the

departure of top executives and U.S. activist investor ValueAct

Capital Management LP becoming the company's largest investor. In

March, Rolls-Royce appointed Bradley Singer, ValueAct's chief

operating officer, to join the board.

ValueAct, which owns more than 10% of Rolls-Royce shares, has

pledged not to battle the company until at least the 2018

shareholder meeting.

Restructuring measures, including layoffs, should start

bolstering the bottom line, Rolls-Royce said. "We are well on track

to delivering the expected cost savings in 2016," the company said,

estimated at GBP30 million to GBP50 million benefit by

year-end.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

May 05, 2016 04:47 ET (08:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

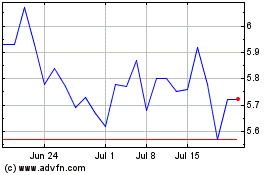

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024